Basic Stats

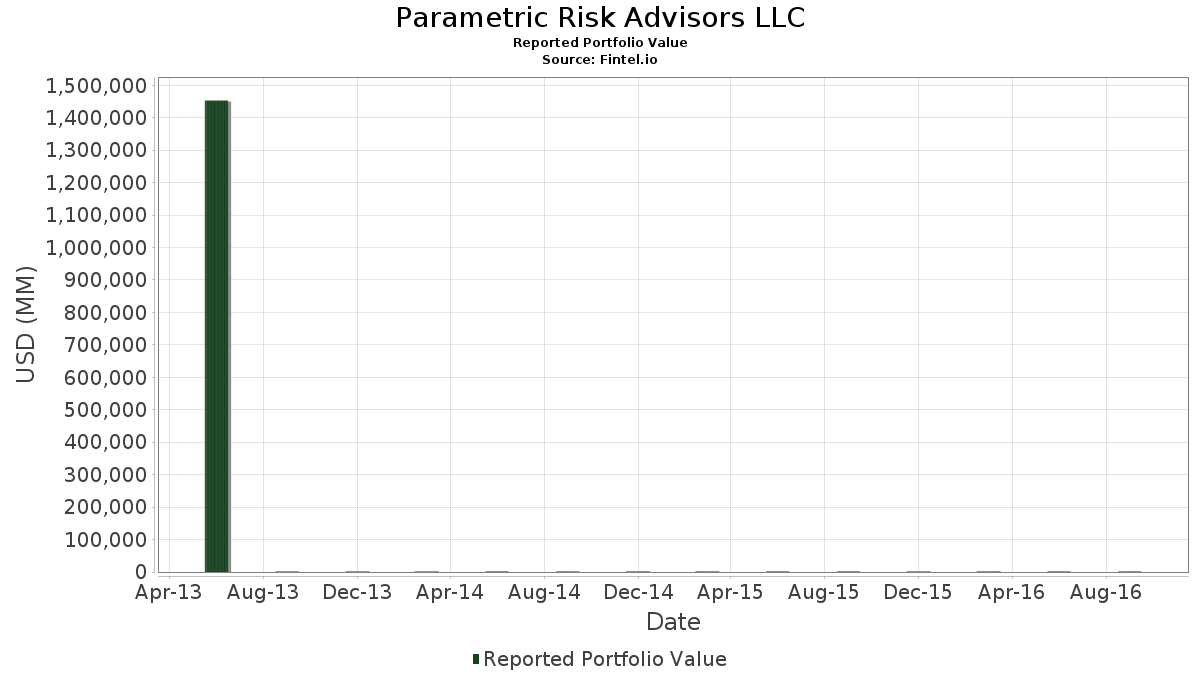

| Portfolio Value | $ 1,482,067,000 |

| Current Positions | 109 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Parametric Risk Advisors LLC has disclosed 109 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,482,067,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Parametric Risk Advisors LLC’s top holdings are Meta Platforms, Inc. (US:META) , United Parcel Service, Inc. (US:UPS) , Comcast Corporation (US:CMCSA) , Oracle Corporation (US:ORCL) , and The Goldman Sachs Group, Inc. (US:GS) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 4.31 | 552.26 | 37.2628 | 4.9206 | |

| 0.06 | 8.95 | 0.6037 | 0.6037 | |

| 0.13 | 8.52 | 0.5747 | 0.5747 | |

| 0.14 | 7.20 | 0.4861 | 0.4861 | |

| 0.01 | 11.00 | 0.7419 | 0.4394 | |

| 0.75 | 23.45 | 1.5825 | 0.3229 | |

| 0.28 | 45.60 | 3.0766 | 0.3143 | |

| 0.12 | 7.54 | 0.5087 | 0.3117 | |

| 0.40 | 28.07 | 1.8941 | 0.2463 | |

| 0.03 | 3.48 | 0.2350 | 0.2350 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.4627 | ||

| 0.00 | 0.00 | -0.7131 | ||

| 0.00 | 0.00 | -0.6003 | ||

| 0.00 | 0.00 | -0.5854 | ||

| 0.22 | 19.53 | 1.3178 | -0.4632 | |

| 0.51 | 14.97 | 1.0099 | -0.4280 | |

| 0.00 | 0.00 | -0.3696 | ||

| 0.07 | 7.22 | 0.4875 | -0.3235 | |

| 0.00 | 0.00 | -0.2413 | ||

| 0.00 | 0.00 | -0.2383 |

13F and Fund Filings

This form was filed on 2016-11-14 for the reporting period 2016-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| META / Meta Platforms, Inc. | 4.31 | 0.03 | 552.26 | 12.28 | 37.2628 | 4.9206 | |||

| UPS / United Parcel Service, Inc. | 0.64 | -2.84 | 69.88 | -1.37 | 4.7147 | 0.0565 | |||

| CMCSA / Comcast Corporation | 0.83 | 0.17 | 55.06 | 1.94 | 3.7154 | 0.1634 | |||

| ORCL / Oracle Corporation | 1.21 | -4.97 | 47.43 | -8.80 | 3.2005 | -0.2193 | |||

| GS / The Goldman Sachs Group, Inc. | 0.28 | 0.00 | 45.60 | 8.54 | 3.0766 | 0.3143 | |||

| SPY / SPDR S&P 500 ETF | 0.20 | -0.85 | 44.26 | 2.38 | 2.9863 | 0.1436 | |||

| MMM / 3M Company | 0.24 | -2.79 | 43.03 | -2.17 | 2.9036 | 0.0111 | |||

| JNJ / Johnson & Johnson | 0.30 | 5.71 | 35.45 | 2.94 | 2.3921 | 0.1276 | |||

| TXN / Texas Instruments Incorporated | 0.40 | 0.00 | 28.07 | 12.02 | 1.8941 | 0.2463 | |||

| DHI / D.R. Horton, Inc. | 0.86 | 0.00 | 26.12 | -4.07 | 1.7626 | -0.0279 | |||

| AAPL / Apple Inc. | 0.21 | -7.11 | 23.82 | 9.84 | 1.6070 | 0.1812 | |||

| IVZ / Invesco Ltd. | 0.75 | 0.00 | 23.45 | 22.44 | 1.5825 | 0.3229 | |||

| CAT / Caterpillar Inc. | 0.23 | 0.10 | 20.26 | 17.21 | 1.3670 | 0.2304 | |||

| XOM / Exxon Mobil Corporation | 0.22 | -22.56 | 19.53 | -27.89 | 1.3178 | -0.4632 | |||

| CSCO / Cisco Systems, Inc. | 0.59 | 0.00 | 18.57 | 10.56 | 1.2529 | 0.1486 | |||

| PG / The Procter & Gamble Company | 0.21 | -4.32 | 18.50 | 1.42 | 1.2480 | 0.0488 | |||

| EMR / Emerson Electric Co. | 0.28 | 0.00 | 15.40 | 4.51 | 1.0394 | 0.0702 | |||

| GE / General Electric Company | 0.51 | -27.26 | 14.97 | -31.55 | 1.0099 | -0.4280 | |||

| KO / The Coca-Cola Company | 0.35 | 23.71 | 14.75 | 15.49 | 0.9954 | 0.1555 | |||

| MS / Morgan Stanley | 0.43 | -7.96 | 13.72 | 13.59 | 0.9259 | 0.1315 | |||

| MCHP / Microchip Technology Incorporated | 0.21 | 0.00 | 13.03 | 22.42 | 0.8791 | 0.1793 | |||

| AMGN / Amgen Inc. | 0.08 | 0.00 | 12.70 | 9.63 | 0.8571 | 0.0952 | |||

| JBLU / JetBlue Airways Corporation | 0.73 | 0.00 | 12.51 | 4.10 | 0.8442 | 0.0539 | |||

| WAG / | 0.14 | 37.20 | 11.60 | 32.83 | 0.7824 | 0.2084 | |||

| GOOGL / Alphabet Inc. | 0.01 | 116.30 | 11.00 | 138.99 | 0.7419 | 0.4394 | |||

| INTU / Intuit Inc. | 0.10 | -5.23 | 10.97 | -6.59 | 0.7400 | -0.0321 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.07 | 1.29 | 10.30 | 1.07 | 0.6951 | 0.0249 | |||

| MDT / Medtronic plc | 0.12 | -0.93 | 10.13 | -1.35 | 0.6832 | 0.0083 | |||

| AAP / Advance Auto Parts, Inc. | 0.06 | 0.00 | 8.95 | -7.74 | 0.6037 | 0.6037 | |||

| QCOM / QUALCOMM Incorporated | 0.13 | 3.45 | 8.82 | 32.29 | 0.5954 | 0.1568 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.19 | 0.00 | 8.74 | -8.40 | 0.5899 | -0.0377 | |||

| BMO / Bank of Montreal | 0.13 | 0.00 | 8.52 | 3.45 | 0.5747 | 0.5747 | |||

| JPM / JPMorgan Chase & Co. | 0.12 | 0.00 | 8.04 | 7.16 | 0.5423 | 0.0491 | |||

| WFC / Wells Fargo & Company | 0.18 | -22.67 | 7.88 | -27.65 | 0.5314 | -0.1844 | |||

| MRK / Merck & Co., Inc. | 0.12 | 132.34 | 7.54 | 151.67 | 0.5087 | 0.3117 | |||

| MSFT / Microsoft Corporation | 0.13 | -9.46 | 7.48 | 1.91 | 0.5050 | 0.0221 | |||

| BMY / Bristol-Myers Squibb Company | 0.14 | 0.00 | 7.40 | -26.68 | 0.4994 | -0.1644 | |||

| GIS / General Mills, Inc. | 0.12 | 0.00 | 7.35 | -10.44 | 0.4957 | -0.0437 | |||

| PEP / PepsiCo, Inc. | 0.07 | -42.95 | 7.22 | -41.42 | 0.4875 | -0.3235 | |||

| DOW / Dow Inc. | 0.14 | -24.86 | 7.20 | -21.66 | 0.4861 | 0.4861 | |||

| CL / Colgate-Palmolive Company | 0.09 | 0.00 | 6.54 | 1.29 | 0.4414 | 0.0167 | |||

| CREE / Cree, Inc. | 0.25 | 0.00 | 6.38 | 5.25 | 0.4303 | 0.0319 | |||

| HON / Honeywell International Inc. | 0.05 | 0.00 | 6.18 | 0.23 | 0.4169 | 0.0115 | |||

| USB / U.S. Bancorp | 0.14 | 9.05 | 6.00 | 15.98 | 0.4046 | 0.0646 | |||

| INTC / Intel Corporation | 0.16 | 0.00 | 5.87 | 15.09 | 0.3963 | 0.0607 | |||

| DFS / Discover Financial Services | 0.09 | 24.14 | 5.24 | 31.01 | 0.3532 | 0.0905 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.04 | 0.00 | 5.20 | 8.02 | 0.3509 | 0.0343 | |||

| PM / Philip Morris International Inc. | 0.05 | 0.00 | 5.01 | -4.43 | 0.3378 | -0.0067 | |||

| YUM / Yum! Brands, Inc. | 0.05 | 0.00 | 4.82 | 9.50 | 0.3250 | 0.0358 | |||

| CME / CME Group Inc. | 0.05 | -47.68 | 4.73 | -43.85 | 0.3189 | -0.2346 | |||

| WMT / Walmart Inc. | 0.06 | 4.03 | 4.68 | 2.75 | 0.3156 | 0.0163 | |||

| ABT / Abbott Laboratories | 0.11 | 30.12 | 4.57 | 39.96 | 0.3082 | 0.0936 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.06 | 0.00 | 4.45 | -5.10 | 0.2999 | -0.0081 | |||

| TGT / Target Corporation | 0.06 | 0.00 | 4.17 | -1.63 | 0.2812 | 0.0026 | |||

| COP / ConocoPhillips | 0.09 | 0.00 | 4.11 | -0.32 | 0.2770 | 0.0062 | |||

| SYK / Stryker Corporation | 0.03 | 0.00 | 3.49 | -2.87 | 0.2356 | -0.0008 | |||

| MTB / M&T Bank Corporation | 0.03 | 0.00 | 3.48 | -1.80 | 0.2350 | 0.2350 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.02 | 0.00 | 3.43 | 3.37 | 0.2316 | 0.0133 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | 0.00 | 3.42 | -8.27 | 0.2306 | -0.0144 | |||

| PFE / Pfizer Inc. | 0.10 | 0.00 | 3.37 | -3.82 | 0.2276 | -0.0030 | |||

| NTAP / NetApp, Inc. | 0.09 | -7.60 | 3.31 | 34.61 | 0.2233 | 0.0616 | |||

| IBM / International Business Machines Corporation | 0.02 | 0.00 | 3.08 | 4.66 | 0.2076 | 0.0143 | |||

| LLY / Eli Lilly and Company | 0.04 | 0.00 | 3.03 | 1.92 | 0.2045 | 0.0090 | |||

| RTX / RTX Corporation | 0.03 | 0.00 | 2.95 | -0.94 | 0.1988 | 0.0032 | |||

| CVX / Chevron Corporation | 0.03 | -5.47 | 2.85 | -7.17 | 0.1922 | -0.0096 | |||

| GLW / Corning Incorporated | 0.11 | 0.00 | 2.56 | 15.49 | 0.1726 | 0.0269 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -19.05 | 2.50 | -4.58 | 0.1688 | -0.0036 | |||

| TXT / Textron Inc. | 0.06 | 0.00 | 2.38 | 8.71 | 0.1609 | 0.0167 | |||

| PPG / PPG Industries, Inc. | 0.02 | 0.00 | 2.32 | -0.77 | 0.1565 | 0.0028 | |||

| MCD / McDonald's Corporation | 0.02 | 0.00 | 2.32 | -4.13 | 0.1565 | -0.0026 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.03 | 0.00 | 2.28 | 10.66 | 0.1541 | 0.0184 | |||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 2.20 | 10.23 | 0.1484 | 0.0172 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.01 | 0.00 | 2.12 | 2.12 | 0.1429 | 0.0065 | |||

| CELG / Celgene Corp. | 0.02 | 0.00 | 2.06 | 5.96 | 0.1391 | 0.0112 | |||

| SLB / Schlumberger Limited | 0.03 | 6.34 | 1.97 | 5.74 | 0.1330 | 0.0104 | |||

| US0549371070 / BB&T Corp. | 0.05 | 0.00 | 1.92 | 5.95 | 0.1298 | 0.0104 | |||

| AXP / American Express Company | 0.03 | 0.00 | 1.92 | 5.38 | 0.1296 | 0.0097 | |||

| HD / The Home Depot, Inc. | 0.01 | 0.00 | 1.88 | 0.75 | 0.1265 | 0.0041 | |||

| NEM / Newmont Corporation | 0.04 | 0.00 | 1.73 | 0.41 | 0.1165 | 0.0034 | |||

| BA / The Boeing Company | 0.01 | 0.00 | 1.70 | 1.43 | 0.1146 | 0.0045 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 1.57 | 21.38 | 0.1057 | 0.0208 | |||

| DIS / The Walt Disney Company | 0.02 | 0.00 | 1.49 | -5.10 | 0.1005 | -0.0027 | |||

| HCA / HCA Healthcare, Inc. | 0.02 | 0.00 | 1.44 | -1.84 | 0.0973 | 0.0007 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | 33.30 | 1.41 | 27.56 | 0.0949 | 0.0224 | |||

| V / Visa Inc. | 0.02 | 0.00 | 1.40 | 11.54 | 0.0945 | 0.0119 | |||

| EOG / EOG Resources, Inc. | 0.01 | 27.79 | 1.24 | 48.20 | 0.0834 | 0.0286 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -44.13 | 1.03 | -35.68 | 0.0697 | -0.0359 | |||

| RTN / Raytheon Co. | 0.01 | -0.59 | 1.00 | -0.50 | 0.0677 | 0.0014 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 0.00 | 0.98 | -3.17 | 0.0659 | -0.0004 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.00 | 0.94 | -5.14 | 0.0636 | -0.0017 | |||

| MAR / Marriott International, Inc. | 0.01 | 0.00 | 0.93 | 1.31 | 0.0627 | 0.0024 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.84 | -3.45 | 0.0566 | 0.0566 | |||

| CE / Celanese Corporation | 0.01 | 17.82 | 0.84 | 19.89 | 0.0565 | 0.0565 | |||

| DE / Deere & Company | 0.01 | 0.00 | 0.84 | 5.41 | 0.0565 | 0.0043 | |||

| ADM / Archer-Daniels-Midland Company | 0.02 | 0.00 | 0.71 | -1.66 | 0.0478 | 0.0004 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | 11.46 | 0.70 | 7.56 | 0.0470 | 0.0044 | |||

| CBOE / Cboe Global Markets, Inc. | 0.01 | 0.00 | 0.66 | -2.65 | 0.0445 | -0.0000 | |||

| WM / Waste Management, Inc. | 0.01 | -3.24 | 0.57 | -6.84 | 0.0386 | -0.0018 | |||

| XHB / SPDR Series Trust - SPDR S&P Homebuilders ETF | 0.01 | -21.45 | 0.51 | -20.47 | 0.0341 | 0.0341 | |||

| UNP / Union Pacific Corporation | 0.01 | 0.00 | 0.49 | 11.93 | 0.0329 | 0.0043 | |||

| MCK / McKesson Corporation | 0.00 | 0.00 | 0.47 | -10.71 | 0.0320 | -0.0029 | |||

| JNPR / Juniper Networks, Inc. | 0.02 | -72.74 | 0.43 | -70.86 | 0.0294 | -0.0688 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | 0.00 | 0.41 | 6.84 | 0.0274 | 0.0024 | |||

| EIX / Edison International | 0.01 | 0.00 | 0.36 | -6.91 | 0.0246 | -0.0012 | |||

| CB / Chubb Limited | 0.00 | 0.00 | 0.33 | -3.78 | 0.0223 | -0.0003 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.29 | 17.00 | 0.0195 | 0.0033 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.00 | 0.26 | 4.07 | 0.0173 | 0.0011 | |||

| US0325111070 / Anadarko Petroleum Corp. | 0.00 | 0.00 | 0.17 | 19.01 | 0.0114 | 0.0021 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | Put | 0.00 | -27.17 | 0.06 | 9.26 | 0.0040 | 0.0040 | ||

| 018490100 / Allergan plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.2279 | ||||

| BIIB / Biogen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1113 | ||||

| HSY / The Hershey Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0216 | ||||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0377 | ||||

| IONS / Ionis Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0040 | ||||

| QRTEA / Qurate Retail Inc - Series A | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| DOW / Dow Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1751 | ||||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0784 | ||||

| BLL / Ball Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7131 | ||||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| RJF / Raymond James Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2383 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| LLL / JX Luxventure Limited | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| ICE / Intercontinental Exchange, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1280 | ||||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5854 | ||||

| EBAY / eBay Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0233 | ||||

| MDLZ / Mondelez International, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0808 | ||||

| 74005P104 / Praxair, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| SWKS / Skyworks Solutions, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1647 | ||||

| PYPL / PayPal Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0565 | ||||

| BBBY / Bed Bath & Beyond, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| FLT / Corpay, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0095 | ||||

| GWW / W.W. Grainger, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| DATA / Tableau Software, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2413 | ||||

| CKP / Checkpoint Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0550 | ||||

| MNST / Monster Beverage Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1564 | ||||

| KRFT / | 0.00 | -100.00 | 0.00 | -100.00 | -0.0582 | ||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.6003 | ||||

| ACN / Accenture plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.3696 | ||||

| ZTS / Zoetis Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0740 | ||||

| IYR / iShares Trust - iShares U.S. Real Estate ETF | 0.00 | -100.00 | 0.00 | -100.00 | -1.4627 |