Basic Stats

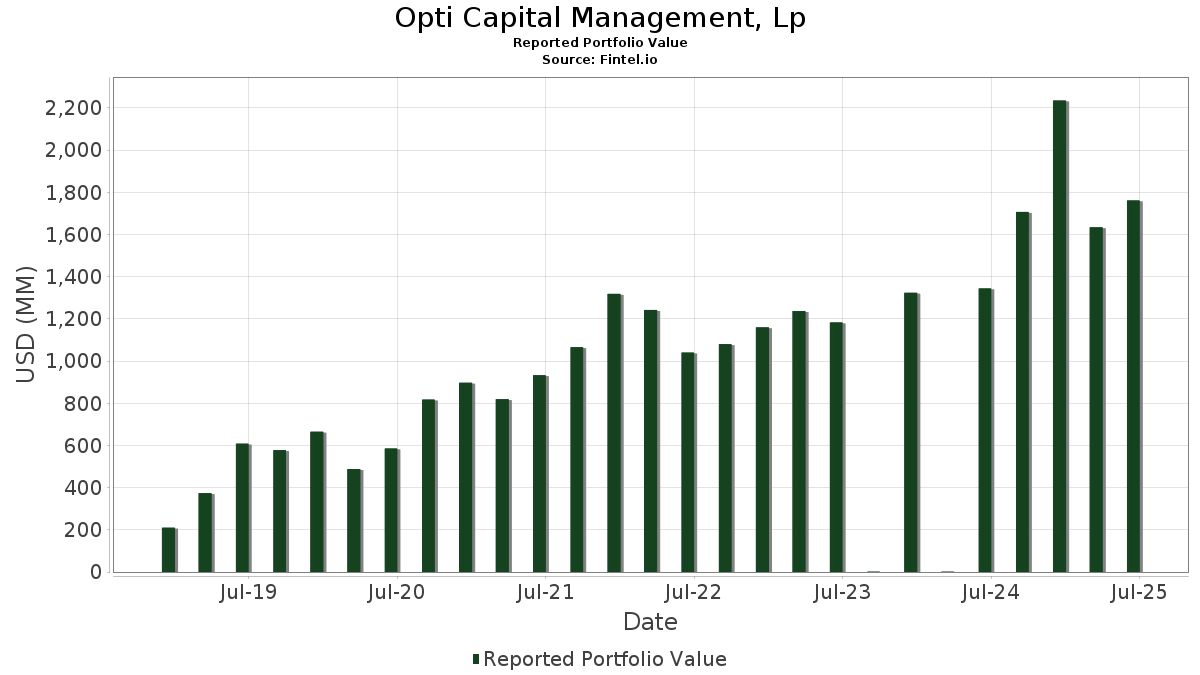

| Portfolio Value | $ 1,761,241,488 |

| Current Positions | 46 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Opti Capital Management, Lp has disclosed 46 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,761,241,488 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Opti Capital Management, Lp’s top holdings are CONV. NOTE (US:US87918AAF21) , CONV. NOTE (US:US852234AK99) , InterDigital, Inc. (US:US45867GAD34) , SNAP INC (US:US83304AAH95) , and CONV. NOTE (US:US55024UAD19) . Opti Capital Management, Lp’s new positions include CONV. NOTE (US:US87918AAF21) , CONV. NOTE (US:US852234AK99) , InterDigital, Inc. (US:US45867GAD34) , SNAP INC (US:US83304AAH95) , and CONV. NOTE (US:US55024UAD19) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 63.44 | 3.6019 | 3.6019 | ||

| 57.39 | 3.2586 | 3.2586 | ||

| 49.36 | 2.8025 | 2.8025 | ||

| 43.36 | 2.4620 | 2.4620 | ||

| 36.32 | 2.0621 | 2.0621 | ||

| 35.19 | 1.9978 | 1.9978 | ||

| 25.41 | 1.4427 | 1.4427 | ||

| 25.01 | 1.4199 | 1.2848 | ||

| 35.95 | 2.0414 | 1.1679 | ||

| 66.89 | 3.7979 | 1.0628 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 26.16 | 1.4850 | -1.5177 | ||

| 123.41 | 7.0068 | -0.9115 | ||

| 24.01 | 1.3634 | -0.6139 | ||

| 27.59 | 1.5666 | -0.4512 | ||

| 21.82 | 1.2387 | -0.3277 | ||

| 73.54 | 4.1752 | -0.2562 | ||

| 43.59 | 2.4750 | -0.1653 | ||

| 14.64 | 0.8311 | -0.1276 | ||

| 28.88 | 1.6395 | -0.1206 | ||

| 22.03 | 1.2506 | -0.0853 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. This investor has not disclosed securities that are counted in shares, so the shares-related columns in the table below are omitted. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US87918AAF21 / CONV. NOTE | 131.09 | 11.80 | 7.4431 | 0.2673 | ||

| US852234AK99 / CONV. NOTE | 123.41 | -4.63 | 7.0068 | -0.9115 | ||

| US45867GAD34 / InterDigital, Inc. | 93.57 | 8.67 | 5.3125 | 0.0433 | ||

| US83304AAH95 / SNAP INC | 80.16 | 22.26 | 4.5511 | 0.5389 | ||

| US55024UAD19 / CONV. NOTE | 78.34 | 22.67 | 4.4482 | 0.5397 | ||

| NVCR / NovoCure Limited | 73.54 | 1.55 | 4.1752 | -0.2562 | ||

| US40637HAD17 / CONV. NOTE | 70.79 | 10.99 | 4.0191 | 0.1161 | ||

| NVMI / Nova Ltd. | 66.89 | 49.67 | 3.7979 | 1.0628 | ||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 63.44 | 3.6019 | 3.6019 | |||

| US538034BA63 / CONV. NOTE | 57.39 | 3.2586 | 3.2586 | |||

| US753422AF15 / Rapid7 Inc | 54.25 | 13.80 | 3.0799 | 0.1628 | ||

| US62886HBD26 / NCL Corp Ltd | 49.36 | 2.8025 | 2.8025 | |||

| US31188VAB62 / FASTLY INC CONV 0% 03/15/2026 | 44.06 | 8.85 | 2.5014 | 0.0246 | ||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 43.59 | 1.03 | 2.4750 | -0.1653 | ||

| US62886HBK68 / CONV. NOTE | 43.36 | 2.4620 | 2.4620 | |||

| US23282WAC47 / CONV. NOTE | 42.01 | 64.94 | 2.3853 | 0.8266 | ||

| CENTERPOINT ENERGY INC / NOTE 4.250% 8/1 (15189TBD8) | 37.98 | 0.0000 | ||||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 36.32 | 2.0621 | 2.0621 | |||

| US29355AAH05 / ENPHASE ENERGY INC CONV 0% 03/01/2026 | 35.95 | 151.91 | 2.0414 | 1.1679 | ||

| US02043QAB32 / CONV. NOTE | 35.19 | 1.9978 | 1.9978 | |||

| US453204AD18 / CONV. NOTE | 34.07 | 9.77 | 1.9346 | 0.0350 | ||

| US30063PAB13 / Exas 3/8 3/15/27 Bond | 33.96 | 46.67 | 1.9281 | 0.5113 | ||

| US896945AD46 / TRIP 0 1/4 04/01/26 | 28.88 | 0.40 | 1.6395 | -0.1206 | ||

| US268158AD40 / Dynavax Technologies Corp | 27.59 | -16.32 | 1.5666 | -0.4512 | ||

| US207410AH48 / CONV. NOTE | 26.16 | -46.70 | 1.4850 | -1.5177 | ||

| US698884AE30 / PAR Technology Corporation | 25.41 | 1.4427 | 1.4427 | |||

| US40131MAB54 / CONVERTIBLE ZERO | 25.01 | 1,032.61 | 1.4199 | 1.2848 | ||

| ENVISTA HOLDINGS CORPORATION / NOTE 1.750% 8/1 (29415FAD6) | 24.23 | 0.0000 | ||||

| US743312AB62 / Progress Software Corp | 24.01 | -25.68 | 1.3634 | -0.6139 | ||

| US64049MAB63 / NeoGenomics Inc | 23.17 | 86.47 | 1.3154 | 0.5551 | ||

| FVRR / Fiverr International Ltd. | 22.03 | 0.90 | 1.2506 | -0.0853 | ||

| US282914AE03 / 8x8, Inc. | 21.82 | -14.76 | 1.2387 | -0.3277 | ||

| US91688FAB04 / CONV. NOTE | 21.32 | 0.93 | 1.2104 | -0.0821 | ||

| US15677JAD00 / CONV. NOTE | 20.78 | 31.51 | 1.1797 | 0.2128 | ||

| US91879QAN97 / CONVERTIBLE ZERO | 19.98 | 1.29 | 1.1347 | -0.0727 | ||

| US695127AF73 / CONV. NOTE | 18.61 | 1.01 | 1.0569 | -0.0708 | ||

| WIX / Wix.com Ltd. | 17.55 | 1.26 | 0.9963 | -0.0641 | ||

| US68213NAD12 / Omnicell Inc | 17.36 | 1.08 | 0.9854 | -0.0653 | ||

| US05988JAD54 / Bandwidth Inc | 16.88 | 79.50 | 0.9581 | 0.3828 | ||

| US011642AB16 / CONVERTIBLE ZERO | 16.53 | 1.14 | 0.9387 | -0.0616 | ||

| US538146AD33 / LivePerson, Inc. | 14.64 | -6.56 | 0.8311 | -0.1276 | ||

| US501812AB77 / LCI INDUSTRIES CONV 1.125% 05/15/2026 | 8.87 | -0.20 | 0.5038 | -0.0403 | ||

| MICROCHIP TECHNOLOGY INC. / NOTE 0.750% 6/0 (595017BG8) | 6.84 | 0.0000 | ||||

| TRANSMEDICS GROUP INC / NOTE 1.500% 6/0 (89377MAB5) | 4.01 | 0.0000 | ||||

| GOSS / Gossamer Bio, Inc. | 0.51 | 11.87 | 0.0289 | 0.0010 | ||

| TPI COMPOSITES INC / NOTE 5.250% 3/1 (87266JAB0) | 0.38 | 0.0000 | ||||

| ITGR / Integer Holdings Corporation | 0.00 | 0.0000 |