Basic Stats

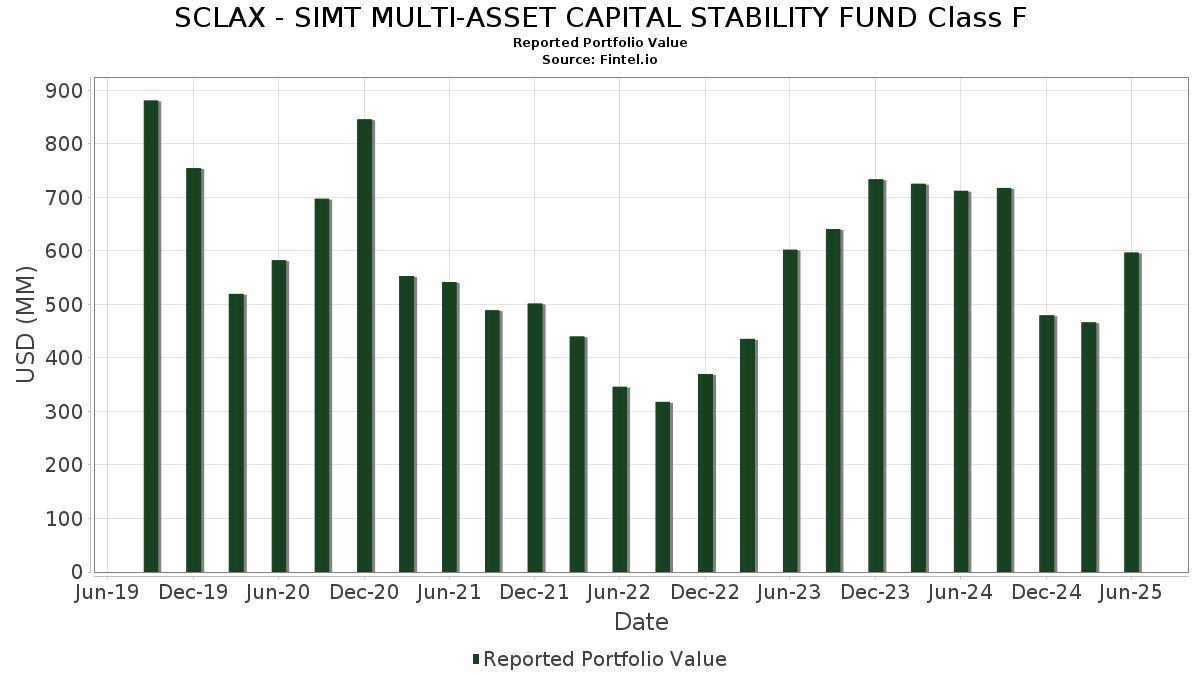

| Portfolio Value | $ 596,755,779 |

| Current Positions | 118 |

Latest Holdings, Performance, AUM (from 13F, 13D)

SCLAX - SIMT MULTI-ASSET CAPITAL STABILITY FUND Class F has disclosed 118 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 596,755,779 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). SCLAX - SIMT MULTI-ASSET CAPITAL STABILITY FUND Class F’s top holdings are United States Treasury Inflation Indexed Bonds (US:US91282CFR79) , UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 (US:US91282CDC29) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , American Honda Finance Corp. (US:US02665JW979) , and SPDR Series Trust - SPDR Bloomberg High Yield Bond ETF (US:JNK) . SCLAX - SIMT MULTI-ASSET CAPITAL STABILITY FUND Class F’s new positions include United States Treasury Inflation Indexed Bonds (US:US91282CFR79) , UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 (US:US91282CDC29) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , American Honda Finance Corp. (US:US02665JW979) , and United States Treasury Inflation Indexed Bonds (US:US91282CGW55) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 50.00 | 10.9798 | 10.9798 | ||

| 49.95 | 10.9683 | 10.9683 | ||

| 34.94 | 7.6717 | 7.6717 | ||

| 30.63 | 6.7260 | 6.7260 | ||

| 18.64 | 4.0931 | 4.0931 | ||

| 17.27 | 3.7918 | 3.7918 | ||

| 16.89 | 3.7079 | 3.7079 | ||

| 12.69 | 2.7865 | 2.7865 | ||

| 11.44 | 2.5132 | 2.5132 | ||

| 11.22 | 2.4636 | 2.4636 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.32 | 0.0702 | -1.1699 | |

| 0.07 | 3.51 | 0.7704 | -1.0245 | |

| 0.00 | 0.39 | 0.0862 | -1.0096 | |

| 0.01 | 1.06 | 0.2328 | -0.9237 | |

| 0.01 | 3.71 | 0.8148 | -0.3527 | |

| 0.00 | 0.07 | 0.0149 | -0.2413 | |

| -0.26 | -0.0579 | -0.1396 | ||

| -0.05 | -0.0120 | -0.0345 | ||

| 0.00 | 0.14 | 0.0317 | -0.0239 | |

| -0.25 | -0.0540 | -0.0225 |

13F and Fund Filings

This form was filed on 2025-08-28 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TREASURY BILL 0.000000% 07/01/2025 / DBT (US912797PU59) | 50.00 | 10.9798 | 10.9798 | ||||||

| TREASURY BILL 0.000000% 07/10/2025 / DBT (US912797LW51) | 49.95 | 10.9683 | 10.9683 | ||||||

| TREASURY BILL 0.000000% 07/17/2025 / DBT (US912797PE18) | 34.94 | 7.6717 | 7.6717 | ||||||

| US 5YR NOTE (CBT) SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 30.63 | 6.7260 | 6.7260 | ||||||

| US 5YR NOTE (CBT) SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 18.64 | 4.0931 | 4.0931 | ||||||

| US 10YR NOTE (CBT)SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 17.27 | 3.7918 | 3.7918 | ||||||

| S&P500 EMINI FUT SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 16.89 | 3.7079 | 3.7079 | ||||||

| US 2YR NOTE (CBT) SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 12.69 | 2.7865 | 2.7865 | ||||||

| CAN 10YR BOND FUT SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 11.44 | 2.5132 | 2.5132 | ||||||

| LONG GILT FUTURE SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 11.22 | 2.4636 | 2.4636 | ||||||

| EURO-BOBL FUTURE SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 10.08 | 2.2144 | 2.2144 | ||||||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 9.89 | 272.67 | 2.1711 | 1.5979 | |||||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 9.17 | 263.13 | 2.0137 | 1.4682 | |||||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 8.69 | 213.08 | 1.9079 | 1.3083 | |||||

| 67705BA36 / Oglethorpe Power Corp | 8.60 | 1.8881 | 1.8881 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 8.59 | 1.8867 | 1.8867 | ||||||

| BROOKFIELD INFRASTRUCTURE HLDG COMMERCIAL PAPER (ISITC) / ABS-APCP (US11275MV782) | 8.56 | 1.8791 | 1.8791 | ||||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 8.52 | 1.8713 | 1.8713 | ||||||

| US02665JW979 / American Honda Finance Corp. | 8.52 | 1.8711 | 1.8711 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8.40 | 1.8444 | 1.8444 | ||||||

| VW CREDIT INC COMMERCIAL PAPER (ISITC) / ABS-APCP (US91842JUN70) | 8.03 | 1.7628 | 1.7628 | ||||||

| TSY INFL IX N/B 2.125000% 04/15/2029 / DBT (US91282CKL45) | 7.93 | 179.08 | 1.7407 | 1.1272 | |||||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 7.39 | 1.6233 | 1.6233 | ||||||

| MSCI EAFE SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 7.24 | 1.5900 | 1.5900 | ||||||

| INTESA FDG LLC COMMERCIAL PAPER (ISITC) / ABS-APCP (US4611K0VC88) | 7.06 | 1.5503 | 1.5503 | ||||||

| NASD100 MICRO EMINSEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 6.96 | 1.5283 | 1.5283 | ||||||

| B1DX34 / Becton, Dickinson and Company - Depositary Receipt (Common Stock) | 6.88 | 1.5117 | 1.5117 | ||||||

| P1HC34 / Parker-Hannifin Corporation - Depositary Receipt (Common Stock) | 6.87 | 1.5096 | 1.5096 | ||||||

| ENEL FIN AMER LLC DISC CP COMMERCIAL PAPER (ISITC) / ABS-APCP (US29279GUR63) | 6.73 | 1.4775 | 1.4775 | ||||||

| TSY INFL IX N/B 1.625000% 10/15/2029 / DBT (US91282CLV18) | 6.59 | 209.64 | 1.4463 | 0.9868 | |||||

| MSCI EMGMKT SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 6.35 | 1.3950 | 1.3950 | ||||||

| TRANSCANADA PIPELINES LTD COMMERCIAL PAPER (ISITC) / ABS-APCP (US89355PUN67) | 5.98 | 1.3139 | 1.3139 | ||||||

| F1NI34 / Fidelity National Information Services, Inc. - Depositary Receipt (Common Stock) | 5.64 | 1.2385 | 1.2385 | ||||||

| EURO-BUND FUTURE SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 5.50 | 1.2078 | 1.2078 | ||||||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 5.09 | 1.1170 | 1.1170 | ||||||

| EURO-BOBL FUTURE SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 4.97 | 1.0920 | 1.0920 | ||||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 4.87 | 1.0693 | 1.0693 | ||||||

| E1TR34 / Entergy Corporation - Depositary Receipt (Common Stock) | 4.79 | 1.0518 | 1.0518 | ||||||

| JNK / SPDR Series Trust - SPDR Bloomberg High Yield Bond ETF | 0.05 | 2.58 | 4.49 | 4.71 | 0.9863 | 0.0596 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.05 | 5.77 | 4.36 | 8.13 | 0.9574 | 0.0865 | |||

| SPI 200 FUTURES SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 4.34 | 0.9522 | 0.9522 | ||||||

| US 10YR NOTE (CBT)SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 4.26 | 0.9356 | 0.9356 | ||||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.01 | 0.00 | 4.12 | 10.55 | 0.9041 | 0.0995 | |||

| E1TR34 / Entergy Corporation - Depositary Receipt (Common Stock) | 3.78 | 0.8304 | 0.8304 | ||||||

| AVGO / Broadcom Inc. | 0.01 | -58.30 | 3.71 | -31.35 | 0.8148 | -0.3527 | |||

| JAAA / Janus Detroit Street Trust - Janus Henderson AAA CLO ETF | 0.07 | -57.81 | 3.51 | -57.78 | 0.7704 | -1.0245 | |||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 3.48 | 0.7643 | 0.7643 | ||||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 3.47 | 34.63 | 0.7618 | 0.2052 | |||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 3.44 | 0.7561 | 0.7561 | ||||||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 3.44 | 34.63 | 0.7549 | 0.2033 | |||||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 3.29 | 18.19 | 0.7219 | 0.1211 | |||

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 3.23 | 0.7092 | 0.7092 | ||||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 3.13 | 34.80 | 0.6866 | 0.1856 | |||||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 3.08 | 34.73 | 0.6755 | 0.1821 | |||||

| US912828S505 / United States Treasury Inflation Indexed Bonds | 3.01 | 34.33 | 0.6619 | 0.1773 | |||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 3.00 | 35.27 | 0.6586 | 0.1796 | |||||

| J2BL34 / Jabil Inc. - Depositary Receipt (Common Stock) | 2.99 | 0.6575 | 0.6575 | ||||||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 2.77 | 34.48 | 0.6091 | 0.1636 | |||||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 2.75 | 34.49 | 0.6037 | 0.1620 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 2.71 | 34.99 | 0.5956 | 0.1616 | |||||

| CRM / Salesforce, Inc. | 0.01 | 0.00 | 2.58 | 1.58 | 0.5659 | 0.0181 | |||

| DHR / Danaher Corporation | 0.01 | 0.00 | 2.49 | -3.61 | 0.5457 | -0.0114 | |||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 2.37 | 34.45 | 0.5203 | 0.1395 | |||||

| EURO-SCHATZ FUT SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 2.27 | 0.4976 | 0.4976 | ||||||

| DAX INDEX FUTURE SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 2.12 | 0.4649 | 0.4649 | ||||||

| NIKKEI 225 MINI SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 2.05 | 0.4496 | 0.4496 | ||||||

| SP500 MIC EMIN FUTSEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.97 | 0.4326 | 0.4326 | ||||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 1.90 | 0.4167 | 0.4167 | ||||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.89 | 0.4160 | 0.4160 | ||||||

| S&P/TSX 60 IX FUT SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.88 | 0.4120 | 0.4120 | ||||||

| FTSE/MIB IDX FUT SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.87 | 0.4109 | 0.4109 | ||||||

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 1.83 | 0.4024 | 0.4024 | ||||||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 1.83 | 0.55 | 0.4016 | 0.0087 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.74 | 0.3829 | 0.3829 | ||||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 1.72 | 34.06 | 0.3788 | 0.1010 | |||||

| P1HC34 / Parker-Hannifin Corporation - Depositary Receipt (Common Stock) | 1.69 | 0.3708 | 0.3708 | ||||||

| EURO-BUND FUTURE SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 1.68 | 0.3690 | 0.3690 | ||||||

| CAC40 10 EURO FUT JUL25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.62 | 0.3559 | 0.3559 | ||||||

| US912810FD55 / Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 | 1.47 | 33.73 | 0.3232 | 0.0855 | |||||

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 1.43 | 34.55 | 0.3148 | 0.0847 | |||||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 1.38 | 33.43 | 0.3026 | 0.0796 | |||||

| NASDAQ 100 E-MINI SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.37 | 0.3016 | 0.3016 | ||||||

| US44890MV417 / HYUNDAI CAP AMER INC | 1.34 | 0.2951 | 0.2951 | ||||||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 1.34 | 1.29 | 0.2942 | 0.0086 | |||||

| IBEX 35 INDX FUTR JUL25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.31 | 0.2871 | 0.2871 | ||||||

| LONG GILT FUTURE SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 1.27 | 0.2799 | 0.2799 | ||||||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 1.25 | 34.63 | 0.2741 | 0.0738 | |||||

| US912828N712 / United States Treasury Inflation Indexed Bonds | 1.20 | 0.50 | 0.2633 | 0.0055 | |||||

| S&P/TSX 60 IX FUT SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.17 | 0.2575 | 0.2575 | ||||||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 1.15 | 0.2525 | 0.2525 | ||||||

| OMXS30 IND FUTURE JUL25 PHYSICAL INDEX FUTURE. / DE (N/A) | 1.10 | 0.2413 | 0.2413 | ||||||

| NVDA / NVIDIA Corporation | 0.01 | -86.42 | 1.06 | -80.20 | 0.2328 | -0.9237 | |||

| EURO-OAT FUTURE SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 1.02 | 0.2235 | 0.2235 | ||||||

| TSY INFL IX N/B 1.625000% 04/15/2030 / DBT (US91282CNB36) | 1.00 | 0.2193 | 0.2193 | ||||||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.01 | -7.68 | 0.85 | -6.37 | 0.1872 | -0.0095 | |||

| FTSE 100 IDX FUT SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 0.84 | 0.1851 | 0.1851 | ||||||

| AUST 10Y BOND FUT SEP25 FINANCIAL COMMODITY FUTURE. / (N/A) | 0.83 | 0.1814 | 0.1814 | ||||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 0.75 | 0.1640 | 0.1640 | ||||||

| E-MINI RUSS 2000 SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 0.66 | 0.1444 | 0.1444 | ||||||

| VW CREDIT INC COMMERCIAL PAPER (ISITC) / ABS-APCP (US91842JVB24) | 0.50 | 0.1092 | 0.1092 | ||||||

| US912810FS25 / United States Treasury Inflation Indexed Bonds | 0.40 | 0.25 | 0.0871 | 0.0016 | |||||

| META / Meta Platforms, Inc. | 0.00 | -93.96 | 0.39 | -92.27 | 0.0862 | -1.0096 | |||

| EURO STOXX 50 SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 0.38 | 0.0824 | 0.0824 | ||||||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.35 | 15.03 | 0.0775 | 0.0114 | |||

| MSFT / Microsoft Corporation | 0.00 | -95.80 | 0.32 | -94.44 | 0.0702 | -1.1699 | |||

| S&P500 EMINI FUT SEP25 PHYSICAL INDEX FUTURE. / DE (N/A) | 0.31 | 0.0687 | 0.0687 | ||||||

| US46652LU215 / JABIL INC | 0.30 | 0.0659 | 0.0659 | ||||||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 0.29 | 13.55 | 0.0627 | 0.0084 | |||

| CAN 10YR BOND FUT SEP25 FINANCIAL COMMODITY FUTURE. / DIR (N/A) | 0.27 | 0.0589 | 0.0589 | ||||||

| F1NI34 / Fidelity National Information Services, Inc. - Depositary Receipt (Common Stock) | 0.25 | 0.0548 | 0.0548 | ||||||

| VCLT / Vanguard Scottsdale Funds - Vanguard Long-Term Corporate Bond ETF | 0.00 | -43.96 | 0.14 | -43.97 | 0.0317 | -0.0239 | |||

| BRK: GOLDMAN SACHS INTERNATIONAL REF:DANAHER_US_USD_XNYS / DE (TRS897955) | 0.10 | 31.94 | 0.0209 | 0.0053 | |||||

| BRK - GOLDMAN SACHS REF - GS USD SHORT VOL BASKET / DE (TRS891112) | 0.09 | 507.14 | 0.0188 | 0.0156 | |||||

| VMBS / Vanguard Scottsdale Funds - Vanguard Mortgage-Backed Securities ETF | 0.00 | -94.29 | 0.07 | -94.35 | 0.0149 | -0.2413 | |||

| BRK: GOLDMAN SACHS REC: GOLDMAN SACHS WEEKLY TY VOLATILITY CARRY STRA / DE (TRS898968) | -0.01 | -10.00 | -0.0022 | 0.0000 | |||||

| BRK: GOLDMAN SACHS INTERNATIONAL REF: SALESFORCE.COM_US_USD_XN / DE (TRS897953) | -0.05 | -151.92 | -0.0120 | -0.0345 | |||||

| BRK: GOLDMAN SACHS INTERNATIONAL REF: JPMORGAN CHASE_US_USD_XN / DE (TRS897954) | -0.25 | 68.97 | -0.0540 | -0.0225 | |||||

| BRK: GOLDMAN SACHS INTERNATIONAL REF: BROADCOM INC_US_USD_XNAS / DE (TRS897952) | -0.26 | -169.58 | -0.0579 | -0.1396 |