Basic Stats

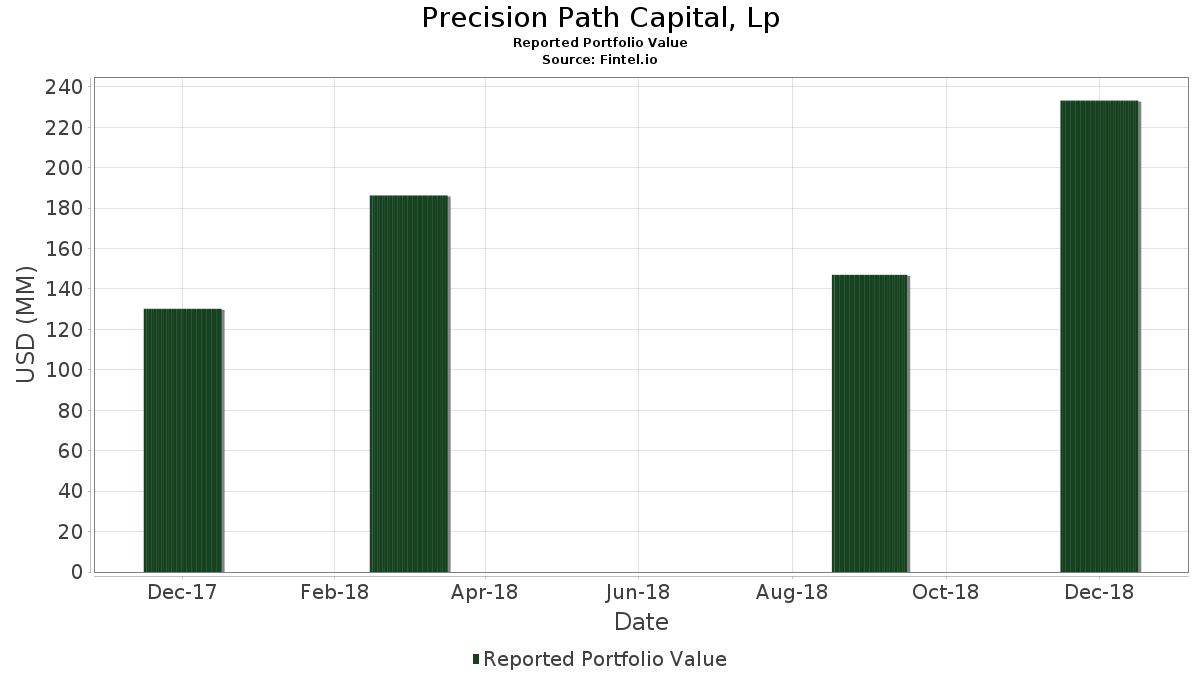

| Portfolio Value | $ 233,204,000 |

| Current Positions | 16 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Precision Path Capital, Lp has disclosed 16 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 233,204,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Precision Path Capital, Lp’s top holdings are United Rentals, Inc. (US:URI) , Union Pacific Corporation (US:UNP) , Carlisle Companies Incorporated (US:CSL) , Norfolk Southern Corporation (US:NSC) , and Dana Incorporated (US:DAN) . Precision Path Capital, Lp’s new positions include Stanley Black & Decker, Inc. (US:SWK) , Canadian Pacific Kansas City Limited (US:CP) , W.R. Grace & Co. (US:GRA) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.30 | 30.76 | 13.1897 | 13.1897 | |

| 0.22 | 30.41 | 13.0405 | 13.0405 | |

| 0.23 | 23.62 | 10.1293 | 10.1293 | |

| 1.37 | 18.67 | 8.0072 | 8.0072 | |

| 0.12 | 14.38 | 6.1641 | 6.1641 | |

| 0.15 | 13.69 | 5.8683 | 5.8683 | |

| 0.14 | 20.19 | 8.6568 | 4.6047 | |

| 0.04 | 9.85 | 4.2233 | 4.2233 | |

| 0.07 | 8.98 | 3.8511 | 3.8511 | |

| 0.18 | 14.11 | 6.0522 | 3.8279 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 10.17 | 4.3593 | -6.6773 | |

| 0.00 | 0.00 | -5.6635 | ||

| 0.00 | 0.00 | -5.1132 | ||

| 0.00 | 0.00 | -3.7160 | ||

| 0.00 | 0.00 | -3.2671 | ||

| 0.00 | 0.00 | -3.2487 | ||

| 0.00 | 0.00 | -2.7984 | ||

| 0.14 | 9.09 | 3.8966 | -1.4506 | |

| 0.00 | 0.00 | -0.6231 |

13F and Fund Filings

This form was filed on 2019-02-14 for the reporting period 2018-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| URI / United Rentals, Inc. | 0.30 | 361.54 | 30.76 | 189.25 | 13.1897 | 13.1897 | |||

| UNP / Union Pacific Corporation | 0.22 | 423.81 | 30.41 | 344.67 | 13.0405 | 13.0405 | |||

| CSL / Carlisle Companies Incorporated | 0.23 | 683.33 | 23.62 | 546.47 | 10.1293 | 10.1293 | |||

| NSC / Norfolk Southern Corporation | 0.14 | 309.09 | 20.19 | 238.90 | 8.6568 | 4.6047 | |||

| DAN / Dana Incorporated | 1.37 | 270.27 | 18.67 | 170.31 | 8.0072 | 8.0072 | |||

| GT / The Goodyear Tire & Rubber Company | 0.75 | 119.94 | 15.31 | 91.93 | 6.5642 | 1.1388 | |||

| LEA / Lear Corporation | 0.12 | 14.38 | 6.1641 | 6.1641 | |||||

| LECO / Lincoln Electric Holdings, Inc. | 0.18 | 411.43 | 14.11 | 331.62 | 6.0522 | 3.8279 | |||

| IR / Ingersoll Rand Inc. | 0.15 | 63.04 | 13.69 | 45.40 | 5.8683 | 5.8683 | |||

| CAT / Caterpillar Inc. | 0.08 | -24.81 | 10.17 | -37.34 | 4.3593 | -6.6773 | |||

| LII / Lennox International Inc. | 0.04 | 80.00 | 9.85 | 80.38 | 4.2233 | 4.2233 | |||

| GRA / W.R. Grace & Co. | 0.14 | 27.27 | 9.09 | 15.60 | 3.8966 | -1.4506 | |||

| SWK / Stanley Black & Decker, Inc. | 0.07 | 8.98 | 3.8511 | 3.8511 | |||||

| CP / Canadian Pacific Kansas City Limited | 0.05 | 8.88 | 3.8070 | 3.8070 | |||||

| ALLE / Allegion plc | 0.06 | 57.89 | 4.78 | 38.96 | 2.0510 | 2.0510 | |||

| GRA / W.R. Grace & Co. | Call | 0.01 | 0.33 | 0.1394 | 0.1394 | ||||

| TRN / Trinity Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6231 | ||||

| WSO / Watsco, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| AOS / A. O. Smith Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -3.2671 | ||||

| AXL / American Axle & Manufacturing Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.1132 | ||||

| KMT / Kennametal Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.6635 | ||||

| SHW / The Sherwin-Williams Company | 0.00 | -100.00 | 0.00 | -100.00 | -3.7160 | ||||

| ADM / Archer-Daniels-Midland Company | 0.00 | -100.00 | 0.00 | -100.00 | -3.2487 | ||||

| VMC / Vulcan Materials Company | 0.00 | -100.00 | 0.00 | -100.00 | -2.7984 |