Basic Stats

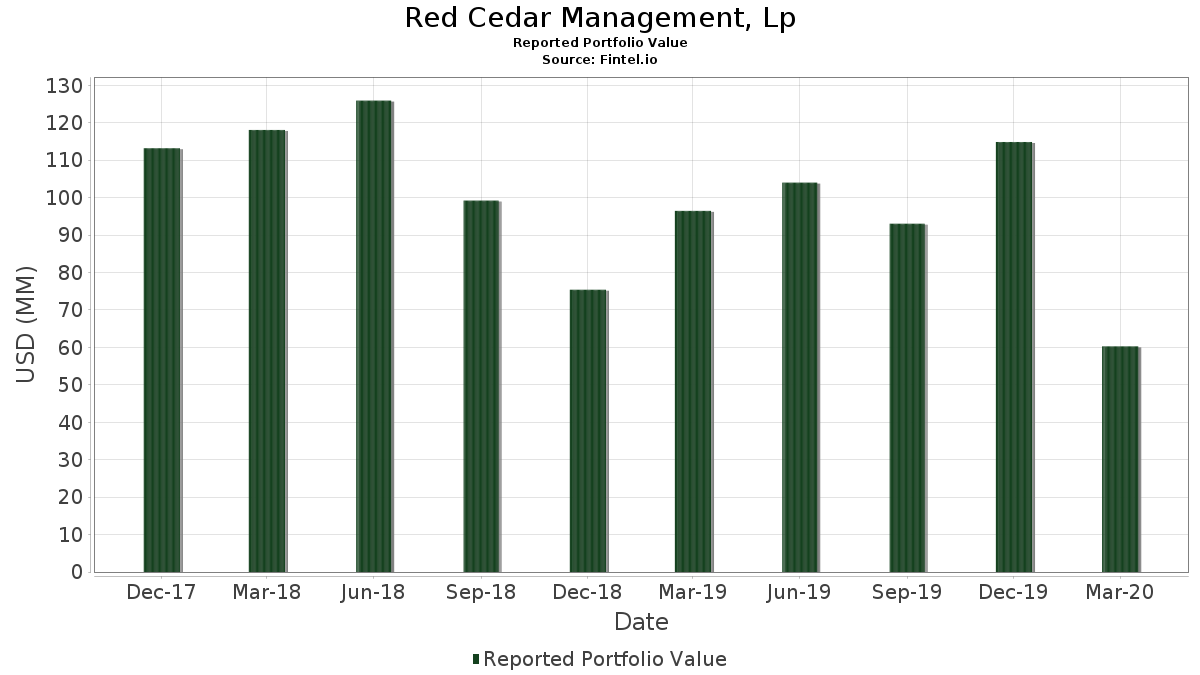

| Portfolio Value | $ 60,280,000 |

| Current Positions | 20 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Red Cedar Management, Lp has disclosed 20 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 60,280,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Red Cedar Management, Lp’s top holdings are EchoStar Corporation (US:SATS) , QuinStreet, Inc. (US:QNST) , Grayscale Funds Trust - Grayscale Bitcoin Adopters ETF (US:BCOR) , U.S. Concrete, Inc. (US:) , and Amazon.com, Inc. (US:AMZN) . Red Cedar Management, Lp’s new positions include Amazon.com, Inc. (US:AMZN) , Vulcan Materials Company (US:VMC) , The Home Depot, Inc. (US:HD) , Alarm.com Holdings, Inc. (US:ALRM) , and American Express Company (US:AXP) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 4.39 | 7.2777 | 7.2777 | |

| 0.03 | 3.57 | 5.9157 | 5.9157 | |

| 0.25 | 8.06 | 13.3776 | 5.8089 | |

| 1.00 | 8.05 | 13.3543 | 5.3574 | |

| 0.01 | 2.61 | 4.3364 | 4.3364 | |

| 0.06 | 2.33 | 3.8736 | 3.8736 | |

| 0.03 | 2.31 | 3.8338 | 3.8338 | |

| 0.01 | 2.25 | 3.7359 | 3.7359 | |

| 0.07 | 2.19 | 3.6248 | 3.6248 | |

| 0.06 | 2.04 | 3.3842 | 3.3842 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -12.3401 | ||

| 0.00 | 0.00 | -7.7453 | ||

| 0.00 | 0.00 | -7.3031 | ||

| 0.00 | 0.00 | -6.4630 | ||

| 0.00 | 0.00 | -6.2088 | ||

| 0.00 | 0.00 | -5.0823 | ||

| 0.00 | 0.00 | -5.0562 | ||

| 0.00 | 0.00 | -3.6494 | ||

| 0.25 | 4.54 | 7.5232 | -1.5436 | |

| 0.20 | 3.01 | 4.9900 | -1.2632 |

13F and Fund Filings

This form was filed on 2020-05-15 for the reporting period 2020-03-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SATS / EchoStar Corporation | 0.25 | 25.66 | 8.06 | -7.25 | 13.3776 | 5.8089 | |||

| QNST / QuinStreet, Inc. | 1.00 | 66.67 | 8.05 | -12.37 | 13.3543 | 5.3574 | |||

| BCOR / Grayscale Funds Trust - Grayscale Bitcoin Adopters ETF | 0.41 | 36.67 | 4.94 | -36.99 | 8.1967 | 1.3698 | |||

| / U.S. Concrete, Inc. | 0.25 | 0.00 | 4.54 | -56.46 | 7.5232 | -1.5436 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 4.39 | 7.2777 | 7.2777 | |||||

| VMC / Vulcan Materials Company | 0.03 | 3.57 | 5.9157 | 5.9157 | |||||

| SUM / Summit Materials, Inc. | 0.20 | -33.27 | 3.01 | -58.12 | 4.9900 | -1.2632 | |||

| HD / The Home Depot, Inc. | 0.01 | 2.61 | 4.3364 | 4.3364 | |||||

| ALRM / Alarm.com Holdings, Inc. | 0.06 | 2.33 | 3.8736 | 3.8736 | |||||

| AXP / American Express Company | 0.03 | 2.31 | 3.8338 | 3.8338 | |||||

| META / Meta Platforms, Inc. | 0.01 | 2.25 | 3.7359 | 3.7359 | |||||

| SCHW / The Charles Schwab Corporation | 0.07 | 2.19 | 3.6248 | 3.6248 | |||||

| MS / Morgan Stanley | 0.06 | 2.04 | 3.3842 | 3.3842 | |||||

| QCOM / QUALCOMM Incorporated | 0.03 | 2.03 | 3.3676 | 3.3676 | |||||

| WEX / WEX Inc. | 0.02 | 75.00 | 1.83 | -12.65 | 3.0358 | 1.2120 | |||

| MCD / McDonald's Corporation | 0.01 | 1.65 | 2.7439 | 2.7439 | |||||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 0.07 | 1.64 | 2.7240 | 2.7240 | |||||

| DRI / Darden Restaurants, Inc. | 0.02 | 1.31 | 2.1682 | 2.1682 | |||||

| SEIC / SEI Investments Company | 0.02 | 0.95 | 1.5843 | 1.5843 | |||||

| TJX / The TJX Companies, Inc. | 0.01 | 0.57 | 0.9522 | 0.9522 | |||||

| GM / General Motors Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ZTO / ZTO Express (Cayman) Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -5.0823 | ||||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -7.3031 | ||||

| AVTR / Avantor, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.0562 | ||||

| GDDY / GoDaddy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -6.2088 | ||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -6.4630 | ||||

| EEFT / Euronet Worldwide, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HQY / HealthEquity, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -7.7453 | ||||

| LOW / Lowe's Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.6494 | ||||

| URI / United Rentals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -12.3401 |