Basic Stats

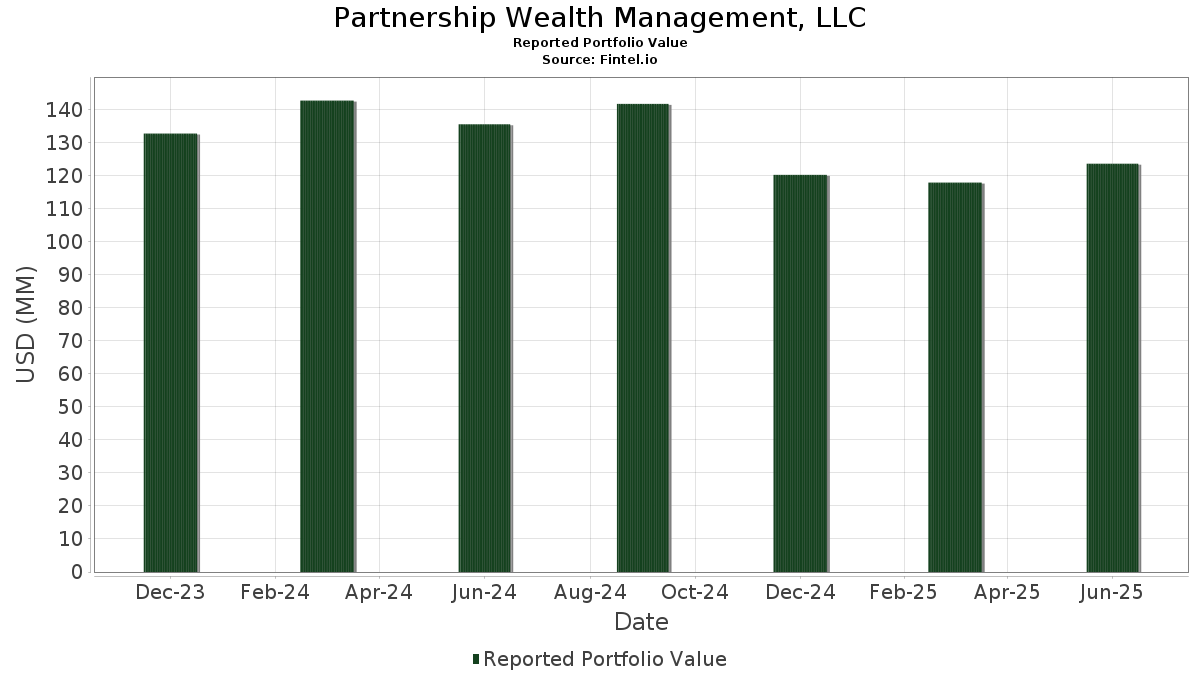

| Portfolio Value | $ 123,522,289 |

| Current Positions | 69 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Partnership Wealth Management, LLC has disclosed 69 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 123,522,289 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Partnership Wealth Management, LLC’s top holdings are Eli Lilly and Company (US:LLY) , iShares Trust - iShares Core S&P Mid-Cap ETF (US:IJH) , SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF (US:SPDW) , iShares Trust - iShares Core S&P Small-Cap ETF (US:IJR) , and iShares Trust - iShares Russell 1000 Growth ETF (US:IWF) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.21 | 8.68 | 7.0231 | 1.5715 | |

| 0.02 | 7.67 | 6.2072 | 0.9551 | |

| 0.01 | 4.24 | 3.4334 | 0.7482 | |

| 0.01 | 1.41 | 1.1415 | 0.5710 | |

| 0.00 | 1.45 | 1.1730 | 0.4047 | |

| 0.01 | 1.56 | 1.2661 | 0.3872 | |

| 0.01 | 2.30 | 1.8591 | 0.3577 | |

| 0.02 | 1.32 | 1.0700 | 0.2457 | |

| 0.04 | 2.92 | 2.3653 | 0.2392 | |

| 0.01 | 1.47 | 1.1938 | 0.1784 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 16.97 | 13.7349 | -1.5667 | |

| 0.07 | 7.88 | 6.3772 | -0.8044 | |

| 0.03 | 1.33 | 1.0773 | -0.3838 | |

| 0.01 | 1.45 | 1.1764 | -0.2588 | |

| 0.01 | 1.57 | 1.2749 | -0.2430 | |

| 0.00 | 1.33 | 1.0740 | -0.2076 | |

| 0.04 | 1.12 | 0.9075 | -0.1769 | |

| 0.01 | 1.53 | 1.2366 | -0.1711 | |

| 0.02 | 1.33 | 1.0783 | -0.1678 | |

| 0.01 | 0.83 | 0.6723 | -0.1512 |

13F and Fund Filings

This form was filed on 2025-07-08 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| LLY / Eli Lilly and Company | 0.02 | -0.29 | 16.97 | -5.89 | 13.7349 | -1.5667 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.17 | -2.32 | 10.47 | 3.83 | 8.4751 | -0.0833 | |||

| SPDW / SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF | 0.21 | 21.46 | 8.68 | 35.08 | 7.0231 | 1.5715 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.07 | -10.92 | 7.88 | -6.89 | 6.3772 | -0.8044 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.02 | 5.38 | 7.67 | 23.92 | 6.2072 | 0.9551 | |||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.14 | 0.89 | 7.27 | 3.40 | 5.8859 | -0.0826 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.04 | 0.04 | 6.60 | 4.95 | 5.3428 | 0.0052 | |||

| MSFT / Microsoft Corporation | 0.01 | 1.17 | 4.24 | 34.05 | 3.4334 | 0.7482 | |||

| SCZ / iShares Trust - iShares MSCI EAFE Small-Cap ETF | 0.04 | 1.96 | 2.92 | 16.65 | 2.3653 | 0.2392 | |||

| SPEM / SPDR Index Shares Funds - SPDR Portfolio Emerging Markets ETF | 0.06 | 2.76 | 2.48 | 11.53 | 2.0052 | 0.1205 | |||

| TT / Trane Technologies plc | 0.01 | 0.00 | 2.30 | 29.86 | 1.8591 | 0.3577 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 0.00 | 2.06 | 8.04 | 1.6651 | 0.0497 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 2.03 | 2.53 | 1.6436 | -0.0371 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.00 | 1.57 | -11.97 | 1.2749 | -0.2430 | |||

| CL / Colgate-Palmolive Company | 0.02 | 0.00 | 1.57 | -2.97 | 1.2697 | -0.1026 | |||

| NVDA / NVIDIA Corporation | 0.01 | 3.61 | 1.56 | 51.01 | 1.2661 | 0.3872 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.00 | 1.53 | -7.90 | 1.2366 | -0.1711 | |||

| DIS / The Walt Disney Company | 0.01 | -1.89 | 1.47 | 23.24 | 1.1938 | 0.1784 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 0.00 | 1.45 | -14.02 | 1.1764 | -0.2588 | |||

| CEG / Constellation Energy Corporation | 0.00 | 0.00 | 1.45 | 60.00 | 1.1730 | 0.4047 | |||

| ILMN / Illumina, Inc. | 0.01 | 74.45 | 1.41 | 109.82 | 1.1415 | 0.5710 | |||

| MDT / Medtronic plc | 0.02 | -0.86 | 1.34 | -3.80 | 1.0868 | -0.0980 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.02 | -0.03 | 1.33 | -9.33 | 1.0783 | -0.1678 | |||

| BMY / Bristol-Myers Squibb Company | 0.03 | 1.85 | 1.33 | -22.72 | 1.0773 | -0.3838 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -3.67 | 1.33 | -12.13 | 1.0740 | -0.2076 | |||

| EL / The Estée Lauder Companies Inc. | 0.02 | 11.17 | 1.32 | 36.05 | 1.0700 | 0.2457 | |||

| PPG / PPG Industries, Inc. | 0.01 | 0.00 | 1.14 | 4.03 | 0.9209 | -0.0073 | |||

| TROW / T. Rowe Price Group, Inc. | 0.01 | -5.32 | 1.13 | -0.62 | 0.9140 | -0.0496 | |||

| CTRA / Coterra Energy Inc. | 0.04 | -0.09 | 1.12 | -12.29 | 0.9075 | -0.1769 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 1.09 | 21.60 | 0.8844 | 0.1219 | |||

| COR / Cencora, Inc. | 0.00 | 0.00 | 1.08 | 7.79 | 0.8739 | 0.0241 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.13 | 1.07 | -6.38 | 0.8671 | -0.1041 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.91 | -6.47 | 0.7370 | -0.0890 | |||

| AAPL / Apple Inc. | 0.00 | 0.02 | 0.87 | -7.65 | 0.7042 | -0.0950 | |||

| CVX / Chevron Corporation | 0.01 | 0.00 | 0.83 | -14.43 | 0.6723 | -0.1512 | |||

| T / AT&T Inc. | 0.02 | 0.00 | 0.72 | 2.42 | 0.5824 | -0.0143 | |||

| PFE / Pfizer Inc. | 0.03 | 0.00 | 0.71 | -4.42 | 0.5780 | -0.0555 | |||

| AXP / American Express Company | 0.00 | 2.43 | 0.71 | 21.47 | 0.5779 | 0.0788 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.67 | 12.37 | 0.5448 | 0.0367 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.63 | 0.96 | 0.5101 | -0.0197 | |||

| MKC / McCormick & Company, Incorporated | 0.01 | 0.00 | 0.61 | -7.90 | 0.4911 | -0.0679 | |||

| EXC / Exelon Corporation | 0.01 | 0.00 | 0.58 | -5.81 | 0.4734 | -0.0534 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.56 | -4.24 | 0.4567 | -0.0440 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 0.00 | 0.56 | -2.12 | 0.4496 | -0.0318 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 6.23 | 0.52 | 17.54 | 0.4181 | 0.0446 | |||

| WEC / WEC Energy Group, Inc. | 0.00 | 0.00 | 0.51 | -4.49 | 0.4134 | -0.0399 | |||

| K / Kellanova | 0.01 | 0.00 | 0.50 | -3.47 | 0.4056 | -0.0355 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.48 | -6.65 | 0.3864 | -0.0481 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.44 | -11.38 | 0.3530 | -0.0648 | |||

| IR / Ingersoll Rand Inc. | 0.00 | 0.00 | 0.40 | 3.92 | 0.3226 | -0.0028 | |||

| RTX / RTX Corporation | 0.00 | 0.00 | 0.40 | 10.25 | 0.3222 | 0.0158 | |||

| SPTM / SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF | 0.01 | 12.24 | 0.39 | 23.49 | 0.3153 | 0.0478 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.38 | 0.80 | 0.3066 | -0.0119 | |||

| GLW / Corning Incorporated | 0.01 | 0.00 | 0.34 | 14.81 | 0.2767 | 0.0242 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 0.00 | 0.32 | -9.30 | 0.2609 | -0.0409 | |||

| VZ / Verizon Communications Inc. | 0.01 | 0.00 | 0.32 | -4.45 | 0.2607 | -0.0258 | |||

| MAS / Masco Corporation | 0.01 | 0.00 | 0.32 | -7.49 | 0.2605 | -0.0346 | |||

| GIS / General Mills, Inc. | 0.01 | 0.00 | 0.31 | -13.41 | 0.2517 | -0.0528 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.31 | -3.14 | 0.2495 | -0.0209 | |||

| MMM / 3M Company | 0.00 | 0.00 | 0.30 | 3.75 | 0.2465 | -0.0028 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.28 | -1.05 | 0.2291 | -0.0141 | |||

| FHLC / Fidelity Covington Trust - Fidelity MSCI Health Care Index ETF | 0.00 | 4.87 | 0.28 | -1.77 | 0.2252 | -0.0153 | |||

| ALLE / Allegion plc | 0.00 | 0.00 | 0.26 | 10.68 | 0.2101 | 0.0107 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.21 | 0.26 | 14.73 | 0.2086 | 0.0184 | |||

| ALB / Albemarle Corporation | 0.00 | 0.00 | 0.25 | -13.19 | 0.2029 | -0.0416 | |||

| UGI / UGI Corporation | 0.01 | 0.00 | 0.25 | 9.87 | 0.1990 | 0.0095 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | -20.29 | 0.23 | -15.02 | 0.1885 | -0.0435 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.22 | -5.15 | 0.1796 | -0.0183 | |||

| FOSL / Fossil Group, Inc. | 0.02 | 0.00 | 0.03 | 29.17 | 0.0256 | 0.0047 | |||

| ETR / Entergy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CPB / The Campbell's Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HBI / Hanesbrands Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |