Basic Stats

| Portfolio Value | $ 475,447,648 |

| Current Positions | 27 |

Latest Holdings, Performance, AUM (from 13F, 13D)

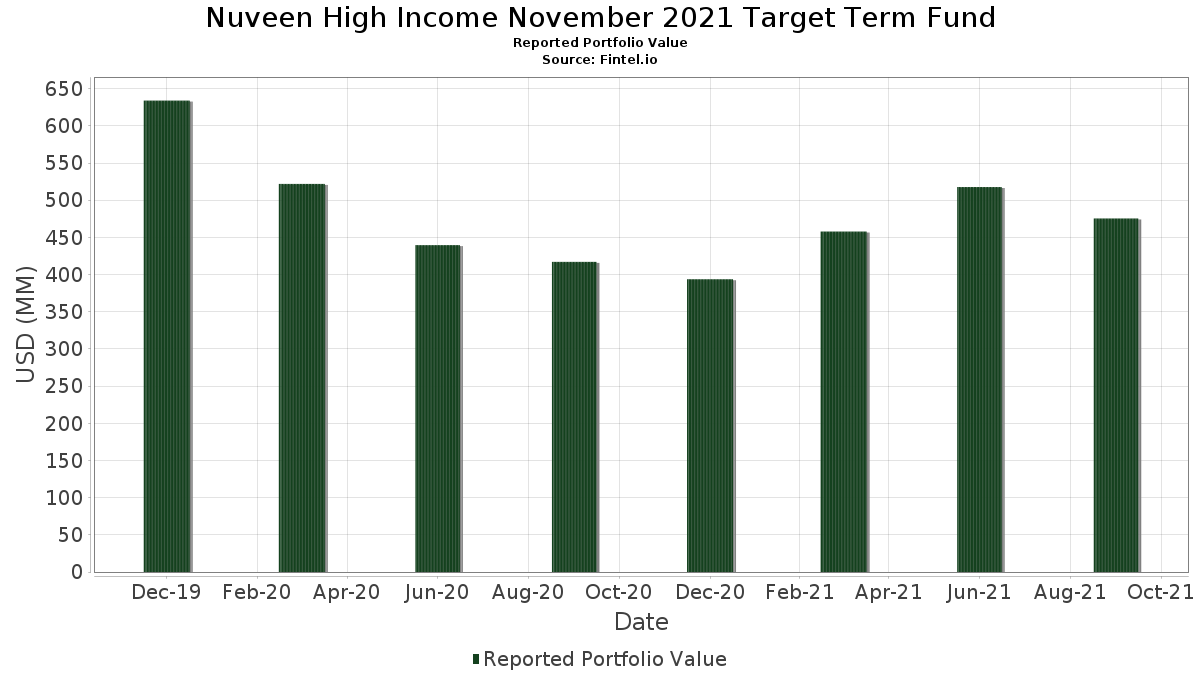

Nuveen High Income November 2021 Target Term Fund has disclosed 27 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 475,447,648 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Nuveen High Income November 2021 Target Term Fund’s top holdings are Federal Home Loan Bank Discount Notes (US:US313385MZ64) , Federal Home Loan Bank (FHLB) (US:US313385NG74) , Credit Suisse AG/New York NY (CH:US22546QAR83) , Federal Home Loan Bank (FHLB) (US:US313385NM43) , and Lennar Corp (US:US526057BY96) . Nuveen High Income November 2021 Target Term Fund’s new positions include Federal Home Loan Bank Discount Notes (US:US313385MZ64) , Federal Home Loan Bank (FHLB) (US:US313385NG74) , Credit Suisse AG/New York NY (CH:US22546QAR83) , Federal Home Loan Bank (FHLB) (US:US313385NM43) , and Lennar Corp (US:US526057BY96) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 147.50 | 28.0418 | 28.0418 | ||

| 107.99 | 20.5311 | 20.5311 | ||

| 17.75 | 3.3745 | 3.3745 | ||

| 11.50 | 2.1862 | 2.1862 | ||

| 10.00 | 1.9011 | 1.9011 | ||

| 10.00 | 1.9011 | 1.9011 | ||

| 10.00 | 1.9011 | 1.9011 | ||

| 10.00 | 1.9011 | 1.9011 | ||

| 10.00 | 1.9011 | 1.9011 | ||

| 9.63 | 1.8304 | 1.8304 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 15.02 | 2.8559 | -0.0142 | ||

| 10.01 | 1.9032 | -0.0090 | ||

| 20.09 | 3.8193 | -0.0080 | ||

| 9.00 | 1.7107 | -0.0064 | ||

| 10.01 | 1.9021 | -0.0038 | ||

| 4.19 | 0.7965 | -0.0026 | ||

| 1.92 | 0.3650 | -0.0024 | ||

| 1.31 | 0.2483 | -0.0014 | ||

| 3.92 | 0.7455 | -0.0014 |

13F and Fund Filings

This form was filed on 2021-11-24 for the reporting period 2021-09-30. This investor has not disclosed securities that are counted in shares, so the shares-related columns in the table below are omitted. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US313385MZ64 / Federal Home Loan Bank Discount Notes | 147.50 | 28.0418 | 28.0418 | |||

| US313385NG74 / Federal Home Loan Bank (FHLB) | 107.99 | 20.5311 | 20.5311 | |||

| US22546QAR83 / Credit Suisse AG/New York NY | 20.09 | -0.71 | 3.8193 | -0.0080 | ||

| US313385NM43 / Federal Home Loan Bank (FHLB) | 17.75 | 3.3745 | 3.3745 | |||

| US526057BY96 / Lennar Corp | 15.02 | -0.99 | 2.8559 | -0.0142 | ||

| Cancara Asset Securitisation LLC / STIV (13738JXT2) | 11.50 | 2.1862 | 2.1862 | |||

| US251526BX61 / Deutsche Bank AG/New York NY | 10.01 | -0.97 | 1.9032 | -0.0090 | ||

| US345397ZH93 / Ford Motor Credit Co LLC | 10.01 | -0.69 | 1.9021 | -0.0038 | ||

| US313385MX17 / Federal Home Loan Bank (FHLB) | 10.00 | 1.9011 | 1.9011 | |||

| NRW Bank / STIV (62939LXL8) | 10.00 | 1.9011 | 1.9011 | |||

| XOM / Exxon Mobil Corporation - Depositary Receipt (Common Stock) | 10.00 | 1.9011 | 1.9011 | |||

| PURE GROVE FUNDING / STIV (74625TXN1) | 10.00 | 1.9011 | 1.9011 | |||

| LIME FUNDING LLC / STIV (53262QXM1) | 10.00 | 1.9011 | 1.9011 | |||

| Chariot Funding LLC / STIV (15963TXS3) | 10.00 | 0.03 | 1.9010 | 0.0100 | ||

| Halkin Finance LLC / STIV (40588LXS3) | 10.00 | 0.03 | 1.9010 | 0.0100 | ||

| US0020A2XK34 / AT&T, Inc. | 10.00 | 0.05 | 1.9010 | 0.0103 | ||

| Mountcliff Funding LLC / STIV (62455AXS1) | 10.00 | 0.04 | 1.9010 | 0.0101 | ||

| Mont Blanc Capital Corp / STIV (6117P4XF2) | 9.63 | 1.8304 | 1.8304 | |||

| US832696AB44 / Smucker (j.m) Co. 3.50% 10/15/21 | 9.00 | -0.87 | 1.7107 | -0.0064 | ||

| Sheffield Receivables Co LLC / STIV (82124LXC1) | 6.75 | 1.2832 | 1.2832 | |||

| Barton Capital SA / STIV (06945LXL7) | 4.87 | 0.9268 | 0.9268 | |||

| US12592BAG95 / CNH Industrial Capital LLC | 4.19 | -0.83 | 0.7965 | -0.0026 | ||

| US07274EAF07 / Bayer US Finance LLC | 3.92 | -0.66 | 0.7455 | -0.0014 | ||

| US03785DXK70 / Apple, Inc. | 3.00 | 0.5703 | 0.5703 | |||

| US87969NAC92 / Telstra Corp Ltd | 1.92 | -1.13 | 0.3650 | -0.0024 | ||

| 05523RAB / BAE Systems PLC | 1.31 | -1.06 | 0.2483 | -0.0014 | ||

| US313385MQ65 / Federal Home Loan Bank Discount Notes | 1.00 | 0.1901 | 0.1901 |