Basic Stats

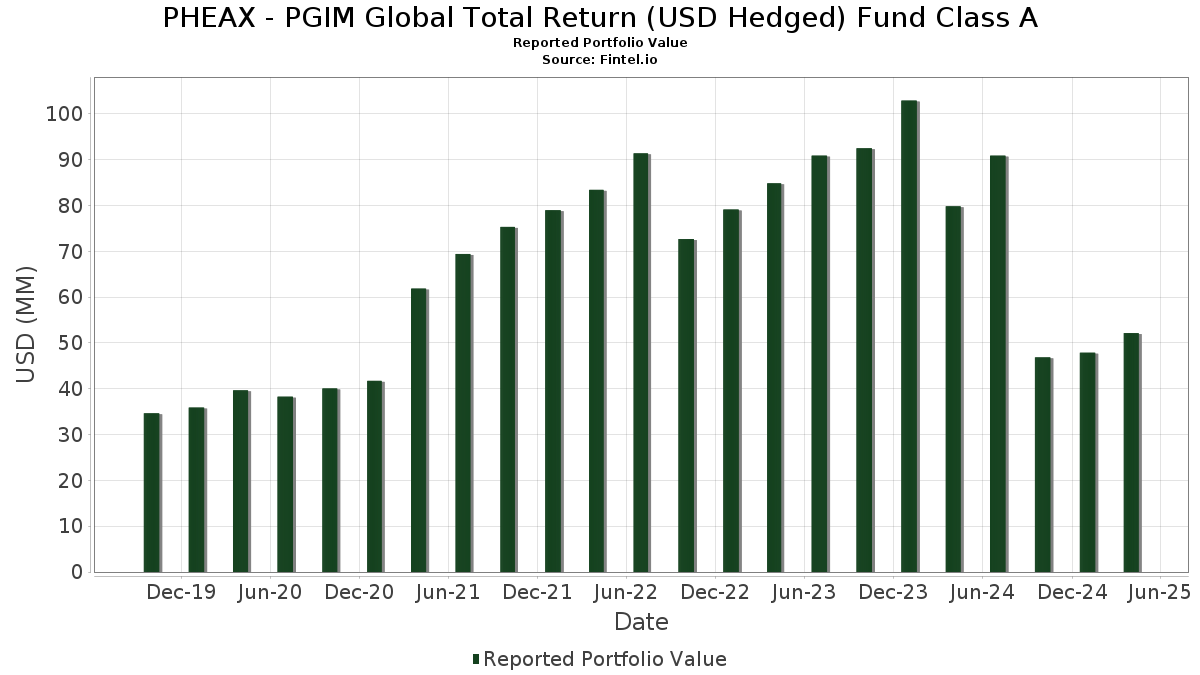

| Portfolio Value | $ 52,135,698 |

| Current Positions | 627 |

Latest Holdings, Performance, AUM (from 13F, 13D)

PHEAX - PGIM Global Total Return (USD Hedged) Fund Class A has disclosed 627 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 52,135,698 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). PHEAX - PGIM Global Total Return (USD Hedged) Fund Class A’s top holdings are PGIM ETF Trust - PGIM AAA CLO ETF (US:PAAA) , United States Treas Bds Bond (US:US912810SE91) , UNITED STATES TREASURY BOND 2.375% 05/15/2051 (US:US912810SX72) , Hellenic Republic Government Bond (GR:BK6L2S8) , and Ares European CLO XI BV (NL:XS2333701428) . PHEAX - PGIM Global Total Return (USD Hedged) Fund Class A’s new positions include United States Treas Bds Bond (US:US912810SE91) , UNITED STATES TREASURY BOND 2.375% 05/15/2051 (US:US912810SX72) , Hellenic Republic Government Bond (GR:BK6L2S8) , Ares European CLO XI BV (NL:XS2333701428) , and Wells Fargo Commercial Mortgage Trust (US:US95003CAC47) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.11 | 3.9722 | 3.9722 | ||

| 2.09 | 3.9422 | 3.9422 | ||

| 1.01 | 1.8971 | 1.8971 | ||

| 0.98 | 0.98 | 1.8486 | 1.8486 | |

| 0.67 | 1.2640 | 1.2640 | ||

| 0.44 | 0.8287 | 0.8287 | ||

| 0.23 | 0.4266 | 0.4266 | ||

| 0.21 | 0.3965 | 0.3965 | ||

| 0.20 | 0.3798 | 0.3798 | ||

| 0.13 | 0.2468 | 0.2468 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -0.66 | -1.2419 | -1.2419 | ||

| -0.44 | -0.8289 | -0.8289 | ||

| -0.30 | -0.5596 | -0.5596 | ||

| 0.50 | 0.9462 | -0.4160 | ||

| -0.19 | -0.3576 | -0.3576 | ||

| 0.04 | 2.09 | 3.9368 | -0.3302 | |

| -0.14 | -0.2616 | -0.2616 | ||

| -0.12 | -0.2310 | -0.2310 | ||

| 0.11 | 0.2010 | -0.2171 | ||

| 0.12 | 0.2168 | -0.2101 |

13F and Fund Filings

This form was filed on 2025-06-26 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Note/Bond / DBT (US91282CMT52) | 2.11 | 3.9722 | 3.9722 | ||||||

| United States Treasury Note/Bond / DBT (US91282CMG32) | 2.09 | 3.9422 | 3.9422 | ||||||

| PAAA / PGIM ETF Trust - PGIM AAA CLO ETF | 0.04 | 0.00 | 2.09 | -0.67 | 3.9368 | -0.3302 | |||

| United States Treasury Note/Bond / DBT (US91282CLS88) | 1.16 | 0.70 | 2.1808 | -0.1508 | |||||

| United States Treasury Note/Bond / DBT (US91282CLW90) | 1.14 | 3.26 | 2.1438 | -0.0937 | |||||

| US912810SE91 / United States Treas Bds Bond | 1.04 | 1.96 | 1.9548 | -0.1104 | |||||

| United States Treasury Note/Bond / DBT (US91282CMH15) | 1.01 | 1.8971 | 1.8971 | ||||||

| (PIPA070) PGIM Core Government Money Market Fund / STIV (000000000) | 0.98 | 0.98 | 1.8486 | 1.8486 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 0.89 | 1.95 | 1.6789 | -0.0935 | |||||

| United States Treasury Note/Bond / DBT (US91282CMK44) | 0.67 | 1.2640 | 1.2640 | ||||||

| BK6L2S8 / Hellenic Republic Government Bond | 0.60 | 9.67 | 1.1324 | 0.0207 | |||||

| XS2333701428 / Ares European CLO XI BV | 0.54 | 10.18 | 1.0195 | 0.0233 | |||||

| US95003CAC47 / Wells Fargo Commercial Mortgage Trust | 0.54 | 2.29 | 1.0085 | -0.0536 | |||||

| United States Treasury Note/Bond / DBT (US91282CKK61) | 0.53 | 0.00 | 1.0069 | -0.0756 | |||||

| USG13201AA91 / Brazil Minas SPE via State of Minas Gerais | 0.50 | -25.30 | 0.9462 | -0.4160 | |||||

| XS1385239006 / Colombia Government International Bond | 0.45 | 9.40 | 0.8558 | 0.0143 | |||||

| IRS USD / DIR (000000000) | 0.44 | 0.8287 | 0.8287 | ||||||

| XS2338355014 / BLACKSTONE PROP PARTNERS EUR HOLD 1% 05/04/2028 REGS | 0.43 | 10.97 | 0.8017 | 0.0240 | |||||

| IT0005421703 / Italy Buoni Poliennali Del Tesoro | 0.42 | 8.48 | 0.7948 | 0.0055 | |||||

| IT0003685093 / Republic of Italy Government International Bond | 0.38 | 9.28 | 0.7114 | 0.0102 | |||||

| XS2339017928 / CARLYLE GLOBAL MARKET STRATEGI CGMSE 2014 2A AR1 144A | 0.35 | -12.59 | 0.6548 | -0.1517 | |||||

| XS2391834251 / CARLYLE EURO CLO 2021-2 DAC | 0.34 | 8.71 | 0.6354 | 0.0052 | |||||

| XS1551677260 / NTPC Ltd | 0.34 | 10.13 | 0.6350 | 0.0135 | |||||

| ES0000012K95 / Spain Government Bond | 0.33 | 6.89 | 0.6151 | -0.0036 | |||||

| XS2104985598 / Philippine Government International Bond | 0.31 | 11.43 | 0.5877 | 0.0182 | |||||

| US91282CBL46 / United States Treasury Note/Bond | 0.30 | 3.85 | 0.5603 | -0.0196 | |||||

| US059891AA97 / Bangko Sentral ng Pilipinas Bond | 0.30 | 0.00 | 0.5582 | -0.0434 | |||||

| US68327LAB27 / Ontario Teachers' Cadillac Fairview Properties Trust | 0.30 | 1.37 | 0.5575 | -0.0362 | |||||

| United States Treasury Note/Bond / DBT (US91282CLN91) | 0.29 | 2.87 | 0.5418 | -0.0256 | |||||

| XS1936100483 / Israel Government International Bond | 0.29 | 10.00 | 0.5388 | 0.0117 | |||||

| XS2024543055 / Saudi Government International Bond | 0.28 | 9.65 | 0.5355 | 0.0093 | |||||

| Palmer Square European CLO 2025-1 DAC / ABS-CBDO (XS2989761452) | 0.28 | 8.11 | 0.5286 | 0.0029 | |||||

| PMT Credit Risk Transfer Trust 2024-1R / ABS-MBS (US73015AAA51) | 0.27 | -2.86 | 0.5124 | -0.0564 | |||||

| RCKT Mortgage Trust 2024-CES6 / ABS-MBS (US749410AA46) | 0.27 | -5.00 | 0.5015 | -0.0678 | |||||

| HK0000153913 / CGB 3.95 06/29/43 | 0.26 | 7.41 | 0.4922 | -0.0019 | |||||

| AU3CB0250512 / Emirates NBD Bank PJSC | 0.26 | 4.05 | 0.4840 | -0.0174 | |||||

| US129268AB43 / Caledonia Generating LLC | 0.25 | -1.18 | 0.4732 | -0.0421 | |||||

| US11124TAJ34 / BDRVR_20-1A | 0.25 | -1.20 | 0.4666 | -0.0404 | |||||

| XS2388562139 / SERBIA INTERNATIONAL BOND MTN 2.050000% 09/23/2036 | 0.25 | 4.22 | 0.4658 | -0.0152 | |||||

| eG Global Finance PLC / DBT (XS2719998952) | 0.24 | 8.00 | 0.4592 | 0.0012 | |||||

| XS2644969425 / Realty Income Corp | 0.24 | 9.95 | 0.4579 | 0.0089 | |||||

| US05583JAK88 / BPCE SA | 0.24 | 1.27 | 0.4528 | -0.0285 | |||||

| XS2590758665 / AT&T INC | 0.24 | 8.80 | 0.4426 | 0.0041 | |||||

| XS1432493440 / Indonesia Government International Bond | 0.23 | 10.48 | 0.4367 | 0.0103 | |||||

| US065404BA28 / BANK 2018-BNK10 | 0.23 | 1.32 | 0.4334 | -0.0280 | |||||

| US052591AS38 / AUSTRIA REP OF | 0.23 | 8.57 | 0.4296 | 0.0033 | |||||

| XS0856123871 / Barclays Bank PLC | 0.23 | 17.01 | 0.4279 | 0.0340 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0.23 | 0.4266 | 0.4266 | ||||||

| XS1883878966 / DP World Ltd/United Arab Emirates | 0.22 | 9.80 | 0.4234 | 0.0098 | |||||

| XS1956050923 / Cyprus Government International Bond | 0.22 | 10.34 | 0.4228 | 0.0101 | |||||

| PTPP / PT PP (Persero) Tbk | 0.22 | 9.27 | 0.4225 | 0.0061 | |||||

| XS2391779134 / British American Tobacco PLC | 0.22 | -27.45 | 0.4195 | -0.2019 | |||||

| XS2321466133 / Barclays PLC | 0.22 | 9.41 | 0.4177 | 0.0070 | |||||

| XS2344772426 / Hammerson Ireland Finance DAC | 0.22 | -26.33 | 0.4173 | -0.1917 | |||||

| XS2398745922 / Blackstone Property Partners Europe Holdings Sarl | 0.22 | 10.00 | 0.4156 | 0.0093 | |||||

| XS2295335413 / Iberdrola International BV | 0.22 | 10.05 | 0.4126 | 0.0074 | |||||

| XS2311412865 / MDGH GMTN RSC LTD /EUR/ REGD REG S MTN SER GMTN 0.37500000 | 0.22 | 10.71 | 0.4093 | 0.0108 | |||||

| XS1214934629 / HKT Capital No 3 Ltd | 0.21 | 10.31 | 0.4035 | 0.0085 | |||||

| XS2384373341 / Power Finance Corp Ltd | 0.21 | 10.42 | 0.4009 | 0.0117 | |||||

| US356834AA97 / Freeport Terminal Malta PLC | 0.21 | 0.95 | 0.4004 | -0.0253 | |||||

| XS2367164576 / Bulgarian Energy Holding EAD | 0.21 | 9.84 | 0.3998 | 0.0066 | |||||

| XS1568888777 / Petroleos Mexicanos | 0.21 | 9.33 | 0.3987 | 0.0068 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 0.21 | 0.3965 | 0.3965 | ||||||

| US682685AD44 / OneMain Direct Auto Receivables Trust 2023-1 | 0.21 | 0.96 | 0.3962 | -0.0257 | |||||

| US95000HBE18 / Wells Fargo Commercial Mortgage Trust 2016-LC24 | 0.21 | 0.97 | 0.3941 | -0.0259 | |||||

| XS2197076651 / Helvetia Europe SA | 0.21 | 8.85 | 0.3935 | 0.0031 | |||||

| XS2339399946 / Andorra International Bond | 0.20 | 10.93 | 0.3825 | 0.0108 | |||||

| US303901BL51 / Fairfax Financial Holdings Ltd. | 0.20 | 0.50 | 0.3816 | -0.0279 | |||||

| US147918AB23 / Cassa Depositi e Prestiti SpA | 0.20 | 0.50 | 0.3811 | -0.0277 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.20 | 0.3798 | 0.3798 | ||||||

| FR0013508694 / La Poste SA | 0.20 | 10.44 | 0.3796 | 0.0103 | |||||

| US16144JAG67 / Chase Auto Owner Trust 2022-A | 0.20 | 1.01 | 0.3795 | -0.0249 | |||||

| US34528QHV95 / FORDF_23-1 | 0.20 | 0.00 | 0.3781 | -0.0289 | |||||

| XS2420426038 / LATVIA REPUBLIC OF 0.25% 01/23/2030 REGS | 0.20 | 10.56 | 0.3761 | 0.0094 | |||||

| XS2309428113 / Croatia Government International Bond | 0.20 | 11.17 | 0.3753 | 0.0118 | |||||

| XS1310032260 / Lithuania Government International Bond | 0.20 | 7.57 | 0.3746 | -0.0008 | |||||

| XS1864523300 / Eskom Holdings SOC Ltd | 0.20 | -1.01 | 0.3703 | -0.0315 | |||||

| US90276VAD10 / UBSCM_18-C8 | 0.20 | 1.55 | 0.3693 | -0.0230 | |||||

| US83368RAZ55 / Societe Generale SA | 0.20 | 1.04 | 0.3686 | -0.0245 | |||||

| US08161CAC55 / BENCHMARK 2018-B2 Mortgage Trust | 0.19 | 0.00 | 0.3641 | -0.0272 | |||||

| US902613AH15 / UBS Group AG | 0.19 | 1.05 | 0.3615 | -0.0237 | |||||

| US698299BF03 / Panama Government International Bond | 0.19 | 2.14 | 0.3597 | -0.0196 | |||||

| US59284MAC82 / Mexico City Airport Trust | 0.19 | 1.60 | 0.3580 | -0.0216 | |||||

| US465410BY32 / Republic of Italy Government International Bond | 0.19 | 2.75 | 0.3538 | -0.0152 | |||||

| XS2280331898 / Indonesia Government International Bond | 0.19 | 10.12 | 0.3484 | 0.0065 | |||||

| US09659W2R48 / BNP Paribas SA | 0.18 | 1.67 | 0.3463 | -0.0193 | |||||

| XS2387734317 / Indonesia Government International Bond | 0.18 | 9.64 | 0.3432 | 0.0049 | |||||

| PMT Credit Risk Transfer Trust 2024-2R / ABS-MBS (US69391NAA90) | 0.18 | -2.67 | 0.3427 | -0.0378 | |||||

| US06540JBB70 / BANK 2020-BNK26 | 0.18 | 2.87 | 0.3370 | -0.0157 | |||||

| IL0060004004 / Israel Electric Corp Ltd | 0.18 | 1.71 | 0.3358 | -0.0190 | |||||

| US09659W2P81 / BNP Paribas SA | 0.18 | 1.74 | 0.3309 | -0.0183 | |||||

| US698299BK97 / Panama Government International Bond | 0.18 | 2.94 | 0.3299 | -0.0157 | |||||

| XS2055111301 / Deco 2019-RAM DAC | 0.17 | 5.49 | 0.3263 | -0.0075 | |||||

| XS1974394758 / Mexico Government International Bond | 0.17 | 6.92 | 0.3214 | -0.0014 | |||||

| US195325DR36 / Colombia Government International Bond | 0.17 | 1.20 | 0.3185 | -0.0209 | |||||

| GR0128014710 / Hellenic Republic Government Bond | 0.17 | 9.80 | 0.3164 | 0.0054 | |||||

| XS1731657497 / Region of Lazio Italy | 0.17 | 8.55 | 0.3121 | 0.0026 | |||||

| SK4000018958 / Slovakia Government Bond | 0.16 | 9.40 | 0.3084 | 0.0057 | |||||

| XS2388586401 / Hungary Government International Bond | 0.16 | 1.25 | 0.3054 | -0.0193 | |||||

| US00973RAL78 / Aker BP ASA | 0.16 | 0.00 | 0.2972 | -0.0225 | |||||

| HK0000789856 / Hong Kong Government International Bond | 0.15 | 5.59 | 0.2855 | -0.0044 | |||||

| FR0010443630 / Caisse Francaise de Financement Local | 0.15 | 5.00 | 0.2785 | -0.0060 | |||||

| US172967MV07 / Citigroup Inc | 0.15 | -1.36 | 0.2746 | -0.0234 | |||||

| BX Commercial Mortgage Trust 2024-PURE / ABS-MBS (CA74625PAB00) | 0.15 | 5.84 | 0.2744 | -0.0051 | |||||

| US25160PAH01 / Deutsche Bank AG/New York NY | 0.14 | 0.70 | 0.2720 | -0.0181 | |||||

| US35564KUX52 / Freddie Mac STACR REMIC Trust 2022-DNA3 | 0.14 | -1.38 | 0.2705 | -0.0237 | |||||

| US17327FAC05 / Citigroup Commercial Mortgage Trust 2018-B2 | 0.14 | 1.43 | 0.2691 | -0.0155 | |||||

| XS2364199757 / Romanian Government International Bond | 0.14 | 10.08 | 0.2675 | 0.0048 | |||||

| US47216QAB95 / JDE Peet's NV | 0.14 | 0.72 | 0.2653 | -0.0184 | |||||

| AU3FN0029609 / AAI Ltd | 0.14 | 2.19 | 0.2642 | -0.0155 | |||||

| XS0109719004 / Isle of Man Government International Bond | 0.14 | 8.59 | 0.2629 | 0.0032 | |||||

| XS0767581407 / Lloyds Bank PLC | 0.14 | 4.51 | 0.2628 | -0.0088 | |||||

| MORGAN STANLEY FINANCE LLC / DBT (XS2641755009) | 0.14 | 0.72 | 0.2619 | -0.0180 | |||||

| HK0000634557 / CORPORATE BONDS | 0.14 | 0.73 | 0.2609 | -0.0177 | |||||

| XS0089572316 / Republic of Italy Government International Bond | 0.14 | 8.73 | 0.2594 | 0.0023 | |||||

| US465410CC03 / Republic of Italy Government International Bond | 0.14 | 0.74 | 0.2592 | -0.0177 | |||||

| XS0096272355 / Spain Government International Bond | 0.14 | 8.80 | 0.2571 | 0.0026 | |||||

| XS0133431360 / Isle of Man Government International Bond | 0.14 | 9.76 | 0.2544 | 0.0044 | |||||

| IRS JPY / DIR (000000000) | 0.13 | 0.2468 | 0.2468 | ||||||

| XS0835891838 / Petrobras Global Finance BV | 0.13 | 7.44 | 0.2453 | -0.0004 | |||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 0.13 | 0.78 | 0.2450 | -0.0185 | |||||

| XS0982711474 / Petrobras Global Finance BV | 0.13 | 7.44 | 0.2449 | -0.0004 | |||||

| TalkTalk Telecom Group Ltd / DBT (XS2966240041) | 0.13 | -2.27 | 0.2445 | -0.0240 | |||||

| XS2297626645 / First Abu Dhabi Bank PJSC | 0.13 | 8.40 | 0.2438 | 0.0022 | |||||

| US92840MAB81 / Vistra Corp | 0.13 | 0.00 | 0.2401 | -0.0190 | |||||

| XS2303072966 / Bellis Finco PLC | 0.13 | 8.62 | 0.2372 | 0.0003 | |||||

| US06051GJS93 / Bank of America Corp | 0.13 | 0.81 | 0.2366 | -0.0155 | |||||

| PTCFPBOM0001 / CP - Comboios de Portugal EPE | 0.12 | 9.73 | 0.2349 | 0.0047 | |||||

| US38144GAG64 / Goldman Sachs Group Inc/The | 0.12 | -0.80 | 0.2335 | -0.0199 | |||||

| US12433EAN13 / BX Trust | 0.12 | -0.81 | 0.2334 | -0.0199 | |||||

| XS1760409042 / CHILE | 0.12 | 10.81 | 0.2323 | 0.0062 | |||||

| US95003EAJ55 / WELLS FARGO COMMERCIAL MORTGAGE TRUST | 0.12 | -2.42 | 0.2294 | -0.0233 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.12 | 0.2294 | 0.2294 | ||||||

| XS2719137965 / Magyar Export-Import Bank Zrt. | 0.12 | 9.01 | 0.2282 | 0.0013 | |||||

| US05610FAF45 / BX Commercial Mortgage Trust 2022-AHP | 0.12 | 0.84 | 0.2265 | -0.0151 | |||||

| XS2062666602 / Virgin Media Secured Finance PLC | 0.12 | 9.17 | 0.2250 | 0.0034 | |||||

| XS2594907664 / Corp. Andina de Fomento | 0.12 | 10.19 | 0.2242 | 0.0049 | |||||

| XS1505143393 / Comision Federal de Electricidad | 0.12 | 1.72 | 0.2229 | -0.0123 | |||||

| US36255NAS45 / GS Mortgage Securities Trust 2018-GS9 | 0.12 | 0.85 | 0.2226 | -0.0146 | |||||

| ES0000012G00 / Spain Government Bond | 0.12 | 5.41 | 0.2216 | -0.0043 | |||||

| XS2617457127 / Volkswagen Bank GmbH | 0.12 | 8.33 | 0.2214 | 0.0005 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.12 | 0.87 | 0.2195 | -0.0142 | |||||

| XS2624938739 / HONEYWELL INTL | 0.12 | 9.43 | 0.2187 | 0.0024 | |||||

| B1DX34 / Becton, Dickinson and Company - Depositary Receipt (Common Stock) | 0.12 | 8.49 | 0.2182 | 0.0017 | |||||

| US05491VAG14 / BBCMS 2018 CHRS C 144A | 0.12 | -0.86 | 0.2181 | -0.0173 | |||||

| GENCAT / Autonomous Community of Catalonia | 0.12 | 9.52 | 0.2174 | 0.0027 | |||||

| XS2511906310 / SELP FINANCE SARL /EUR/ REGD REG S EMTN 3.75000000 | 0.12 | -45.24 | 0.2168 | -0.2101 | |||||

| FR0013299591 / BPIFRANCE | 0.11 | 9.62 | 0.2159 | 0.0044 | |||||

| US138616AK34 / Cantor Fitzgerald LP | 0.11 | 0.88 | 0.2149 | -0.0143 | |||||

| SFIL SA / DBT (FR001400N9E1) | 0.11 | 9.71 | 0.2145 | 0.0057 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.11 | 0.2144 | 0.2144 | ||||||

| Finance Department Government of Sharjah / DBT (XS2846983802) | 0.11 | 8.65 | 0.2140 | 0.0029 | |||||

| XS1048428442 / Volkswagen International Finance NV | 0.11 | 8.65 | 0.2136 | 0.0025 | |||||

| FISERV FUNDING ULC / DBT (XS3060656884) | 0.11 | 0.2135 | 0.2135 | ||||||

| TDF Infrastructure SASU / DBT (FR001400TG54) | 0.11 | 9.71 | 0.2135 | 0.0033 | |||||

| XS1891336932 / Perusahaan Perseroan Persero PT Perusahaan Listrik Negara | 0.11 | 9.71 | 0.2131 | 0.0034 | |||||

| FISERV FUNDING ULC / DBT (XS3060660050) | 0.11 | 0.2123 | 0.2123 | ||||||

| FR001400FIM6 / ILE DE FRANCE MOBILITES /EUR/ REGD REG S EMTN 3.05000000 | 0.11 | 10.89 | 0.2121 | 0.0056 | |||||

| US902973BC96 / US Bancorp | 0.11 | -1.75 | 0.2116 | -0.0197 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.11 | 0.2084 | 0.2084 | ||||||

| XS1551294256 / Israel Government International Bond | 0.11 | 11.11 | 0.2076 | 0.0051 | |||||

| XS2348280707 / MFB Magyar Fejlesztesi Bank Zrt | 0.11 | 11.11 | 0.2072 | 0.0058 | |||||

| XS1208856341 / Bulgaria Government International Bond | 0.11 | 6.93 | 0.2051 | -0.0010 | |||||

| XS2225207468 / HEIMSTADEN BOSTAD TRESRY COMPANY GUAR 03/27 1.375 | 0.11 | 9.09 | 0.2037 | 0.0029 | |||||

| XS2356569819 / Last Mile Logistics Pan Euro Finance DAC | 0.11 | 6.93 | 0.2036 | -0.0017 | |||||

| Digicel Intermediate Holdings Ltd / Digicel International Finance Ltd / Difl US / DBT (USG27753AA36) | 0.11 | -48.54 | 0.2010 | -0.2171 | |||||

| XS2444273168 / Mexico Government International Bond | 0.11 | 10.42 | 0.2002 | 0.0053 | |||||

| US29375NAB10 / EFF_23-2 | 0.11 | -16.54 | 0.1998 | -0.0592 | |||||

| XS2407028435 / MVM Energetika Zrt | 0.11 | 10.42 | 0.1997 | 0.0050 | |||||

| XS2436807940 / P3 GROUP SARL | 0.11 | 9.38 | 0.1989 | 0.0040 | |||||

| FR001400AON3 / REGIE AUTONOME DES TRANS /EUR/ REGD REG S EMTN 1.87500000 | 0.10 | 10.64 | 0.1970 | 0.0058 | |||||

| XS1172951508 / Petroleos Mexicanos | 0.10 | 10.64 | 0.1970 | 0.0053 | |||||

| US34535CAD83 / Ford Credit Auto Owner Trust 2023-REV2 | 0.10 | 0.00 | 0.1956 | -0.0138 | |||||

| US207942AB90 / Fannie Mae Connecticut Avenue Securities | 0.10 | -1.90 | 0.1955 | -0.0180 | |||||

| US68269HAD70 / OMFIT_23-2A | 0.10 | 0.00 | 0.1952 | -0.0152 | |||||

| US68269HAC97 / OMFIT_23-2A | 0.10 | 0.98 | 0.1950 | -0.0135 | |||||

| GR0128017747 / Hellenic Republic Government Bond | 0.10 | 8.42 | 0.1945 | 0.0000 | |||||

| FR0013431137 / Agence Francaise de Developpement EPIC | 0.10 | 11.96 | 0.1945 | 0.0070 | |||||

| US55283QAA22 / MFA 2021-RPL1 Trust | 0.10 | -2.83 | 0.1939 | -0.0209 | |||||

| Plaquemines Port Harbor & Terminal District / DBT (US727521AB21) | 0.10 | 2.00 | 0.1931 | -0.0097 | |||||

| XS1824424706 / Petroleos Mexicanos | 0.10 | 9.68 | 0.1922 | 0.0030 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.10 | 2.02 | 0.1903 | -0.0117 | |||||

| XS2010039548 / Deutsche Bahn Finance GMBH, Series CB | 0.10 | 8.70 | 0.1895 | 0.0016 | |||||

| US802918AE20 / Santander Drive Auto Receivables Trust 2022-6 | 0.10 | 0.00 | 0.1884 | -0.0147 | |||||

| IRS GBP / DIR (000000000) | 0.10 | 0.1884 | 0.1884 | ||||||

| US68267EAD67 / ODART 2019 1A D 144A | 0.10 | 0.00 | 0.1874 | -0.0137 | |||||

| US29273VAM28 / Energy Transfer LP | 0.10 | -2.97 | 0.1860 | -0.0198 | |||||

| US95003EAE68 / WELLS FARGO COMMERCIAL MORTGAGE TRUST | 0.10 | -1.01 | 0.1859 | -0.0161 | |||||

| XS2314020806 / Peruvian Government International Bond | 0.10 | 10.23 | 0.1842 | 0.0047 | |||||

| FR00140005B8 / Societe Du Grand Paris EPIC | 0.10 | 11.49 | 0.1842 | 0.0069 | |||||

| PLNIJ / Perusahaan Perseroan Persero PT Perusahaan Listrik Negara | 0.10 | 10.23 | 0.1834 | 0.0039 | |||||

| US75050KAA43 / Radnor RE Ltd., Series 2023-1, Class M1A | 0.10 | -17.09 | 0.1830 | -0.0553 | |||||

| US172967NA50 / Citigroup Inc | 0.10 | 1.05 | 0.1818 | -0.0121 | |||||

| US38141GYG36 / Goldman Sachs Group Inc/The | 0.10 | 2.13 | 0.1807 | -0.0117 | |||||

| US26982EAA47 / Eagle RE 2023-1 Ltd | 0.09 | -17.54 | 0.1775 | -0.0553 | |||||

| International Bank for Reconstruction & Development / DBT (XS2622190549) | 0.09 | 0.00 | 0.1759 | -0.0132 | |||||

| US06051GJZ37 / Bank of America Corp | 0.09 | 2.20 | 0.1753 | -0.0096 | |||||

| HK0000317740 / CHINA GOVERNMENT BOND SR UNSECURED REGS 12/46 4.4 | 0.09 | 5.68 | 0.1751 | -0.0047 | |||||

| US682413AG40 / ONE 2021-PARK Mortgage Trust | 0.09 | -3.16 | 0.1741 | -0.0200 | |||||

| IRS JPY / DIR (000000000) | 0.09 | 0.1740 | 0.1740 | ||||||

| US682680BL63 / CORPORATE BONDS | 0.09 | 0.00 | 0.1739 | -0.0137 | |||||

| US08162XBE31 / Benchmark 2020-B20 Mortgage Trust | 0.09 | 2.25 | 0.1720 | -0.0094 | |||||

| IT0005496770 / BUONI POLIENNALI DEL TES /EUR/ REGD 3.25000000 | 0.09 | 9.64 | 0.1713 | 0.0019 | |||||

| XS1313004928 / Romanian Government International Bond | 0.09 | 7.14 | 0.1710 | -0.0013 | |||||

| XS1388864503 / SNCF RESEAU | 0.09 | 11.11 | 0.1695 | 0.0040 | |||||

| XS2308620793 / Serbia International Bond | 0.09 | 7.23 | 0.1691 | -0.0006 | |||||

| US25470XAY13 / DISH DBS CORP 7.75% 07/01/2026 | 0.09 | 0.00 | 0.1640 | -0.0132 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.09 | 0.1636 | 0.1636 | ||||||

| XS2434895475 / Romania, Government of | 0.09 | 11.69 | 0.1629 | 0.0052 | |||||

| XS2181689659 / Hungary Government International Bond | 0.09 | 6.17 | 0.1621 | -0.0036 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.09 | 2.38 | 0.1621 | -0.0093 | |||||

| IT0005217390 / Italy Buoni Poliennali Del Tesoro | 0.09 | 4.94 | 0.1609 | -0.0052 | |||||

| US14307PAC95 / Carlyle C17 CLO Ltd | 0.08 | 0.00 | 0.1588 | -0.0124 | |||||

| XS2368114505 / Taurus CMBS | 0.08 | 7.69 | 0.1588 | -0.0007 | |||||

| IRS CNY / DIR (000000000) | 0.08 | 0.1584 | 0.1584 | ||||||

| US46647PCJ30 / JPMORGAN CHASE and CO 2.069/VAR 06/01/2029 | 0.08 | 1.22 | 0.1580 | -0.0087 | |||||

| US513075BW03 / Lamar Media Corp | 0.08 | -1.19 | 0.1579 | -0.0143 | |||||

| HK0000274073 / China Government Bond | 0.08 | 3.80 | 0.1544 | -0.0066 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.08 | 1.25 | 0.1533 | -0.0095 | |||||

| XS0125234590 / Repubic of Italy Government International Bond Coupon Strip | 0.08 | 9.72 | 0.1487 | 0.0012 | |||||

| XS2368105008 / Taurus CMBS | 0.08 | 6.85 | 0.1478 | -0.0003 | |||||

| US75907DAA54 / REGIONAL MANAGEMENT ISSUANCE TRUST 2022-1 SER 2022-1 CL A REGD 144A P/P 3.07000000 | 0.08 | -20.41 | 0.1469 | -0.0535 | |||||

| US55903VBA08 / Warnermedia Holdings Inc | 0.08 | 0.00 | 0.1465 | -0.0105 | |||||

| IRS EUR / DIR (000000000) | 0.08 | 0.1439 | 0.1439 | ||||||

| CA761034AA56 / SNCF Reseau | 0.08 | 4.17 | 0.1420 | -0.0052 | |||||

| Towd Point Mortgage Trust 2024-CES1 / ABS-MBS (US89183CAA36) | 0.07 | -7.59 | 0.1389 | -0.0221 | |||||

| Towd Point Mortgage Trust 2024-CES2 / ABS-MBS (US89182JAA97) | 0.07 | -8.75 | 0.1383 | -0.0239 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 0.07 | 0.1372 | 0.1372 | ||||||

| US30166AAF12 / EART_21-3A | 0.07 | -19.10 | 0.1369 | -0.0444 | |||||

| US36267QAA22 / Forward Air Corp | 0.07 | -10.13 | 0.1353 | -0.0253 | |||||

| US880349AU90 / Tenneco Inc | 0.07 | 0.00 | 0.1346 | -0.0104 | |||||

| US11135FBH38 / Broadcom Inc | 0.07 | 1.45 | 0.1331 | -0.0069 | |||||

| US35564KJP57 / Freddie Mac STACR REMIC Trust 2021-HQA3 | 0.07 | 0.00 | 0.1321 | -0.0112 | |||||

| C1MA34 / Comerica Incorporated - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 0.1314 | -0.0098 | |||||

| DIGICEL INTL FIN LTD Common Equity / EC (000000000) | 0.01 | 0.07 | 0.1304 | 0.1304 | |||||

| XS0191352847 / Hellenic Republic Government International Bond | 0.07 | 7.94 | 0.1298 | 0.0005 | |||||

| IRS EUR / DIR (000000000) | 0.07 | 0.1295 | 0.1295 | ||||||

| US55336VBU35 / MPLX LP | 0.07 | 0.00 | 0.1279 | -0.0097 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 0.07 | 1.52 | 0.1279 | -0.0073 | |||||

| US29878TBG85 / European Investment Bank | 0.07 | 4.76 | 0.1252 | -0.0028 | |||||

| XS2234571771 / Bulgaria Government International Bond | 0.07 | 6.45 | 0.1249 | -0.0012 | |||||

| US06051GJT76 / Bank of America Corp | 0.07 | 3.13 | 0.1248 | -0.0068 | |||||

| US38141GYB49 / Goldman Sachs Group Inc/The | 0.07 | 1.56 | 0.1240 | -0.0066 | |||||

| US08162MAW82 / Benchmark 2020-B17 Mortgage Trust | 0.07 | 1.56 | 0.1237 | -0.0066 | |||||

| AU3CB0256907 / AT&T Inc. | 0.06 | 3.28 | 0.1204 | -0.0050 | |||||

| AU3CB0247419 / Deutsche Bahn Finance GMBH | 0.06 | 3.28 | 0.1200 | -0.0037 | |||||

| XS0513009711 / Autonomous Community of Catalonia | 0.06 | 10.71 | 0.1174 | 0.0023 | |||||

| XS0181673798 / Republic of Italy Government International Bond | 0.06 | 7.14 | 0.1146 | -0.0006 | |||||

| ES00000128E2 / Spain Government Bond | 0.06 | 5.26 | 0.1138 | -0.0030 | |||||

| US925650AC72 / VICI Properties LP | 0.06 | 1.72 | 0.1123 | -0.0073 | |||||

| US92916WAA71 / VOYA CLO LTD FRN 04/25/2031 2013-2A A1R 144A | 0.06 | -23.68 | 0.1102 | -0.0448 | |||||

| US95000U2U64 / Wells Fargo & Co | 0.06 | 1.75 | 0.1099 | -0.0063 | |||||

| US131347CP95 / Calpine Corp | 0.06 | 0.00 | 0.1091 | -0.0073 | |||||

| US3137FVEE89 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.06 | -5.00 | 0.1089 | -0.0130 | |||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | 0.06 | 0.1088 | 0.1088 | ||||||

| US14310MAW73 / Carlyle Global Market Strategies CLO 2014-1 Ltd | 0.06 | -24.00 | 0.1084 | -0.0445 | |||||

| XS1533910508 / Cooperatieve Rabobank UA | 0.06 | 3.70 | 0.1070 | -0.0035 | |||||

| US845467AR03 / CORP. NOTE | 0.05 | 0.00 | 0.1032 | -0.0071 | |||||

| US39729RAB42 / Greenwood Park CLO Ltd | 0.05 | -34.57 | 0.1004 | -0.0645 | |||||

| US912810RV26 / United States Treas Bds Bond | 0.05 | 1.92 | 0.0999 | -0.0056 | |||||

| GR0138005716 / Hellenic Republic Government Bond | 0.05 | 8.33 | 0.0995 | 0.0016 | |||||

| US25470MAG42 / DISH Network Corp | 0.05 | 0.00 | 0.0989 | -0.0081 | |||||

| US3137FV5Q11 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K113, Class X1 | 0.05 | -3.77 | 0.0976 | -0.0112 | |||||

| US19828TAB26 / Columbia Pipelines Operating Co LLC | 0.05 | 0.00 | 0.0973 | -0.0067 | |||||

| U.S. TREASURY BOND / DIR (000000000) | 0.05 | 0.0964 | 0.0964 | ||||||

| US6174468X01 / Morgan Stanley | 0.05 | 2.04 | 0.0951 | -0.0052 | |||||

| US08949LAB62 / Big River Steel LLC / BRS Finance Corp | 0.05 | 0.00 | 0.0947 | -0.0073 | |||||

| US29273VAN01 / Energy Transfer LP | 0.05 | 0.00 | 0.0936 | -0.0076 | |||||

| XS1414134061 / MORGAN STANLEY | 0.05 | 8.89 | 0.0930 | 0.0007 | |||||

| US92556VAE65 / Viatris Inc | 0.05 | -5.77 | 0.0925 | -0.0138 | |||||

| GR0133006198 / Hellenic Republic Government Bond | 0.05 | 11.36 | 0.0925 | 0.0019 | |||||

| US44267DAD93 / Howard Hughes Corp/The | 0.05 | 0.00 | 0.0908 | -0.0077 | |||||

| US55903VBE20 / Warnermedia Holdings Inc | 0.05 | -7.69 | 0.0904 | -0.0154 | |||||

| US70932MAC10 / PennyMac Financial Services Inc | 0.05 | 0.00 | 0.0897 | -0.0073 | |||||

| XS0306322065 / Republic of Colombia | 0.05 | 0.00 | 0.0875 | -0.0065 | |||||

| US95000U2G70 / Wells Fargo & Co | 0.05 | 2.22 | 0.0872 | -0.0048 | |||||

| XS2027596704 / Romanian Government International Bond | 0.05 | 9.52 | 0.0868 | 0.0009 | |||||

| US513272AE49 / Lamb Weston Holdings Inc | 0.05 | 0.00 | 0.0864 | -0.0059 | |||||

| IRS EUR / DIR (000000000) | 0.05 | 0.0855 | 0.0855 | ||||||

| IRS USD / DIR (000000000) | 0.04 | 0.0835 | 0.0835 | ||||||

| US23918KAT51 / DaVita Inc | 0.04 | -2.27 | 0.0827 | -0.0065 | |||||

| IRS KRW / DIR (000000000) | 0.04 | 0.0827 | 0.0827 | ||||||

| IRS USD / DIR (000000000) | 0.04 | 0.0824 | 0.0824 | ||||||

| FR0013469665 / Regie Autonome des Transports Parisiens | 0.04 | 10.26 | 0.0824 | 0.0027 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 0.04 | 2.44 | 0.0807 | -0.0039 | |||||

| US29878TAD63 / European Investment Bank | 0.04 | 5.13 | 0.0789 | -0.0008 | |||||

| GR0138014809 / Hellenic Republic Government Bond | 0.04 | 5.13 | 0.0782 | -0.0015 | |||||

| GB00H240B223 / LME Nickel Base Metal | 0.04 | 0.0774 | 0.0774 | ||||||

| US46647PCC86 / JPMorgan Chase & Co | 0.04 | 2.63 | 0.0751 | -0.0039 | |||||

| GR0128013704 / Hellenic Republic Government Bond | 0.04 | 8.57 | 0.0732 | 0.0009 | |||||

| US35565TBD00 / STACR_20-HQA5 | 0.04 | -2.56 | 0.0724 | -0.0084 | |||||

| GR0138007738 / Hellenic Republic Government Bond | 0.04 | 8.82 | 0.0704 | 0.0011 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.03 | 0.0659 | 0.0659 | ||||||

| US172967MY46 / Citigroup Inc | 0.03 | 0.00 | 0.0658 | -0.0035 | |||||

| US55903VBD47 / Warnermedia Holdings Inc | 0.03 | -8.33 | 0.0637 | -0.0097 | |||||

| IRS CNY / DIR (000000000) | 0.03 | 0.0607 | 0.0607 | ||||||

| Crescent Energy Finance LLC / DBT (US45344LAD55) | 0.03 | -11.43 | 0.0599 | -0.0116 | |||||

| US05565QDU94 / COMPANY GUAR 12/99 VAR | 0.03 | 0.00 | 0.0598 | -0.0048 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0.03 | -3.23 | 0.0583 | -0.0053 | |||||

| BWIN / The Baldwin Insurance Group, Inc. | 0.03 | -3.23 | 0.0573 | -0.0074 | |||||

| 2 YEAR U.S. TREASURY NOTE / DIR (000000000) | 0.03 | 0.0573 | 0.0573 | ||||||

| TFS_18-3-A1 / ABS-MBS (000000000) | 0.03 | 0.0570 | 0.0570 | ||||||

| M1GM34 / MGM Resorts International - Depositary Receipt (Common Stock) | 0.03 | -3.33 | 0.0557 | -0.0053 | |||||

| US04364VAK98 / Ascent Resources Utica Holdings LLC / ARU Finance Corp | 0.03 | -3.33 | 0.0552 | -0.0074 | |||||

| GR0133007204 / Hellenic Republic Government Bond | 0.03 | 11.54 | 0.0551 | 0.0012 | |||||

| US914906AY80 / Univision Communications, Inc. | 0.03 | -3.33 | 0.0549 | -0.0072 | |||||

| IRS EUR / DIR (000000000) | 0.03 | 0.0549 | 0.0549 | ||||||

| US61772BAB99 / Morgan Stanley | 0.03 | 3.57 | 0.0548 | -0.0036 | |||||

| IRS EUR / DIR (000000000) | 0.03 | 0.0547 | 0.0547 | ||||||

| XS1989383788 / Cyprus Government International Bond | 0.03 | 7.69 | 0.0538 | -0.0008 | |||||

| TalkTalk Telecom Group Ltd / DBT (XS2966240397) | 0.03 | 3.70 | 0.0533 | -0.0021 | |||||

| GR0133010232 / Hellenic Republic Government Bond | 0.03 | 8.00 | 0.0524 | 0.0010 | |||||

| IRS JPY / DIR (000000000) | 0.03 | 0.0516 | 0.0516 | ||||||

| US629377CU45 / NRG Energy Inc | 0.03 | 0.00 | 0.0515 | -0.0046 | |||||

| GR0138008744 / Hellenic Republic Government Bond | 0.03 | 8.33 | 0.0508 | 0.0006 | |||||

| US20753XAF15 / Connecticut Avenue Securities Trust, Series 2022-R03, Class 1B1 | 0.03 | -3.70 | 0.0507 | -0.0051 | |||||

| GR0133009226 / Hellenic Republic Government Bond | 0.03 | 8.33 | 0.0505 | 0.0010 | |||||

| IRS THB / DIR (000000000) | 0.03 | 0.0497 | 0.0497 | ||||||

| US46647PCR55 / JPMORGAN CHASE & CO REGD V/R 2.54500000 | 0.03 | 4.00 | 0.0492 | -0.0024 | |||||

| GR0138012787 / Hellenic Republic Government Bond | 0.03 | 4.17 | 0.0488 | -0.0007 | |||||

| GR0138013793 / Hellenic Republic Government Bond | 0.03 | 4.17 | 0.0483 | -0.0013 | |||||

| US89788MAP77 / Truist Financial Corp | 0.03 | 0.00 | 0.0482 | -0.0035 | |||||

| US61747YED31 / Morgan Stanley | 0.03 | 0.00 | 0.0481 | -0.0027 | |||||

| US27034RAA14 / Earthstone Energy Holdings LLC | 0.03 | 0.00 | 0.0479 | -0.0040 | |||||

| US92840MAC64 / Vistra Corp | 0.03 | 0.00 | 0.0475 | -0.0032 | |||||

| Sally Holdings LLC / Sally Capital Inc / DBT (US79546VAQ95) | 0.03 | 0.00 | 0.0475 | -0.0036 | |||||

| US87724RAA05 / Taylor Morrison Communities Inc | 0.03 | 0.00 | 0.0473 | -0.0037 | |||||

| GR0138006722 / Hellenic Republic Government Bond | 0.03 | 13.64 | 0.0473 | 0.0007 | |||||

| GR0138011771 / Hellenic Republic Government Bond | 0.03 | 8.70 | 0.0471 | 0.0002 | |||||

| US235825AF32 / Dana, Inc. | 0.02 | 0.00 | 0.0468 | -0.0037 | |||||

| US030981AJ33 / AmeriGas Partners LP / AmeriGas Finance Corp | 0.02 | 0.00 | 0.0465 | -0.0038 | |||||

| US707569AS84 / Penn National Gaming Inc | 0.02 | 0.00 | 0.0464 | -0.0038 | |||||

| IRS EUR / DIR (000000000) | 0.02 | 0.0460 | 0.0460 | ||||||

| US55305BAS07 / M/I HOMES INC 4.95% 02/01/2028 | 0.02 | 0.00 | 0.0459 | -0.0038 | |||||

| US06051GKD06 / Bank of America Corp | 0.02 | 4.35 | 0.0458 | -0.0024 | |||||

| US670001AG19 / Novelis Corp | 0.02 | 0.00 | 0.0457 | -0.0033 | |||||

| US46647PBD78 / JPMorgan Chase & Co | 0.02 | 4.35 | 0.0455 | -0.0026 | |||||

| AAL / American Airlines Group Inc. | 0.02 | 0.00 | 0.0455 | -0.0051 | |||||

| US29279FAA75 / Energy Transfer Operating LP | 0.02 | -4.17 | 0.0446 | -0.0060 | |||||

| US68267EAA29 / OneMain Direct Auto Receivables Trust 2019-1 | 0.02 | -34.29 | 0.0445 | -0.0270 | |||||

| US06051GHV41 / Bank of America Corp | 0.02 | 0.00 | 0.0444 | -0.0026 | |||||

| IRS USD / DIR (000000000) | 0.02 | 0.0442 | 0.0442 | ||||||

| US013092AG61 / ALBERTSONS COS LLC / SAFEWAY INC / NEW ALBERTSONS INC / ALBERTSONS LLC 3.5% 03/15/2029 144A | 0.02 | 4.55 | 0.0439 | -0.0027 | |||||

| US045086AM71 / Ashton Woods USA LLC / Ashton Woods Finance Co | 0.02 | 0.00 | 0.0436 | -0.0032 | |||||

| US475795AD24 / JELD-WEN INC 4.875% 12/15/2027 144A | 0.02 | -4.17 | 0.0434 | -0.0055 | |||||

| US045086AP03 / Ashton Woods USA LLC / Ashton Woods Finance Co | 0.02 | -4.35 | 0.0432 | -0.0035 | |||||

| MATHOM / Mattamy Group Corp | 0.02 | -4.35 | 0.0431 | -0.0041 | |||||

| XS1109952025 / Aircraft Finance Co Ltd | 0.02 | -26.67 | 0.0430 | -0.0185 | |||||

| US11135FBK66 / BROADCOM INC 3.419% 04/15/2033 144A | 0.02 | 4.76 | 0.0419 | -0.0023 | |||||

| US682691AA80 / OneMain Finance Corp | 0.02 | 0.00 | 0.0417 | -0.0037 | |||||

| IRS CNY / DIR (000000000) | 0.02 | 0.0414 | 0.0414 | ||||||

| US431318AZ78 / Hilcorp Energy I LP | 0.02 | -8.70 | 0.0410 | -0.0071 | |||||

| US04433LAA08 / Ashland LLC | 0.02 | 0.00 | 0.0408 | -0.0027 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.02 | 0.0408 | 0.0408 | ||||||

| IRS THB / DIR (000000000) | 0.02 | 0.0405 | 0.0405 | ||||||

| US20753YAF97 / Connecticut Avenue Securities Trust 2022-R04 | 0.02 | 0.00 | 0.0399 | -0.0040 | |||||

| IRS USD / DIR (000000000) | 0.02 | 0.0389 | 0.0389 | ||||||

| US097751BZ39 / Bombardier, Inc. | 0.02 | 0.00 | 0.0388 | -0.0034 | |||||

| US3137FUZE77 / FREDDIE MAC MULTIFAMILY STRUCTURED PASS THROUGH CE | 0.02 | -4.76 | 0.0385 | -0.0042 | |||||

| BHCCN / Bausch Health Cos Inc | 0.02 | 566.67 | 0.0385 | 0.0316 | |||||

| US071734AN72 / Bausch Health Cos Inc | 0.02 | 0.00 | 0.0382 | -0.0031 | |||||

| POST / Post Holdings, Inc. | 0.02 | 0.00 | 0.0380 | -0.0026 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.02 | 5.26 | 0.0377 | -0.0025 | |||||

| DIAMOND SPORTS GRP LLC- CS / EC (000000000) | 0.00 | 0.02 | 0.0374 | 0.0374 | |||||

| US88339WAA45 / Williams Cos Inc/The | 0.02 | -5.00 | 0.0372 | -0.0040 | |||||

| IRS KRW / DIR (000000000) | 0.02 | 0.0369 | 0.0369 | ||||||

| US07556QBT13 / Beazer Homes USA Inc | 0.02 | -5.00 | 0.0366 | -0.0043 | |||||

| IRS USD / DIR (000000000) | 0.02 | 0.0356 | 0.0356 | ||||||

| IRS MXN / DIR (000000000) | 0.02 | 0.0350 | 0.0350 | ||||||

| IRS USD / DIR (000000000) | 0.02 | 0.0345 | 0.0345 | ||||||

| US87612GAA94 / Targa Resources Corp | 0.02 | 0.00 | 0.0344 | -0.0025 | |||||

| EURO-SCHATZ / DIR (000000000) | 0.02 | 0.0341 | 0.0341 | ||||||

| GR0138009759 / Hellenic Republic Government Bond | 0.02 | 6.25 | 0.0335 | 0.0003 | |||||

| US12591QAR39 / Commercial Mortgage Trust, Series 2014-UBS4, Class A5 | 0.02 | -46.87 | 0.0334 | -0.0331 | |||||

| US12527GAD51 / CF Industries Inc | 0.02 | 0.00 | 0.0321 | -0.0037 | |||||

| US38141GXR00 / Goldman Sachs Group Inc/The | 0.02 | 6.25 | 0.0321 | -0.0017 | |||||

| TRT061124T11 / Turkey Government Bond | 0.02 | 0.0319 | 0.0319 | ||||||

| US25470XBB01 / DISH DBS CORPORATION 07/28 7.375 | 0.02 | -5.88 | 0.0318 | -0.0045 | |||||

| XS2105097393 / Cyprus Government International Bond | 0.02 | 6.67 | 0.0313 | 0.0003 | |||||

| GR0138010765 / Hellenic Republic Government Bond | 0.02 | 6.67 | 0.0310 | 0.0002 | |||||

| GB00H240B223 / LME Nickel Base Metal | 0.02 | 0.0306 | 0.0306 | ||||||

| IRS CAD / DIR (000000000) | 0.02 | 0.0298 | 0.0298 | ||||||

| US071734AM99 / Bausch Health Cos Inc | 0.02 | 7.14 | 0.0296 | -0.0000 | |||||

| US25470XBD66 / CORP. NOTE | 0.02 | -6.25 | 0.0293 | -0.0040 | |||||

| IRS JPY / DIR (000000000) | 0.02 | 0.0289 | 0.0289 | ||||||

| IRS CHF / DIR (000000000) | 0.02 | 0.0284 | 0.0284 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.0280 | -0.0022 | |||||

| BHCCN / Bausch Health Cos Inc | 0.01 | 366.67 | 0.0274 | 0.0202 | |||||

| IRS EUR / DIR (000000000) | 0.01 | 0.0256 | 0.0256 | ||||||

| US071734AL17 / Bausch Health Cos Inc | 0.01 | 0.00 | 0.0254 | -0.0012 | |||||

| US17327CAQ69 / Citigroup Inc | 0.01 | 0.0248 | 0.0248 | ||||||

| US46657FAA30 / JP Morgan Mortgage Trust 2023-HE2 | 0.01 | -14.29 | 0.0242 | -0.0060 | |||||

| IRS CAD / DIR (000000000) | 0.01 | 0.0236 | 0.0236 | ||||||

| US15135UAW99 / Cenovus Energy Inc/CA | 0.01 | 0.00 | 0.0236 | -0.0018 | |||||

| IRS USD / DIR (000000000) | 0.01 | 0.0235 | 0.0235 | ||||||

| US3130AG3T09 / Federal Home Loan Banks | 0.01 | 0.00 | 0.0232 | -0.0015 | |||||

| GR0133008210 / Hellenic Republic Government Bond | 0.01 | 10.00 | 0.0221 | 0.0005 | |||||

| IRS CNY / DIR (000000000) | 0.01 | 0.0215 | 0.0215 | ||||||

| IRS AUD / DIR (000000000) | 0.01 | 0.0212 | 0.0212 | ||||||

| IRS JPY / DIR (000000000) | 0.01 | 0.0210 | 0.0210 | ||||||

| IRS EUR / DIR (000000000) | 0.01 | 0.0206 | 0.0206 | ||||||

| IRS CNY / DIR (000000000) | 0.01 | 0.0205 | 0.0205 | ||||||

| IRS CNY / DIR (000000000) | 0.01 | 0.0191 | 0.0191 | ||||||

| US87724RAJ14 / Taylor Morrison Communities Inc | 0.01 | 0.00 | 0.0182 | -0.0014 | |||||

| Dcli Bidco LLC / DBT (US233104AA67) | 0.01 | -10.00 | 0.0175 | -0.0033 | |||||

| IRS CNY / DIR (000000000) | 0.01 | 0.0175 | 0.0175 | ||||||

| IRS CAD / DIR (000000000) | 0.01 | 0.0173 | 0.0173 | ||||||

| CA75585RRT46 / Real Estate Asset Liquidity Trust | 0.01 | 12.50 | 0.0170 | -0.0011 | |||||

| IRS GBP / DIR (000000000) | 0.01 | 0.0167 | 0.0167 | ||||||

| US11120VAL71 / Brixmor Operating Partnership LP | 0.01 | 0.00 | 0.0162 | -0.0008 | |||||

| DIAMOND SPORTS NET LLC / LON (US25277EAB83) | 0.01 | 14.29 | 0.0155 | -0.0007 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0150 | 0.0150 | ||||||

| IRS USD / DIR (000000000) | 0.01 | 0.0148 | 0.0148 | ||||||

| US35564KHE29 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class M2 | 0.01 | -12.50 | 0.0140 | -0.0029 | |||||

| DIGICEL INTL FIN LTD / EC (000000000) | 0.00 | 0.01 | 0.0140 | 0.0140 | |||||

| XS0279120793 / Peru Enhanced Pass-Through Finance Ltd | 0.01 | 16.67 | 0.0136 | -0.0006 | |||||

| IRS EUR / DIR (000000000) | 0.01 | 0.0135 | 0.0135 | ||||||

| EUR/USD FORWARD / DFE (000000000) | 0.01 | 0.0131 | 0.0131 | ||||||

| IRS GBP / DIR (000000000) | 0.01 | 0.0129 | 0.0129 | ||||||

| IRS CAD / DIR (000000000) | 0.01 | 0.0128 | 0.0128 | ||||||

| IRS CAD / DIR (000000000) | 0.01 | 0.0124 | 0.0124 | ||||||

| BHC / Bausch Health Companies Inc. | 0.01 | 0.00 | 0.0123 | -0.0002 | |||||

| US15135UAX72 / Cenovus Energy Inc | 0.01 | 0.00 | 0.0121 | -0.0017 | |||||

| US92556VAF31 / CORPORATE BONDS | 0.01 | 0.00 | 0.0119 | -0.0019 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0114 | 0.0114 | ||||||

| US097751BV25 / Bombardier Inc | 0.01 | 0.00 | 0.0113 | -0.0009 | |||||

| IRS JPY / DIR (000000000) | 0.01 | 0.0111 | 0.0111 | ||||||

| IRS USD / DIR (000000000) | 0.01 | 0.0108 | 0.0108 | ||||||

| IRS MYR / DIR (000000000) | 0.01 | 0.0101 | 0.0101 | ||||||

| US92328MAA18 / Venture Global Calcasieu Pass LLC | 0.00 | 0.00 | 0.0086 | -0.0007 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.00 | 0.0085 | 0.0085 | ||||||

| US92328MAB90 / Venture Global Calcasieu Pass LLC | 0.00 | 0.00 | 0.0085 | -0.0007 | |||||

| US12527GAE35 / CF Industries Inc | 0.00 | 0.00 | 0.0085 | -0.0010 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0.00 | -20.00 | 0.0084 | -0.0018 | |||||

| US3137BMTY26 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.00 | -42.86 | 0.0083 | -0.0065 | |||||

| IRS THB / DIR (000000000) | 0.00 | 0.0080 | 0.0080 | ||||||

| IRS GBP / DIR (000000000) | 0.00 | 0.0079 | 0.0079 | ||||||

| IRS GBP / DIR (000000000) | 0.00 | 0.0076 | 0.0076 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.00 | 0.0076 | 0.0076 | ||||||

| IRS CAD / DIR (000000000) | 0.00 | 0.0075 | 0.0075 | ||||||

| BHCCN / Bausch Health Cos Inc | 0.00 | -85.00 | 0.0072 | -0.0313 | |||||

| EURO-BUND / DIR (000000000) | 0.00 | 0.0063 | 0.0063 | ||||||

| IRS CAD / DIR (000000000) | 0.00 | 0.0055 | 0.0055 | ||||||

| USD/JPY FORWARD / DFE (000000000) | 0.00 | 0.0053 | 0.0053 | ||||||

| IRS DKK / DIR (000000000) | 0.00 | 0.0053 | 0.0053 | ||||||

| IRS GBP / DIR (000000000) | 0.00 | 0.0048 | 0.0048 | ||||||

| IRS CAD / DIR (000000000) | 0.00 | 0.0048 | 0.0048 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.0046 | 0.0046 | ||||||

| SWOP IRS USD / DIR (000000000) | 0.00 | 0.0046 | 0.0046 | ||||||

| S68 / Singapore Exchange Limited | 0.00 | 0.0043 | 0.0043 | ||||||

| DGZ / DB Gold Short ETN | 0.00 | 0.0042 | 0.0042 | ||||||

| IRS JPY / DIR (000000000) | 0.00 | 0.0040 | 0.0040 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.00 | 0.0040 | 0.0040 | ||||||

| IRS JPY / DIR (000000000) | 0.00 | 0.0037 | 0.0037 | ||||||

| 3 MONTH SOFR / DIR (000000000) | 0.00 | 0.0037 | 0.0037 | ||||||

| IRS MXN / DIR (000000000) | 0.00 | 0.0035 | 0.0035 | ||||||

| IRS CNY / DIR (000000000) | 0.00 | 0.0035 | 0.0035 | ||||||

| IRS EUR / DIR (000000000) | 0.00 | 0.0033 | 0.0033 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0031 | 0.0031 | ||||||

| COP/USD FORWARD / DFE (000000000) | 0.00 | 0.0029 | 0.0029 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0028 | 0.0028 | ||||||

| IRS JPY / DIR (000000000) | 0.00 | 0.0028 | 0.0028 | ||||||

| IRS MYR / DIR (000000000) | 0.00 | 0.0026 | 0.0026 | ||||||

| IRS USD / DIR (000000000) | 0.00 | 0.0025 | 0.0025 | ||||||

| IRS CHF / DIR (000000000) | 0.00 | 0.0024 | 0.0024 | ||||||

| IRS CHF / DIR (000000000) | 0.00 | 0.0022 | 0.0022 | ||||||

| BRL/USD FORWARD / DFE (000000000) | 0.00 | 0.0021 | 0.0021 | ||||||

| IRS CNY / DIR (000000000) | 0.00 | 0.0020 | 0.0020 | ||||||

| IRS CHF / DIR (000000000) | 0.00 | 0.0020 | 0.0020 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.0018 | 0.0018 | ||||||

| IRS MYR / DIR (000000000) | 0.00 | 0.0016 | 0.0016 | ||||||

| DIAMOND SPORTS GRP LLC- WARRANTS / EC (000000000) | 0.00 | 0.00 | 0.0013 | 0.0013 | |||||

| CHF/USD FORWARD / DFE (000000000) | 0.00 | 0.0013 | 0.0013 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0012 | 0.0012 | ||||||

| EUR/USD FORWARD / DFE (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| IRS USD / DIR (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| DGZ / DB Gold Short ETN | 0.00 | 0.0010 | 0.0010 | ||||||

| USD/GBP FORWARD / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| CDS BANK OF AMERICA CORP / DCR (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| CDS MORGAN STANLEY / DCR (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| CDS CITIGROUP INC / DCR (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| EUR/USD FORWARD / DFE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| GB00H240B223 / LME Nickel Base Metal | 0.00 | 0.0009 | 0.0009 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.00 | 0.0009 | 0.0009 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0008 | 0.0008 | ||||||

| USD/EUR FORWARD / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.0008 | 0.0008 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.00 | 0.0004 | 0.0004 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.00 | 0.0004 | 0.0004 | ||||||

| SWOP IRS USD / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| PLN/USD FORWARD / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| IRS CHF / DIR (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.00 | 0.0001 | 0.0001 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.00 | 0.0000 | 0.0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.00 | 0.0000 | 0.0000 | ||||||

| SWOP IRS USD / DIR (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| TFS_18-3 / ABS-MBS (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| US25381HAD08 / DIGICEL GROUP HOLDINGS REGD ZCP 144A P/P SER 1B14 0.00000000 | 0.00 | -100.00 | 0.0000 | -0.0025 | |||||

| US25381HAM07 / DIGICEL GROUP HOLDINGS REGD ZCP 144A P/P SER 3B14 0.00000000 | 0.00 | 0.0000 | -0.0001 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0001 | -0.0001 | ||||||

| SWOP IRS USD / DIR (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.00 | -0.0002 | -0.0002 | ||||||

| CDS REPUBLIC OF PANAMA / DCR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.00 | -0.0004 | -0.0004 | ||||||

| IRS USD / DIR (000000000) | -0.00 | -0.0006 | -0.0006 | ||||||

| IRS CAD / DIR (000000000) | -0.00 | -0.0006 | -0.0006 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0007 | -0.0007 | ||||||

| IRS JPY / DIR (000000000) | -0.00 | -0.0007 | -0.0007 | ||||||

| IRS JPY / DIR (000000000) | -0.00 | -0.0007 | -0.0007 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -0.00 | -0.0011 | -0.0011 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0011 | -0.0011 | ||||||

| BNP / BNP Paribas SA | -0.00 | -0.0015 | -0.0015 | ||||||

| IRS MYR / DIR (000000000) | -0.00 | -0.0016 | -0.0016 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0017 | -0.0017 | ||||||

| IRS EUR / DIR (000000000) | -0.00 | -0.0018 | -0.0018 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0019 | -0.0019 | ||||||

| IRS THB / DIR (000000000) | -0.00 | -0.0023 | -0.0023 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.00 | -0.0029 | -0.0029 | ||||||

| IRS GBP / DIR (000000000) | -0.00 | -0.0030 | -0.0030 | ||||||

| EURO-BOBL / DIR (000000000) | -0.00 | -0.0031 | -0.0031 | ||||||

| IRS JPY / DIR (000000000) | -0.00 | -0.0035 | -0.0035 | ||||||

| IRS CLP / DIR (000000000) | -0.00 | -0.0035 | -0.0035 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0038 | -0.0038 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0039 | -0.0039 | ||||||

| DGZ / DB Gold Short ETN | -0.00 | -0.0042 | -0.0042 | ||||||

| USD/JPY FORWARD / DFE (000000000) | -0.00 | -0.0044 | -0.0044 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.00 | -0.0046 | -0.0046 | ||||||

| IRS JPY / DIR (000000000) | -0.00 | -0.0047 | -0.0047 | ||||||

| SWOP IRS USD / DIR (000000000) | -0.00 | -0.0047 | -0.0047 | ||||||

| IRS GBP / DIR (000000000) | -0.00 | -0.0051 | -0.0051 | ||||||

| USD/JPY FORWARD / DFE (000000000) | -0.00 | -0.0053 | -0.0053 | ||||||

| IRS USD / DIR (000000000) | -0.00 | -0.0054 | -0.0054 | ||||||

| IRS GBP / DIR (000000000) | -0.00 | -0.0060 | -0.0060 | ||||||

| IRS USD / DIR (000000000) | -0.00 | -0.0060 | -0.0060 | ||||||

| IRS KRW / DIR (000000000) | -0.00 | -0.0065 | -0.0065 | ||||||

| IRS CAD / DIR (000000000) | -0.00 | -0.0071 | -0.0071 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0071 | -0.0071 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | -0.00 | -0.0073 | -0.0073 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0077 | -0.0077 | ||||||

| USD/AUD FORWARD / DFE (000000000) | -0.00 | -0.0078 | -0.0078 | ||||||

| IRS DKK / DIR (000000000) | -0.00 | -0.0081 | -0.0081 | ||||||

| IRS JPY / DIR (000000000) | -0.00 | -0.0090 | -0.0090 | ||||||

| BRL/USD FORWARD / DFE (000000000) | -0.00 | -0.0094 | -0.0094 | ||||||

| IRS NZD / DIR (000000000) | -0.01 | -0.0094 | -0.0094 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0095 | -0.0095 | ||||||

| IRS PLN / DIR (000000000) | -0.01 | -0.0102 | -0.0102 | ||||||

| IRS GBP / DIR (000000000) | -0.01 | -0.0107 | -0.0107 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.01 | -0.0112 | -0.0112 | ||||||

| IRS CAD / DIR (000000000) | -0.01 | -0.0112 | -0.0112 | ||||||

| IRS NOK / DIR (000000000) | -0.01 | -0.0114 | -0.0114 | ||||||

| CDS REPUBLIC OF FRANCE / DCR (000000000) | -0.01 | -0.0116 | -0.0116 | ||||||

| IRS SGD / DIR (000000000) | -0.01 | -0.0124 | -0.0124 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0129 | -0.0129 | ||||||

| CDS COMISION FEDERAL DE ELECTRICIDAD CFE / DCR (000000000) | -0.01 | -0.0131 | -0.0131 | ||||||

| IRS GBP / DIR (000000000) | -0.01 | -0.0139 | -0.0139 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0142 | -0.0142 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0143 | -0.0143 | ||||||

| IRS AUD / DIR (000000000) | -0.01 | -0.0150 | -0.0150 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.01 | -0.0154 | -0.0154 | ||||||

| IRS USD / DIR (000000000) | -0.01 | -0.0159 | -0.0159 | ||||||

| IRS USD / DIR (000000000) | -0.01 | -0.0165 | -0.0165 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.01 | -0.0173 | -0.0173 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0176 | -0.0176 | ||||||

| IRS USD / DIR (000000000) | -0.01 | -0.0182 | -0.0182 | ||||||

| IRS USD / DIR (000000000) | -0.01 | -0.0188 | -0.0188 | ||||||

| IRS SEK / DIR (000000000) | -0.01 | -0.0188 | -0.0188 | ||||||

| US 10YR ULTRA / DIR (000000000) | -0.01 | -0.0197 | -0.0197 | ||||||

| IRS GBP / DIR (000000000) | -0.01 | -0.0198 | -0.0198 | ||||||

| IRS CHF / DIR (000000000) | -0.01 | -0.0204 | -0.0204 | ||||||

| IRS USD / DIR (000000000) | -0.01 | -0.0204 | -0.0204 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0208 | -0.0208 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0223 | -0.0223 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0224 | -0.0224 | ||||||

| IRS HUF / DIR (000000000) | -0.01 | -0.0236 | -0.0236 | ||||||

| USD/MXN FORWARD / DFE (000000000) | -0.01 | -0.0240 | -0.0240 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.01 | -0.0251 | -0.0251 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0269 | -0.0269 | ||||||

| IRS USD / DIR (000000000) | -0.01 | -0.0275 | -0.0275 | ||||||

| IRS JPY / DIR (000000000) | -0.01 | -0.0282 | -0.0282 | ||||||

| IRS CAD / DIR (000000000) | -0.02 | -0.0287 | -0.0287 | ||||||

| 3 MONTH SOFR / DIR (000000000) | -0.02 | -0.0290 | -0.0290 | ||||||

| BP CURRENCY / DFE (000000000) | -0.02 | -0.0298 | -0.0298 | ||||||

| IRS EUR / DIR (000000000) | -0.02 | -0.0310 | -0.0310 | ||||||

| US ULTRA BOND CBT / DIR (000000000) | -0.02 | -0.0352 | -0.0352 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0373 | -0.0373 | ||||||

| IRS EUR / DIR (000000000) | -0.02 | -0.0375 | -0.0375 | ||||||

| IRS USD / DIR (000000000) | -0.02 | -0.0414 | -0.0414 | ||||||

| IRS EUR / DIR (000000000) | -0.02 | -0.0416 | -0.0416 | ||||||

| IRS JPY / DIR (000000000) | -0.02 | -0.0426 | -0.0426 | ||||||

| IRS USD / DIR (000000000) | -0.02 | -0.0440 | -0.0440 | ||||||

| IRS JPY / DIR (000000000) | -0.02 | -0.0456 | -0.0456 | ||||||

| IRS EUR / DIR (000000000) | -0.03 | -0.0485 | -0.0485 | ||||||

| JPY/USD FORWARD / DFE (000000000) | -0.03 | -0.0514 | -0.0514 | ||||||

| IRS CZK / DIR (000000000) | -0.03 | -0.0528 | -0.0528 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.03 | -0.0547 | -0.0547 | ||||||

| IRS USD / DIR (000000000) | -0.03 | -0.0554 | -0.0554 | ||||||

| IRS EUR / DIR (000000000) | -0.03 | -0.0555 | -0.0555 | ||||||

| IRS GBP / DIR (000000000) | -0.03 | -0.0571 | -0.0571 | ||||||

| IRS EUR / DIR (000000000) | -0.03 | -0.0585 | -0.0585 | ||||||

| IRS USD / DIR (000000000) | -0.03 | -0.0596 | -0.0596 | ||||||

| IRS JPY / DIR (000000000) | -0.03 | -0.0609 | -0.0609 | ||||||

| IRS JPY / DIR (000000000) | -0.03 | -0.0612 | -0.0612 | ||||||

| IRS USD / DIR (000000000) | -0.03 | -0.0622 | -0.0622 | ||||||

| IRS EUR / DIR (000000000) | -0.03 | -0.0632 | -0.0632 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.04 | -0.0665 | -0.0665 | ||||||

| IRS CHF / DIR (000000000) | -0.04 | -0.0693 | -0.0693 | ||||||

| IRS EUR / DIR (000000000) | -0.04 | -0.0754 | -0.0754 | ||||||

| IRS GBP / DIR (000000000) | -0.04 | -0.0793 | -0.0793 | ||||||

| IRS AUD / DIR (000000000) | -0.04 | -0.0807 | -0.0807 | ||||||

| IRS JPY / DIR (000000000) | -0.05 | -0.0883 | -0.0883 | ||||||

| IRS EUR / DIR (000000000) | -0.05 | -0.0929 | -0.0929 | ||||||

| IRS JPY / DIR (000000000) | -0.05 | -0.0944 | -0.0944 | ||||||

| IRS EUR / DIR (000000000) | -0.05 | -0.0959 | -0.0959 | ||||||

| IRS GBP / DIR (000000000) | -0.06 | -0.1177 | -0.1177 | ||||||

| IRS JPY / DIR (000000000) | -0.06 | -0.1207 | -0.1207 | ||||||

| IRS EUR / DIR (000000000) | -0.07 | -0.1310 | -0.1310 | ||||||

| IRS JPY / DIR (000000000) | -0.07 | -0.1332 | -0.1332 | ||||||

| IRS EUR / DIR (000000000) | -0.08 | -0.1448 | -0.1448 | ||||||

| IRS GBP / DIR (000000000) | -0.10 | -0.1792 | -0.1792 | ||||||

| IRS JPY / DIR (000000000) | -0.11 | -0.1994 | -0.1994 | ||||||

| IRS GBP / DIR (000000000) | -0.11 | -0.2013 | -0.2013 | ||||||

| IRS GBP / DIR (000000000) | -0.12 | -0.2310 | -0.2310 | ||||||

| IRS GBP / DIR (000000000) | -0.14 | -0.2616 | -0.2616 | ||||||

| IRS GBP / DIR (000000000) | -0.19 | -0.3576 | -0.3576 | ||||||

| EURO FX CURR / DFE (000000000) | -0.30 | -0.5596 | -0.5596 | ||||||

| IRS USD / DIR (000000000) | -0.44 | -0.8289 | -0.8289 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.66 | -1.2419 | -1.2419 |