Basic Stats

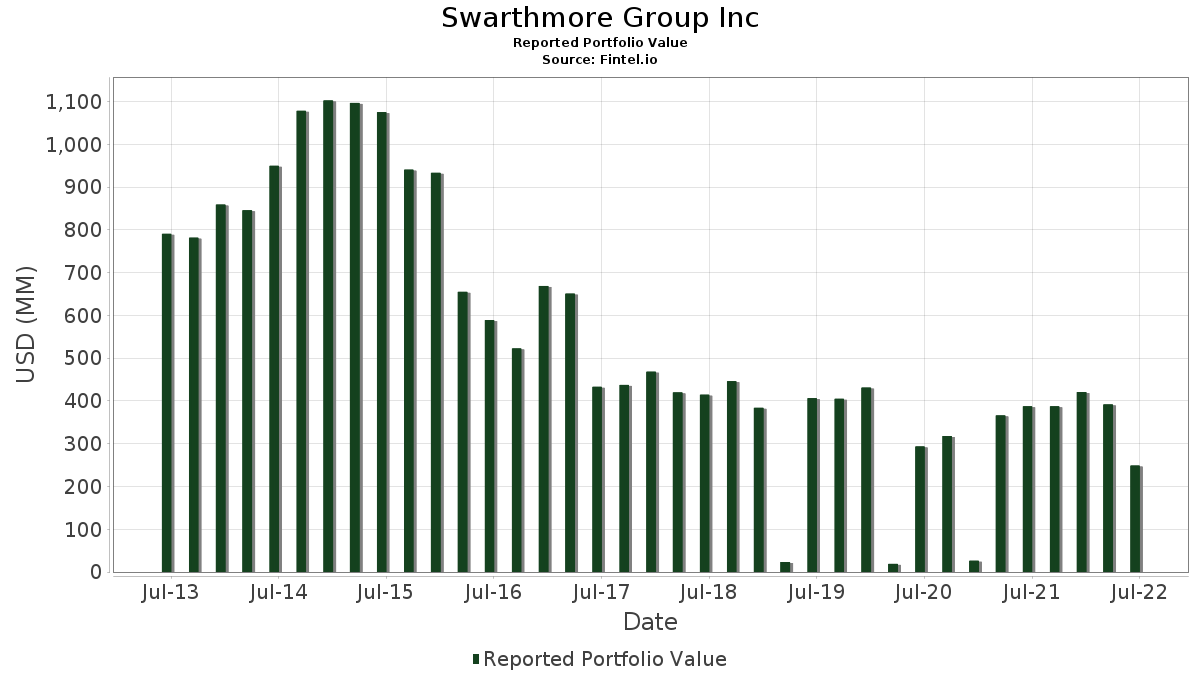

| Portfolio Value | $ 248,672,000 |

| Current Positions | 46 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Swarthmore Group Inc has disclosed 46 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 248,672,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Swarthmore Group Inc’s top holdings are iShares Trust - iShares Core S&P 500 ETF (US:IVV) , SPDR S&P 500 ETF (US:SPY) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , and Alphabet Inc. (US:GOOGL) . Swarthmore Group Inc’s new positions include SPDR S&P 500 ETF (US:SPY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.24 | 89.34 | 35.9289 | 35.9289 | |

| 0.37 | 141.65 | 56.9630 | 34.4896 | |

| 0.00 | 0.94 | 0.3768 | 0.1350 | |

| 0.00 | 0.39 | 0.1564 | 0.0964 | |

| 0.00 | 0.29 | 0.1114 | 0.0371 | |

| 0.00 | 0.28 | 0.1126 | 0.0350 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.23 | 0.4942 | -3.2498 | |

| 0.00 | 1.17 | 0.4689 | -3.1678 | |

| 0.01 | 1.48 | 0.5932 | -3.0063 | |

| 0.00 | 0.44 | 0.1781 | -2.1245 | |

| 0.00 | 0.47 | 0.1910 | -2.1030 | |

| 0.00 | 0.62 | 0.2509 | -2.0385 | |

| 0.00 | 0.33 | 0.1256 | -1.9715 | |

| 0.00 | 0.29 | 0.1110 | -1.7560 | |

| 0.00 | 0.31 | 0.1251 | -1.6970 | |

| 0.00 | 0.35 | 0.1364 | -1.6709 |

13F and Fund Filings

This form was filed on 2022-07-20 for the reporting period 2022-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.37 | 92.61 | 141.65 | 60.96 | 56.9630 | 34.4896 | |||

| SPY / SPDR S&P 500 ETF | 0.24 | 89.34 | 35.9289 | 35.9289 | |||||

| AAPL / Apple Inc. | 0.01 | -86.64 | 1.48 | -89.54 | 0.5932 | -3.0063 | |||

| MSFT / Microsoft Corporation | 0.00 | -89.94 | 1.23 | -91.62 | 0.4942 | -3.2498 | |||

| GOOGL / Alphabet Inc. | 0.00 | -89.55 | 1.17 | -91.81 | 0.4689 | -3.1678 | |||

| HSY / The Hershey Company | 0.00 | -0.39 | 0.94 | -1.06 | 0.3768 | 0.1350 | |||

| ABBV / AbbVie Inc. | 0.00 | -92.63 | 0.62 | -93.04 | 0.2509 | -2.0385 | |||

| AVGO / Broadcom Inc. | 0.00 | -90.24 | 0.51 | -92.47 | 0.1948 | -1.5236 | |||

| PFE / Pfizer Inc. | 0.01 | -92.51 | 0.48 | -92.42 | 0.1934 | -1.4261 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -94.25 | 0.47 | -94.71 | 0.1910 | -2.1030 | |||

| VZ / Verizon Communications Inc. | 0.01 | -93.63 | 0.45 | -93.66 | 0.1806 | -1.6270 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -94.12 | 0.44 | -95.09 | 0.1781 | -2.1245 | |||

| PG / The Procter & Gamble Company | 0.00 | -92.55 | 0.40 | -92.99 | 0.1596 | -1.2873 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 4,983.33 | 0.39 | 65.53 | 0.1564 | 0.0964 | |||

| CVX / Chevron Corporation | 0.00 | -92.09 | 0.38 | -92.96 | 0.1536 | -1.2325 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -94.11 | 0.35 | -94.98 | 0.1364 | -1.6709 | |||

| MS / Morgan Stanley | 0.00 | -93.87 | 0.35 | -94.67 | 0.1403 | -1.5326 | |||

| V / Visa Inc. | 0.00 | -94.03 | 0.35 | -94.70 | 0.1329 | -1.5334 | |||

| TSN / Tyson Foods, Inc. | 0.00 | -93.36 | 0.33 | -93.63 | 0.1279 | -1.2069 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -95.39 | 0.33 | -96.02 | 0.1256 | -1.9715 | |||

| CAT / Caterpillar Inc. | 0.00 | -93.39 | 0.32 | -94.70 | 0.1283 | -1.4075 | |||

| PXD / Pioneer Natural Resources Company | 0.00 | -93.82 | 0.31 | -94.49 | 0.1263 | -1.3301 | |||

| ANTM / Anthem Inc | 0.00 | -95.57 | 0.31 | -95.64 | 0.1251 | -1.6970 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | -92.59 | 0.31 | -92.80 | 0.1231 | -0.9620 | |||

| AMJ / JPMorgan Alerian MLP Index ETN - Corporate Bond/Note | 0.00 | -94.14 | 0.30 | -95.15 | 0.1168 | -1.4839 | |||

| KLAC / KLA Corporation | 0.00 | -93.64 | 0.30 | -94.46 | 0.1145 | -1.2581 | |||

| CBOE / Cboe Global Markets, Inc. | 0.00 | -94.85 | 0.30 | -94.91 | 0.1194 | -1.3696 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.29 | -0.34 | 0.1114 | 0.0371 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | -95.72 | 0.29 | -96.05 | 0.1110 | -1.7560 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -94.10 | 0.29 | -95.49 | 0.1158 | -1.5150 | |||

| ABT / Abbott Laboratories | 0.00 | -94.14 | 0.28 | -94.63 | 0.1126 | -1.2192 | |||

| NVDA / NVIDIA Corporation | 0.00 | 65.98 | 0.28 | -7.89 | 0.1126 | 0.0350 | |||

| RF / Regions Financial Corporation | 0.01 | -93.43 | 0.28 | -94.48 | 0.1122 | -1.1777 | |||

| ORCL / Oracle Corporation | 0.00 | -94.23 | 0.27 | -95.12 | 0.1082 | -1.2982 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.00 | -94.55 | 0.26 | -95.78 | 0.1046 | -1.4670 | |||

| CVS / CVS Health Corporation | 0.00 | -92.87 | 0.26 | -93.48 | 0.1038 | -0.9062 | |||

| RHI / Robert Half Inc. | 0.00 | -92.88 | 0.26 | -95.32 | 0.1038 | -1.3054 | |||

| NKE / NIKE, Inc. | 0.00 | -94.07 | 0.26 | -95.49 | 0.1038 | -1.3567 | |||

| UNP / Union Pacific Corporation | 0.00 | -94.69 | 0.26 | -95.85 | 0.1025 | -1.4682 | |||

| NTAP / NetApp, Inc. | 0.00 | -93.85 | 0.24 | -95.18 | 0.0985 | -1.1982 | |||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.00 | -93.28 | 0.23 | -93.84 | 0.0895 | -0.8771 | |||

| INTU / Intuit Inc. | 0.00 | -92.82 | 0.23 | -94.24 | 0.0933 | -0.9348 | |||

| EXR / Extra Space Storage Inc. | 0.00 | -94.03 | 0.23 | -95.05 | 0.0933 | -1.1036 | |||

| KR / The Kroger Co. | 0.00 | -94.14 | 0.23 | -95.16 | 0.0929 | -1.1247 | |||

| ZION / Zions Bancorporation, National Association | 0.00 | -93.97 | 0.22 | -95.33 | 0.0873 | -1.0982 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.01 | -94.00 | 0.21 | -95.33 | 0.0840 | -1.0592 | |||

| META / Meta Platforms, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0695 | ||||

| LRCX / Lam Research Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8938 | ||||

| RSG / Republic Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9559 | ||||

| HCC / Warrior Met Coal, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0470 | ||||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8389 | ||||

| CE / Celanese Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9661 | ||||

| NLOK / NortonLifeLock Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.7526 | ||||

| IRM / Iron Mountain Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.8443 | ||||

| MOS / The Mosaic Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.0008 | ||||

| GM / General Motors Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.7255 | ||||

| WFC / Wells Fargo & Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.2209 | ||||

| GAFFX / Growth Fund Of America - Growth Fund of America - Class F-3 | 0.00 | -100.00 | 0.00 | -100.00 | -0.6915 | ||||

| DHI / D.R. Horton, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6989 |