Basic Stats

| Portfolio Value | $ 594,314,614 |

| Current Positions | 38 |

Latest Holdings, Performance, AUM (from 13F, 13D)

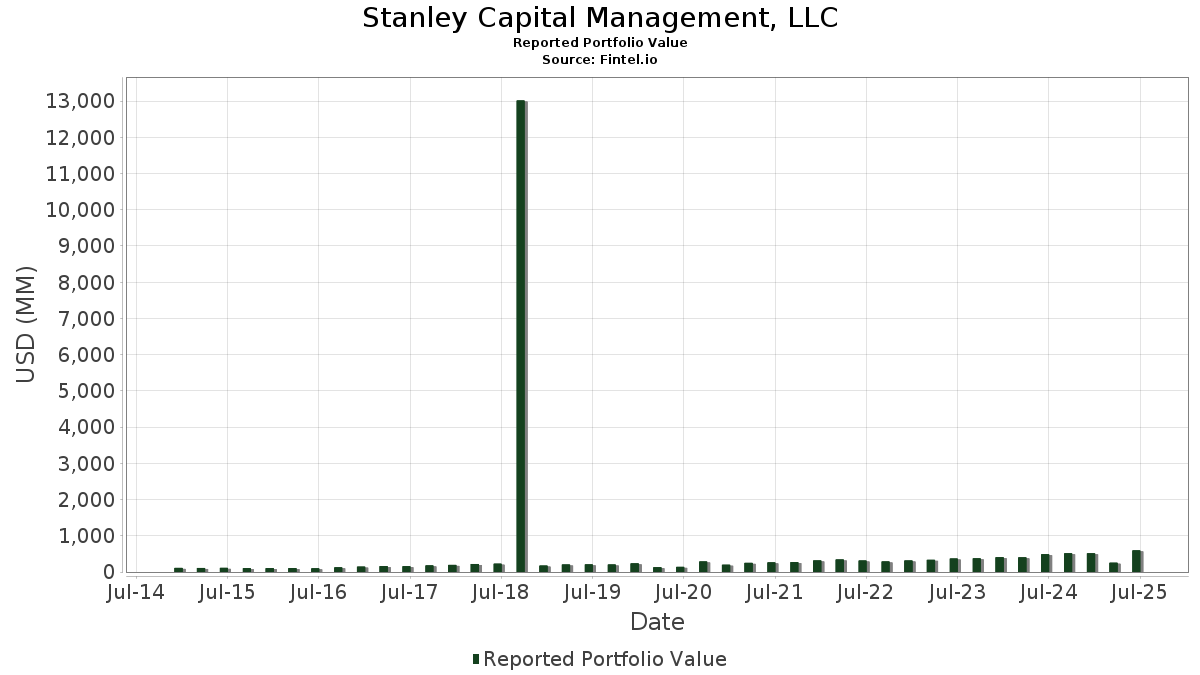

Stanley Capital Management, LLC has disclosed 38 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 594,314,614 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Stanley Capital Management, LLC’s top holdings are Vertiv Holdings Co (US:VRT) , Meta Platforms, Inc. (US:META) , Oracle Corporation (US:ORCL) , Corpay, Inc. (US:CPAY) , and Corteva, Inc. (US:CTVA) . Stanley Capital Management, LLC’s new positions include Regal Rexnord Corporation (US:RRX) , Marvell Technology, Inc. (US:MRVL) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.36 | 46.23 | 7.7237 | 4.0451 | |

| 0.13 | 19.37 | 3.2587 | 3.2587 | |

| 0.13 | 9.91 | 1.6670 | 1.6670 | |

| 0.13 | 29.47 | 4.9241 | 1.2166 | |

| 0.41 | 9.92 | 1.6579 | 0.7569 | |

| 0.30 | 12.38 | 2.0678 | 0.5494 | |

| 0.11 | 19.73 | 3.2973 | 0.4482 | |

| 0.04 | 32.40 | 5.4138 | 0.4362 | |

| 0.03 | 14.94 | 2.4958 | 0.3520 | |

| 0.07 | 12.12 | 2.0258 | 0.2370 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.84 | 10.55 | 1.7626 | -2.5047 | |

| 0.05 | 21.05 | 3.5171 | -1.8838 | |

| 0.14 | 23.37 | 3.9326 | -1.5220 | |

| 2.78 | 15.74 | 2.6298 | -0.9876 | |

| 0.33 | 18.02 | 3.0102 | -0.9539 | |

| 0.16 | 12.94 | 2.1612 | -0.6437 | |

| 0.38 | 10.87 | 1.8154 | -0.5580 | |

| 0.95 | 15.05 | 2.5147 | -0.5304 | |

| 0.06 | 7.69 | 1.2856 | -0.4757 | |

| 0.95 | 4.28 | 0.7145 | -0.4165 |

13F and Fund Filings

This form was filed on 2025-08-13 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VRT / Vertiv Holdings Co | 0.36 | 39.00 | 46.23 | 147.22 | 7.7237 | 4.0451 | |||

| META / Meta Platforms, Inc. | 0.04 | 0.00 | 32.40 | 28.06 | 5.4138 | 0.4362 | |||

| ORCL / Oracle Corporation | 0.13 | 0.00 | 29.47 | 56.38 | 4.9241 | 1.2166 | |||

| CPAY / Corpay, Inc. | 0.08 | 14.33 | 26.48 | 8.78 | 4.4236 | -0.3641 | |||

| CTVA / Corteva, Inc. | 0.34 | 0.00 | 25.47 | 18.43 | 4.2550 | 0.0249 | |||

| MCK / McKesson Corporation | 0.03 | 0.00 | 24.55 | 8.88 | 4.1015 | -0.3336 | |||

| FI / Fiserv, Inc. | 0.14 | 7.96 | 23.37 | -15.71 | 3.9326 | -1.5220 | |||

| ELV / Elevance Health, Inc. | 0.05 | -14.26 | 21.05 | -23.33 | 3.5171 | -1.8838 | |||

| VNT / Vontier Corporation | 0.54 | 0.00 | 19.78 | 12.33 | 3.3046 | -0.1592 | |||

| AMAT / Applied Materials, Inc. | 0.11 | 8.02 | 19.73 | 36.27 | 3.2973 | 0.4482 | |||

| RRX / Regal Rexnord Corporation | 0.13 | 19.37 | 3.2587 | 3.2587 | |||||

| CNC / Centene Corporation | 0.33 | 0.00 | 18.02 | -10.59 | 3.0102 | -0.9539 | |||

| AVTR / Avantor, Inc. | 1.32 | 32.05 | 17.75 | 9.65 | 2.9652 | -0.2189 | |||

| EXPE / Expedia Group, Inc. | 0.10 | 24.50 | 17.14 | 24.92 | 2.8643 | 0.1648 | |||

| BAC / Bank of America Corporation | 0.34 | -6.01 | 16.28 | 6.58 | 2.7209 | -0.2849 | |||

| ALIT / Alight, Inc. | 2.78 | -10.32 | 15.74 | -14.40 | 2.6298 | -0.9876 | |||

| AXP / American Express Company | 0.05 | 0.00 | 15.58 | 18.56 | 2.6208 | 0.0363 | |||

| BRSL / Brightstar Lottery PLC | 0.95 | 0.00 | 15.05 | -2.77 | 2.5147 | -0.5304 | |||

| WAL / Western Alliance Bancorporation | 0.19 | 0.00 | 14.97 | 1.50 | 2.5016 | -0.4004 | |||

| ULTA / Ulta Beauty, Inc. | 0.03 | 7.40 | 14.94 | 37.07 | 2.4958 | 0.3520 | |||

| ACM / AECOM | 0.12 | 0.00 | 13.14 | 21.71 | 2.1949 | 0.0715 | |||

| GPN / Global Payments Inc. | 0.16 | 10.99 | 12.94 | -9.27 | 2.1612 | -0.6437 | |||

| RHI / Robert Half Inc. | 0.30 | 113.08 | 12.38 | 60.35 | 2.0678 | 0.5494 | |||

| GOOGL / Alphabet Inc. | 0.07 | 17.01 | 12.12 | 33.35 | 2.0258 | 0.2370 | |||

| QDEL / QuidelOrtho Corporation | 0.38 | 9.28 | 10.87 | -9.94 | 1.8154 | -0.5580 | |||

| VSTS / Vestis Corporation | 1.84 | -15.97 | 10.55 | -51.37 | 1.7626 | -2.5047 | |||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 0.41 | 106.72 | 9.92 | 116.64 | 1.6579 | 0.7569 | |||

| MRVL / Marvell Technology, Inc. | 0.13 | 9.91 | 1.6670 | 1.6670 | |||||

| ARMK / Aramark | 0.23 | 0.00 | 9.82 | 21.29 | 1.6412 | 0.0480 | |||

| CMCO / Columbus McKinnon Corporation | 0.55 | 4.76 | 8.40 | -5.51 | 1.4032 | -0.3453 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 8.01 | 20.93 | 1.3390 | 0.0354 | |||

| MCO / Moody's Corporation | 0.02 | 0.00 | 7.90 | 7.71 | 1.3206 | -0.1230 | |||

| FANG / Diamondback Energy, Inc. | 0.06 | 0.00 | 7.69 | -14.06 | 1.2856 | -0.4757 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 7.31 | 32.51 | 1.2213 | 0.1361 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.22 | 0.00 | 6.43 | -10.50 | 1.0745 | -0.3389 | |||

| PRM / Perimeter Solutions, Inc. | 0.35 | 0.00 | 4.86 | 38.25 | 0.8117 | 0.1203 | |||

| GOOG / Alphabet Inc. | 0.02 | 0.00 | 4.43 | 13.54 | 0.7398 | -0.0273 | |||

| STGW / Stagwell Inc. | 0.95 | 0.00 | 4.28 | -25.62 | 0.7145 | -0.4165 |