Basic Stats

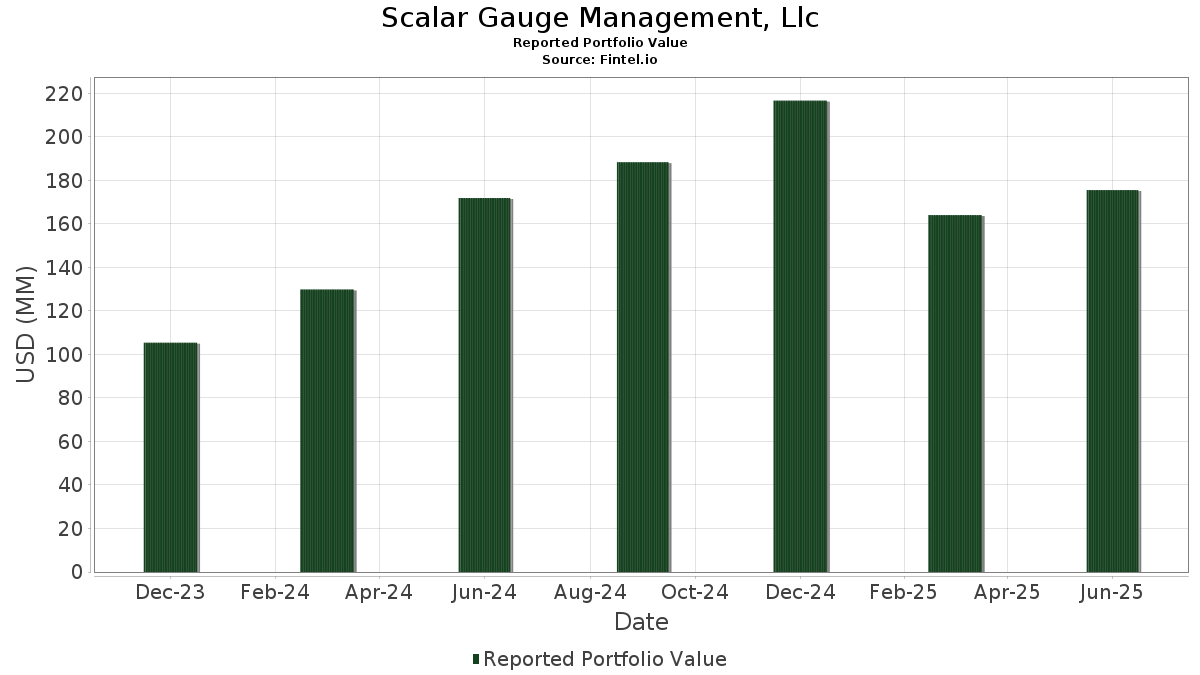

| Portfolio Value | $ 175,529,701 |

| Current Positions | 30 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Scalar Gauge Management, Llc has disclosed 30 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 175,529,701 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Scalar Gauge Management, Llc’s top holdings are BlackLine, Inc. (US:BL) , PagerDuty, Inc. (US:PD) , Celestica Inc. (CA:CLS) , Clearwater Analytics Holdings, Inc. (US:CWAN) , and Five9, Inc. (US:FIVN) . Scalar Gauge Management, Llc’s new positions include Celestica Inc. (CA:CLS) , Broadcom Inc. (US:AVGO) , Mastercard Incorporated (US:MA) , Fiserv, Inc. (US:FI) , and AutoZone, Inc. (US:AZO) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 13.97 | 7.9604 | 7.9604 | |

| 0.03 | 9.37 | 5.3393 | 5.3393 | |

| 0.01 | 7.87 | 4.4820 | 4.4820 | |

| 0.04 | 7.76 | 4.4200 | 4.4200 | |

| 0.01 | 7.04 | 4.0093 | 4.0093 | |

| 0.00 | 6.31 | 3.5953 | 3.5953 | |

| 0.01 | 5.90 | 3.3639 | 3.3639 | |

| 0.05 | 4.75 | 2.7044 | 2.7044 | |

| 0.98 | 14.93 | 8.5042 | 2.3983 | |

| 0.02 | 4.03 | 2.2947 | 2.2947 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.52 | 11.50 | 6.5497 | -4.2923 | |

| 0.40 | 10.58 | 6.0300 | -3.5350 | |

| 0.13 | 2.12 | 1.2051 | -3.0501 | |

| 1.12 | 8.75 | 4.9861 | -1.1304 | |

| 0.10 | 3.10 | 1.7665 | -0.6149 | |

| 0.17 | 2.84 | 1.6164 | -0.3813 | |

| 0.22 | 4.16 | 2.3694 | -0.2784 | |

| 0.09 | 0.89 | 0.5060 | -0.1858 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BL / BlackLine, Inc. | 0.57 | 0.17 | 32.21 | 17.13 | 18.3477 | 1.5855 | |||

| PD / PagerDuty, Inc. | 0.98 | 78.21 | 14.93 | 49.05 | 8.5042 | 2.3983 | |||

| CLS / Celestica Inc. | 0.08 | 13.97 | 7.9604 | 7.9604 | |||||

| CWAN / Clearwater Analytics Holdings, Inc. | 0.52 | -21.00 | 11.50 | -35.36 | 6.5497 | -4.2923 | |||

| FIVN / Five9, Inc. | 0.40 | -30.83 | 10.58 | -32.54 | 6.0300 | -3.5350 | |||

| AVGO / Broadcom Inc. | 0.03 | 9.37 | 5.3393 | 5.3393 | |||||

| SMWB / Similarweb Ltd. | 1.12 | -7.98 | 8.75 | -12.77 | 4.9861 | -1.1304 | |||

| MA / Mastercard Incorporated | 0.01 | 7.87 | 4.4820 | 4.4820 | |||||

| FI / Fiserv, Inc. | 0.04 | 7.76 | 4.4200 | 4.4200 | |||||

| AXON / Axon Enterprise, Inc. | 0.01 | 7.04 | 4.0093 | 4.0093 | |||||

| AZO / AutoZone, Inc. | 0.00 | 6.31 | 3.5953 | 3.5953 | |||||

| META / Meta Platforms, Inc. | 0.01 | 5.90 | 3.3639 | 3.3639 | |||||

| CGNT / Cognyte Software Ltd. | 0.55 | 18.48 | 5.04 | 40.36 | 2.8691 | 0.6816 | |||

| CHDN / Churchill Downs Incorporated | 0.05 | 4.75 | 2.7044 | 2.7044 | |||||

| AVPT / AvePoint, Inc. | 0.22 | -28.39 | 4.16 | -4.24 | 2.3694 | -0.2784 | |||

| SNOW / Snowflake Inc. | 0.02 | 4.03 | 2.2947 | 2.2947 | |||||

| NABL / N-able, Inc. | 0.45 | 421.12 | 3.61 | 495.38 | 2.0560 | 1.6864 | |||

| MOD / Modine Manufacturing Company | 0.03 | 3.35 | 1.9079 | 1.9079 | |||||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 3.10 | -20.63 | 1.7665 | -0.6149 | |||

| OSPN / OneSpan Inc. | 0.17 | -20.88 | 2.84 | -13.40 | 1.6164 | -0.3813 | |||

| ZD / Ziff Davis, Inc. | 0.09 | 2.60 | 1.4831 | 1.4831 | |||||

| CTAS / Cintas Corporation | 0.01 | 0.00 | 2.23 | 8.42 | 1.2697 | 0.0167 | |||

| CLBT / Cellebrite DI Ltd. | 0.13 | -63.20 | 2.12 | -69.70 | 1.2051 | -3.0501 | |||

| JAMF / Jamf Holding Corp. | 0.09 | 0.00 | 0.89 | -21.69 | 0.5060 | -0.1858 | |||

| BL / BlackLine, Inc. | Call | 0.00 | 0.24 | 0.1368 | 0.1368 | ||||

| PD / PagerDuty, Inc. | Call | 0.00 | 0.20 | 0.1160 | 0.1160 | ||||

| FIVN / Five9, Inc. | Call | 0.00 | 0.12 | 0.0691 | 0.0691 | ||||

| Clearwater Analytics Holdings Inc / CALL (185123906) | Call | 0.00 | 0.03 | 0.0000 | |||||

| CHDN / Churchill Downs Incorporated | Call | 0.00 | 0.03 | 0.0150 | 0.0150 | ||||

| JCOM / J2 Global Inc. | Call | 0.00 | 0.02 | 0.0100 | 0.0100 | ||||

| INFA / Informatica Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PGR / The Progressive Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VERX / Vertex, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| Invesco QQQ TR / PUT (46090E953) | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| TWLO / Twilio Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALKT / Alkami Technology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HPE / Hewlett Packard Enterprise Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BLZE / Backblaze, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GB / Global Blue Group Holding AG | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VIXY / ProShares Trust II - ProShares VIX Short-Term Futures ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPSC / SPS Commerce, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SWI / SolarWinds Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FRSH / Freshworks Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NRG / NRG Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |