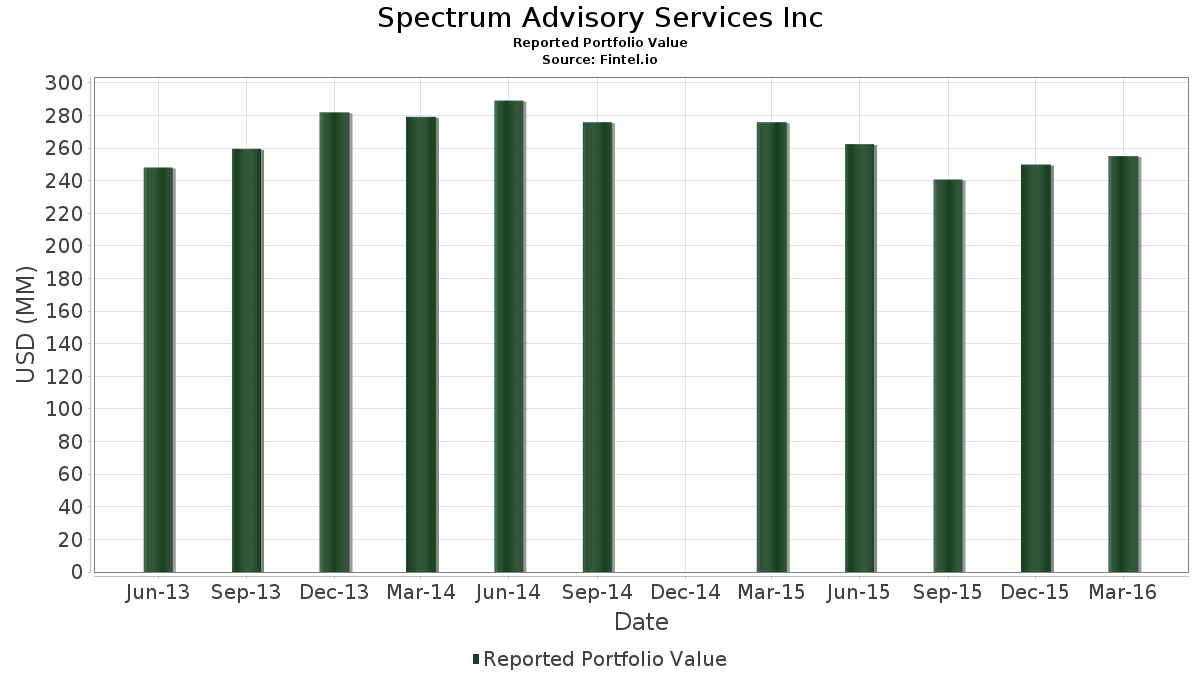

Basic Stats

| Portfolio Value | $ 255,104,000 |

| Current Positions | 149 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Spectrum Advisory Services Inc has disclosed 149 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 255,104,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Spectrum Advisory Services Inc’s top holdings are Valspar Corp. (US:920355104) , 3M Company (US:MMM) , Danaher Corporation (US:DHR) , Graco Inc. (US:GGG) , and Berkshire Hathaway Inc. (US:BRK.B) . Spectrum Advisory Services Inc’s new positions include Weyerhaeuser Company (US:WY) , DSM-Firmenich AG (US:KDSKF) , SECOM CO., LTD. - Depositary Receipt (Common Stock) (US:SOMLY) , Martin Marietta Materials, Inc. (US:MLM) , and Compass Diversified (US:CODI) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.19 | 5.77 | 2.2614 | 2.2614 | |

| 0.08 | 7.04 | 2.7601 | 0.3272 | |

| 0.05 | 8.28 | 3.2450 | 0.2055 | |

| 0.05 | 5.22 | 2.0474 | 0.1731 | |

| 0.00 | 6.62 | 2.5938 | 0.1402 | |

| 0.03 | 3.06 | 1.1987 | 0.1340 | |

| 0.06 | 3.47 | 1.3606 | 0.1158 | |

| 0.03 | 1.78 | 0.6989 | 0.1111 | |

| 0.12 | 5.41 | 2.1195 | 0.1092 | |

| 0.04 | 1.87 | 0.7346 | 0.1092 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.2504 | ||

| 0.01 | 2.21 | 0.8683 | -0.1445 | |

| 0.05 | 3.79 | 1.4845 | -0.1313 | |

| 0.07 | 0.67 | 0.2619 | -0.1303 | |

| 0.00 | 0.00 | -0.1260 | ||

| 0.02 | 1.44 | 0.5660 | -0.1234 | |

| 0.01 | 0.54 | 0.2117 | -0.1096 | |

| 0.04 | 0.71 | 0.2795 | -0.1094 | |

| 0.00 | 0.00 | -0.1060 | ||

| 0.03 | 1.19 | 0.4649 | -0.0985 |

13F and Fund Filings

This form was filed on 2016-05-12 for the reporting period 2016-03-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 920355104 / Valspar Corp. | 0.08 | -19.11 | 8.64 | 4.36 | 3.3857 | 0.0741 | |||

| MMM / 3M Company | 0.05 | -1.49 | 8.28 | 8.98 | 3.2450 | 0.2055 | |||

| DHR / Danaher Corporation | 0.08 | -1.02 | 7.34 | 1.09 | 2.8776 | -0.0282 | |||

| GGG / Graco Inc. | 0.08 | -0.59 | 7.04 | 15.81 | 2.7601 | 0.3272 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.05 | -1.53 | 6.68 | 5.83 | 2.6201 | 0.0928 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 6.62 | 7.91 | 2.5938 | 0.1402 | |||

| WY / Weyerhaeuser Company | 0.19 | 5.77 | 2.2614 | 2.2614 | |||||

| KO / The Coca-Cola Company | 0.12 | -0.34 | 5.41 | 7.62 | 2.1195 | 0.1092 | |||

| IBM / International Business Machines Corporation | 0.04 | -2.60 | 5.38 | 7.17 | 2.1089 | 0.1002 | |||

| PPG / PPG Industries, Inc. | 0.05 | -1.16 | 5.22 | 11.51 | 2.0474 | 0.1731 | |||

| HD / The Home Depot, Inc. | 0.04 | -0.13 | 5.09 | 0.75 | 1.9972 | -0.0263 | |||

| UPS / United Parcel Service, Inc. | 0.04 | -1.30 | 4.64 | 8.20 | 1.8208 | 0.1030 | |||

| LLTC / Linear Technology Corp. | 0.09 | 3.23 | 4.14 | 8.30 | 1.6213 | 0.0932 | |||

| ITW / Illinois Tool Works Inc. | 0.04 | -2.07 | 4.05 | 8.25 | 1.5892 | 0.0906 | |||

| BDX / Becton, Dickinson and Company | 0.03 | -2.04 | 4.00 | -3.50 | 1.5692 | -0.0906 | |||

| Y / Alleghany Corp. | 0.01 | -2.74 | 3.95 | 0.97 | 1.5468 | -0.0169 | |||

| LOW / Lowe's Companies, Inc. | 0.05 | -5.84 | 3.79 | -6.22 | 1.4845 | -0.1313 | |||

| GE / General Electric Company | 0.12 | -5.06 | 3.67 | -3.11 | 1.4398 | -0.0771 | |||

| JNJ / Johnson & Johnson | 0.03 | -1.12 | 3.49 | 4.15 | 1.3673 | 0.0272 | |||

| ETN / Eaton Corporation plc | 0.06 | -7.19 | 3.47 | 11.57 | 1.3606 | 0.1158 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 1.01 | 3.44 | 8.31 | 1.3481 | 0.0776 | |||

| PG / The Procter & Gamble Company | 0.04 | 0.00 | 3.23 | 3.66 | 1.2662 | 0.0193 | |||

| PEP / PepsiCo, Inc. | 0.03 | -0.64 | 3.17 | 1.90 | 1.2430 | -0.0022 | |||

| ZBRA / Zebra Technologies Corporation | 0.04 | -2.92 | 3.10 | -3.82 | 1.2140 | -0.0744 | |||

| AVT / Avnet, Inc. | 0.07 | 0.00 | 3.09 | 3.41 | 1.2117 | 0.0156 | |||

| GPC / Genuine Parts Company | 0.03 | -0.65 | 3.06 | 14.92 | 1.1987 | 0.1340 | |||

| RAVN / Raven Industries, Inc. | 0.19 | -2.64 | 3.05 | 0.00 | 1.1972 | -0.0249 | |||

| AAPL / Apple Inc. | 0.03 | 3.80 | 3.03 | 7.47 | 1.1893 | 0.0597 | |||

| USB / U.S. Bancorp | 0.07 | 0.43 | 2.81 | -4.48 | 1.1031 | -0.0757 | |||

| AX / Axos Financial, Inc. | 0.13 | -4.07 | 2.77 | -2.74 | 1.0862 | -0.0538 | |||

| AON / Aon plc | 0.02 | 0.00 | 2.58 | 13.31 | 1.0110 | 0.1002 | |||

| MCD / McDonald's Corporation | 0.02 | -7.67 | 2.54 | -1.78 | 0.9945 | -0.0391 | |||

| COST / Costco Wholesale Corporation | 0.02 | -2.43 | 2.53 | -4.81 | 0.9933 | -0.0719 | |||

| KDSKF / DSM-Firmenich AG | 0.05 | 2.52 | 0.9863 | 0.0391 | |||||

| GPN / Global Payments Inc. | 0.04 | -6.98 | 2.50 | -5.84 | 0.9800 | -0.0824 | |||

| TEL / TE Connectivity plc | 0.04 | 0.00 | 2.50 | -4.15 | 0.9784 | -0.0635 | |||

| EMR / Emerson Electric Co. | 0.04 | -0.91 | 2.36 | 12.68 | 0.9263 | 0.0872 | |||

| SYK / Stryker Corporation | 0.02 | -3.51 | 2.36 | 11.41 | 0.9263 | 0.0776 | |||

| CL / Colgate-Palmolive Company | 0.03 | -1.19 | 2.35 | 4.81 | 0.9216 | 0.0241 | |||

| EFX / Equifax Inc. | 0.02 | -2.84 | 2.34 | -0.30 | 0.9184 | -0.0219 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 2.27 | -1.86 | 0.8914 | -0.0357 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.04 | -2.66 | 2.25 | 9.89 | 0.8840 | 0.0629 | |||

| COKE / Coca-Cola Consolidated, Inc. | 0.01 | 0.00 | 2.21 | -12.49 | 0.8683 | -0.1445 | |||

| EW / Edwards Lifesciences Corporation | 0.02 | 0.00 | 2.14 | 11.68 | 0.8393 | 0.0722 | |||

| BBBY / Bed Bath & Beyond, Inc. | 0.04 | -0.69 | 2.14 | 2.15 | 0.8377 | 0.0006 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 0.00 | 2.07 | 10.41 | 0.8106 | 0.0612 | |||

| CSCO / Cisco Systems, Inc. | 0.07 | -1.10 | 2.05 | 3.70 | 0.8028 | 0.0125 | |||

| JCI / Johnson Controls International plc | 0.05 | -1.20 | 1.97 | 13.77 | 0.7707 | 0.0792 | |||

| AAP / Advance Auto Parts, Inc. | 0.01 | -4.91 | 1.94 | 1.31 | 0.7589 | -0.0058 | |||

| BNS / The Bank of Nova Scotia | 0.04 | -0.78 | 1.87 | 19.90 | 0.7346 | 0.1092 | |||

| MSFT / Microsoft Corporation | 0.03 | 1.22 | 1.84 | 0.77 | 0.7205 | -0.0094 | |||

| CPB / The Campbell's Company | 0.03 | 0.00 | 1.78 | 21.38 | 0.6989 | 0.1111 | |||

| AYI / Acuity Inc. | 0.01 | 0.00 | 1.78 | -6.71 | 0.6981 | -0.0657 | |||

| STJ / St. Jude Medical, Inc. | 0.03 | 1.27 | 1.76 | -9.83 | 0.6903 | -0.0912 | |||

| CLC / CLARCOR Inc. | 0.03 | 0.00 | 1.74 | 16.29 | 0.6801 | 0.0831 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 1.72 | -1.94 | 0.6731 | -0.0276 | |||

| CAH / Cardinal Health, Inc. | 0.02 | 0.00 | 1.64 | -8.22 | 0.6433 | -0.0722 | |||

| US8865471085 / Tiffany & Co. | 0.02 | 0.00 | 1.60 | -3.85 | 0.6260 | -0.0386 | |||

| TXN / Texas Instruments Incorporated | 0.03 | 0.00 | 1.59 | 4.80 | 0.6245 | 0.0162 | |||

| NBN / Northeast Bank | 0.14 | 0.00 | 1.51 | 1.00 | 0.5919 | -0.0063 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 0.00 | 1.51 | 5.68 | 0.5903 | 0.0201 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.04 | -3.43 | 1.49 | -2.94 | 0.5821 | -0.0301 | |||

| PFE / Pfizer Inc. | 0.05 | -0.25 | 1.46 | -8.42 | 0.5715 | -0.0655 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | -0.50 | 1.44 | -16.19 | 0.5660 | -0.1234 | |||

| INTC / Intel Corporation | 0.04 | 0.00 | 1.44 | -6.05 | 0.5657 | -0.0490 | |||

| EGP / EastGroup Properties, Inc. | 0.02 | 1.06 | 1.44 | 9.67 | 0.5649 | 0.0391 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | 0.00 | 1.34 | -7.13 | 0.5261 | -0.0521 | |||

| PSX / Phillips 66 | 0.02 | 0.00 | 1.33 | 5.88 | 0.5225 | 0.0188 | |||

| SOMLY / SECOM CO., LTD. - Depositary Receipt (Common Stock) | 0.02 | 1.31 | 0.5143 | 0.0297 | |||||

| GVDNY / Givaudan SA - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 1.27 | 5.75 | 0.4971 | 0.0173 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -13.00 | 1.20 | -7.83 | 0.4708 | -0.0506 | |||

| NOC / Northrop Grumman Corporation | 0.01 | 0.00 | 1.19 | 4.74 | 0.4677 | 0.0119 | |||

| STI / Solidion Technology, Inc. | 0.03 | 0.00 | 1.19 | -15.77 | 0.4649 | -0.0985 | |||

| RES / RPC, Inc. | 0.08 | -5.59 | 1.15 | 11.98 | 0.4508 | 0.0399 | |||

| JW.A / John Wiley & Sons Inc. - Class A | 0.02 | -3.72 | 1.14 | 4.50 | 0.4461 | 0.0103 | |||

| SNV / Synovus Financial Corp. | 0.04 | -1.49 | 1.09 | -12.06 | 0.4288 | -0.0689 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 1.08 | -6.71 | 0.4249 | -0.0400 | |||

| WMT / Walmart Inc. | 0.02 | -7.66 | 1.07 | 3.17 | 0.4206 | 0.0045 | |||

| DBRG / DigitalBridge Group, Inc. | 0.06 | -0.40 | 1.03 | -14.25 | 0.4057 | -0.0773 | |||

| EMC / Global X Funds - Global X Emerging Markets Great Consumer ETF | 0.04 | -0.80 | 0.99 | 2.90 | 0.3889 | 0.0031 | |||

| MTB / M&T Bank Corporation | 0.01 | 0.00 | 0.96 | -8.42 | 0.3751 | -0.0430 | |||

| CVX / Chevron Corporation | 0.01 | 2.15 | 0.91 | 8.24 | 0.3551 | 0.0202 | |||

| RDI / Reading International, Inc. | 0.08 | -4.94 | 0.90 | -13.10 | 0.3536 | -0.0618 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | -5.91 | 0.90 | -6.94 | 0.3520 | -0.0341 | |||

| PII / Polaris Inc. | 0.01 | 4.60 | 0.90 | 19.79 | 0.3512 | 0.0519 | |||

| TSS / Total System Services, Inc. | 0.02 | 0.00 | 0.87 | -4.41 | 0.3403 | -0.0231 | |||

| VRSK / Verisk Analytics, Inc. | 0.01 | 0.00 | 0.85 | 4.02 | 0.3344 | 0.0063 | |||

| DIS / The Walt Disney Company | 0.01 | 0.00 | 0.79 | -5.59 | 0.3112 | -0.0253 | |||

| HSY / The Hershey Company | 0.01 | -4.48 | 0.79 | -1.51 | 0.3077 | -0.0112 | |||

| FCE.A / Forest City Realty Trust, Inc. | 0.04 | -2.43 | 0.76 | -6.16 | 0.2987 | -0.0262 | |||

| COP / ConocoPhillips | 0.02 | 0.56 | 0.72 | -13.17 | 0.2842 | -0.0499 | |||

| SKM / SK Telecom Co., Ltd. - Depositary Receipt (Common Stock) | 0.04 | -26.73 | 0.71 | -26.65 | 0.2795 | -0.1094 | |||

| NWLI / National Western Life Group, Inc. | 0.00 | 0.00 | 0.67 | -8.47 | 0.2626 | -0.0303 | |||

| UEPS / Lesaka Technologies Inc | 0.07 | 0.00 | 0.67 | -31.84 | 0.2619 | -0.1303 | |||

| CTA.PRB / EIDP, Inc. - Preferred Stock | 0.01 | 0.00 | 0.66 | 7.87 | 0.2579 | 0.0138 | |||

| WPM / Wheaton Precious Metals Corp. | 0.04 | 1.31 | 0.64 | 35.44 | 0.2517 | 0.0620 | |||

| BAC / Bank of America Corporation | 0.04 | 0.00 | 0.60 | -19.71 | 0.2364 | -0.0641 | |||

| KEX / Kirby Corporation | 0.01 | 21.38 | 0.58 | 39.23 | 0.2281 | 0.0609 | |||

| JEF / Jefferies Financial Group Inc. | 0.04 | -7.07 | 0.57 | -13.55 | 0.2250 | -0.0407 | |||

| RY / Royal Bank of Canada | 0.01 | -2.01 | 0.56 | 5.24 | 0.2203 | 0.0066 | |||

| US0325111070 / Anadarko Petroleum Corp. | 0.01 | -29.79 | 0.54 | -32.75 | 0.2117 | -0.1096 | |||

| VZ / Verizon Communications Inc. | 0.01 | 0.00 | 0.54 | 16.92 | 0.2113 | 0.0268 | |||

| AFL / Aflac Incorporated | 0.01 | -3.44 | 0.53 | 1.72 | 0.2085 | -0.0007 | |||

| US0549371070 / BB&T Corp. | 0.02 | 0.00 | 0.52 | -11.99 | 0.2042 | -0.0327 | |||

| ADM / Archer-Daniels-Midland Company | 0.01 | -1.39 | 0.51 | -2.47 | 0.2015 | -0.0094 | |||

| QGEN / Qiagen N.V. | 0.02 | 0.00 | 0.51 | -19.27 | 0.1987 | -0.0525 | |||

| CBT / Cabot Corporation | 0.01 | 0.00 | 0.51 | 18.22 | 0.1984 | 0.0271 | |||

| IMKTA / Ingles Markets, Incorporated | 0.01 | 0.00 | 0.49 | -14.83 | 0.1936 | -0.0384 | |||

| DVN / Devon Energy Corporation | 0.02 | 10.81 | 0.48 | -4.97 | 0.1874 | -0.0139 | |||

| TWX / Warner Media LLC | 0.01 | 0.00 | 0.47 | 12.20 | 0.1838 | 0.0166 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.45 | 11.60 | 0.1772 | 0.0151 | |||

| FAST / Fastenal Company | 0.01 | 8.43 | 0.44 | 30.09 | 0.1729 | 0.0372 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.44 | -10.95 | 0.1721 | -0.0252 | |||

| SASOF / Sasol Limited | 0.01 | 0.00 | 0.43 | 10.03 | 0.1678 | 0.0121 | |||

| SCL / Stepan Company | 0.01 | 0.00 | 0.42 | 11.11 | 0.1646 | 0.0134 | |||

| WMK / Weis Markets, Inc. | 0.01 | 0.00 | 0.40 | 1.77 | 0.1576 | -0.0005 | |||

| SJM / The J. M. Smucker Company | 0.00 | 0.00 | 0.38 | 5.21 | 0.1505 | 0.0045 | |||

| VLVLY / AB Volvo (publ) - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.38 | 17.19 | 0.1470 | 0.0190 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | -6.82 | 0.33 | 0.60 | 0.1305 | -0.0019 | |||

| NWE / NorthWestern Energy Group, Inc. | 0.01 | 0.00 | 0.32 | 13.83 | 0.1258 | 0.0130 | |||

| MKL / Markel Group Inc. | 0.00 | 0.00 | 0.32 | 0.95 | 0.1247 | -0.0014 | |||

| SOMLY / SECOM CO., LTD. - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.31 | 9.29 | 0.1200 | 0.0079 | |||

| AHEXF / Adecco Group AG | 0.00 | 0.00 | 0.29 | -6.71 | 0.1145 | -0.0108 | |||

| TUP / Tupperware Brands Corporation | 0.01 | 0.00 | 0.29 | 4.29 | 0.1145 | 0.0024 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0.01 | -1.87 | 0.29 | -16.08 | 0.1125 | -0.0243 | |||

| DHI / D.R. Horton, Inc. | 0.01 | 0.00 | 0.28 | -5.65 | 0.1113 | -0.0091 | |||

| AGCO / AGCO Corporation | 0.01 | -18.97 | 0.28 | -11.25 | 0.1082 | -0.0163 | |||

| MO / Altria Group, Inc. | 0.00 | 0.00 | 0.24 | 7.59 | 0.0945 | 0.0048 | |||

| SU / Suncor Energy Inc. | 0.01 | 0.00 | 0.23 | 7.91 | 0.0909 | 0.0049 | |||

| 47W / Neurotrope Inc | 0.43 | 0.00 | 0.22 | -13.18 | 0.0878 | -0.0154 | |||

| 748356102 / Questar Corp. | 0.01 | 0.22 | 0.0878 | 0.0878 | |||||

| WU / The Western Union Company | 0.01 | -4.18 | 0.22 | 3.27 | 0.0866 | 0.0010 | |||

| KDSKF / DSM-Firmenich AG | 0.02 | 0.00 | 0.22 | 9.50 | 0.0858 | 0.0058 | |||

| DOW / Dow Inc. | 0.00 | 0.00 | 0.21 | -4.98 | 0.0823 | -0.0061 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | 0.21 | 0.0811 | 0.0811 | |||||

| PUKPF / Prudential plc | 0.01 | -9.30 | 0.20 | -10.96 | 0.0796 | 0.0796 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.20 | 0.0796 | 0.0796 | ||||

| 00B65Z9D7 / Noble Corporation plc | 0.02 | -3.04 | 0.20 | -4.81 | 0.0776 | -0.0056 | |||

| OPK / OPKO Health, Inc. | 0.02 | 0.00 | 0.19 | 3.19 | 0.0760 | 0.0008 | |||

| JOF / Japan Smaller Capitalization Fund, Inc. | 0.02 | -1.52 | 0.19 | -6.93 | 0.0737 | -0.0071 | |||

| SLRC / SLR Investment Corp. | 0.01 | 0.00 | 0.19 | 5.08 | 0.0729 | 0.0021 | |||

| KPELY / Keppel Ltd. - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 0.17 | -3.87 | 0.0682 | -0.0042 | |||

| CODI / Compass Diversified | 0.01 | 0.16 | 0.0631 | 0.0631 | |||||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.02 | 124.97 | 0.16 | 106.41 | 0.0631 | 0.0319 | |||

| NOBLE GROUP LTD ORD / (G6542T119) | 0.37 | 0.00 | 0.12 | 17.65 | 0.0000 | ||||

| CDI / CDI Corp. | 0.02 | -2.11 | 0.12 | -8.59 | 0.0459 | -0.0054 | |||

| MPX / Marine Products Corporation | 0.01 | 0.00 | 0.11 | 25.88 | 0.0419 | 0.0079 | |||

| CTG / Computer Task Group, Inc. | 0.01 | 0.00 | 0.07 | -22.73 | 0.0267 | -0.0086 | |||

| FSRPF / Frasers Property Limited | 0.01 | 0.00 | 0.01 | 0.00 | 0.0055 | -0.0001 | |||

| XCO / EXCO Resources, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0096 | ||||

| AAWW / Atlas Air Worldwide Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1060 | ||||

| EARN / Ellington Credit Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0500 | ||||

| PCP / Precision Castparts Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0880 | ||||

| IVR / Invesco Mortgage Capital Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0956 | ||||

| DX / Dynex Capital, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0612 | ||||

| 91911K102 / Bausch Health Companies | 0.00 | -100.00 | 0.00 | -100.00 | -0.1260 | ||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0904 | ||||

| TKOMY / Tokio Marine Holdings, Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0908 | ||||

| PCL / PGIM ETF Trust - PGIM Corporate Bond 10+ Year ETF | 0.00 | -100.00 | 0.00 | -100.00 | -2.2504 | ||||

| JPM / JPMorgan Chase & Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0840 |