Basic Stats

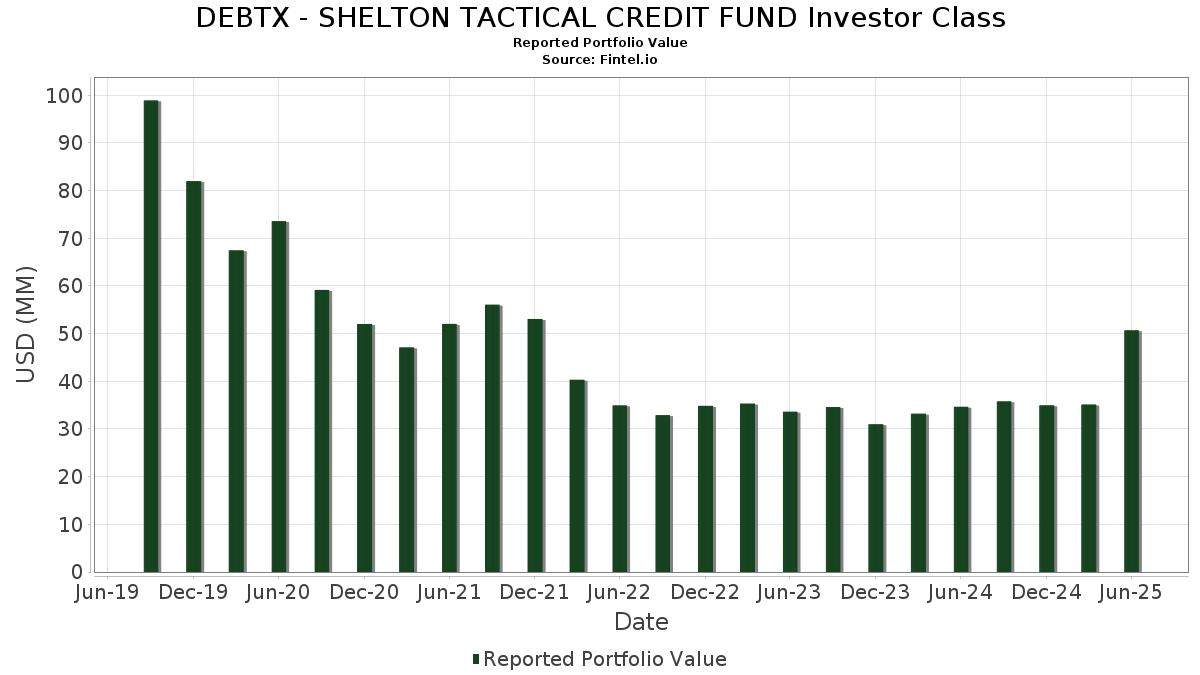

| Portfolio Value | $ 50,688,902 |

| Current Positions | 49 |

Latest Holdings, Performance, AUM (from 13F, 13D)

DEBTX - SHELTON TACTICAL CREDIT FUND Investor Class has disclosed 49 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 50,688,902 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). DEBTX - SHELTON TACTICAL CREDIT FUND Investor Class’s top holdings are PETM 7 3/4 02/15/29 (US:US71677KAB44) , AMC Entertainment Holdings Inc (US:US00165CBA18) , Sirius XM Radio Inc (US:US82967NBM92) , JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. (US:US46590XAY22) , and Cinemark USA Inc (US:US172441BF30) . DEBTX - SHELTON TACTICAL CREDIT FUND Investor Class’s new positions include PETM 7 3/4 02/15/29 (US:US71677KAB44) , AMC Entertainment Holdings Inc (US:US00165CBA18) , Sirius XM Radio Inc (US:US82967NBM92) , JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. (US:US46590XAY22) , and Cinemark USA Inc (US:US172441BF30) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 4.08 | 7.9048 | 7.9048 | ||

| 1.52 | 2.9412 | 2.9412 | ||

| 1.27 | 2.4609 | 2.4609 | ||

| 1.24 | 2.3967 | 2.3967 | ||

| 1.23 | 2.3841 | 2.3841 | ||

| 1.02 | 1.9754 | 1.9754 | ||

| 1.01 | 1.9642 | 1.9642 | ||

| 1.00 | 1.9461 | 1.9461 | ||

| 1.01 | 1.9557 | 0.5447 | ||

| 0.99 | 1.9244 | 0.5384 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.01 | 1.9588 | -1.5241 | ||

| 0.77 | 1.4843 | -1.4046 | ||

| 1.54 | 2.9883 | -1.3389 | ||

| 1.43 | 2.7747 | -1.2459 | ||

| 1.30 | 2.5257 | -1.1491 | ||

| 1.13 | 2.1952 | -0.9942 | ||

| 1.05 | 2.0378 | -0.9738 | ||

| 1.13 | 2.1970 | -0.9694 | ||

| 1.80 | 3.4915 | -0.8048 | ||

| 1.48 | 2.8662 | -0.6718 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WIB 0 08/14/25 / DBT (US912797PN17) | 4.08 | 7.9048 | 7.9048 | ||||||

| FUN 6.625 05/01/32 144A / DBT (US83002YAA73) | 1.80 | 19.11 | 3.4915 | -0.8048 | |||||

| I1RM34 / Iron Mountain Incorporated - Depositary Receipt (Common Stock) | 1.80 | 45.08 | 3.4875 | -0.0361 | |||||

| US71677KAB44 / PETM 7 3/4 02/15/29 | 1.70 | 48.77 | 3.2947 | 0.0485 | |||||

| US00165CBA18 / AMC Entertainment Holdings Inc | 1.59 | 69.33 | 3.0818 | 0.4138 | |||||

| US82967NBM92 / Sirius XM Radio Inc | 1.56 | 45.60 | 3.0142 | -0.0229 | |||||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 1.54 | 1.18 | 2.9883 | -1.3389 | |||||

| AMH 5.5 02/01/34 / DBT (US02666TAG22) | 1.53 | 52.81 | 2.9563 | 0.1188 | |||||

| F2RT34 / First Industrial Realty Trust, Inc. - Depositary Receipt (Common Stock) | 1.52 | 2.9412 | 2.9412 | ||||||

| US172441BF30 / Cinemark USA Inc | 1.49 | 53.81 | 2.8927 | 0.1366 | |||||

| US893830BL24 / Transocean Inc | 1.48 | 18.71 | 2.8662 | -0.6718 | |||||

| US771196CH33 / ROCHE HOLDINGS INC 144A LIFE SR UNSEC 5.593% 11-13-33 | 1.43 | 1.13 | 2.7747 | -1.2459 | |||||

| US40204BAA35 / Guitar Center Inc | 1.41 | 39.31 | 2.7280 | -0.1419 | |||||

| GEO 10.25 04/15/31 / DBT (US36162JAH95) | 1.37 | 68.10 | 2.6572 | 0.3410 | |||||

| US005095AA29 / Acushnet Co | 1.30 | 0.77 | 2.5257 | -1.1491 | |||||

| C1MI34 / Cummins Inc. - Depositary Receipt (Common Stock) | 1.27 | 2.4609 | 2.4609 | ||||||

| K1LA34 / KLA Corporation - Depositary Receipt (Common Stock) | 1.24 | 26.81 | 2.4114 | -0.3763 | |||||

| US131347CQ78 / Calpine Corp | 1.24 | 2.3967 | 2.3967 | ||||||

| RIVHOL 10 01/15/31 144A / DBT (US76954LAD10) | 1.23 | 2.3841 | 2.3841 | ||||||

| RISBAK 8.625 11/01/31 144A / DBT (US92676AAA51) | 1.22 | 76.33 | 2.3700 | 0.4001 | |||||

| US92933BAR50 / WMG Acquisition Corp | 1.13 | 1.71 | 2.1970 | -0.9694 | |||||

| US92826CAK80 / VISA INC 2.7 4/40 | 1.13 | 0.89 | 2.1952 | -0.9942 | |||||

| US46647PAJ57 / JPMorgan Chase & Co | 1.10 | 69.54 | 2.1369 | 0.2890 | |||||

| US008911BD05 / Air Canada 2020-1 Class C Pass Through Trust | 1.05 | -0.85 | 2.0378 | -0.9738 | |||||

| US911365BQ63 / United Rentals North America, Inc. | 1.02 | 34.56 | 1.9849 | -0.1785 | |||||

| US645370AB35 / New Home Co Inc/The | 1.02 | 1.9754 | 1.9754 | ||||||

| DIGMID 10.5 11/25/28 / DBT (USG27707AA90) | 1.01 | 1.9642 | 1.9642 | ||||||

| US50077LAB27 / Kraft Heinz Foods Co | 1.01 | -17.55 | 1.9588 | -1.5241 | |||||

| BHCCN 10 04/15/32 144A / DBT (US68288AAA51) | 1.01 | 103.43 | 1.9557 | 0.5447 | |||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 1.00 | 1.9461 | 1.9461 | ||||||

| MARS 5.65 05/01/45 144a / DBT (US571676BB09) | 1.00 | 101.00 | 1.9441 | 0.5247 | |||||

| US00774MAZ86 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1.00 | 69.20 | 1.9386 | 0.2586 | |||||

| K1RC34 / The Kroger Co. - Depositary Receipt (Common Stock) | 0.99 | 103.70 | 1.9244 | 0.5384 | |||||

| ALK 5.308 10/20/31 144A / DBT (US00218QAB68) | 0.98 | 101.43 | 1.9068 | 0.5192 | |||||

| PYYX / Pyxus International, Inc. | 0.18 | 11.72 | 0.94 | 45.36 | 1.8210 | -0.0169 | |||

| WIN 8.25 10/01/31 144A / DBT (US97381AAA07) | 0.79 | 54.53 | 1.5218 | 0.0760 | |||||

| TALO 9.375 02/01/31 144A / DBT (US87485LAE48) | 0.77 | -24.70 | 1.4843 | -1.4046 | |||||

| PRMWCN 6.25 04/01/29 144A / DBT (US74168RAC79) | 0.76 | 1.07 | 1.4638 | -0.6600 | |||||

| US91327BAA89 / UNITI GROUP LP / UNITI GROUP FINANCE INC / CSL CAPITAL LLC 6.5% 02/15/2029 144A | 0.72 | 61.25 | 1.4052 | 0.1294 | |||||

| US74738YAD13 / Pyxus Holding Inc 2023 Term Loan | 0.42 | 6.65 | 0.8087 | -0.3037 | |||||

| US74738YAF60 / Pyxus Holding Inc 2023 First Lien Term Loan | 0.29 | 0.00 | 0.5713 | -0.2640 | |||||

| US130536RA56 / CALIFORNIA ST POLL CONTROL FIN AUTH SOL WST DISP REVENUE | 0.02 | -14.81 | 0.0447 | -0.0339 | |||||

| HYG A 2025-08-15 PUT 78 / DE (N/A) | 0.01 | 0.0233 | 0.0233 | ||||||

| TYU5 COMDTY 2025-08-25 PUT 109.5 / DE (N/A) | 0.01 | 0.0212 | 0.0212 | ||||||

| TYU5 COMDTY 2025-08-25 PUT 108.5 / DE (N/A) | 0.01 | 0.0106 | 0.0106 | ||||||

| HYG A 2025-08-15 PUT 76 / DE (N/A) | 0.00 | 0.0078 | 0.0078 | ||||||

| US130536RM94 / CALIFORNIA ST POLL CONTROL FIN AUTH SOL WST DISP REVENUE | 0.00 | -33.33 | 0.0055 | -0.0041 | |||||

| TYU5 COMDTY 2025-08-25 PUT 109 / DE (N/A) | 0.00 | 0.0045 | 0.0045 | ||||||

| US125ESCAG89 / ESC GCB CBL ASSOCS L | 0.00 | 0.0000 | 0.0000 | ||||||

| US125ESCAF07 / ESCROW | 0.00 | 0.0000 | 0.0000 | ||||||

| US28620EAB65 / Eletson Holdings Inc / Eletson Finance US LLC / Agathonissos Finance LLC | 0.00 | 0.0000 | 0.0000 | ||||||

| CHHCF / CHC Group LLC | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| CDX.NA.HY SERIES 44 06/30 / DO (N/A) | -0.33 | -0.6400 | -0.6400 |