Basic Stats

| Portfolio Value | $ 34,725,000 |

| Current Positions | 19 |

Latest Holdings, Performance, AUM (from 13F, 13D)

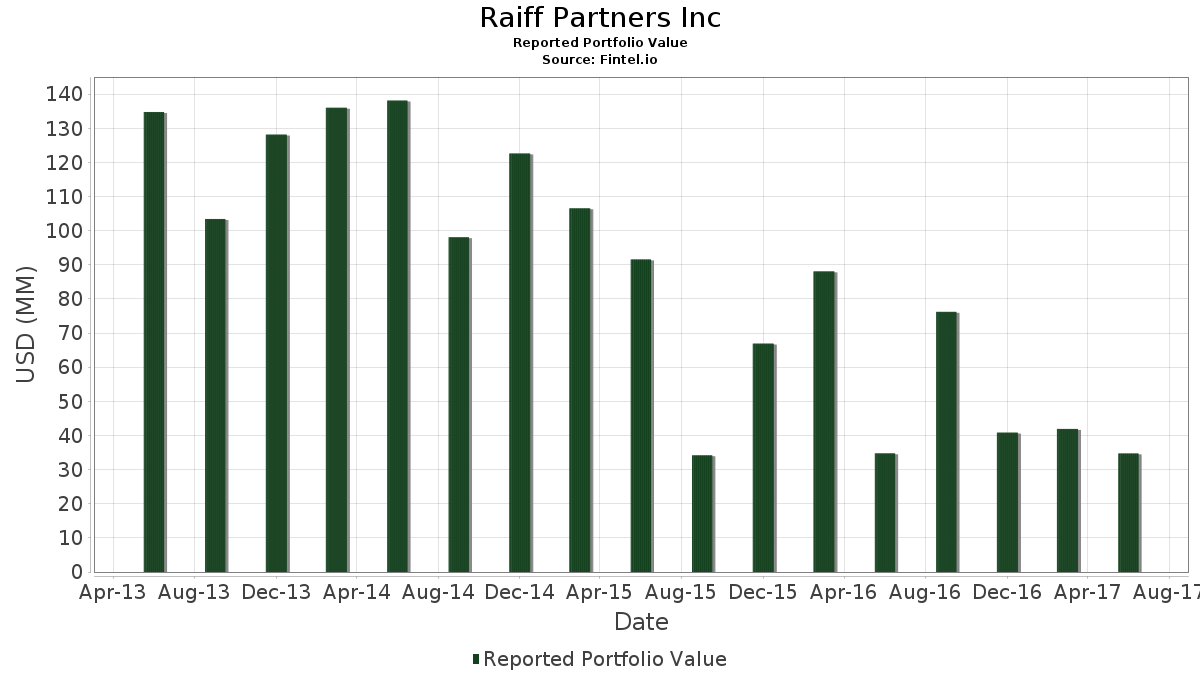

Raiff Partners Inc has disclosed 19 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 34,725,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Raiff Partners Inc’s top holdings are MetLife, Inc. (US:MET) , Costco Wholesale Corporation (US:COST) , Apollo Global Management, Inc. (US:APO) , Athene Holding Ltd - Class A (US:ATH) , and Ares Capital Corporation (US:ARCC) . Raiff Partners Inc’s new positions include Sun Life Financial, Inc. - 4.75% PRF PERPETUAL CAD 25 - Cls A Ser 1 (US:SLFYF) , Dow Inc. (US:DOW) , Two Harbors Investment Corp. (US:TWO) , Annaly Capital Management, Inc. (US:NLY) , and Lions Gate Entertainment Corp. (US:LGF.B) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 3.35 | 9.6501 | 9.6501 | |

| 0.02 | 3.20 | 9.2124 | 9.2124 | |

| 0.10 | 2.65 | 7.6170 | 7.6170 | |

| 0.05 | 2.58 | 7.4298 | 7.4298 | |

| 0.15 | 2.46 | 7.0756 | 7.0756 | |

| 0.07 | 2.32 | 6.6926 | 6.6926 | |

| 0.03 | 2.29 | 6.5803 | 6.5803 | |

| 0.10 | 2.24 | 6.4478 | 6.4478 | |

| 0.13 | 1.89 | 5.4456 | 5.4456 | |

| 0.03 | 1.70 | 4.9042 | 4.9042 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -7.5418 | ||

| 0.00 | 0.00 | -3.6743 | ||

| 0.00 | 0.00 | -3.4476 | ||

| 0.00 | 0.00 | -3.2687 | ||

| 0.04 | 1.97 | 5.6847 | -1.7927 |

13F and Fund Filings

This form was filed on 2017-08-14 for the reporting period 2017-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MET / MetLife, Inc. | 0.06 | 3.35 | 9.6501 | 9.6501 | |||||

| COST / Costco Wholesale Corporation | 0.02 | 3.20 | 9.2124 | 9.2124 | |||||

| APO / Apollo Global Management, Inc. | 0.10 | -28.57 | 2.65 | -22.32 | 7.6170 | 7.6170 | |||

| ATH / Athene Holding Ltd - Class A | 0.05 | -20.00 | 2.58 | -20.59 | 7.4298 | 7.4298 | |||

| ARCC / Ares Capital Corporation | 0.15 | -41.18 | 2.46 | -44.56 | 7.0756 | 7.0756 | |||

| SLFYF / Sun Life Financial, Inc. - 4.75% PRF PERPETUAL CAD 25 - Cls A Ser 1 | 0.07 | 2.32 | 6.6926 | 6.6926 | |||||

| JPM / JPMorgan Chase & Co. | 0.03 | 2.29 | 6.5803 | 6.5803 | |||||

| STWD / Starwood Property Trust, Inc. | 0.10 | 2.24 | 6.4478 | 6.4478 | |||||

| HES / Hess Corporation | 0.04 | -30.77 | 1.97 | -37.01 | 5.6847 | -1.7927 | |||

| NMFC / New Mountain Finance Corporation | 0.13 | 1.89 | 5.4456 | 5.4456 | |||||

| DOW / Dow Inc. | 0.03 | 1.70 | 4.9042 | 4.9042 | |||||

| TWO / Two Harbors Investment Corp. | 0.17 | 1.69 | 4.8524 | 4.8524 | |||||

| BX / Blackstone Inc. | 0.05 | 1.67 | 4.8006 | 4.8006 | |||||

| NLY / Annaly Capital Management, Inc. | 0.11 | 1.35 | 3.8877 | 3.8877 | |||||

| AINV / Apollo Investment Corporation | 0.20 | -11.11 | 1.28 | -13.41 | 3.6803 | 0.1588 | |||

| LGF.B / Lions Gate Entertainment Corp. | 0.05 | 1.21 | 3.4816 | 3.4816 | |||||

| CYBR / CyberArk Software Ltd. | 0.01 | 0.75 | 2.1569 | 2.1569 | |||||

| CISN / Cision Ltd. | 0.01 | 0.10 | 0.2966 | 0.2966 | |||||

| ZNGA / Zynga Inc - Class A | 0.01 | -50.00 | 0.04 | -36.84 | 0.1037 | 0.1037 | |||

| ARI / Apollo Commercial Real Estate Finance, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| MGM / MGM Resorts International | 0.00 | -100.00 | 0.00 | -100.00 | -3.2687 | ||||

| FGL / Founder Group Limited | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| XPO / XPO, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| GTN / Gray Media, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| US98212B1035 / WPX Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| Y / Alleghany Corp. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ARES / Ares Management Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| LVS / Las Vegas Sands Corp. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| STX / Seagate Technology Holdings plc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| MC / Moelis & Company | 0.00 | -100.00 | 0.00 | -100.00 | -3.6743 | ||||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.4476 | ||||

| MGP / MGM Growth Properties LLC - Class A | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -7.5418 |