Basic Stats

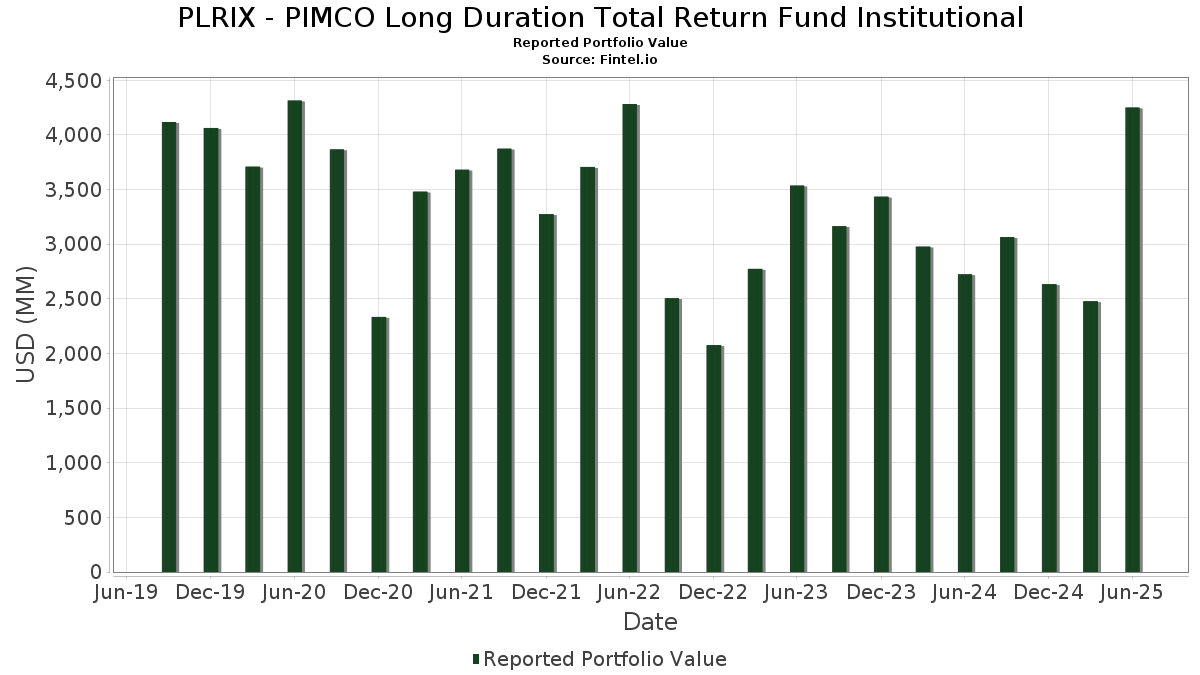

| Portfolio Value | $ 4,249,868,179 |

| Current Positions | 2,050 |

Latest Holdings, Performance, AUM (from 13F, 13D)

PLRIX - PIMCO Long Duration Total Return Fund Institutional has disclosed 2,050 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 4,249,868,179 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). PLRIX - PIMCO Long Duration Total Return Fund Institutional’s top holdings are United States Treasury Note/Bond (US:US912810SW99) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , U.S. Treasury Bonds (US:US912810TA60) , Us Treasury Bond (US:US912810SF66) , and United States Treasury Note/Bond (US:US912810SQ22) . PLRIX - PIMCO Long Duration Total Return Fund Institutional’s new positions include United States Treasury Note/Bond (US:US912810SW99) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , U.S. Treasury Bonds (US:US912810TA60) , Us Treasury Bond (US:US912810SF66) , and United States Treasury Note/Bond (US:US912810SQ22) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 241.44 | 11.2323 | 6.6976 | ||

| 81.99 | 3.8143 | 1.2897 | ||

| 81.99 | 3.8143 | 1.2897 | ||

| 81.99 | 3.8143 | 1.2897 | ||

| 55.24 | 2.5698 | 1.2713 | ||

| 34.38 | 1.5995 | 1.1094 | ||

| 14.70 | 0.6837 | 0.6837 | ||

| 14.70 | 0.6837 | 0.6837 | ||

| 14.70 | 0.6837 | 0.6837 | ||

| 14.36 | 0.6680 | 0.6680 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -114.47 | -5.3254 | -5.3254 | ||

| -114.47 | -5.3254 | -5.3254 | ||

| -109.02 | -5.0720 | -5.0720 | ||

| -109.02 | -5.0720 | -5.0720 | ||

| -82.76 | -3.8502 | -3.8502 | ||

| -82.76 | -3.8502 | -3.8502 | ||

| -40.23 | -1.8717 | -1.8717 | ||

| 9.18 | 0.4272 | -1.5075 | ||

| 4.81 | 0.2236 | -1.0023 | ||

| 4.81 | 0.2236 | -1.0023 |

13F and Fund Filings

This form was filed on 2025-08-29 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912810SW99 / United States Treasury Note/Bond | 273.67 | -1.98 | 12.7316 | 0.3293 | |||||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 241.44 | 116.01 | 11.2323 | 6.6976 | |||||

| US TREASURY N/B 08/44 4.125 / DBT (US912810UD80) | 100.72 | -2.21 | 4.6856 | 0.1101 | |||||

| US TREASURY N/B 08/44 4.125 / DBT (US912810UD80) | 100.72 | -2.21 | 4.6856 | 0.1101 | |||||

| US TREASURY N/B 08/44 4.125 / DBT (US912810UD80) | 100.72 | -2.21 | 4.6856 | 0.1101 | |||||

| US TREASURY N/B 02/45 4.75 / DBT (US912810UJ50) | 81.99 | 44.27 | 3.8143 | 1.2897 | |||||

| US TREASURY N/B 02/45 4.75 / DBT (US912810UJ50) | 81.99 | 44.27 | 3.8143 | 1.2897 | |||||

| US TREASURY N/B 02/45 4.75 / DBT (US912810UJ50) | 81.99 | 44.27 | 3.8143 | 1.2897 | |||||

| US912810TA60 / U.S. Treasury Bonds | 65.76 | -2.05 | 3.0592 | 0.0768 | |||||

| US912810SF66 / Us Treasury Bond | 65.62 | -2.56 | 3.0530 | 0.0612 | |||||

| US912810SQ22 / United States Treasury Note/Bond | 58.48 | -1.84 | 2.7206 | 0.0739 | |||||

| US912810SE91 / United States Treas Bds Bond | 55.24 | 88.98 | 2.5698 | 1.2713 | |||||

| US912810TK43 / U.S. Treasury Bonds | 51.51 | -2.10 | 2.3965 | 0.0590 | |||||

| US9128337V62 / U.S. Treasury STRIPS Bonds | 49.15 | 1.20 | 2.2864 | 0.1291 | |||||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 46.05 | 0.91 | 2.1424 | 0.1152 | |||||

| US TREASURY N/B 11/44 4.625 / DBT (US912810UF39) | 45.73 | -2.23 | 2.1274 | 0.0496 | |||||

| US TREASURY N/B 11/44 4.625 / DBT (US912810UF39) | 45.73 | -2.23 | 2.1274 | 0.0496 | |||||

| US TREASURY N/B 11/44 4.625 / DBT (US912810UF39) | 45.73 | -2.23 | 2.1274 | 0.0496 | |||||

| US TREASURY N/B 11/44 4.625 / DBT (US912810UF39) | 45.73 | -2.23 | 2.1274 | 0.0496 | |||||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 43.31 | 0.74 | 2.0149 | 0.1050 | |||||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 40.26 | 0.30 | 1.8729 | 0.0899 | |||||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 40.26 | 0.30 | 1.8729 | 0.0899 | |||||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 40.26 | 0.30 | 1.8729 | 0.0899 | |||||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 40.26 | 0.30 | 1.8729 | 0.0899 | |||||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 40.12 | 13.84 | 1.8664 | 0.3009 | |||||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 40.12 | 13.84 | 1.8664 | 0.3009 | |||||

| US21H0406817 / Ginnie Mae | 38.79 | -20.61 | 1.8048 | 0.2606 | |||||

| US912810ST60 / TREASURY BOND | 35.40 | -1.99 | 1.6469 | 0.0424 | |||||

| US01F0506844 / UMBS TBA | 34.38 | 184.60 | 1.5995 | 1.1094 | |||||

| R2035 / South Africa - Corporate Bond/Note | 33.40 | 8.02 | 1.5538 | 0.1803 | |||||

| US912810SU34 / United States Treasury Note/Bond | 29.45 | -3.12 | 1.3700 | 0.0197 | |||||

| US912810SR05 / United States Treasury Note/Bond - When Issued | 29.34 | -36.67 | 1.3652 | -0.6932 | |||||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 24.87 | 1.14 | 1.1569 | 0.0646 | |||||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 24.15 | 6.77 | 1.1234 | 0.1187 | |||||

| US912833Y388 / STRIPS 11/36 0.00000 | 22.53 | 0.37 | 1.0480 | 0.0510 | |||||

| US9128334Y39 / U.S. Treasury STRIPS Bonds | 22.24 | 1.07 | 1.0346 | 0.0571 | |||||

| US912833X885 / United States Treasury Strip Coupon | 21.09 | 0.88 | 0.9812 | 0.0524 | |||||

| US912810SJ88 / United States Treas Bds Bond | 20.45 | 83.40 | 0.9512 | 0.4559 | |||||

| US912810QZ49 / United States Treas Bds Bond | 19.80 | -2.02 | 0.9211 | 0.0234 | |||||

| US21H0426799 / Ginnie Mae | 19.43 | 0.69 | 0.9041 | 0.1211 | |||||

| US912810SD19 / United States Treas Bds Bond | 19.23 | -2.60 | 0.8946 | 0.0175 | |||||

| US101137AL15 / Boston Scientific Corp 7.375% Senior Notes 01/15/40 | 15.47 | -0.01 | 0.7196 | 0.0324 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 14.99 | 1.76 | 0.6975 | 0.0430 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 14.99 | 1.76 | 0.6975 | 0.0430 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 14.99 | 1.76 | 0.6975 | 0.0430 | |||||

| US05571AAS42 / BPCE SA | 14.78 | 0.88 | 0.6878 | 0.0367 | |||||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 14.70 | 0.6837 | 0.6837 | ||||||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 14.70 | 0.6837 | 0.6837 | ||||||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 14.70 | 0.6837 | 0.6837 | ||||||

| US TREASURY N/B 04/30 3.875 / DBT (US91282CMZ13) | 14.36 | 0.6680 | 0.6680 | ||||||

| US TREASURY N/B 04/30 3.875 / DBT (US91282CMZ13) | 14.36 | 0.6680 | 0.6680 | ||||||

| US TREASURY N/B 04/30 3.875 / DBT (US91282CMZ13) | 14.36 | 0.6680 | 0.6680 | ||||||

| RFRF USD SOFR/2.33000 10/25/23-30Y CME / DIR (EZF048P6G9L5) | 13.59 | 7.72 | 0.6322 | 0.0718 | |||||

| RFRF USD SOFR/2.33000 10/25/23-30Y CME / DIR (EZF048P6G9L5) | 13.59 | 7.72 | 0.6322 | 0.0718 | |||||

| RFRF USD SOFR/2.33000 10/25/23-30Y CME / DIR (EZF048P6G9L5) | 13.59 | 7.72 | 0.6322 | 0.0718 | |||||

| US912810SL35 / United States Treasury Note/Bond | 12.94 | -2.94 | 0.6022 | 0.0097 | |||||

| ES00000124H4 / Spain Government Bond | 12.33 | 10.73 | 0.5735 | 0.0789 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 11.37 | -2.20 | 0.5291 | 0.0125 | |||||

| US912810RH32 / United States Treas Bds Bond | 11.29 | -2.24 | 0.5251 | 0.0122 | |||||

| US912810RJ97 / United States Treas Bds Bond | 11.05 | -2.26 | 0.5143 | 0.0118 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 10.99 | -2.74 | 0.5111 | 0.0093 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 10.99 | -2.74 | 0.5111 | 0.0093 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 10.99 | -2.74 | 0.5111 | 0.0093 | |||||

| US912810RK60 / United States Treas Bds Bond | 10.93 | -2.36 | 0.5085 | 0.0112 | |||||

| US30251BAE83 / FMR LLC | 10.73 | -1.61 | 0.4993 | 0.0147 | |||||

| US42217KBB17 / Health Care Reit Hcn 5.125 03/15/43 | 9.87 | 0.17 | 0.4593 | 0.0214 | |||||

| US912810SA79 / United States Treas Bds Bond | 9.59 | 0.4461 | 0.4461 | ||||||

| US912810RM27 / United States Treas Bds Bond | 9.47 | -2.34 | 0.4406 | 0.0098 | |||||

| US912810RY64 / United States Treas Bds Bond | 9.20 | 0.4280 | 0.4280 | ||||||

| US21H0406734 / Ginnie Mae | 9.18 | -80.74 | 0.4272 | -1.5075 | |||||

| OIS USD SOFR/1.75000 12/15/21-30Y CME / DIR (EZF57987L8X1) | 8.77 | 6.14 | 0.4079 | 0.0409 | |||||

| OIS USD SOFR/1.75000 12/15/21-30Y CME / DIR (EZF57987L8X1) | 8.77 | 6.14 | 0.4079 | 0.0409 | |||||

| OIS USD SOFR/1.75000 12/15/21-30Y CME / DIR (EZF57987L8X1) | 8.77 | 6.14 | 0.4079 | 0.0409 | |||||

| OIS USD SOFR/1.75000 12/15/21-30Y CME / DIR (EZF57987L8X1) | 8.77 | 6.14 | 0.4079 | 0.0409 | |||||

| OIS USD SOFR/1.75000 12/15/21-30Y CME / DIR (EZF57987L8X1) | 8.77 | 6.14 | 0.4079 | 0.0409 | |||||

| US91086QAZ19 / Mexico Government International Bond | 8.23 | 0.49 | 0.3830 | 0.0191 | |||||

| US912810TS78 / United States Treasury Note/Bond | 8.13 | -2.15 | 0.3783 | 0.0091 | |||||

| US456837BH52 / ING Groep NV | 8.10 | -10.42 | 0.3770 | -0.0248 | |||||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 8.04 | 1.36 | 0.3742 | 0.0523 | |||||

| US626207YF57 / MUNI ELEC AUTH OF GEORGIA | 8.01 | -2.70 | 0.3728 | 0.0070 | |||||

| XS2364199674 / Romanian Government International Bond | 7.90 | 11.86 | 0.3676 | 0.0538 | |||||

| US05377RHM97 / Avis Budget Rental Car Funding AESOP LLC | 7.64 | 0.14 | 0.3556 | 0.0165 | |||||

| US797440BW34 / San Diego Gas & Electric Co | 7.32 | -1.38 | 0.3404 | 0.0108 | |||||

| US912810TC27 / United States Treasury Note/Bond | 7.22 | -2.10 | 0.3361 | 0.0083 | |||||

| INVITATION HOMES TRUST IHSFR 2024 SFR1 A 144A / ABS-MBS (US46188DAA63) | 7.20 | 1.05 | 0.3352 | 0.0184 | |||||

| INVITATION HOMES TRUST IHSFR 2024 SFR1 A 144A / ABS-MBS (US46188DAA63) | 7.20 | 1.05 | 0.3352 | 0.0184 | |||||

| INVITATION HOMES TRUST IHSFR 2024 SFR1 A 144A / ABS-MBS (US46188DAA63) | 7.20 | 1.05 | 0.3352 | 0.0184 | |||||

| RFRF USD SF+26.161/1.4* 07/21/21-10Y LCH / DIR (EZZMCMLRYMY7) | 7.12 | -12.71 | 0.3311 | -0.0311 | |||||

| RFRF USD SF+26.161/1.4* 07/21/21-10Y LCH / DIR (EZZMCMLRYMY7) | 7.12 | -12.71 | 0.3311 | -0.0311 | |||||

| US23636AAR23 / Danske Bank A/S | 7.08 | -3.48 | 0.3295 | 0.0035 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 7.01 | 0.81 | 0.3261 | 0.0172 | |||||

| US54251PAD96 / Long Beach Mortgage Loan Trust 2006-5 | 6.97 | -0.77 | 0.3241 | 0.0122 | |||||

| US909319AA30 / United Airlines 2013-1 Class A Pass Through Trust | 6.93 | 0.27 | 0.3224 | 0.0154 | |||||

| US225401AU28 / Credit Suisse Group AG | 6.81 | 1.98 | 0.3168 | 0.0201 | |||||

| US38239KAA60 / Goodman US Finance Four LLC | 6.76 | 0.12 | 0.3147 | 0.0146 | |||||

| US29273RBL24 / Energy Transfer Partners LP | 6.53 | -0.24 | 0.3040 | 0.0130 | |||||

| US695114CT39 / PacifiCorp | 6.37 | -0.84 | 0.2961 | 0.0110 | |||||

| US780097BG51 / NatWest Group PLC | 6.36 | -13.01 | 0.2961 | -0.0289 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 6.29 | 1.80 | 0.2925 | 0.0181 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 6.29 | 1.80 | 0.2925 | 0.0181 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 6.29 | 1.80 | 0.2925 | 0.0181 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 6.29 | 1.80 | 0.2925 | 0.0181 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 6.29 | 1.80 | 0.2925 | 0.0181 | |||||

| US63861VAJ61 / Nationwide Building Society | 6.26 | -13.03 | 0.2910 | -0.0285 | |||||

| US91087BAN01 / Mexico Government International Bond | 6.21 | 1.52 | 0.2889 | 0.0172 | |||||

| US345397C924 / Ford Motor Credit Co LLC | 6.10 | 0.63 | 0.2838 | 0.0145 | |||||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 6.05 | -0.43 | 0.2814 | 0.0115 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 5.99 | 0.2786 | 0.2786 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 5.99 | 0.2786 | 0.2786 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 5.99 | 0.2786 | 0.2786 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 5.99 | 0.2786 | 0.2786 | ||||||

| US025932AL88 / American Financial Group Inc/OH | 5.98 | -2.70 | 0.2784 | 0.0052 | |||||

| TELECOM SERBIA EUR TERM LOAN A / LON (BA0005336) | 5.85 | 7.20 | 0.2722 | 0.0297 | |||||

| US63861CAE93 / Nationstar Mortgage Holdings Inc | 5.79 | 1.58 | 0.2695 | 0.0162 | |||||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 5.78 | 4.88 | 0.2691 | 0.0241 | |||||

| US14314CAA36 / Carlyle Finance LLC | 5.71 | -1.94 | 0.2658 | 0.0070 | |||||

| US29273RAF64 / Energy Transfer 6.625% Senior Notes 10/15/36 | 5.61 | 0.36 | 0.2612 | 0.0127 | |||||

| US87166PAL58 / SYNIT 23-A2 A 5.74% 10-15-29/26 | 5.60 | -0.18 | 0.2606 | 0.0113 | |||||

| US12668KAE38 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 5 2A4 | 5.55 | -2.18 | 0.2584 | 0.0061 | |||||

| US68389XBY04 / Oracle Corp | 5.52 | 0.27 | 0.2569 | 0.0122 | |||||

| US880451AU37 / Tennessee Gas Pipeline Co Debentures 7.625% 04/01/37 | 5.49 | -0.13 | 0.2553 | 0.0112 | |||||

| US902613AH15 / UBS Group AG | 5.42 | -14.34 | 0.2520 | -0.0289 | |||||

| CVC CORDATUS OPPORTUNITY LOAN COLFR 1A AR 144A / ABS-CBDO (XS3020835339) | 5.42 | 6.57 | 0.2520 | 0.0262 | |||||

| CVC CORDATUS OPPORTUNITY LOAN COLFR 1A AR 144A / ABS-CBDO (XS3020835339) | 5.42 | 6.57 | 0.2520 | 0.0262 | |||||

| CVC CORDATUS OPPORTUNITY LOAN COLFR 1A AR 144A / ABS-CBDO (XS3020835339) | 5.42 | 6.57 | 0.2520 | 0.0262 | |||||

| CVC CORDATUS OPPORTUNITY LOAN COLFR 1A AR 144A / ABS-CBDO (XS3020835339) | 5.42 | 6.57 | 0.2520 | 0.0262 | |||||

| XS2363250833 / Gazprom PJSC via Gaz Finance PLC | 5.40 | 7.14 | 0.2512 | 0.0273 | |||||

| US38141GYB49 / Goldman Sachs Group Inc/The | 5.33 | 1.79 | 0.2482 | 0.0154 | |||||

| US01F0406854 / UMBS TBA | 5.20 | -191.35 | 0.2417 | 0.4725 | |||||

| US210385AC48 / Constellation Energy Generation LLC | 5.18 | 2.11 | 0.2412 | 0.0157 | |||||

| US904678AY53 / UniCredit SpA | 5.17 | 1.75 | 0.2403 | 0.0148 | |||||

| US912833Z526 / STRIPS 08/37 0.00000 | 5.11 | 0.22 | 0.2378 | 0.0112 | |||||

| BMO MORTGAGE TRUST BMO 2025 5C11 A2 / ABS-MBS (US096941AB56) | 5.11 | 0.2377 | 0.2377 | ||||||

| BMO MORTGAGE TRUST BMO 2025 5C11 A2 / ABS-MBS (US096941AB56) | 5.11 | 0.2377 | 0.2377 | ||||||

| BMO MORTGAGE TRUST BMO 2025 5C11 A2 / ABS-MBS (US096941AB56) | 5.11 | 0.2377 | 0.2377 | ||||||

| BMO MORTGAGE TRUST BMO 2025 5C11 A2 / ABS-MBS (US096941AB56) | 5.11 | 0.2377 | 0.2377 | ||||||

| CHILE ELECTRICITY LUX GOVT GUARANT 144A 10/35 5.58 / DBT (US16882LAA08) | 5.09 | -2.15 | 0.2368 | 0.0057 | |||||

| CHILE ELECTRICITY LUX GOVT GUARANT 144A 10/35 5.58 / DBT (US16882LAA08) | 5.09 | -2.15 | 0.2368 | 0.0057 | |||||

| CHILE ELECTRICITY LUX GOVT GUARANT 144A 10/35 5.58 / DBT (US16882LAA08) | 5.09 | -2.15 | 0.2368 | 0.0057 | |||||

| US694308JQ18 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 07/40 4.5 | 5.09 | -1.87 | 0.2367 | 0.0064 | |||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 5.07 | 0.2359 | 0.2359 | ||||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 5.07 | 0.2359 | 0.2359 | ||||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 5.07 | 0.2359 | 0.2359 | ||||||

| FORD CREDIT FLOORPLAN MASTER O FORDF 2024 3 A2 144A / ABS-O (US34528QJL95) | 5.01 | -0.02 | 0.2332 | 0.0105 | |||||

| FORD CREDIT FLOORPLAN MASTER O FORDF 2024 3 A2 144A / ABS-O (US34528QJL95) | 5.01 | -0.02 | 0.2332 | 0.0105 | |||||

| FORD CREDIT FLOORPLAN MASTER O FORDF 2024 3 A2 144A / ABS-O (US34528QJL95) | 5.01 | -0.02 | 0.2332 | 0.0105 | |||||

| FORD CREDIT FLOORPLAN MASTER O FORDF 2024 3 A2 144A / ABS-O (US34528QJL95) | 5.01 | -0.02 | 0.2332 | 0.0105 | |||||

| FORD CREDIT FLOORPLAN MASTER O FORDF 2024 3 A2 144A / ABS-O (US34528QJL95) | 5.01 | -0.02 | 0.2332 | 0.0105 | |||||

| US05635JAC45 / Bacardi Ltd / Bacardi-Martini BV | 4.91 | -8.63 | 0.2286 | -0.0103 | |||||

| TVC / Tennessee Valley Authority - Preferred Stock | 4.91 | 0.2285 | 0.2285 | ||||||

| TVC / Tennessee Valley Authority - Preferred Stock | 4.91 | 0.2285 | 0.2285 | ||||||

| TVC / Tennessee Valley Authority - Preferred Stock | 4.91 | 0.2285 | 0.2285 | ||||||

| TVC / Tennessee Valley Authority - Preferred Stock | 4.91 | 0.2285 | 0.2285 | ||||||

| TVC / Tennessee Valley Authority - Preferred Stock | 4.91 | 0.2285 | 0.2285 | ||||||

| US665501AL66 / Northern Natural Gas Co | 4.84 | -1.22 | 0.2254 | 0.0075 | |||||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 4.81 | -82.59 | 0.2236 | -1.0023 | |||||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 4.81 | -82.59 | 0.2236 | -1.0023 | |||||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 4.81 | -82.59 | 0.2236 | -1.0023 | |||||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 4.81 | -82.59 | 0.2236 | -1.0023 | |||||

| US75972BAB71 / RENESAS ELECTRONICS CORP | 4.74 | 0.92 | 0.2205 | 0.0118 | |||||

| US29273RAJ86 / Energy Transfer Partners 7.5% Senior Notes 7/1/38 | 4.74 | 0.40 | 0.2204 | 0.0108 | |||||

| US665772CQ04 / Northern States Power Co./MN | 4.73 | 0.49 | 0.2200 | 0.0110 | |||||

| US11271LAB80 / Brookfield Finance Inc | 4.70 | 0.49 | 0.2187 | 0.0109 | |||||

| 4020 / Saudi Real Estate Company | 4.67 | 1.24 | 0.2173 | 0.0123 | |||||

| 4020 / Saudi Real Estate Company | 4.67 | 1.24 | 0.2173 | 0.0123 | |||||

| 4020 / Saudi Real Estate Company | 4.67 | 1.24 | 0.2173 | 0.0123 | |||||

| US694308JJ74 / Pacific Gas and Electric Co | 4.65 | -3.52 | 0.2166 | 0.0022 | |||||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 4.60 | 50.26 | 0.2142 | 0.0781 | |||||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 4.60 | 50.26 | 0.2142 | 0.0781 | |||||

| US11135FBL40 / Broadcom Inc | 4.60 | -20.21 | 0.2141 | -0.0421 | |||||

| US71654QDP46 / Petroleos Mexicanos | 4.58 | 2.76 | 0.2129 | 0.0151 | |||||

| US100743AN37 / Boston Gas Co. | 4.57 | -1.46 | 0.2128 | 0.0066 | |||||

| US74456QBF28 / PUBLIC SERVICE ELECTRIC & GAS CO MTN 4.000000% 06/01/2044 | 4.57 | -0.69 | 0.2128 | 0.0082 | |||||

| US93363DAB38 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 4.57 | -0.57 | 0.2127 | 0.0084 | |||||

| US00206RLV23 / AT&T Inc | 4.52 | -0.53 | 0.2103 | 0.0084 | |||||

| US79467BDG77 / Sales Tax Securitization Corp. | 4.50 | 1.40 | 0.2092 | 0.0122 | |||||

| US91324PEX69 / UnitedHealth Group Inc | 4.46 | -1.41 | 0.2075 | 0.0065 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.46 | 0.2074 | 0.2074 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.46 | 0.2074 | 0.2074 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.46 | 0.2074 | 0.2074 | ||||||

| US256141AB88 / DOCTORS CO INTERINSURANC REGD 144A P/P 4.50000000 | 4.45 | 2.41 | 0.2072 | 0.0140 | |||||

| US33939HAA77 / FLEX INTERMEDIATE HOLDCO LLC | 4.45 | 0.91 | 0.2069 | 0.0111 | |||||

| US11272BAA17 / Brookfield Finance I UK Plc | 4.42 | 0.91 | 0.2054 | 0.0111 | |||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 4.41 | 0.2052 | 0.2052 | ||||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 4.41 | 0.2052 | 0.2052 | ||||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 4.41 | 0.2052 | 0.2052 | ||||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 4.41 | 0.2052 | 0.2052 | ||||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 4.41 | 0.2052 | 0.2052 | ||||||

| US092113AW94 / Black Hills Corp | 4.41 | 0.14 | 0.2052 | 0.0095 | |||||

| US36251PBD50 / GS Mortgage Securities Trust 2016-GS3 | 4.40 | 3.95 | 0.2046 | 0.0166 | |||||

| US08160JAE73 / Benchmark 2019-B9 Mortgage Trust | 4.38 | 1.01 | 0.2040 | 0.0112 | |||||

| ANTX / AN2 Therapeutics, Inc. | 4.37 | -0.84 | 0.2035 | 0.0075 | |||||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 4.37 | 4.08 | 0.2031 | 0.0167 | |||||

| MX0SGO0000K0 / Mexican Udibonos | 4.32 | 11.66 | 0.2010 | 0.0291 | |||||

| SBA TOWER TRUST ASSET BACKED 144A 10/29 4.831 / DBT (US78403DBD12) | 4.31 | 0.94 | 0.2005 | 0.0109 | |||||

| SBA TOWER TRUST ASSET BACKED 144A 10/29 4.831 / DBT (US78403DBD12) | 4.31 | 0.94 | 0.2005 | 0.0109 | |||||

| SBA TOWER TRUST ASSET BACKED 144A 10/29 4.831 / DBT (US78403DBD12) | 4.31 | 0.94 | 0.2005 | 0.0109 | |||||

| SBA TOWER TRUST ASSET BACKED 144A 10/29 4.831 / DBT (US78403DBD12) | 4.31 | 0.94 | 0.2005 | 0.0109 | |||||

| US64135DAA37 / Neuberger Berman Loan Advisers CLO 47 Ltd., Series 2022-47A, Class A | 4.30 | 0.23 | 0.2001 | 0.0095 | |||||

| US12803RAC88 / CaixaBank SA | 4.29 | 1.11 | 0.1994 | 0.0111 | |||||

| US26442UAQ76 / Duke Energy Progress LLC | 4.24 | 1.39 | 0.1970 | 0.0115 | |||||

| FORD AUTO SECURITIZATION TRUST FASTR 2024 AA A2 144A / ABS-O (CA345214BJ84) | 4.21 | -0.96 | 0.1958 | 0.0070 | |||||

| FORD AUTO SECURITIZATION TRUST FASTR 2024 AA A2 144A / ABS-O (CA345214BJ84) | 4.21 | -0.96 | 0.1958 | 0.0070 | |||||

| FORD AUTO SECURITIZATION TRUST FASTR 2024 AA A2 144A / ABS-O (CA345214BJ84) | 4.21 | -0.96 | 0.1958 | 0.0070 | |||||

| US880451AW92 / Tennessee Gas Pipeline Co Notes 8.375% 06/15/32 | 4.18 | 0.31 | 0.1944 | 0.0093 | |||||

| US11271LAF94 / Brookfield Finance Inc | 4.14 | -1.47 | 0.1927 | 0.0059 | |||||

| US91324PEW86 / UnitedHealth Group Inc | 4.11 | -1.42 | 0.1912 | 0.0060 | |||||

| NATIONAL SECS CLEARING SR UNSECURED 144A 06/29 4.9 / DBT (US637639AM77) | 4.10 | 0.79 | 0.1906 | 0.0100 | |||||

| US842400HD82 / Southern California Edison Co | 4.08 | 0.69 | 0.1900 | 0.0098 | |||||

| US05541VAF31 / BG Energy Capital plc | 4.07 | -0.49 | 0.1893 | 0.0077 | |||||

| US87162WAF77 / TD SYNNEX Corp. | 4.06 | 0.92 | 0.1890 | 0.0102 | |||||

| US743263AE50 / Progress Energy Inc 7.750% Senior Notes 03/01/31 | 4.03 | 0.95 | 0.1876 | 0.0101 | |||||

| US12636GAA94 / COMM 2016-667M Mortgage Trust | 4.00 | 6.10 | 0.1860 | 0.0186 | |||||

| US826418BE49 / SIERRA PACIFIC POWER CO GENL REF MOR 07/37 6.75 | 3.98 | -1.14 | 0.1851 | 0.0063 | |||||

| ILGOV / Ministry Of Finance, Shachar - Corporate Bond/Note | 3.93 | 11.46 | 0.1828 | 0.0262 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 3.93 | 6.45 | 0.1827 | 0.0188 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 3.93 | 6.45 | 0.1827 | 0.0188 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 3.93 | 6.45 | 0.1827 | 0.0188 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 3.93 | 6.45 | 0.1827 | 0.0188 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 3.93 | 6.45 | 0.1827 | 0.0188 | |||||

| BLUE OWL FINANCE LLC COMPANY GUAR 06/31 3.125 / DBT (US09581JAR77) | 3.92 | -38.10 | 0.1822 | -0.0989 | |||||

| NEW YORK NY CITY TRANSITIONAL NYCGEN 05/37 FIXED OID 4.375 / DBT (US64972JLP11) | 3.87 | -0.49 | 0.1800 | 0.0073 | |||||

| NEW YORK NY CITY TRANSITIONAL NYCGEN 05/37 FIXED OID 4.375 / DBT (US64972JLP11) | 3.87 | -0.49 | 0.1800 | 0.0073 | |||||

| XS2716891440 / EPH Financing International AS | 3.84 | 9.66 | 0.1785 | 0.0231 | |||||

| VALE OVERSEAS LIMITED COMPANY GUAR 06/54 6.4 / DBT (US91911TAS24) | 3.84 | -0.42 | 0.1785 | 0.0073 | |||||

| VALE OVERSEAS LIMITED COMPANY GUAR 06/54 6.4 / DBT (US91911TAS24) | 3.84 | -0.42 | 0.1785 | 0.0073 | |||||

| VALE OVERSEAS LIMITED COMPANY GUAR 06/54 6.4 / DBT (US91911TAS24) | 3.84 | -0.42 | 0.1785 | 0.0073 | |||||

| VALE OVERSEAS LIMITED COMPANY GUAR 06/54 6.4 / DBT (US91911TAS24) | 3.84 | -0.42 | 0.1785 | 0.0073 | |||||

| US12644VAD01 / CSN Resources SA | 3.78 | 1.58 | 0.1760 | 0.0106 | |||||

| US66573RAA68 / Northern Star Resources Ltd | 3.76 | 0.67 | 0.1747 | 0.0090 | |||||

| US38122ND336 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/32 FIXED 3.037 | 3.73 | 0.98 | 0.1733 | 0.0094 | |||||

| US05366DAA63 / Aviation Capital Group LLC | 3.72 | 1.14 | 0.1729 | 0.0097 | |||||

| US842400ES88 / Southern California Edison 6% Due 1/15/34 | 3.69 | -0.62 | 0.1719 | 0.0067 | |||||

| US404119CK30 / CORP. NOTE | 3.69 | 2.05 | 0.1717 | 0.0110 | |||||

| US76209PAC77 / RGA GLOBAL FUNDING | 3.67 | 0.25 | 0.1709 | 0.0081 | |||||

| US341099CR80 / Duke Energy Florida LLC | 3.67 | -0.54 | 0.1707 | 0.0068 | |||||

| US373334KP56 / Georgia Power Co | 3.64 | 1.11 | 0.1693 | 0.0094 | |||||

| US03027XCD03 / American Tower Corp | 3.61 | 0.95 | 0.1680 | 0.0091 | |||||

| US87264ABY01 / T-MOBILE USA INC | 3.60 | -0.39 | 0.1677 | 0.0069 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3Q28) | 3.60 | -21.71 | 0.1674 | -0.0368 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3Q28) | 3.60 | -21.71 | 0.1674 | -0.0368 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3Q28) | 3.60 | -21.71 | 0.1674 | -0.0368 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3Q28) | 3.60 | -21.71 | 0.1674 | -0.0368 | |||||

| US03939AAA51 / Arch Capital Group Ltd | 3.58 | 0.31 | 0.1663 | 0.0080 | |||||

| US92857WBS89 / Vodafone Group PLC | 3.57 | 0.91 | 0.1659 | 0.0089 | |||||

| US69121KAG94 / Owl Rock Capital Corp | 3.54 | 1.52 | 0.1647 | 0.0098 | |||||

| EPH FINANCING INTERNATIONAL 08/29 5 / DBT (XS2822505439) | 3.53 | 9.91 | 0.1642 | 0.0215 | |||||

| EPH FINANCING INTERNATIONAL 08/29 5 / DBT (XS2822505439) | 3.53 | 9.91 | 0.1642 | 0.0215 | |||||

| XS2689949555 / Romanian Government International Bond | 3.50 | 9.44 | 0.1629 | 0.0207 | |||||

| US87612GAD34 / Targa Resources Corp. | 3.49 | -1.30 | 0.1625 | 0.0053 | |||||

| US695114CG18 / Pacificorp 6.250000% 10/15/2037 Bond | 3.49 | 0.14 | 0.1624 | 0.0076 | |||||

| R2037 / South Africa - Sovereign or Government Agency Debt | 3.48 | 8.41 | 0.1620 | 0.0193 | |||||

| US22550L2M24 / Credit Suisse AG/New York NY | 3.45 | 0.17 | 0.1606 | 0.0075 | |||||

| US186108CL84 / Cleveland Electric Illuminating Co. (The) | 3.44 | 0.73 | 0.1601 | 0.0083 | |||||

| US06051GLS65 / Bank of America Corp | 3.44 | -22.85 | 0.1600 | -0.0380 | |||||

| US842434CR16 / Southern California Gas Co | 3.43 | -0.72 | 0.1597 | 0.0061 | |||||

| US595620AW50 / MidAmerican Energy Co. | 3.41 | 1.43 | 0.1586 | 0.0093 | |||||

| US880451AZ24 / TENNESSEE GAS PIPELINE REGD 144A P/P 2.90000000 | 3.38 | 1.23 | 0.1573 | 0.0089 | |||||

| IGT LOTTERY HOLDINGS BV IGT LOTTERY HOLDINGS BV / DBT (XS2893175971) | 3.37 | 10.58 | 0.1566 | 0.0213 | |||||

| IGT LOTTERY HOLDINGS BV IGT LOTTERY HOLDINGS BV / DBT (XS2893175971) | 3.37 | 10.58 | 0.1566 | 0.0213 | |||||

| IGT LOTTERY HOLDINGS BV IGT LOTTERY HOLDINGS BV / DBT (XS2893175971) | 3.37 | 10.58 | 0.1566 | 0.0213 | |||||

| US00108WAR16 / AEP Texas Inc | 3.35 | 0.84 | 0.1558 | 0.0083 | |||||

| US715638BE14 / Peruvian Government International Bond | 3.32 | -15.63 | 0.1542 | -0.0203 | |||||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 3.31 | 0.33 | 0.1541 | 0.0074 | |||||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 3.31 | 0.33 | 0.1541 | 0.0074 | |||||

| US04012XAA37 / Argent Securities Trust 2006-W5 | 3.31 | -0.81 | 0.1538 | 0.0058 | |||||

| US059165EQ94 / BALTIMORE GAS AND ELECTRIC CO | 3.25 | -24.21 | 0.1511 | -0.0393 | |||||

| WOODSIDE FINANCE LTD COMPANY GUAR 05/30 5.4 / DBT (US980236AT06) | 3.25 | 0.1510 | 0.1510 | ||||||

| US98313RAH93 / Wynn Macau Ltd | 3.25 | 2.17 | 0.1510 | 0.0099 | |||||

| US373334JW27 / Georgia Power Company 4.3% 03/15/42 | 3.24 | 0.62 | 0.1508 | 0.0077 | |||||

| US031162CF59 / Amgen Inc | 3.24 | 0.22 | 0.1506 | 0.0071 | |||||

| US46188BAE20 / Invitation Homes Operating Partnership, LP | 3.21 | 1.13 | 0.1494 | 0.0083 | |||||

| US29273RAP47 / Energy Transfer Partners 6.05% 06/01/41 | 3.21 | 1.58 | 0.1491 | 0.0090 | |||||

| US708696BZ13 / Pennsylvania Electric Co. | 3.19 | 0.82 | 0.1483 | 0.0079 | |||||

| US87162WAH34 / TD SYNNEX Corp | 3.19 | 1.40 | 0.1482 | 0.0087 | |||||

| US29278GBA58 / ENEL FINANCE INTERNATIONAL NV | 3.16 | -42.36 | 0.1469 | -0.0965 | |||||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AR40) | 3.15 | -0.22 | 0.1465 | 0.0063 | |||||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AR40) | 3.15 | -0.22 | 0.1465 | 0.0063 | |||||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AR40) | 3.15 | -0.22 | 0.1465 | 0.0063 | |||||

| US12513GBG38 / CDW LLC / CDW Finance Corp | 3.12 | 1.04 | 0.1452 | 0.0080 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 3.10 | 1.60 | 0.1444 | 0.0087 | |||||

| US06738ECG89 / Barclays PLC | 3.08 | 1.89 | 0.1432 | 0.0090 | |||||

| US694308JW85 / Pacific Gas and Electric Co | 3.04 | 1.00 | 0.1414 | 0.0077 | |||||

| US147918AB23 / Cassa Depositi e Prestiti SpA | 3.03 | -0.10 | 0.1410 | 0.0062 | |||||

| US902674ZW39 / UBS AG | 3.02 | 0.70 | 0.1405 | 0.0073 | |||||

| US358266CH59 / FRESNO CNTY CA PENSN OBLG FREGEN 08/30 ZEROCPNOID 0 | 3.01 | 1.28 | 0.1400 | 0.0080 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 3.01 | 1.01 | 0.1399 | 0.0076 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 3.01 | 1.01 | 0.1399 | 0.0076 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 3.01 | 1.01 | 0.1399 | 0.0076 | |||||

| CUMULUS STATIC CLO CMLST 2024 1A A 144A / ABS-CBDO (XS2797421414) | 3.00 | 1.97 | 0.1398 | 0.0089 | |||||

| CUMULUS STATIC CLO CMLST 2024 1A A 144A / ABS-CBDO (XS2797421414) | 3.00 | 1.97 | 0.1398 | 0.0089 | |||||

| CUMULUS STATIC CLO CMLST 2024 1A A 144A / ABS-CBDO (XS2797421414) | 3.00 | 1.97 | 0.1398 | 0.0089 | |||||

| CUMULUS STATIC CLO CMLST 2024 1A A 144A / ABS-CBDO (XS2797421414) | 3.00 | 1.97 | 0.1398 | 0.0089 | |||||

| US48275EAA47 / KREF 2022-FL3 Ltd | 3.00 | -13.57 | 0.1396 | -0.0146 | |||||

| CAPITAL STREET MASTER TRUST CAPST 2024 1 A 144A / ABS-O (US14051LAA08) | 3.00 | -0.07 | 0.1396 | 0.0062 | |||||

| CAPITAL STREET MASTER TRUST CAPST 2024 1 A 144A / ABS-O (US14051LAA08) | 3.00 | -0.07 | 0.1396 | 0.0062 | |||||

| CAPITAL STREET MASTER TRUST CAPST 2024 1 A 144A / ABS-O (US14051LAA08) | 3.00 | -0.07 | 0.1396 | 0.0062 | |||||

| US054561AM77 / AXA EQUITABLE HOLDINGS I SR UNSECURED 04/48 5 | 3.00 | -1.64 | 0.1394 | 0.0041 | |||||

| US638612AM35 / Nationwide Financial Services, Inc. | 2.99 | -1.25 | 0.1391 | 0.0046 | |||||

| US89054XAD75 / Topaz Solar Farms LLC | 2.98 | -3.28 | 0.1387 | 0.0018 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 2.96 | 0.1379 | 0.1379 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 2.96 | 0.1379 | 0.1379 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 2.96 | 0.1379 | 0.1379 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 2.96 | 0.1379 | 0.1379 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 2.96 | 0.1379 | 0.1379 | ||||||

| US976656CJ54 / Wisconsin Electric Power Co | 2.96 | -0.70 | 0.1379 | 0.0053 | |||||

| MX0SGO0000F0 / Mexican Udibonos | 2.95 | 11.39 | 0.1374 | 0.0196 | |||||

| WINSTON RE LTD UNSECURED 144A 02/31 VAR / DBT (US975660AB76) | 2.94 | 0.20 | 0.1370 | 0.0064 | |||||

| GBDC / Golub Capital BDC, Inc. | 2.94 | 0.51 | 0.1368 | 0.0068 | |||||

| GBDC / Golub Capital BDC, Inc. | 2.94 | 0.51 | 0.1368 | 0.0068 | |||||

| GBDC / Golub Capital BDC, Inc. | 2.94 | 0.51 | 0.1368 | 0.0068 | |||||

| GBDC / Golub Capital BDC, Inc. | 2.94 | 0.51 | 0.1368 | 0.0068 | |||||

| GBDC / Golub Capital BDC, Inc. | 2.94 | 0.51 | 0.1368 | 0.0068 | |||||

| XS2586739729 / Imperial Brands Finance Netherlands BV | 2.93 | 9.64 | 0.1365 | 0.0176 | |||||

| IL0011920878 / Israel Discount Bank Ltd | 2.90 | 0.00 | 0.1351 | 0.0061 | |||||

| US161175BZ64 / Charter Communications Operating LLC / Charter Communications Operating Capital | 2.90 | 4.69 | 0.1351 | 0.0119 | |||||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADD63) | 2.87 | 1.60 | 0.1333 | 0.0080 | |||||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADD63) | 2.87 | 1.60 | 0.1333 | 0.0080 | |||||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADD63) | 2.87 | 1.60 | 0.1333 | 0.0080 | |||||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADD63) | 2.87 | 1.60 | 0.1333 | 0.0080 | |||||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADD63) | 2.87 | 1.60 | 0.1333 | 0.0080 | |||||

| US91087BAX82 / Mexico Government International Bond | 2.85 | 0.96 | 0.1327 | 0.0072 | |||||

| US65364UAE64 / Niagara Mohawk Power Corp | 2.85 | -0.59 | 0.1325 | 0.0052 | |||||

| US023771R919 / American Airlines 2016-3 Class AA Pass Through Trust | 2.83 | -3.80 | 0.1318 | 0.0010 | |||||

| US748940AA13 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QS7 A1 | 2.82 | -2.86 | 0.1312 | 0.0023 | |||||

| US74365PAH10 / Prosus NV | 2.81 | 2.74 | 0.1308 | 0.0092 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 2.81 | 1.26 | 0.1306 | 0.0074 | |||||

| US20281PNE87 / CMWLTH FING AUTH PA | 2.79 | -1.14 | 0.1296 | 0.0045 | |||||

| US65473PAN50 / NiSource Inc | 2.79 | -26.42 | 0.1296 | -0.0386 | |||||

| US29365TAK07 / Entergy Texas, Inc. | 2.76 | 1.69 | 0.1286 | 0.0078 | |||||

| US912810RC45 / United States Treas Bds Bond | 2.75 | -2.13 | 0.1281 | 0.0031 | |||||

| US68389XCB91 / Oracle Corp | 2.75 | 1.14 | 0.1279 | 0.0072 | |||||

| FISH POND RE LTD UNSECURED 144A 01/27 VAR / DBT (US33774EAA29) | 2.75 | -0.47 | 0.1279 | 0.0052 | |||||

| FISH POND RE LTD UNSECURED 144A 01/27 VAR / DBT (US33774EAA29) | 2.75 | -0.47 | 0.1279 | 0.0052 | |||||

| FISH POND RE LTD UNSECURED 144A 01/27 VAR / DBT (US33774EAA29) | 2.75 | -0.47 | 0.1279 | 0.0052 | |||||

| US12505BAG59 / CBRE Services Inc | 2.74 | 0.70 | 0.1274 | 0.0066 | |||||

| CAPE LOOKOUT RE LTD UNSECURED 144A 04/27 VAR / DBT (US13947LAF94) | 2.74 | -1.33 | 0.1274 | 0.0041 | |||||

| CAPE LOOKOUT RE LTD UNSECURED 144A 04/27 VAR / DBT (US13947LAF94) | 2.74 | -1.33 | 0.1274 | 0.0041 | |||||

| BP CAPITAL MARKETS B.V. 09/31 3.36 / DBT (XS2902720171) | 2.73 | 10.42 | 0.1272 | 0.0172 | |||||

| BP CAPITAL MARKETS B.V. 09/31 3.36 / DBT (XS2902720171) | 2.73 | 10.42 | 0.1272 | 0.0172 | |||||

| BP CAPITAL MARKETS B.V. 09/31 3.36 / DBT (XS2902720171) | 2.73 | 10.42 | 0.1272 | 0.0172 | |||||

| BP CAPITAL MARKETS B.V. 09/31 3.36 / DBT (XS2902720171) | 2.73 | 10.42 | 0.1272 | 0.0172 | |||||

| US404119BY43 / HCA Inc | 2.73 | 1.34 | 0.1270 | 0.0073 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2.72 | 1.38 | 0.1268 | 0.0074 | |||||

| US14019TAA43 / Capital Farm Credit ACA | 2.70 | 0.00 | 2.71 | 0.04 | 0.1262 | 0.0057 | |||

| US309601AE28 / Farmers Insurance Exchange | 2.70 | 0.67 | 0.1257 | 0.0065 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 2.69 | -1.36 | 0.1252 | 0.0040 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 2.69 | -1.36 | 0.1252 | 0.0040 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 2.69 | -1.36 | 0.1252 | 0.0040 | |||||

| US462613AP51 / CORP. NOTE | 2.69 | 0.86 | 0.1251 | 0.0067 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.68 | 0.1248 | 0.1248 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.68 | 0.1248 | 0.1248 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.68 | 0.1248 | 0.1248 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.68 | 0.1248 | 0.1248 | ||||||

| US12513GBJ76 / CDW LLC / CDW Finance Corp | 2.67 | 1.83 | 0.1243 | 0.0077 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.67 | 0.1241 | 0.1241 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.67 | 0.1241 | 0.1241 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.67 | 0.1241 | 0.1241 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.67 | 0.1241 | 0.1241 | ||||||

| US842400FW81 / Southern Cal Edison 3.9% 03/15/43 | 2.66 | -2.74 | 0.1238 | 0.0023 | |||||

| US46115HBV87 / INTESA SANPAOLO SPA | 2.66 | -51.80 | 0.1237 | -0.1213 | |||||

| US225401AT54 / Credit Suisse Group AG | 2.65 | -26.38 | 0.1233 | -0.0366 | |||||

| US88258MAB19 / Texas Natural Gas Securitization Finance Corp. | 2.63 | -0.08 | 0.1223 | 0.0054 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.61 | 1.44 | 0.1214 | 0.0071 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.61 | 1.44 | 0.1214 | 0.0071 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.61 | 1.44 | 0.1214 | 0.0071 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.61 | 1.44 | 0.1214 | 0.0071 | |||||

| URSA RE LTD UNSECURED 144A 12/26 VAR / DBT (US90323WAP59) | 2.58 | -0.77 | 0.1199 | 0.0045 | |||||

| URSA RE LTD UNSECURED 144A 12/26 VAR / DBT (US90323WAP59) | 2.58 | -0.77 | 0.1199 | 0.0045 | |||||

| URSA RE LTD UNSECURED 144A 12/26 VAR / DBT (US90323WAP59) | 2.58 | -0.77 | 0.1199 | 0.0045 | |||||

| URSA RE LTD UNSECURED 144A 12/26 VAR / DBT (US90323WAP59) | 2.58 | -0.77 | 0.1199 | 0.0045 | |||||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 2.57 | -83.68 | 0.1197 | -0.5808 | |||||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 2.57 | -83.68 | 0.1197 | -0.5808 | |||||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 2.57 | -83.68 | 0.1197 | -0.5808 | |||||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 2.57 | -83.68 | 0.1197 | -0.5808 | |||||

| XS0765596357 / Morgan Stanley | 2.57 | 3.42 | 0.1195 | 0.0092 | |||||

| XS2262961076 / ZF Finance GmbH | 2.56 | -2.33 | 0.1192 | 0.0027 | |||||

| XS2262961076 / ZF Finance GmbH | 2.56 | -2.33 | 0.1192 | 0.0027 | |||||

| XS2262961076 / ZF Finance GmbH | 2.56 | -2.33 | 0.1192 | 0.0027 | |||||

| US733174AL01 / Popular Inc | 2.55 | 2.45 | 0.1187 | 0.0081 | |||||

| US11135FBK66 / BROADCOM INC 3.419% 04/15/2033 144A | 2.54 | 1.89 | 0.1182 | 0.0074 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.52 | 0.88 | 0.1173 | 0.0063 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.52 | 0.88 | 0.1173 | 0.0063 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.52 | 0.88 | 0.1173 | 0.0063 | |||||

| US64828XAA19 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2020-RPL1 SER 2020-RPL1 CL A1 V/R REGD 144A P/P 2.75000000 | 2.49 | -4.16 | 0.1159 | 0.0005 | |||||

| US045054AR41 / Ashtead Capital, Inc. | 2.49 | 2.14 | 0.1157 | 0.0075 | |||||

| US35640YAK38 / Freedom Mortgage Corp | 2.47 | 0.08 | 0.1151 | 0.0053 | |||||

| US36245YAW49 / GSAMP Trust 2007-H1 | 2.45 | -1.92 | 0.1140 | 0.0030 | |||||

| SOUND POINT CLO LTD SNDPT 2020 3A A1R 144A / ABS-CBDO (US83615CAL00) | 2.45 | -10.40 | 0.1139 | -0.0075 | |||||

| SOUND POINT CLO LTD SNDPT 2020 3A A1R 144A / ABS-CBDO (US83615CAL00) | 2.45 | -10.40 | 0.1139 | -0.0075 | |||||

| SOUND POINT CLO LTD SNDPT 2020 3A A1R 144A / ABS-CBDO (US83615CAL00) | 2.45 | -10.40 | 0.1139 | -0.0075 | |||||

| SOUND POINT CLO LTD SNDPT 2020 3A A1R 144A / ABS-CBDO (US83615CAL00) | 2.45 | -10.40 | 0.1139 | -0.0075 | |||||

| USU5009LAZ32 / Kraft Heinz Foods Co | 2.45 | -10.44 | 0.1137 | -0.0076 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 2.43 | 0.79 | 0.1132 | 0.0060 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 2.43 | 0.79 | 0.1132 | 0.0060 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 2.43 | 0.79 | 0.1132 | 0.0060 | |||||

| US45866FAQ72 / Intercontinental Exchange Inc | 2.42 | 0.25 | 0.1128 | 0.0054 | |||||

| US86358EPD21 / STRUCTURED ASSET INVESTMENT LO SAIL 2004 10 M2 | 2.41 | 0.84 | 0.1122 | 0.0059 | |||||

| US636180BR19 / National Fuel Gas Co | 2.41 | 0.58 | 0.1121 | 0.0057 | |||||

| US32027NED93 / FIRST FRANKLIN MTG LOAN ASSET FFML 2003 FFH1 M1 | 2.41 | -7.03 | 0.1121 | -0.0030 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/27 4.95 / DBT (US928668CN06) | 2.41 | 0.17 | 0.1120 | 0.0052 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/27 4.95 / DBT (US928668CN06) | 2.41 | 0.17 | 0.1120 | 0.0052 | |||||

| CBAMR LTD CBAMR 2019 9A AR 144A / ABS-CBDO (US14987VAN91) | 2.41 | 0.12 | 0.1120 | 0.0052 | |||||

| US68389XBP96 / Oracle Corp | 2.40 | 1.61 | 0.1116 | 0.0067 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 2.40 | 1.14 | 0.1115 | 0.0062 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 2.40 | 1.14 | 0.1115 | 0.0062 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 2.40 | 1.14 | 0.1115 | 0.0062 | |||||

| GATEWAY LEASE CTL A WHLN03785 / ABS-O (963SPPII4) | 2.39 | 4.79 | 0.1110 | 0.0098 | |||||

| US28504KAA51 / Electricite de France SA | 2.37 | 0.25 | 0.1104 | 0.0053 | |||||

| US38381RCG20 / GOVERNMENT NATIONAL MORTGAGE A GNR 2019 20 ZG | 2.37 | 1.63 | 0.1104 | 0.0067 | |||||

| TEVA PHARM FNC NL II COMPANY GUAR 06/31 4.125 / DBT (XS3081797964) | 2.37 | 0.1101 | 0.1101 | ||||||

| TEVA PHARM FNC NL II COMPANY GUAR 06/31 4.125 / DBT (XS3081797964) | 2.37 | 0.1101 | 0.1101 | ||||||

| TEVA PHARM FNC NL II COMPANY GUAR 06/31 4.125 / DBT (XS3081797964) | 2.37 | 0.1101 | 0.1101 | ||||||

| TEVA PHARM FNC NL II COMPANY GUAR 06/31 4.125 / DBT (XS3081797964) | 2.37 | 0.1101 | 0.1101 | ||||||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2024 1A BR 144A / ABS-CBDO (XS3040415286) | 2.36 | 9.25 | 0.1099 | 0.0138 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2.36 | 0.1097 | 0.1097 | ||||||

| ARBOUR CLO ARBR 11A AR / ABS-CBDO (XS2814888132) | 2.36 | 8.87 | 0.1097 | 0.0135 | |||||

| ARBOUR CLO ARBR 11A AR / ABS-CBDO (XS2814888132) | 2.36 | 8.87 | 0.1097 | 0.0135 | |||||

| ARBOUR CLO ARBR 11A AR / ABS-CBDO (XS2814888132) | 2.36 | 8.87 | 0.1097 | 0.0135 | |||||

| ARBOUR CLO ARBR 11A AR / ABS-CBDO (XS2814888132) | 2.36 | 8.87 | 0.1097 | 0.0135 | |||||

| US98162JAA43 / Worldwide Plaza Trust 2017-WWP | 2.35 | 2.81 | 0.1091 | 0.0078 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 2.34 | -31.74 | 0.1090 | -0.0435 | |||||

| US87264ACT07 / T-Mobile USA Inc | 2.34 | -1.14 | 0.1089 | 0.0037 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2.34 | 0.86 | 0.1088 | 0.0058 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2.34 | 0.86 | 0.1088 | 0.0058 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2.34 | 0.86 | 0.1088 | 0.0058 | |||||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 2.33 | 0.1085 | 0.1085 | ||||||

| US19075QAD43 / CoBank, ACB | 2.40 | 0.00 | 2.32 | 0.65 | 0.1079 | 0.0055 | |||

| US26442UAK07 / Duke Energy Progress LLC | 2.31 | -1.07 | 0.1076 | 0.0037 | |||||

| US48020QAB32 / JONES LANG LASALLE INCORPORATED | 2.31 | 1.14 | 0.1074 | 0.0060 | |||||

| US845437BL54 / Southwestern Elec Pwr Co Senior Notes-h 6.2% 03/15/40 | 2.30 | -1.80 | 0.1068 | 0.0030 | |||||

| US65536PAC41 / Nomura Asset Acceptance Corp Alternative Loan Trust Series 2006-AF1 | 2.29 | -4.46 | 0.1066 | 0.0001 | |||||

| US797440BX17 / San Diego Gas & Electric Co | 2.29 | -1.29 | 0.1065 | 0.0035 | |||||

| BERRY GLOBAL INC SR SECURED 04/28 5.5 / DBT (US08576PAL58) | 2.26 | 0.67 | 0.1051 | 0.0054 | |||||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 2.25 | 0.1049 | 0.1049 | ||||||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 2.25 | 0.1049 | 0.1049 | ||||||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 2.25 | 0.1049 | 0.1049 | ||||||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 2.25 | 0.1049 | 0.1049 | ||||||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 2.25 | 0.1049 | 0.1049 | ||||||

| US373334KR13 / GEORGIA POWER COMPANY | 2.25 | 0.81 | 0.1045 | 0.0055 | |||||

| EQT / EQT AB (publ) | 2.25 | 0.1045 | 0.1045 | ||||||

| US29250NBR52 / Enbridge Inc | 2.23 | 1.04 | 0.1038 | 0.0057 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 2.23 | -26.02 | 0.1036 | -0.0301 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 2.23 | -26.02 | 0.1036 | -0.0301 | |||||

| US23371DAG97 / DAE Funding LLC | 2.21 | 0.91 | 0.1030 | 0.0056 | |||||

| US87612GAC50 / Targa Resources Corporation | 2.21 | 1.00 | 0.1030 | 0.0056 | |||||

| US902613AS79 / UBS Group AG | 2.20 | 0.18 | 0.1026 | 0.0048 | |||||

| US759351AR05 / Reinsurance Group of America Inc | 2.20 | 0.92 | 0.1025 | 0.0055 | |||||

| US83611XAB01 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 EQ2 A2 | 2.19 | -2.01 | 0.1021 | 0.0026 | |||||

| US57643LFN10 / MASTR ASSET BACKED SECURITIES MABS 2004 WMC3 M1 | 2.18 | -2.63 | 0.1016 | 0.0020 | |||||

| US45262BAB99 / IMPERIAL BRANDS FIN PLC REGD 144A P/P 3.50000000 | 2.17 | 0.28 | 0.1012 | 0.0048 | |||||

| US039936AA70 / Ares Finance Co. IV LLC | 2.15 | -2.89 | 0.1001 | 0.0017 | |||||

| IL0060004004 / Israel Electric Corp Ltd | 2.15 | 0.23 | 0.1000 | 0.0047 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.14 | -31.19 | 0.0997 | -0.0387 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.14 | -31.19 | 0.0997 | -0.0387 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.14 | -31.19 | 0.0997 | -0.0387 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.14 | -31.19 | 0.0997 | -0.0387 | |||||

| US46115HCD70 / Intesa Sanpaolo SpA | 2.13 | 1.23 | 0.0993 | 0.0056 | |||||

| EAST LANE RE VII LTD UNSECURED 144A 03/26 VAR / DBT (US27332EAA91) | 2.13 | 0.52 | 0.0990 | 0.0050 | |||||

| EAST LANE RE VII LTD UNSECURED 144A 03/26 VAR / DBT (US27332EAA91) | 2.13 | 0.52 | 0.0990 | 0.0050 | |||||

| EAST LANE RE VII LTD UNSECURED 144A 03/26 VAR / DBT (US27332EAA91) | 2.13 | 0.52 | 0.0990 | 0.0050 | |||||

| EAST LANE RE VII LTD UNSECURED 144A 03/26 VAR / DBT (US27332EAA91) | 2.13 | 0.52 | 0.0990 | 0.0050 | |||||

| EVERGY KANSAS CENTRAL 1ST MORTGAGE 03/35 5.25 / DBT (US30036FAD33) | 2.13 | 0.76 | 0.0989 | 0.0052 | |||||

| EVERGY KANSAS CENTRAL 1ST MORTGAGE 03/35 5.25 / DBT (US30036FAD33) | 2.13 | 0.76 | 0.0989 | 0.0052 | |||||

| EVERGY KANSAS CENTRAL 1ST MORTGAGE 03/35 5.25 / DBT (US30036FAD33) | 2.13 | 0.76 | 0.0989 | 0.0052 | |||||

| EVERGY KANSAS CENTRAL 1ST MORTGAGE 03/35 5.25 / DBT (US30036FAD33) | 2.13 | 0.76 | 0.0989 | 0.0052 | |||||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 2.12 | -6.57 | 0.0987 | -0.0022 | |||||

| 4020 / Saudi Real Estate Company | 2.11 | 9.94 | 0.0983 | 0.0129 | |||||

| 4020 / Saudi Real Estate Company | 2.11 | 9.94 | 0.0983 | 0.0129 | |||||

| US29364GAP81 / Entergy Corp | 2.11 | 2.47 | 0.0983 | 0.0067 | |||||

| US302635AL16 / FS KKR Capital Corp. | 2.11 | 0.19 | 0.0982 | 0.0046 | |||||

| US695114CL03 / PacifiCorp | 2.11 | 0.24 | 0.0981 | 0.0046 | |||||

| HPS CORPORATE LENDING FU SR UNSECURED 144A 06/30 5.85 / DBT (US40440VAN55) | 2.10 | 0.0975 | 0.0975 | ||||||

| HPS CORPORATE LENDING FU SR UNSECURED 144A 06/30 5.85 / DBT (US40440VAN55) | 2.10 | 0.0975 | 0.0975 | ||||||

| HPS CORPORATE LENDING FU SR UNSECURED 144A 06/30 5.85 / DBT (US40440VAN55) | 2.10 | 0.0975 | 0.0975 | ||||||

| HPS CORPORATE LENDING FU SR UNSECURED 144A 06/30 5.85 / DBT (US40440VAN55) | 2.10 | 0.0975 | 0.0975 | ||||||

| JANE STREET GROUP LLC 2024 TERM LOAN B1 / LON (US47077DAM20) | 2.09 | 0.82 | 0.0972 | 0.0051 | |||||

| JANE STREET GROUP LLC 2024 TERM LOAN B1 / LON (US47077DAM20) | 2.09 | 0.82 | 0.0972 | 0.0051 | |||||

| JANE STREET GROUP LLC 2024 TERM LOAN B1 / LON (US47077DAM20) | 2.09 | 0.82 | 0.0972 | 0.0051 | |||||

| JANE STREET GROUP LLC 2024 TERM LOAN B1 / LON (US47077DAM20) | 2.09 | 0.82 | 0.0972 | 0.0051 | |||||

| JANE STREET GROUP LLC 2024 TERM LOAN B1 / LON (US47077DAM20) | 2.09 | 0.82 | 0.0972 | 0.0051 | |||||

| FNMA POOL BZ1178 FN 06/31 FIXED 5.81 / ABS-MBS (US3140NVJY44) | 2.08 | -1.14 | 0.0966 | 0.0033 | |||||

| FNMA POOL BZ1178 FN 06/31 FIXED 5.81 / ABS-MBS (US3140NVJY44) | 2.08 | -1.14 | 0.0966 | 0.0033 | |||||

| US30225VAK35 / Extra Space Storage LP | 2.08 | 1.17 | 0.0966 | 0.0054 | |||||

| US842400HM81 / Southern California Edison Co | 2.07 | 1.27 | 0.0963 | 0.0055 | |||||

| US546676AZ04 / Louisville Gas and Electric Co | 2.07 | 1.12 | 0.0963 | 0.0054 | |||||

| US491674BN65 / Kentucky Utilities Co | 2.06 | 0.73 | 0.0960 | 0.0050 | |||||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 2.06 | -0.29 | 0.0960 | 0.0041 | |||||

| US16165WAA45 / ChaseFlex Trust Series 2007-2 | 2.05 | -6.59 | 0.0956 | -0.0021 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 2.05 | -27.92 | 0.0955 | -0.0310 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 2.05 | -27.92 | 0.0955 | -0.0310 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 2.05 | -27.92 | 0.0955 | -0.0310 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2.05 | 1.13 | 0.0955 | 0.0053 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2.05 | 0.98 | 0.0954 | 0.0052 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2.05 | 0.98 | 0.0954 | 0.0052 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2.05 | 0.98 | 0.0954 | 0.0052 | |||||

| SRG / Snam S.p.A. | 2.04 | 0.0951 | 0.0951 | ||||||

| US06738EBV65 / Barclays PLC | 2.04 | 2.11 | 0.0947 | 0.0061 | |||||

| US235218M502 / DALLAS TX DAL 02/33 ZEROCPNOID 0 | 2.03 | 2.47 | 0.0945 | 0.0064 | |||||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 2.02 | 0.70 | 0.0942 | 0.0049 | |||||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 2.02 | 0.70 | 0.0942 | 0.0049 | |||||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 2.02 | 0.70 | 0.0942 | 0.0049 | |||||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 2.02 | 0.70 | 0.0942 | 0.0049 | |||||

| US45434L2H62 / Indian Railway Finance Corp Ltd | 2.02 | 1.25 | 0.0942 | 0.0054 | |||||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 2.02 | 548.40 | 0.0941 | 0.0802 | |||||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 2.02 | 548.40 | 0.0941 | 0.0802 | |||||

| US87162WAK62 / TD SYNNEX Corp. | 2.02 | 1.05 | 0.0940 | 0.0052 | |||||

| US80007RAN52 / Sands China Ltd | 2.02 | 1.36 | 0.0939 | 0.0054 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 2.02 | -0.05 | 0.0938 | 0.0042 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 2.02 | -0.05 | 0.0938 | 0.0042 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 2.02 | -0.05 | 0.0938 | 0.0042 | |||||

| GROSVENOR PLACE CLO GROSV 2024 2A A 144A / ABS-CBDO (XS2925040128) | 2.00 | 8.81 | 0.0931 | 0.0114 | |||||

| GROSVENOR PLACE CLO GROSV 2024 2A A 144A / ABS-CBDO (XS2925040128) | 2.00 | 8.81 | 0.0931 | 0.0114 | |||||

| GROSVENOR PLACE CLO GROSV 2024 2A A 144A / ABS-CBDO (XS2925040128) | 2.00 | 8.81 | 0.0931 | 0.0114 | |||||

| GROSVENOR PLACE CLO GROSV 2024 2A A 144A / ABS-CBDO (XS2925040128) | 2.00 | 8.81 | 0.0931 | 0.0114 | |||||

| GROSVENOR PLACE CLO GROSV 2024 2A A 144A / ABS-CBDO (XS2925040128) | 2.00 | 8.81 | 0.0931 | 0.0114 | |||||

| TRINITAS CLO LTD TRNTS 2020 14A A1R 144A / ABS-CBDO (US89641QAN07) | 2.00 | 0.10 | 0.0931 | 0.0043 | |||||

| TRINITAS CLO LTD TRNTS 2020 14A A1R 144A / ABS-CBDO (US89641QAN07) | 2.00 | 0.10 | 0.0931 | 0.0043 | |||||

| TRINITAS CLO LTD TRNTS 2020 14A A1R 144A / ABS-CBDO (US89641QAN07) | 2.00 | 0.10 | 0.0931 | 0.0043 | |||||

| US00452AAA88 / Accident Fund Insurance Company of America | 2.00 | 0.10 | 0.0929 | 0.0043 | |||||

| US25714PEP99 / Dominican Republic International Bond | 2.00 | 1.22 | 0.0929 | 0.0052 | |||||

| US694308HA83 / Pacific Gas & Electric 3.75% 08/15/42 | 1.99 | -4.28 | 0.0926 | 0.0002 | |||||

| US66988RAD98 / NOVASTAR HOME EQUITY LOAN NHEL 2006 6 A2C | 1.97 | -1.45 | 0.0914 | 0.0028 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 1.96 | 0.26 | 0.0912 | 0.0043 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 1.96 | 0.26 | 0.0912 | 0.0043 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 1.96 | 0.26 | 0.0912 | 0.0043 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 1.96 | 0.26 | 0.0912 | 0.0043 | |||||

| US694308KB20 / Pacific Gas and Electric Co | 1.95 | 0.88 | 0.0908 | 0.0049 | |||||

| US682691AB63 / OneMain Finance Corp | 1.95 | 2.15 | 0.0907 | 0.0059 | |||||

| US09261BAD29 / Blackstone Holdings Finance Co LLC | 1.94 | 1.95 | 0.0901 | 0.0057 | |||||

| US12687GAA76 / Cablevision Lightpath LLC | 1.93 | 1.42 | 0.0897 | 0.0053 | |||||

| US11135FBT75 / Broadcom, Inc. | 1.93 | 1.63 | 0.0897 | 0.0054 | |||||

| US00928QAU58 / Aircastle Ltd | 1.91 | -36.64 | 0.0891 | -0.0452 | |||||

| US161175BL78 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.91 | 4.71 | 0.0889 | 0.0078 | |||||

| US023771S255 / American Airlines 2016-3 Class A Pass Through Trust | 1.91 | -3.69 | 0.0888 | 0.0008 | |||||

| US066836AC15 / Baptist Health South Florida Obligated Group | 1.90 | -5.13 | 0.0886 | -0.0006 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1.90 | 0.0885 | 0.0885 | ||||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1.90 | 0.0885 | 0.0885 | ||||||

| US35729PJF80 / Fremont Home Loan Trust 2005-1 | 1.89 | -12.55 | 0.0879 | -0.0081 | |||||

| US41162DAA72 / HarborView Mortgage Loan Trust 2006-12 | 1.89 | -1.31 | 0.0877 | 0.0029 | |||||

| CITADEL SECURITIES LP 2024 FIRST LIEN TERM LOAN / LON (US17288YAN22) | 1.88 | 0.27 | 0.0875 | 0.0042 | |||||

| CITADEL SECURITIES LP 2024 FIRST LIEN TERM LOAN / LON (US17288YAN22) | 1.88 | 0.27 | 0.0875 | 0.0042 | |||||

| INVESCO EURO CLO INVSC 5A AR 144A / ABS-CBDO (XS3036677501) | 1.88 | 8.73 | 0.0875 | 0.0107 | |||||

| INVESCO EURO CLO INVSC 5A AR 144A / ABS-CBDO (XS3036677501) | 1.88 | 8.73 | 0.0875 | 0.0107 | |||||

| INVESCO EURO CLO INVSC 5A AR 144A / ABS-CBDO (XS3036677501) | 1.88 | 8.73 | 0.0875 | 0.0107 | |||||

| INVESCO EURO CLO INVSC 5A AR 144A / ABS-CBDO (XS3036677501) | 1.88 | 8.73 | 0.0875 | 0.0107 | |||||

| INVESCO EURO CLO INVSC 5A AR 144A / ABS-CBDO (XS3036677501) | 1.88 | 8.73 | 0.0875 | 0.0107 | |||||

| US694308KC03 / Pacific Gas and Electric Co | 1.88 | 0.21 | 0.0873 | 0.0041 | |||||

| US38122ND666 / GOLDEN ST TOBACCO SECURITIZATION CORP CA TOBACCO SETTLEMENT | 1.87 | -4.63 | 0.0872 | -0.0001 | |||||

| VAR ENERGI ASA SR UNSECURED 144A 05/35 6.5 / DBT (US92212WAG50) | 1.87 | 0.0868 | 0.0868 | ||||||

| VAR ENERGI ASA SR UNSECURED 144A 05/35 6.5 / DBT (US92212WAG50) | 1.87 | 0.0868 | 0.0868 | ||||||

| VAR ENERGI ASA SR UNSECURED 144A 05/35 6.5 / DBT (US92212WAG50) | 1.87 | 0.0868 | 0.0868 | ||||||

| VAR ENERGI ASA SR UNSECURED 144A 05/35 6.5 / DBT (US92212WAG50) | 1.87 | 0.0868 | 0.0868 | ||||||

| VAR ENERGI ASA SR UNSECURED 144A 05/35 6.5 / DBT (US92212WAG50) | 1.87 | 0.0868 | 0.0868 | ||||||

| US12668BB774 / Alternative Loan Trust 2006-OA3 | 1.85 | -4.84 | 0.0860 | -0.0003 | |||||

| US81211KAZ30 / Sealed Air Corp. | 1.84 | 0.60 | 0.0856 | 0.0043 | |||||

| US694308JG36 / Pacific Gas and Electric Co | 1.82 | 1.05 | 0.0849 | 0.0046 | |||||

| US20402CAA36 / Community Preservation Corp/The | 1.82 | 2.30 | 0.0848 | 0.0057 | |||||

| US46653KAB44 / JAB Holdings BV | 1.82 | -0.82 | 0.0846 | 0.0031 | |||||

| VOYA CLO LTD VOYA 2019 2A AR 144A / ABS-CBDO (US92917RAL33) | 1.81 | -1.26 | 0.0841 | 0.0028 | |||||

| VOYA CLO LTD VOYA 2019 2A AR 144A / ABS-CBDO (US92917RAL33) | 1.81 | -1.26 | 0.0841 | 0.0028 | |||||

| VOYA CLO LTD VOYA 2019 2A AR 144A / ABS-CBDO (US92917RAL33) | 1.81 | -1.26 | 0.0841 | 0.0028 | |||||

| VOYA CLO LTD VOYA 2019 2A AR 144A / ABS-CBDO (US92917RAL33) | 1.81 | -1.26 | 0.0841 | 0.0028 | |||||

| VOYA CLO LTD VOYA 2019 2A AR 144A / ABS-CBDO (US92917RAL33) | 1.81 | -1.26 | 0.0841 | 0.0028 | |||||

| US52107QAK13 / Lazard Group LLC | 1.78 | 0.34 | 0.0828 | 0.0040 | |||||

| POLESTAR RE LTD UNSECURED 144A 01/27 VAR / DBT (US73110JAB89) | 1.78 | 0.91 | 0.0826 | 0.0045 | |||||

| POLESTAR RE LTD UNSECURED 144A 01/27 VAR / DBT (US73110JAB89) | 1.78 | 0.91 | 0.0826 | 0.0045 | |||||

| US03027XBK54 / American Tower Corp | 1.77 | 0.28 | 0.0826 | 0.0040 | |||||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 1.76 | 0.86 | 0.0819 | 0.0043 | |||||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 1.76 | 0.86 | 0.0819 | 0.0043 | |||||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 1.76 | 0.86 | 0.0819 | 0.0043 | |||||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 1.76 | 0.86 | 0.0819 | 0.0043 | |||||

| US842400GY39 / Southern California Edison Co | 1.76 | -3.40 | 0.0819 | 0.0009 | |||||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1.75 | 0.81 | 0.0816 | 0.0043 | |||||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1.75 | 0.81 | 0.0816 | 0.0043 | |||||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1.75 | 0.81 | 0.0816 | 0.0043 | |||||

| ABU DHABI DEVELOPMENTAL ABU DHABI DEVELOPMENTAL / DBT (US00402D2A25) | 1.75 | 0.52 | 0.0815 | 0.0040 | |||||

| ABU DHABI DEVELOPMENTAL ABU DHABI DEVELOPMENTAL / DBT (US00402D2A25) | 1.75 | 0.52 | 0.0815 | 0.0040 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1.75 | 0.87 | 0.0812 | 0.0043 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1.75 | 0.87 | 0.0812 | 0.0043 | |||||

| US073871AA35 / Bear Stearns ALT-A Trust 2006-4 | 1.75 | -2.35 | 0.0812 | 0.0018 | |||||

| US61753NAF78 / MORGAN STANLEY CAPITAL INC MSAC 2007 NC2 A2D | 1.74 | -0.97 | 0.0811 | 0.0029 | |||||

| US87804AAA07 / TBW Mortgage-Backed Trust Series 2006-3 | 1.74 | -1.42 | 0.0808 | 0.0025 | |||||

| US539439AY57 / LLOYDS BANKING GROUP PLC 5.985000% 08/07/2027 | 1.73 | -37.12 | 0.0803 | -0.0416 | |||||

| US345397D260 / Ford Motor Credit Co LLC | 1.72 | -0.17 | 0.0802 | 0.0035 | |||||

| US649840CT03 / New York State Electric & Gas Corp | 1.72 | 1.24 | 0.0799 | 0.0045 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.70 | 1.13 | 0.0792 | 0.0044 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.70 | 1.13 | 0.0792 | 0.0044 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.70 | 1.13 | 0.0792 | 0.0044 | |||||

| US09261BAF76 / Blackstone Holdings Finance Co. LLC | 1.70 | -0.41 | 0.0791 | 0.0032 | |||||

| BRO / Brown & Brown, Inc. | 1.70 | 0.89 | 0.0789 | 0.0042 | |||||

| US404280DR76 / HSBC Holdings PLC | 1.70 | -36.11 | 0.0789 | -0.0390 | |||||

| US902613AT52 / UBS Group AG | 1.70 | 1.50 | 0.0789 | 0.0047 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 1.69 | 0.0787 | 0.0787 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 1.69 | 0.0787 | 0.0787 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 1.69 | 0.0787 | 0.0787 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 1.69 | 0.0787 | 0.0787 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 1.69 | 0.0787 | 0.0787 | ||||||

| VISTRA ZERO OPRTNG COMPANY LLC TERM LOAN B / LON (US92841DAB73) | 1.67 | 2.14 | 0.0778 | 0.0051 | |||||

| VISTRA ZERO OPRTNG COMPANY LLC TERM LOAN B / LON (US92841DAB73) | 1.67 | 2.14 | 0.0778 | 0.0051 | |||||

| VISTRA ZERO OPRTNG COMPANY LLC TERM LOAN B / LON (US92841DAB73) | 1.67 | 2.14 | 0.0778 | 0.0051 | |||||

| VFQS / Vodafone Qatar P.Q.S.C. | 1.66 | 0.24 | 0.0774 | 0.0037 | |||||

| VFQS / Vodafone Qatar P.Q.S.C. | 1.66 | 0.24 | 0.0774 | 0.0037 | |||||

| VFQS / Vodafone Qatar P.Q.S.C. | 1.66 | 0.24 | 0.0774 | 0.0037 | |||||

| US02666TAE73 / American Homes 4 Rent LP | 1.66 | 1.71 | 0.0773 | 0.0047 | |||||

| US010392FS24 / Alabama Power Co | 1.66 | 0.18 | 0.0772 | 0.0036 | |||||

| US302635AK33 / FS KKR Capital Corp. | 1.65 | 0.79 | 0.0768 | 0.0040 | |||||

| US39541EAA10 / Greensaif Pipelines Bidco Sarl | 1.65 | 0.30 | 0.0768 | 0.0037 | |||||

| US919451AA29 / Valley Children's Hospital | 1.61 | -3.53 | 0.0751 | 0.0007 | |||||

| US90931EAA29 / United Airlines Pass Through Trust, Series 2019-1, Class A | 1.61 | -0.25 | 0.0749 | 0.0032 | |||||

| 4020 / Saudi Real Estate Company | 1.61 | 10.36 | 0.0748 | 0.0100 | |||||

| 4020 / Saudi Real Estate Company | 1.61 | 10.36 | 0.0748 | 0.0100 | |||||

| 4020 / Saudi Real Estate Company | 1.61 | 10.36 | 0.0748 | 0.0100 | |||||

| US48255BAA44 / KKR Group Finance Co X LLC | 1.61 | 0.88 | 0.0747 | 0.0040 | |||||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/30 5.8 / DBT (US04020EAK38) | 1.61 | 0.0747 | 0.0747 | ||||||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/30 5.8 / DBT (US04020EAK38) | 1.61 | 0.0747 | 0.0747 | ||||||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/30 5.8 / DBT (US04020EAK38) | 1.61 | 0.0747 | 0.0747 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.60 | -37.59 | 0.0744 | -0.0394 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.60 | -37.59 | 0.0744 | -0.0394 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.60 | -37.59 | 0.0744 | -0.0394 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.60 | -37.59 | 0.0744 | -0.0394 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.60 | -37.59 | 0.0744 | -0.0394 | |||||

| 37 CAPITAL CLO LTD PUTNM 2023 2A AR 144A / ABS-CBDO (US883932AN54) | 1.59 | 0.13 | 0.0742 | 0.0034 | |||||

| 37 CAPITAL CLO LTD PUTNM 2023 2A AR 144A / ABS-CBDO (US883932AN54) | 1.59 | 0.13 | 0.0742 | 0.0034 | |||||

| 37 CAPITAL CLO LTD PUTNM 2023 2A AR 144A / ABS-CBDO (US883932AN54) | 1.59 | 0.13 | 0.0742 | 0.0034 | |||||

| AS MILEAGE PLAN IP LTD SR SECURED 144A 10/31 5.308 / DBT (US00218QAB68) | 1.58 | 0.64 | 0.0733 | 0.0037 | |||||

| AS MILEAGE PLAN IP LTD SR SECURED 144A 10/31 5.308 / DBT (US00218QAB68) | 1.58 | 0.64 | 0.0733 | 0.0037 | |||||

| AS MILEAGE PLAN IP LTD SR SECURED 144A 10/31 5.308 / DBT (US00218QAB68) | 1.58 | 0.64 | 0.0733 | 0.0037 | |||||

| AS MILEAGE PLAN IP LTD SR SECURED 144A 10/31 5.308 / DBT (US00218QAB68) | 1.58 | 0.64 | 0.0733 | 0.0037 | |||||

| US11135FBQ37 / Broadcom Inc | 1.58 | -12.74 | 0.0733 | -0.0069 | |||||

| US12668ACG85 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 51 1A1 | 1.57 | -12.14 | 0.0731 | -0.0064 | |||||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1.57 | 1.03 | 0.0729 | 0.0040 | |||||

| TSNF34 / Tyson Foods, Inc. - Depositary Receipt (Common Stock) | 1.57 | 1.03 | 0.0729 | 0.0040 | |||||

| US031162DG24 / Amgen Inc | 1.56 | -0.70 | 0.0725 | 0.0028 | |||||

| NEWMARK GROUP INC SR UNSECURED 01/29 7.5 / DBT (US65158NAD49) | 1.55 | -40.82 | 0.0722 | -0.0443 | |||||

| NEWMARK GROUP INC SR UNSECURED 01/29 7.5 / DBT (US65158NAD49) | 1.55 | -40.82 | 0.0722 | -0.0443 | |||||

| NEWMARK GROUP INC SR UNSECURED 01/29 7.5 / DBT (US65158NAD49) | 1.55 | -40.82 | 0.0722 | -0.0443 | |||||

| NEW YORK NY NYC 02/45 FIXED 6.291 / DBT (US64966SNH57) | 1.55 | 0.0722 | 0.0722 | ||||||

| NEW YORK NY NYC 02/45 FIXED 6.291 / DBT (US64966SNH57) | 1.55 | 0.0722 | 0.0722 | ||||||

| NEW YORK NY NYC 02/45 FIXED 6.291 / DBT (US64966SNH57) | 1.55 | 0.0722 | 0.0722 | ||||||

| US29082HAA05 / Embraer Netherlands Finance BV | 1.55 | 1.31 | 0.0720 | 0.0041 | |||||

| US29082HAA05 / Embraer Netherlands Finance BV | 1.55 | 1.31 | 0.0720 | 0.0041 | |||||

| US29082HAA05 / Embraer Netherlands Finance BV | 1.55 | 1.31 | 0.0720 | 0.0041 | |||||

| US29082HAA05 / Embraer Netherlands Finance BV | 1.55 | 1.31 | 0.0720 | 0.0041 | |||||

| US36143L2G95 / GA Global Funding Trust | 1.55 | 0.72 | 0.0719 | 0.0037 | |||||

| US TREASURY N/B 10/29 4.125 / DBT (US91282CLR06) | 1.54 | 0.72 | 0.0717 | 0.0037 | |||||

| US TREASURY N/B 10/29 4.125 / DBT (US91282CLR06) | 1.54 | 0.72 | 0.0717 | 0.0037 | |||||

| US TREASURY N/B 10/29 4.125 / DBT (US91282CLR06) | 1.54 | 0.72 | 0.0717 | 0.0037 | |||||

| US01882YAD85 / Alliant Energy Finance LLC | 1.54 | 0.33 | 0.0717 | 0.0034 | |||||

| WESTLAKE AUTOMOBILE RECEIVABLE WLAKE 2024 2A A2A 144A / ABS-O (US96042YAB92) | 1.54 | -32.01 | 0.0715 | -0.0289 | |||||

| WESTLAKE AUTOMOBILE RECEIVABLE WLAKE 2024 2A A2A 144A / ABS-O (US96042YAB92) | 1.54 | -32.01 | 0.0715 | -0.0289 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 1.53 | -39.60 | 0.0712 | -0.0414 | |||||

| US694308JT56 / Pacific Gas and Electric Co | 1.53 | 0.86 | 0.0710 | 0.0038 | |||||

| US517834AF40 / Las Vegas Sands Corp | 1.52 | 1.20 | 0.0709 | 0.0040 | |||||

| US912810QS06 / United States Treas Bds Bond | 1.52 | -1.74 | 0.0709 | 0.0020 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 1.52 | 0.66 | 0.0706 | 0.0036 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 1.52 | 0.66 | 0.0706 | 0.0036 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 1.52 | 0.66 | 0.0706 | 0.0036 | |||||

| US03027XBG43 / American Tower Corp | 1.51 | 1.61 | 0.0704 | 0.0042 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.51 | 0.27 | 0.0704 | 0.0034 | |||||

| US30040WAU27 / EVERSOURCE ENERGY | 1.50 | 1.28 | 0.0699 | 0.0040 | |||||

| US68389XBZ78 / Oracle Corp | 1.50 | 1.56 | 0.0697 | 0.0042 | |||||

| US842400FZ13 / Southern California Edison Co. Bond 4.65% Due 10/1/2043 | 1.50 | -3.42 | 0.0697 | 0.0008 | |||||

| US904678AU32 / UniCredit SpA | 1.49 | 0.61 | 0.0694 | 0.0035 | |||||

| US01166VAA70 / Alaska Airlines 2020-1 Class A Pass Through Trust | 1.49 | 0.40 | 0.0694 | 0.0034 | |||||

| US50065RAL15 / Korea Housing Finance Corp | 1.49 | 0.27 | 0.0693 | 0.0033 | |||||

| INDIGO CREDIT MANAGEMENT INDI 2A A 144A / ABS-CBDO (XS2916992865) | 1.48 | 9.18 | 0.0686 | 0.0086 | |||||

| INDIGO CREDIT MANAGEMENT INDI 2A A 144A / ABS-CBDO (XS2916992865) | 1.48 | 9.18 | 0.0686 | 0.0086 | |||||

| INDIGO CREDIT MANAGEMENT INDI 2A A 144A / ABS-CBDO (XS2916992865) | 1.48 | 9.18 | 0.0686 | 0.0086 | |||||

| INDIGO CREDIT MANAGEMENT INDI 2A A 144A / ABS-CBDO (XS2916992865) | 1.48 | 9.18 | 0.0686 | 0.0086 | |||||

| US30326MAA36 / FS RIALTO | 1.47 | -2.07 | 0.0684 | 0.0017 | |||||

| US04010LBA08 / Ares Capital Corp. | 1.46 | 1.04 | 0.0680 | 0.0037 | |||||

| US68402BAD82 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2007 3 2A3 | 1.46 | 0.07 | 0.0678 | 0.0031 | |||||

| US842400HN64 / Southern California Edison Co. | 1.45 | -4.49 | 0.0673 | -0.0000 | |||||

| DIAGEO INVESTMENT CORP COMPANY GUAR 08/30 5.125 / DBT (US25245BAC19) | 1.44 | 0.0671 | 0.0671 | ||||||

| DIAGEO INVESTMENT CORP COMPANY GUAR 08/30 5.125 / DBT (US25245BAC19) | 1.44 | 0.0671 | 0.0671 | ||||||

| US667274AC84 / Northwell Healthcare Inc | 1.43 | -1.10 | 0.0667 | 0.0023 | |||||

| US13648TAH05 / Canadian Pacific Railway Co. | 1.43 | 2.21 | 0.0667 | 0.0044 | |||||

| US55037AAB44 / Lundin Energy Finance BV | 1.43 | 1.42 | 0.0665 | 0.0039 | |||||

| US631005BJ39 / Narragansett Electric Co/The | 1.42 | 0.92 | 0.0661 | 0.0036 | |||||

| US403950AA61 / HGI CRE CLO 2021-FL3 Ltd | 1.42 | 0.21 | 0.0660 | 0.0031 | |||||

| BANCO BTG PACTUAL/CAYMAN SR UNSECURED 144A 01/30 5.75 / DBT (US05971AAL52) | 1.40 | 0.94 | 0.0652 | 0.0035 | |||||

| BANCO BTG PACTUAL/CAYMAN SR UNSECURED 144A 01/30 5.75 / DBT (US05971AAL52) | 1.40 | 0.94 | 0.0652 | 0.0035 | |||||

| US36143L2H78 / GA Global Funding Trust | 1.40 | 0.94 | 0.0651 | 0.0035 | |||||

| JACKSON NATL LIFE GLOBAL SECURED 144A 10/29 4.6 / DBT (US46849LVB43) | 1.40 | 0.94 | 0.0651 | 0.0035 | |||||

| JACKSON NATL LIFE GLOBAL SECURED 144A 10/29 4.6 / DBT (US46849LVB43) | 1.40 | 0.94 | 0.0651 | 0.0035 | |||||

| QUIKRETE HOLDINGS INC 2025 TERM LOAN B / LON (US74839XAL38) | 1.40 | 0.72 | 0.0650 | 0.0034 | |||||

| QUIKRETE HOLDINGS INC 2025 TERM LOAN B / LON (US74839XAL38) | 1.40 | 0.72 | 0.0650 | 0.0034 | |||||

| QUIKRETE HOLDINGS INC 2025 TERM LOAN B / LON (US74839XAL38) | 1.40 | 0.72 | 0.0650 | 0.0034 | |||||

| QUIKRETE HOLDINGS INC 2025 TERM LOAN B / LON (US74839XAL38) | 1.40 | 0.72 | 0.0650 | 0.0034 | |||||

| US196522AE66 / Colorado Interstate Gas Co 6.85% Debs 6/15/37 | 1.39 | -0.36 | 0.0647 | 0.0027 | |||||

| US12532HAF10 / CGI Inc | 1.38 | 1.62 | 0.0644 | 0.0039 | |||||

| US33939HAB50 / Flex Intermediate Holdco LLC | 1.38 | -0.14 | 0.0643 | 0.0029 | |||||

| US45660LMF30 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2005 AR12 1A1 | 1.38 | -1.99 | 0.0641 | 0.0017 | |||||

| US03027XBC39 / AMERICAN TOWER CORP SR UNSECURED 06/30 2.1 | 1.38 | 1.55 | 0.0641 | 0.0038 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1.38 | 1.10 | 0.0640 | 0.0035 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1.38 | 1.10 | 0.0640 | 0.0035 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1.38 | 1.10 | 0.0640 | 0.0035 | |||||

| US61750MAF23 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE7 A2D | 1.37 | -2.77 | 0.0638 | 0.0011 | |||||

| US22160NAA72 / CoStar Group Inc | 1.36 | 1.57 | 0.0632 | 0.0038 | |||||

| US38122NB769 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/46 FIXED 3 | 1.35 | -13.05 | 0.0629 | -0.0062 | |||||

| US88732JAU25 / Time Warner Cable Inc 6.75% 06/15/39 | 1.35 | 3.69 | 0.0627 | 0.0050 | |||||

| US842400HF31 / Southern California Edison Co | 1.34 | -3.47 | 0.0622 | 0.0007 | |||||

| US88732JAN81 / Time Warner Cable 7.3% Senior Notes 7/1/38 | 1.34 | 3.89 | 0.0622 | 0.0050 | |||||

| US37959GAB32 / Global Atlantic Fin Co | 1.33 | 0.76 | 0.0620 | 0.0032 | |||||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LVA69) | 1.33 | 0.15 | 0.0617 | 0.0029 | |||||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LVA69) | 1.33 | 0.15 | 0.0617 | 0.0029 | |||||

| US87264ACQ67 / T-Mobile USA Inc | 1.32 | 1.85 | 0.0615 | 0.0039 | |||||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 1.32 | 0.0613 | 0.0613 | ||||||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 1.32 | 0.0613 | 0.0613 | ||||||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 1.32 | 0.0613 | 0.0613 | ||||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.31 | 0.77 | 0.0612 | 0.0032 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.31 | 0.77 | 0.0612 | 0.0032 | |||||

| US29364WBD92 / Entergy Louisiana LLC | 1.30 | 0.31 | 0.0606 | 0.0029 | |||||

| US87241EAQ89 / TCW CLO 2019-1 AMR Ltd | 1.30 | 0.23 | 0.0606 | 0.0029 | |||||

| OCEAN TRAILS CLO OCTR 2020 8A ARR / ABS-CBDO (US67514UAU51) | 1.30 | 0.15 | 0.0605 | 0.0028 | |||||

| OCEAN TRAILS CLO OCTR 2020 8A ARR / ABS-CBDO (US67514UAU51) | 1.30 | 0.15 | 0.0605 | 0.0028 | |||||

| US64830KAA51 / New Residential Mortgage Loan Trust 2018-3 | 1.30 | -3.85 | 0.0605 | 0.0004 | |||||

| US36143L2D64 / GA Global Funding Trust | 1.29 | 1.41 | 0.0602 | 0.0035 | |||||

| US12481QAC96 / CBAM 2018-5 Ltd | 1.28 | -24.48 | 0.0597 | -0.0158 | |||||

| US07400HAA14 / Bear Stearns Mortgage Funding Trust 2006-AR3 | 1.28 | -0.08 | 0.0594 | 0.0027 | |||||

| US00206RKJ04 / AT&T Inc | 1.28 | -0.70 | 0.0593 | 0.0023 | |||||

| US29444UBT25 / Equinix Inc | 1.28 | -1.16 | 0.0593 | 0.0020 | |||||

| US85205TAG58 / Spirit AeroSystems Inc | 1.27 | -0.47 | 0.0593 | 0.0024 | |||||

| REGATTA XVI FUNDING LTD. REG16 2019 2A A1R 144A / ABS-CBDO (US75888TAL98) | 1.27 | -2.69 | 0.0589 | 0.0011 | |||||

| REGATTA XVI FUNDING LTD. REG16 2019 2A A1R 144A / ABS-CBDO (US75888TAL98) | 1.27 | -2.69 | 0.0589 | 0.0011 | |||||

| REGATTA XVI FUNDING LTD. REG16 2019 2A A1R 144A / ABS-CBDO (US75888TAL98) | 1.27 | -2.69 | 0.0589 | 0.0011 | |||||

| REGATTA XVI FUNDING LTD. REG16 2019 2A A1R 144A / ABS-CBDO (US75888TAL98) | 1.27 | -2.69 | 0.0589 | 0.0011 | |||||

| US87264ABN46 / T-MOBILE USA INC 3.3% 02/15/2051 | 1.26 | -0.55 | 0.0587 | 0.0023 | |||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 1.26 | 0.0585 | 0.0585 | ||||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 1.26 | 0.0585 | 0.0585 | ||||||

| XS2364200357 / ROMANIA | 1.24 | 12.10 | 0.0578 | 0.0086 | |||||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 1.24 | -41.99 | 0.0577 | -0.0373 | |||||

| US694308KJ55 / Pacific Gas and Electric Co. | 1.24 | 0.00 | 0.0575 | 0.0026 | |||||

| US225401BC11 / UBS Group AG | 1.23 | 0.00 | 0.0573 | 0.0026 | |||||

| US12668BLG67 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 2CB A7 | 1.23 | -4.43 | 0.0572 | 0.0000 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3T66) | 1.22 | -45.46 | 0.0568 | -0.0426 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3T66) | 1.22 | -45.46 | 0.0568 | -0.0426 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3T66) | 1.22 | -45.46 | 0.0568 | -0.0426 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3T66) | 1.22 | -45.46 | 0.0568 | -0.0426 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3T66) | 1.22 | -45.46 | 0.0568 | -0.0426 | |||||

| US55336VAN01 / MPLX LP | 1.22 | -0.81 | 0.0567 | 0.0021 | |||||

| MARS INC SR UNSECURED 144A 03/30 4.8 / DBT (US571676AY11) | 1.22 | 0.75 | 0.0566 | 0.0030 | |||||

| MARS INC SR UNSECURED 144A 03/30 4.8 / DBT (US571676AY11) | 1.22 | 0.75 | 0.0566 | 0.0030 | |||||

| MARS INC SR UNSECURED 144A 03/30 4.8 / DBT (US571676AY11) | 1.22 | 0.75 | 0.0566 | 0.0030 | |||||

| US161175CA05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.22 | 6.11 | 0.0566 | 0.0057 | |||||

| DAI ICHI LIFE INSURANCE SUBORDINATED 144A 12/99 VAR / DBT (US23381LAA26) | 1.21 | 0.58 | 0.0565 | 0.0029 | |||||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2019 15A A1R 144A / ABS-CBDO (US04942MAN48) | 1.21 | -13.05 | 0.0561 | -0.0055 | |||||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2019 15A A1R 144A / ABS-CBDO (US04942MAN48) | 1.21 | -13.05 | 0.0561 | -0.0055 | |||||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2019 15A A1R 144A / ABS-CBDO (US04942MAN48) | 1.21 | -13.05 | 0.0561 | -0.0055 | |||||

| US842434CT71 / Southern California Gas Co. | 1.20 | -1.07 | 0.0560 | 0.0020 | |||||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 1.20 | 0.08 | 0.0559 | 0.0026 | |||||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 1.20 | 0.08 | 0.0559 | 0.0026 | |||||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 1.20 | 0.08 | 0.0559 | 0.0026 | |||||

| US677050AN64 / Oglethorpe Power Corp | 1.20 | -78.12 | 0.0559 | -0.1880 | |||||

| MEIJI YASUDA LIFE INSURA SUBORDINATED 144A 06/55 VAR / DBT (US585270AE15) | 1.20 | 0.17 | 0.0559 | 0.0026 | |||||

| MEIJI YASUDA LIFE INSURA SUBORDINATED 144A 06/55 VAR / DBT (US585270AE15) | 1.20 | 0.17 | 0.0559 | 0.0026 | |||||

| US05369AAD37 / Aviation Capital Group LLC | 1.20 | 0.25 | 0.0558 | 0.0026 | |||||

| MILLER HOMES GROUP FIN SR SECURED 144A 10/30 VAR / DBT (XS3047272334) | 1.20 | 0.0558 | 0.0558 | ||||||

| MILLER HOMES GROUP FIN SR SECURED 144A 10/30 VAR / DBT (XS3047272334) | 1.20 | 0.0558 | 0.0558 | ||||||

| MILLER HOMES GROUP FIN SR SECURED 144A 10/30 VAR / DBT (XS3047272334) | 1.20 | 0.0558 | 0.0558 | ||||||

| MILLER HOMES GROUP FIN SR SECURED 144A 10/30 VAR / DBT (XS3047272334) | 1.20 | 0.0558 | 0.0558 | ||||||

| US133434AD26 / Cameron LNG LLC | 1.20 | 2.40 | 0.0557 | 0.0038 | |||||