Basic Stats

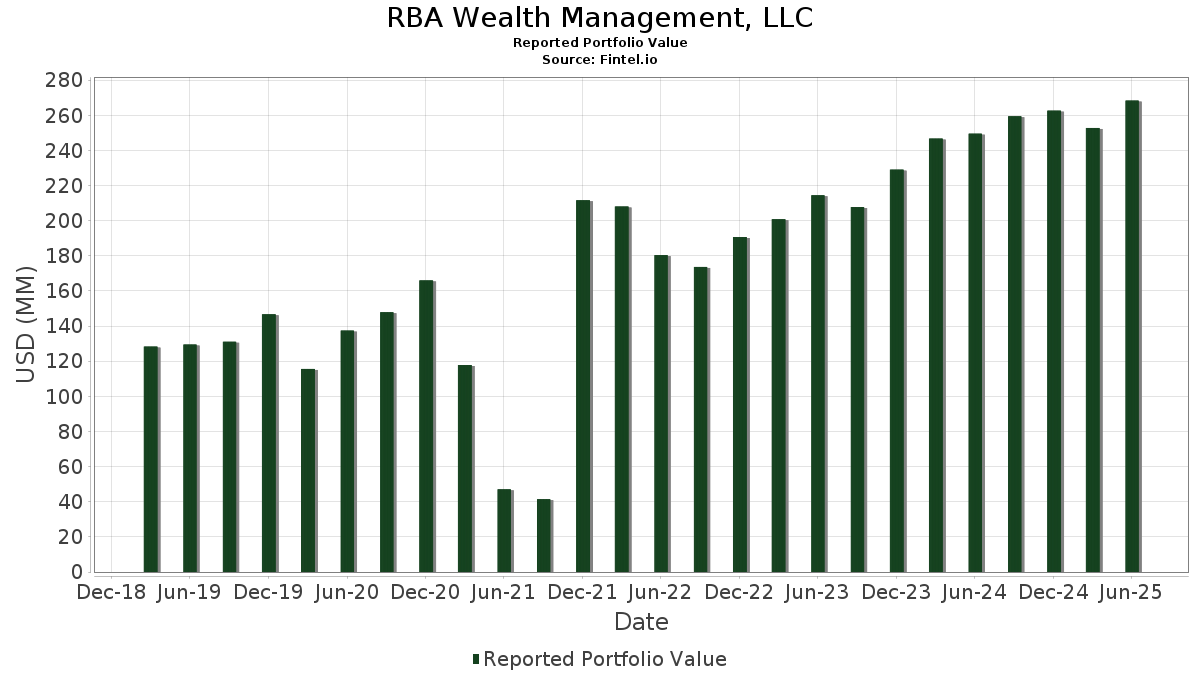

| Portfolio Value | $ 268,384,663 |

| Current Positions | 93 |

Latest Holdings, Performance, AUM (from 13F, 13D)

RBA Wealth Management, LLC has disclosed 93 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 268,384,663 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). RBA Wealth Management, LLC’s top holdings are Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , and Visa Inc. (US:V) . RBA Wealth Management, LLC’s new positions include Ingredion Incorporated (US:INGR) , NRG Energy, Inc. (US:NRG) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 5.64 | 2.1016 | 2.1016 | |

| 0.03 | 8.97 | 3.3419 | 1.1394 | |

| 0.02 | 2.80 | 1.0429 | 1.0429 | |

| 0.01 | 2.33 | 0.8686 | 0.8686 | |

| 0.02 | 10.03 | 3.7384 | 0.6747 | |

| 0.01 | 6.97 | 2.5982 | 0.5139 | |

| 0.02 | 5.20 | 1.9392 | 0.4448 | |

| 0.03 | 5.21 | 1.9400 | 0.3402 | |

| 0.01 | 5.34 | 1.9911 | 0.2949 | |

| 0.01 | 5.93 | 2.2078 | 0.2927 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.60 | 0.2222 | -1.7863 | |

| 0.00 | 5.69 | 2.1204 | -1.4317 | |

| 0.02 | 3.98 | 1.4835 | -0.5057 | |

| 0.04 | 8.65 | 3.2236 | -0.4469 | |

| 0.00 | 1.03 | 0.3839 | -0.4380 | |

| 0.02 | 5.11 | 1.9041 | -0.3341 | |

| 0.02 | 3.98 | 1.4844 | -0.3234 | |

| 0.06 | 5.91 | 2.2007 | -0.2987 | |

| 0.02 | 4.59 | 1.7088 | -0.2464 | |

| 0.02 | 7.61 | 2.8344 | -0.2374 |

13F and Fund Filings

This form was filed on 2025-07-17 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.02 | -2.23 | 10.03 | 29.56 | 3.7384 | 0.6747 | |||

| AVGO / Broadcom Inc. | 0.03 | -2.15 | 8.97 | 61.11 | 3.3419 | 1.1394 | |||

| AAPL / Apple Inc. | 0.04 | 0.96 | 8.65 | -6.76 | 3.2236 | -0.4469 | |||

| GOOGL / Alphabet Inc. | 0.05 | -1.02 | 8.27 | 12.80 | 3.0827 | 0.1811 | |||

| V / Visa Inc. | 0.02 | -3.30 | 7.61 | -2.02 | 2.8344 | -0.2374 | |||

| WM / Waste Management, Inc. | 0.03 | -0.54 | 7.25 | -1.70 | 2.7002 | -0.2161 | |||

| META / Meta Platforms, Inc. | 0.01 | 3.36 | 6.97 | 32.37 | 2.5982 | 0.5139 | |||

| CMI / Cummins Inc. | 0.02 | 0.02 | 6.81 | 4.51 | 2.5384 | -0.0403 | |||

| BSX / Boston Scientific Corporation | 0.06 | -5.26 | 6.80 | 0.88 | 2.5336 | -0.1330 | |||

| MET / MetLife, Inc. | 0.08 | 0.15 | 6.24 | 0.32 | 2.3258 | -0.1359 | |||

| EWBC / East West Bancorp, Inc. | 0.06 | 1.53 | 6.18 | 14.21 | 2.3029 | 0.1623 | |||

| SNPS / Synopsys, Inc. | 0.01 | 0.15 | 5.93 | 19.73 | 2.2111 | 0.2503 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 1.20 | 5.93 | 22.39 | 2.2078 | 0.2927 | |||

| ACGL / Arch Capital Group Ltd. | 0.06 | -1.25 | 5.91 | -6.51 | 2.2007 | -0.2987 | |||

| CBOE / Cboe Global Markets, Inc. | 0.03 | 4.55 | 5.86 | 7.73 | 2.1852 | 0.0319 | |||

| AZO / AutoZone, Inc. | 0.00 | -34.90 | 5.69 | -36.63 | 2.1204 | -1.4317 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 5.64 | 2.1016 | 2.1016 | |||||

| URI / United Rentals, Inc. | 0.01 | 3.67 | 5.34 | 24.63 | 1.9911 | 0.2949 | |||

| AMAT / Applied Materials, Inc. | 0.03 | 2.06 | 5.21 | 28.77 | 1.9400 | 0.3402 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | 0.98 | 5.20 | 37.78 | 1.9392 | 0.4448 | |||

| TMUS / T-Mobile US, Inc. | 0.02 | 1.11 | 5.11 | -9.67 | 1.9041 | -0.3341 | |||

| HD / The Home Depot, Inc. | 0.01 | 0.46 | 5.01 | 0.50 | 1.8651 | -0.1053 | |||

| AEP / American Electric Power Company, Inc. | 0.05 | 1.55 | 4.96 | -3.58 | 1.8489 | -0.1868 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 0.75 | 4.91 | 4.45 | 1.8288 | -0.0301 | |||

| PG / The Procter & Gamble Company | 0.03 | 1.77 | 4.86 | -4.86 | 1.8105 | -0.2099 | |||

| MDT / Medtronic plc | 0.05 | 1.30 | 4.65 | -1.75 | 1.7329 | -0.1394 | |||

| CRM / Salesforce, Inc. | 0.02 | 0.96 | 4.61 | 2.58 | 1.7161 | -0.0600 | |||

| EXP / Eagle Materials Inc. | 0.02 | 1.89 | 4.59 | -7.20 | 1.7088 | -0.2464 | |||

| EA / Electronic Arts Inc. | 0.03 | 0.65 | 4.53 | 11.24 | 1.6890 | 0.0766 | |||

| ADBE / Adobe Inc. | 0.01 | 1.85 | 4.47 | 2.74 | 1.6645 | -0.0556 | |||

| FIS / Fidelity National Information Services, Inc. | 0.05 | 1.20 | 4.43 | 10.33 | 1.6519 | 0.0622 | |||

| FLS / Flowserve Corporation | 0.08 | 0.88 | 4.26 | 8.15 | 1.5877 | 0.0288 | |||

| CI / The Cigna Group | 0.01 | 5.06 | 4.16 | 5.56 | 1.5503 | -0.0090 | |||

| PVH / PVH Corp. | 0.06 | 1.23 | 4.04 | 7.42 | 1.5044 | 0.0176 | |||

| PLD / Prologis, Inc. | 0.04 | 0.30 | 4.01 | -5.70 | 1.4934 | -0.1877 | |||

| TRGP / Targa Resources Corp. | 0.02 | 0.40 | 3.98 | -12.83 | 1.4844 | -0.3234 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 5.30 | 3.98 | -20.82 | 1.4835 | -0.5057 | |||

| KBH / KB Home | 0.07 | 2.67 | 3.50 | -6.44 | 1.3058 | -0.1758 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.01 | -0.19 | 3.40 | 22.08 | 1.2651 | 0.1646 | |||

| MHK / Mohawk Industries, Inc. | 0.03 | 3.59 | 3.33 | -4.88 | 1.2412 | -0.1442 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | 2.66 | 3.20 | 18.01 | 1.1939 | 0.1198 | |||

| INGR / Ingredion Incorporated | 0.02 | 2.80 | 1.0429 | 1.0429 | |||||

| TFX / Teleflex Incorporated | 0.02 | 6.23 | 2.69 | -9.03 | 1.0022 | -0.1673 | |||

| EOG / EOG Resources, Inc. | 0.02 | 5.31 | 2.59 | -1.78 | 0.9642 | -0.0780 | |||

| ACN / Accenture plc | 0.01 | 12.98 | 2.47 | 8.18 | 0.9218 | 0.0174 | |||

| NRG / NRG Energy, Inc. | 0.01 | 2.33 | 0.8686 | 0.8686 | |||||

| VICI / VICI Properties Inc. | 0.06 | 2.63 | 2.06 | 2.59 | 0.7662 | -0.0269 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.02 | -0.68 | 1.62 | -0.43 | 0.6033 | -0.0401 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.02 | -2.24 | 1.60 | -1.97 | 0.5948 | -0.0493 | |||

| VFH / Vanguard World Fund - Vanguard Financials ETF | 0.01 | 4.56 | 1.52 | 11.41 | 0.5677 | 0.0267 | |||

| TGT / Target Corporation | 0.02 | 10.75 | 1.51 | 4.71 | 0.5632 | -0.0080 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.46 | -8.71 | 0.5431 | -0.0886 | |||

| CVX / Chevron Corporation | 0.01 | -7.10 | 1.29 | -20.48 | 0.4804 | -0.1611 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 0.02 | 1.18 | 15.36 | 0.4395 | 0.0349 | |||

| VCR / Vanguard World Fund - Vanguard Consumer Discretionary ETF | 0.00 | 7.82 | 1.07 | 20.02 | 0.4001 | 0.0462 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.00 | 3.67 | 1.03 | -2.83 | 0.3845 | -0.0353 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -16.74 | 1.03 | -50.41 | 0.3839 | -0.4380 | |||

| VIS / Vanguard World Fund - Vanguard Industrials ETF | 0.00 | 2.32 | 1.00 | 15.89 | 0.3722 | 0.0308 | |||

| VOX / Vanguard World Fund - Vanguard Communication Services ETF | 0.01 | -0.68 | 0.97 | 14.54 | 0.3611 | 0.0262 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -1.00 | 0.95 | 17.04 | 0.3535 | 0.0328 | |||

| WMT / Walmart Inc. | 0.01 | -10.59 | 0.87 | -0.46 | 0.3237 | -0.0214 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.93 | 0.83 | 23.65 | 0.3081 | 0.0437 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.02 | 2.82 | 0.65 | 19.89 | 0.2406 | 0.0276 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -89.55 | 0.60 | -88.26 | 0.2222 | -1.7863 | |||

| NVDA / NVIDIA Corporation | 0.00 | 3.83 | 0.56 | 51.62 | 0.2090 | 0.0624 | |||

| OTTR / Otter Tail Corporation | 0.01 | -3.85 | 0.53 | -7.89 | 0.1959 | -0.0296 | |||

| VDC / Vanguard World Fund - Vanguard Consumer Staples ETF | 0.00 | -2.67 | 0.49 | -2.60 | 0.1816 | -0.0163 | |||

| IBM / International Business Machines Corporation | 0.00 | -16.36 | 0.48 | -0.83 | 0.1786 | -0.0127 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -27.55 | 0.47 | -24.92 | 0.1743 | -0.0720 | |||

| SCHZ / Schwab Strategic Trust - Schwab U.S. Aggregate Bond ETF | 0.02 | 2.86 | 0.41 | 3.27 | 0.1528 | -0.0044 | |||

| DIS / The Walt Disney Company | 0.00 | -5.50 | 0.40 | 18.69 | 0.1493 | 0.0158 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.56 | 0.40 | 18.51 | 0.1480 | 0.0152 | |||

| COST / Costco Wholesale Corporation | 0.00 | -7.08 | 0.39 | -2.74 | 0.1454 | -0.0133 | |||

| SCHM / Schwab Strategic Trust - Schwab U.S. Mid-Cap ETF | 0.01 | 2.67 | 0.38 | 9.86 | 0.1414 | 0.0048 | |||

| SPYG / SPDR Series Trust - SPDR Portfolio S&P 500 Growth ETF | 0.00 | 1.37 | 0.37 | 20.32 | 0.1390 | 0.0163 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -7.75 | 0.35 | 1.73 | 0.1315 | -0.0055 | |||

| VDE / Vanguard World Fund - Vanguard Energy ETF | 0.00 | 13.19 | 0.35 | 3.83 | 0.1314 | -0.0028 | |||

| CB / Chubb Limited | 0.00 | -1.53 | 0.33 | -5.65 | 0.1247 | -0.0154 | |||

| PEP / PepsiCo, Inc. | 0.00 | -19.54 | 0.30 | -29.21 | 0.1130 | -0.0563 | |||

| SCHA / Schwab Strategic Trust - Schwab U.S. Small-Cap ETF | 0.01 | 5.67 | 0.30 | 13.96 | 0.1128 | 0.0078 | |||

| TECK / Teck Resources Limited | 0.01 | -9.87 | 0.30 | 0.00 | 0.1111 | -0.0070 | |||

| CPRT / Copart, Inc. | 0.01 | 0.00 | 0.27 | -13.38 | 0.1016 | -0.0228 | |||

| IAGG / iShares Trust - iShares Core International Aggregate Bond ETF | 0.01 | 7.42 | 0.26 | 9.54 | 0.0986 | 0.0032 | |||

| SCHV / Schwab Strategic Trust - Schwab U.S. Large-Cap Value ETF | 0.01 | 0.37 | 0.26 | 4.49 | 0.0956 | -0.0016 | |||

| SCHF / Schwab Strategic Trust - Schwab International Equity ETF | 0.01 | -0.95 | 0.26 | 10.39 | 0.0953 | 0.0039 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | 4.63 | 0.26 | 2.82 | 0.0953 | -0.0030 | |||

| VPU / Vanguard World Fund - Vanguard Utilities ETF | 0.00 | 4.64 | 0.25 | 8.09 | 0.0949 | 0.0017 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.00 | -5.11 | 0.25 | -5.66 | 0.0933 | -0.0116 | |||

| MCD / McDonald's Corporation | 0.00 | -0.71 | 0.24 | -6.87 | 0.0909 | -0.0130 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -7.89 | 0.24 | -15.90 | 0.0887 | -0.0234 | |||

| RJF / Raymond James Financial, Inc. | 0.00 | -2.81 | 0.23 | 7.37 | 0.0870 | 0.0009 | |||

| FDX / FedEx Corporation | 0.00 | -1.00 | 0.22 | -7.82 | 0.0837 | -0.0126 | |||

| VAW / Vanguard World Fund - Vanguard Materials ETF | 0.00 | 1.29 | 0.21 | 4.41 | 0.0797 | -0.0013 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COP / ConocoPhillips | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPGI / S&P Global Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |