Basic Stats

| Portfolio Value | $ 168,030,243 |

| Current Positions | 24 |

Latest Holdings, Performance, AUM (from 13F, 13D)

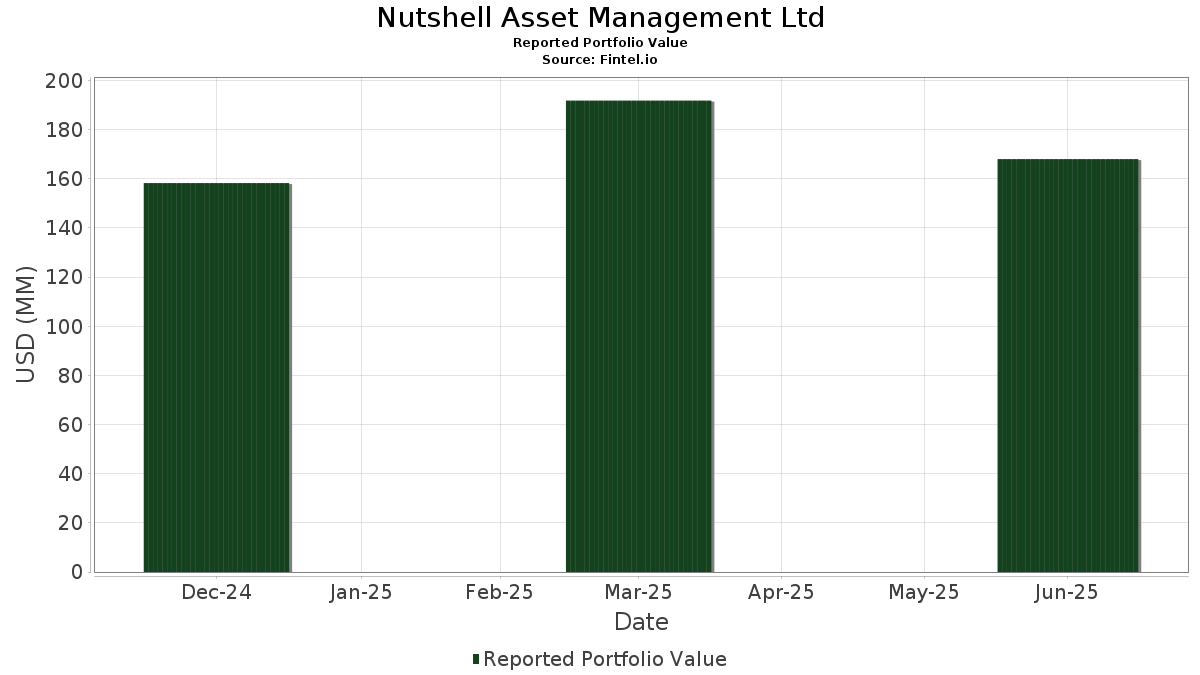

Nutshell Asset Management Ltd has disclosed 24 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 168,030,243 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Nutshell Asset Management Ltd’s top holdings are SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF (US:BIL) , Fortinet, Inc. (US:FTNT) , Adobe Inc. (US:ADBE) , Medpace Holdings, Inc. (US:MEDP) , and Alphabet Inc. (US:GOOGL) . Nutshell Asset Management Ltd’s new positions include SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF (US:BIL) , Medpace Holdings, Inc. (US:MEDP) , Fiserv, Inc. (US:FI) , Copart, Inc. (US:CPRT) , and Automatic Data Processing, Inc. (US:ADP) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.34 | 31.19 | 18.5611 | 18.5611 | |

| 0.04 | 12.85 | 7.6450 | 7.6450 | |

| 0.04 | 9.10 | 5.4139 | 3.1006 | |

| 0.02 | 3.19 | 1.8982 | 1.8982 | |

| 0.06 | 3.14 | 1.8690 | 1.8690 | |

| 0.01 | 3.09 | 1.8381 | 1.8381 | |

| 0.01 | 2.31 | 1.3765 | 1.3765 | |

| 0.02 | 1.89 | 1.1264 | 1.1264 | |

| 0.01 | 1.84 | 1.0967 | 1.0967 | |

| 0.00 | 7.69 | 4.5776 | 0.9326 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 6.08 | 3.6174 | -5.9747 | |

| 0.02 | 1.17 | 0.6992 | -5.5424 | |

| 0.00 | 2.58 | 1.5374 | -4.1709 | |

| 0.03 | 13.18 | 7.8433 | -2.8211 | |

| 0.04 | 4.40 | 2.6182 | -1.4138 | |

| 0.01 | 3.34 | 1.9863 | -0.2261 | |

| 0.07 | 11.49 | 6.8396 | -0.2096 | |

| 0.02 | 8.86 | 5.2707 | -0.1039 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.34 | 31.19 | 18.5611 | 18.5611 | |||||

| FTNT / Fortinet, Inc. | 0.13 | -13.03 | 13.77 | -4.48 | 8.1952 | 0.6803 | |||

| ADBE / Adobe Inc. | 0.03 | -36.14 | 13.18 | -35.58 | 7.8433 | -2.8211 | |||

| MEDP / Medpace Holdings, Inc. | 0.04 | 12.85 | 7.6450 | 7.6450 | |||||

| GOOGL / Alphabet Inc. | 0.07 | -25.43 | 11.49 | -15.02 | 6.8396 | -0.2096 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | 50.24 | 9.10 | 105.00 | 5.4139 | 3.1006 | |||

| NVDA / NVIDIA Corporation | 0.06 | -27.61 | 8.89 | 5.52 | 5.2894 | 0.8990 | |||

| MSCI / MSCI Inc. | 0.02 | -15.78 | 8.86 | -14.10 | 5.2707 | -0.1039 | |||

| MA / Mastercard Incorporated | 0.02 | -11.51 | 8.63 | -9.28 | 5.1388 | 0.1777 | |||

| AZO / AutoZone, Inc. | 0.00 | 12.98 | 7.69 | 10.00 | 4.5776 | 0.9326 | |||

| MSFT / Microsoft Corporation | 0.01 | -75.07 | 6.08 | -66.97 | 3.6174 | -5.9747 | |||

| ANET / Arista Networks Inc | 0.04 | -56.93 | 4.40 | -43.12 | 2.6182 | -1.4138 | |||

| PYPL / PayPal Holdings, Inc. | 0.05 | -16.35 | 3.57 | -4.72 | 2.1275 | 0.1718 | |||

| TW / Tradeweb Markets Inc. | 0.02 | 39.15 | 3.46 | 37.26 | 2.0610 | 0.7454 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.01 | -38.43 | 3.34 | -21.37 | 1.9863 | -0.2261 | |||

| FI / Fiserv, Inc. | 0.02 | 3.19 | 1.8982 | 1.8982 | |||||

| CPRT / Copart, Inc. | 0.06 | 3.14 | 1.8690 | 1.8690 | |||||

| LULU / lululemon athletica inc. | 0.01 | 3.09 | 1.8381 | 1.8381 | |||||

| META / Meta Platforms, Inc. | 0.00 | -81.58 | 2.58 | -76.41 | 1.5374 | -4.1709 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 2.31 | 1.3765 | 1.3765 | |||||

| V / Visa Inc. | 0.01 | 35.42 | 2.31 | 37.16 | 1.3735 | 0.4966 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.02 | 1.89 | 1.1264 | 1.1264 | |||||

| AMGN / Amgen Inc. | 0.01 | 1.84 | 1.0967 | 1.0967 | |||||

| FLOT / iShares Trust - iShares Floating Rate Bond ETF | 0.02 | -90.18 | 1.17 | -90.19 | 0.6992 | -5.5424 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MTD / Mettler-Toledo International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| APH / Amphenol Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LRCX / Lam Research Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NKE / NIKE, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RMD / ResMed Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LLY / Eli Lilly and Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QLYS / Qualys, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |