Basic Stats

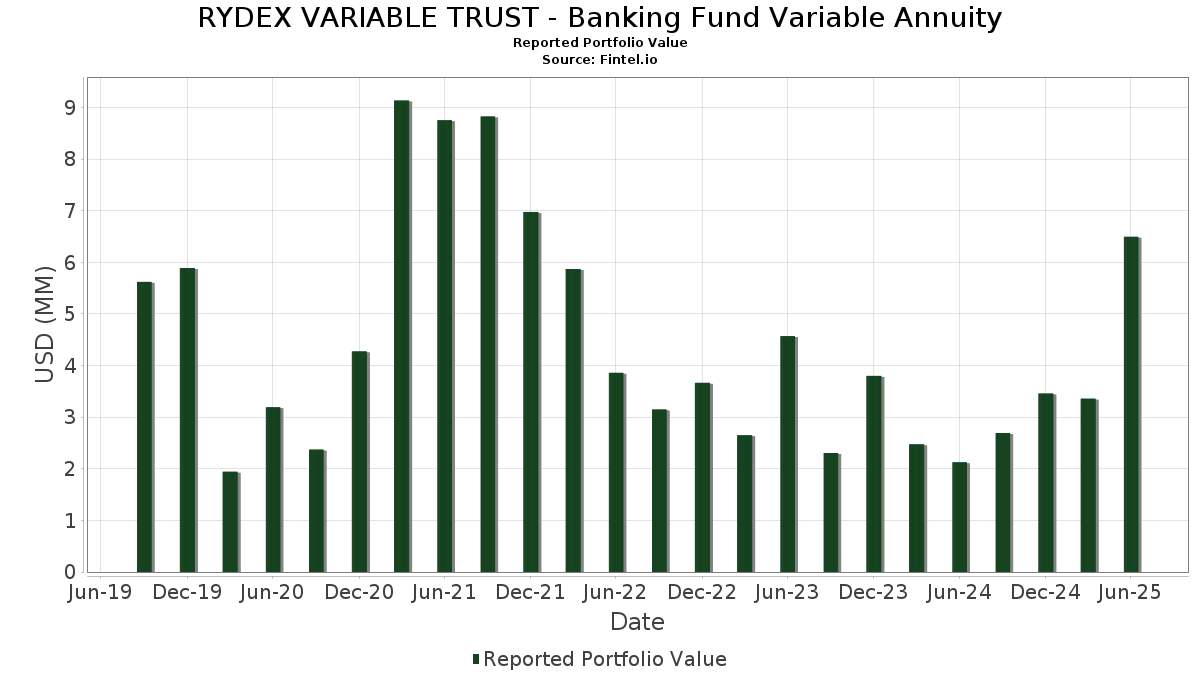

| Portfolio Value | $ 6,493,401 |

| Current Positions | 82 |

Latest Holdings, Performance, AUM (from 13F, 13D)

RYDEX VARIABLE TRUST - Banking Fund Variable Annuity has disclosed 82 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 6,493,401 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). RYDEX VARIABLE TRUST - Banking Fund Variable Annuity’s top holdings are Citigroup Inc. (US:C) , Wells Fargo & Company (US:WFC) , JPMorgan Chase & Co. (US:JPM) , Capital One Financial Corporation (US:COF) , and Bank of America Corporation (US:BAC) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.26 | 4.0537 | 0.8289 | |

| 0.04 | 0.04 | 0.5496 | 0.5496 | |

| 0.01 | 0.19 | 2.9887 | 0.4023 | |

| 0.02 | 0.3035 | 0.3035 | ||

| 0.00 | 0.12 | 1.8560 | 0.2012 | |

| 0.00 | 0.07 | 1.0957 | 0.1776 | |

| 0.00 | 0.05 | 0.8272 | 0.1576 | |

| 0.01 | 0.1310 | 0.1310 | ||

| 0.01 | 0.1265 | 0.1265 | ||

| 0.00 | 0.27 | 4.1349 | 0.0810 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.02 | 0.3657 | -0.1865 | |

| 0.00 | 0.05 | 0.8183 | -0.1361 | |

| 0.00 | 0.19 | 2.8918 | -0.1276 | |

| 0.00 | 0.09 | 1.3444 | -0.1020 | |

| 0.00 | 0.04 | 0.6269 | -0.0987 | |

| 0.00 | 0.26 | 4.1001 | -0.0963 | |

| 0.00 | 0.20 | 3.1245 | -0.0953 | |

| 0.00 | 0.19 | 3.0133 | -0.0944 | |

| 0.00 | 0.04 | 0.6589 | -0.0944 | |

| 0.00 | 0.07 | 1.0131 | -0.0892 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| C / Citigroup Inc. | 0.00 | 66.28 | 0.27 | 100.00 | 4.1349 | 0.0810 | |||

| WFC / Wells Fargo & Company | 0.00 | 78.00 | 0.27 | 99.25 | 4.1179 | 0.0662 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 61.59 | 0.26 | 91.30 | 4.1001 | -0.0963 | |||

| COF / Capital One Financial Corporation | 0.00 | 107.07 | 0.26 | 146.23 | 4.0537 | 0.8289 | |||

| BAC / Bank of America Corporation | 0.01 | 69.51 | 0.26 | 93.28 | 4.0183 | -0.0679 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 78.84 | 0.20 | 89.62 | 3.1245 | -0.0953 | |||

| USB / U.S. Bancorp | 0.00 | 76.84 | 0.19 | 90.20 | 3.0133 | -0.0944 | |||

| M1Z / Nu Holdings Ltd. | 0.01 | 68.58 | 0.19 | 125.88 | 2.9887 | 0.4023 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | 72.33 | 0.19 | 87.88 | 2.8918 | -0.1276 | |||

| TFC / Truist Financial Corporation | 0.00 | 83.86 | 0.18 | 92.47 | 2.7769 | -0.0489 | |||

| MTB / M&T Bank Corporation | 0.00 | 76.56 | 0.13 | 92.65 | 2.0373 | -0.0409 | |||

| STT / State Street Corporation | 0.00 | 69.14 | 0.13 | 103.17 | 1.9866 | 0.0537 | |||

| FITB / Fifth Third Bancorp | 0.00 | 80.92 | 0.12 | 89.23 | 1.9145 | -0.0569 | |||

| NTRS / Northern Trust Corporation | 0.00 | 70.58 | 0.12 | 120.37 | 1.8560 | 0.2012 | |||

| HBAN / Huntington Bancshares Incorporated | 0.01 | 73.51 | 0.12 | 94.92 | 1.7937 | -0.0160 | |||

| RF / Regions Financial Corporation | 0.00 | 78.99 | 0.11 | 94.64 | 1.6949 | -0.0151 | |||

| KEY / KeyCorp | 0.01 | 77.75 | 0.10 | 96.23 | 1.6188 | -0.0152 | |||

| CFG / Citizens Financial Group, Inc. | 0.00 | 80.72 | 0.10 | 96.15 | 1.5922 | 0.0156 | |||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.00 | 75.17 | 0.09 | 86.00 | 1.4523 | -0.0661 | |||

| EWBC / East West Bancorp, Inc. | 0.00 | 74.40 | 0.09 | 95.56 | 1.3749 | 0.0052 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.00 | 57.44 | 0.09 | 82.98 | 1.3444 | -0.1020 | |||

| TD / The Toronto-Dominion Bank | 0.00 | 51.76 | 0.08 | 88.10 | 1.2276 | -0.0627 | |||

| FHN / First Horizon Corporation | 0.00 | 75.37 | 0.08 | 92.50 | 1.2042 | -0.0253 | |||

| BPOP / Popular, Inc. | 0.00 | 62.50 | 0.08 | 92.31 | 1.1762 | -0.0096 | |||

| RY / Royal Bank of Canada | 0.00 | 72.22 | 0.07 | 102.78 | 1.1371 | 0.0313 | |||

| SSB / SouthState Corporation | 0.00 | 85.04 | 0.07 | 82.05 | 1.1105 | -0.0727 | |||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.00 | 92.76 | 0.07 | 133.33 | 1.0957 | 0.1776 | |||

| WBS / Webster Financial Corporation | 0.00 | 74.02 | 0.07 | 84.21 | 1.0936 | -0.0661 | |||

| BNS / The Bank of Nova Scotia | 0.00 | 76.01 | 0.07 | 102.94 | 1.0805 | 0.0508 | |||

| WAL / Western Alliance Bancorporation | 0.00 | 86.54 | 0.07 | 94.29 | 1.0545 | -0.0342 | |||

| CMA / Comerica Incorporated | 0.00 | 84.62 | 0.07 | 85.71 | 1.0201 | -0.0493 | |||

| ITUB / Itaú Unibanco Holding S.A. - Depositary Receipt (Common Stock) | 0.01 | 70.81 | 0.07 | 109.68 | 1.0163 | 0.0742 | |||

| CBSH / Commerce Bancshares, Inc. | 0.00 | 79.83 | 0.07 | 80.56 | 1.0131 | -0.0892 | |||

| ZION / Zions Bancorporation, National Association | 0.00 | 80.63 | 0.07 | 91.18 | 1.0129 | -0.0393 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.00 | 80.94 | 0.06 | 88.24 | 1.0015 | -0.0523 | |||

| UMBF / UMB Financial Corporation | 0.00 | 86.52 | 0.06 | 93.75 | 0.9692 | -0.0073 | |||

| SNV / Synovus Financial Corp. | 0.00 | 74.78 | 0.06 | 93.75 | 0.9667 | -0.0097 | |||

| ONB / Old National Bancorp | 0.00 | 82.19 | 0.06 | 84.85 | 0.9467 | -0.0619 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.00 | 83.72 | 0.06 | 96.77 | 0.9458 | -0.0206 | |||

| PB / Prosperity Bancshares, Inc. | 0.00 | 83.48 | 0.06 | 81.25 | 0.9063 | -0.0747 | |||

| CM / Canadian Imperial Bank of Commerce | 0.00 | 48.80 | 0.06 | 90.00 | 0.8832 | -0.0390 | |||

| CADE / Cadence Bank | 0.00 | 79.10 | 0.06 | 89.66 | 0.8659 | -0.0313 | |||

| WTFC / Wintrust Financial Corporation | 0.00 | 61.31 | 0.05 | 80.00 | 0.8488 | -0.0841 | |||

| FNB / F.N.B. Corporation | 0.00 | 78.35 | 0.05 | 96.30 | 0.8298 | -0.0092 | |||

| UBSG / UBS Group AG | 0.00 | 118.70 | 0.05 | 140.91 | 0.8272 | 0.1576 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 58.82 | 0.05 | 67.74 | 0.8183 | -0.1361 | |||

| OZK / Bank OZK | 0.00 | 79.17 | 0.05 | 92.59 | 0.8150 | -0.0059 | |||

| HSBC / HSBC Holdings plc - Depositary Receipt (Common Stock) | 0.00 | 89.04 | 0.05 | 100.00 | 0.8117 | 0.0188 | |||

| UBSI / United Bankshares, Inc. | 0.00 | 78.12 | 0.05 | 88.89 | 0.8041 | -0.0357 | |||

| HWC / Hancock Whitney Corporation | 0.00 | 74.46 | 0.05 | 96.15 | 0.7958 | -0.0189 | |||

| COLB / Columbia Banking System, Inc. | 0.00 | 88.31 | 0.05 | 75.86 | 0.7931 | -0.0851 | |||

| BMO / Bank of Montreal | 0.00 | 51.22 | 0.05 | 77.78 | 0.7437 | -0.0862 | |||

| AX / Axos Financial, Inc. | 0.00 | 69.81 | 0.05 | 104.35 | 0.7421 | 0.0173 | |||

| VLY / Valley National Bancorp | 0.01 | 80.91 | 0.05 | 80.77 | 0.7395 | -0.0559 | |||

| FFIN / First Financial Bankshares, Inc. | 0.00 | 81.51 | 0.05 | 80.77 | 0.7385 | -0.0555 | |||

| ASB / Associated Banc-Corp | 0.00 | 76.17 | 0.05 | 91.67 | 0.7235 | -0.0180 | |||

| GGAL / Grupo Financiero Galicia S.A. - Depositary Receipt (Common Stock) | 0.00 | 120.24 | 0.05 | 109.09 | 0.7220 | 0.0293 | |||

| BBD / Banco Bradesco S.A. - Depositary Receipt (Common Stock) | 0.02 | 51.37 | 0.05 | 109.09 | 0.7215 | 0.0491 | |||

| TCBI / Texas Capital Bancshares, Inc. | 0.00 | 78.10 | 0.04 | 91.30 | 0.6900 | -0.0225 | |||

| FLG / Flagstar Financial, Inc. | 0.00 | 87.44 | 0.04 | 75.00 | 0.6589 | -0.0944 | |||

| FULT / Fulton Financial Corporation | 0.00 | 84.53 | 0.04 | 90.91 | 0.6533 | -0.0406 | |||

| FHB / First Hawaiian, Inc. | 0.00 | 84.82 | 0.04 | 95.24 | 0.6403 | -0.0228 | |||

| WSFS / WSFS Financial Corporation | 0.00 | 77.25 | 0.04 | 95.24 | 0.6373 | -0.0255 | |||

| CATY / Cathay General Bancorp | 0.00 | 79.84 | 0.04 | 90.48 | 0.6291 | -0.0171 | |||

| IBOC / International Bancshares Corporation | 0.00 | 60.00 | 0.04 | 73.91 | 0.6269 | -0.0987 | |||

| EBC / Eastern Bankshares, Inc. | 0.00 | 87.17 | 0.04 | 77.27 | 0.6176 | -0.0751 | |||

| TBBK / The Bancorp, Inc. | 0.00 | 82.13 | 0.04 | 100.00 | 0.6027 | 0.0028 | |||

| FIBK / First Interstate BancSystem, Inc. | 0.00 | 92.50 | 0.04 | 100.00 | 0.5955 | -0.0056 | |||

| CVBF / CVB Financial Corp. | 0.00 | 81.95 | 0.04 | 94.74 | 0.5840 | -0.0012 | |||

| INDB / Independent Bank Corp. | 0.00 | 79.14 | 0.04 | 80.00 | 0.5689 | -0.0495 | |||

| SBCF / Seacoast Banking Corporation of Florida | 0.00 | 85.11 | 0.04 | 100.00 | 0.5639 | 0.0092 | |||

| First American Government Obligations Fund - Class X / STIV (N/A) | 0.04 | 0.04 | 0.5496 | 0.5496 | |||||

| SFNC / Simmons First National Corporation | 0.00 | 91.67 | 0.04 | 84.21 | 0.5472 | -0.0571 | |||

| WAFD / WaFd, Inc | 0.00 | 79.32 | 0.04 | 84.21 | 0.5465 | -0.0350 | |||

| FFBC / First Financial Bancorp. | 0.00 | 85.88 | 0.03 | 78.95 | 0.5344 | -0.0442 | |||

| PPBI / Pacific Premier Bancorp, Inc. | 0.00 | 87.14 | 0.03 | 88.24 | 0.5038 | -0.0282 | |||

| BANC / Banc of California, Inc. | 0.00 | 73.97 | 0.03 | 76.47 | 0.4771 | -0.0643 | |||

| BANR / Banner Corporation | 0.00 | 28.67 | 0.02 | 27.78 | 0.3657 | -0.1865 | |||

| BOKF / BOK Financial Corporation | 0.00 | 92.37 | 0.02 | 83.33 | 0.3433 | -0.0288 | |||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.02 | 0.3035 | 0.3035 | ||||||

| Barclays Capital, Inc. / RA (N/A) | 0.01 | 0.1310 | 0.1310 | ||||||

| BofA Securities, Inc. / RA (N/A) | 0.01 | 0.1265 | 0.1265 |