Basic Stats

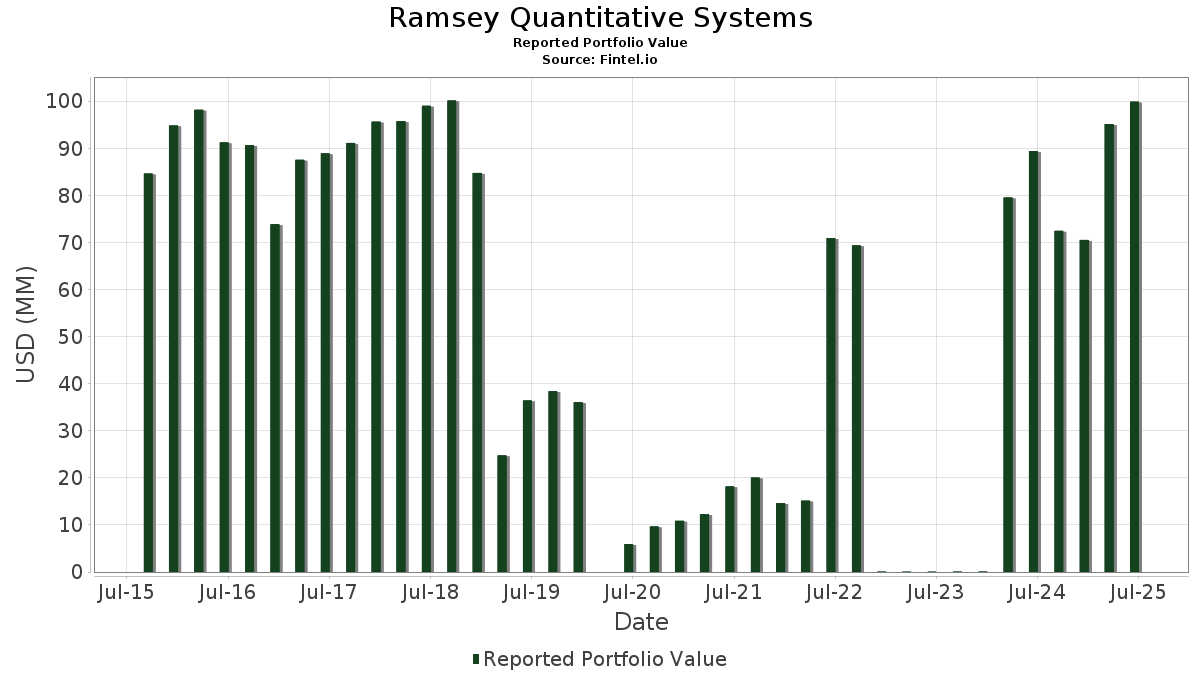

| Portfolio Value | $ 99,886,630 |

| Current Positions | 11 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Ramsey Quantitative Systems has disclosed 11 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 99,886,630 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Ramsey Quantitative Systems’s top holdings are SPDR S&P 500 ETF (US:SPY) , and Ready Capital Corporation (US:RC) . Ramsey Quantitative Systems’s new positions include SPDR S&P 500 ETF (US:SPY) , and Ready Capital Corporation (US:RC) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.15 | 94.43 | 94.5357 | 1.2191 | |

| 0.15 | 94.43 | 93.7705 | 0.4540 | |

| 0.00 | 0.21 | 0.2080 | 0.2080 | |

| 0.00 | 0.15 | 0.1514 | 0.1514 | |

| 0.00 | 0.13 | 0.1307 | 0.1307 | |

| 0.00 | 0.13 | 0.1255 | 0.1255 | |

| 0.00 | 0.08 | 0.0821 | 0.0821 | |

| 0.00 | 0.07 | 0.0676 | 0.0676 | |

| 0.00 | 0.04 | 0.0440 | 0.0440 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.25 | 5.46 | 5.4201 | -1.2633 | |

| 1.25 | 5.46 | 5.4643 | -1.2191 |

13F and Fund Filings

This form was filed on 2025-07-28 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.15 | 94.43 | 94.5357 | 1.2191 | |||||

| SPY / SPDR S&P 500 ETF | 0.15 | -3.68 | 94.43 | 6.38 | 93.7705 | 0.4540 | |||

| RC / Ready Capital Corporation | 1.25 | 5.46 | 5.4643 | -1.2191 | |||||

| RC / Ready Capital Corporation | 1.25 | 0.00 | 5.46 | -14.14 | 5.4201 | -1.2633 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.00 | 0.21 | 0.2080 | 0.2080 | |||||

| GLD / SPDR Gold Trust | 0.00 | 0.15 | 0.1514 | 0.1514 | |||||

| AMZN / Amazon.com, Inc. | 0.00 | 0.13 | 0.1307 | 0.1307 | |||||

| NVDA / NVIDIA Corporation | 0.00 | 0.13 | 0.1255 | 0.1255 | |||||

| AVGO / Broadcom Inc. | 0.00 | 0.08 | 0.0821 | 0.0821 | |||||

| C / Citigroup Inc. | 0.00 | 0.07 | 0.0676 | 0.0676 | |||||

| IBKR / Interactive Brokers Group, Inc. | 0.00 | 0.04 | 0.0440 | 0.0440 |