Basic Stats

| Portfolio Value | $ 368,952,231 |

| Current Positions | 82 |

Latest Holdings, Performance, AUM (from 13F, 13D)

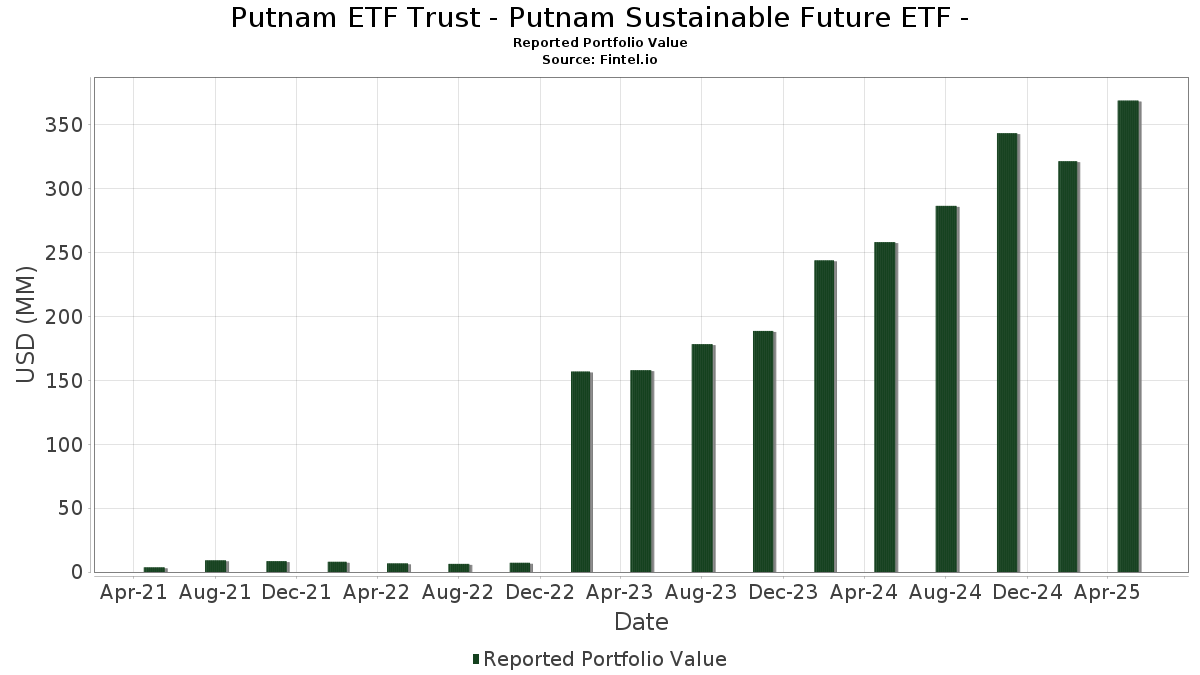

Putnam ETF Trust - Putnam Sustainable Future ETF - has disclosed 82 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 368,952,231 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Putnam ETF Trust - Putnam Sustainable Future ETF -’s top holdings are AppLovin Corporation (US:APP) , Verisk Analytics, Inc. (US:VRSK) , SHORT TERM INV FUND (US:US74680A8696) , Datadog, Inc. (US:DDOG) , and Constellation Energy Corporation (US:CEG) . Putnam ETF Trust - Putnam Sustainable Future ETF -’s new positions include Republic Services, Inc. (US:RSG) , The Trade Desk, Inc. (US:TTD) , Bright Horizons Family Solutions Inc. (US:BFAM) , Zimmer Biomet Holdings, Inc. (US:ZBH) , and Keurig Dr Pepper Inc. (US:KDP) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 6.23 | 1.7209 | 1.7209 | |

| 0.07 | 5.25 | 1.4523 | 1.4523 | |

| 0.03 | 4.20 | 1.1619 | 1.1619 | |

| 0.06 | 6.74 | 1.8624 | 1.1015 | |

| 9.26 | 9.26 | 2.5585 | 1.0146 | |

| 0.01 | 5.67 | 1.5684 | 0.9349 | |

| 0.04 | 3.33 | 0.9195 | 0.9195 | |

| 0.07 | 5.06 | 1.3976 | 0.8066 | |

| 0.03 | 12.71 | 3.5121 | 0.7927 | |

| 0.01 | 6.87 | 1.8983 | 0.7770 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.7715 | ||

| 0.07 | 1.64 | 0.4533 | -0.8211 | |

| 0.02 | 4.37 | 1.2067 | -0.7532 | |

| 0.25 | 3.84 | 1.0613 | -0.6233 | |

| 0.02 | 2.35 | 0.6488 | -0.6195 | |

| 0.01 | 3.48 | 0.9622 | -0.5500 | |

| 0.01 | 3.26 | 0.9002 | -0.4351 | |

| 0.01 | 3.09 | 0.8551 | -0.4350 | |

| 0.51 | 1.96 | 0.5408 | -0.4145 | |

| 0.17 | 5.40 | 1.4924 | -0.4035 |

13F and Fund Filings

This form was filed on 2025-07-09 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| APP / AppLovin Corporation | 0.03 | 18.91 | 12.71 | 43.46 | 3.5121 | 0.7927 | |||

| VRSK / Verisk Analytics, Inc. | 0.03 | 16.10 | 10.92 | 22.84 | 3.0192 | 0.2889 | |||

| US74680A8696 / SHORT TERM INV FUND | 9.26 | 84.08 | 9.26 | 84.11 | 2.5585 | 1.0146 | |||

| DDOG / Datadog, Inc. | 0.07 | 37.28 | 8.23 | 38.86 | 2.2759 | 0.4550 | |||

| CEG / Constellation Energy Corporation | 0.02 | 16.48 | 7.16 | 42.33 | 1.9789 | 0.4345 | |||

| PWR / Quanta Services, Inc. | 0.02 | 16.99 | 6.90 | 54.35 | 1.9061 | 0.5344 | |||

| NOW / ServiceNow, Inc. | 0.01 | 44.67 | 6.89 | 57.32 | 1.9036 | 0.5595 | |||

| DUOL / Duolingo, Inc. | 0.01 | 12.95 | 6.87 | 88.09 | 1.8983 | 0.7770 | |||

| IT / Gartner, Inc. | 0.02 | 17.01 | 6.79 | 2.48 | 1.8764 | -0.1576 | |||

| VRT / Vertiv Holdings Co | 0.06 | 139.74 | 6.74 | 171.98 | 1.8624 | 1.1015 | |||

| XYL / Xylem Inc. | 0.05 | 17.02 | 6.70 | 12.68 | 1.8525 | 0.0263 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.02 | 18.62 | 6.69 | 46.42 | 1.8487 | 0.4461 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.01 | 32.45 | 6.31 | 55.56 | 1.7456 | 0.4991 | |||

| COIN / Coinbase Global, Inc. | 0.03 | -9.71 | 6.24 | 3.26 | 1.7257 | -0.1305 | |||

| RSG / Republic Services, Inc. | 0.02 | 6.23 | 1.7209 | 1.7209 | |||||

| HUBS / HubSpot, Inc. | 0.01 | 32.41 | 6.18 | 7.88 | 1.7075 | -0.0506 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.04 | 17.10 | 6.17 | 36.40 | 1.7051 | 0.3164 | |||

| MA / Mastercard Incorporated | 0.01 | 16.69 | 6.07 | 18.57 | 1.6785 | 0.1060 | |||

| RMD / ResMed Inc. | 0.02 | 16.95 | 6.05 | 22.61 | 1.6716 | 0.1570 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 13.72 | 5.74 | 10.96 | 1.5865 | -0.0019 | |||

| GEV / GE Vernova Inc. | 0.01 | 94.90 | 5.67 | 174.99 | 1.5684 | 0.9349 | |||

| NRG / NRG Energy, Inc. | 0.03 | -5.81 | 5.42 | 38.90 | 1.4984 | 0.3001 | |||

| FSS / Federal Signal Corporation | 0.06 | 17.25 | 5.41 | 35.67 | 1.4963 | 0.2714 | |||

| PINS / Pinterest, Inc. | 0.17 | 3.94 | 5.40 | -12.57 | 1.4924 | -0.4035 | |||

| STX / Seagate Technology Holdings plc | 0.05 | 7.40 | 5.38 | 24.28 | 1.4885 | 0.1582 | |||

| CWST / Casella Waste Systems, Inc. | 0.05 | 16.23 | 5.36 | 21.61 | 1.4823 | 0.1284 | |||

| MSCI / MSCI Inc. | 0.01 | 11.87 | 5.33 | 6.85 | 1.4740 | -0.0584 | |||

| TTD / The Trade Desk, Inc. | 0.07 | 5.25 | 1.4523 | 1.4523 | |||||

| PEN / Penumbra, Inc. | 0.02 | -4.01 | 5.10 | -10.22 | 1.4105 | -0.3348 | |||

| NEE / NextEra Energy, Inc. | 0.07 | 160.95 | 5.06 | 162.73 | 1.3976 | 0.8066 | |||

| ONON / On Holding AG | 0.08 | 17.25 | 4.93 | 43.62 | 1.3619 | 0.3087 | |||

| GWRE / Guidewire Software, Inc. | 0.02 | 15.30 | 4.83 | 23.15 | 1.3354 | 0.1308 | |||

| TRMB / Trimble Inc. | 0.07 | 73.69 | 4.77 | 71.97 | 1.3199 | 0.4674 | |||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.19 | 3.38 | 4.71 | -9.86 | 1.3010 | -0.3023 | |||

| HAS / Hasbro, Inc. | 0.07 | 27.40 | 4.70 | 30.53 | 1.2992 | 0.1936 | |||

| TPG / TPG Inc. | 0.10 | 16.15 | 4.70 | 1.36 | 1.2985 | -0.1247 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.09 | 44.60 | 4.50 | 34.17 | 1.2441 | 0.2141 | |||

| VERX / Vertex, Inc. | 0.11 | 58.91 | 4.40 | 94.74 | 1.2173 | 0.5229 | |||

| COF / Capital One Financial Corporation | 0.02 | -27.48 | 4.37 | -31.60 | 1.2067 | -0.7532 | |||

| TOST / Toast, Inc. | 0.10 | -16.76 | 4.29 | -9.04 | 1.1854 | -0.2622 | |||

| MRVL / Marvell Technology, Inc. | 0.07 | 125.73 | 4.25 | 48.00 | 1.1739 | 0.2927 | |||

| BFAM / Bright Horizons Family Solutions Inc. | 0.03 | 4.20 | 1.1619 | 1.1619 | |||||

| KKR / KKR & Co. Inc. | 0.03 | 87.45 | 4.01 | 67.97 | 1.1074 | 0.3748 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | 16.60 | 3.99 | 5.86 | 1.1039 | -0.0544 | |||

| ACN / Accenture plc | 0.01 | 28.42 | 3.96 | 16.74 | 1.0951 | 0.0531 | |||

| LULU / lululemon athletica inc. | 0.01 | 46.17 | 3.91 | 26.59 | 1.0808 | 0.1325 | |||

| FWRG / First Watch Restaurant Group, Inc. | 0.25 | -3.36 | 3.84 | -30.02 | 1.0613 | -0.6233 | |||

| GTLB / GitLab Inc. | 0.08 | 27.34 | 3.82 | -3.75 | 1.0564 | -0.1628 | |||

| FSV / FirstService Corporation | 0.02 | 17.08 | 3.82 | 16.38 | 1.0548 | 0.0481 | |||

| COCO / The Vita Coco Company, Inc. | 0.10 | 16.32 | 3.63 | 27.65 | 1.0032 | 0.1299 | |||

| CAVA / CAVA Group, Inc. | 0.04 | 61.95 | 3.63 | 38.54 | 1.0026 | 0.1985 | |||

| LTH / Life Time Group Holdings, Inc. | 0.12 | 17.05 | 3.51 | 9.91 | 0.9693 | -0.0104 | |||

| AVGO / Broadcom Inc. | 0.01 | -11.08 | 3.49 | 7.94 | 0.9660 | -0.0282 | |||

| DOCU / DocuSign, Inc. | 0.04 | -12.79 | 3.49 | -7.06 | 0.9637 | -0.1884 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -7.19 | 3.48 | -29.33 | 0.9622 | -0.5500 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 17.13 | 3.45 | 21.73 | 0.9523 | 0.0831 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.04 | 3.33 | 0.9195 | 0.9195 | |||||

| CRWD / CrowdStrike Holdings, Inc. | 0.01 | 54.43 | 3.31 | 86.89 | 0.9139 | 0.3705 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | -22.29 | 3.26 | -25.11 | 0.9002 | -0.4351 | |||

| IOT / Samsara Inc. | 0.07 | 72.99 | 3.14 | 68.87 | 0.8672 | 0.2967 | |||

| CDNS / Cadence Design Systems, Inc. | 0.01 | -35.75 | 3.09 | -26.37 | 0.8551 | -0.4350 | |||

| KDP / Keurig Dr Pepper Inc. | 0.08 | 2.80 | 0.7749 | 0.7749 | |||||

| ICLR / ICON Public Limited Company | 0.02 | 21.33 | 2.78 | -24.82 | 0.7688 | -0.3083 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 16.01 | 2.72 | 15.03 | 0.7533 | 0.0259 | |||

| EW / Edwards Lifesciences Corporation | 0.03 | 3,146.03 | 2.59 | 3,223.08 | 0.7166 | -0.3782 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 16.53 | 2.49 | -18.21 | 0.6889 | -0.2470 | |||

| FSLR / First Solar, Inc. | 0.02 | 17.17 | 2.49 | 36.05 | 0.6886 | 0.1262 | |||

| BMRN / BioMarin Pharmaceutical Inc. | 0.04 | -9.79 | 2.43 | -26.40 | 0.6707 | -0.3414 | |||

| COMMON STOCK / EC (US81764X1037) | 0.02 | 60.75 | 2.40 | 87.35 | 0.6635 | 0.2702 | |||

| COMMON STOCK / EC (US81764X1037) | 0.02 | 60.75 | 2.40 | 87.35 | 0.6635 | 0.2702 | |||

| COMMON STOCK / EC (US81764X1037) | 0.02 | 60.75 | 2.40 | 87.35 | 0.6635 | 0.2702 | |||

| COMMON STOCK / EC (US81764X1037) | 0.02 | 60.75 | 2.40 | 87.35 | 0.6635 | 0.2702 | |||

| ASND / Ascendis Pharma A/S - Depositary Receipt (Common Stock) | 0.01 | 16.83 | 2.37 | 21.51 | 0.6544 | 0.0561 | |||

| DHI / D.R. Horton, Inc. | 0.02 | 2.35 | 0.6503 | 0.6503 | |||||

| QCOM / QUALCOMM Incorporated | 0.02 | -38.49 | 2.35 | -43.17 | 0.6488 | -0.6195 | |||

| CTAS / Cintas Corporation | 0.01 | 17.25 | 2.12 | 27.98 | 0.5856 | 0.0773 | |||

| RARE / Ultragenyx Pharmaceutical Inc. | 0.06 | 57.92 | 2.00 | 25.27 | 0.5537 | 0.0625 | |||

| PL / Planet Labs PBC | 0.51 | -24.34 | 1.96 | -37.11 | 0.5408 | -0.4145 | |||

| ARGX / argenx SE - Depositary Receipt (Common Stock) | 0.00 | -16.48 | 1.86 | -23.39 | 0.5155 | -0.2316 | |||

| AMT / American Tower Corporation | 0.01 | 1.79 | 0.4946 | 0.4946 | |||||

| GPK / Graphic Packaging Holding Company | 0.07 | -52.56 | 1.64 | -60.51 | 0.4533 | -0.8211 | |||

| VEEV / Veeva Systems Inc. | 0.01 | -47.19 | 1.60 | -34.09 | 0.4410 | -0.3024 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.7715 |