Basic Stats

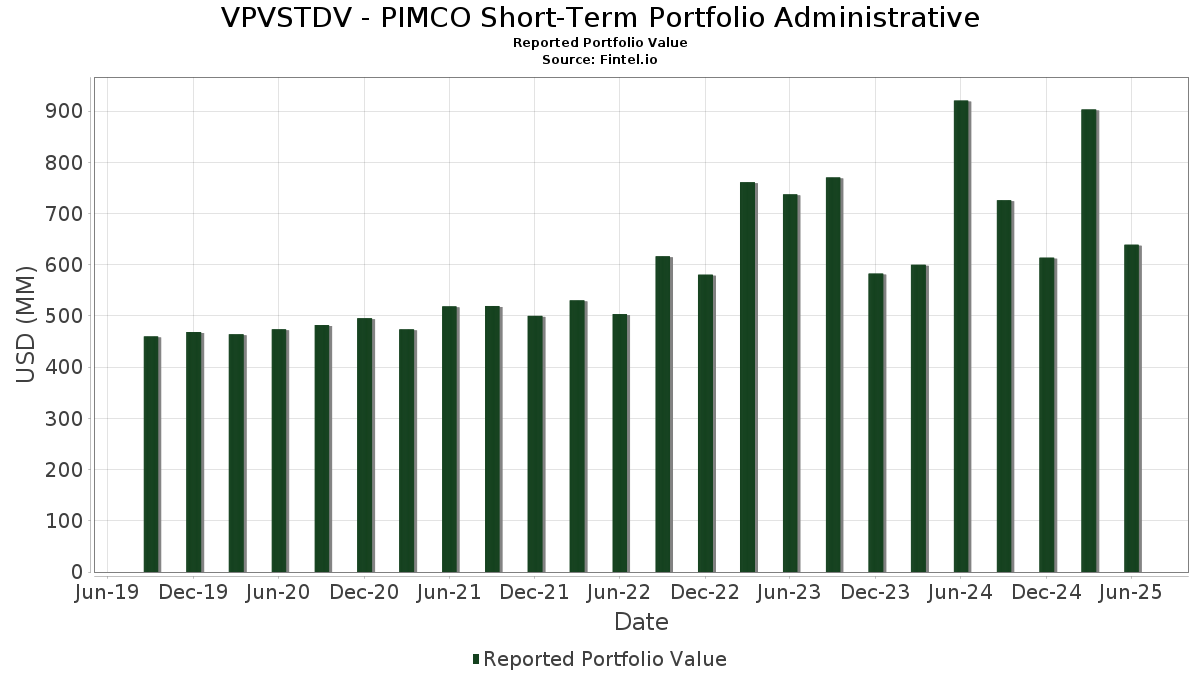

| Portfolio Value | $ 638,944,664 |

| Current Positions | 594 |

Latest Holdings, Performance, AUM (from 13F, 13D)

VPVSTDV - PIMCO Short-Term Portfolio Administrative has disclosed 594 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 638,944,664 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). VPVSTDV - PIMCO Short-Term Portfolio Administrative’s top holdings are PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , Bayer US Finance II LLC (US:US07274NAJ28) , TRILLIUM CREDIT CARD TRUST II SER 2023-3A CL A V/R REGD 144A P/P 6.16523200 (CA:US89621ABT51) , and Hyundai Capital America (US:US44891ACL98) . VPVSTDV - PIMCO Short-Term Portfolio Administrative’s new positions include PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , Bayer US Finance II LLC (US:US07274NAJ28) , TRILLIUM CREDIT CARD TRUST II SER 2023-3A CL A V/R REGD 144A P/P 6.16523200 (CA:US89621ABT51) , and Hyundai Capital America (US:US44891ACL98) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 15.59 | 2.4741 | 2.4741 | ||

| 13.99 | 2.2203 | 2.2203 | ||

| 6.29 | 0.9991 | 0.9991 | ||

| 6.19 | 0.9829 | 0.9829 | ||

| 4.29 | 0.6807 | 0.6807 | ||

| 4.28 | 0.6801 | 0.6801 | ||

| 4.24 | 0.6728 | 0.6728 | ||

| 3.69 | 0.5850 | 0.5850 | ||

| 3.30 | 0.5238 | 0.5238 | ||

| 3.29 | 0.5229 | 0.5229 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 0.0152 | -0.7990 | ||

| -1.57 | -0.2491 | -0.2491 | ||

| 0.05 | 0.0073 | -0.2368 | ||

| 0.70 | 0.1113 | -0.1500 | ||

| 0.80 | 0.1273 | -0.0957 | ||

| 0.81 | 0.1283 | -0.0945 | ||

| -0.58 | -0.0926 | -0.0926 | ||

| 0.71 | 0.1128 | -0.0914 | ||

| 1.37 | 0.2181 | -0.0846 | ||

| 2.51 | 0.3988 | -0.0814 |

13F and Fund Filings

This form was filed on 2025-08-29 for the reporting period 2025-06-30. This investor has not disclosed securities that are counted in shares, so the shares-related columns in the table below are omitted. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US72202G3801 / PIMCO ST FLOATING NAV PORT IV MUTUAL FUND | 28.17 | 1.31 | 4.4709 | 0.0504 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 15.59 | 2.4741 | 2.4741 | |||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 13.99 | 2.2203 | 2.2203 | |||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 8.01 | -5.18 | 1.2708 | -0.0716 | ||

| US07274NAJ28 / Bayer US Finance II LLC | 6.38 | 0.16 | 1.0132 | 0.0000 | ||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 6.29 | 0.9991 | 0.9991 | |||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 6.19 | 0.9829 | 0.9829 | |||

| US89621ABT51 / TRILLIUM CREDIT CARD TRUST II SER 2023-3A CL A V/R REGD 144A P/P 6.16523200 | 6.00 | -0.13 | 0.9531 | -0.0028 | ||

| FANNIE MAE FNR 2025 18 FM / ABS-MBS (US3136BVKH00) | 5.66 | -4.89 | 0.8986 | -0.0477 | ||

| TRILLIUM CREDIT CARD TRUST II TCCT 2024 1A A 144A / ABS-MBS (US89621ABZ12) | 5.51 | -0.04 | 0.8747 | -0.0018 | ||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 5.40 | -0.18 | 0.8570 | -0.0031 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 03/27 VAR / DBT (US04685A3U30) | 5.34 | 0.11 | 0.8479 | -0.0005 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 5.30 | 17.78 | 0.8413 | 0.1257 | ||

| US44891ACL98 / Hyundai Capital America | 5.24 | 3.80 | 0.8315 | 0.0291 | ||

| HSBC26D / HSBC Holdings PLC | 4.91 | -0.32 | 0.7800 | -0.0039 | ||

| US37046US851 / General Motors Financial Co Inc | 4.69 | -0.11 | 0.7451 | -0.0020 | ||

| US22822VAV36 / Crown Castle International Corp | 4.62 | 1.05 | 0.7340 | 0.0064 | ||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 4.61 | -0.30 | 0.7319 | -0.0034 | ||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 4.40 | 158.30 | 0.6991 | 0.4279 | ||

| US576339DJ15 / MASTER CR CARD TR II 23-2A A SOFR30A+85 01/21/2027 144A | 4.40 | -0.18 | 0.6981 | -0.0025 | ||

| FREDDIE MAC FHR 5526 FA / ABS-MBS (US3137HKT469) | 4.38 | -4.82 | 0.6956 | -0.0365 | ||

| FREDDIE MAC FHR 5472 FA / ABS-MBS (US3137HHEK38) | 4.32 | -3.98 | 0.6851 | -0.0296 | ||

| FREDDIE MAC FHR 5534 FM / ABS-MBS (US3137HLEP37) | 4.29 | 0.6807 | 0.6807 | |||

| FREDDIE MAC FHR 5549 FA / ABS-MBS (US3137HLST03) | 4.28 | 0.6801 | 0.6801 | |||

| FREDDIE MAC FHR 5546 FB / ABS-MBS (US3137HLME97) | 4.24 | 0.6728 | 0.6728 | |||

| FREDDIE MAC FHR 5532 FA / ABS-MBS (US3137HKPJ74) | 4.19 | -4.88 | 0.6651 | -0.0353 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 4.11 | 0.29 | 0.6530 | 0.0008 | ||

| VERIZON MASTER TRUST VZMT 2024 1 A1B / ABS-O (US92348KCM36) | 4.01 | -0.05 | 0.6359 | -0.0013 | ||

| MASTER CREDIT CARD TRUST MCCT 2024 1A A 144A / ABS-MBS (US576339DZ56) | 4.01 | -0.10 | 0.6358 | -0.0017 | ||

| MORGAN STANLEY BANK NA SR UNSECURED 10/27 VAR / DBT (US61690U8F08) | 4.00 | -0.12 | 0.6355 | -0.0018 | ||

| US38383KEF57 / GOVERNMENT NATIONAL MORTGAGE A GNR 2023 H22 FB | 3.94 | -0.40 | 0.6258 | -0.0035 | ||

| US09659W2N34 / BNP Paribas SA | 3.93 | 55.27 | 0.6240 | 0.2214 | ||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 3.91 | 0.00 | 0.6206 | -0.0010 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 3.69 | 0.5850 | 0.5850 | |||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 3.63 | 226.06 | 0.5762 | 0.3991 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 3.60 | 5.79 | 0.5716 | 0.0304 | ||

| US842400GV99 / Southern California Edison Co., Series 20C | 3.41 | 0.47 | 0.5417 | 0.0017 | ||

| US46647PCY07 / JPMorgan Chase & Co | 3.33 | -0.15 | 0.5284 | -0.0018 | ||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 3.30 | 0.5238 | 0.5238 | |||

| FREDDIE MAC FHR 5549 CF / ABS-MBS (US3137HLSA12) | 3.29 | 0.5229 | 0.5229 | |||

| US90932LAG23 / United Airlines Inc | 3.28 | 0.5207 | 0.5207 | |||

| FREDDIEMAC STRIP FHS 413 F25 / ABS-MBS (US3133Q3LH28) | 3.17 | -12.57 | 0.5025 | -0.0732 | ||

| US08576PAH47 / Berry Global Inc | 3.04 | 0.73 | 0.4833 | 0.0028 | ||

| PIKES PEAK CLO PIPK 2019 4A ARR 144A / ABS-CBDO (US72132WAN92) | 3.00 | 0.27 | 0.4766 | 0.0005 | ||

| GREYWOLF CLO LTD GWOLF 2020 3RA A1R2 144A / ABS-CBDO (US39809CAY03) | 2.91 | 0.24 | 0.4614 | 0.0003 | ||

| US69335PFA84 / PFSFC 23-D A 144A FRN (SOFR30A+115) 08-16-27/08-15-25 | 2.90 | -0.17 | 0.4607 | -0.0015 | ||

| FANNIE MAE FNR 2024 103 FC / ABS-MBS (US3136BUQH62) | 2.81 | -4.36 | 0.4461 | -0.0211 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 08/26 VAR / DBT (US928668CJ93) | 2.81 | 0.07 | 0.4459 | -0.0004 | ||

| FANNIE MAE FNR 2024 104 FA / ABS-MBS (US3136BUEQ99) | 2.81 | -4.23 | 0.4454 | -0.0206 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.71 | 0.04 | 0.4308 | -0.0006 | ||

| XS2683120211 / Avon Finance No.4 PLC | 2.71 | 0.93 | 0.4300 | 0.0033 | ||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 2.67 | 0.34 | 0.4245 | 0.0007 | ||

| US251526CE71 / DEUTSCHE BANK AG NEW YORK BNCH 2.129%/VAR 11/24/2026 | 2.67 | 0.79 | 0.4243 | 0.0027 | ||

| US05583JAN28 / BPCE SA | 2.57 | 239.55 | 0.4076 | 0.2872 | ||

| FREDDIE MAC FHR 5544 F / ABS-MBS (US3137HLNN87) | 2.55 | 0.4052 | 0.4052 | |||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 2.52 | -5.94 | 0.3999 | -0.0259 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 2.51 | -16.82 | 0.3988 | -0.0814 | ||

| ARES CLO LTD ARES 2015 2A AR3 144A / ABS-CBDO (US04015GAX79) | 2.51 | 0.20 | 0.3981 | 0.0000 | ||

| TRALEE CLO LTD TRAL 2018 5A A1RR 144A / ABS-CBDO (US89300JBA51) | 2.40 | 0.13 | 0.3814 | -0.0001 | ||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 2.40 | 0.63 | 0.3814 | 0.0018 | ||

| DRYDEN SENIOR LOAN FUND DRSLF 2021 95A AR 144A / ABS-CBDO (US262487AJ07) | 2.39 | -0.21 | 0.3801 | -0.0015 | ||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/28 VAR / DBT (US05565ECX13) | 2.39 | 59.81 | 0.3800 | 0.1417 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 2.39 | 0.3795 | 0.3795 | |||

| US055742AA88 / BSST MORTGAGE TRUST BSST 2022 1700 A 144A | 2.35 | 1.08 | 0.3727 | 0.0034 | ||

| US00217VAA89 / AREIT 2022-CRE7 LLC | 2.31 | -10.77 | 0.3671 | -0.0450 | ||

| FANNIE MAE FNR 2024 101 FB / ABS-MBS (US3136BUFJ48) | 2.31 | -2.45 | 0.3663 | -0.0098 | ||

| US05583JAH59 / BPCE SA | 2.28 | 190.20 | 0.3621 | 0.2370 | ||

| FREDDIE MAC FHR 5500 GF / ABS-MBS (US3137HJB303) | 2.25 | -4.91 | 0.3565 | -0.0192 | ||

| FREDDIE MAC FHR 5517 FE / ABS-MBS (US3137HKGJ75) | 2.22 | -6.26 | 0.3520 | -0.0241 | ||

| US91282CAQ42 / USTN TII 0.125% 10/15/2025 | 2.22 | 0.54 | 0.3520 | 0.0014 | ||

| US15032DAR26 / Cedar Funding VI CLO Ltd | 2.21 | 0.3502 | 0.3502 | |||

| US38145GAN07 / Goldman Sachs Group Inc/The | 2.20 | -0.23 | 0.3496 | -0.0014 | ||

| US31429KAK97 / Federation des Caisses Desjardins du Quebec | 2.20 | -12.00 | 0.3495 | -0.0481 | ||

| FREDDIE MAC FHR 5496 AF / ABS-MBS (US3137HHZL81) | 2.19 | -2.79 | 0.3481 | -0.0105 | ||

| US30227FAA84 / Extended Stay America Trust | 2.15 | -0.83 | 0.3407 | -0.0035 | ||

| US86562MCU27 / Sumitomo Mitsui Financial Group Inc | 2.11 | -0.28 | 0.3353 | -0.0015 | ||

| US42806MBS70 / Hertz Vehicle Financing III LLC | 2.11 | -0.14 | 0.3352 | -0.0010 | ||

| CITIBANK NA SR UNSECURED 08/26 VAR / DBT (US17325FBH01) | 2.11 | -0.14 | 0.3342 | -0.0011 | ||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 2.10 | -0.14 | 0.3337 | -0.0011 | ||

| US65480CAC91 / NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/26 1.85 | 2.10 | 0.48 | 0.3333 | 0.0010 | ||

| US412822AD08 / Harley-Davidson, Inc. | 2.10 | 11.07 | 0.3329 | 0.0325 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 2.06 | 0.3275 | 0.3275 | |||

| US20048FAA66 / COMM MORTGAGE TRUST COMM 2021 2400 A 144A | 2.03 | -0.20 | 0.3222 | -0.0012 | ||

| US05591UAA51 / BSREP COMMERCIAL MORTGAGE TRUST 2021-DC BSREP 2021-DC A | 2.03 | -0.25 | 0.3218 | -0.0013 | ||

| FANNIE MAE FNR 2024 90 FB / ABS-MBS (US3136BTXD03) | 2.02 | -4.85 | 0.3210 | -0.0170 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 2.01 | 0.35 | 0.3187 | 0.0005 | ||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2.01 | -0.20 | 0.3184 | -0.0013 | ||

| PNC BANK NA SR UNSECURED 01/27 VAR / DBT (US69353RFW34) | 2.00 | -0.10 | 0.3176 | -0.0009 | ||

| FREDDIE MAC FHR 5480 FG / ABS-MBS (US3137HHUD11) | 1.99 | -9.50 | 0.3162 | -0.0337 | ||

| TSY INFL IX N/B 04/29 2.125 / DBT (US91282CKL45) | 1.98 | 0.76 | 0.3145 | 0.0017 | ||

| CARVAL CLO LTD CARVL 2018 1A AR 144A / ABS-CBDO (US146865AJ95) | 1.97 | -3.82 | 0.3121 | -0.0130 | ||

| GOLDEN CREDIT CARD TRUST GCCT 2022 1A A 144A / ABS-MBS (US380881FE74) | 1.93 | 0.78 | 0.3067 | 0.0020 | ||

| XS1235295539 / WHITBREAD GROUP PLC 3.375% 10/16/2025 REGS | 1.91 | 6.82 | 0.3036 | 0.0190 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U7Z70) | 1.91 | -0.21 | 0.3035 | -0.0010 | ||

| FANNIE MAE FNR 2025 52 FB / ABS-MBS (US3136BWUZ70) | 1.90 | 0.3023 | 0.3023 | |||

| US02665WES61 / American Honda Finance Corp. | 1.90 | -0.05 | 0.3020 | -0.0007 | ||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 1.90 | 0.05 | 0.3019 | -0.0002 | ||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 07/26 VAR / DBT (US58769JAV98) | 1.90 | -0.05 | 0.3017 | -0.0005 | ||

| FANNIE MAE GS 3353 FNR GS 3353 F SOFR30A+120BP / ABS-MBS (955RVTII1) | 1.90 | 0.3015 | 0.3015 | |||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 1.85 | 5.30 | 0.2935 | 0.0143 | ||

| US899062BQ58 / Tulane Univ La Rfdg-tulane Univ-c Bond | 1.85 | 0.27 | 0.2933 | 0.0005 | ||

| SWED A / Swedbank AB (publ) | 1.84 | 0.44 | 0.2916 | 0.0007 | ||

| FREDDIE MAC FHR 5493 FK / ABS-MBS (US3137HHWV90) | 1.83 | -6.21 | 0.2904 | -0.0197 | ||

| FREDDIE MAC FHR 5481 FJ / ABS-MBS (US3137HHQ958) | 1.81 | -6.08 | 0.2870 | -0.0190 | ||

| D05 / DBS Group Holdings Ltd | 1.80 | -14.31 | 0.2863 | -0.0483 | ||

| GLENCORE FUNDING LLC COMPANY GUAR 144A 10/26 VAR / DBT (US378272BX50) | 1.80 | -0.06 | 0.2857 | -0.0007 | ||

| FREDDIE MAC FHR 5517 VF / ABS-MBS (US3137HKP400) | 1.80 | -4.82 | 0.2853 | -0.0150 | ||

| COREBRIDGE GLOB FUNDING SECURED 144A 01/28 VAR / DBT (US00138CBE75) | 1.79 | -0.22 | 0.2846 | -0.0012 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2024 D A1B 144A / ABS-O (US83207QAB59) | 1.78 | -3.10 | 0.2825 | -0.0094 | ||

| FREDDIE MAC FHR 5511 FG / ABS-MBS (US3137HKKP89) | 1.78 | -9.05 | 0.2823 | -0.0286 | ||

| US92332LAU35 / VENTURE CDO LTD VENTR 2019 36A A1AR 144A | 1.72 | -18.05 | 0.2733 | -0.0607 | ||

| FANNIE MAE FNR 2025 19 FC / ABS-MBS (US3136BVBY34) | 1.72 | -4.03 | 0.2725 | -0.0119 | ||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/27 VAR / DBT (US05565ECV56) | 1.70 | 0.24 | 0.2701 | 0.0002 | ||

| US25160PAJ66 / Deutsche Bank AG/New York NY | 1.70 | -0.29 | 0.2700 | -0.0012 | ||

| WELF 2021 1A A1R TSFR3M 04/34 5.49348 / ABS-MBS (000000000) | 1.70 | 0.2698 | 0.2698 | |||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1.70 | -0.12 | 0.2695 | -0.0007 | ||

| FANNIE MAE FNR 2025 16 FA / ABS-MBS (US3136BU5D84) | 1.69 | -5.48 | 0.2685 | -0.0160 | ||

| VOLVO FINANCIAL EQUIPMENT LLC VFET 2024 1A A2 144A / ABS-O (US92887QAB32) | 1.68 | -6.50 | 0.2674 | -0.0191 | ||

| US853254BZ29 / Standard Chartered PLC | 1.67 | 0.84 | 0.2654 | 0.0018 | ||

| US00130HCE36 / CORP. NOTE | 1.67 | 0.85 | 0.2647 | 0.0018 | ||

| US817826AC47 / 7-Eleven Inc | 1.66 | 0.2639 | 0.2639 | |||

| BOQPF / Bank of Queensland Limited - Preferred Stock | 1.65 | 5.38 | 0.2614 | 0.0130 | ||

| US33767JAA07 / FirstKey Homes 2020-SFR2 Trust | 1.64 | -2.55 | 0.2606 | -0.0072 | ||

| BANQUE FED CRED MUTUEL BANQUE FED CRED MUTUEL / DBT (US06675DCL47) | 1.61 | -0.19 | 0.2553 | -0.0009 | ||

| CARMAX AUTO OWNER TRUST CARMX 2025 2 A2A / ABS-O (US14320AAB70) | 1.61 | 0.2549 | 0.2549 | |||

| US456837AX12 / ING Groep NV | 1.60 | 45.29 | 0.2547 | 0.0790 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/27 VAR / DBT (US928668CT75) | 1.60 | 0.2538 | 0.2538 | |||

| US345397XL24 / FORD MOTOR CREDIT CO LLC | 1.60 | 129.60 | 0.2537 | 0.1430 | ||

| US62955HAA59 / NYO COMMERCIAL MORTGAGE TRUST 2021-1290 SER 2021-1290 CL A V/R REGD 144A P/P 1.17500000 | 1.60 | 0.50 | 0.2536 | 0.0010 | ||

| TIAA CLO LTD TIA 2018 1A A1AR 144A / ABS-CBDO (US88631YAL11) | 1.57 | -6.70 | 0.2500 | -0.0183 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H01 FB / ABS-MBS (US38383KNN80) | 1.55 | -2.02 | 0.2460 | -0.0054 | ||

| US36265QAE61 / GMCAR 2022-4 A4 | 1.51 | 0.07 | 0.2395 | -0.0001 | ||

| US37045XDZ69 / General Motors Financial Co Inc | 1.50 | -0.33 | 0.2389 | -0.0011 | ||

| FORD CREDIT FLOORPLAN MASTER O FORDF 2024 3 A2 144A / ABS-O (US34528QJL95) | 1.50 | -0.07 | 0.2387 | -0.0005 | ||

| US65535HAR03 / Nomura Holdings Inc | 1.50 | 0.67 | 0.2378 | 0.0012 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2024 2 A2 144A / ABS-O (US29375RAB24) | 1.42 | -20.70 | 0.2256 | -0.0593 | ||

| US13607LWU33 / Canadian Imperial Bank of Commerce | 1.41 | -0.21 | 0.2243 | -0.0008 | ||

| US65535HBG39 / Nomura Holdings Inc | 1.41 | -0.21 | 0.2234 | -0.0008 | ||

| COOPERAT RABOBANK UA/NY SR UNSECURED 03/27 VAR / DBT (US21688ABE10) | 1.41 | 0.00 | 0.2231 | -0.0004 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.40 | -0.43 | 0.2229 | -0.0013 | ||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2015 6A AR3 144A / ABS-CBDO (US03328QBL41) | 1.40 | 0.14 | 0.2227 | -0.0000 | ||

| US06738EBZ79 / Barclays PLC | 1.40 | 366.67 | 0.2223 | 0.1745 | ||

| US90353TAK60 / Uber Technologies Inc | 1.39 | 254.20 | 0.2211 | 0.1585 | ||

| FREDDIE MAC FHR 5484 FA / ABS-MBS (US3137HHKS99) | 1.38 | -7.80 | 0.2196 | -0.0190 | ||

| US07336CAA18 / BDS 2022-FL12 LLC | 1.37 | -27.80 | 0.2181 | -0.0846 | ||

| US08576PAF80 / Berry Global Inc | 1.35 | 0.2138 | 0.2138 | |||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.31 | 0.46 | 0.2085 | 0.0006 | ||

| US90353TAE01 / Uber Technologies Inc | 1.31 | 159.29 | 0.2083 | 0.1278 | ||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ACW53) | 1.31 | -0.46 | 0.2076 | -0.0013 | ||

| US0158578734 / Algonquin Power & Utilities Corp | 1.31 | 0.00 | 0.2075 | -0.0005 | ||

| US90353TAG58 / Uber Technologies Inc | 1.31 | -0.23 | 0.2075 | -0.0008 | ||

| US63906EB929 / NatWest Markets PLC | 1.30 | -0.08 | 0.2070 | -0.0005 | ||

| US05401AAK79 / Avolon Holdings Funding Ltd | 1.30 | -0.23 | 0.2067 | -0.0009 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 1.30 | 0.08 | 0.2067 | -0.0002 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 1.30 | 29.48 | 0.2065 | 0.0467 | ||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1.30 | 0.00 | 0.2062 | -0.0004 | ||

| US085770AA31 / Berry Global Escrow Corp. | 1.28 | 0.00 | 0.2026 | -0.0004 | ||

| US22535WAH07 / Credit Agricole SA | 1.28 | 162.35 | 0.2024 | 0.1251 | ||

| US55336VBR06 / MPLX LP | 1.28 | 336.64 | 0.2024 | 0.1559 | ||

| US29374LAB62 / Enterprise Fleet Financing 2023-3 LLC | 1.27 | -12.94 | 0.2020 | -0.0305 | ||

| US10921U2C16 / Brighthouse Financial Global Funding | 1.26 | 0.88 | 0.2008 | 0.0014 | ||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075479) | 1.25 | 5.29 | 0.1991 | 0.0096 | ||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 PJ7 A25 144A / ABS-MBS (US362949BR97) | 1.22 | -8.36 | 0.1933 | -0.0179 | ||

| ACA / Crédit Agricole S.A. | 1.21 | -0.25 | 0.1919 | -0.0007 | ||

| BANQUE FED CRED MUTUEL BANQUE FED CRED MUTUEL / DBT (US06675DCH35) | 1.21 | -0.25 | 0.1917 | -0.0008 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 1.20 | 0.00 | 0.1913 | -0.0003 | ||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 1.20 | -0.08 | 0.1911 | -0.0004 | ||

| US38141GXN95 / Goldman Sachs Group Inc/The | 1.20 | -0.08 | 0.1908 | -0.0004 | ||

| BACR / Barclays Bank PLC - Corporate Bond/Note | 1.20 | 0.08 | 0.1904 | -0.0001 | ||

| US23636AAZ49 / Danske Bank A/S | 1.19 | 0.76 | 0.1893 | 0.0011 | ||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2023 2A AR 144A / ABS-CBDO (XS2878983712) | 1.19 | -11.43 | 0.1883 | -0.0246 | ||

| AU3FN0055299 / UBS AG AUSTRALIA | 1.19 | 5.24 | 0.1881 | 0.0091 | ||

| US05369AAK79 / Aviation Capital Group LLC | 1.18 | 34.36 | 0.1875 | 0.0477 | ||

| US654740BS71 / Nissan Motor Acceptance Corp | 1.17 | 1.21 | 0.1858 | 0.0020 | ||

| US165183CV43 / Chesapeake Funding II LLC, Series 2023-1A, Class A2 | 1.17 | -17.92 | 0.1855 | -0.0407 | ||

| US05369AAL52 / Aviation Capital Group LLC | 1.16 | 0.78 | 0.1844 | 0.0011 | ||

| COLT FUNDING LLC COLT 2024 1 A1 144A / ABS-MBS (US19688TAA34) | 1.13 | -10.38 | 0.1796 | -0.0212 | ||

| US842400HU08 / Southern California Edison Co | 1.11 | 0.1769 | 0.1769 | |||

| JOHN DEERE CAPITAL CORP JOHN DEERE CAPITAL CORP / DBT (US24422EXW47) | 1.11 | 0.09 | 0.1757 | -0.0002 | ||

| US969457CH11 / Williams Cos Inc/The | 1.11 | 450.25 | 0.1756 | 0.1436 | ||

| FANNIE MAE FNR 2024 95 KF / ABS-MBS (US3136BTS533) | 1.10 | -4.17 | 0.1752 | -0.0080 | ||

| MORGAN STANLEY BANK NA SR UNSECURED 05/28 VAR / DBT (US61690U8C76) | 1.10 | -0.09 | 0.1752 | -0.0004 | ||

| GOLDMAN SACHS BANK USA GOLDMAN SACHS BANK USA / DBT (US38151LAH33) | 1.10 | 22.28 | 0.1751 | 0.0316 | ||

| MMAF EQUIPMENT FINANCE LLC MMAF 2024 A A2 144A / ABS-O (US55318CAB00) | 1.10 | -20.36 | 0.1751 | -0.0452 | ||

| US36261WAA53 / GS MORTGAGE BACKED SECURITIES GSMBS 2021 RPL1 A1 144A | 1.10 | -3.50 | 0.1750 | -0.0068 | ||

| 43AB / Rolls-Royce plc - Corporate Bond/Note | 1.10 | 37.77 | 0.1744 | 0.0476 | ||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 VAR / DBT (US44891ADS33) | 1.10 | -0.09 | 0.1744 | -0.0004 | ||

| US654744AB77 / Nissan Motor Co Ltd | 1.09 | 0.46 | 0.1736 | 0.0006 | ||

| US38382Y5K59 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H12 CL FA V/R 6.06629000 | 1.05 | -2.32 | 0.1674 | -0.0043 | ||

| FANNIE MAE FNR 2024 77 DF / ABS-MBS (US3136BTWY58) | 1.05 | 0.1671 | 0.1671 | |||

| US06675FBB22 / Banque Federative du Credit Mutuel SA | 1.04 | 0.48 | 0.1648 | 0.0005 | ||

| US50200YAQ17 / LCM LTD PARTNERSHIP LCM 30A AR 144A | 1.02 | -20.76 | 0.1624 | -0.0429 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 NQM3 A1 144A / ABS-MBS (US67118KAA16) | 1.02 | -7.76 | 0.1622 | -0.0141 | ||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 1.01 | -0.20 | 0.1604 | -0.0006 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1.01 | -0.20 | 0.1602 | -0.0006 | ||

| US17325FBD96 / Citibank NA | 1.01 | -0.10 | 0.1599 | -0.0005 | ||

| HCA INC COMPANY GUAR 03/28 VAR / DBT (US404119CX50) | 1.01 | -28.55 | 0.1597 | -0.0643 | ||

| US00084DBC39 / ABN AMRO Bank NV | 1.01 | -0.40 | 0.1596 | -0.0010 | ||

| US682680BD48 / ONEOK Inc | 1.01 | -0.20 | 0.1596 | -0.0007 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1.01 | 0.10 | 0.1596 | -0.0001 | ||

| US780153BJ00 / Royal Caribbean Cruises Ltd | 1.00 | 0.1594 | 0.1594 | |||

| BAYVIEW OPPORTUNITY MASTER FUN BVINV 2025 3 AF1 144A / ABS-MBS (US67648CAU45) | 1.00 | 0.1591 | 0.1591 | |||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 1.00 | -0.10 | 0.1591 | -0.0004 | ||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 2 A 144A / ABS-O (US83407HAA59) | 1.00 | 0.1590 | 0.1590 | |||

| US38145GAM24 / Goldman Sachs Group Inc/The | 1.00 | 0.1590 | 0.1590 | |||

| TRINITAS CLO LTD TRNTS 2020 12A A1R 144A / ABS-CBDO (US89641GAN25) | 1.00 | 0.10 | 0.1589 | -0.0002 | ||

| DELL EQUIPMENT FINANCE TRUST DEFT 2024 2 A2 144A / ABS-O (US24704EAC21) | 1.00 | -0.10 | 0.1589 | -0.0004 | ||

| US14161GCF54 / CARDS II TRUST SER 2023-2A CL A V/R REGD 144A P/P 5.92649700 | 1.00 | -0.10 | 0.1588 | -0.0005 | ||

| US00928QAT85 / Aircastle Ltd | 1.00 | -0.10 | 0.1587 | -0.0004 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 2A A1R 144A / ABS-CBDO (US05684RAL69) | 1.00 | 0.10 | 0.1586 | -0.0001 | ||

| US37046US851 / General Motors Financial Co Inc | 1.00 | -0.50 | 0.1586 | -0.0011 | ||

| US251526BZ10 / Deutsche Bank AG/New York NY | 1.00 | 0.10 | 0.1582 | -0.0001 | ||

| US647622AA79 / New Orleans Hotel Trust 2019-HNLA | 0.99 | 0.40 | 0.1576 | 0.0004 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2025 A A1B 144A / ABS-O (US83207EAB20) | 0.99 | 0.1576 | 0.1576 | |||

| AU3CB0261576 / INCITEC PIVOT | 0.99 | 44.51 | 0.1567 | 0.0480 | ||

| XS2283175516 / Standard Chartered PLC | 0.98 | 0.82 | 0.1561 | 0.0011 | ||

| FANNIE MAE FNR 2025 35 FB / ABS-MBS (US3136BVF783) | 0.96 | 0.1532 | 0.1532 | |||

| US74977RDL50 / Cooperatieve Rabobank UA | 0.96 | 0.84 | 0.1531 | 0.0010 | ||

| TOWD POINT MORTGAGE FUNDING TPMF 2024 GR6A A1 144A / ABS-MBS (XS2799791848) | 0.96 | -0.52 | 0.1518 | -0.0010 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 02/26 VAR / DBT (AU3FN0075313) | 0.92 | 5.36 | 0.1467 | 0.0071 | ||

| US63906EB929 / NatWest Markets PLC | 0.92 | 5.25 | 0.1464 | 0.0071 | ||

| SBNA AUTO LEASE TRUST SBALT 2024 B A3 144A / ABS-O (US78437VAE02) | 0.91 | -0.11 | 0.1441 | -0.0004 | ||

| US23341CAC73 / DNB Bank ASA | 0.90 | -0.22 | 0.1434 | -0.0005 | ||

| CCG RECEIVABLES TRUST CCG 2025 1 A2 144A / ABS-O (US12515XAB64) | 0.90 | 0.11 | 0.1432 | -0.0001 | ||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 0.90 | 0.22 | 0.1431 | 0.0001 | ||

| US63906EB929 / NatWest Markets PLC | 0.90 | -0.11 | 0.1430 | -0.0003 | ||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0.90 | 0.67 | 0.1427 | 0.0008 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0.90 | 0.34 | 0.1427 | 0.0002 | ||

| US69291QAA31 / PFP III PFP 2022 9 A 144A | 0.90 | -21.82 | 0.1423 | -0.0401 | ||

| SOUND POINT CLO LTD SNDPT 2020 3A A1R 144A / ABS-CBDO (US83615CAL00) | 0.87 | -10.36 | 0.1388 | -0.0164 | ||

| US63942AAB26 / Navient Private Education Loan Trust 2020-I | 0.87 | -5.23 | 0.1382 | -0.0079 | ||

| US12551JAL08 / CIFC FUNDING LTD CIFC 2017 4A A1R 144A | 0.86 | -23.51 | 0.1369 | -0.0423 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 07/26 VAR / DBT (AU3FN0070181) | 0.86 | 5.26 | 0.1367 | 0.0066 | ||

| US65535HBE80 / Nomura Holdings Inc | 0.86 | 0.00 | 0.1362 | -0.0003 | ||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 C A2A / ABS-O (US448976AB65) | 0.85 | -15.30 | 0.1345 | -0.0245 | ||

| US08162FAF09 / Benchmark 2019-B12 Mortgage Trust | 0.84 | -5.53 | 0.1329 | -0.0081 | ||

| US89178WAU27 / TOWD POINT MORTGAGE TRUST 2020-1 SER 2020-1 CL A1 V/R REGD 144A P/P 2.71000000 | 0.83 | -5.47 | 0.1318 | -0.0080 | ||

| US86563VBF58 / Sumitomo Mitsui Trust Bank Ltd | 0.83 | -0.12 | 0.1317 | -0.0004 | ||

| US92331LBC37 / VENTURE CDO LTD VENTR 2017 27A AR 144A | 0.81 | -42.33 | 0.1283 | -0.0945 | ||

| USY8085FBJ85 / SK Hynix Inc | 0.81 | -0.12 | 0.1282 | -0.0003 | ||

| US63906EB929 / NatWest Markets PLC | 0.80 | 0.00 | 0.1276 | -0.0001 | ||

| US29278GAW87 / Enel Finance International NV | 0.80 | 0.50 | 0.1275 | 0.0004 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 01/28 VAR / DBT (US46849CJN20) | 0.80 | -0.50 | 0.1275 | -0.0008 | ||

| GOLDMAN SACHS BANK USA SR UNSECURED 03/27 VAR / DBT (US38151LAE02) | 0.80 | -42.80 | 0.1273 | -0.0957 | ||

| US05946KAK79 / Banco Bilbao Vizcaya Argentaria S.A. | 0.80 | -0.25 | 0.1273 | -0.0005 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 0.80 | -0.37 | 0.1272 | -0.0006 | ||

| US78449DAC02 / SMB PRIVATE EDUCATION LOAN TRUST 2020-PTB SMB 2020-PTB A2B | 0.80 | -6.99 | 0.1268 | -0.0098 | ||

| FANNIE MAE FNR 2025 4 FB / ABS-MBS (US3136BUU651) | 0.80 | -9.23 | 0.1266 | -0.0131 | ||

| US097023BP90 / Boeing Co. | 0.79 | 0.38 | 0.1259 | 0.0003 | ||

| SEQUOIA MORTGAGE TRUST SEMT 2024 HYB1 A1A 144A / ABS-MBS (US81749EAA38) | 0.79 | -10.94 | 0.1255 | -0.0155 | ||

| TOYOTA LEASE OWNER TRUST TLOT 2024 B A2B 144A / ABS-O (US891943AC65) | 0.79 | -29.26 | 0.1251 | -0.0521 | ||

| US902613AC28 / UBS Group AG | 0.79 | 0.90 | 0.1247 | 0.0009 | ||

| XS2326485898 / BAIN CAPITAL EURO CLO BCCE 2018 2A AR 144A | 0.78 | -10.03 | 0.1238 | -0.0142 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 1 A1 144A / ABS-MBS (US92540EAA10) | 0.77 | -12.49 | 0.1224 | -0.0177 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 9 A11 144A / ABS-MBS (US16160QAX25) | 0.77 | -10.09 | 0.1217 | -0.0139 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 CES3 A1 144A / ABS-MBS (US89183EAA91) | 0.77 | -8.38 | 0.1214 | -0.0114 | ||

| US53947XAA00 / LoanCore 2021-CRE5 Issuer Ltd | 0.76 | -37.42 | 0.1200 | -0.0721 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 NQM6 A1 144A / ABS-MBS (US67118XAA37) | 0.73 | -7.25 | 0.1158 | -0.0093 | ||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 09/26 VAR / DBT (AU3FN0081139) | 0.73 | 5.36 | 0.1154 | 0.0057 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 NQM4 A1 144A / ABS-MBS (US67118TAA25) | 0.73 | -7.16 | 0.1154 | -0.0090 | ||

| US25160PAN78 / Deutsche Bank AG | 0.72 | -0.28 | 0.1139 | -0.0005 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 1 A2B / ABS-O (US14318WAC10) | 0.71 | -44.66 | 0.1128 | -0.0914 | ||

| US83207DAB47 / SMB 23-C A1B 144A (SOFR30A+155) FRN 11-15-52/10-17-33 | 0.71 | -5.84 | 0.1127 | -0.0072 | ||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.71 | -0.42 | 0.1125 | -0.0007 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.71 | -0.28 | 0.1121 | -0.0005 | ||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.71 | 249.01 | 0.1120 | 0.0798 | ||

| US68785CAC55 / Oscar U.S. Funding XV LLC | 0.70 | 0.1118 | 0.1118 | |||

| SHB A / Svenska Handelsbanken AB (publ) | 0.70 | 0.00 | 0.1114 | -0.0002 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A2B 144A / ABS-O (US17331QAC06) | 0.70 | -57.37 | 0.1113 | -0.1500 | ||

| GM FINANCIAL AUTOMOBILE LEASIN GMALT 2025 1 A2B / ABS-O (US36271VAC19) | 0.70 | 0.00 | 0.1112 | -0.0001 | ||

| FANNIE MAE FNR 2025 35 FM / ABS-MBS (US3136BVJ660) | 0.70 | 0.1108 | 0.1108 | |||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.70 | 0.1107 | 0.1107 | |||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.70 | 0.1107 | 0.1107 | |||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 0.70 | 75.95 | 0.1104 | 0.0475 | ||

| US45262BAB99 / IMPERIAL BRANDS FIN PLC REGD 144A P/P 3.50000000 | 0.69 | 0.14 | 0.1098 | 0.0001 | ||

| US00774MAS44 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.69 | 0.59 | 0.1092 | 0.0005 | ||

| US50189XAA37 / LCM LOAN INCOME FUND I LTD SER 1A CL A V/R REGD 144A P/P 6.61775000 | 0.69 | -34.57 | 0.1091 | -0.0578 | ||

| US64033AAA25 / NELNET STUDENT LOAN TRUST 2012-4 NSLT 2012-4A A | 0.68 | -4.08 | 0.1084 | -0.0047 | ||

| US36361UAL44 / Gallatin CLO VIII 2017-1 Ltd | 0.68 | -1.31 | 0.1079 | -0.0016 | ||

| BARCLAYS MORTGAGE LOAN TRUST BARC 2024 NQM1 A1 144A / ABS-MBS (US06745AAA25) | 0.67 | -8.33 | 0.1065 | -0.0099 | ||

| CHESAPEAKE FUNDING II LLC CFII 2024 1A A1 144A / ABS-O (US165183DE19) | 0.67 | -11.66 | 0.1059 | -0.0142 | ||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.66 | 5.25 | 0.1051 | 0.0050 | ||

| BOQPF / Bank of Queensland Limited - Preferred Stock | 0.66 | 5.27 | 0.1047 | 0.0051 | ||

| US36168XAA72 / GCAT 2022-HX1 TRUST SER 2022-HX1 CL A1 V/R REGD 144A P/P 2.88500000 | 0.65 | -2.41 | 0.1031 | -0.0027 | ||

| IL0011746976 / Israel Government Bond - Fixed | 0.64 | 0.1015 | 0.1015 | |||

| FANNIE MAE FNR 2025 6 FA / ABS-MBS (US3136BUTN04) | 0.63 | -7.45 | 0.1007 | -0.0083 | ||

| PROGRESS TRUST PROGS 2020 1 A / ABS-MBS (AU3FN0053294) | 0.63 | -2.63 | 0.0999 | -0.0028 | ||

| XS2499838881 / KINBANE 2022-RPL 1 DAC SER 2022-RPL1A CL A V/R REGD 144A P/P /EUR/ 0.00000000 | 0.62 | 5.60 | 0.0987 | 0.0050 | ||

| US36262JAJ43 / GS MORTGAGE-BACKED SECURITIES TRUST 2021-GR2 SER 2021-GR2 CL A9 V/R REGD 144A P/P 0.90000000 | 0.62 | -1.91 | 0.0980 | -0.0021 | ||

| US64830VAA17 / CORP CMO | 0.62 | -2.84 | 0.0979 | -0.0031 | ||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.61 | 0.66 | 0.0974 | 0.0004 | ||

| BANQUE FED CRED MUTUEL REGS 07/26 VAR / DBT (USF0803NAF99) | 0.61 | -0.17 | 0.0961 | -0.0003 | ||

| US53944YAW30 / Lloyds Banking Group PLC | 0.60 | 0.0960 | 0.0960 | |||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 0.60 | -0.17 | 0.0959 | -0.0003 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 01/27 4.95 / DBT (US04685A4E88) | 0.60 | 0.33 | 0.0959 | 0.0001 | ||

| A3KMYN / Air Lease Corporation - Preferred Stock | 0.60 | 0.00 | 0.0959 | -0.0003 | ||

| US404119BS74 / Hca Inc Bond | 0.60 | 98.36 | 0.0958 | 0.0475 | ||

| US12662GAC24 / CSMC 2021-RPL4 Trust | 0.60 | -3.37 | 0.0956 | -0.0035 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2025 98 GF / ABS-MBS (US38381NNT18) | 0.60 | 0.0953 | 0.0953 | |||

| US92331EAF34 / XXIX Venture Limited | 0.60 | -37.57 | 0.0953 | -0.0576 | ||

| US251526CN70 / Deutsche Bank AG/New York NY | 0.60 | -0.33 | 0.0953 | -0.0005 | ||

| US87166FAD50 / Synchrony Bank | 0.60 | -0.17 | 0.0952 | -0.0003 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0.60 | 0.0949 | 0.0949 | |||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2025 3 A29 144A / ABS-MBS (US17332RCX98) | 0.60 | 0.0947 | 0.0947 | |||

| NISSAN MOTOR ACCEPTANCE SR UNSECURED REGS 03/26 2 / DBT (USU65478BU93) | 0.59 | 1.21 | 0.0929 | 0.0010 | ||

| US63942TAB17 / Navient Student Loan Trust | 0.59 | -10.14 | 0.0929 | -0.0106 | ||

| US65535HAW97 / Nomura Holdings Inc | 0.58 | 0.87 | 0.0925 | 0.0007 | ||

| XS1617830721 / Wells Fargo & Co | 0.58 | 9.87 | 0.0920 | 0.0082 | ||

| BLUEMOUNTAIN CLO LTD BLUEM 2018 3A A1R 144A / ABS-CBDO (US09630AAN63) | 0.57 | -12.25 | 0.0899 | -0.0127 | ||

| US78449CAB46 / SMB PRIVATE EDUCATION LOAN TRU SMB 2022 C A1B 144A | 0.57 | -5.36 | 0.0897 | -0.0053 | ||

| US63941TAA43 / Navient Private Education Refi Loan Trust 2020-E | 0.56 | -7.15 | 0.0886 | -0.0070 | ||

| US345397C502 / Ford Motor Credit Co LLC | 0.56 | -0.54 | 0.0881 | -0.0006 | ||

| US89180LAA61 / TPMT_21-SJ2 | 0.54 | -10.78 | 0.0855 | -0.0104 | ||

| US62955RAA32 / NEW YORK MORTGAGE TRUST 08/51 1.6696 | 0.54 | -4.27 | 0.0855 | -0.0039 | ||

| US36167HAA32 / GCAT | 0.53 | -4.00 | 0.0839 | -0.0036 | ||

| US29374GAB77 / Enterprise Fleet Financing 2022-4 LLC | 0.53 | -23.66 | 0.0836 | -0.0260 | ||

| BRIGHTHSE FIN GLBL FUND SECURED REGS 04/27 5.55 / DBT (US10921V2J41) | 0.51 | 0.40 | 0.0806 | 0.0001 | ||

| US404280DQ93 / HSBC Holdings PLC | 0.50 | -0.59 | 0.0801 | -0.0006 | ||

| STELLANTIS FIN US INC COMPANY GUAR 144A 03/28 5.35 / DBT (US85855CAM29) | 0.50 | 0.80 | 0.0800 | 0.0004 | ||

| US06738ECC75 / Barclays PLC | 0.50 | -0.59 | 0.0800 | -0.0006 | ||

| US61691XAA19 / Morgan Stanley Capital I Trust 2019-PLND | 0.50 | -8.53 | 0.0800 | -0.0076 | ||

| US29278GAZ19 / Enel Finance International NV | 0.50 | -0.40 | 0.0798 | -0.0004 | ||

| CA14913LAA85 / CATERP FIN S LTD | 0.50 | 0.00 | 0.0797 | -0.0002 | ||

| US452327AN93 / Illumina Inc | 0.50 | -0.20 | 0.0797 | -0.0004 | ||

| STAB / Standard Chartered PLC - Preferred Security | 0.50 | -0.20 | 0.0797 | -0.0004 | ||

| US46647PCQ72 / JPMorgan Chase & Co | 0.50 | 5.47 | 0.0796 | 0.0009 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.50 | -0.20 | 0.0795 | -0.0003 | ||

| US694308JL21 / PACIFIC GAS and ELECTRIC CO 3.45% 07/01/2025 | 0.50 | 0.40 | 0.0794 | 0.0002 | ||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 03/28 VAR / DBT (US58769JBF30) | 0.50 | 0.0793 | 0.0793 | |||

| US268317AS33 / Electricite de France SA | 0.50 | 0.40 | 0.0791 | 0.0001 | ||

| US411618AB75 / Harbour Energy PLC | 0.49 | 0.0785 | 0.0785 | |||

| US959802AZ22 / Western Union Co/The | 0.49 | 0.0775 | 0.0775 | |||

| ELLINGTON FINANCIAL MORTGAGE T EFMT 2025 CES2 A1A 144A / ABS-MBS (US28225GAA22) | 0.49 | -2.59 | 0.0775 | -0.0022 | ||

| GMF CANADA LEASING TRUST GCOLT 2024 1A A2 144A / ABS-O (CA36252MDE71) | 0.49 | -30.33 | 0.0774 | -0.0338 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 NQM5 A1 144A / ABS-MBS (US67448NAA63) | 0.48 | -8.37 | 0.0766 | -0.0071 | ||

| US00501BAA70 / ACREC LLC, Series 2023-FL2, Class A | 0.48 | -1.85 | 0.0758 | -0.0016 | ||

| US38383KGP12 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H24 CL FA V/R 6.27507000 | 0.47 | -2.67 | 0.0751 | -0.0022 | ||

| US63941HAA05 / Navient Private Education Refi Loan Trust 2020-D | 0.47 | -6.93 | 0.0747 | -0.0057 | ||

| DRYDEN SENIOR LOAN FUND DRSLF 2017 54A AR 144A / ABS-CBDO (US26244RAF82) | 0.47 | -26.49 | 0.0745 | -0.0270 | ||

| US38383KFR86 / Government National Mortgage Association | 0.47 | -1.47 | 0.0743 | -0.0013 | ||

| AU3FN0029609 / AAI Ltd | 0.46 | 5.25 | 0.0733 | 0.0035 | ||

| FANNIE MAE FNR 2024 38 AF / ABS-MBS (US3136BR5A18) | 0.46 | -5.77 | 0.0726 | -0.0046 | ||

| US055979AC23 / BMW Vehicle Lease Trust 2023-2 | 0.46 | -47.88 | 0.0722 | -0.0666 | ||

| ACA / Crédit Agricole S.A. | 0.45 | -0.44 | 0.0716 | -0.0003 | ||

| US92331AAW45 / Venture XXVIII CLO Ltd | 0.44 | -42.04 | 0.0706 | -0.0513 | ||

| PFP III PFP 2024 11 A 144A / ABS-MBS (US69291WAA09) | 0.44 | -9.80 | 0.0702 | -0.0078 | ||

| US05401AAM36 / Avolon Holdings Funding Ltd | 0.43 | -44.69 | 0.0687 | -0.0555 | ||

| PRP ADVISORS, LLC PRPM 2024 NQM2 A1 144A / ABS-MBS (US74448PAA75) | 0.41 | -7.21 | 0.0654 | -0.0052 | ||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 0.41 | -0.25 | 0.0644 | -0.0002 | ||

| HY9H / SK hynix Inc. - Depositary Receipt (Common Stock) | 0.41 | 0.00 | 0.0644 | -0.0001 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H12 FC / ABS-MBS (US38383KZF29) | 0.40 | -0.99 | 0.0637 | -0.0007 | ||

| US75951ACY29 / Reliance Standard Life Global Funding II | 0.40 | 0.00 | 0.0637 | -0.0001 | ||

| ACA / Crédit Agricole S.A. | 0.40 | 0.0636 | 0.0636 | |||

| US38141GYH19 / Goldman Sachs Group Inc/The | 0.40 | 0.00 | 0.0636 | -0.0001 | ||

| FREDDIE MAC FHR 5560 FB / ABS-MBS (US3137HLZD77) | 0.40 | 0.0636 | 0.0636 | |||

| US53944YAT01 / Lloyds Banking Group PLC | 0.40 | 0.0635 | 0.0635 | |||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 18A A1R 144A / ABS-CBDO (US04943EAQ44) | 0.40 | -0.25 | 0.0634 | -0.0001 | ||

| OSCAR US FUNDING TRUST OSCAR 2024 1A A2 144A / ABS-O (US68784GAB95) | 0.40 | -30.66 | 0.0633 | -0.0281 | ||

| US28628BAA61 / ELFI Graduate Loan Program LLC, Series 2021-A, Class A | 0.40 | -4.35 | 0.0629 | -0.0029 | ||

| 69033MD95 / OVERSEA CHINESE BANKING | 0.40 | 5.32 | 0.0629 | 0.0031 | ||

| US74977RDK77 / Cooperatieve Rabobank UA | 0.39 | 1.03 | 0.0621 | 0.0005 | ||

| 3 MONTH SOFR FUT MAR26 XCME 20260616 / DIR (000000000) | 0.39 | 0.0618 | 0.0618 | |||

| WOODWARD CAPITAL MANAGEMENT RCKT 2025 CES1 A1A 144A / ABS-MBS (US749427AA88) | 0.38 | -4.58 | 0.0596 | -0.0029 | ||

| TRITON TRUST TRTN 2021 2 A1AU / ABS-MBS (AU3FN0061305) | 0.37 | -4.90 | 0.0587 | -0.0030 | ||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0.37 | 0.0581 | 0.0581 | |||

| US64031DAA81 / NELNET STUDENT LOAN TRUST 2019-3 SER 2019-3A CL A V/R 144A P/P 2.50800000 | 0.36 | -3.72 | 0.0575 | -0.0024 | ||

| US59982HAC43 / MILL CITY MORTGAGE LOAN TRUST 2021-NMR1 MCMLT 2021-NMR1 A1 | 0.36 | -5.31 | 0.0568 | -0.0033 | ||

| OCTAGON INVESTMENT PARTNERS 39 OCT39 2018 3A AR 144A / ABS-CBDO (US67592CAL00) | 0.35 | -25.37 | 0.0561 | -0.0193 | ||

| US78446CAA99 / SLM Student Loan Trust 2013-2 | 0.35 | -1.40 | 0.0560 | -0.0009 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 CES1 A1A 144A / ABS-MBS (US89183CAA36) | 0.35 | -8.18 | 0.0554 | -0.0050 | ||

| BANQUE FED CRED MUTUEL REGS 05/27 VAR / DBT (AU3FN0088043) | 0.33 | 5.11 | 0.0523 | 0.0025 | ||

| US12564NAA00 / CLNY Trust 2019-IKPR | 0.33 | -11.44 | 0.0517 | -0.0067 | ||

| US63935BAA17 / Navient Private Education Refi Loan Trust 2020-H | 0.32 | -8.67 | 0.0503 | -0.0049 | ||

| US52474XAA37 / LEGACY MORTGAGE ASSET TRUST SER 2021-GS3 CL A1 V/R REGD 144A P/P 0.00000000 | 0.31 | -2.80 | 0.0496 | -0.0015 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 2 A2A 144A / ABS-O (US17331XAB73) | 0.31 | -47.98 | 0.0492 | -0.0454 | ||

| ACA / Crédit Agricole S.A. | 0.30 | -0.33 | 0.0479 | -0.0002 | ||

| ACA / Crédit Agricole S.A. | 0.30 | -0.33 | 0.0479 | -0.0002 | ||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 0.30 | 0.00 | 0.0479 | -0.0001 | ||

| US06051GJV23 / Bank of America Corp | 0.30 | 0.00 | 0.0478 | -0.0002 | ||

| US38141GZL12 / Goldman Sachs Group, Inc./The | 0.30 | -0.33 | 0.0478 | -0.0003 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.30 | 0.33 | 0.0478 | -0.0001 | ||

| KOREA NATIONAL OIL CORP SR UNSECURED 144A 03/28 VAR / DBT (US50065LAP58) | 0.30 | 0.33 | 0.0476 | -0.0000 | ||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.30 | 0.0476 | 0.0476 | |||

| GOVERNMENT NATIONAL MORTGAGE 06/55 1 / ABS-MBS (3838PM955) | 0.30 | 0.0476 | 0.0476 | |||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2025 98 GF SOFR30A+90BP / ABS-MBS (955SFGII5) | 0.30 | 0.0476 | 0.0476 | |||

| US17331KAD19 / Citizens Auto Receivables Trust | 0.30 | -22.34 | 0.0475 | -0.0138 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0.30 | 0.0475 | 0.0475 | |||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 0.30 | 0.0475 | 0.0475 | |||

| AU3FN0029609 / AAI Ltd | 0.30 | 0.0472 | 0.0472 | |||

| US38141GYA65 / Goldman Sachs Group Inc/The | 0.29 | 1.03 | 0.0466 | 0.0003 | ||

| US842400GJ61 / Southern California Edison Co | 0.29 | 0.0463 | 0.0463 | |||

| WOODWARD CAPITAL MANAGEMENT RCKT 2025 CES3 A1A 144A / ABS-MBS (US749420AA36) | 0.29 | -3.67 | 0.0460 | -0.0017 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H07 JF / ABS-MBS (US38383KVX70) | 0.29 | -2.03 | 0.0459 | -0.0010 | ||

| MA MONEY RESIDENTIAL SECURITIS MAMAU 2025 1PN A1S / ABS-MBS (AU3FN0095246) | 0.29 | -34.10 | 0.0458 | -0.0238 | ||

| FANNIE MAE FNR 2025 12 FG / ABS-MBS (US3136BVFH64) | 0.29 | -4.04 | 0.0453 | -0.0020 | ||

| US48251JAL70 / KKR CLO 18 Ltd | 0.28 | -32.69 | 0.0446 | -0.0217 | ||

| US61772QAN07 / MORGAN STANLEY RESIDENTIAL MORTGAGE LOAN TR SER 2021-6 CL A6 V/R REGD 144A P/P 0.89967000 | 0.28 | -2.48 | 0.0437 | -0.0012 | ||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 0.27 | 0.0433 | 0.0433 | |||

| US55317WAB72 / MMAF Equipment Finance LLC 2023-A | 0.27 | -32.66 | 0.0426 | -0.0207 | ||

| US924934AA00 / Verus Securitization Trust, Series 2023-5, Class A1 | 0.27 | -13.64 | 0.0423 | -0.0067 | ||

| US26828HAA59 / ECMC Group Student Loan Trust 2018-1 | 0.26 | -1.49 | 0.0420 | -0.0007 | ||

| US29374FAB94 / Enterprise Fleet Financing 2022-3 LLC | 0.26 | -37.14 | 0.0419 | -0.0249 | ||

| AU3FN0059994 / Victoria Power Networks Finance Pty. Ltd. | 0.26 | 5.62 | 0.0418 | 0.0020 | ||

| US12661XBC56 / CREDIT SUISSE MORTGAGE TRUST 144A 07/56 0.85 | 0.26 | -2.61 | 0.0415 | -0.0011 | ||

| AU3FN0029609 / AAI Ltd | 0.25 | -0.40 | 0.0400 | -0.0002 | ||

| US46650FAA03 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES T JPMCC 2018-PHH A | 0.25 | -1.57 | 0.0399 | -0.0007 | ||

| US89175MAA18 / Towd Point Mortgage Trust 2018-3 | 0.24 | -5.45 | 0.0386 | -0.0023 | ||

| S56431109 / Northam Platinum Holdings Ltd | 0.24 | 9.01 | 0.0385 | 0.0030 | ||

| US52475XAA28 / Legacy Mortgage Asset Trust 2021-GS5 | 0.24 | -3.23 | 0.0383 | -0.0012 | ||

| US38376RPV23 / Government National Mortgage Association | 0.24 | -13.82 | 0.0378 | -0.0061 | ||

| DLLST LLC DLLST 2024 1A A2 144A / ABS-O (US23346HAB33) | 0.24 | -55.30 | 0.0376 | -0.0464 | ||

| US61746RGK14 / MORGAN STANLEY ABS CAPITAL I INC TRUST 2004-HE4 SER 2004-HE4 CL M1 V/R REGD 2.60800000 | 0.24 | -1.67 | 0.0376 | -0.0007 | ||

| US12651QAA76 / CSMC 2017-CHOP A 1ML+75 07/15/2032 | 0.24 | 0.43 | 0.0375 | 0.0000 | ||

| US26829XAB73 / ECMC Group Student Loan Trust | 0.23 | -1.72 | 0.0363 | -0.0007 | ||

| US59981TAC99 / MILL CITY MORTGAGE LOAN TRUST 2019-GS2 SER 2019-GS2 CL A1 V/R REGD 144A P/P 2.75000000 | 0.22 | -9.35 | 0.0355 | -0.0037 | ||

| US36263KAJ07 / GS MORTGAGE-BACKED SECURITIES TRUST 2021-INV1 SER 2021-INV1 CL A9 V/R REGD 144A P/P 0.90000000 | 0.21 | -1.40 | 0.0337 | -0.0006 | ||

| US89179XAL91 / TOWD POINT ASSET TRUST 2021-SL1 SER 2021-SL1 CL A2 V/R REGD 144A P/P 0.00000000 | 0.21 | -12.97 | 0.0331 | -0.0050 | ||

| US3137G1AK38 / Freddie Mac Whole Loan Securities Trust | 0.21 | -2.38 | 0.0326 | -0.0009 | ||

| US87020PAT49 / Swedbank AB | 0.20 | 0.49 | 0.0324 | 0.0001 | ||

| US38141GZS64 / GOLDMAN SACHS GROUP INC SR UNSECURED 03/28 VAR | 0.20 | -0.49 | 0.0324 | -0.0001 | ||

| US65480CAE57 / Nissan Motor Acceptance Co LLC | 0.20 | -0.49 | 0.0321 | -0.0002 | ||

| US06675DCG51 / Banque Federative du Credit Mutuel SA | 0.20 | -0.50 | 0.0320 | -0.0001 | ||

| US404280DY28 / HSBC HOLDINGS PLC FRN SOFR+0 08/14/2027 | 0.20 | -0.50 | 0.0320 | -0.0002 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0.20 | 0.50 | 0.0319 | 0.0000 | ||

| BANQUE FED CRED MUTUEL BANQUE FED CRED MUTUEL / DBT (USF0803NAK84) | 0.20 | 0.00 | 0.0319 | -0.0001 | ||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 0.20 | 0.0319 | 0.0319 | |||

| US842400HQ95 / SOUTHERN CAL EDISON REGD SER D 4.70000000 | 0.20 | 0.50 | 0.0319 | 0.0001 | ||

| US842400HW63 / Southern California Edison Co | 0.20 | 0.00 | 0.0318 | -0.0000 | ||

| US928668BY79 / Volkswagen Group of America Finance LLC | 0.20 | 0.0318 | 0.0318 | |||

| FREDDIE MAC FHR 5557 FM / ABS-MBS (US3137HLZ217) | 0.20 | 0.0318 | 0.0318 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR REGS 03/26 VAR / DBT (USU9273ADZ58) | 0.20 | 0.00 | 0.0318 | -0.0001 | ||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.20 | -0.50 | 0.0317 | -0.0001 | ||

| FHR 5557 FM SOFR30A+110BP / ABS-MBS (955TAMII5) | 0.20 | 0.0317 | 0.0317 | |||

| US80282KAE64 / Santander Holdings USA Inc | 0.20 | 0.00 | 0.0317 | -0.0000 | ||

| US05367AAH68 / Aviation Capital Group LLC | 0.20 | 0.00 | 0.0317 | -0.0001 | ||

| US05369AAD37 / Aviation Capital Group LLC | 0.20 | 0.00 | 0.0317 | 0.0000 | ||

| HSBC26C / HSBC Holdings PLC | 0.20 | 0.00 | 0.0317 | -0.0000 | ||

| GA GLOBAL FUNDING TRUST SECURED 144A 09/27 4.4 / DBT (US36143L2N47) | 0.20 | 0.51 | 0.0317 | 0.0001 | ||

| US004421EW92 / ACE Securities Corp Home Equity Loan Trust Series 2004-OP1 | 0.20 | -1.00 | 0.0317 | -0.0004 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2025 89 PF / ABS-MBS (US38385GMK21) | 0.20 | 0.0317 | 0.0317 | |||

| US25152R2Y86 / Deutsche Bank AG | 0.20 | 0.00 | 0.0316 | -0.0000 | ||

| US46592WBE57 / JP Morgan Mortgage Trust 2021-12 | 0.20 | -1.49 | 0.0316 | -0.0006 | ||

| US00928QAS03 / Aircastle Ltd | 0.20 | 0.0316 | 0.0316 | |||

| US345397XU23 / Ford Motor Credit Co LLC | 0.20 | 0.51 | 0.0316 | -0.0000 | ||

| US391399AA00 / Great-West Lifeco US Finance 2020 LP | 0.20 | 0.0316 | 0.0316 | |||

| SHINHAN BANK SR UNSECURED REGS 11/25 VAR / DBT (AU3FN0073540) | 0.20 | 4.76 | 0.0315 | 0.0014 | ||

| US92539BAA08 / Verus Securitization Trust 2023-1 | 0.20 | -3.41 | 0.0315 | -0.0011 | ||

| US75575RAA59 / Ready Capital Mortgage Financing 2023-FL11 LLC | 0.20 | -28.36 | 0.0314 | -0.0123 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0.20 | 5.35 | 0.0313 | 0.0016 | ||

| US38382Y5C34 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H11 CL FC V/R 6.10000000 | 0.20 | -1.50 | 0.0313 | -0.0006 | ||

| US38383KHV70 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H27 CL FD V/R 6.42200000 | 0.20 | -2.00 | 0.0312 | -0.0006 | ||

| US337932AN77 / FirstEnergy Corp | 0.20 | 0.51 | 0.0312 | 0.0002 | ||

| US89177HAA05 / Towd Point Mortgage Trust, Series 2019-HY2, Class A1 | 0.19 | -7.18 | 0.0309 | -0.0024 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.19 | 0.0309 | 0.0309 | |||

| US38141GYG36 / Goldman Sachs Group Inc/The | 0.19 | 1.05 | 0.0307 | 0.0002 | ||

| US63941FAC05 / Navient Private Education Refi Loan Trust 2020-A | 0.19 | -7.69 | 0.0305 | -0.0027 | ||

| USU6547TAC46 / Nissan Motor Acceptance Co. LLC | 0.19 | 0.53 | 0.0303 | 0.0001 | ||

| US78449VAB27 / SMB Private Education Loan Trust 2020-PT-A | 0.19 | -6.86 | 0.0303 | -0.0022 | ||

| US78449MAA45 / SMB PRIVATE EDUCATION LOAN TRUST 2021-D SER 2021-D CL A1A REGD 144A P/P 1.34000000 | 0.16 | -7.87 | 0.0262 | -0.0022 | ||

| US3622ABBH49 / GNMA II POOL 785540 G2 05/71 FLOATING VAR | 0.16 | -14.14 | 0.0261 | -0.0043 | ||

| US92539TAA16 / Verus Securitization Trust, Series 2023-4, Class A1 | 0.16 | -11.96 | 0.0259 | -0.0034 | ||

| US12666DAB73 / CNH Equipment Trust, Series 2023-B, Class A2 | 0.16 | -69.11 | 0.0255 | -0.0569 | ||

| US64831EAA82 / NEW RESIDENTIAL MORTGAGE LOAN TRUST SER 2021-NQ2R CL A1 V/R REGD 144A P/P 0.94054000 | 0.16 | -3.07 | 0.0252 | -0.0009 | ||

| US38376RJ724 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H24 F | 0.15 | -12.14 | 0.0242 | -0.0034 | ||

| US64034NAA37 / NELNET STUDENT LOAN TRUST 2019-2 SER 2019-2A CL A V/R 144A P/P 2.60800000 | 0.15 | -3.21 | 0.0240 | -0.0009 | ||

| XS2279559889 / GEMGARTO GMG 2021 1A A 144A | 0.15 | -6.33 | 0.0236 | -0.0017 | ||

| US12663TAA79 / CSMC_22-RPL4 | 0.14 | -3.38 | 0.0228 | -0.0008 | ||

| AG TRUST AG 2024 NLP A 144A / ABS-MBS (US00792MAA18) | 0.14 | 0.70 | 0.0227 | -0.0000 | ||

| US46651QAA58 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-FL12 | 0.14 | -1.44 | 0.0218 | -0.0004 | ||

| US89177XAA54 / TOWD POINT MORTGAGE TRUST 2019-HY3 SER 2019-HY3 CL A1A V/R REGD 144A P/P 2.70800000 | 0.14 | -8.78 | 0.0215 | -0.0021 | ||

| US552751AA74 / MFA 2020-NQM2 TRUST SER 2020-NQM2 CL A1 V/R REGD 144A P/P 1.38100000 | 0.13 | -21.18 | 0.0214 | -0.0057 | ||

| US92540BAA70 / CORP CMO | 0.13 | -8.90 | 0.0212 | -0.0020 | ||

| PRKCM TRUST PRKCM 2024 AFC1 A1 144A / ABS-MBS (US69380WAA27) | 0.13 | -12.16 | 0.0208 | -0.0028 | ||

| XS1641479750 / Credit Agricole SA/London | 0.13 | 5.69 | 0.0208 | 0.0011 | ||

| RFR USD SOFR/4.10000 02/11/25-1Y LCH / DIR (EZR57YL70MG8) | 0.13 | -1,100.00 | 0.0206 | 0.0228 | ||

| US3137FQZF31 / Freddie Mac REMICS | 0.13 | -1.56 | 0.0201 | -0.0005 | ||

| US48250LAW90 / KKR FINANCIAL CLO LTD 07/30 1 | 0.13 | -38.54 | 0.0200 | -0.0127 | ||

| US63941UAA16 / Navient Private Education Refi Loan Trust 2020-G | 0.13 | -6.67 | 0.0200 | -0.0016 | ||

| US14318XAH89 / CarMax Auto Owner Trust 2023-4 | 0.13 | -69.14 | 0.0200 | -0.0445 | ||

| US317350BD73 / Finance America Mortgage Loan Trust 2004-2 | 0.12 | -1.67 | 0.0188 | -0.0003 | ||

| US542514KV50 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2005 2 M5 | 0.12 | -25.81 | 0.0184 | -0.0063 | ||

| US126673PS59 / COUNTRYWIDE ASSET BACKED CERTI CWL 2004 BC5 M5 | 0.11 | -33.33 | 0.0182 | -0.0091 | ||

| US44918CAB81 / HYUNDAI AUTO RECEIVABLES TRUST 2023-C 5.8% 01/15/2027 | 0.11 | -57.85 | 0.0176 | -0.0241 | ||

| US64830KAA51 / New Residential Mortgage Loan Trust 2018-3 | 0.10 | -3.77 | 0.0163 | -0.0007 | ||

| 317U8CLA3 PIMCO SWAPTION 3.6 CALL USD 20250812 / DIR (000000000) | 0.10 | 0.0161 | 0.0161 | |||

| US57643LFG68 / MASTR ASSET BACKED SECURITIES TRUST 2004-OPT2 SER 2004-OPT2 CL A1 V/R REGD 2.40800000 | 0.10 | 0.00 | 0.0161 | -0.0001 | ||

| US04018LAJ44 / ARES CLO LTD ARES 2018 50A AR 144A | 0.10 | -30.07 | 0.0159 | -0.0070 | ||

| US79588TAC45 / SAMMONS FINANCIAL GROUP SR UNSECURED 144A 05/27 4.45 | 0.10 | 0.0158 | 0.0158 | |||

| US780153BH44 / Royal Caribbean Cruises Ltd | 0.10 | 0.0158 | 0.0158 | |||

| US38376RRA67 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H04 FB | 0.10 | -11.82 | 0.0154 | -0.0021 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 0.10 | -98.07 | 0.0152 | -0.7990 | ||

| US78433XAA81 / Stonepeak ABS, Series 2021-1A | 0.09 | -10.00 | 0.0143 | -0.0016 | ||

| US14687TAD90 / Carvana Auto Receivables Trust FRN, due 01/10/27 | 0.08 | -41.18 | 0.0128 | -0.0089 | ||

| US05608VAA44 / BX 2021-MFM1 | 0.08 | 1.33 | 0.0121 | 0.0000 | ||

| US46591LAC54 / JP Morgan Mortgage Trust 2019-INV3 | 0.07 | -1.49 | 0.0105 | -0.0003 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 1 A 144A / ABS-O (US69548AAA97) | 0.06 | -18.67 | 0.0098 | -0.0022 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.06 | 0.0092 | 0.0092 | |||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2019 H20 FC / ABS-MBS (US38380LQ559) | 0.06 | -11.29 | 0.0088 | -0.0011 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0087 | 0.0087 | |||

| US379930AC41 / GM Financial Consumer Automobile Receivables Trust 2023-4 | 0.05 | -79.54 | 0.0086 | -0.0326 | ||

| FORD CREDIT AUTO LEASE TRUST FORDL 2024 A A2B / ABS-O (US345290AC46) | 0.05 | -97.00 | 0.0073 | -0.2368 | ||

| US45254NLJ45 / IMPAC CMB TRUST SERIES 2004-10 SER 2004-10 CL 1A1 V/R REGD 2.34800000 | 0.05 | 0.00 | 0.0073 | -0.0001 | ||

| XS2352500636 / FINSBURY SQUARE FSQ 2021 1GRA AGRN 144A | 0.05 | -13.46 | 0.0072 | -0.0012 | ||

| US38382CP473 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2020-17 CL EU 2.50000000 | 0.04 | -2.22 | 0.0071 | -0.0002 | ||

| US64034AAB98 / NELNET STUDENT LOAN TRUST 2018-3 NSLT 2018-3A A2 | 0.04 | -41.10 | 0.0068 | -0.0049 | ||

| US81744FAA57 / SEQUOIA MORTGAGE TRUST SEMT 2004 1 A | 0.04 | -4.55 | 0.0067 | -0.0004 | ||

| US38382DMC01 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2020-21 CL AC 2.50000000 | 0.04 | -2.44 | 0.0064 | -0.0001 | ||

| US65480MAC73 / Nissan Auto Receivables 2023-B Owner Trust | 0.04 | -90.91 | 0.0064 | -0.0637 | ||

| US23292HAB78 / DLLAA 2023-1 LLC | 0.04 | -68.25 | 0.0064 | -0.0137 | ||

| US64829VAA44 / New Residential Mortgage Loan Trust 2018-RPL1 | 0.04 | -5.00 | 0.0061 | -0.0003 | ||

| US55379AAA25 / M360 2021-CRE3 Ltd | 0.03 | -60.71 | 0.0053 | -0.0081 | ||

| US35729PHN33 / Fremont Home Loan Trust 2005-A | 0.03 | -40.38 | 0.0050 | -0.0034 | ||

| US42704RAA95 / HERA COMMERCIAL MORTGAGE LTD HERA 2021 FL1 A 144A | 0.03 | 0.00 | 0.0049 | 0.0000 | ||

| AUST 3YR BOND FUT SEP25 XSFE 20250915 / DIR (000000000) | 0.03 | 0.0048 | 0.0048 | |||

| US61913PAP71 / MortgageIT Trust 2005-1 | 0.02 | -8.00 | 0.0038 | -0.0003 | ||

| US20267VAA52 / Commonbond Student Loan Trust 2017-A-GS | 0.02 | -8.33 | 0.0036 | -0.0003 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0034 | 0.0034 | |||

| US31395M2F53 / Freddie Mac Structured Pass-Through Certificates | 0.02 | -5.26 | 0.0030 | -0.0001 | ||

| XS0290416527 / EUROHOME UK MORTGAGES PLC EHMU 2007 1 A REGS | 0.02 | -20.00 | 0.0027 | -0.0005 | ||

| US31395HHV50 / Freddie Mac Structured Pass-Through Certificates | 0.02 | 0.00 | 0.0026 | -0.0001 | ||

| US3132DV3P85 / FREDDIE MAC POOL UMBS P#SD8006 4.00000000 | 0.01 | -7.69 | 0.0021 | -0.0001 | ||

| US31396PSN23 / FANNIE MAE REMICS SER 2007-7 CL FJ V/R 1.90800000 | 0.01 | -7.69 | 0.0020 | -0.0001 | ||

| US31396X2G81 / FNMA, Series 2007-109, Class GF | 0.01 | 0.00 | 0.0018 | -0.0001 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0014 | 0.0014 | |||

| US86359LJA89 / STRUCTURED ASSET MORTGAGE INVE SAMI 2005 AR2 2A1 | 0.01 | 0.00 | 0.0014 | -0.0000 | ||

| US41161PLR28 / HARBORVIEW MORTGAGE LOAN TRUST 2005-2 SER 2005-2 CL 2A1A V/R REGD 2.17325000 | 0.01 | -12.50 | 0.0013 | -0.0001 | ||

| US31397RFC51 / FREDDIE MAC FHR 3411 FL | 0.01 | 0.00 | 0.0012 | -0.0001 | ||

| US66987WDE49 / NOVASTAR MORTGAGE FUNDING TRUST SERIES 2005-4 SER 2005-4 CL M1 V/R REGD 2.36800000 | 0.01 | -70.00 | 0.0011 | -0.0023 | ||

| US31395A3J20 / Freddie Mac Structured Pass-Through Certificates | 0.01 | 0.00 | 0.0010 | -0.0000 | ||

| US3137AFEP32 / FHLMC, Series 3927, Class FH | 0.01 | 0.00 | 0.0009 | -0.0000 | ||

| US92925CDA71 / WaMu Mortgage Pass-Through Certificates Series 2006-AR3 Trust | 0.00 | 0.00 | 0.0007 | -0.0000 | ||

| US93363DAA54 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 0.00 | 0.00 | 0.0007 | -0.0000 | ||

| BARCLAYS BANK PLC SNR SE ICE / DCR (EZB88Z42LS80) | 0.00 | -20.00 | 0.0007 | -0.0001 | ||

| US39538RAB50 / GreenPoint MTA Trust 2005-AR1 | 0.00 | -25.00 | 0.0006 | -0.0000 | ||

| US31404Q5M78 / Fannie Mae Pool | 0.00 | 0.00 | 0.0006 | -0.0000 | ||

| US07386HVS74 / BEAR STEARNS ALT A TRUST BALTA 2005 7 22A1 | 0.00 | 0.00 | 0.0005 | -0.0000 | ||

| US759950DY16 / Renaissance Home Equity Loan Trust 2004-3 | 0.00 | 0.00 | 0.0004 | -0.0000 | ||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| US759950AW86 / Renaissance Home Equity Loan Trust 2003-2 | 0.00 | -50.00 | 0.0003 | -0.0000 | ||

| US12669GN644 / Reperforming Loan REMIC Trust 2005-R2 | 0.00 | 0.00 | 0.0003 | -0.0000 | ||

| US22541QCT76 / Credit Suisse First Boston Mortgage Securities Corp | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| US929227XB72 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2002-AR17 SER 2002-AR17 CL 1A V/R REGD 3.52644500 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| RFR USD SOFR/3.92000 04/21/25-1Y* LCH / DIR (EZH75C6DK4N7) | 0.00 | 0.0002 | 0.0002 | |||

| US362341RX95 / GSR Mortgage Loan Trust, Series 2005-AR6, Class 2A1 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| US31396L4T48 / FNMA, REMIC, Series 2006-118, Class A2 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| US31393CX406 / FNMA, Series 2003-W8, Class 3F2 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| US22540VUG57 / Credit Suisse First Boston Mortgage Securities Corp | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| US36225CUD63 / Ginnie Mae II Pool | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| US86359LPD54 / Structured Asset Mortgage Investments II Trust 2005-AR5 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| US07384MZV70 / BEAR STEARNS ARM TRUST 2003-8 BSARM 2003-8 4A1 | 0.00 | 0.0001 | -0.0000 | |||

| US22540VK434 / Credit Suisse First Boston Mortgage Securities Corp | 0.00 | 0.0001 | -0.0000 | |||

| US17307GXP89 / Citigroup Mortgage Loan Trust Inc | 0.00 | 0.0001 | -0.0000 | |||

| US31405PRS10 / Fannie Mae Pool | 0.00 | 0.0001 | -0.0000 | |||

| US576449AA06 / Mastr Asset Backed Securities Trust 2006-HE4 | 0.00 | 0.0001 | -0.0000 | |||

| US585525EN47 / MRFC Mortgage Pass-Through Trust Series 2000-TBC3 | 0.00 | 0.0001 | -0.0000 | |||

| US31393T7H31 / Fannie Mae REMICS | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US929227QB55 / WaMu Mortgage Pass-Through Certificates Series 2002-AR6 Trust | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US86358HNX34 / Structured Asset Mortgage Investments Trust 2002-AR3 | 0.00 | 0.0000 | -0.0000 | |||

| 317U8CKA4 PIMCO SWAPTION 4.6 PUT USD 20250812 / DIR (EZDZRNFWMZT1) | 0.00 | -100.00 | 0.0000 | -0.0037 | ||

| US31394ANT96 / Fannie Mae REMICS | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT ILS SOLD USD 20250709 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US06050HKR83 / Bank of America Mortgage 2002-G Trust | 0.00 | 0.0000 | -0.0000 | |||

| US22541NHE22 / HOME EQUITY ASSET TRUST HEAT 2002 3 A4 | 0.00 | 0.0000 | 0.0000 | |||

| 317U79UA1 PIMCO SWAPTION 5.4 PUT USD 20250926 / DIR (EZMGDQQCNYM0) | 0.00 | 0.0000 | -0.0001 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QMA4 PIMCO CDSOPT PUT USD 1.0 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD CHF BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QMB2 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QN88 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CHF BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0012 | -0.0012 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0.01 | -0.0014 | -0.0014 | |||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | -0.05 | -0.0074 | -0.0074 | |||

| SOLD ILS BOUGHT USD 20260227 / DFE (000000000) | -0.05 | -0.0087 | -0.0087 | |||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0.05 | -0.0087 | -0.0087 | |||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | -0.06 | -0.0092 | -0.0092 | |||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0.09 | -0.0142 | -0.0142 | |||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | -0.10 | -0.0166 | -0.0166 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.13 | -0.0199 | -0.0199 | |||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | -0.19 | -0.0299 | -0.0299 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -0.20 | -0.0310 | -0.0310 | |||

| RFR USD SOFR/3.75000 12/18/24-5Y LCH / DIR (EZ2V74HC3Q62) | -0.21 | 328.00 | -0.0340 | -0.0260 | ||

| RFR USD SOFR/3.8616* 12/02/24-4Y* LCH / DIR (EZSGM4VHBMV4) | -0.22 | 92.24 | -0.0354 | -0.0170 | ||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | -0.25 | -58.49 | -0.0393 | 0.0554 | ||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0.32 | -0.0511 | -0.0511 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | -0.33 | -0.0525 | -0.0525 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | -0.58 | -0.0926 | -0.0926 | |||

| RFR USD SOFR/3.62000 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | -1.57 | -0.2491 | -0.2491 |