Basic Stats

| Portfolio Value | $ 406,423,963 |

| Current Positions | 32 |

Latest Holdings, Performance, AUM (from 13F, 13D)

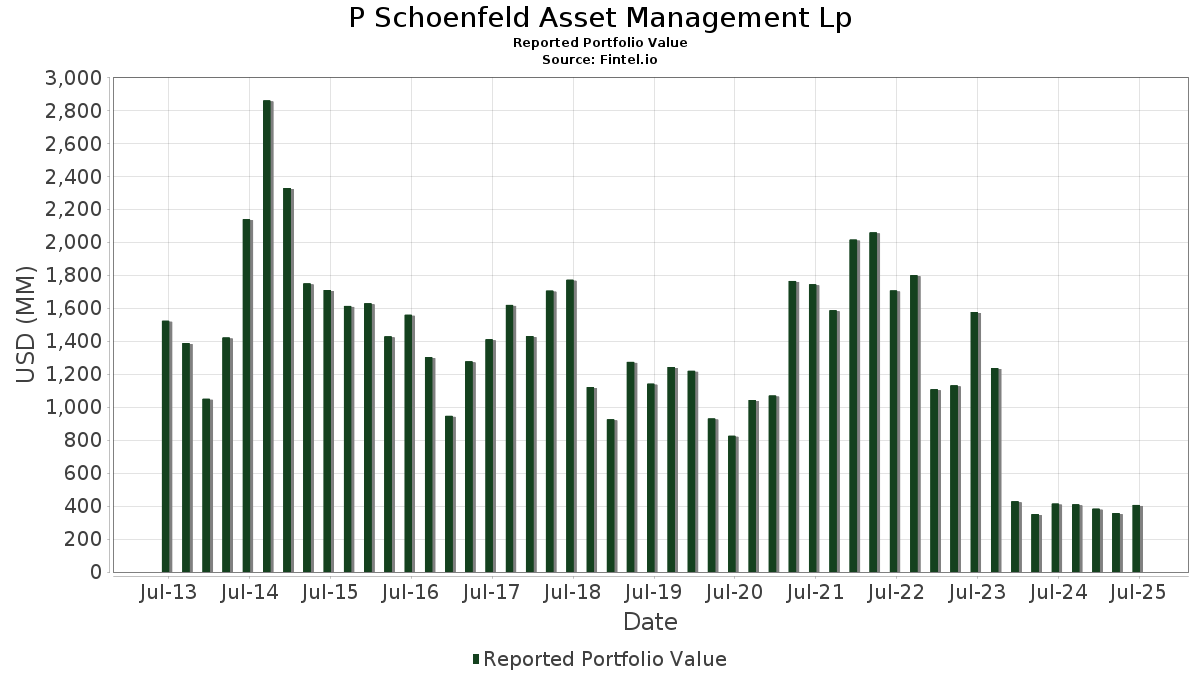

P Schoenfeld Asset Management Lp has disclosed 32 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 406,423,963 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). P Schoenfeld Asset Management Lp’s top holdings are Talen Energy Corporation (US:TLN) , Kellanova (US:K) , Juniper Networks, Inc. (US:JNPR) , Juniper Networks, Inc. (US:JNPR) , and IAMGOLD Corporation (US:IAG) . P Schoenfeld Asset Management Lp’s new positions include Dun & Bradstreet Holdings, Inc. (US:DNB) , Foot Locker, Inc. (US:FL) , SpringWorks Therapeutics, Inc. (US:SWTX) , VanEck ETF Trust - VanEck Junior Gold Miners ETF (US:GDXJ) , and Skechers U.S.A., Inc. (US:SKX) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.42 | 21.96 | 5.4025 | 5.4025 | |

| 0.87 | 34.68 | 8.5337 | 4.9808 | |

| 0.80 | 19.56 | 4.8131 | 4.8131 | |

| 0.51 | 40.43 | 9.9465 | 4.0763 | |

| 0.35 | 16.51 | 4.0628 | 4.0628 | |

| 0.22 | 14.87 | 3.6587 | 3.6587 | |

| 0.17 | 10.88 | 2.6766 | 2.6766 | |

| 0.17 | 49.31 | 12.1320 | 2.6346 | |

| 0.45 | 10.01 | 2.4626 | 2.4626 | |

| 0.46 | 9.41 | 2.3146 | 2.3146 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.25 | 3.21 | 0.7903 | -3.5627 | |

| 0.00 | 0.00 | -3.5529 | ||

| 0.10 | 1.35 | 0.3333 | -2.4166 | |

| 0.16 | 21.65 | 5.3274 | -1.6748 | |

| 0.64 | 23.34 | 5.7427 | -1.6122 | |

| 0.07 | 21.66 | 5.3300 | -0.9036 | |

| 0.33 | 1.45 | 0.3556 | -0.3221 | |

| 0.03 | 3.51 | 0.8632 | -0.0736 | |

| 0.05 | 2.92 | 0.7175 | -0.0319 | |

| 0.03 | 0.45 | 0.1099 | -0.0045 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TLN / Talen Energy Corporation | 0.17 | 0.00 | 49.31 | 45.62 | 12.1320 | 2.6346 | |||

| K / Kellanova | 0.51 | 100.35 | 40.43 | 93.17 | 9.9465 | 4.0763 | |||

| JNPR / Juniper Networks, Inc. | 0.91 | 37.53 | 36.20 | 51.74 | 8.9078 | 2.2154 | |||

| JNPR / Juniper Networks, Inc. | Put | 0.87 | 148.17 | 34.68 | 173.83 | 8.5337 | 4.9808 | ||

| IAG / IAMGOLD Corporation | 3.26 | 14.30 | 23.96 | 34.43 | 5.8961 | 0.8957 | |||

| FYBR / Frontier Communications Parent, Inc. | 0.64 | -12.31 | 23.34 | -10.99 | 5.7427 | -1.6122 | |||

| DNB / Dun & Bradstreet Holdings, Inc. | 2.42 | 21.96 | 5.4025 | 5.4025 | |||||

| TLN / Talen Energy Corporation | Put | 0.07 | -33.06 | 21.66 | -2.52 | 5.3300 | -0.9036 | ||

| HES / Hess Corporation | 0.16 | 0.00 | 21.65 | -13.27 | 5.3274 | -1.6748 | |||

| FL / Foot Locker, Inc. | 0.80 | 19.56 | 4.8131 | 4.8131 | |||||

| SWTX / SpringWorks Therapeutics, Inc. | 0.35 | 16.51 | 4.0628 | 4.0628 | |||||

| GDXJ / VanEck ETF Trust - VanEck Junior Gold Miners ETF | Call | 0.22 | 14.87 | 3.6587 | 3.6587 | ||||

| SKX / Skechers U.S.A., Inc. | 0.17 | 10.88 | 2.6766 | 2.6766 | |||||

| SGRY / Surgery Partners, Inc. | 0.45 | 10.01 | 2.4626 | 2.4626 | |||||

| HPE / Hewlett Packard Enterprise Company | 0.46 | 9.41 | 2.3146 | 2.3146 | |||||

| HPE / Hewlett Packard Enterprise Company | Put | 0.37 | 7.57 | 1.8617 | 1.8617 | ||||

| AZEK / The AZEK Company Inc. | 0.14 | 204.44 | 7.45 | 238.41 | 1.8321 | 1.2150 | |||

| TECK / Teck Resources Limited | 0.17 | 110.20 | 6.93 | 132.97 | 1.7056 | 0.8711 | |||

| LBRDK / Liberty Broadband Corporation | 0.06 | 103.87 | 6.22 | 135.85 | 1.5298 | 0.7903 | |||

| ATUS / Altice USA, Inc. | 2.00 | 4.28 | 1.0531 | 1.0531 | |||||

| EXE / Expand Energy Corporation | Call | 0.03 | 0.00 | 3.51 | 5.06 | 0.8632 | -0.0736 | ||

| PARA / Paramount Global | 0.25 | -80.81 | 3.21 | -79.30 | 0.7903 | -3.5627 | |||

| EQT / EQT Corporation | Call | 0.05 | 0.00 | 2.92 | 9.17 | 0.7175 | -0.0319 | ||

| HTZ / Hertz Global Holdings, Inc. | Call | 0.40 | 99.25 | 2.72 | 245.30 | 0.6697 | 0.4487 | ||

| HPE / Hewlett Packard Enterprise Company | Call | 0.10 | 2.04 | 0.5032 | 0.5032 | ||||

| WULF / TeraWulf Inc. | Put | 0.33 | -62.71 | 1.45 | -40.19 | 0.3556 | -0.3221 | ||

| PARA / Paramount Global | Put | 0.10 | -87.19 | 1.35 | -86.19 | 0.3333 | -2.4166 | ||

| WULF / TeraWulf Inc. | Call | 0.25 | 1.09 | 0.2694 | 0.2694 | ||||

| USARW / USA Rare Earth, Inc. - Equity Warrant | 0.25 | 0.00 | 0.60 | 256.80 | 0.1485 | 0.1008 | |||

| PENN / PENN Entertainment, Inc. | 0.03 | 0.00 | 0.45 | 9.58 | 0.1099 | -0.0045 | |||

| BTMWW / Bitcoin Depot Inc. - Equity Warrant | 0.51 | 0.00 | 0.20 | 474.29 | 0.0497 | 0.0397 | |||

| SDSTW / Stardust Power Inc. - Equity Warrant | 0.02 | 0.00 | 0.00 | -100.00 | 0.0002 | -0.0003 | |||

| JNPR / Juniper Networks, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -3.5529 | |||

| TGI / Triumph Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BECN / Beacon Roofing Supply, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| BECN / Beacon Roofing Supply, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| X / United States Steel Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| ITCI / Intra-Cellular Therapies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HOUS / Anywhere Real Estate Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NFE / New Fortress Energy Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| JWN / Nordstrom, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AFK / VanEck ETF Trust - VanEck Africa Index ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CHX / ChampionX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |