Basic Stats

| Portfolio Value | $ 129,642,038 |

| Current Positions | 20 |

Latest Holdings, Performance, AUM (from 13F, 13D)

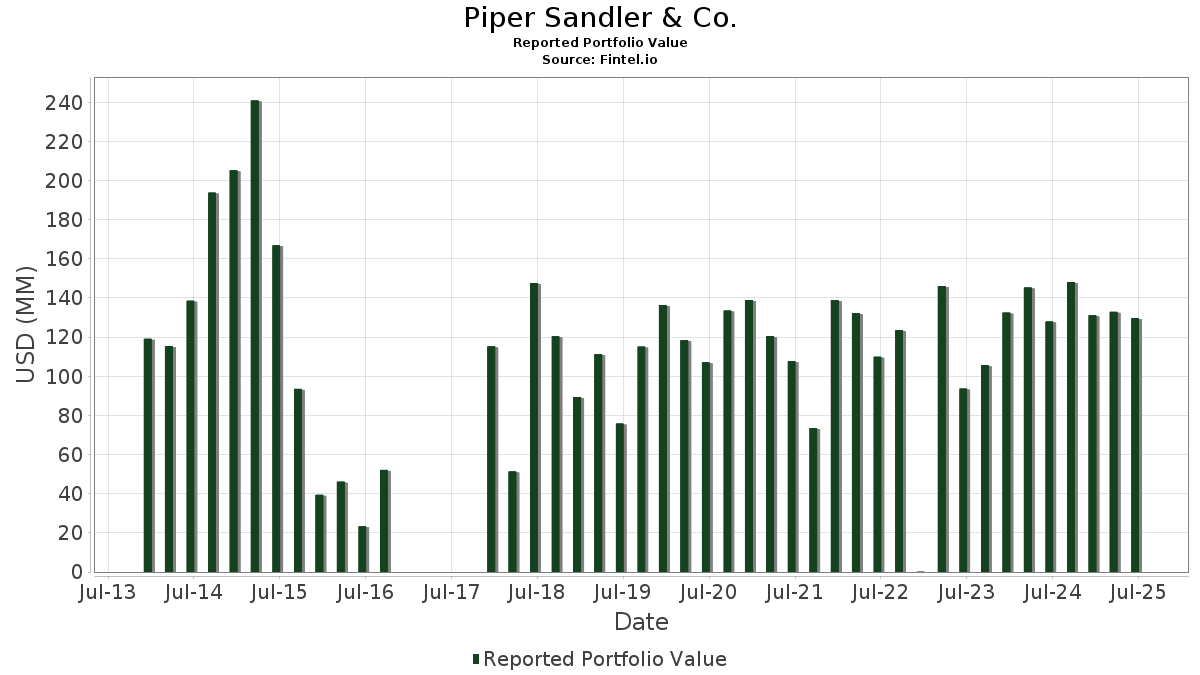

Piper Sandler & Co. has disclosed 20 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 129,642,038 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Piper Sandler & Co.’s top holdings are Nrg Energy Inc Bond (US:US629377CG50) , CONV. NOTE (US:US457985AM13) , SolarEdge Technologies, Inc. (US:SEDG) , RWT Holdings Inc (US:US749772AD11) , and Fiverr International Ltd. (US:FVRR) . Piper Sandler & Co.’s new positions include Nrg Energy Inc Bond (US:US629377CG50) , CONV. NOTE (US:US457985AM13) , SolarEdge Technologies, Inc. (US:SEDG) , RWT Holdings Inc (US:US749772AD11) , and Fiverr International Ltd. (US:FVRR) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 5.00 | 18.57 | 14.3217 | 14.3217 | |

| 14.07 | 13.63 | 10.5138 | 10.5138 | |

| 18.39 | 18.19 | 14.0294 | 8.1030 | |

| 9.09 | 8.97 | 6.9205 | 3.2285 | |

| 4.16 | 3.99 | 3.0754 | 3.0754 | |

| 4.11 | 4.09 | 3.1552 | 3.0264 | |

| 5.15 | 5.13 | 3.9577 | 2.3815 | |

| 3.00 | 2.88 | 2.2221 | 2.2221 | |

| 7.22 | 7.16 | 5.5227 | 1.7982 | |

| 12.80 | 12.55 | 9.6820 | 1.7335 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 0.03 | 0.0241 | -0.0041 |

13F and Fund Filings

This form was filed on 2025-08-13 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US629377CG50 / Nrg Energy Inc Bond | 5.00 | 18.57 | 14.3217 | 14.3217 | |||||

| US457985AM13 / CONV. NOTE | 18.39 | 18.19 | 130.93 | 14.0294 | 8.1030 | ||||

| SEDG / SolarEdge Technologies, Inc. | 14.07 | 13.63 | 10.5138 | 10.5138 | |||||

| US749772AD11 / RWT Holdings Inc | 12.60 | 12.56 | 1.06 | 9.6909 | 0.3373 | ||||

| FVRR / Fiverr International Ltd. | 12.80 | 12.55 | 18.83 | 9.6820 | 1.7335 | ||||

| ARBOR REALTY TRUST INC / NOTE 7.500% 8/0 (038923BA5) | 10.17 | 10.16 | 0.0000 | ||||||

| US94419LAM37 / CONV. NOTE | 9.09 | 8.97 | 82.86 | 6.9205 | 3.2285 | ||||

| US90187BAB71 / TWO HARBORS INVESTMENT COR CONV 6.25% 01/15/2026 | 7.22 | 7.16 | 44.63 | 5.5227 | 1.7982 | ||||

| WIX / Wix.com Ltd. | 6.67 | 6.62 | 2.57 | 5.1063 | 0.2508 | ||||

| US695127AF73 / CONV. NOTE | 5.15 | 5.13 | 144.99 | 3.9577 | 2.3815 | ||||

| US70932AAF03 / PENNYMAC CORP | 4.11 | 4.09 | 2,291.81 | 3.1552 | 3.0264 | ||||

| US29355AAH05 / ENPHASE ENERGY INC CONV 0% 03/01/2026 | 4.16 | 3.99 | 3.0754 | 3.0754 | |||||

| US59064RAA77 / Mesa Labs Inc Bond | 3.50 | 3.47 | 138.20 | 2.6795 | 1.5819 | ||||

| US31188VAB62 / FASTLY INC CONV 0% 03/15/2026 | 3.00 | 2.88 | 2.2221 | 2.2221 | |||||

| US29975EAB56 / Eventbrite, Inc. | 1.50 | 1.49 | 1.22 | 1.1512 | 0.0418 | ||||

| ACDC / ProFrac Holding Corp. | 0.01 | 0.00 | 0.06 | 3.28 | 0.0489 | 0.0022 | |||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0.04 | 0.04 | 0.0304 | 0.0304 | |||||

| US94419LAF85 / CONV. NOTE | 0.03 | 0.03 | 3.23 | 0.0248 | 0.0009 | ||||

| STTK / Shattuck Labs, Inc. | 0.04 | 0.00 | 0.03 | -16.22 | 0.0241 | -0.0041 | |||

| US68213NAD12 / Omnicell Inc | 0.01 | 0.01 | 0.00 | 0.0091 | 0.0003 | ||||

| RENEW / Cartesian Growth Corporation II - Equity Warrant | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SEI / Solaris Energy Infrastructure, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NBBK / NB Bancorp, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |