Basic Stats

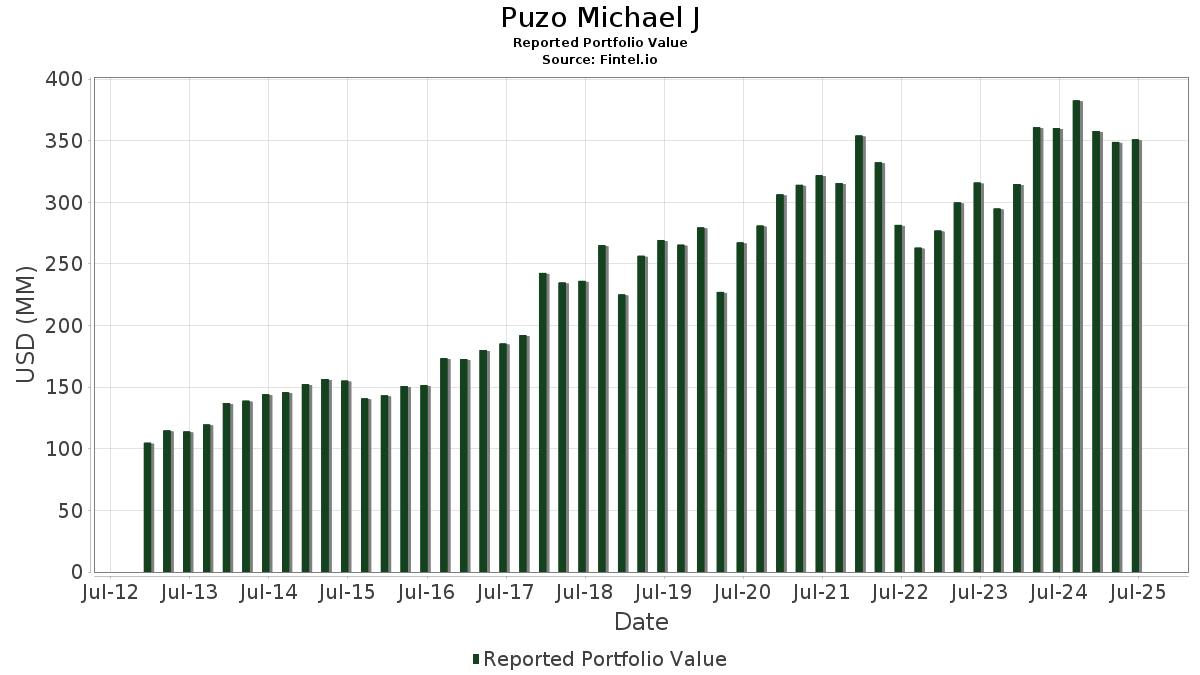

| Portfolio Value | $ 350,974,496 |

| Current Positions | 71 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Puzo Michael J has disclosed 71 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 350,974,496 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Puzo Michael J’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , and Mastercard Incorporated (US:MA) . Puzo Michael J’s new positions include Applied Materials, Inc. (US:AMAT) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 18.69 | 5.3242 | 1.4526 | |

| 0.04 | 18.43 | 5.2514 | 1.0970 | |

| 0.03 | 3.08 | 0.8772 | 0.5436 | |

| 0.01 | 1.70 | 0.4849 | 0.4849 | |

| 0.01 | 2.48 | 0.7061 | 0.4823 | |

| 0.05 | 12.35 | 3.5189 | 0.4425 | |

| 0.00 | 3.57 | 1.0175 | 0.4158 | |

| 0.09 | 15.86 | 4.5193 | 0.3827 | |

| 0.06 | 12.81 | 3.6490 | 0.3470 | |

| 0.12 | 8.45 | 2.4070 | 0.3104 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 11.55 | 0.6355 | -3.7915 | |

| 0.04 | 12.87 | 0.7086 | -3.2414 | |

| 0.07 | 11.14 | 0.6130 | -2.8992 | |

| 0.07 | 10.32 | 0.5680 | -2.7993 | |

| 0.08 | 11.96 | 0.6585 | -2.6573 | |

| 0.07 | 11.09 | 0.6103 | -2.5459 | |

| 0.05 | 9.18 | 0.5052 | -2.2856 | |

| 0.03 | 9.30 | 0.5118 | -2.1941 | |

| 0.00 | 8.02 | 0.4412 | -2.0757 | |

| 0.03 | 9.29 | 0.5112 | -1.9614 |

13F and Fund Filings

This form was filed on 2025-07-23 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.12 | -5.12 | 18.69 | 38.31 | 5.3242 | 1.4526 | |||

| MSFT / Microsoft Corporation | 0.04 | -4.05 | 18.43 | 27.14 | 5.2514 | 1.0970 | |||

| AAPL / Apple Inc. | 0.08 | -3.33 | 15.92 | -10.71 | 4.5358 | -0.5736 | |||

| GOOGL / Alphabet Inc. | 0.09 | -3.58 | 15.86 | 9.89 | 4.5193 | 0.3827 | |||

| MA / Mastercard Incorporated | 0.03 | -5.69 | 15.63 | -3.32 | 4.4536 | -0.1793 | |||

| ADP / Automatic Data Processing, Inc. | 0.04 | -7.46 | 12.87 | -6.60 | 0.7086 | -3.2414 | |||

| AMZN / Amazon.com, Inc. | 0.06 | -3.61 | 12.81 | 11.15 | 3.6490 | 0.3470 | |||

| ABT / Abbott Laboratories | 0.09 | -7.07 | 12.51 | -4.72 | 3.5632 | -0.1980 | |||

| ADI / Analog Devices, Inc. | 0.05 | -2.53 | 12.35 | 15.04 | 3.5189 | 0.4425 | |||

| RTX / RTX Corporation | 0.08 | -6.20 | 11.96 | 3.41 | 0.6585 | -2.6573 | |||

| FI / Fiserv, Inc. | 0.07 | -4.26 | 11.55 | -25.26 | 0.6355 | -3.7915 | |||

| PG / The Procter & Gamble Company | 0.07 | -2.79 | 11.14 | -9.12 | 0.6130 | -2.8992 | |||

| ATR / AptarGroup, Inc. | 0.07 | -4.50 | 11.09 | 0.69 | 0.6103 | -2.5459 | |||

| JNJ / Johnson & Johnson | 0.07 | -4.64 | 10.32 | -12.17 | 0.5680 | -2.7993 | |||

| TJX / The TJX Companies, Inc. | 0.08 | -3.19 | 9.80 | -1.85 | 2.7915 | -0.0691 | |||

| AMD / Advanced Micro Devices, Inc. | 0.07 | -13.78 | 9.56 | 19.09 | 0.5261 | -1.7742 | |||

| HD / The Home Depot, Inc. | 0.03 | -1.56 | 9.30 | -1.51 | 0.5118 | -2.1941 | |||

| ROK / Rockwell Automation, Inc. | 0.03 | -16.27 | 9.29 | 7.64 | 0.5112 | -1.9614 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.17 | -2.12 | 9.18 | 13.78 | 0.5053 | -1.8070 | |||

| DHR / Danaher Corporation | 0.05 | -2.18 | 9.18 | -5.74 | 0.5052 | -2.2856 | |||

| CARR / Carrier Global Corporation | 0.12 | 0.02 | 8.45 | 15.46 | 2.4070 | 0.3104 | |||

| XYL / Xylem Inc. | 0.06 | -2.78 | 8.33 | 5.28 | 2.3738 | 0.1060 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 8.02 | -8.72 | 0.4412 | -2.0757 | |||

| CNI / Canadian National Railway Company | 0.07 | -8.25 | 7.31 | -2.06 | 0.4024 | -1.7367 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.02 | 0.36 | 6.83 | -7.84 | 1.9458 | -0.1778 | |||

| CVX / Chevron Corporation | 0.05 | -3.66 | 6.62 | -17.54 | 1.8875 | -0.4146 | |||

| MKC / McCormick & Company, Incorporated | 0.08 | 0.09 | 5.77 | -7.80 | 1.6434 | -0.1493 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 4.19 | 5.20 | -37.94 | 1.4802 | -0.9186 | |||

| XOM / Exxon Mobil Corporation | 0.04 | -2.99 | 4.08 | -12.06 | 1.1614 | -0.1670 | |||

| CRM / Salesforce, Inc. | 0.01 | 20.87 | 3.67 | 22.81 | 1.0447 | 0.1892 | |||

| LLY / Eli Lilly and Company | 0.00 | 80.21 | 3.57 | 70.13 | 1.0175 | 0.4158 | |||

| UBER / Uber Technologies, Inc. | 0.03 | 106.53 | 3.08 | 164.43 | 0.8772 | 0.5436 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.04 | 78.95 | 3.03 | 77.93 | 0.1669 | -0.3216 | |||

| MURGY / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 2.89 | 2.26 | 0.1593 | -0.6518 | |||

| AXP / American Express Company | 0.01 | 167.62 | 2.48 | 217.29 | 0.7061 | 0.4823 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.02 | -52.45 | 2.35 | -53.34 | 0.1294 | -1.3139 | |||

| ABBV / AbbVie Inc. | 0.01 | -5.41 | 1.75 | -16.20 | 0.4996 | -0.1000 | |||

| AMAT / Applied Materials, Inc. | 0.01 | 1.70 | 0.4849 | 0.4849 | |||||

| SCHW / The Charles Schwab Corporation | 0.02 | 268.23 | 1.62 | 330.24 | 0.0893 | -0.0190 | |||

| MRK / Merck & Co., Inc. | 0.02 | 0.00 | 1.42 | -11.79 | 0.4050 | -0.0569 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -20.34 | 1.36 | -27.35 | 0.0749 | -0.4616 | |||

| EMR / Emerson Electric Co. | 0.01 | -7.51 | 1.15 | 12.52 | 0.3277 | 0.0347 | |||

| WMT / Walmart Inc. | 0.01 | -5.00 | 1.11 | 5.79 | 0.3176 | 0.0157 | |||

| PEP / PepsiCo, Inc. | 0.01 | -8.25 | 1.04 | -19.20 | 0.2951 | -0.0722 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.98 | -0.91 | 0.2781 | -0.0043 | |||

| CAT / Caterpillar Inc. | 0.00 | -4.02 | 0.93 | 12.91 | 0.2644 | 0.0290 | |||

| DE / Deere & Company | 0.00 | -13.67 | 0.76 | -6.54 | 0.2159 | -0.0163 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | -2.44 | 0.64 | 18.05 | 0.1827 | 0.0270 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.01 | 3.92 | 0.58 | 12.09 | 0.0321 | -0.1173 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.52 | -2.64 | 0.1475 | -0.0048 | |||

| V / Visa Inc. | 0.00 | -40.49 | 0.47 | -39.72 | 0.1345 | -0.0899 | |||

| ECL / Ecolab Inc. | 0.00 | -8.22 | 0.45 | -2.38 | 0.1286 | -0.0040 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.40 | 11.73 | 0.1141 | 0.0113 | |||

| BMO / Bank of Montreal | 0.00 | 0.00 | 0.39 | 15.87 | 0.0213 | -0.0745 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.38 | -4.01 | 0.0211 | -0.0933 | |||

| FXAIX / Fidelity Concord Street Trust - Fidelity 500 Index Fund | 0.00 | 0.00 | 0.35 | 10.63 | 0.1011 | 0.0091 | |||

| FNCMX / Fidelity Concord Street Trust - Fidelity NASDAQ Composite Index | 0.00 | 0.00 | 0.34 | 17.83 | 0.0961 | 0.0141 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.30 | 13.58 | 0.0166 | -0.0595 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -10.00 | 0.28 | 4.09 | 0.0799 | 0.0026 | |||

| KO / The Coca-Cola Company | 0.00 | -1.50 | 0.28 | -2.80 | 0.0794 | -0.0027 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.28 | 27.78 | 0.0789 | 0.0169 | |||

| HON / Honeywell International Inc. | 0.00 | -18.21 | 0.26 | -10.00 | 0.0144 | -0.0689 | |||

| SYY / Sysco Corporation | 0.00 | 0.00 | 0.26 | 0.79 | 0.0728 | 0.0003 | |||

| OZK / Bank OZK | 0.01 | -0.09 | 0.25 | 8.12 | 0.0723 | 0.0051 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.25 | 18.27 | 0.0702 | 0.0105 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | -16.43 | 0.25 | -9.23 | 0.0702 | -0.0076 | |||

| NUE / Nucor Corporation | 0.00 | 0.00 | 0.23 | 7.87 | 0.0128 | -0.0492 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.00 | 0.23 | -1.28 | 0.0663 | -0.0011 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -15.96 | 0.22 | -5.60 | 0.0121 | -0.0544 | |||

| CL / Colgate-Palmolive Company | 0.00 | -27.23 | 0.22 | -29.45 | 0.0120 | -0.0767 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.21 | 0.0611 | 0.0611 | |||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0858 | ||||

| ADBE / Adobe Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BALL / Ball Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |