Basic Stats

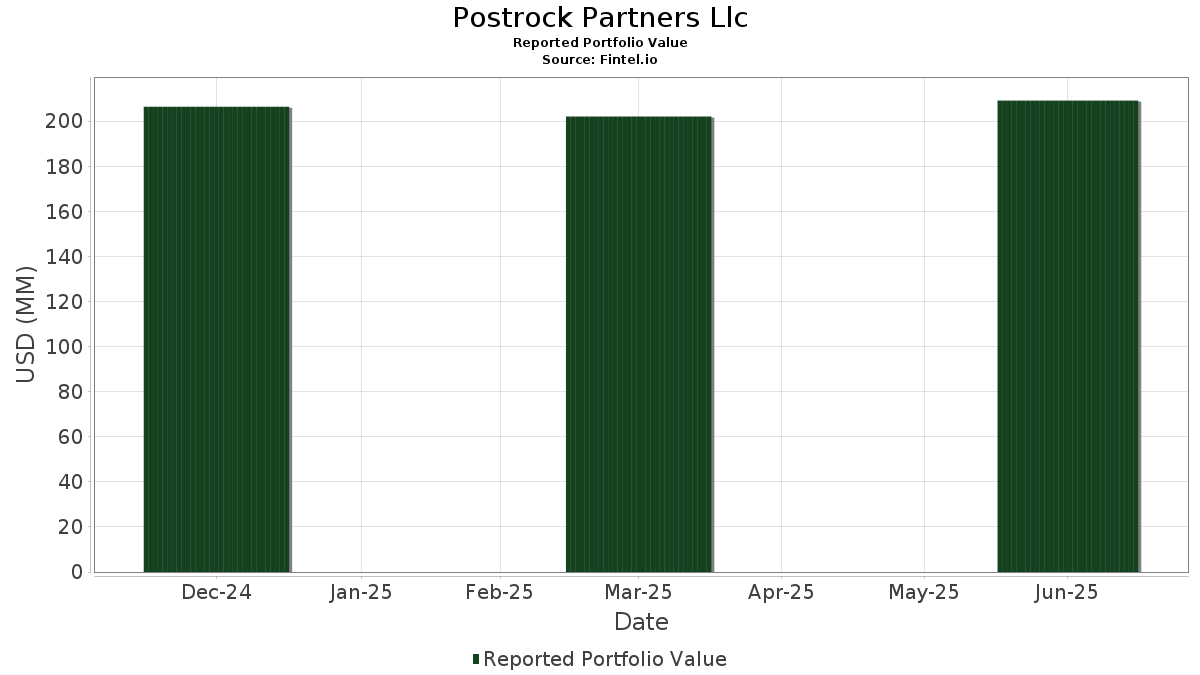

| Portfolio Value | $ 209,124,710 |

| Current Positions | 82 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Postrock Partners Llc has disclosed 82 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 209,124,710 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Postrock Partners Llc’s top holdings are Berkshire Hathaway Inc. (US:BRK.A) , Apple Inc. (US:AAPL) , Fastenal Company (US:FAST) , Booking Holdings Inc. (US:BKNG) , and iShares Trust - iShares Core S&P 500 ETF (US:IVV) . Postrock Partners Llc’s new positions include United Parcel Service, Inc. (US:UPS) , GE Vernova Inc. (US:GEV) , Constellation Energy Corporation (US:CEG) , EQT Corporation (US:EQT) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 7.11 | 3.3988 | 0.9857 | |

| 0.00 | 11.38 | 5.4425 | 0.9601 | |

| 0.02 | 1.52 | 0.7289 | 0.7289 | |

| 0.05 | 8.49 | 4.0583 | 0.3727 | |

| 0.34 | 14.23 | 6.8028 | 0.3054 | |

| 0.02 | 10.20 | 4.8755 | 0.3009 | |

| 0.03 | 3.05 | 1.4566 | 0.2793 | |

| 0.00 | 2.33 | 1.1139 | 0.2574 | |

| 0.01 | 3.02 | 1.4418 | 0.2416 | |

| 0.01 | 3.25 | 1.5562 | 0.2390 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 32.07 | 15.3340 | -2.0527 | |

| 0.14 | 29.46 | 14.0869 | -1.6974 | |

| 0.00 | 0.54 | 0.2586 | -0.6485 | |

| 0.01 | 0.59 | 0.2804 | -0.5332 | |

| 0.03 | 1.48 | 0.7082 | -0.1371 | |

| 0.03 | 10.12 | 4.8397 | -0.1005 | |

| 0.02 | 1.08 | 0.5188 | -0.0955 | |

| 0.04 | 3.08 | 1.4747 | -0.0917 | |

| 0.04 | 2.23 | 1.0655 | -0.0859 | |

| 0.00 | 0.54 | 0.2568 | -0.0791 |

13F and Fund Filings

This form was filed on 2025-07-15 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 32.07 | -8.72 | 15.3340 | -2.0527 | |||

| AAPL / Apple Inc. | 0.14 | 0.00 | 29.46 | -7.63 | 14.0869 | -1.6974 | |||

| FAST / Fastenal Company | 0.34 | 100.08 | 14.23 | 8.36 | 6.8028 | 0.3054 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 11.38 | 25.66 | 5.4425 | 0.9601 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.02 | -0.18 | 10.20 | 10.30 | 4.8755 | 0.3009 | |||

| V / Visa Inc. | 0.03 | 0.08 | 10.12 | 1.39 | 4.8397 | -0.1005 | |||

| GOOGL / Alphabet Inc. | 0.05 | 0.00 | 8.49 | 13.95 | 4.0583 | 0.3727 | |||

| NVDA / NVIDIA Corporation | 0.04 | 0.00 | 7.11 | 45.78 | 3.3988 | 0.9857 | |||

| QCOM / QUALCOMM Incorporated | 0.04 | -2.44 | 5.74 | 1.16 | 2.7434 | -0.0636 | |||

| GOOG / Alphabet Inc. | 0.03 | 0.54 | 4.95 | 14.17 | 2.3658 | 0.2209 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 0.54 | 3.89 | 15.94 | 1.8580 | 0.1993 | |||

| VRSK / Verisk Analytics, Inc. | 0.01 | -1.73 | 3.28 | 2.86 | 1.5671 | -0.0098 | |||

| HEI / HEICO Corporation | 0.01 | -0.39 | 3.25 | 22.28 | 1.5562 | 0.2390 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.04 | -4.47 | 3.08 | -2.56 | 1.4747 | -0.0917 | |||

| UBER / Uber Technologies, Inc. | 0.03 | 0.00 | 3.05 | 28.09 | 1.4566 | 0.2793 | |||

| VEEV / Veeva Systems Inc. | 0.01 | 0.00 | 3.02 | 24.33 | 1.4418 | 0.2416 | |||

| SPGI / S&P Global Inc. | 0.01 | 0.00 | 2.74 | 3.78 | 1.3124 | 0.0035 | |||

| IBMP / iShares Trust - iShares iBonds Dec 2027 Term Muni Bond ETF | 0.10 | 4.01 | 2.45 | 4.30 | 1.1711 | 0.0090 | |||

| MSFT / Microsoft Corporation | 0.00 | 1.58 | 2.33 | 34.62 | 1.1139 | 0.2574 | |||

| WMT / Walmart Inc. | 0.02 | 0.32 | 2.24 | 11.74 | 1.0699 | 0.0789 | |||

| TSCO / Tractor Supply Company | 0.04 | 0.00 | 2.23 | -4.21 | 1.0655 | -0.0859 | |||

| ROST / Ross Stores, Inc. | 0.02 | -2.87 | 2.20 | -3.04 | 1.0528 | -0.0709 | |||

| LOPE / Grand Canyon Education, Inc. | 0.01 | -0.41 | 1.97 | 8.78 | 0.9424 | 0.0458 | |||

| RBA / RB Global, Inc. | 0.02 | 0.00 | 1.89 | 5.89 | 0.9028 | 0.0203 | |||

| ANSS / ANSYS, Inc. | 0.01 | -0.20 | 1.78 | 10.77 | 0.8508 | 0.0556 | |||

| ROL / Rollins, Inc. | 0.03 | 0.00 | 1.53 | 4.43 | 0.7330 | 0.0065 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 1.52 | 0.7289 | 0.7289 | |||||

| CPRT / Copart, Inc. | 0.03 | 0.00 | 1.48 | -13.30 | 0.7082 | -0.1371 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | 0.00 | 1.38 | 19.93 | 0.6594 | 0.0903 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | 0.00 | 1.38 | 16.53 | 0.6578 | 0.0737 | |||

| AMT / American Tower Corporation | 0.01 | 0.00 | 1.36 | 1.57 | 0.6487 | -0.0123 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 0.00 | 1.28 | 38.16 | 0.6113 | 0.1532 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 1.18 | 1.21 | 11.80 | 0.5802 | 0.0428 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.35 | 1.19 | 11.23 | 0.5690 | 0.0397 | |||

| TECH / Bio-Techne Corporation | 0.02 | -0.40 | 1.08 | -12.65 | 0.5188 | -0.0955 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.00 | 1.04 | 29.21 | 0.4951 | 0.0983 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 1.03 | 4.69 | 0.4914 | 0.0055 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 4.16 | 1.02 | 23.18 | 0.4855 | 0.0773 | |||

| IBMO / iShares Trust - iShares iBonds Dec 2026 Term Muni Bond ETF | 0.04 | 3.64 | 0.98 | 3.91 | 0.4707 | 0.0018 | |||

| CSGP / CoStar Group, Inc. | 0.01 | 0.00 | 0.92 | 1.43 | 0.4398 | -0.0088 | |||

| SUB / iShares Trust - iShares Short-Term National Muni Bond ETF | 0.01 | 0.00 | 0.89 | 0.68 | 0.4271 | -0.0119 | |||

| EMB / iShares Trust - iShares J.P. Morgan USD Emerging Markets Bond ETF | 0.01 | 0.00 | 0.83 | 2.21 | 0.3986 | -0.0049 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | -0.31 | 0.68 | -4.22 | 0.3257 | -0.0264 | |||

| MU / Micron Technology, Inc. | 0.01 | 0.00 | 0.68 | 42.05 | 0.3247 | 0.0878 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.01 | 9.90 | 0.67 | 10.16 | 0.3218 | 0.0196 | |||

| LKQ / LKQ Corporation | 0.02 | 0.00 | 0.61 | -13.12 | 0.2916 | -0.0553 | |||

| DHR / Danaher Corporation | 0.00 | -4.24 | 0.60 | -7.73 | 0.2858 | -0.0348 | |||

| IBMN / iShares Trust - iShares iBonds Dec 2025 Term Muni Bond ETF | 0.02 | 6.71 | 0.60 | 6.63 | 0.2850 | 0.0087 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.01 | -67.01 | 0.59 | -64.36 | 0.2804 | -0.5332 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -72.73 | 0.54 | -70.52 | 0.2586 | -0.6485 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | 0.00 | 0.54 | 2.66 | 0.2584 | -0.0024 | |||

| GNTX / Gentex Corporation | 0.02 | -0.53 | 0.54 | -6.26 | 0.2582 | -0.0265 | |||

| CHE / Chemed Corporation | 0.00 | 0.00 | 0.54 | -20.80 | 0.2568 | -0.0791 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | 0.00 | 0.52 | 4.59 | 0.2509 | 0.0024 | |||

| USB / U.S. Bancorp | 0.01 | 0.00 | 0.50 | 7.25 | 0.2407 | 0.0083 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.48 | -8.81 | 0.2279 | -0.0307 | |||

| BAC / Bank of America Corporation | 0.01 | 4.85 | 0.46 | 18.91 | 0.2200 | 0.0285 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.01 | 5.40 | 0.43 | 5.65 | 0.2057 | 0.0040 | |||

| IBMQ / iShares Trust - iShares iBonds Dec 2028 Term Muni Bond ETF | 0.02 | 26.71 | 0.43 | 27.08 | 0.2046 | 0.0383 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.00 | 0.43 | 14.21 | 0.2037 | 0.0188 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | 0.00 | 0.39 | -1.53 | 0.1846 | -0.0096 | |||

| INTU / Intuit Inc. | 0.00 | 0.00 | 0.38 | 28.14 | 0.1812 | 0.0350 | |||

| TYL / Tyler Technologies, Inc. | 0.00 | 0.00 | 0.37 | 1.91 | 0.1786 | -0.0027 | |||

| HWM / Howmet Aerospace Inc. | 0.00 | 0.00 | 0.34 | 43.33 | 0.1647 | 0.0459 | |||

| CGNX / Cognex Corporation | 0.01 | 0.00 | 0.31 | 6.23 | 0.1470 | 0.0039 | |||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.00 | 0.00 | 0.30 | 4.83 | 0.1457 | 0.0019 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.00 | 0.30 | -1.00 | 0.1421 | -0.0065 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.29 | 0.1382 | 0.1382 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.27 | 17.60 | 0.1311 | 0.0158 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.27 | 2.26 | 0.1301 | -0.0012 | |||

| HD / The Home Depot, Inc. | 0.00 | 3.33 | 0.26 | 3.57 | 0.1250 | -0.0001 | |||

| GDDY / GoDaddy Inc. | 0.00 | 0.00 | 0.26 | 0.00 | 0.1234 | -0.0044 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.25 | 3.67 | 0.1219 | 0.0005 | |||

| CRM / Salesforce, Inc. | 0.00 | 0.00 | 0.25 | 1.65 | 0.1179 | -0.0022 | |||

| IBDQ / iShares Trust - iShares iBonds Dec 2025 Term Corporate ETF | 0.01 | 0.00 | 0.24 | 0.00 | 0.1156 | -0.0039 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | 4.50 | 0.24 | 17.56 | 0.1155 | 0.0138 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.00 | 1.53 | 0.24 | 13.27 | 0.1145 | 0.0096 | |||

| CEG / Constellation Energy Corporation | 0.00 | 0.23 | 0.1113 | 0.1113 | |||||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.00 | 0.00 | 0.22 | -0.92 | 0.1037 | -0.0046 | |||

| T / AT&T Inc. | 0.01 | 0.00 | 0.22 | 2.37 | 0.1034 | -0.0012 | |||

| EQT / EQT Corporation | 0.00 | 0.21 | 0.0987 | 0.0987 | |||||

| ADBE / Adobe Inc. | 0.00 | -1.12 | 0.21 | -0.49 | 0.0984 | -0.0037 | |||

| MIDD / The Middleby Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 |