Basic Stats

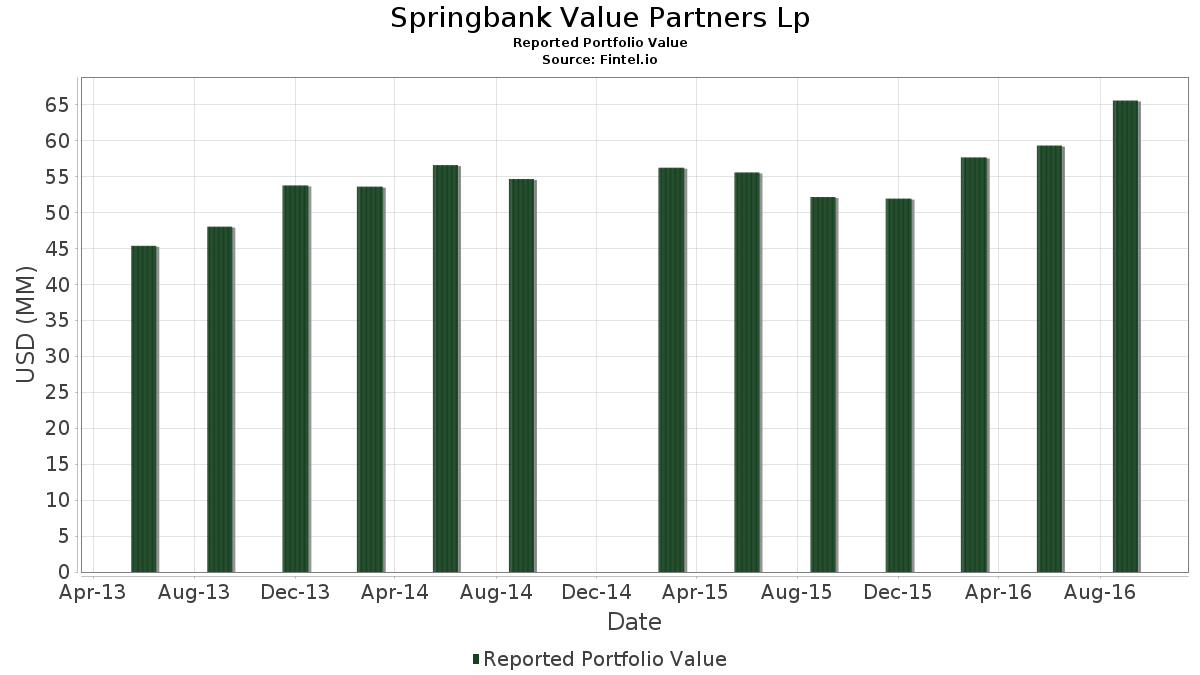

| Portfolio Value | $ 65,531,000 |

| Current Positions | 38 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Springbank Value Partners Lp has disclosed 38 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 65,531,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Springbank Value Partners Lp’s top holdings are MKS Inc. (US:MKSI) , Global Payments Inc. (US:GPN) , Westinghouse Air Brake Technologies Corporation (US:WAB) , EMCOR Group, Inc. (US:EME) , and THOR Industries, Inc. (US:THO) . Springbank Value Partners Lp’s new positions include SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF (US:XOP) , OneSpan Inc. (US:OSPN) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 0.72 | 1.0972 | 1.0972 | |

| 0.05 | 4.18 | 6.3848 | 0.9895 | |

| 0.03 | 0.54 | 0.8256 | 0.8256 | |

| 0.08 | 4.54 | 6.9204 | 0.5989 | |

| 0.04 | 4.03 | 6.1498 | 0.5048 | |

| 0.02 | 0.32 | 0.4944 | 0.4944 | |

| 0.06 | 4.76 | 7.2637 | 0.4749 | |

| 0.11 | 5.69 | 8.6860 | 0.3720 | |

| 0.01 | 0.20 | 0.2976 | 0.2976 | |

| 0.01 | 0.19 | 0.2945 | 0.2945 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 4.08 | 6.2230 | -1.5274 | |

| 0.05 | 3.95 | 6.0292 | -1.0582 | |

| 0.13 | 3.81 | 5.8064 | -0.6112 | |

| 0.09 | 3.60 | 5.5012 | -0.4306 | |

| 0.07 | 5.06 | 7.7185 | -0.3373 | |

| 0.02 | 1.39 | 2.1181 | -0.3366 | |

| 0.00 | 0.00 | -0.2952 | ||

| 0.03 | 2.33 | 3.5617 | -0.2241 | |

| 0.04 | 1.68 | 2.5683 | -0.1733 | |

| 0.02 | 0.53 | 0.8118 | -0.0773 |

13F and Fund Filings

This form was filed on 2016-11-10 for the reporting period 2016-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MKSI / MKS Inc. | 0.11 | 0.00 | 5.69 | 15.50 | 8.6860 | 0.3720 | |||

| GPN / Global Payments Inc. | 0.07 | -1.49 | 5.06 | 5.93 | 7.7185 | -0.3373 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.06 | 1.75 | 4.76 | 18.29 | 7.2637 | 0.4749 | |||

| EME / EMCOR Group, Inc. | 0.08 | 0.00 | 4.54 | 21.03 | 6.9204 | 0.5989 | |||

| THO / THOR Industries, Inc. | 0.05 | 0.00 | 4.18 | 30.83 | 6.3848 | 0.9895 | |||

| TSS / Total System Services, Inc. | 0.09 | 0.00 | 4.08 | -11.23 | 6.2230 | -1.5274 | |||

| COHR / Coherent Corp. | 0.04 | 0.00 | 4.03 | 20.44 | 6.1498 | 0.5048 | |||

| NSP / Insperity, Inc. | 0.05 | 0.00 | 3.95 | -5.95 | 6.0292 | -1.0582 | |||

| ROL / Rollins, Inc. | 0.13 | 0.00 | 3.81 | 0.03 | 5.8064 | -0.6112 | |||

| CSGS / CSG Systems International, Inc. | 0.09 | 0.00 | 3.60 | 2.53 | 5.5012 | -0.4306 | |||

| TTEK / Tetra Tech, Inc. | 0.09 | 0.00 | 3.05 | 15.38 | 4.6589 | 0.1948 | |||

| PRIM / Primoris Services Corporation | 0.13 | 0.77 | 2.70 | 9.67 | 4.1171 | -0.0331 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.03 | 0.00 | 2.33 | 4.01 | 3.5617 | -0.2241 | |||

| US2296691064 / Cubic Corporation | 0.04 | 2.43 | 1.98 | 19.41 | 3.0138 | 0.2234 | |||

| XEC / Cimarex Energy Co. | 0.01 | 0.00 | 1.95 | 12.60 | 2.9726 | 0.0540 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.04 | 0.00 | 1.68 | 3.57 | 2.5683 | -0.1733 | |||

| DRQ / Dril-Quip, Inc. | 0.02 | 0.00 | 1.39 | -4.60 | 2.1181 | -0.3366 | |||

| LCII / LCI Industries | 0.01 | 0.00 | 0.78 | 15.46 | 1.1964 | 0.0509 | |||

| SRCI / SRC Energy Inc | 0.10 | 65.39 | 0.72 | 72.01 | 1.0972 | 1.0972 | |||

| GIFI / Gulf Island Fabrication, Inc. | 0.07 | 8.09 | 0.61 | 43.36 | 0.9385 | 0.2147 | |||

| RTEC / Rudolph Technologies, Inc. | 0.03 | 3.39 | 0.54 | 18.12 | 0.8256 | 0.8256 | |||

| HURC / Hurco Companies, Inc. | 0.02 | 0.00 | 0.53 | 0.95 | 0.8118 | -0.0773 | |||

| ROG / Rogers Corporation | 0.01 | 0.00 | 0.43 | 0.00 | 0.6531 | -0.0689 | |||

| ONTO / Onto Innovation Inc. | 0.02 | 12.89 | 0.39 | 21.05 | 0.5967 | 0.0517 | |||

| VECO / Veeco Instruments Inc. | 0.02 | 50.00 | 0.35 | 77.39 | 0.5387 | 0.2029 | |||

| MRCY / Mercury Systems, Inc. | 0.01 | 0.00 | 0.35 | -1.13 | 0.5356 | -0.0633 | |||

| RAIL / FreightCar America, Inc. | 0.02 | 15.38 | 0.32 | 18.25 | 0.4944 | 0.4944 | |||

| BW / Babcock & Wilcox Enterprises, Inc. | 0.02 | 36.50 | 0.31 | 53.73 | 0.4715 | 0.1324 | |||

| MTDR / Matador Resources Company | 0.01 | 14.29 | 0.20 | 40.29 | 0.2976 | 0.2976 | |||

| GHM / Graham Corporation | 0.01 | -11.46 | 0.19 | -8.10 | 0.2945 | 0.2945 | |||

| VMI / Valmont Industries, Inc. | 0.00 | 0.00 | 0.19 | -0.53 | 0.2869 | -0.0320 | |||

| MTRX / Matrix Service Company | 0.01 | 900.00 | 0.19 | 1,075.00 | 0.2869 | 0.2869 | |||

| PDFS / PDF Solutions, Inc. | 0.01 | 0.00 | 0.18 | 30.00 | 0.2777 | 0.2777 | |||

| COHU / Cohu, Inc. | 0.01 | 11.20 | 0.16 | 19.85 | 0.2487 | 0.2487 | |||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | 0.00 | 0.12 | 0.1755 | 0.1755 | |||||

| PLPM / Planet Payment, Inc. | 0.03 | 511.11 | 0.10 | 410.00 | 0.1557 | 0.1557 | |||

| DGII / Digi International Inc. | 0.00 | 300.00 | 0.05 | 318.18 | 0.0702 | 0.0702 | |||

| OSPN / OneSpan Inc. | 0.00 | 0.04 | 0.0534 | 0.0534 | |||||

| ZBRA / Zebra Technologies Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2952 |