Basic Stats

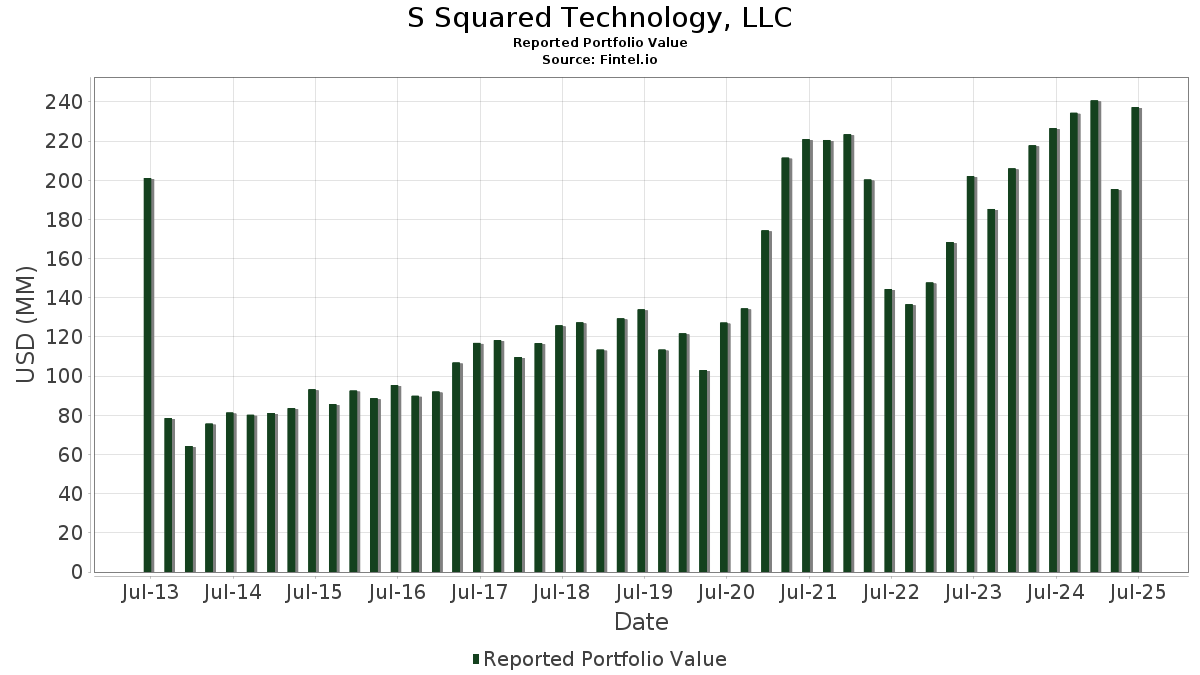

| Portfolio Value | $ 237,326,488 |

| Current Positions | 35 |

Latest Holdings, Performance, AUM (from 13F, 13D)

S Squared Technology, LLC has disclosed 35 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 237,326,488 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). S Squared Technology, LLC’s top holdings are Symbotic Inc. (US:SYM) , Lattice Semiconductor Corporation (US:LSCC) , Dave Inc. (US:DAVE) , Krystal Biotech, Inc. (US:KRYS) , and Universal Display Corporation (US:OLED) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 16.47 | 6.9386 | 3.4558 | |

| 0.48 | 18.65 | 7.8575 | 2.8941 | |

| 0.18 | 4.90 | 2.0642 | 2.0642 | |

| 0.34 | 16.48 | 6.9436 | 1.4322 | |

| 0.52 | 8.82 | 3.7144 | 1.3660 | |

| 0.31 | 7.40 | 3.1163 | 1.0635 | |

| 0.40 | 13.59 | 5.7258 | 0.6155 | |

| 0.05 | 1.21 | 0.5094 | 0.5094 | |

| 0.09 | 12.53 | 5.2778 | 0.4397 | |

| 0.58 | 3.41 | 1.4383 | 0.4238 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 15.01 | 6.3258 | -2.6424 | |

| 0.09 | 6.99 | 2.9468 | -2.4198 | |

| 0.69 | 5.38 | 2.2684 | -1.9650 | |

| 0.23 | 4.50 | 1.8943 | -1.3322 | |

| 0.12 | 7.83 | 3.3001 | -1.0918 | |

| 0.04 | 2.56 | 1.0785 | -1.0302 | |

| 2.88 | 4.52 | 1.9041 | -0.6502 | |

| 0.58 | 5.68 | 2.3939 | -0.6214 | |

| 0.26 | 12.05 | 5.0785 | -0.6101 | |

| 0.11 | 1.72 | 0.7262 | -0.5907 |

13F and Fund Filings

This form was filed on 2025-08-07 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SYM / Symbotic Inc. | 0.48 | 0.00 | 18.65 | 92.25 | 7.8575 | 2.8941 | |||

| LSCC / Lattice Semiconductor Corporation | 0.34 | 63.79 | 16.48 | 52.98 | 6.9436 | 1.4322 | |||

| DAVE / Dave Inc. | 0.06 | -25.50 | 16.47 | 141.91 | 6.9386 | 3.4558 | |||

| KRYS / Krystal Biotech, Inc. | 0.11 | 12.34 | 15.01 | -14.35 | 6.3258 | -2.6424 | |||

| OLED / Universal Display Corporation | 0.10 | 5.56 | 14.67 | 16.89 | 6.1829 | -0.2399 | |||

| ALGM / Allegro MicroSystems, Inc. | 0.40 | 0.00 | 13.59 | 36.06 | 5.7258 | 0.6155 | |||

| SLAB / Silicon Laboratories Inc. | 0.09 | 1.19 | 12.53 | 32.47 | 5.2778 | 0.4397 | |||

| PRLB / Proto Labs, Inc. | 0.31 | 1.34 | 12.46 | 15.79 | 5.2487 | -0.2553 | |||

| KTOS / Kratos Defense & Security Solutions, Inc. | 0.26 | -30.71 | 12.05 | 8.40 | 5.0785 | -0.6101 | |||

| ARLO / Arlo Technologies, Inc. | 0.52 | 11.77 | 8.82 | 92.09 | 3.7144 | 1.3660 | |||

| AMBA / Ambarella, Inc. | 0.12 | -30.49 | 7.83 | -8.75 | 3.3001 | -1.0918 | |||

| MGNI / Magnite, Inc. | 0.31 | -12.80 | 7.40 | 84.37 | 3.1163 | 1.0635 | |||

| MRVL / Marvell Technology, Inc. | 0.09 | -46.96 | 6.99 | -33.32 | 2.9468 | -2.4198 | |||

| ASUR / Asure Software, Inc. | 0.58 | -5.67 | 5.68 | -3.60 | 2.3939 | -0.6214 | |||

| THRY / Thryv Holdings, Inc. | 0.44 | 50.30 | 5.40 | 42.68 | 2.2763 | 0.3389 | |||

| SMWB / Similarweb Ltd. | 0.69 | -31.37 | 5.38 | -34.94 | 2.2684 | -1.9650 | |||

| IPGP / IPG Photonics Corporation | 0.07 | 7.26 | 5.07 | 16.61 | 2.1367 | -0.0881 | |||

| FIVN / Five9, Inc. | 0.18 | 4.90 | 2.0642 | 2.0642 | |||||

| CXM / Sprinklr, Inc. | 0.57 | 28.31 | 4.83 | 29.98 | 2.0356 | 0.1343 | |||

| DCGO / DocGo Inc. | 2.88 | 52.21 | 4.52 | -9.50 | 1.9041 | -0.6502 | |||

| ICHR / Ichor Holdings, Ltd. | 0.23 | -17.93 | 4.50 | -28.72 | 1.8943 | -1.3322 | |||

| BIGC / Commerce.com, Inc. | 0.80 | 29.01 | 3.99 | 11.98 | 1.6815 | -0.1417 | |||

| APPS / Digital Turbine, Inc. | 0.58 | -20.78 | 3.41 | 72.20 | 1.4383 | 0.4238 | |||

| FTK / Flotek Industries, Inc. | 0.22 | -15.13 | 3.26 | 50.44 | 1.3749 | 0.2647 | |||

| GAIA / Gaia, Inc. | 0.72 | 0.00 | 3.18 | 14.04 | 1.3379 | -0.0869 | |||

| SITM / SiTime Corporation | 0.01 | -32.88 | 3.04 | -6.45 | 1.2829 | -0.3822 | |||

| EGHT / 8x8, Inc. | 1.42 | 0.00 | 2.78 | -2.01 | 1.1719 | -0.2802 | |||

| PSIX / Power Solutions International, Inc. | 0.04 | -75.73 | 2.56 | -37.90 | 1.0785 | -1.0302 | |||

| MX / Magnachip Semiconductor Corporation | 0.61 | -4.56 | 2.43 | 10.71 | 1.0238 | -0.0988 | |||

| CTLP / Cantaloupe, Inc. | 0.20 | 0.00 | 2.17 | 39.72 | 0.9161 | 0.1195 | |||

| KLTR / Kaltura, Inc. | 0.89 | 0.00 | 1.80 | 6.91 | 0.7565 | -0.1027 | |||

| PRO / PROS Holdings, Inc. | 0.11 | -18.63 | 1.72 | -33.04 | 0.7262 | -0.5907 | |||

| GDYN / Grid Dynamics Holdings, Inc. | 0.14 | 0.00 | 1.59 | -26.19 | 0.6710 | -0.4330 | |||

| EVER / EverQuote, Inc. | 0.05 | 1.21 | 0.5094 | 0.5094 | |||||

| LITE / Lumentum Holdings Inc. | 0.01 | 0.95 | 0.4005 | 0.4005 | |||||

| MTSI / MACOM Technology Solutions Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |