Basic Stats

| Portfolio Value | $ 391,838,174 |

| Current Positions | 76 |

Latest Holdings, Performance, AUM (from 13F, 13D)

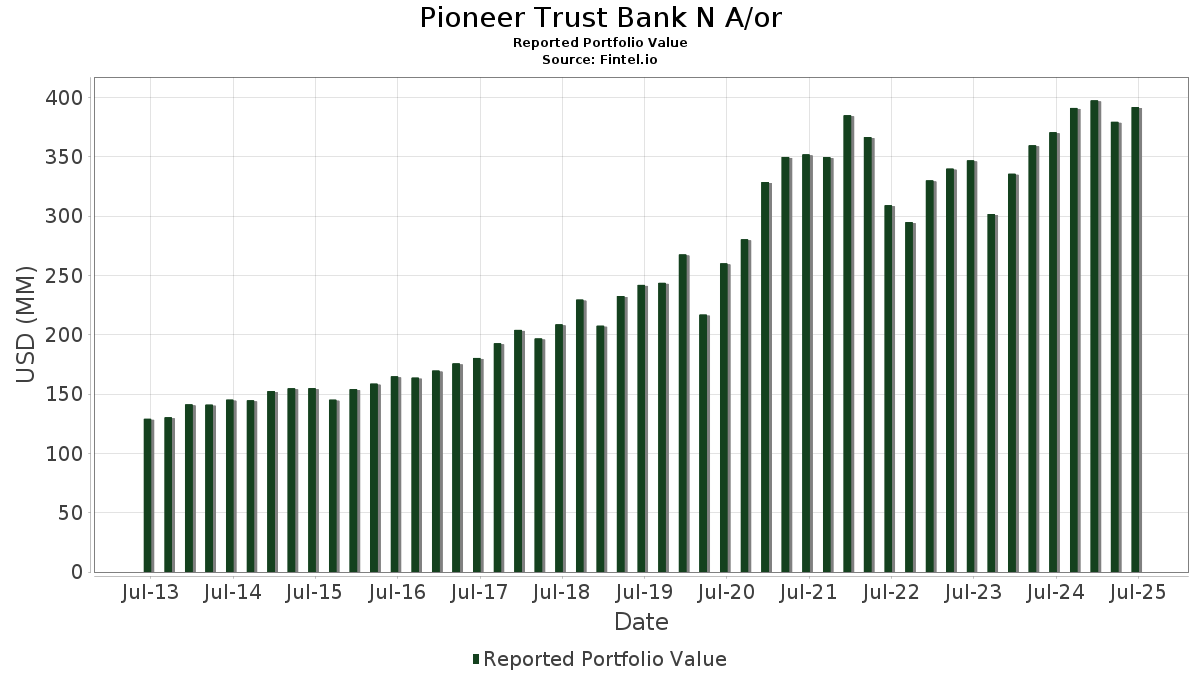

Pioneer Trust Bank N A/or has disclosed 76 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 391,838,174 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Pioneer Trust Bank N A/or’s top holdings are Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Berkshire Hathaway Inc. (US:BRK.A) , SPDR S&P 500 ETF (US:SPY) , and Oracle Corporation (US:ORCL) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 17.56 | 4.4827 | 1.5051 | |

| 0.06 | 13.23 | 3.3768 | 0.4016 | |

| 0.02 | 3.29 | 0.8397 | 0.0738 | |

| 0.00 | 0.21 | 0.0538 | 0.0538 | |

| 0.00 | 0.53 | 0.1362 | 0.0279 | |

| 0.00 | 0.83 | 0.2117 | 0.0273 | |

| 0.07 | 4.74 | 1.2096 | 0.0222 | |

| 0.00 | 0.52 | 0.1315 | 0.0169 | |

| 0.00 | 0.27 | 0.0677 | 0.0083 | |

| 0.00 | 0.67 | 0.1699 | 0.0077 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 24.33 | 3.4515 | -3.6737 | |

| 0.12 | 24.41 | 3.4636 | -3.4148 | |

| 0.03 | 8.92 | 1.2660 | -2.5070 | |

| 0.03 | 19.90 | 2.8230 | -2.0694 | |

| 0.07 | 34.08 | 4.8355 | -2.0560 | |

| 0.05 | 16.46 | 2.3351 | -1.6447 | |

| 0.09 | 16.71 | 2.3708 | -1.4783 | |

| 0.03 | 9.85 | 1.3982 | -1.2503 | |

| 0.04 | 6.85 | 0.9716 | -1.2048 | |

| 0.05 | 13.57 | 1.9259 | -1.1662 |

13F and Fund Filings

This form was filed on 2025-08-08 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.07 | -1.63 | 34.08 | 30.34 | 4.8355 | -2.0560 | |||

| AAPL / Apple Inc. | 0.12 | 1.27 | 24.41 | -6.46 | 3.4636 | -3.4148 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.05 | -1.34 | 24.33 | -10.01 | 3.4515 | -3.6737 | |||

| SPY / SPDR S&P 500 ETF | 0.03 | -2.95 | 19.90 | 7.19 | 2.8230 | -2.0694 | |||

| ORCL / Oracle Corporation | 0.08 | -0.58 | 17.56 | 55.47 | 4.4827 | 1.5051 | |||

| GOOGL / Alphabet Inc. | 0.09 | 0.77 | 16.71 | 14.42 | 2.3708 | -1.4783 | |||

| VMI / Valmont Industries, Inc. | 0.05 | -4.76 | 16.46 | 8.99 | 2.3351 | -1.6447 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | -2.10 | 13.57 | 15.70 | 1.9259 | -1.1662 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 1.65 | 13.23 | 17.21 | 3.3768 | 0.4016 | |||

| ACN / Accenture plc | 0.04 | -0.05 | 12.09 | -4.26 | 3.0859 | -0.2429 | |||

| BLK / BlackRock, Inc. | 0.01 | -0.36 | 10.24 | 10.47 | 1.4525 | -0.9902 | |||

| V / Visa Inc. | 0.03 | -3.20 | 9.85 | -1.93 | 1.3982 | -1.2503 | |||

| UNH / UnitedHealth Group Incorporated | 0.03 | 4.65 | 8.92 | -37.67 | 1.2660 | -2.5070 | |||

| LLY / Eli Lilly and Company | 0.01 | 5.35 | 8.68 | -0.57 | 2.2150 | -0.0857 | |||

| CSCO / Cisco Systems, Inc. | 0.12 | 3.57 | 8.48 | 16.45 | 1.2035 | -0.7164 | |||

| NVDA / NVIDIA Corporation | 0.05 | 6.62 | 8.17 | 55.42 | 1.1595 | -0.2264 | |||

| ABT / Abbott Laboratories | 0.06 | 0.84 | 7.91 | 3.40 | 2.0186 | 0.0023 | |||

| ITW / Illinois Tool Works Inc. | 0.03 | -3.01 | 7.17 | -3.31 | 1.0169 | -0.9368 | |||

| PEP / PepsiCo, Inc. | 0.05 | -0.33 | 6.90 | -12.22 | 0.9790 | -1.0931 | |||

| DIS / The Walt Disney Company | 0.06 | -2.91 | 6.89 | 21.98 | 0.9772 | -0.5109 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.04 | -11.29 | 6.85 | -17.06 | 0.9716 | -1.2048 | |||

| HON / Honeywell International Inc. | 0.03 | -0.58 | 6.71 | 9.34 | 0.9517 | -0.6652 | |||

| CRM / Salesforce, Inc. | 0.02 | 0.51 | 6.66 | 2.13 | 0.9448 | -0.7736 | |||

| CVX / Chevron Corporation | 0.05 | -11.00 | 6.46 | -23.82 | 1.6479 | -0.5862 | |||

| JNJ / Johnson & Johnson | 0.04 | 0.38 | 6.22 | -7.56 | 1.5866 | -0.1856 | |||

| RTX / RTX Corporation | 0.04 | -0.80 | 6.13 | 9.36 | 0.8699 | -0.6078 | |||

| NEE / NextEra Energy, Inc. | 0.09 | 4.41 | 6.08 | 2.25 | 0.8630 | -0.7049 | |||

| LOW / Lowe's Companies, Inc. | 0.03 | 0.46 | 6.04 | -4.43 | 1.5413 | -0.1243 | |||

| XOM / Exxon Mobil Corporation | 0.06 | -5.98 | 5.97 | -14.77 | 1.5239 | -0.3229 | |||

| DHR / Danaher Corporation | 0.03 | -7.28 | 5.80 | -10.66 | 0.8229 | -0.8880 | |||

| TJX / The TJX Companies, Inc. | 0.04 | 0.30 | 5.39 | 1.68 | 1.3757 | -0.0214 | |||

| ADBE / Adobe Inc. | 0.01 | -2.15 | 5.18 | -1.31 | 0.7355 | -0.6488 | |||

| MCD / McDonald's Corporation | 0.02 | -0.97 | 4.95 | -7.36 | 1.2621 | -0.1450 | |||

| NKE / NIKE, Inc. | 0.07 | -5.99 | 4.74 | 5.19 | 1.2096 | 0.0222 | |||

| CMCSA / Comcast Corporation | 0.12 | -3.64 | 4.27 | -6.82 | 0.6053 | -0.6011 | |||

| GOOGL / Alphabet Inc. | 0.02 | -0.64 | 3.29 | 13.25 | 0.8397 | 0.0738 | |||

| WMT / Walmart Inc. | 0.02 | -0.47 | 1.97 | 10.84 | 0.2802 | -0.1893 | |||

| COST / Costco Wholesale Corporation | 0.00 | -21.73 | 1.68 | -18.09 | 0.4277 | -0.1115 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.01 | 0.00 | 1.59 | 10.68 | 0.2251 | -0.1527 | |||

| AMGN / Amgen Inc. | 0.01 | -0.88 | 1.42 | -11.22 | 0.3616 | -0.0588 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.02 | 0.00 | 1.16 | 6.23 | 0.1646 | -0.1230 | |||

| SBUX / Starbucks Corporation | 0.01 | 0.00 | 1.04 | -6.58 | 0.1471 | -0.1454 | |||

| USB / U.S. Bancorp | 0.02 | -12.50 | 1.00 | -6.17 | 0.2560 | -0.0259 | |||

| KO / The Coca-Cola Company | 0.01 | -4.42 | 0.92 | -5.56 | 0.1302 | -0.1259 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.88 | 3.76 | 0.1254 | -0.0993 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.83 | 18.60 | 0.2117 | 0.0273 | |||

| ABBV / AbbVie Inc. | 0.00 | -10.57 | 0.79 | -20.79 | 0.1114 | -0.1498 | |||

| CSX / CSX Corporation | 0.02 | 0.00 | 0.76 | 10.90 | 0.1083 | -0.0731 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.74 | -2.64 | 0.1883 | -0.0114 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | -0.61 | 0.72 | 3.77 | 0.1830 | 0.0011 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.67 | 8.13 | 0.1699 | 0.0077 | |||

| AFL / Aflac Incorporated | 0.01 | 0.00 | 0.57 | -5.18 | 0.0807 | -0.0773 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.57 | 21.77 | 0.0802 | -0.0423 | |||

| MRK / Merck & Co., Inc. | 0.01 | -8.22 | 0.55 | -19.03 | 0.1401 | -0.0387 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.55 | 64.95 | 0.0775 | -0.0099 | |||

| TT / Trane Technologies plc | 0.00 | 0.00 | 0.53 | 29.68 | 0.1362 | 0.0279 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.52 | 18.66 | 0.1315 | 0.0169 | |||

| LIN / Linde plc | 0.00 | -1.72 | 0.48 | -1.02 | 0.0686 | -0.0601 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.47 | 11.58 | 0.0671 | -0.0446 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | 0.00 | 0.46 | 9.43 | 0.0660 | -0.0461 | |||

| SCHX / Schwab Strategic Trust - Schwab U.S. Large-Cap ETF | 0.02 | 0.00 | 0.44 | 10.58 | 0.0624 | -0.0423 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.42 | 6.12 | 0.0591 | -0.0443 | |||

| BA / The Boeing Company | 0.00 | -17.02 | 0.41 | 2.00 | 0.1043 | -0.0014 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.00 | 0.00 | 0.33 | 18.15 | 0.0472 | -0.0271 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.00 | 0.00 | 0.33 | 22.14 | 0.0471 | -0.0244 | |||

| AON / Aon plc | 0.00 | 0.00 | 0.33 | -10.66 | 0.0465 | -0.0501 | |||

| IJT / iShares Trust - iShares S&P Small-Cap 600 Growth ETF | 0.00 | 0.00 | 0.29 | 6.96 | 0.0415 | -0.0307 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.29 | 31.36 | 0.0410 | -0.0170 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.27 | 17.78 | 0.0677 | 0.0083 | |||

| T / AT&T Inc. | 0.01 | 0.98 | 0.26 | 3.63 | 0.0365 | -0.0291 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.24 | -3.19 | 0.0622 | -0.0042 | |||

| HD / The Home Depot, Inc. | 0.00 | -2.96 | 0.24 | -2.83 | 0.0341 | -0.0312 | |||

| CSL / Carlisle Companies Incorporated | 0.00 | 0.00 | 0.22 | 9.80 | 0.0572 | 0.0033 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.22 | 6.97 | 0.0550 | 0.0019 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 0.21 | 0.0538 | 0.0538 | |||||

| VZ / Verizon Communications Inc. | 0.00 | -24.08 | 0.20 | -27.66 | 0.0522 | -0.0222 | |||

| SYK / Stryker Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMB / The Williams Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SCHA / Schwab Strategic Trust - Schwab U.S. Small-Cap ETF | 0.00 | -100.00 | 0.00 | 0.0000 |