Basic Stats

| Portfolio Value | $ 876,310,958 |

| Current Positions | 71 |

Latest Holdings, Performance, AUM (from 13F, 13D)

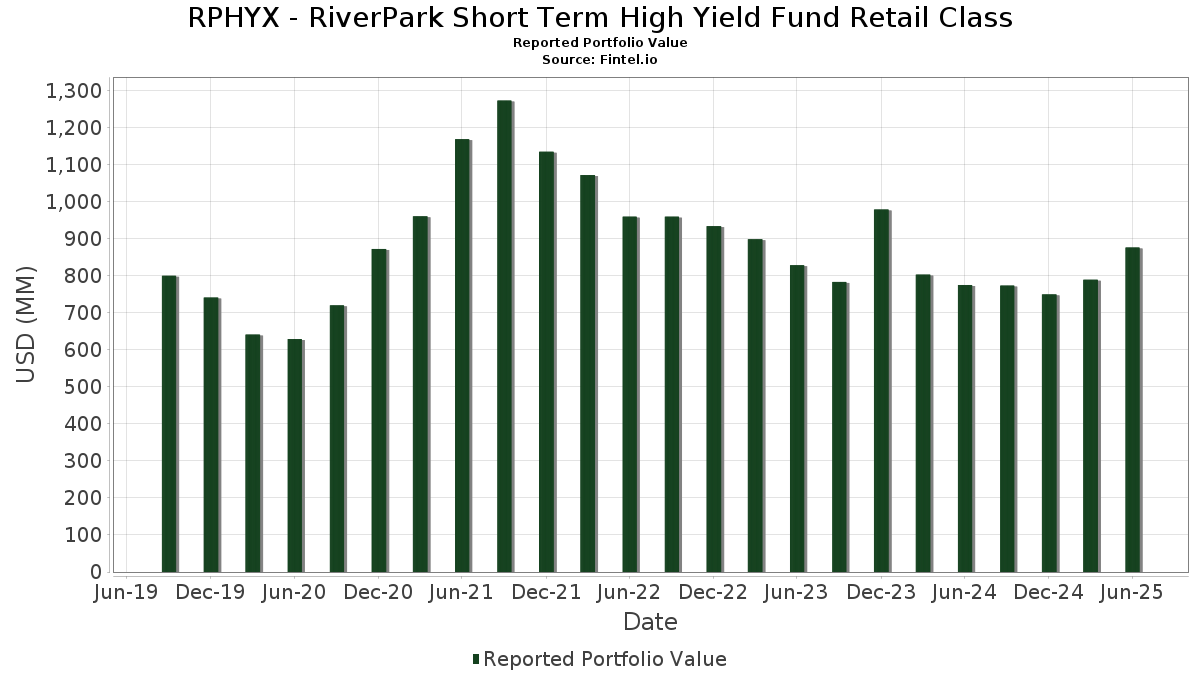

RPHYX - RiverPark Short Term High Yield Fund Retail Class has disclosed 71 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 876,310,958 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). RPHYX - RiverPark Short Term High Yield Fund Retail Class’s top holdings are Latam Airlines Group SA (CL:US51818LAB45) , Consolidated Communications Inc (US:US20903XAH61) , Sizzling Platter LLC / Sizzling Platter Finance Corp (US:US830146AB28) , Tidewater, Inc. (US:NO0012952227) , and Tidewater Inc (US:NO0011129579) . RPHYX - RiverPark Short Term High Yield Fund Retail Class’s new positions include Latam Airlines Group SA (CL:US51818LAB45) , Consolidated Communications Inc (US:US20903XAH61) , Sizzling Platter LLC / Sizzling Platter Finance Corp (US:US830146AB28) , Tidewater, Inc. (US:NO0012952227) , and Tidewater Inc (US:NO0011129579) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 47.37 | 6.3523 | 6.3523 | ||

| 35.40 | 4.7478 | 4.7478 | ||

| 29.91 | 4.0113 | 4.0113 | ||

| 23.96 | 3.2128 | 3.2128 | ||

| 18.98 | 2.5449 | 2.5449 | ||

| 18.98 | 2.5449 | 2.5449 | ||

| 18.50 | 2.4813 | 2.4813 | ||

| 18.19 | 2.4399 | 2.4399 | ||

| 16.90 | 2.2672 | 2.2672 | ||

| 16.90 | 2.2672 | 2.2672 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.60 | 0.8849 | -1.5652 | ||

| 5.80 | 0.7778 | -0.3560 | ||

| 18.59 | 2.4938 | -0.1436 | ||

| 19.19 | 2.5742 | -0.0113 | ||

| 0.05 | 0.00 | 0.0002 | -0.0008 |

13F and Fund Filings

This form was filed on 2025-08-28 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US51818LAB45 / Latam Airlines Group SA | 47.37 | 6.3523 | 6.3523 | ||||||

| BROWN BROTHERS HARRIMAN SWEEP INTEREST / STIV (N/A) | 35.40 | 4.7478 | 4.7478 | ||||||

| US20903XAH61 / Consolidated Communications Inc | 29.91 | 4.0113 | 4.0113 | ||||||

| US830146AB28 / Sizzling Platter LLC / Sizzling Platter Finance Corp | 24.27 | 24.33 | 3.2544 | 0.6827 | |||||

| NO0012952227 / Tidewater, Inc. | 23.96 | 3.2128 | 3.2128 | ||||||

| NO0011129579 / Tidewater Inc | 23.69 | 218.24 | 3.1772 | 2.1961 | |||||

| NO0011123432 / Golar LNG Ltd. | 23.19 | -0.12 | 3.1100 | 0.0504 | |||||

| US896818AU56 / Triumph Group Inc | 21.96 | 49.02 | 2.9449 | 1.0031 | |||||

| US451102BT32 / Icahn Enterprises LP / Icahn Enterprises Finance Corp | 19.98 | -0.04 | 2.6801 | 0.0456 | |||||

| US374276AJ21 / Getty Images, Inc. | 19.19 | -2.17 | 2.5742 | -0.0113 | |||||

| J2BL34 / Jabil Inc. - Depositary Receipt (Common Stock) | 18.98 | 2.5449 | 2.5449 | ||||||

| J2BL34 / Jabil Inc. - Depositary Receipt (Common Stock) | 18.98 | 2.5449 | 2.5449 | ||||||

| US92537VAA89 / Vertical Holdco GmbH | 18.59 | -7.10 | 2.4938 | -0.1436 | |||||

| US460599AF06 / International Game Technology PLC | 18.50 | 2.4813 | 2.4813 | ||||||

| US04624VAB53 / AssuredPartners Inc | 18.30 | -0.09 | 2.4541 | 0.0407 | |||||

| US20903XAF06 / Consolidated Communications Inc | 18.19 | 2.4399 | 2.4399 | ||||||

| THE DUN & BRADSTREET CORPORATION 1/18/2029 / LON (26483NAW0) | 16.90 | 2.2672 | 2.2672 | ||||||

| THE DUN & BRADSTREET CORPORATION 1/18/2029 / LON (26483NAW0) | 16.90 | 2.2672 | 2.2672 | ||||||

| US02376RAF91 / American Airlines Group Inc | 15.72 | 2.1086 | 2.1086 | ||||||

| US419838AA57 / HAWAIIAN AIRLINES 2013-1 CLASS A PASS THROUGH CERT | 15.69 | -0.49 | 2.1043 | 0.0266 | |||||

| Informatica 6/24 TLB 27-Oct-2028 / LON (45673YAL0) | 15.05 | 2.0186 | 2.0186 | ||||||

| Informatica 6/24 TLB 27-Oct-2028 / LON (45673YAL0) | 15.05 | 2.0186 | 2.0186 | ||||||

| HCA 0% CP 8/6/2025 0% CP / ABS-APCP (US40412BV672) | 15.02 | 2.0148 | 2.0148 | ||||||

| HCA 0% CP 8/6/2025 0% CP / ABS-APCP (US40412BV672) | 15.02 | 2.0148 | 2.0148 | ||||||

| US93710WAA36 / WASH Multifamily Acquisition Inc | 14.97 | 2.32 | 2.0082 | 0.0797 | |||||

| P1HC34 / Parker-Hannifin Corporation - Depositary Receipt (Common Stock) | 14.93 | 2.0027 | 2.0027 | ||||||

| P1HC34 / Parker-Hannifin Corporation - Depositary Receipt (Common Stock) | 14.93 | 2.0027 | 2.0027 | ||||||

| G1PC34 / Genuine Parts Company - Depositary Receipt (Common Stock) | 14.92 | 2.0006 | 2.0006 | ||||||

| US74166MAC01 / Prime Security Services Borrrower, LLC / Prime Finance, Inc. | 14.84 | 1.9904 | 1.9904 | ||||||

| US37045XDZ69 / General Motors Financial Co Inc | 14.66 | 1.9662 | 1.9662 | ||||||

| US009066AB74 / CONVERTIBLE ZERO | 14.50 | 1.9443 | 1.9443 | ||||||

| BACARD BV 0% CP 7/10/2025 0% CP / ABS-APCP (US05634EUA80) | 14.48 | 1.9423 | 1.9423 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 14.29 | 1.9171 | 1.9171 | ||||||

| US87901JAF21 / TEGNA Inc | 13.16 | 60.17 | 1.7644 | 0.6820 | |||||

| US421924BT72 / HEALTHSOUTH Corp. Bond | 12.53 | 75.92 | 1.6804 | 0.7418 | |||||

| US78466CAC01 / SS&C Technologies Holdings Inc. | 11.46 | 1.5367 | 1.5367 | ||||||

| MATW / Matthews International Corporation | 11.32 | 0.16 | 1.5175 | 0.0288 | |||||

| MATW / Matthews International Corporation | 11.32 | 0.16 | 1.5175 | 0.0288 | |||||

| US235825AG15 / Dana Inc | 11.07 | 1.4849 | 1.4849 | ||||||

| US644535AH91 / New Gold Inc | 10.75 | 78.98 | 1.4415 | 0.6502 | |||||

| WTFCM / Wintrust Financial Corporation - Preferred Stock | 0.42 | 10.74 | 1.4406 | 1.4406 | |||||

| NO0013009282 / OKEA ASA | 10.14 | 1.3594 | 1.3594 | ||||||

| PENSKE 0% CP 8/8/2025 0% CP / ABS-APCP (US70962AV861) | 9.95 | 1.3343 | 1.3343 | ||||||

| PENSKE 0% CP 8/8/2025 0% CP / ABS-APCP (US70962AV861) | 9.95 | 1.3343 | 1.3343 | ||||||

| US83001WAC82 / Six Flags Theme Parks Inc | 8.50 | 12.43 | 1.1405 | 0.1437 | |||||

| US527298BU63 / Level 3 Financing Inc | 8.33 | 1.1170 | 1.1170 | ||||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 7.98 | 1.0696 | 1.0696 | ||||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 7.97 | 1.0693 | 1.0693 | ||||||

| US384637AA23 / Graham Holdings Co | 7.54 | 1.0114 | 1.0114 | ||||||

| US538034AN93 / Live Nation Entertainment Inc | 7.25 | 0.9720 | 0.9720 | ||||||

| Global Cash Access 6/21 TLB 6/30/2028 / LON (N/A) | 7.01 | 0.9403 | 0.9403 | ||||||

| Global Cash Access 6/21 TLB 6/30/2028 / LON (N/A) | 7.01 | 0.9403 | 0.9403 | ||||||

| US958102AM75 / Western Digital Corp 4.75% 02/15/2026 Bond | 6.60 | -64.52 | 0.8849 | -1.5652 | |||||

| US64828TAA07 / New Residential Investment Corp | 5.85 | 0.7844 | 0.7844 | ||||||

| US55955DAB64 / MAGNITE INC CONV 0.25% 03/15/2026 | 5.80 | -32.60 | 0.7778 | -0.3560 | |||||

| US87612BBL53 / CORP. NOTE | 4.96 | 0.6658 | 0.6658 | ||||||

| CANNABIST CO HOLDINGS INC/THE 9.250000% 12/31/2028 / DBT (CA13766HAA73) | 4.72 | 0.6330 | 0.6330 | ||||||

| US47010BAJ35 / Jaguar Land Rover Automotive PLC | 4.01 | 0.02 | 0.5376 | 0.0095 | |||||

| US1248EPBR37 / Cco Holdings Llc/capital Corp 5.50% 05/01/2026 144a Bond | 4.00 | 0.5366 | 0.5366 | ||||||

| US345397XL24 / FORD MOTOR CREDIT CO LLC | 3.78 | 12.37 | 0.5067 | 0.0636 | |||||

| US200340AU17 / Comerica Inc | 3.50 | 0.4687 | 0.4687 | ||||||

| US92922PAM86 / W&T Offshore Inc | 2.94 | 474.76 | 0.3940 | 0.3265 | |||||

| JVSA / JVSPAC Acquisition Corp. | 0.19 | 2.11 | 0.2829 | 0.2829 | |||||

| IBAC / IB Acquisition Corp. | 0.16 | 0.00 | 1.72 | 1.65 | 0.2309 | 0.0077 | |||

| WTFCP / Wintrust Financial Corporation - Preferred Stock | 0.05 | 1.36 | 0.1820 | 0.1820 | |||||

| US235825AF32 / Dana, Inc. | 1.00 | 0.1346 | 0.1346 | ||||||

| US66679NAA81 / Northriver Midstream Finance LP | 0.90 | 0.34 | 0.1200 | 0.0024 | |||||

| PRIF.PRI / Priority Income Fund, Inc. - Preferred Stock | 0.02 | 0.38 | 0.0513 | 0.0513 | |||||

| UMBFP / UMB Financial Corporation - Preferred Stock | 0.01 | 0.32 | 0.0431 | 0.0431 | |||||

| VRNOF / Verano Holdings Corp. | 0.09 | 0.05 | 0.0062 | 0.0062 | |||||

| US87284T1007 / TS Innovation Acquisitions Corp., Class A | 0.05 | 0.00 | 0.00 | -85.71 | 0.0002 | -0.0008 | |||

| CANNABIST CO HLDGS INC RESTRICTED UNLISTED COMMON STOCK / EC (13765Y509) | 1.89 | 0.00 | 0.0000 | 0.0000 | |||||

| CANNABIST CO HLDGS INC RESTRICTED UNLISTED COMMON STOCK / EC (13765Y400) | 1.89 | 0.00 | 0.0000 | 0.0000 |