Basic Stats

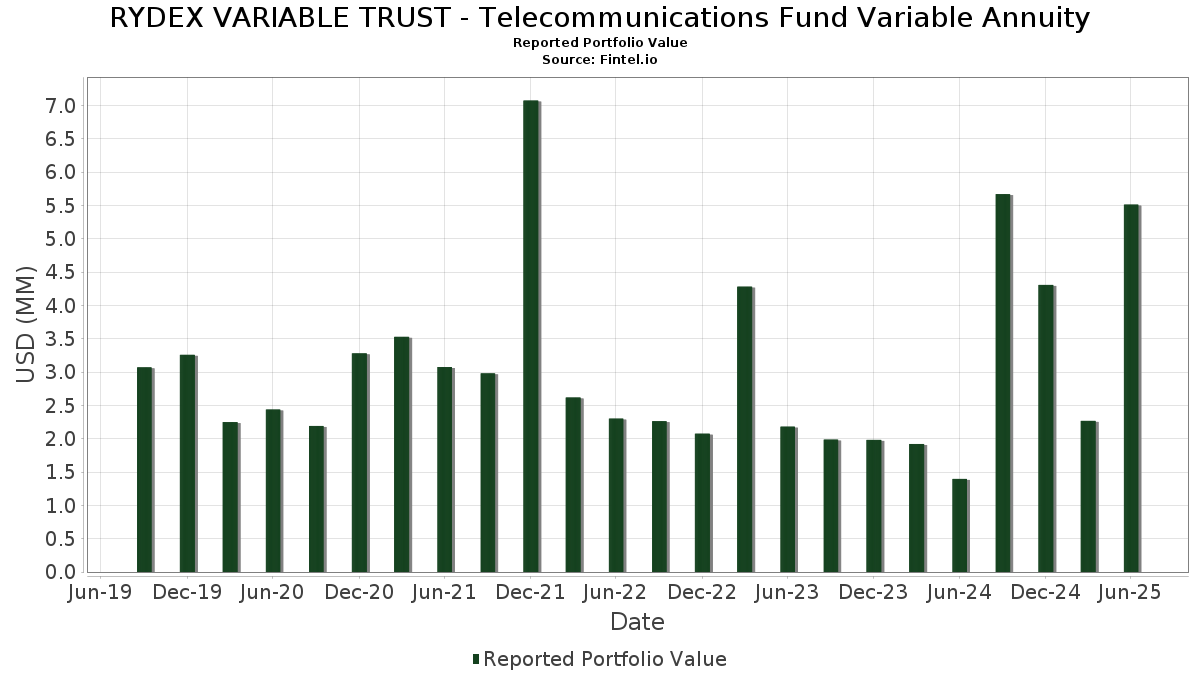

| Portfolio Value | $ 5,512,490 |

| Current Positions | 46 |

Latest Holdings, Performance, AUM (from 13F, 13D)

RYDEX VARIABLE TRUST - Telecommunications Fund Variable Annuity has disclosed 46 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 5,512,490 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). RYDEX VARIABLE TRUST - Telecommunications Fund Variable Annuity’s top holdings are Cisco Systems, Inc. (US:CSCO) , AT&T Inc. (US:T) , Verizon Communications Inc. (US:VZ) , Comcast Corporation (US:CMCSA) , and T-Mobile US, Inc. (US:TMUS) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.44 | 14.7095 | 6.0912 | |

| 0.00 | 0.27 | 9.2157 | 5.0698 | |

| 0.01 | 0.40 | 13.3421 | 4.2842 | |

| 0.01 | 0.35 | 11.8831 | 4.0862 | |

| 0.01 | 0.31 | 10.5455 | 3.7587 | |

| 0.00 | 0.23 | 7.6448 | 3.5081 | |

| 0.00 | 0.15 | 4.8745 | 3.3768 | |

| 0.00 | 0.29 | 9.7029 | 2.8617 | |

| 0.00 | 0.15 | 5.0487 | 2.8196 | |

| 0.00 | 0.21 | 7.0863 | 2.6851 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CSCO / Cisco Systems, Inc. | 0.01 | 103.84 | 0.44 | 129.32 | 14.7095 | 6.0912 | |||

| T / AT&T Inc. | 0.01 | 93.27 | 0.40 | 98.50 | 13.3421 | 4.2842 | |||

| VZ / Verizon Communications Inc. | 0.01 | 114.53 | 0.35 | 105.23 | 11.8831 | 4.0862 | |||

| CMCSA / Comcast Corporation | 0.01 | 115.71 | 0.31 | 109.33 | 10.5455 | 3.7587 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 113.18 | 0.29 | 91.39 | 9.7029 | 2.8617 | |||

| ANET / Arista Networks Inc | 0.00 | 126.03 | 0.27 | 201.10 | 9.2157 | 5.0698 | |||

| CHTR / Charter Communications, Inc. | 0.00 | 123.69 | 0.23 | 149.45 | 7.6448 | 3.5081 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 125.11 | 0.21 | 117.53 | 7.0863 | 2.6851 | |||

| ROKU / Roku, Inc. | 0.00 | 143.73 | 0.15 | 206.12 | 5.0487 | 2.8196 | |||

| JNPR / Juniper Networks, Inc. | 0.00 | 153.42 | 0.15 | 182.69 | 4.9601 | 2.5782 | |||

| ASTS / AST SpaceMobile, Inc. | 0.00 | 112.66 | 0.15 | 339.39 | 4.8745 | 3.3768 | |||

| LBRDK / Liberty Broadband Corporation | 0.00 | 133.33 | 0.14 | 169.81 | 4.8322 | 2.4282 | |||

| CIEN / Ciena Corporation | 0.00 | 128.22 | 0.14 | 206.82 | 4.5490 | 2.5604 | |||

| FFIV / F5, Inc. | 0.00 | 127.42 | 0.12 | 153.06 | 4.1798 | 1.9471 | |||

| SATS / EchoStar Corporation | 0.00 | 195.07 | 0.12 | 221.05 | 4.1216 | 2.3896 | |||

| FYBR / Frontier Communications Parent, Inc. | 0.00 | 152.50 | 0.12 | 155.56 | 3.8910 | 1.8525 | |||

| ERIC / Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) | 0.01 | 155.07 | 0.11 | 181.58 | 3.6143 | 1.8732 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.01 | 162.38 | 0.10 | 202.94 | 3.4790 | 1.9140 | |||

| LITE / Lumentum Holdings Inc. | 0.00 | 102.30 | 0.10 | 212.50 | 3.3702 | 1.9032 | |||

| BCE / BCE Inc. | 0.00 | 178.38 | 0.10 | 175.00 | 3.3256 | 1.6644 | |||

| RCI / Rogers Communications Inc. | 0.00 | 172.25 | 0.10 | 200.00 | 3.2532 | 1.8072 | |||

| LBTYA / Liberty Global Ltd. | 0.01 | 203.14 | 0.09 | 168.57 | 3.1825 | 1.5616 | |||

| TU / TELUS Corporation | 0.01 | 147.79 | 0.09 | 176.47 | 3.1785 | 1.6406 | |||

| NOK / Nokia Oyj - Depositary Receipt (Common Stock) | 0.02 | 164.78 | 0.09 | 162.86 | 3.1164 | 1.5086 | |||

| AMX / América Móvil, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.01 | 124.46 | 0.09 | 187.50 | 3.1067 | 1.6336 | |||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0.00 | 66.42 | 0.07 | 85.00 | 2.5008 | 0.6591 | |||

| TDS / Telephone and Data Systems, Inc. | 0.00 | 158.12 | 0.07 | 140.00 | 2.4297 | 1.0535 | |||

| CALX / Calix, Inc. | 0.00 | 101.97 | 0.07 | 204.35 | 2.3804 | 1.3260 | |||

| IRDM / Iridium Communications Inc. | 0.00 | 139.87 | 0.07 | 175.00 | 2.2182 | 1.0938 | |||

| LUMN / Lumen Technologies, Inc. | 0.01 | 112.87 | 0.06 | 137.04 | 2.1740 | 0.9467 | |||

| First American Government Obligations Fund - Class X / STIV (N/A) | 0.06 | 0.06 | 2.1583 | 2.1583 | |||||

| EXTR / Extreme Networks, Inc. | 0.00 | 132.14 | 0.06 | 215.79 | 2.0369 | 1.1685 | |||

| VIAV / Viavi Solutions Inc. | 0.01 | 169.62 | 0.06 | 145.83 | 1.9835 | 0.8858 | |||

| VSAT / Viasat, Inc. | 0.00 | 136.75 | 0.06 | 241.18 | 1.9798 | 1.1784 | |||

| COMM / CommScope Holding Company, Inc. | 0.01 | 9.61 | 0.06 | 72.73 | 1.9342 | 0.4147 | |||

| CCOI / Cogent Communications Holdings, Inc. | 0.00 | 240.97 | 0.06 | 171.43 | 1.9261 | 0.9615 | |||

| AAOI / Applied Optoelectronics, Inc. | 0.00 | 138.18 | 0.05 | 307.69 | 1.7810 | 1.1811 | |||

| NTCT / NetScout Systems, Inc. | 0.00 | 135.32 | 0.05 | 183.33 | 1.7425 | 0.9005 | |||

| IDCC / InterDigital, Inc. | 0.00 | 158.82 | 0.05 | 188.24 | 1.6562 | 0.8640 | |||

| GOGO / Gogo Inc. | 0.00 | 103.41 | 0.04 | 258.33 | 1.4717 | 0.9012 | |||

| HLIT / Harmonic Inc. | 0.00 | 157.68 | 0.04 | 160.00 | 1.3182 | 0.6226 | |||

| 1LLC / Liberty Latin America Ltd. | 0.01 | 160.03 | 0.04 | 164.29 | 1.2582 | 0.6095 | |||

| GSAT / Globalstar, Inc. | 0.00 | 178.97 | 0.04 | 227.27 | 1.2374 | 0.7098 | |||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.01 | 0.3633 | 0.3633 | ||||||

| Barclays Capital, Inc. / RA (N/A) | 0.00 | 0.1568 | 0.1568 | ||||||

| BofA Securities, Inc. / RA (N/A) | 0.00 | 0.1514 | 0.1514 |