Basic Stats

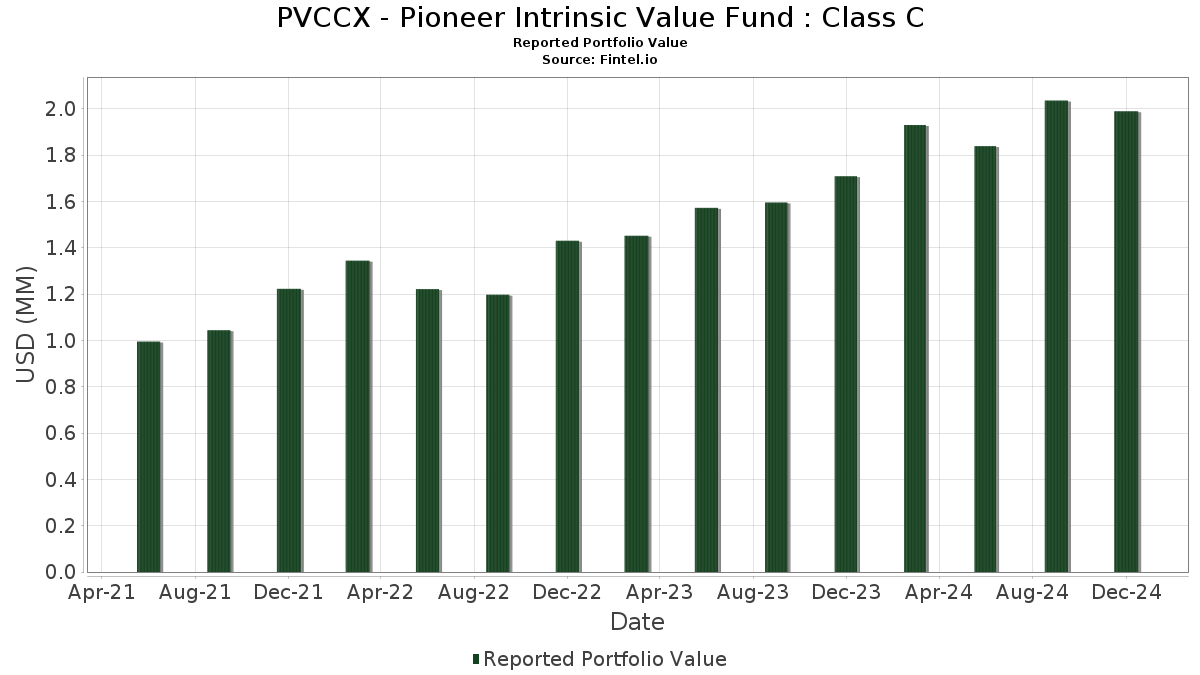

| Portfolio Value | $ 1,989,646 |

| Current Positions | 55 |

Latest Holdings, Performance, AUM (from 13F, 13D)

PVCCX - Pioneer Intrinsic Value Fund : Class C has disclosed 55 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,989,646 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). PVCCX - Pioneer Intrinsic Value Fund : Class C’s top holdings are United Parcel Service, Inc. (US:UPS) , Wells Fargo & Company (US:WFC) , Bank of America Corporation (US:BAC) , Exxon Mobil Corporation (US:XOM) , and International Business Machines Corporation (US:IBM) . PVCCX - Pioneer Intrinsic Value Fund : Class C’s new positions include Zimmer Biomet Holdings, Inc. (US:ZBH) , Host Hotels & Resorts, Inc. (US:HST) , Prudential Financial, Inc. (US:PRU) , Comerica Incorporated (US:CMA) , and ON Semiconductor Corporation (US:ON) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.03 | 1.2899 | 1.2899 | |

| 0.00 | 0.02 | 1.2236 | 1.2236 | |

| 0.00 | 0.02 | 1.0168 | 1.0168 | |

| 0.00 | 0.06 | 3.0291 | 0.9776 | |

| 0.00 | 0.02 | 0.9582 | 0.9582 | |

| 0.00 | 0.02 | 0.9513 | 0.9513 | |

| 0.00 | 0.04 | 1.9885 | 0.9197 | |

| 0.00 | 0.02 | 0.8612 | 0.8612 | |

| 0.00 | 0.03 | 1.5537 | 0.7806 | |

| 0.00 | 0.01 | 0.7098 | 0.7098 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.03 | 1.4325 | -2.2828 | |

| 0.00 | 0.02 | 0.9744 | -1.4028 | |

| 0.00 | 0.03 | 1.4549 | -1.0352 | |

| 0.00 | 0.06 | 2.9246 | -0.9442 | |

| 0.00 | 0.01 | 0.4640 | -0.7666 | |

| 0.00 | 0.07 | 3.5880 | -0.7651 | |

| 0.00 | 0.05 | 2.3220 | -0.7575 | |

| 0.00 | 0.01 | 0.6828 | -0.7293 | |

| 0.00 | 0.01 | 0.7006 | -0.6481 | |

| 0.00 | 0.00 | -0.5180 |

13F and Fund Filings

This form was filed on 2025-02-26 for the reporting period 2024-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UPS / United Parcel Service, Inc. | 0.00 | 18.93 | 0.08 | 9.46 | 4.1170 | 0.3439 | |||

| WFC / Wells Fargo & Company | 0.00 | -27.31 | 0.08 | -9.20 | 3.9910 | -0.4603 | |||

| BAC / Bank of America Corporation | 0.00 | 0.00 | 0.07 | 10.61 | 3.7126 | 0.3335 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -9.45 | 0.07 | -16.47 | 3.5880 | -0.7651 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.07 | 0.00 | 3.3501 | -0.0464 | |||

| STT / State Street Corporation | 0.00 | 0.00 | 0.07 | 11.86 | 3.3382 | 0.3048 | |||

| AIG / American International Group, Inc. | 0.00 | 17.32 | 0.06 | 17.65 | 3.0601 | 0.4152 | |||

| JNJ / Johnson & Johnson | 0.00 | 23.30 | 0.06 | 11.11 | 3.0505 | 0.2557 | |||

| MMM / 3M Company | 0.00 | 57.63 | 0.06 | 50.00 | 3.0291 | 0.9776 | |||

| MS / Morgan Stanley | 0.00 | -12.97 | 0.06 | 5.45 | 2.9373 | 0.1162 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -31.49 | 0.06 | -25.00 | 2.9246 | -0.9442 | |||

| TFC / Truist Financial Corporation | 0.00 | 0.00 | 0.06 | 1.79 | 2.8786 | 0.0175 | |||

| COG / Cabot Oil & Gas Corp. | 0.00 | 0.00 | 0.05 | 8.00 | 2.7425 | 0.1499 | |||

| TGT / Target Corporation | 0.00 | 47.71 | 0.05 | 30.00 | 2.6399 | 0.5625 | |||

| LYB / LyondellBasell Industries N.V. | 0.00 | 22.47 | 0.05 | -5.77 | 2.4923 | -0.1568 | |||

| ES / Eversource Energy | 0.00 | 11.33 | 0.05 | -5.88 | 2.4488 | -0.1787 | |||

| COP / ConocoPhillips | 0.00 | -19.30 | 0.05 | -23.33 | 2.3220 | -0.7575 | |||

| NTRS / Northern Trust Corporation | 0.00 | -11.86 | 0.05 | 0.00 | 2.3069 | -0.0106 | |||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.04 | -12.00 | 2.2452 | -0.3058 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.00 | 13.53 | 0.04 | -4.44 | 2.1855 | -0.1335 | |||

| VZ / Verizon Communications Inc. | 0.00 | 19.24 | 0.04 | 8.11 | 2.0260 | 0.1024 | |||

| RJF / Raymond James Financial, Inc. | 0.00 | 0.00 | 0.04 | 25.81 | 2.0144 | 0.4134 | |||

| CMCSA / Comcast Corporation | 0.00 | 108.75 | 0.04 | 85.71 | 1.9885 | 0.9197 | |||

| BMY / Bristol-Myers Squibb Company | 0.00 | -22.58 | 0.04 | -15.22 | 1.9865 | -0.3798 | |||

| GPC / Genuine Parts Company | 0.00 | 48.76 | 0.03 | 21.43 | 1.7617 | 0.3334 | |||

| CPB / The Campbell's Company | 0.00 | 26.82 | 0.03 | 23.08 | 1.6590 | 0.0785 | |||

| DUK / Duke Energy Corporation | 0.00 | 16.86 | 0.03 | 6.67 | 1.6582 | 0.1273 | |||

| EBAY / eBay Inc. | 0.00 | -2.10 | 0.03 | -8.82 | 1.6006 | -0.1317 | |||

| PCAR / PACCAR Inc | 0.00 | 92.21 | 0.03 | 100.00 | 1.5537 | 0.7806 | |||

| MOS / The Mosaic Company | 0.00 | 15.67 | 0.03 | 7.41 | 1.4835 | 0.0748 | |||

| TAP / Molson Coors Beverage Company | 0.00 | -40.89 | 0.03 | -41.67 | 1.4549 | -1.0352 | |||

| DE / Deere & Company | 0.00 | -61.71 | 0.03 | -61.64 | 1.4325 | -2.2828 | |||

| F / Ford Motor Company | 0.00 | 0.00 | 0.03 | -6.90 | 1.3833 | -0.1042 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | 0.03 | 1.2899 | 1.2899 | |||||

| HST / Host Hotels & Resorts, Inc. | 0.00 | 0.02 | 1.2236 | 1.2236 | |||||

| CFG / Citizens Financial Group, Inc. | 0.00 | 0.00 | 0.02 | 9.52 | 1.1615 | 0.0626 | |||

| EXPE / Expedia Group, Inc. | 0.00 | 0.00 | 0.02 | 22.22 | 1.1565 | 0.2303 | |||

| DDS / Dillard's, Inc. | 0.00 | 77.78 | 0.02 | 100.00 | 1.0457 | 0.5187 | |||

| DGCXX / Dreyfus Government Cash Management Funds - Dreyfus Government Cash Management Fund Institutional Shares | 0.02 | -4.14 | 0.02 | -4.76 | 1.0271 | -0.0530 | |||

| PRU / Prudential Financial, Inc. | 0.00 | 0.02 | 1.0168 | 1.0168 | |||||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 89.25 | 0.02 | 90.00 | 1.0044 | 0.4890 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | -57.48 | 0.02 | -58.70 | 0.9744 | -1.4028 | |||

| RRC / Range Resources Corporation | 0.00 | -24.68 | 0.02 | -14.29 | 0.9586 | -0.1383 | |||

| CMA / Comerica Incorporated | 0.00 | 0.02 | 0.9582 | 0.9582 | |||||

| ON / ON Semiconductor Corporation | 0.00 | 0.02 | 0.9513 | 0.9513 | |||||

| DHLGY / Deutsche Post AG - Depositary Receipt (Common Stock) | 0.00 | 0.02 | 0.8612 | 0.8612 | |||||

| CB / Chubb Limited | 0.00 | 48.65 | 0.02 | 50.00 | 0.7668 | 0.2240 | |||

| US21871X1090 / Corebridge Financial, Inc. | 0.00 | 0.01 | 0.7098 | 0.7098 | |||||

| NEM / Newmont Corporation | 0.00 | -24.80 | 0.01 | -50.00 | 0.7006 | -0.6481 | |||

| CI / The Cigna Group | 0.00 | -34.67 | 0.01 | -13.33 | 0.6828 | -0.7293 | |||

| BIIB / Biogen Inc. | 0.00 | 0.01 | 0.6328 | 0.6328 | |||||

| AGCO / AGCO Corporation | 0.00 | 0.01 | 0.5330 | 0.5330 | |||||

| VLO / Valero Energy Corporation | 0.00 | -54.82 | 0.01 | -52.63 | 0.4640 | -0.7666 | |||

| WHR / Whirlpool Corporation | 0.00 | -20.00 | 0.01 | -10.00 | 0.4621 | -0.0822 | |||

| HAL / Halliburton Company | 0.00 | -13.02 | 0.01 | -25.00 | 0.4583 | -0.2562 | |||

| ZM / Zoom Communications Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5180 |