Basic Stats

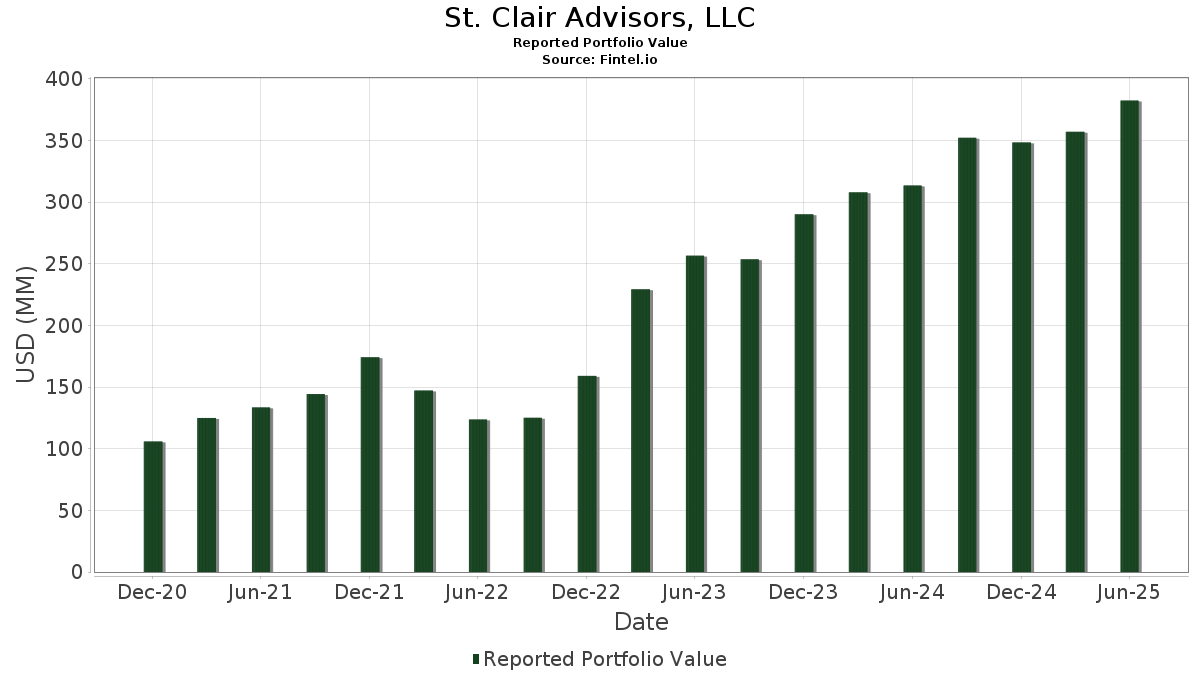

| Portfolio Value | $ 382,317,509 |

| Current Positions | 80 |

Latest Holdings, Performance, AUM (from 13F, 13D)

St. Clair Advisors, LLC has disclosed 80 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 382,317,509 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). St. Clair Advisors, LLC’s top holdings are iShares Trust - iShares Core S&P 500 ETF (US:IVV) , Microsoft Corporation (US:MSFT) , iShares Trust - iShares Select Dividend ETF (US:DVY) , iShares, Inc. - iShares Core MSCI Emerging Markets ETF (US:IEMG) , and The Progressive Corporation (US:PGR) . St. Clair Advisors, LLC’s new positions include Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF (US:VGSH) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 127.25 | 33.2838 | 1.8870 | |

| 0.05 | 26.91 | 7.0377 | 1.2604 | |

| 0.01 | 3.18 | 0.8326 | 0.3424 | |

| 0.01 | 4.94 | 1.2908 | 0.2405 | |

| 0.02 | 3.93 | 1.0277 | 0.1869 | |

| 0.14 | 8.18 | 2.1396 | 0.1525 | |

| 0.01 | 1.80 | 0.4701 | 0.1248 | |

| 0.02 | 4.81 | 1.2569 | 0.1215 | |

| 0.05 | 5.51 | 1.4412 | 0.1194 | |

| 0.02 | 3.23 | 0.8457 | 0.0929 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 26.00 | 6.8002 | -0.8790 | |

| 0.09 | 18.24 | 4.7718 | -0.8736 | |

| 0.07 | 18.62 | 4.8711 | -0.8383 | |

| 0.01 | 4.34 | 1.1359 | -0.2217 | |

| 0.02 | 3.20 | 0.8382 | -0.1811 | |

| 0.30 | 16.88 | 4.4159 | -0.1556 | |

| 0.02 | 3.71 | 0.9710 | -0.1413 | |

| 0.02 | 3.29 | 0.8601 | -0.1372 | |

| 0.02 | 3.34 | 0.8738 | -0.1220 | |

| 0.05 | 3.60 | 0.9404 | -0.0791 |

13F and Fund Filings

This form was filed on 2025-07-07 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.20 | 2.74 | 127.25 | 13.53 | 33.2838 | 1.8870 | |||

| MSFT / Microsoft Corporation | 0.05 | -1.55 | 26.91 | 30.45 | 7.0377 | 1.2604 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.20 | -4.11 | 26.00 | -5.17 | 6.8002 | -0.8790 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.32 | -4.44 | 19.26 | 6.29 | 5.0369 | -0.0379 | |||

| PGR / The Progressive Corporation | 0.07 | -3.10 | 18.62 | -8.63 | 4.8711 | -0.8383 | |||

| AAPL / Apple Inc. | 0.09 | -2.00 | 18.24 | -9.48 | 4.7718 | -0.8736 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.30 | 3.97 | 16.88 | 3.44 | 4.4159 | -0.1556 | |||

| GQRE / FlexShares Trust - FlexShares Global Quality Real Estate Index Fund | 0.14 | 12.02 | 8.18 | 15.31 | 2.1396 | 0.1525 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.07 | 1.10 | 6.15 | 11.56 | 1.6080 | 0.0645 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.05 | -1.55 | 5.51 | 16.77 | 1.4412 | 0.1194 | |||

| ETN / Eaton Corporation plc | 0.01 | 0.22 | 4.94 | 31.64 | 1.2908 | 0.2405 | |||

| IBM / International Business Machines Corporation | 0.02 | 0.00 | 4.81 | 18.55 | 1.2569 | 0.1215 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.01 | -19.06 | 4.34 | -10.40 | 1.1359 | -0.2217 | |||

| SYK / Stryker Corporation | 0.01 | -0.71 | 4.16 | 5.53 | 1.0884 | -0.0161 | |||

| GOOGL / Alphabet Inc. | 0.02 | 14.86 | 3.93 | 30.92 | 1.0277 | 0.1869 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | 0.01 | -4.67 | 3.73 | 7.13 | 0.9744 | 0.0003 | |||

| PG / The Procter & Gamble Company | 0.02 | 0.00 | 3.71 | -6.50 | 0.9710 | -0.1413 | |||

| KO / The Coca-Cola Company | 0.05 | 0.00 | 3.60 | -1.21 | 0.9404 | -0.0791 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.02 | -8.36 | 3.34 | -6.02 | 0.8738 | -0.1220 | |||

| JNJ / Johnson & Johnson | 0.02 | 0.27 | 3.29 | -7.64 | 0.8601 | -0.1372 | |||

| VGRSX / Vanguard REIT Index Fund | 0.02 | -3.06 | 3.24 | 2.27 | 0.8470 | -0.0399 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | 0.32 | 3.23 | 20.32 | 0.8457 | 0.0929 | |||

| PEP / PepsiCo, Inc. | 0.02 | 0.00 | 3.20 | -11.93 | 0.8382 | -0.1811 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 57.74 | 3.18 | 81.89 | 0.8326 | 0.3424 | |||

| GOOG / Alphabet Inc. | 0.02 | -0.28 | 3.11 | 13.23 | 0.8129 | 0.0440 | |||

| BX / Blackstone Inc. | 0.02 | 0.25 | 2.98 | 7.28 | 0.7789 | 0.0014 | |||

| AMT / American Tower Corporation | 0.01 | 0.20 | 2.77 | 1.76 | 0.7257 | -0.0379 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.01 | 0.00 | 2.59 | 4.95 | 0.6764 | -0.0138 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 5.77 | 2.43 | -4.11 | 0.6346 | -0.0742 | |||

| ABT / Abbott Laboratories | 0.02 | 0.00 | 2.06 | 2.54 | 0.5393 | -0.0240 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.02 | -4.81 | 2.05 | 2.91 | 0.5361 | -0.0218 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.03 | -1.77 | 2.03 | 4.42 | 0.5310 | -0.0136 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 1.96 | 4.71 | 0.5114 | -0.0118 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | 1.55 | 1.82 | 14.14 | 0.4753 | 0.0295 | |||

| NVDA / NVIDIA Corporation | 0.01 | 0.00 | 1.80 | 45.74 | 0.4701 | 0.1248 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -3.14 | 1.79 | 14.42 | 0.4671 | 0.0301 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | 4.85 | 1.63 | 9.56 | 0.4259 | 0.0097 | |||

| CRM / Salesforce, Inc. | 0.01 | 0.00 | 1.44 | 1.63 | 0.3762 | -0.0203 | |||

| SBUX / Starbucks Corporation | 0.02 | 0.00 | 1.42 | -6.57 | 0.3723 | -0.0545 | |||

| DLN / WisdomTree Trust - WisdomTree U.S. LargeCap Dividend Fund | 0.02 | 0.00 | 1.29 | 3.45 | 0.3376 | -0.0117 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.00 | 1.22 | -4.84 | 0.3192 | -0.0401 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | -7.48 | 1.08 | 8.80 | 0.2817 | 0.0044 | |||

| NKE / NIKE, Inc. | 0.02 | -6.53 | 1.07 | 4.69 | 0.2802 | -0.0067 | |||

| IUSG / iShares Trust - iShares Core S&P U.S. Growth ETF | 0.01 | 19.00 | 1.06 | 40.82 | 0.2772 | 0.0664 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 1.05 | 8.04 | 0.2743 | 0.0025 | |||

| MDT / Medtronic plc | 0.01 | 0.00 | 0.97 | -3.09 | 0.2545 | -0.0265 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.92 | 1.33 | 0.2399 | -0.0137 | |||

| PFE / Pfizer Inc. | 0.04 | 0.00 | 0.87 | -4.39 | 0.2280 | -0.0273 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.86 | 8.61 | 0.2245 | 0.0030 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.78 | -10.44 | 0.2045 | -0.0399 | |||

| MMM / 3M Company | 0.01 | 0.00 | 0.77 | 3.62 | 0.2022 | -0.0067 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | 0.79 | 0.73 | 13.04 | 0.1905 | 0.0100 | |||

| GIS / General Mills, Inc. | 0.01 | 0.00 | 0.72 | -13.40 | 0.1895 | -0.0447 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.72 | 28.62 | 0.1883 | 0.0315 | |||

| ACN / Accenture plc | 0.00 | 17.86 | 0.69 | 12.93 | 0.1806 | 0.0093 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.66 | -6.64 | 0.1729 | -0.0257 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.00 | 0.62 | 5.41 | 0.1633 | -0.0028 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.61 | 28.00 | 0.1593 | 0.0261 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.00 | 0.58 | -1.03 | 0.1513 | -0.0125 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.51 | 6.92 | 0.1335 | -0.0001 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.00 | 0.00 | 0.51 | 18.18 | 0.1327 | 0.0123 | |||

| DIS / The Walt Disney Company | 0.00 | 0.00 | 0.50 | 25.63 | 0.1308 | 0.0193 | |||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.49 | -3.72 | 0.1288 | -0.0143 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.00 | 0.00 | 0.46 | 4.28 | 0.1214 | -0.0030 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.46 | -11.83 | 0.1211 | -0.0259 | |||

| GEV / GE Vernova Inc. | 0.00 | 14.37 | 0.42 | 98.58 | 0.1102 | 0.0507 | |||

| CVS / CVS Health Corporation | 0.01 | 0.00 | 0.41 | 1.72 | 0.1083 | -0.0056 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 0.28 | 0.37 | 9.41 | 0.0976 | 0.0022 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.37 | 56.54 | 0.0972 | 0.0306 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.00 | 0.37 | 18.33 | 0.0964 | 0.0091 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -36.04 | 0.36 | -30.93 | 0.0954 | -0.0523 | |||

| AWK / American Water Works Company, Inc. | 0.00 | 0.00 | 0.28 | -5.76 | 0.0728 | -0.0099 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.28 | -24.11 | 0.0726 | -0.0299 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.00 | 0.28 | 0.0721 | 0.0721 | |||||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.26 | 13.36 | 0.0688 | 0.0038 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.25 | 8.55 | 0.0665 | 0.0008 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.24 | -6.30 | 0.0623 | -0.0090 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 0.00 | 0.23 | 2.20 | 0.0608 | -0.0028 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.21 | -8.70 | 0.0550 | -0.0096 | |||

| EIX / Edison International | 0.00 | -20.00 | 0.21 | -29.93 | 0.0540 | -0.0285 | |||

| NDSN / Nordson Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 |