Basic Stats

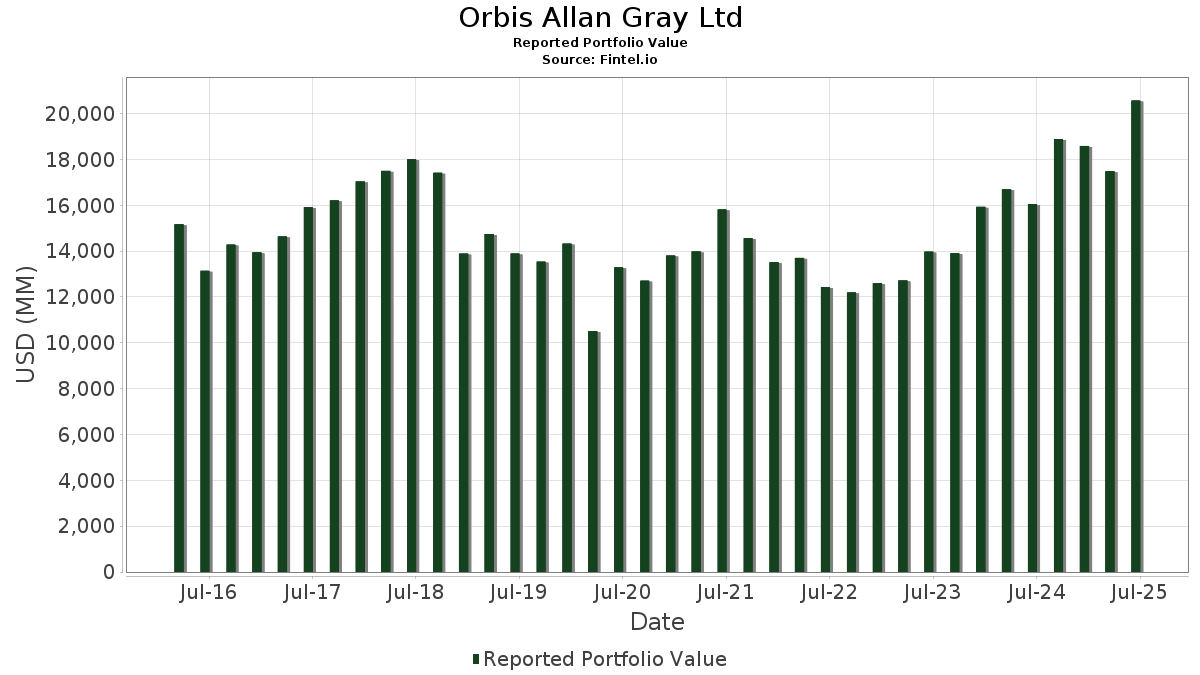

| Portfolio Value | $ 20,565,982,804 |

| Current Positions | 78 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Orbis Allan Gray Ltd has disclosed 78 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 20,565,982,804 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Orbis Allan Gray Ltd’s top holdings are QXO, Inc. (US:QXO) , Corpay, Inc. (US:CPAY) , Elevance Health, Inc. (US:ELV) , Nebius Group N.V. (US:NBIS) , and Smurfit Westrock Plc (US:SW) . Orbis Allan Gray Ltd’s new positions include Banco Bradesco S.A. - Depositary Receipt (Common Stock) (US:BBD) , Bruker Corporation (US:BRKR) , Insmed Incorporated (US:INSM) , Barrick Mining Corporation (US:B) , and BWX Technologies, Inc. (US:BWXT) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 17.65 | 976.68 | 4.7490 | 2.8531 | |

| 96.29 | 2,074.08 | 10.0850 | 1.6118 | |

| 81.03 | 250.40 | 1.2175 | 1.2175 | |

| 4.68 | 192.74 | 0.9372 | 0.9372 | |

| 1.52 | 153.39 | 0.7458 | 0.7458 | |

| 6.30 | 131.22 | 0.6380 | 0.6380 | |

| 84.54 | 574.05 | 1.8615 | 0.5595 | |

| 8.00 | 161.64 | 0.5242 | 0.5242 | |

| 14.50 | 686.47 | 3.3379 | 0.4934 | |

| 0.81 | 168.17 | 0.5453 | 0.3868 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.86 | 1,110.81 | 3.6021 | -3.4862 | |

| 3.86 | 1,279.36 | 4.1487 | -3.2935 | |

| 31.38 | 493.22 | 1.5994 | -1.7034 | |

| 0.99 | 240.83 | 0.7810 | -1.6188 | |

| 0.18 | 73.82 | 0.2394 | -1.6039 | |

| 22.64 | 665.47 | 2.1580 | -1.4262 | |

| 19.67 | 190.95 | 0.6192 | -1.1651 | |

| 4.64 | 326.58 | 1.0590 | -1.0551 | |

| 7.33 | 516.36 | 1.6744 | -1.0317 | |

| 27.62 | 290.54 | 0.9422 | -1.0127 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| QXO / QXO, Inc. | 96.29 | -11.99 | 2,074.08 | 40.01 | 10.0850 | 1.6118 | |||

| CPAY / Corpay, Inc. | 3.86 | 3.33 | 1,279.36 | -1.67 | 4.1487 | -3.2935 | |||

| ELV / Elevance Health, Inc. | 2.86 | 0.23 | 1,110.81 | -10.37 | 3.6021 | -3.4862 | |||

| NBIS / Nebius Group N.V. | 17.65 | 12.42 | 976.68 | 194.65 | 4.7490 | 2.8531 | |||

| SW / Smurfit Westrock Plc | 18.40 | 81.93 | 793.98 | 74.22 | 2.5747 | -0.0320 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 2.12 | 29.76 | 691.77 | 56.70 | 2.2433 | -0.2818 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 14.50 | 20.65 | 686.47 | 38.03 | 3.3379 | 0.4934 | |||

| KMI / Kinder Morgan, Inc. | 22.64 | 3.05 | 665.47 | 6.20 | 2.1580 | -1.4262 | |||

| GXO / GXO Logistics, Inc. | 13.17 | -2.22 | 641.55 | 21.85 | 2.0804 | -0.9312 | |||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 5.65 | 135.59 | 591.09 | 108.34 | 1.9168 | 0.2940 | |||

| ITUB / Itaú Unibanco Holding S.A. - Depositary Receipt (Common Stock) | 84.54 | 104.26 | 574.05 | 152.17 | 1.8615 | 0.5595 | |||

| IBKR / Interactive Brokers Group, Inc. | 9.74 | 178.82 | 539.70 | -6.70 | 2.6242 | -0.6844 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 7.33 | 13.59 | 516.36 | 9.14 | 1.6744 | -1.0317 | |||

| STE / STERIS plc | 2.10 | 36.02 | 504.49 | 44.16 | 1.6359 | -0.3657 | |||

| RXO / RXO, Inc. | 31.38 | 3.78 | 493.22 | -14.59 | 1.5994 | -1.7034 | |||

| NTES / NetEase, Inc. - Depositary Receipt (Common Stock) | 3.51 | -4.30 | 472.00 | 25.13 | 1.5306 | -0.6269 | |||

| MU / Micron Technology, Inc. | 3.46 | 50.23 | 426.16 | 113.09 | 1.3820 | 0.2381 | |||

| DIS / The Walt Disney Company | 3.35 | -6.61 | 415.61 | 17.34 | 1.3477 | -0.6781 | |||

| XPO / XPO, Inc. | 3.15 | 16.79 | 397.82 | 37.10 | 1.2900 | -0.3696 | |||

| UNH / UnitedHealth Group Incorporated | 1.09 | 63.38 | 339.02 | -2.68 | 1.0994 | -0.8932 | |||

| MCHP / Microchip Technology Incorporated | 4.64 | -39.22 | 326.58 | -11.64 | 1.0590 | -1.0551 | |||

| CNK / Cinemark Holdings, Inc. | 10.10 | -0.43 | 304.76 | 20.73 | 0.9883 | -0.4556 | |||

| NEM / Newmont Corporation | 5.01 | -11.69 | 291.85 | 6.56 | 0.9464 | -0.6201 | |||

| AES / The AES Corporation | 27.62 | 0.36 | 290.54 | -14.99 | 0.9422 | -1.0127 | |||

| NU / Nu Holdings Ltd. | 18.87 | 28.17 | 258.90 | 71.73 | 0.8396 | -0.0228 | |||

| BBD / Banco Bradesco S.A. - Depositary Receipt (Common Stock) | 81.03 | 250.40 | 1.2175 | 1.2175 | |||||

| FSV / FirstService Corporation | 1.42 | 0.47 | 248.64 | 5.72 | 0.8063 | -0.5389 | |||

| GLD / SPDR Gold Trust | 0.81 | -14.86 | 246.97 | -9.93 | 0.8009 | -0.7674 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.99 | -43.28 | 240.83 | -42.60 | 0.7810 | -1.6188 | |||

| FNV / Franco-Nevada Corporation | 1.41 | -26.41 | 231.47 | -23.44 | 0.7506 | -0.9787 | |||

| BRKR / Bruker Corporation | 4.68 | 192.74 | 0.9372 | 0.9372 | |||||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 19.67 | -37.09 | 190.95 | -38.79 | 0.6192 | -1.1651 | |||

| CX / CEMEX, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 26.30 | 90.15 | 182.26 | 134.90 | 0.5910 | 0.1472 | |||

| BKNG / Booking Holdings Inc. | 0.03 | -27.63 | 176.69 | -9.06 | 0.5730 | -0.5383 | |||

| TXN / Texas Instruments Incorporated | 0.81 | 425.14 | 168.17 | 506.74 | 0.5453 | 0.3868 | |||

| GMAB / Genmab A/S - Depositary Receipt (Common Stock) | 7.92 | 38.69 | 163.64 | 46.34 | 0.5306 | -0.1089 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 1.02 | 22.75 | 162.74 | 50.45 | 0.5277 | -0.0910 | |||

| XP / XP Inc. | 8.00 | 161.64 | 0.5242 | 0.5242 | |||||

| R / Ryder System, Inc. | 1.01 | 15.43 | 159.86 | 27.63 | 0.5184 | -0.1980 | |||

| INSM / Insmed Incorporated | 1.52 | 153.39 | 0.7458 | 0.7458 | |||||

| IMAX / IMAX Corporation | 5.11 | 31.69 | 142.96 | 39.73 | 0.4636 | -0.1216 | |||

| CRSP / CRISPR Therapeutics AG | 2.76 | 76.88 | 134.47 | 152.82 | 0.4360 | 0.1318 | |||

| B / Barrick Mining Corporation | 6.30 | 131.22 | 0.6380 | 0.6380 | |||||

| SYNA / Synaptics Incorporated | 1.83 | -16.93 | 118.85 | -15.49 | 0.3854 | -0.4190 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 1.16 | 236.61 | 116.77 | 223.92 | 0.3787 | 0.1725 | |||

| BUR / Burford Capital Limited | 7.73 | 6.86 | 110.26 | 15.36 | 0.3575 | -0.1891 | |||

| WPM / Wheaton Precious Metals Corp. | 1.02 | -22.81 | 91.95 | -10.70 | 0.2982 | -0.2908 | |||

| MAR / Marriott International, Inc. | 0.31 | 0.00 | 84.60 | 14.70 | 0.2743 | -0.1475 | |||

| PTLO / Portillo's Inc. | 6.36 | 6.44 | 74.20 | 4.47 | 0.3608 | -0.0455 | |||

| MSI / Motorola Solutions, Inc. | 0.18 | -76.15 | 73.82 | -77.09 | 0.2394 | -1.6039 | |||

| VIPS / Vipshop Holdings Limited - Depositary Receipt (Common Stock) | 4.87 | -30.45 | 73.36 | -33.25 | 0.2379 | -0.3907 | |||

| DAO / Youdao, Inc. - Depositary Receipt (Common Stock) | 7.50 | -10.10 | 64.48 | 1.33 | 0.2091 | -0.1549 | |||

| GFI / Gold Fields Limited - Depositary Receipt (Common Stock) | 2.67 | -23.61 | 63.19 | -18.15 | 0.2049 | -0.2367 | |||

| FBIN / Fortune Brands Innovations, Inc. | 1.01 | 32.65 | 52.12 | 12.17 | 0.1690 | -0.0968 | |||

| CRC / California Resources Corporation | 1.12 | -6.45 | 51.22 | -2.84 | 0.1661 | -0.1354 | |||

| ICLR / ICON Public Limited Company | 0.34 | 48.82 | 0.1583 | 0.1583 | |||||

| GNRC / Generac Holdings Inc. | 0.31 | 50.16 | 44.02 | 69.80 | 0.1427 | -0.0055 | |||

| ENB / Enbridge Inc. | 0.96 | 24.72 | 43.68 | 27.56 | 0.1416 | -0.0542 | |||

| BWXT / BWX Technologies, Inc. | 0.30 | 42.50 | 0.2067 | 0.2067 | |||||

| MTZ / MasTec, Inc. | 0.24 | 5.11 | 40.80 | 53.50 | 0.1323 | -0.0197 | |||

| NAVI / Navient Corporation | 2.85 | 23.23 | 40.17 | 37.57 | 0.1303 | -0.0368 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.42 | -7.01 | 32.16 | 7.31 | 0.1043 | -0.0671 | |||

| MSFT / Microsoft Corporation | 0.06 | -33.28 | 31.50 | -11.60 | 0.1021 | -0.1016 | |||

| KB / KB Financial Group Inc. - Depositary Receipt (Common Stock) | 0.37 | 0.91 | 30.58 | 54.02 | 0.0992 | -0.0144 | |||

| ATKR / Atkore Inc. | 0.36 | 45.01 | 25.68 | 70.53 | 0.0833 | -0.0029 | |||

| EME / EMCOR Group, Inc. | 0.05 | 61.63 | 25.02 | 133.90 | 0.0811 | 0.0199 | |||

| MCS / The Marcus Corporation | 1.38 | 9.09 | 23.18 | 10.20 | 0.0752 | -0.0452 | |||

| NCMI / National CineMedia, Inc. | 4.20 | 20.34 | 0.0660 | 0.0660 | |||||

| PAGS / PagSeguro Digital Ltd. | 2.09 | 20.11 | 0.0978 | 0.0978 | |||||

| NE / Noble Corporation plc | 0.74 | 19.68 | 0.0638 | 0.0638 | |||||

| AU / AngloGold Ashanti plc | 0.43 | -27.93 | 19.50 | -11.53 | 0.0632 | -0.0628 | |||

| MS / Morgan Stanley | 0.12 | 1.03 | 16.25 | 21.97 | 0.0527 | -0.0235 | |||

| G / Genpact Limited | 0.36 | -76.12 | 15.83 | -79.14 | 0.0513 | -0.3828 | |||

| CMCL / Caledonia Mining Corporation Plc | 0.78 | 0.00 | 15.12 | 54.68 | 0.0490 | -0.0069 | |||

| INTC / Intel Corporation | 0.64 | 1.01 | 14.41 | -0.37 | 0.0467 | -0.0360 | |||

| FUTU / Futu Holdings Limited - Depositary Receipt (Common Stock) | 0.09 | -67.68 | 10.99 | -60.97 | 0.0356 | -0.1254 | |||

| IQV / IQVIA Holdings Inc. | 0.05 | 8.23 | 0.0400 | 0.0400 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 1.23 | 0.0040 | 0.0040 | |||||

| BORR / Borr Drilling Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TS / Tenaris S.A. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOOGL / Alphabet Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HWM / Howmet Aerospace Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ACGL / Arch Capital Group Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFSI / PennyMac Financial Services, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GLBE / Global-E Online Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GPN / Global Payments Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |