Basic Stats

| Portfolio Value | $ 358,834 |

| Current Positions | 91 |

Latest Holdings, Performance, AUM (from 13F, 13D)

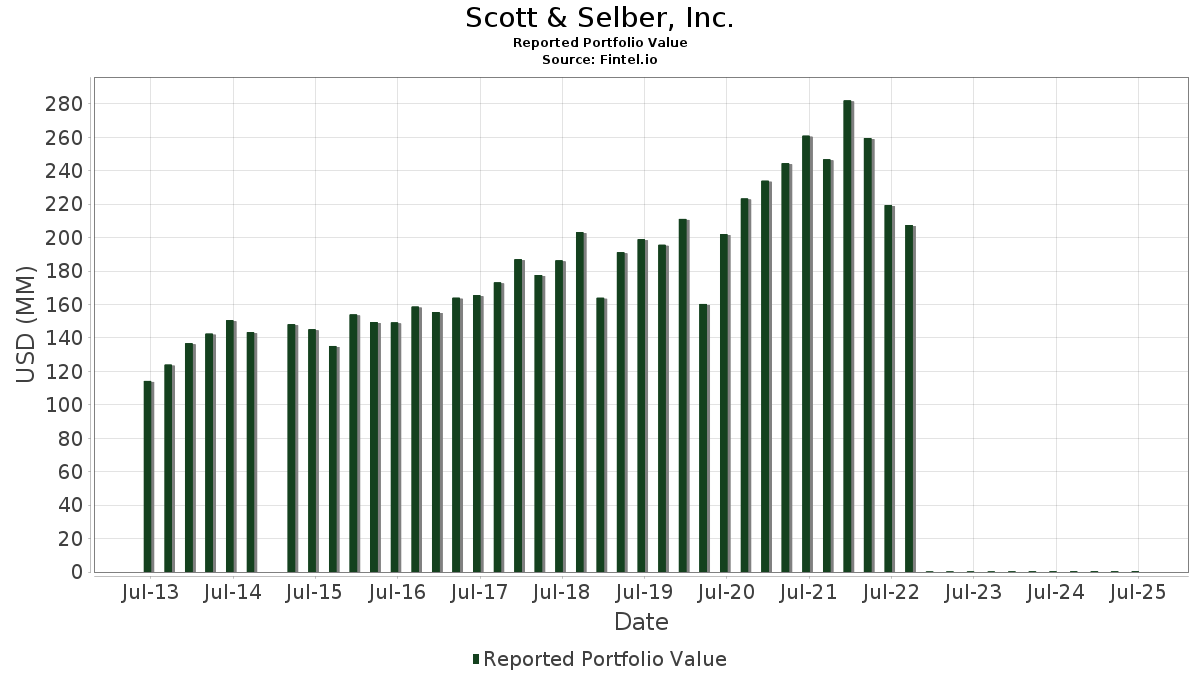

Scott & Selber, Inc. has disclosed 91 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 358,834 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Scott & Selber, Inc.’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Broadcom Inc. (US:AVGO) , and Amazon.com, Inc. (US:AMZN) . Scott & Selber, Inc.’s new positions include Pinterest, Inc. (US:PINS) , Maplebear Inc. (US:CART) , Airbnb, Inc. (US:ABNB) , Devon Energy Corporation (US:DVN) , and Hilton Worldwide Holdings Inc. (US:HLT) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 0.03 | 7.9895 | 1.2795 | |

| 0.07 | 0.02 | 5.3033 | 1.2241 | |

| 0.05 | 0.02 | 6.6256 | 0.9091 | |

| 0.05 | 0.01 | 1.5771 | 0.8141 | |

| 0.07 | 0.00 | 0.6995 | 0.6995 | |

| 0.05 | 0.00 | 0.6920 | 0.6920 | |

| 0.02 | 0.00 | 0.6883 | 0.6883 | |

| 0.08 | 0.00 | 0.6842 | 0.6842 | |

| 0.01 | 0.00 | 0.5306 | 0.5306 | |

| 0.02 | 0.00 | 0.8996 | 0.4645 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 0.02 | 6.5454 | -1.5679 | |

| 0.01 | 0.00 | 0.4453 | -0.9109 | |

| 0.00 | 0.00 | 0.8865 | -0.6907 | |

| 0.00 | 0.00 | 0.0719 | -0.4871 | |

| 0.01 | 0.01 | 1.5868 | -0.3985 | |

| 0.04 | 0.00 | 1.3357 | -0.3477 | |

| 0.01 | 0.00 | 0.7017 | -0.2815 | |

| 0.12 | 0.00 | 0.6568 | -0.2665 | |

| 0.02 | 0.00 | 0.9361 | -0.2645 | |

| 0.04 | 0.00 | 0.5674 | -0.2449 |

13F and Fund Filings

This form was filed on 2025-07-17 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.18 | -6.16 | 0.03 | 40.00 | 7.9895 | 1.2795 | |||

| MSFT / Microsoft Corporation | 0.05 | 0.49 | 0.02 | 35.29 | 6.6256 | 0.9091 | |||

| AAPL / Apple Inc. | 0.11 | 0.35 | 0.02 | -8.00 | 6.5454 | -1.5679 | |||

| AVGO / Broadcom Inc. | 0.07 | -9.28 | 0.02 | 58.33 | 5.3033 | 1.2241 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 0.74 | 0.01 | 18.18 | 3.7377 | 0.0414 | |||

| GOOG / Alphabet Inc. | 0.07 | 0.61 | 0.01 | 9.09 | 3.6136 | -0.0205 | |||

| META / Meta Platforms, Inc. | 0.01 | 1.08 | 0.01 | 28.57 | 2.5875 | 0.2913 | |||

| KMI / Kinder Morgan, Inc. | 0.27 | 0.85 | 0.01 | 0.00 | 2.1938 | -0.2315 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 0.08 | 0.01 | 16.67 | 2.0909 | 0.0601 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.02 | -0.09 | 0.01 | 16.67 | 2.0764 | 0.0568 | |||

| C / Citigroup Inc. | 0.08 | 1.08 | 0.01 | 20.00 | 1.9332 | 0.1009 | |||

| WMB / The Williams Companies, Inc. | 0.10 | 0.69 | 0.01 | 0.00 | 1.7877 | -0.1531 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.01 | 0.68 | 0.01 | -16.67 | 1.5868 | -0.3985 | |||

| HD / The Home Depot, Inc. | 0.02 | 0.58 | 0.01 | 0.00 | 1.5860 | -0.2249 | |||

| MU / Micron Technology, Inc. | 0.05 | 67.44 | 0.01 | 150.00 | 1.5771 | 0.8141 | |||

| CCL / Carnival Corporation & plc | 0.19 | 1.41 | 0.01 | 66.67 | 1.4845 | 0.3162 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.08 | 0.00 | 0.01 | 25.00 | 1.4544 | -0.0475 | |||

| RTX / RTX Corporation | 0.04 | 0.30 | 0.01 | 25.00 | 1.4249 | -0.0555 | |||

| BAC / Bank of America Corporation | 0.11 | 0.48 | 0.01 | 25.00 | 1.4140 | -0.0117 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.02 | 0.00 | 0.00 | 0.00 | 1.3625 | -0.1212 | |||

| HON / Honeywell International Inc. | 0.02 | 0.18 | 0.00 | 0.00 | 1.3466 | -0.0577 | |||

| CSCO / Cisco Systems, Inc. | 0.07 | 0.83 | 0.00 | 0.00 | 1.3402 | -0.0180 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 0.57 | 0.00 | -20.00 | 1.3357 | -0.3477 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 0.57 | 0.00 | 33.33 | 1.3257 | 0.1568 | |||

| Lam Research / COMM (512807108) | 0.05 | 0.00 | 0.0000 | ||||||

| AMAT / Applied Materials, Inc. | 0.02 | 1.53 | 0.00 | 33.33 | 1.1627 | 0.1199 | |||

| ORCL / Oracle Corporation | 0.02 | 0.46 | 0.00 | 100.00 | 1.1328 | 0.3042 | |||

| TSLA / Tesla, Inc. | 0.01 | 0.24 | 0.00 | 0.00 | 1.0551 | 0.0687 | |||

| V / Visa Inc. | 0.01 | 0.52 | 0.00 | 0.00 | 1.0495 | -0.1345 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | 0.59 | 0.00 | 0.00 | 1.0281 | -0.0419 | |||

| WM / Waste Management, Inc. | 0.02 | 0.54 | 0.00 | 0.00 | 1.0230 | -0.1597 | |||

| ABBV / AbbVie Inc. | 0.02 | 1.11 | 0.00 | 0.00 | 0.9361 | -0.2645 | |||

| INTU / Intuit Inc. | 0.00 | 0.66 | 0.00 | 50.00 | 0.9308 | 0.1028 | |||

| GNRC / Generac Holdings Inc. | 0.02 | 110.00 | 0.00 | 200.00 | 0.8996 | 0.4645 | |||

| AZO / AutoZone, Inc. | 0.00 | -33.67 | 0.00 | -25.00 | 0.8865 | -0.6907 | |||

| ADBE / Adobe Inc. | 0.01 | 134.39 | 0.00 | 200.00 | 0.8831 | 0.4541 | |||

| MA / Mastercard Incorporated | 0.01 | 0.61 | 0.00 | 0.00 | 0.8266 | -0.0942 | |||

| SCHW / The Charles Schwab Corporation | 0.03 | 0.91 | 0.00 | 0.00 | 0.8241 | 0.0192 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.01 | 0.00 | 0.00 | 0.00 | 0.8093 | -0.0500 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.01 | 0.00 | 0.00 | 0.00 | 0.7563 | -0.0566 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.10 | -1.14 | 0.00 | 0.00 | 0.7179 | -0.1626 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 0.60 | 0.00 | -33.33 | 0.7017 | -0.2815 | |||

| PINS / Pinterest, Inc. | 0.07 | 0.00 | 0.6995 | 0.6995 | |||||

| CART / Maplebear Inc. | 0.05 | 0.00 | 0.6920 | 0.6920 | |||||

| PG / The Procter & Gamble Company | 0.02 | -1.25 | 0.00 | 0.00 | 0.6900 | -0.1687 | |||

| ABNB / Airbnb, Inc. | 0.02 | 0.00 | 0.6883 | 0.6883 | |||||

| DVN / Devon Energy Corporation | 0.08 | 0.00 | 0.6842 | 0.6842 | |||||

| WFC / Wells Fargo & Company | 0.03 | 0.56 | 0.00 | 0.00 | 0.6791 | -0.0159 | |||

| C.WSA / Citigroup, Inc. | 0.00 | 0.57 | 0.00 | 0.00 | 0.6752 | -0.0205 | |||

| SMG / The Scotts Miracle-Gro Company | 0.04 | 58.94 | 0.00 | 100.00 | 0.6747 | 0.2687 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.54 | 0.00 | 0.00 | 0.6722 | -0.0616 | |||

| JNJ / Johnson & Johnson | 0.02 | 0.60 | 0.00 | 0.00 | 0.6660 | -0.1597 | |||

| HAL / Halliburton Company | 0.12 | 1.76 | 0.00 | 0.00 | 0.6568 | -0.2665 | |||

| SBUX / Starbucks Corporation | 0.02 | 0.87 | 0.00 | 0.00 | 0.6351 | -0.1390 | |||

| KVUE / Kenvue Inc. | 0.11 | 0.89 | 0.00 | 0.00 | 0.6273 | -0.1914 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.02 | 0.00 | 0.00 | 0.00 | 0.6181 | -0.1039 | |||

| UNP / Union Pacific Corporation | 0.01 | 0.61 | 0.00 | 0.00 | 0.6050 | -0.1045 | |||

| COP / ConocoPhillips | 0.02 | 0.54 | 0.00 | 0.00 | 0.5891 | -0.1988 | |||

| ABT / Abbott Laboratories | 0.02 | 0.68 | 0.00 | 0.00 | 0.5794 | -0.0654 | |||

| TAP / Molson Coors Beverage Company | 0.04 | 1.58 | 0.00 | 0.00 | 0.5674 | -0.2449 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.04 | 0.73 | 0.00 | 100.00 | 0.5588 | -0.0111 | |||

| CVX / Chevron Corporation | 0.01 | 0.58 | 0.00 | -50.00 | 0.5317 | -0.1778 | |||

| ADI / Analog Devices, Inc. | 0.01 | 0.00 | 0.5306 | 0.5306 | |||||

| VV / Vanguard Index Funds - Vanguard Large-Cap ETF | 0.01 | 0.00 | 0.00 | 0.00 | 0.5217 | -0.0184 | |||

| ZTS / Zoetis Inc. | 0.01 | 0.58 | 0.00 | 0.00 | 0.5064 | -0.1042 | |||

| KO / The Coca-Cola Company | 0.02 | 0.99 | 0.00 | 0.00 | 0.4913 | -0.0744 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.85 | 0.00 | 0.00 | 0.4646 | -0.0960 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -36.65 | 0.00 | -75.00 | 0.4453 | -0.9109 | |||

| CRM / Salesforce, Inc. | 0.01 | 0.67 | 0.00 | 0.00 | 0.4445 | -0.0546 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 0.70 | 0.00 | 0.00 | 0.4138 | 0.0719 | |||

| MRK / Merck & Co., Inc. | 0.02 | 0.91 | 0.00 | 0.00 | 0.3447 | -0.1003 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.82 | 0.00 | 0.00 | 0.3419 | -0.0519 | |||

| AMGN / Amgen Inc. | 0.00 | 0.78 | 0.00 | 0.00 | 0.2823 | -0.0769 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -4.98 | 0.00 | 0.2319 | -0.0063 | ||||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.00 | 0.1653 | -0.0361 | ||||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.02 | 0.06 | 0.00 | 0.1647 | -0.0059 | ||||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.01 | 0.02 | 0.00 | 0.1466 | -0.0164 | ||||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | -2.19 | 0.00 | 0.1424 | -0.0193 | ||||

| JLL / Jones Lang LaSalle Incorporated | 0.00 | 0.00 | 0.00 | 0.1120 | -0.0125 | ||||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.00 | 6.40 | 0.00 | 0.1023 | -0.0079 | ||||

| TPST / Tempest Therapeutics, Inc. | 0.00 | 0.00 | 0.00 | 0.0931 | 0.0230 | ||||

| IGM / iShares Trust - iShares Expanded Tech Sector ETF | 0.00 | 0.00 | 0.00 | 0.0828 | 0.0059 | ||||

| WMT / Walmart Inc. | 0.00 | 1.88 | 0.00 | 0.0811 | -0.0009 | ||||

| PEP / PepsiCo, Inc. | 0.00 | -83.26 | 0.00 | -100.00 | 0.0719 | -0.4871 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.00 | 0.0686 | -0.0028 | ||||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.00 | 0.0649 | -0.0151 | ||||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.00 | 0.0627 | -0.0087 | ||||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.0596 | 0.0596 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | 0.00 | 0.0569 | 0.0569 | |||||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.00 | 0.05 | 0.00 | 0.0566 | -0.0081 | ||||

| SLI / Standard Lithium Ltd. | 0.01 | 0.00 | 0.0059 | 0.0059 | |||||

| MMM / 3M Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ULTA / Ulta Beauty, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| YUMC / Yum China Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TXN / Texas Instruments Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DSX / Diana Shipping Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |