Basic Stats

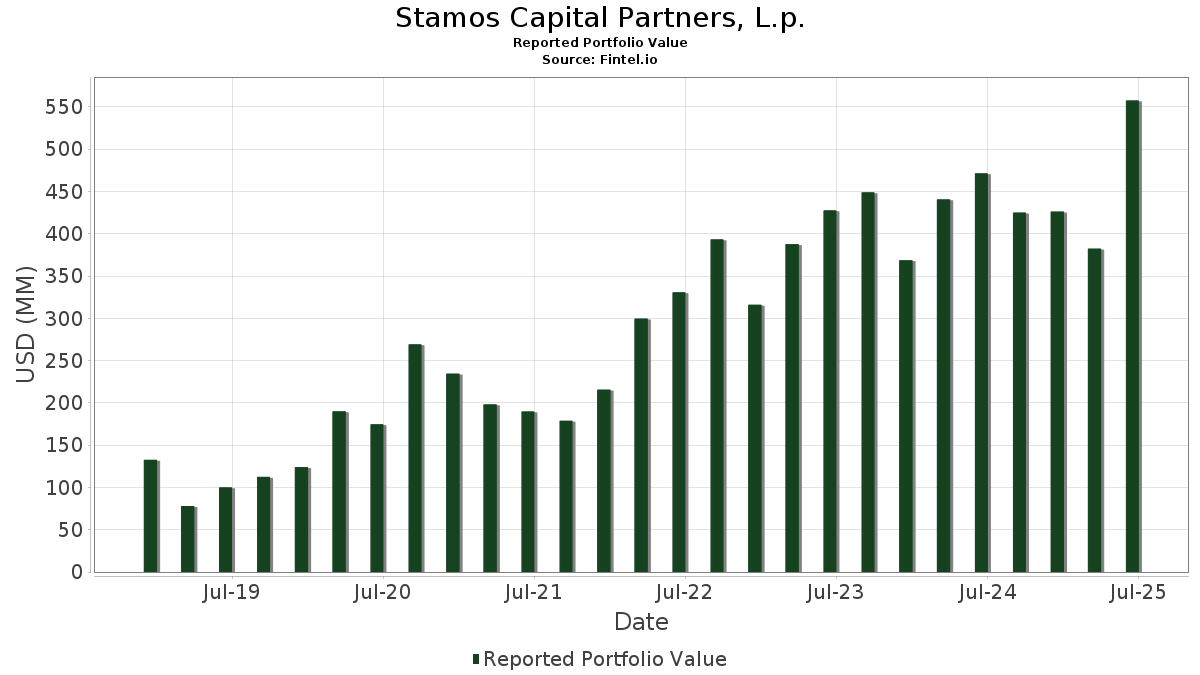

| Portfolio Value | $ 557,486,482 |

| Current Positions | 138 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Stamos Capital Partners, L.p. has disclosed 138 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 557,486,482 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Stamos Capital Partners, L.p.’s top holdings are iShares Trust - iShares Core U.S. Aggregate Bond ETF (US:AGG) , Merck & Co., Inc. (US:MRK) , Exxon Mobil Corporation (US:XOM) , UnitedHealth Group Incorporated (US:UNH) , and Chevron Corporation (US:CVX) . Stamos Capital Partners, L.p.’s new positions include iShares Trust - iShares MSCI India ETF (US:INDA) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 17.59 | 3.1556 | 1.5292 | |

| 0.16 | 17.70 | 3.1746 | 0.9996 | |

| 0.07 | 13.20 | 2.3681 | 0.8006 | |

| 0.11 | 15.62 | 2.8011 | 0.6298 | |

| 0.23 | 17.96 | 3.2219 | 0.5399 | |

| 0.08 | 5.78 | 1.0372 | 0.4485 | |

| 0.03 | 7.05 | 1.2646 | 0.4226 | |

| 0.03 | 8.84 | 1.5864 | 0.4049 | |

| 0.48 | 14.33 | 2.5697 | 0.3991 | |

| 0.02 | 9.57 | 1.7161 | 0.3947 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.48 | 48.06 | 8.6201 | -8.4163 | |

| 0.12 | 5.20 | 0.9322 | -0.2455 | |

| 0.35 | 8.49 | 1.5235 | -0.2372 | |

| 0.00 | 0.00 | -0.2093 | ||

| 0.19 | 7.14 | 1.2811 | -0.1920 | |

| 0.06 | 3.97 | 0.7116 | -0.1896 | |

| 0.03 | 1.99 | 0.3572 | -0.1671 | |

| 0.01 | 2.01 | 0.3614 | -0.1630 | |

| 0.04 | 2.02 | 0.3618 | -0.1617 | |

| 0.03 | 2.01 | 0.3609 | -0.1614 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.48 | -26.43 | 48.06 | -26.22 | 8.6201 | -8.4163 | |||

| MRK / Merck & Co., Inc. | 0.23 | 98.63 | 17.96 | 75.18 | 3.2219 | 0.5399 | |||

| XOM / Exxon Mobil Corporation | 0.16 | 134.81 | 17.70 | 112.83 | 3.1746 | 0.9996 | |||

| UNH / UnitedHealth Group Incorporated | 0.06 | 374.98 | 17.59 | 182.95 | 3.1556 | 1.5292 | |||

| CVX / Chevron Corporation | 0.11 | 119.78 | 15.62 | 88.13 | 2.8011 | 0.6298 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.48 | 94.89 | 14.33 | 72.63 | 2.5697 | 0.3991 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.19 | 69.29 | 13.54 | 62.67 | 2.4292 | 0.2515 | |||

| GOOGL / Alphabet Inc. | 0.07 | 93.31 | 13.20 | 120.31 | 2.3681 | 0.8006 | |||

| NEE / NextEra Energy, Inc. | 0.16 | 82.59 | 11.05 | 78.80 | 1.9818 | 0.3656 | |||

| JNJ / Johnson & Johnson | 0.07 | 58.73 | 9.94 | 46.21 | 1.7834 | 0.0046 | |||

| MSFT / Microsoft Corporation | 0.02 | 42.92 | 9.57 | 89.41 | 1.7161 | 0.3947 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | 26.58 | 9.07 | 72.71 | 1.6278 | 0.2534 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 65.66 | 8.84 | 95.81 | 1.5864 | 0.4049 | |||

| PFE / Pfizer Inc. | 0.35 | 31.90 | 8.49 | 26.18 | 1.5235 | -0.2372 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 60.23 | 8.20 | 84.75 | 1.4715 | 0.3101 | |||

| BAC / Bank of America Corporation | 0.16 | 46.84 | 7.52 | 66.52 | 1.3480 | 0.1675 | |||

| TM / Toyota Motor Corporation - Depositary Receipt (Common Stock) | 0.04 | 93.36 | 7.25 | 88.68 | 1.3011 | 0.2955 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 27.64 | 7.18 | 54.36 | 1.2873 | 0.0712 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.19 | 27.94 | 7.14 | 26.83 | 1.2811 | -0.1920 | |||

| AAPL / Apple Inc. | 0.03 | 137.12 | 7.05 | 119.05 | 1.2646 | 0.4226 | |||

| F / Ford Motor Company | 0.60 | 25.66 | 6.46 | 35.94 | 1.1583 | -0.0843 | |||

| BA / The Boeing Company | 0.03 | 46.72 | 6.45 | 80.25 | 1.1577 | 0.2211 | |||

| T / AT&T Inc. | 0.21 | 41.37 | 6.20 | 44.67 | 1.1125 | -0.0089 | |||

| BLK / BlackRock, Inc. | 0.01 | 21.91 | 6.06 | 35.16 | 1.0862 | -0.0858 | |||

| AMD / Advanced Micro Devices, Inc. | 0.04 | 12.84 | 5.79 | 55.88 | 1.0388 | 0.0669 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.08 | 158.46 | 5.78 | 156.98 | 1.0372 | 0.4485 | |||

| BN / Brookfield Corporation | 0.09 | 60.22 | 5.71 | 89.08 | 1.0247 | 0.2344 | |||

| MDT / Medtronic plc | 0.06 | 29.70 | 5.30 | 25.83 | 0.9508 | -0.1512 | |||

| VZ / Verizon Communications Inc. | 0.12 | 21.00 | 5.20 | 15.42 | 0.9322 | -0.2455 | |||

| DHI / D.R. Horton, Inc. | 0.04 | 61.78 | 4.89 | 64.07 | 0.8765 | 0.0974 | |||

| LEN / Lennar Corporation | 0.04 | 69.91 | 4.86 | 63.76 | 0.8723 | 0.0955 | |||

| TOL / Toll Brothers, Inc. | 0.04 | 51.15 | 4.83 | 63.37 | 0.8658 | 0.0930 | |||

| CNI / Canadian National Railway Company | 0.05 | 29.31 | 4.74 | 38.04 | 0.8502 | -0.0479 | |||

| BX / Blackstone Inc. | 0.03 | 59.26 | 4.72 | 70.41 | 0.8472 | 0.1223 | |||

| AVGO / Broadcom Inc. | 0.02 | -10.45 | 4.72 | 47.45 | 0.8462 | 0.0092 | |||

| NVDA / NVIDIA Corporation | 0.03 | 13.77 | 4.51 | 65.85 | 0.8092 | 0.0977 | |||

| SLB / Schlumberger Limited | 0.13 | 121.37 | 4.50 | 79.01 | 0.8077 | 0.1497 | |||

| ADBE / Adobe Inc. | 0.01 | 93.67 | 4.33 | 95.40 | 0.7768 | 0.1970 | |||

| V / Visa Inc. | 0.01 | 60.96 | 4.25 | 63.08 | 0.7630 | 0.0807 | |||

| LLY / Eli Lilly and Company | 0.01 | 96.14 | 4.20 | 85.09 | 0.7528 | 0.1598 | |||

| DIS / The Walt Disney Company | 0.03 | 26.19 | 4.14 | 58.60 | 0.7428 | 0.0596 | |||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.22 | 14.88 | 4.11 | 39.03 | 0.7368 | -0.0359 | |||

| DELL / Dell Technologies Inc. | 0.03 | -5.57 | 4.09 | 27.00 | 0.7333 | -0.1086 | |||

| CEG / Constellation Energy Corporation | 0.01 | 12.21 | 4.00 | 79.63 | 0.7183 | 0.1352 | |||

| CVS / CVS Health Corporation | 0.06 | 13.09 | 3.97 | 15.15 | 0.7116 | -0.1896 | |||

| CP / Canadian Pacific Kansas City Limited | 0.05 | 48.89 | 3.87 | 68.13 | 0.6946 | 0.0921 | |||

| CRM / Salesforce, Inc. | 0.01 | 91.50 | 3.87 | 94.62 | 0.6945 | 0.1741 | |||

| MLPX / Global X Funds - Global X MLP & Energy Infrastructure ETF | 0.06 | 51.80 | 3.80 | 49.04 | 0.6816 | 0.0148 | |||

| CME / CME Group Inc. | 0.01 | 22.72 | 3.78 | 27.49 | 0.6789 | -0.0976 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.08 | 56.75 | 3.77 | 47.44 | 0.6769 | 0.0075 | |||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | 0.03 | 91.57 | 3.70 | 82.95 | 0.6640 | 0.1348 | |||

| UNP / Union Pacific Corporation | 0.02 | 55.94 | 3.67 | 51.90 | 0.6583 | 0.0262 | |||

| HSBC / HSBC Holdings plc - Depositary Receipt (Common Stock) | 0.06 | 17.36 | 3.66 | 24.24 | 0.6566 | -0.1142 | |||

| ENB / Enbridge Inc. | 0.08 | 45.56 | 3.64 | 48.92 | 0.6526 | 0.0134 | |||

| VST / Vistra Corp. | 0.02 | -6.53 | 3.44 | 54.28 | 0.6170 | 0.0338 | |||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.04 | 47.74 | 3.33 | 51.09 | 0.5975 | 0.0208 | |||

| HD / The Home Depot, Inc. | 0.01 | 276.31 | 3.21 | 276.64 | 0.5757 | 0.3527 | |||

| CCJ / Cameco Corporation | 0.04 | -18.98 | 3.08 | 46.11 | 0.5532 | 0.0011 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | 8.36 | 3.06 | 21.83 | 0.5497 | -0.1083 | |||

| CAT / Caterpillar Inc. | 0.01 | 17.50 | 3.03 | 38.30 | 0.5442 | -0.0296 | |||

| IYR / iShares Trust - iShares U.S. Real Estate ETF | 0.03 | 64.13 | 2.81 | 62.51 | 0.5032 | 0.0515 | |||

| USRT / iShares Trust - iShares Core U.S. REIT ETF | 0.05 | 63.88 | 2.78 | 60.94 | 0.4990 | 0.0468 | |||

| KMI / Kinder Morgan, Inc. | 0.09 | 33.35 | 2.68 | 37.40 | 0.4813 | -0.0295 | |||

| D / Dominion Energy, Inc. | 0.05 | 20.68 | 2.63 | 21.67 | 0.4714 | -0.0937 | |||

| SPG / Simon Property Group, Inc. | 0.02 | 67.72 | 2.62 | 62.37 | 0.4698 | 0.0478 | |||

| FSLR / First Solar, Inc. | 0.02 | 98.70 | 2.61 | 160.36 | 0.4689 | 0.2061 | |||

| PAVE / Global X Funds - Global X U.S. Infrastructure Development ETF | 0.06 | 31.53 | 2.44 | 51.90 | 0.4380 | 0.0176 | |||

| UBER / Uber Technologies, Inc. | 0.03 | -6.71 | 2.39 | 19.46 | 0.4296 | -0.0948 | |||

| SO / The Southern Company | 0.03 | 22.24 | 2.39 | 22.14 | 0.4286 | -0.0833 | |||

| UBS / UBS Group AG | 0.07 | 54.39 | 2.38 | 70.58 | 0.4275 | 0.0618 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.03 | 44.86 | 2.34 | 67.24 | 0.4195 | 0.0536 | |||

| AEP / American Electric Power Company, Inc. | 0.02 | 23.24 | 2.31 | 17.00 | 0.4138 | -0.1018 | |||

| DUK / Duke Energy Corporation | 0.02 | 20.50 | 2.29 | 16.58 | 0.4112 | -0.1031 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.09 | 66.73 | 2.23 | 70.97 | 0.3995 | 0.0587 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.04 | 29.05 | 2.21 | 46.10 | 0.3964 | 0.0009 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | 49.50 | 2.19 | 79.25 | 0.3921 | 0.0732 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 195.87 | 2.16 | 169.96 | 0.3870 | 0.1779 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.03 | 68.37 | 2.15 | 52.84 | 0.3861 | 0.0176 | |||

| DE / Deere & Company | 0.00 | 31.61 | 2.12 | 42.56 | 0.3798 | -0.0086 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.03 | 45.26 | 2.09 | 50.43 | 0.3746 | 0.0115 | |||

| EOG / EOG Resources, Inc. | 0.02 | 94.07 | 2.06 | 81.02 | 0.3695 | 0.0718 | |||

| COP / ConocoPhillips | 0.02 | 108.95 | 2.06 | 78.56 | 0.3690 | 0.0676 | |||

| OXY / Occidental Petroleum Corporation | 0.05 | 110.60 | 2.05 | 79.33 | 0.3674 | 0.0685 | |||

| GIS / General Mills, Inc. | 0.04 | 16.29 | 2.02 | 0.80 | 0.3618 | -0.1617 | |||

| PG / The Procter & Gamble Company | 0.01 | 7.51 | 2.01 | 0.50 | 0.3614 | -0.1630 | |||

| KO / The Coca-Cola Company | 0.03 | 2.01 | 2.01 | 0.80 | 0.3609 | -0.1614 | |||

| GE / General Electric Company | 0.01 | 56.29 | 2.01 | 101.00 | 0.3607 | 0.0990 | |||

| MDLZ / Mondelez International, Inc. | 0.03 | -0.06 | 1.99 | -0.65 | 0.3572 | -0.1671 | |||

| MA / Mastercard Incorporated | 0.00 | 34.69 | 1.94 | 38.12 | 0.3472 | -0.0195 | |||

| GEV / GE Vernova Inc. | 0.00 | 11.01 | 1.93 | 92.52 | 0.3464 | 0.0839 | |||

| MFC / Manulife Financial Corporation | 0.06 | 8.28 | 1.82 | 11.08 | 0.3273 | -0.1023 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 70.45 | 1.81 | 38.85 | 0.3252 | -0.0162 | |||

| EWY / iShares, Inc. - iShares MSCI South Korea ETF | 0.03 | 1.81 | 0.3242 | 0.3242 | |||||

| ARE / Alexandria Real Estate Equities, Inc. | 0.02 | 72.83 | 1.80 | 35.67 | 0.3235 | -0.0242 | |||

| GM / General Motors Company | 0.04 | 30.39 | 1.77 | 36.36 | 0.3177 | -0.0219 | |||

| NFLX / Netflix, Inc. | 0.00 | -6.21 | 1.76 | 34.69 | 0.3156 | -0.0261 | |||

| SNOW / Snowflake Inc. | 0.01 | -6.59 | 1.76 | 43.04 | 0.3154 | -0.0062 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | 43.99 | 1.69 | 51.57 | 0.3027 | 0.0114 | |||

| ETN / Eaton Corporation plc | 0.00 | 60.19 | 1.68 | 110.38 | 0.3020 | 0.0927 | |||

| XME / SPDR Series Trust - SPDR S&P Metals & Mining ETF | 0.02 | 26.42 | 1.65 | 51.71 | 0.2954 | 0.0116 | |||

| EQT / EQT Corporation | 0.03 | 34.85 | 1.65 | 47.14 | 0.2952 | 0.0028 | |||

| PICK / iShares, Inc. - iShares MSCI Global Metals & Mining Producers ETF | 0.04 | 50.42 | 1.55 | 57.58 | 0.2780 | 0.0208 | |||

| URA / Global X Funds - Global X Uranium ETF | 0.04 | -7.75 | 1.55 | 56.26 | 0.2775 | 0.0184 | |||

| FINX / Global X Funds - Global X FinTech ETF | 0.04 | 9.47 | 1.36 | 35.94 | 0.2436 | -0.0177 | |||

| IQV / IQVIA Holdings Inc. | 0.01 | 48.60 | 1.33 | 32.80 | 0.2391 | -0.0234 | |||

| MMM / 3M Company | 0.01 | 10.41 | 1.32 | 14.42 | 0.2364 | -0.0648 | |||

| GLD / SPDR Gold Trust | 0.00 | 39.90 | 1.31 | 48.08 | 0.2354 | 0.0035 | |||

| BXP / Boston Properties, Inc. | 0.02 | 29.83 | 1.30 | 30.46 | 0.2336 | -0.0277 | |||

| AMGN / Amgen Inc. | 0.00 | 12.16 | 1.16 | 0.52 | 0.2073 | -0.0934 | |||

| INDA / iShares Trust - iShares MSCI India ETF | 0.02 | 1.13 | 0.2031 | 0.2031 | |||||

| ADP / Automatic Data Processing, Inc. | 0.00 | 9.77 | 1.11 | 10.87 | 0.1995 | -0.0631 | |||

| HPQ / HP Inc. | 0.04 | 24.13 | 1.09 | 9.66 | 0.1956 | -0.0645 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -3.20 | 1.03 | 39.84 | 0.1852 | -0.0079 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 82.19 | 0.98 | 100.00 | 0.1765 | 0.0478 | |||

| KR / The Kroger Co. | 0.01 | 8.99 | 0.98 | 15.52 | 0.1750 | -0.0460 | |||

| IBM / International Business Machines Corporation | 0.00 | -6.57 | 0.95 | 10.76 | 0.1699 | -0.0538 | |||

| NUE / Nucor Corporation | 0.01 | 42.74 | 0.94 | 53.76 | 0.1689 | 0.0086 | |||

| SPGI / S&P Global Inc. | 0.00 | 39.07 | 0.87 | 44.19 | 0.1559 | -0.0016 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.77 | 0.85 | -0.35 | 0.1528 | -0.0707 | |||

| MCO / Moody's Corporation | 0.00 | 29.54 | 0.84 | 39.53 | 0.1507 | -0.0068 | |||

| WOOD / iShares Trust - iShares Global Timber & Forestry ETF | 0.01 | 67.01 | 0.80 | 62.35 | 0.1439 | 0.0147 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.02 | 63.20 | 0.80 | 61.82 | 0.1438 | 0.0141 | |||

| FCX / Freeport-McMoRan Inc. | 0.02 | 39.63 | 0.78 | 59.71 | 0.1403 | 0.0123 | |||

| MOO / VanEck ETF Trust - VanEck Agribusiness ETF | 0.01 | 43.65 | 0.78 | 55.89 | 0.1402 | 0.0090 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 21.97 | 0.78 | 29.78 | 0.1400 | -0.0174 | |||

| ADM / Archer-Daniels-Midland Company | 0.01 | 40.11 | 0.78 | 53.97 | 0.1393 | 0.0074 | |||

| CB / Chubb Limited | 0.00 | 32.18 | 0.76 | 26.83 | 0.1366 | -0.0205 | |||

| CG / The Carlyle Group Inc. | 0.01 | 61.81 | 0.76 | 90.66 | 0.1356 | 0.0320 | |||

| BAM / Brookfield Asset Management Ltd. | 0.01 | 68.47 | 0.75 | 92.58 | 0.1351 | 0.0326 | |||

| KKR / KKR & Co. Inc. | 0.01 | 65.15 | 0.75 | 90.08 | 0.1341 | 0.0312 | |||

| ARES / Ares Management Corporation | 0.00 | 55.59 | 0.75 | 83.99 | 0.1341 | 0.0277 | |||

| APO / Apollo Global Management, Inc. | 0.01 | 79.46 | 0.74 | 86.00 | 0.1336 | 0.0288 | |||

| TPG / TPG Inc. | 0.01 | 68.57 | 0.74 | 86.43 | 0.1331 | 0.0290 | |||

| WMT / Walmart Inc. | 0.01 | 23.60 | 0.69 | 37.57 | 0.1243 | -0.0074 | |||

| BWXT / BWX Technologies, Inc. | 0.00 | 4.29 | 0.61 | 52.25 | 0.1093 | 0.0046 | |||

| BEPC / Brookfield Renewable Corporation | 0.02 | 73.72 | 0.51 | 104.02 | 0.0911 | 0.0260 | |||

| BIPC / Brookfield Infrastructure Corporation | 0.01 | 71.99 | 0.50 | 97.63 | 0.0898 | 0.0236 | |||

| PHO / Invesco Exchange-Traded Fund Trust - Invesco Water Resources ETF | 0.01 | 45.56 | 0.40 | 57.94 | 0.0716 | 0.0054 | |||

| COST / Costco Wholesale Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2093 | ||||

| ENPH / Enphase Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |