Basic Stats

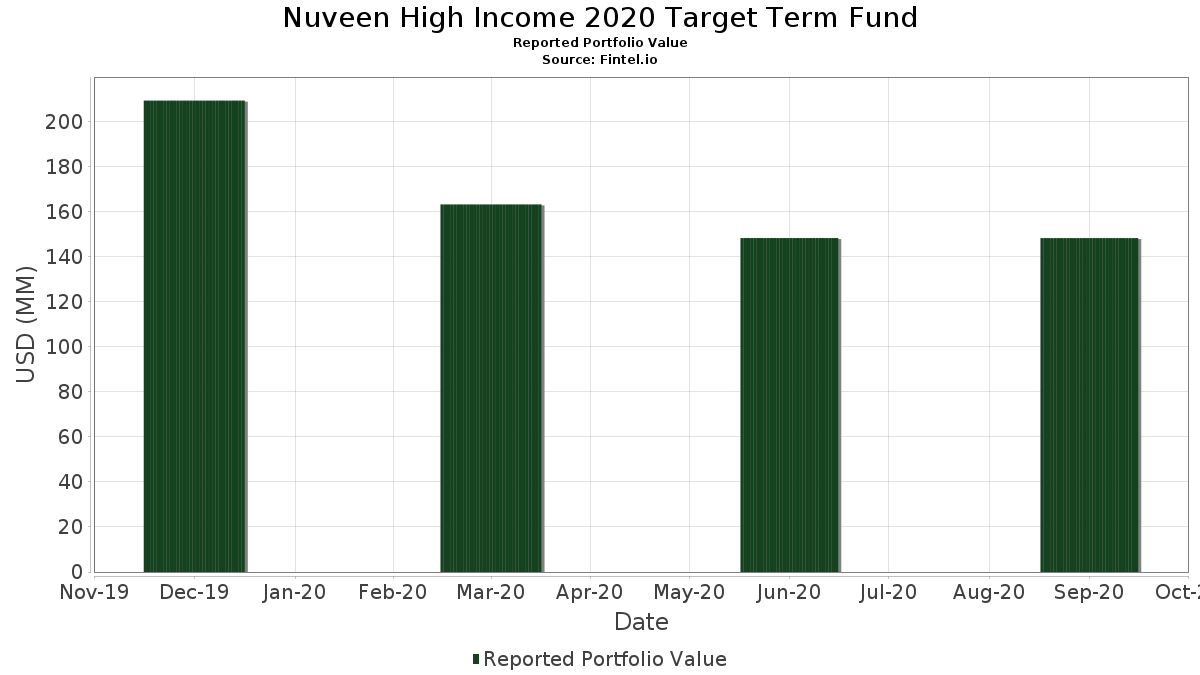

| Portfolio Value | $ 148,234,778 |

| Current Positions | 49 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Nuveen High Income 2020 Target Term Fund has disclosed 49 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 148,234,778 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Nuveen High Income 2020 Target Term Fund’s top holdings are CASH MGMT BILL 0.000000% 10/27/2020 (US:US9127964K26) , Ford Motor Credit Co LLC (US:US345397YS67) , Jupiter Securitization Co LLC (US:4820P2K12) , Limited Brands, Inc. 6.625% Senior Notes 04/01/21 (US:US532716AT46) , and CIT GROUP INC SR UNSECURED 03/21 4.125 (US:US125581GV41) . Nuveen High Income 2020 Target Term Fund’s new positions include CASH MGMT BILL 0.000000% 10/27/2020 (US:US9127964K26) , Ford Motor Credit Co LLC (US:US345397YS67) , Jupiter Securitization Co LLC (US:4820P2K12) , Limited Brands, Inc. 6.625% Senior Notes 04/01/21 (US:US532716AT46) , and CIT GROUP INC SR UNSECURED 03/21 4.125 (US:US125581GV41) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 22.10 | 14.6902 | 14.6902 | ||

| 4.00 | 2.6590 | 2.6590 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9941 | 1.9941 | ||

| 3.00 | 1.9941 | 1.9941 | ||

| 3.00 | 1.9941 | 1.9941 | ||

| 3.00 | 1.9941 | 1.9941 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.49 | 0.3229 | -3.3000 | ||

| 0.91 | 0.6073 | -0.6556 | ||

| 3.13 | 2.0833 | -0.0407 | ||

| 3.40 | 2.2626 | -0.0392 | ||

| 2.51 | 1.6682 | -0.0295 | ||

| 3.98 | 2.6488 | -0.0195 | ||

| 3.42 | 2.2701 | -0.0151 | ||

| 2.52 | 1.6723 | -0.0145 | ||

| 1.50 | 0.9985 | -0.0144 | ||

| 1.25 | 0.8340 | -0.0104 |

13F and Fund Filings

This form was filed on 2020-11-27 for the reporting period 2020-09-30. This investor has not disclosed securities that are counted in shares, so the shares-related columns in the table below are omitted. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US9127964K26 / CASH MGMT BILL 0.000000% 10/27/2020 | 22.10 | 14.6902 | 14.6902 | |||

| US345397YS67 / Ford Motor Credit Co LLC | 7.49 | 0.63 | 4.9794 | 0.0069 | ||

| 4820P2K12 / Jupiter Securitization Co LLC | 4.00 | 2.6590 | 2.6590 | |||

| US532716AT46 / Limited Brands, Inc. 6.625% Senior Notes 04/01/21 | 3.98 | -0.25 | 2.6488 | -0.0195 | ||

| US125581GV41 / CIT GROUP INC SR UNSECURED 03/21 4.125 | 3.42 | -0.15 | 2.2701 | -0.0151 | ||

| US64110LAE65 / Netflix, Inc. Bond | 3.40 | -1.22 | 2.2626 | -0.0392 | ||

| US988498AG64 / Yum! Brands Inc 3.875% Senior Notes 11/01/20 | 3.17 | 0.03 | 2.1083 | -0.0093 | ||

| US526057CK83 / Lennar Corp | 3.13 | -1.45 | 2.0833 | -0.0407 | ||

| Old Line Funding LLC / STIV (67983TK54) | 3.00 | 1.9942 | 1.9942 | |||

| 30229AK65 / Exxon Mobil Corp | 3.00 | 0.03 | 1.9942 | -0.0086 | ||

| Columbia Funding Co LLC / STIV (19767CK70) | 3.00 | 1.9942 | 1.9942 | |||

| Bennington Stark Capital Co LLC / STIV (08224LKD7) | 3.00 | 1.9942 | 1.9942 | |||

| NRW Bank / STIV (62939LKD0) | 3.00 | 1.9942 | 1.9942 | |||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 3.00 | 1.9941 | 1.9941 | |||

| Lloyds Bank PLC / STIV (53943RKD0) | 3.00 | 1.9941 | 1.9941 | |||

| 12619TKD5 / CRC Funding LLC | 3.00 | 1.9941 | 1.9941 | |||

| Cornell University / STIV (21920NKF8) | 3.00 | 1.9941 | 1.9941 | |||

| Corp Andina de Fomento / STIV (2198X2KE8) | 3.00 | 1.9940 | 1.9940 | |||

| Kells Funding LLC / STIV (PPEF0C5R0) | 3.00 | 1.9940 | 1.9940 | |||

| Private Export Funding Corp / STIV (7426M2KW0) | 3.00 | 1.9939 | 1.9939 | |||

| 22533TKU9 / Credit Agricole Corporate and Investment Bank/New York | 3.00 | 0.07 | 1.9939 | -0.0087 | ||

| MetLife Short Term Funding LLC / STIV (59157TKW2) | 3.00 | 1.9939 | 1.9939 | |||

| Crown Point Capital Co LLC / STIV (2284K0KN4) | 3.00 | 1.9939 | 1.9939 | |||

| Thunder Bay Funding LLC / STIV (88602TKS1) | 3.00 | 1.9939 | 1.9939 | |||

| Manhattan Asset Funding Co LLC / STIV (56274LKU7) | 3.00 | 1.9939 | 1.9939 | |||

| Halkin Finance LLC / STIV (40588LKU2) | 3.00 | 1.9939 | 1.9939 | |||

| 39021UKU9 / GREAT BRDGE CPTL CO LL | 3.00 | 0.07 | 1.9939 | -0.0084 | ||

| Sheffield Receivables Co LLC / STIV (82124LKS0) | 3.00 | 1.9938 | 1.9938 | |||

| Ciesco LLC / STIV (17177LKW3) | 3.00 | 1.9938 | 1.9938 | |||

| US85571BAP04 / Starwood Property Trust Inc | 3.00 | 1.70 | 1.9929 | 0.0239 | ||

| US63938CAA62 / Navient Corp | 2.87 | 0.42 | 1.9078 | -0.0014 | ||

| US745867AV39 / PulteGroup Inc | 2.52 | -0.40 | 1.6723 | -0.0145 | ||

| US900123BH29 / Turkey Government International Bond | 2.51 | -1.26 | 1.6682 | -0.0295 | ||

| US910047AG49 / United Airlines Holdings Inc | 2.51 | 1.01 | 1.6660 | 0.0085 | ||

| AVOL / Park Aerospace Holdings Ltd | 2.36 | 0.90 | 1.5720 | 0.0064 | ||

| US71654QAX07 / Petroleos Mexicanos | 2.27 | 1.11 | 1.5088 | 0.0095 | ||

| US02005NBG43 / Ally Financial Inc | 2.03 | -0.10 | 1.3522 | -0.0079 | ||

| US12553NK204 / Cigna Corporation | 2.00 | 1.3295 | 1.3295 | |||

| US247361ZM39 / Delta Air Lines Inc | 1.99 | 2.47 | 1.3244 | 0.0251 | ||

| US296464AA84 / Eskom Holdings SOC Ltd | 1.95 | 2.52 | 1.2967 | 0.0258 | ||

| US00928QAM33 / Aircastle Ltd Senior Notes 9.75% 08/01/2018 | 1.81 | 1.06 | 1.2019 | 0.0067 | ||

| US06739GBP37 / Barclays Bank Plc 5.140% Lower Tier 2 Notes 10/14/20 | 1.50 | -0.92 | 0.9985 | -0.0144 | ||

| US65412AAA07 / Nigeria Government International Bond | 1.25 | -0.79 | 0.8340 | -0.0104 | ||

| US37247DAN66 / Genworth Finl Inc Fixed Rt Senior Notes 7.2% 02/15/2021 | 1.00 | 7.49 | 0.6681 | 0.0435 | ||

| 94XL / Gold Fields Orogen Holdings BVI Ltd | 1.00 | -0.50 | 0.6632 | -0.0061 | ||

| US059613AC35 / Banco Nacional de Costa Rica | 0.91 | -51.69 | 0.6073 | -0.6556 | ||

| US85748R0096 / Dreyfus Institutional Preferred Government Plus Money Market Fund | 0.49 | -91.06 | 0.3229 | -3.3000 | ||

| US38869PAK03 / Graphic Packaging Intl 4.75% 04/15/21 | 0.45 | -0.44 | 0.3014 | -0.0030 | ||

| US74153QAH56 / Pride Intl Inc Del Fixed Rt Notes 6.875% 08/15/2020 | 0.11 | -5.83 | 0.0755 | -0.0047 |