Basic Stats

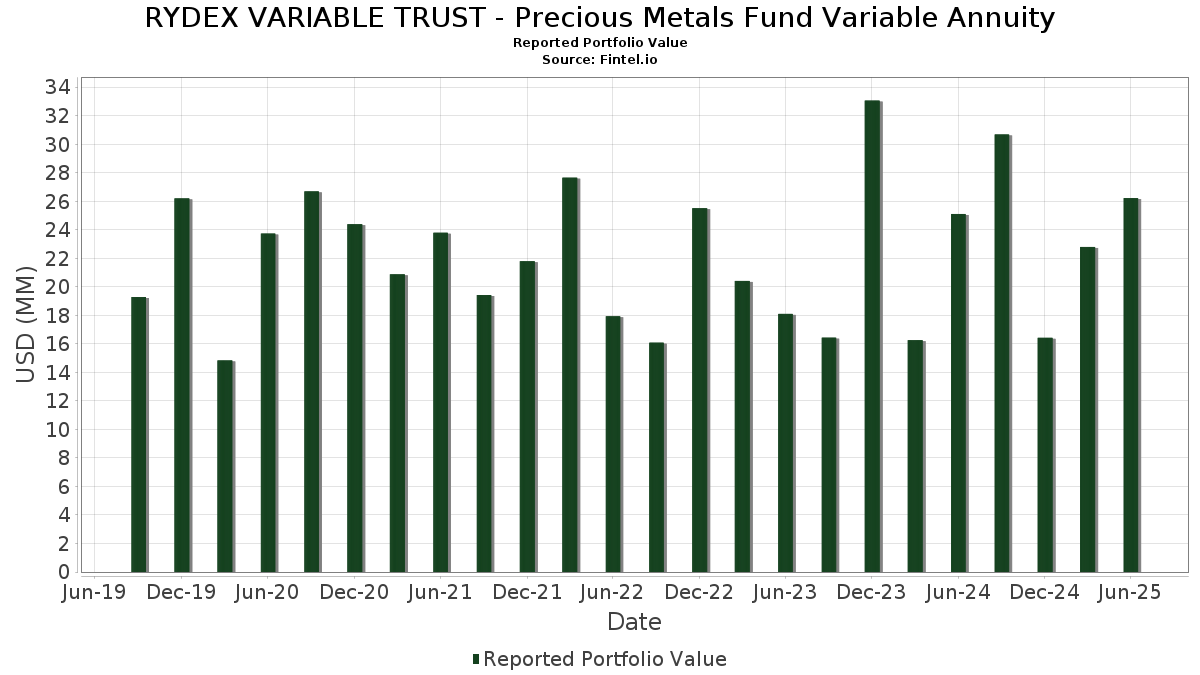

| Portfolio Value | $ 26,224,812 |

| Current Positions | 37 |

Latest Holdings, Performance, AUM (from 13F, 13D)

RYDEX VARIABLE TRUST - Precious Metals Fund Variable Annuity has disclosed 37 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 26,224,812 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). RYDEX VARIABLE TRUST - Precious Metals Fund Variable Annuity’s top holdings are Newmont Corporation (US:NEM) , Freeport-McMoRan Inc. (US:FCX) , Agnico Eagle Mines Limited (US:AEM) , Wheaton Precious Metals Corp. (US:WPM) , and Barrick Mining Corporation (US:B) . RYDEX VARIABLE TRUST - Precious Metals Fund Variable Annuity’s new positions include OR Royalties Inc. (US:OR) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 0.59 | 2.2716 | 2.2716 | |

| 0.05 | 2.24 | 8.5627 | 0.6241 | |

| 0.15 | 0.5721 | 0.5721 | ||

| 0.04 | 2.26 | 8.6559 | 0.4778 | |

| 0.10 | 0.50 | 1.9125 | 0.3909 | |

| 0.07 | 0.62 | 2.3565 | 0.3201 | |

| 0.02 | 0.40 | 1.5278 | 0.2708 | |

| 0.06 | 0.2468 | 0.2468 | ||

| 0.06 | 0.2384 | 0.2384 | ||

| 0.03 | 0.44 | 1.6985 | 0.2063 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 1.03 | 3.9486 | -0.6424 | |

| 0.04 | 0.61 | 2.3198 | -0.3779 | |

| 0.02 | 2.10 | 8.0490 | -0.3720 | |

| 0.03 | 0.90 | 3.4476 | -0.3528 | |

| 0.04 | 1.04 | 3.9631 | -0.3258 | |

| 0.07 | 0.41 | 1.5768 | -0.3023 | |

| 0.00 | 0.72 | 2.7359 | -0.2288 | |

| 0.06 | 0.38 | 1.4416 | -0.1559 | |

| 0.08 | 1.63 | 6.2452 | -0.1558 | |

| 0.07 | 1.11 | 4.2296 | -0.1529 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NEM / Newmont Corporation | 0.04 | 0.87 | 2.26 | 21.73 | 8.6559 | 0.4778 | |||

| FCX / Freeport-McMoRan Inc. | 0.05 | 8.33 | 2.24 | 24.04 | 8.5627 | 0.6241 | |||

| AEM / Agnico Eagle Mines Limited | 0.02 | 0.20 | 2.10 | 9.93 | 8.0490 | -0.3720 | |||

| WPM / Wheaton Precious Metals Corp. | 0.02 | 0.27 | 1.76 | 16.00 | 6.7386 | 0.0575 | |||

| B / Barrick Mining Corporation | 0.08 | 4.77 | 1.63 | 12.23 | 6.2452 | -0.1558 | |||

| KGC / Kinross Gold Corporation | 0.07 | -10.46 | 1.11 | 11.04 | 4.2296 | -0.1529 | |||

| FNV / Franco-Nevada Corporation | 0.01 | 10.03 | 1.08 | 14.50 | 4.1390 | -0.0191 | |||

| GFI / Gold Fields Limited - Depositary Receipt (Common Stock) | 0.04 | -0.83 | 1.04 | 6.26 | 3.9631 | -0.3258 | |||

| AU / AngloGold Ashanti plc | 0.02 | -19.43 | 1.03 | -1.05 | 3.9486 | -0.6424 | |||

| AGI / Alamos Gold Inc. | 0.03 | 5.03 | 0.90 | 4.28 | 3.4476 | -0.3528 | |||

| PAAS / Pan American Silver Corp. | 0.03 | 4.77 | 0.88 | 15.28 | 3.3475 | 0.0055 | |||

| RGLD / Royal Gold, Inc. | 0.00 | -2.43 | 0.72 | 6.08 | 2.7359 | -0.2288 | |||

| CDE / Coeur Mining, Inc. | 0.07 | -11.08 | 0.62 | 33.05 | 2.3565 | 0.3201 | |||

| HMY / Harmony Gold Mining Company Limited - Depositary Receipt (Common Stock) | 0.04 | 4.55 | 0.61 | -1.14 | 2.3198 | -0.3779 | |||

| OR / OR Royalties Inc. | 0.02 | 0.59 | 2.2716 | 2.2716 | |||||

| EGO / Eldorado Gold Corporation | 0.03 | -6.03 | 0.55 | 13.64 | 2.1049 | -0.0252 | |||

| IAG / IAMGOLD Corporation | 0.07 | -2.97 | 0.55 | 14.17 | 2.0971 | -0.0164 | |||

| AG / First Majestic Silver Corp. | 0.07 | -1.66 | 0.54 | 21.57 | 2.0725 | 0.1120 | |||

| HL / Hecla Mining Company | 0.09 | 9.46 | 0.52 | 18.10 | 1.9969 | 0.0496 | |||

| NGD / New Gold Inc. | 0.10 | 8.34 | 0.50 | 44.93 | 1.9125 | 0.3909 | |||

| SBSW / Sibanye Stillwater Limited - Depositary Receipt (Common Stock) | 0.07 | -20.79 | 0.48 | 25.00 | 1.8191 | 0.1438 | |||

| SAND / Sandstorm Gold Ltd. | 0.05 | -9.35 | 0.46 | 12.87 | 1.7456 | -0.0331 | |||

| SSRM / SSR Mining Inc. | 0.03 | 3.06 | 0.44 | 30.97 | 1.6985 | 0.2063 | |||

| BTG / B2Gold Corp. | 0.12 | -5.53 | 0.42 | 19.77 | 1.5994 | 0.0623 | |||

| EQX / Equinox Gold Corp. | 0.07 | 15.47 | 0.41 | -3.51 | 1.5768 | -0.3023 | |||

| MAG / MAG Silver Corp. | 0.02 | 1.08 | 0.40 | 40.00 | 1.5278 | 0.2708 | |||

| FSM / Fortuna Mining Corp. | 0.06 | -3.21 | 0.38 | 3.58 | 1.4416 | -0.1559 | |||

| CGAU / Centerra Gold Inc. | 0.05 | -0.77 | 0.34 | 12.62 | 1.2999 | -0.0269 | |||

| SA / Seabridge Gold Inc. | 0.02 | -0.02 | 0.32 | 24.31 | 1.2159 | 0.0918 | |||

| EXK / Endeavour Silver Corp. | 0.06 | 3.27 | 0.30 | 18.97 | 1.1514 | 0.0386 | |||

| NG / NovaGold Resources Inc. | 0.06 | 2.05 | 0.24 | 43.20 | 0.9281 | 0.1814 | |||

| SVM / Silvercorp Metals Inc. | 0.05 | -10.46 | 0.21 | -2.30 | 0.8130 | -0.1445 | |||

| MUX / McEwen Inc. | 0.02 | 1.80 | 0.19 | 29.37 | 0.7103 | 0.0799 | |||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.15 | 0.5721 | 0.5721 | ||||||

| PPTA / Perpetua Resources Corp. | 0.01 | 1.17 | 0.13 | 14.78 | 0.5068 | -0.0005 | |||

| Barclays Capital, Inc. / RA (N/A) | 0.06 | 0.2468 | 0.2468 | ||||||

| BofA Securities, Inc. / RA (N/A) | 0.06 | 0.2384 | 0.2384 |