Basic Stats

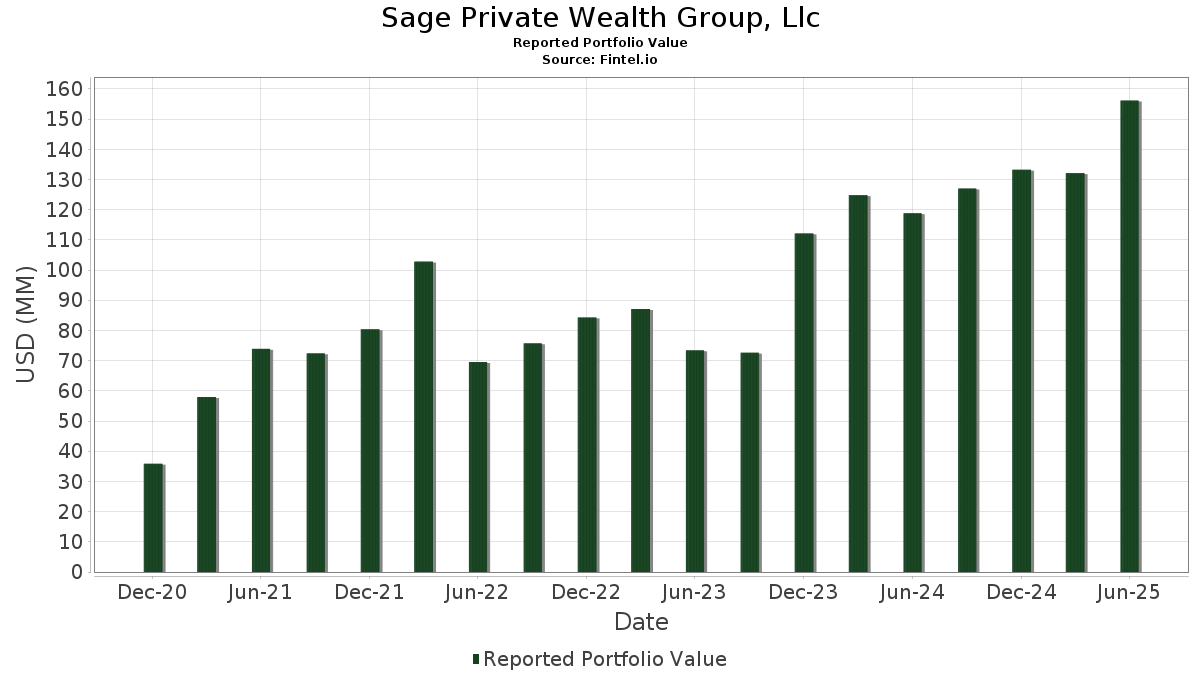

| Portfolio Value | $ 156,110,170 |

| Current Positions | 86 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Sage Private Wealth Group, Llc has disclosed 86 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 156,110,170 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Sage Private Wealth Group, Llc’s top holdings are WisdomTree Trust - WisdomTree U.S. Quality Dividend Growth Fund (US:DGRW) , First Trust Exchange-Traded Fund VI - First Trust RBA American Industrial Renaissance ETF (US:AIRR) , DBX ETF Trust - Xtrackers MSCI EAFE Hedged Equity ETF (US:DBEF) , Litman Gregory Funds Trust - iMGP DBi Managed Futures Strategy ETF (US:DBMF) , and World Gold Trust - SPDR Gold MiniShares Trust (US:GLDM) . Sage Private Wealth Group, Llc’s new positions include World Gold Trust - SPDR Gold MiniShares Trust (US:GLDM) , Global X Funds - Global X MLP & Energy Infrastructure ETF (US:MLPX) , Chipotle Mexican Grill, Inc. (US:CMG) , Monster Beverage Corporation (US:MNST) , and Realty Income Corporation (US:O) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.43 | 35.71 | 22.8736 | 8.2514 | |

| 0.18 | 11.53 | 7.3851 | 7.3851 | |

| 0.18 | 11.01 | 7.0518 | 7.0518 | |

| 0.17 | 10.68 | 6.8420 | 0.7361 | |

| 0.02 | 3.73 | 2.3867 | 0.3163 | |

| 0.01 | 0.45 | 0.2906 | 0.2906 | |

| 0.01 | 3.69 | 2.3648 | 0.2702 | |

| 0.01 | 0.40 | 0.2567 | 0.2567 | |

| 0.01 | 0.40 | 0.2539 | 0.2539 | |

| 0.01 | 1.53 | 0.9792 | 0.2492 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.27 | 11.92 | 7.6362 | -5.9954 | |

| 0.17 | 13.58 | 8.6976 | -0.4866 | |

| 0.46 | 11.86 | 7.5974 | -0.4179 | |

| 0.00 | 0.23 | 0.1481 | -0.2551 | |

| 0.00 | 1.18 | 0.7570 | -0.1991 | |

| 0.00 | 0.88 | 0.5650 | -0.1419 | |

| 0.02 | 3.22 | 2.0610 | -0.1352 | |

| 0.01 | 0.32 | 0.2033 | -0.1150 | |

| 0.00 | 0.33 | 0.2112 | -0.1050 | |

| 0.00 | 0.88 | 0.5654 | -0.0798 |

13F and Fund Filings

This form was filed on 2025-07-29 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DGRW / WisdomTree Trust - WisdomTree U.S. Quality Dividend Growth Fund | 0.43 | 76.33 | 35.71 | 84.90 | 22.8736 | 8.2514 | |||

| AIRR / First Trust Exchange-Traded Fund VI - First Trust RBA American Industrial Renaissance ETF | 0.17 | -6.20 | 13.58 | 11.93 | 8.6976 | -0.4866 | |||

| DBEF / DBX ETF Trust - Xtrackers MSCI EAFE Hedged Equity ETF | 0.27 | -34.47 | 11.92 | -33.79 | 7.6362 | -5.9954 | |||

| DBMF / Litman Gregory Funds Trust - iMGP DBi Managed Futures Strategy ETF | 0.46 | 9.99 | 11.86 | 12.03 | 7.5974 | -0.4179 | |||

| GLDM / World Gold Trust - SPDR Gold MiniShares Trust | 0.18 | 11.53 | 7.3851 | 7.3851 | |||||

| MLPX / Global X Funds - Global X MLP & Energy Infrastructure ETF | 0.18 | 11.01 | 7.0518 | 7.0518 | |||||

| IAU / iShares Gold Trust | 0.17 | 25.22 | 10.68 | 32.45 | 6.8420 | 0.7361 | |||

| NVDA / NVIDIA Corporation | 0.02 | -6.53 | 3.73 | 36.25 | 2.3867 | 0.3163 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.71 | 3.69 | 33.44 | 2.3648 | 0.2702 | |||

| AAPL / Apple Inc. | 0.02 | 20.09 | 3.22 | 10.93 | 2.0610 | -0.1352 | |||

| AVGO / Broadcom Inc. | 0.01 | -3.70 | 1.53 | 58.51 | 0.9792 | 0.2492 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -1.61 | 1.30 | 16.32 | 0.8310 | -0.0135 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 8.57 | 1.26 | 25.27 | 0.8065 | 0.0451 | |||

| LLY / Eli Lilly and Company | 0.00 | -0.85 | 1.18 | -6.42 | 0.7570 | -0.1991 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 23.22 | 1.02 | 18.38 | 0.6562 | 0.0009 | |||

| GOOG / Alphabet Inc. | 0.01 | 8.43 | 0.95 | 23.15 | 0.6068 | 0.0242 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.94 | 5.77 | 0.5995 | -0.0703 | |||

| V / Visa Inc. | 0.00 | 2.22 | 0.88 | 3.52 | 0.5654 | -0.0798 | |||

| CME / CME Group Inc. | 0.00 | -9.07 | 0.88 | -5.47 | 0.5650 | -0.1419 | |||

| ETN / Eaton Corporation plc | 0.00 | -11.25 | 0.86 | 16.55 | 0.5505 | -0.0077 | |||

| WMT / Walmart Inc. | 0.01 | 0.46 | 0.77 | 11.87 | 0.4957 | -0.0280 | |||

| GOOGL / Alphabet Inc. | 0.00 | 10.98 | 0.74 | 26.53 | 0.4772 | 0.0312 | |||

| HD / The Home Depot, Inc. | 0.00 | 7.41 | 0.73 | 7.53 | 0.4664 | -0.0468 | |||

| INCY / Incyte Corporation | 0.01 | 15.92 | 0.70 | 30.48 | 0.4500 | 0.0420 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 45.05 | 0.69 | 70.79 | 0.4424 | 0.1358 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 18.84 | 0.69 | 20.63 | 0.4422 | 0.0084 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.00 | 19.48 | 0.67 | 32.28 | 0.4283 | 0.0456 | |||

| CMCSA / Comcast Corporation | 0.02 | 26.47 | 0.67 | 22.43 | 0.4268 | 0.0144 | |||

| ILMN / Illumina, Inc. | 0.01 | 79.51 | 0.63 | 116.38 | 0.4064 | 0.1839 | |||

| CRM / Salesforce, Inc. | 0.00 | 12.47 | 0.61 | 14.31 | 0.3893 | -0.0133 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | 16.61 | 0.61 | 14.77 | 0.3884 | -0.0117 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.22 | 0.59 | 14.45 | 0.3807 | -0.0130 | |||

| AXP / American Express Company | 0.00 | -4.68 | 0.57 | 13.00 | 0.3621 | -0.0166 | |||

| INTU / Intuit Inc. | 0.00 | 0.14 | 0.56 | 28.57 | 0.3576 | 0.0286 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -8.38 | 0.54 | 2.86 | 0.3465 | -0.0511 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 107.93 | 0.52 | 23.80 | 0.3300 | 0.0150 | |||

| ABBV / AbbVie Inc. | 0.00 | 59.93 | 0.51 | 41.99 | 0.3294 | 0.0547 | |||

| CB / Chubb Limited | 0.00 | 8.57 | 0.51 | 4.12 | 0.3246 | -0.0437 | |||

| JNJ / Johnson & Johnson | 0.00 | 13.03 | 0.50 | 4.13 | 0.3233 | -0.0438 | |||

| FSLR / First Solar, Inc. | 0.00 | 71.59 | 0.50 | 124.77 | 0.3202 | 0.1518 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.12 | 0.50 | 10.67 | 0.3192 | -0.0220 | |||

| MA / Mastercard Incorporated | 0.00 | 9.55 | 0.50 | 12.22 | 0.3179 | -0.0170 | |||

| INTC / Intel Corporation | 0.02 | 17.77 | 0.49 | 16.04 | 0.3155 | -0.0055 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 18.02 | 0.48 | 22.22 | 0.3107 | 0.0105 | |||

| ADI / Analog Devices, Inc. | 0.00 | 27.48 | 0.48 | 50.47 | 0.3077 | 0.0659 | |||

| AFL / Aflac Incorporated | 0.00 | 5.54 | 0.48 | 0.00 | 0.3066 | -0.0554 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | 0.45 | 0.2906 | 0.2906 | |||||

| TT / Trane Technologies plc | 0.00 | 15.65 | 0.45 | 50.17 | 0.2859 | 0.0609 | |||

| ACN / Accenture plc | 0.00 | 16.88 | 0.44 | 11.73 | 0.2811 | -0.0158 | |||

| STE / STERIS plc | 0.00 | 5.50 | 0.43 | 11.75 | 0.2744 | -0.0158 | |||

| TSLA / Tesla, Inc. | 0.00 | -11.94 | 0.42 | 8.03 | 0.2672 | -0.0254 | |||

| TGT / Target Corporation | 0.00 | 83.74 | 0.41 | 73.84 | 0.2643 | 0.0844 | |||

| MNST / Monster Beverage Corporation | 0.01 | 0.40 | 0.2567 | 0.2567 | |||||

| APD / Air Products and Chemicals, Inc. | 0.00 | 10.79 | 0.40 | 5.84 | 0.2562 | -0.0294 | |||

| COST / Costco Wholesale Corporation | 0.00 | 23.69 | 0.40 | 29.64 | 0.2552 | 0.0222 | |||

| O / Realty Income Corporation | 0.01 | 0.40 | 0.2539 | 0.2539 | |||||

| DRI / Darden Restaurants, Inc. | 0.00 | -12.65 | 0.39 | -8.27 | 0.2487 | -0.0721 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 11.55 | 0.39 | 9.30 | 0.2486 | -0.0204 | |||

| META / Meta Platforms, Inc. | 0.00 | 14.35 | 0.38 | 46.36 | 0.2450 | 0.0473 | |||

| NFLX / Netflix, Inc. | 0.00 | -21.19 | 0.37 | 13.03 | 0.2393 | -0.0106 | |||

| JCI / Johnson Controls International plc | 0.00 | -4.07 | 0.37 | 26.44 | 0.2390 | 0.0157 | |||

| FIS / Fidelity National Information Services, Inc. | 0.00 | 20.50 | 0.37 | 31.56 | 0.2379 | 0.0238 | |||

| UAA / Under Armour, Inc. | 0.05 | 99.68 | 0.37 | 117.86 | 0.2349 | 0.1077 | |||

| SJM / The J. M. Smucker Company | 0.00 | 0.37 | 0.2341 | 0.2341 | |||||

| VZ / Verizon Communications Inc. | 0.01 | -7.50 | 0.36 | -11.88 | 0.2286 | -0.0776 | |||

| MDT / Medtronic plc | 0.00 | 16.84 | 0.35 | 13.10 | 0.2274 | -0.0097 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.00 | 0.35 | 0.2247 | 0.2247 | |||||

| MDLZ / Mondelez International, Inc. | 0.01 | 5.04 | 0.35 | 4.50 | 0.2233 | -0.0295 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 0.00 | 0.35 | -9.37 | 0.2233 | -0.0679 | |||

| MCD / McDonald's Corporation | 0.00 | -15.57 | 0.33 | -21.10 | 0.2112 | -0.1050 | |||

| MO / Altria Group, Inc. | 0.01 | -22.73 | 0.32 | -24.52 | 0.2033 | -0.1150 | |||

| UNP / Union Pacific Corporation | 0.00 | 18.67 | 0.30 | 15.69 | 0.1893 | -0.0043 | |||

| SAM / The Boston Beer Company, Inc. | 0.00 | 0.29 | 0.1876 | 0.1876 | |||||

| CMI / Cummins Inc. | 0.00 | 0.27 | 0.1750 | 0.1750 | |||||

| BBY / Best Buy Co., Inc. | 0.00 | 0.27 | 0.1714 | 0.1714 | |||||

| ADSK / Autodesk, Inc. | 0.00 | 5.38 | 0.25 | 24.51 | 0.1630 | 0.0084 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.86 | 0.23 | 15.84 | 0.1503 | -0.0031 | |||

| ADBE / Adobe Inc. | 0.00 | 0.23 | 0.1499 | 0.1499 | |||||

| PEP / PepsiCo, Inc. | 0.00 | 28.14 | 0.23 | 12.68 | 0.1483 | -0.0070 | |||

| MRK / Merck & Co., Inc. | 0.00 | -50.78 | 0.23 | -56.58 | 0.1481 | -0.2551 | |||

| CSX / CSX Corporation | 0.01 | -21.62 | 0.23 | -13.21 | 0.1478 | -0.0532 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | 0.23 | 0.1455 | 0.1455 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | 0.23 | 0.1447 | 0.1447 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.21 | 0.1366 | 0.1366 | |||||

| NAD / Nuveen Quality Municipal Income Fund | 0.02 | 0.00 | 0.19 | -2.07 | 0.1214 | -0.0250 | |||

| NVG / Nuveen AMT-Free Municipal Credit Income Fund | 0.01 | 0.00 | 0.14 | -4.23 | 0.0877 | -0.0199 | |||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DFIV / Dimensional ETF Trust - Dimensional International Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SDVY / First Trust Exchange-Traded Fund VI - First Trust SMID Cap Rising Dividend Achievers ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DFUS / Dimensional ETF Trust - Dimensional U.S. Equity Market ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CALF / Pacer Funds Trust - Pacer US Small Cap Cash Cows ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NMZ / Nuveen Municipal High Income Opportunity Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GCOW / Pacer Funds Trust - Pacer Global Cash Cows Dividend ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SO / The Southern Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SSUS / Strategy Shares - Day Hagan Smart Sector ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JBSS / John B. Sanfilippo & Son, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | -100.00 | 0.00 | 0.0000 |