Basic Stats

| Insider Profile | Steamboat Capital Partners, LLC |

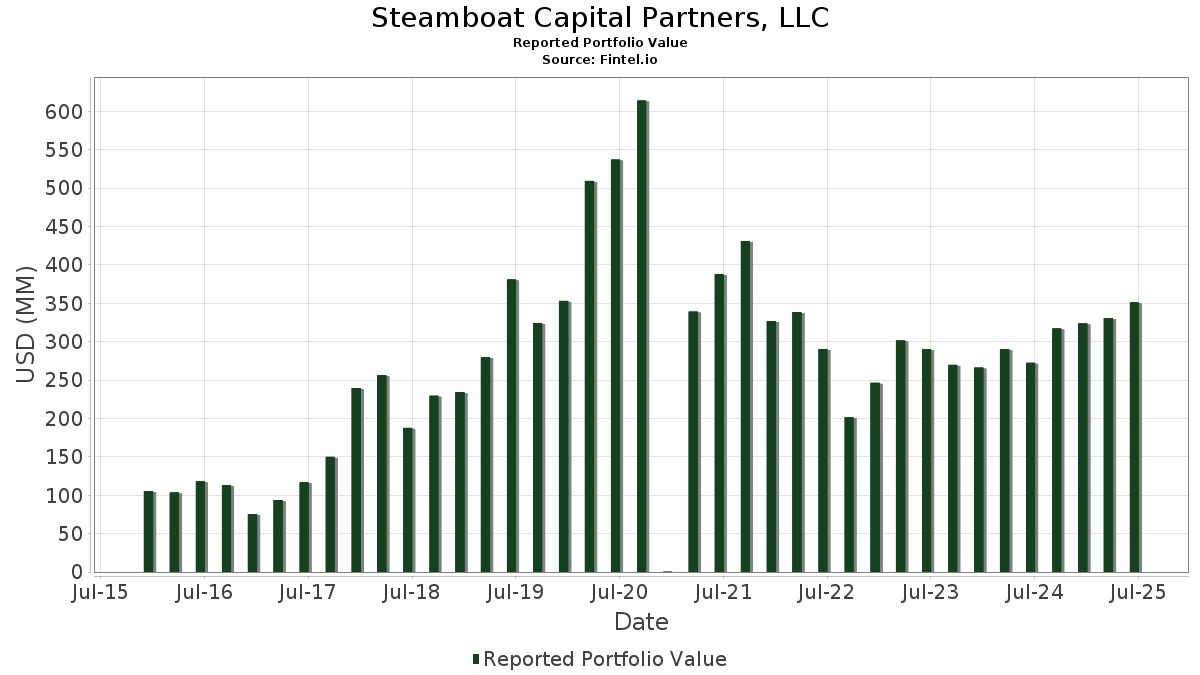

| Portfolio Value | $ 351,186,664 |

| Current Positions | 58 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Steamboat Capital Partners, LLC has disclosed 58 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 351,186,664 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Steamboat Capital Partners, LLC’s top holdings are ACM Research, Inc. (US:ACMR) , Priority Technology Holdings, Inc. (US:PRTH) , AerCap Holdings N.V. (US:AER) , Meta Platforms, Inc. (US:META) , and Apollo Global Management, Inc. (US:APO) . Steamboat Capital Partners, LLC’s new positions include Phillips 66 (US:PSX) , Hallador Energy Company (US:HNRG) , Core Scientific, Inc. (US:CORZ) , OraSure Technologies, Inc. (US:OSUR) , and Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) . Steamboat Capital Partners, LLC’s top industries are "Transportation Equipment" (sic 37) , "Insurance Carriers" (sic 63) , and "Transportation Services" (sic 47) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.15 | 11.74 | 3.3415 | 3.3415 | |

| 0.10 | 11.66 | 3.3204 | 3.3204 | |

| 0.39 | 6.19 | 1.7631 | 1.7631 | |

| 1.47 | 12.24 | 3.4852 | 1.4588 | |

| 0.29 | 5.01 | 1.4280 | 1.4280 | |

| 1.59 | 4.78 | 1.3609 | 1.3609 | |

| 0.02 | 4.44 | 1.2630 | 1.2630 | |

| 0.05 | 9.85 | 2.8047 | 1.1606 | |

| 0.58 | 15.02 | 4.2773 | 0.9242 | |

| 0.39 | 4.65 | 1.3239 | 0.7612 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 8.46 | 2.4080 | -2.2673 | |

| 0.01 | 3.25 | 0.9262 | -2.0600 | |

| 0.06 | 10.44 | 2.9740 | -1.7512 | |

| 0.05 | 8.65 | 2.4627 | -1.5855 | |

| 0.39 | 5.54 | 1.5786 | -1.0671 | |

| 0.09 | 12.52 | 3.5650 | -0.9909 | |

| 1.85 | 14.38 | 4.0961 | -0.8508 | |

| 0.20 | 11.04 | 3.1438 | -0.7949 | |

| 0.04 | 12.19 | 3.4713 | -0.5799 | |

| 0.04 | 9.38 | 2.6720 | -0.5547 |

13D/G Filings

This is a list of 13D and 13G filings made in the last year (if any). Click the link icon to see the full transaction history. Green rows indicate new positions. Red rows indicate closed positions.

| File Date | Form | Security | Prev Shares |

Current Shares |

ΔShares % | % Ownership |

% ΔOwnership | |

|---|---|---|---|---|---|---|---|---|

| 2024-11-14 | CMPO / CompoSecure, Inc. | 1,400,000 | 2,037,227 | 45.52 | 2.50 | -63.24 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ACMR / ACM Research, Inc. | 0.58 | 22.10 | 15.02 | 35.50 | 4.2773 | 0.9242 | |||

| PRTH / Priority Technology Holdings, Inc. | 1.85 | -22.96 | 14.38 | -12.06 | 4.0961 | -0.8508 | |||

| AER / AerCap Holdings N.V. | 0.12 | -9.61 | 13.75 | 3.51 | 3.9148 | -0.1024 | |||

| META / Meta Platforms, Inc. | 0.02 | -25.34 | 12.67 | -4.40 | 3.6088 | -0.4006 | |||

| APO / Apollo Global Management, Inc. | 0.09 | -19.77 | 12.52 | -16.89 | 3.5650 | -0.9909 | |||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1.47 | 47.46 | 12.24 | 82.67 | 3.4852 | 1.4588 | |||

| AVGO / Broadcom Inc. | 0.04 | -44.72 | 12.19 | -8.99 | 3.4713 | -0.5799 | |||

| TMHC / Taylor Morrison Home Corporation | 0.20 | -1.76 | 12.07 | 0.50 | 3.4364 | -0.1954 | |||

| GPN / Global Payments Inc. | 0.15 | 11.74 | 3.3415 | 3.3415 | |||||

| PSX / Phillips 66 | 0.10 | 11.66 | 3.3204 | 3.3204 | |||||

| EQH / Equitable Holdings, Inc. | 0.20 | -21.28 | 11.04 | -15.22 | 3.1438 | -0.7949 | |||

| GOOG / Alphabet Inc. | 0.06 | -41.12 | 10.44 | -33.15 | 2.9740 | -1.7512 | |||

| GPOR / Gulfport Energy Corporation | 0.05 | 65.86 | 9.85 | 81.21 | 2.8047 | 1.1606 | |||

| TMUS / T-Mobile US, Inc. | 0.04 | -1.54 | 9.38 | -12.05 | 2.6720 | -0.5547 | |||

| HALO / Halozyme Therapeutics, Inc. | 0.17 | 14.33 | 8.92 | -6.79 | 2.5404 | -0.3546 | |||

| THC / Tenet Healthcare Corporation | 0.05 | -50.62 | 8.65 | -35.39 | 2.4627 | -1.5855 | |||

| PM / Philip Morris International Inc. | 0.05 | -1.79 | 8.58 | 12.69 | 2.4430 | 0.1403 | |||

| FI / Fiserv, Inc. | 0.05 | -29.93 | 8.46 | -45.30 | 2.4080 | -2.2673 | |||

| MSFT / Microsoft Corporation | 0.02 | -1.74 | 7.86 | 30.20 | 2.2380 | 0.4122 | |||

| VCTR / Victory Capital Holdings, Inc. | 0.11 | -1.72 | 7.17 | 8.14 | 2.0428 | 0.0362 | |||

| SLM / SLM Corporation | 0.20 | -21.31 | 6.45 | -12.15 | 1.8367 | -0.3840 | |||

| IAC / IAC Inc. | 0.17 | 15.71 | 6.39 | -5.96 | 1.8197 | -0.2355 | |||

| MHO / M/I Homes, Inc. | 0.06 | -1.73 | 6.23 | -3.50 | 1.7731 | -0.1785 | |||

| HNRG / Hallador Energy Company | 0.39 | 6.19 | 1.7631 | 1.7631 | |||||

| DELL / Dell Technologies Inc. | 0.05 | -34.57 | 6.05 | -12.00 | 1.7214 | -0.3563 | |||

| IESC / IES Holdings, Inc. | 0.02 | -1.86 | 5.70 | 76.07 | 1.6242 | 0.6445 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -1.48 | 5.56 | 13.60 | 1.5820 | 0.1029 | |||

| CMPO / CompoSecure, Inc. | 0.39 | -51.11 | 5.54 | -36.63 | 1.5786 | -1.0671 | |||

| SN / SharkNinja, Inc. | 0.05 | -1.73 | 5.04 | 16.64 | 1.4352 | 0.1281 | |||

| CORZ / Core Scientific, Inc. | 0.29 | 5.01 | 1.4280 | 1.4280 | |||||

| TLN / Talen Energy Corporation | 0.02 | -1.88 | 4.85 | 42.91 | 1.3801 | 0.3542 | |||

| OSUR / OraSure Technologies, Inc. | 1.59 | 4.78 | 1.3609 | 1.3609 | |||||

| GAMB / Gambling.com Group Limited | 0.39 | 165.25 | 4.65 | 149.95 | 1.3239 | 0.7612 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 104.90 | 4.45 | 125.30 | 1.2678 | 0.6700 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | 4.44 | 1.2630 | 1.2630 | |||||

| ACGL / Arch Capital Group Ltd. | 0.05 | -1.81 | 4.40 | -7.04 | 1.2519 | -0.1786 | |||

| VST / Vistra Corp. | 0.02 | -1.88 | 3.74 | 61.92 | 1.0643 | 0.3662 | |||

| BX / Blackstone Inc. | 0.02 | -1.73 | 3.46 | 5.17 | 0.9844 | -0.0099 | |||

| CENX / Century Aluminum Company | 0.19 | -1.84 | 3.45 | -4.70 | 0.9820 | -0.1125 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | -1.74 | 3.44 | -6.53 | 0.9789 | -0.1335 | |||

| CRH / CRH plc | 0.04 | -1.73 | 3.37 | 2.56 | 0.9599 | -0.0344 | |||

| CI / The Cigna Group | 0.01 | -67.21 | 3.25 | -67.06 | 0.9262 | -2.0600 | |||

| NRG / NRG Energy, Inc. | 0.02 | 70.68 | 3.16 | 187.18 | 0.8995 | 0.5668 | |||

| LAD / Lithia Motors, Inc. | 0.01 | -1.74 | 3.14 | 13.09 | 0.8934 | 0.0543 | |||

| DAL / Delta Air Lines, Inc. | 0.06 | -1.86 | 3.14 | 10.69 | 0.8933 | 0.0361 | |||

| MU / Micron Technology, Inc. | 0.02 | -1.56 | 2.39 | 39.67 | 0.6798 | 0.1627 | |||

| TIPT / Tiptree Inc. | 0.09 | -1.72 | 2.18 | -3.79 | 0.6217 | -0.0647 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.02 | 228.91 | 2.14 | 182.32 | 0.6095 | 0.3800 | |||

| GFF / Griffon Corporation | 0.03 | -1.88 | 2.09 | -0.67 | 0.5946 | -0.0414 | |||

| PSFE / Paysafe Limited | 0.12 | 50.87 | 1.54 | 21.32 | 0.4392 | 0.0548 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.05 | -1.81 | 1.53 | -22.06 | 0.4367 | -0.1584 | |||

| HOV / Hovnanian Enterprises, Inc. | 0.01 | -1.92 | 1.26 | -2.02 | 0.3586 | -0.0303 | |||

| CMPOW / CompoSecure, Inc. - Equity Warrant | 0.19 | -6.17 | 1.17 | 53.40 | 0.3340 | 0.1029 | |||

| KSPI / Joint Stock Company Kaspi.kz - Depositary Receipt (Common Stock) | 0.01 | -1.66 | 0.76 | -10.06 | 0.2166 | -0.0393 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.73 | -8.77 | 0.2075 | -0.0340 | |||

| NRDS / NerdWallet, Inc. | 0.04 | 0.00 | 0.44 | 20.99 | 0.1249 | 0.0155 | |||

| SARO / StandardAero, Inc. | 0.01 | -1.87 | 0.30 | 16.47 | 0.0848 | 0.0075 | |||

| CRON / Cronos Group Inc. | 0.10 | 0.19 | 0.0544 | 0.0544 | |||||

| WFRD / Weatherford International plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CEG / Constellation Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SSTK / Shutterstock, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LOGC / ContextLogic Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |