Basic Stats

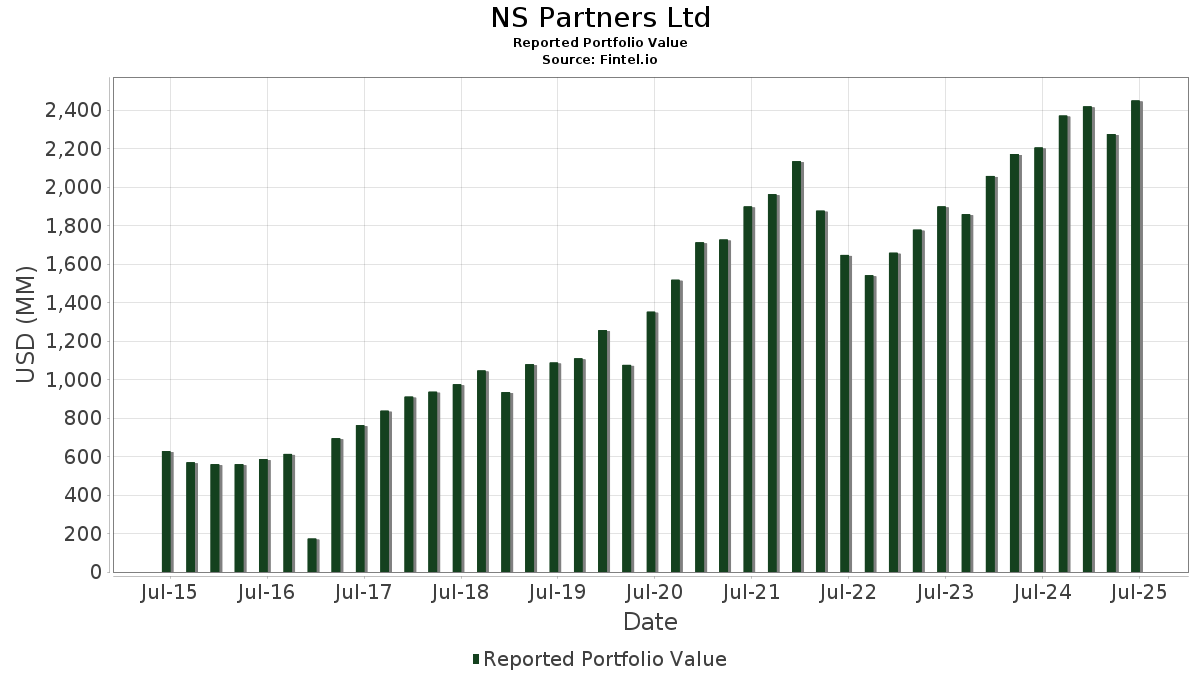

| Portfolio Value | $ 2,449,387,137 |

| Current Positions | 72 |

Latest Holdings, Performance, AUM (from 13F, 13D)

NS Partners Ltd has disclosed 72 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 2,449,387,137 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). NS Partners Ltd’s top holdings are Microsoft Corporation (US:MSFT) , Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , Meta Platforms, Inc. (US:META) , Alphabet Inc. (US:GOOG) , and Apple Inc. (US:AAPL) . NS Partners Ltd’s new positions include Grupo Financiero Galicia S.A. - Depositary Receipt (Common Stock) (MX:GGAL N) , Futu Holdings Limited - Depositary Receipt (Common Stock) (US:FUTU) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.51 | 255.09 | 10.4143 | 1.6469 | |

| 0.35 | 26.97 | 0.5666 | 0.5666 | |

| 0.19 | 9.72 | 0.3968 | 0.3968 | |

| 0.07 | 8.59 | 0.3507 | 0.3507 | |

| 0.07 | 19.75 | 0.8063 | 0.0926 | |

| 0.34 | 11.29 | 0.2372 | 0.0708 | |

| 0.10 | 29.64 | 1.2102 | 0.0326 | |

| 0.47 | 22.08 | 0.9013 | 0.0223 | |

| 0.16 | 47.16 | 1.9253 | 0.0200 | |

| 0.05 | 5.04 | 0.2058 | 0.0178 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.50 | 236.82 | 4.9751 | -2.3164 | |

| 0.45 | 99.35 | 2.0871 | -1.7846 | |

| 0.17 | 123.19 | 2.5880 | -1.7435 | |

| 0.19 | 46.39 | 0.9746 | -1.4041 | |

| 0.16 | 58.39 | 1.2266 | -1.4000 | |

| 0.10 | 77.05 | 1.6187 | -1.1027 | |

| 0.13 | 39.15 | 0.8224 | -1.0176 | |

| 0.08 | 43.40 | 0.9118 | -1.0091 | |

| 0.56 | 114.40 | 4.6707 | -1.0047 | |

| 0.12 | 36.18 | 0.7601 | -1.0034 |

13F and Fund Filings

This form was filed on 2025-08-07 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.51 | -3.49 | 255.09 | 27.88 | 10.4143 | 1.6469 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 1.50 | -2.07 | 236.82 | 42.76 | 4.9751 | -2.3164 | |||

| META / Meta Platforms, Inc. | 0.17 | -2.39 | 123.19 | 25.01 | 2.5880 | -1.7435 | |||

| GOOG / Alphabet Inc. | 0.67 | -5.46 | 118.91 | 7.34 | 4.8546 | -0.0143 | |||

| AAPL / Apple Inc. | 0.56 | -4.07 | 114.40 | -11.40 | 4.6707 | -1.0047 | |||

| AMZN / Amazon.com, Inc. | 0.45 | -2.19 | 99.35 | 12.78 | 2.0871 | -1.7846 | |||

| INTU / Intuit Inc. | 0.10 | -2.99 | 77.05 | 24.45 | 1.6187 | -1.1027 | |||

| V / Visa Inc. | 0.16 | -3.56 | 58.39 | -2.29 | 1.2266 | -1.4000 | |||

| MA / Mastercard Incorporated | 0.10 | -3.28 | 57.56 | -0.84 | 2.3499 | -0.2014 | |||

| JPM / JPMorgan Chase & Co. | 0.16 | -7.95 | 47.16 | 8.79 | 1.9253 | 0.0200 | |||

| TMUS / T-Mobile US, Inc. | 0.19 | -4.04 | 46.39 | -14.28 | 0.9746 | -1.4041 | |||

| MSCI / MSCI Inc. | 0.08 | -2.62 | 43.40 | -0.69 | 0.9118 | -1.0091 | |||

| SYK / Stryker Corporation | 0.11 | -2.72 | 43.27 | 3.40 | 1.7667 | -0.0729 | |||

| SPGI / S&P Global Inc. | 0.08 | -3.85 | 42.98 | -0.22 | 0.9029 | -0.9903 | |||

| MAR / Marriott International, Inc. | 0.15 | -7.55 | 40.10 | 6.04 | 0.8424 | -0.8197 | |||

| ISRG / Intuitive Surgical, Inc. | 0.07 | -2.17 | 39.23 | 7.34 | 0.8242 | -0.7822 | |||

| UNH / UnitedHealth Group Incorporated | 0.13 | 56.99 | 39.15 | -6.49 | 0.8224 | -1.0176 | |||

| BSX / Boston Scientific Corporation | 0.36 | -2.59 | 38.52 | 3.72 | 1.5727 | -0.0598 | |||

| VRSK / Verisk Analytics, Inc. | 0.12 | -2.67 | 37.89 | 1.87 | 1.5469 | -0.0879 | |||

| MCO / Moody's Corporation | 0.07 | -3.64 | 37.03 | 3.79 | 1.5119 | -0.0563 | |||

| MCD / McDonald's Corporation | 0.12 | -3.59 | 36.18 | -9.83 | 0.7601 | -1.0034 | |||

| NEE / NextEra Energy, Inc. | 0.47 | -2.95 | 32.72 | -4.96 | 0.6873 | -0.8257 | |||

| KO / The Coca-Cola Company | 0.45 | -4.55 | 31.70 | -5.71 | 0.6660 | -0.8118 | |||

| BKNG / Booking Holdings Inc. | 0.01 | -2.51 | 30.79 | 22.51 | 0.6468 | -0.4578 | |||

| VRSN / VeriSign, Inc. | 0.10 | -2.74 | 29.64 | 10.64 | 1.2102 | 0.0326 | |||

| CRM / Salesforce, Inc. | 0.11 | -8.18 | 29.23 | -6.70 | 0.6142 | -0.7630 | |||

| ZTS / Zoetis Inc. | 0.17 | -3.00 | 27.04 | -8.13 | 1.1040 | -0.1897 | |||

| ADP / Automatic Data Processing, Inc. | 0.09 | -2.84 | 27.03 | -1.93 | 1.1037 | -0.1079 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.35 | 26.97 | 0.5666 | 0.5666 | |||||

| ADBE / Adobe Inc. | 0.07 | -2.51 | 26.00 | -1.66 | 0.5463 | -0.6160 | |||

| YUM / Yum! Brands, Inc. | 0.17 | -2.93 | 25.57 | -8.59 | 0.5371 | -0.6922 | |||

| NOW / ServiceNow, Inc. | 0.02 | -2.33 | 24.88 | 26.12 | 0.5227 | -0.3444 | |||

| EFX / Equifax Inc. | 0.09 | -0.63 | 24.58 | 5.82 | 1.0036 | -0.0175 | |||

| EQIX / Equinix, Inc. | 0.03 | -2.58 | 24.44 | -4.95 | 0.9979 | -0.1324 | |||

| BAC / Bank of America Corporation | 0.47 | -2.65 | 22.08 | 10.40 | 0.9013 | 0.0223 | |||

| MNST / Monster Beverage Corporation | 0.34 | -2.58 | 21.56 | 4.28 | 0.8802 | -0.0285 | |||

| HON / Honeywell International Inc. | 0.09 | -2.74 | 20.81 | 6.96 | 0.4371 | -0.4179 | |||

| ADSK / Autodesk, Inc. | 0.07 | -2.27 | 20.73 | 15.56 | 0.4356 | -0.3530 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.04 | -2.99 | 20.38 | 23.90 | 0.4281 | -0.2948 | |||

| VEEV / Veeva Systems Inc. | 0.07 | -2.18 | 19.75 | 21.62 | 0.8063 | 0.0926 | |||

| QFIN / Qfin Holdings, Inc. - Depositary Receipt (Common Stock) | 0.44 | 11.29 | 19.11 | 7.45 | 0.4014 | -0.3802 | |||

| MKC.V / McCormick & Company, Incorporated | 0.25 | -2.88 | 18.97 | -10.54 | 0.3985 | -0.5334 | |||

| CSGP / CoStar Group, Inc. | 0.21 | -2.29 | 17.25 | -0.85 | 0.3623 | -0.4022 | |||

| NKE / NIKE, Inc. | 0.23 | -2.63 | 16.62 | 8.97 | 0.3492 | -0.3213 | |||

| NOC / Northrop Grumman Corporation | 0.03 | -3.01 | 16.26 | -5.29 | 0.3416 | -0.4130 | |||

| SBUX / Starbucks Corporation | 0.18 | -13.47 | 16.10 | -19.17 | 0.6573 | -0.2181 | |||

| PM / Philip Morris International Inc. | 0.09 | -2.88 | 15.83 | 11.44 | 0.3327 | -0.2919 | |||

| EW / Edwards Lifesciences Corporation | 0.20 | -2.42 | 15.74 | 5.29 | 0.6428 | -0.0145 | |||

| CCI / Crown Castle Inc. | 0.15 | -3.15 | 15.52 | -4.54 | 0.3261 | -0.3887 | |||

| GRAB / Grab Holdings Limited | 3.02 | 65.76 | 15.18 | 84.07 | 0.3189 | -0.0436 | |||

| TRU / TransUnion | 0.17 | -0.51 | 15.04 | 5.49 | 0.6140 | -0.0126 | |||

| LMT / Lockheed Martin Corporation | 0.03 | -2.83 | 14.98 | 0.74 | 0.3148 | -0.3390 | |||

| PYPL / PayPal Holdings, Inc. | 0.19 | -2.51 | 14.32 | 11.04 | 0.5848 | 0.0178 | |||

| BAP / Credicorp Ltd. | 0.06 | -14.50 | 13.55 | 2.66 | 0.5532 | -0.0270 | |||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.34 | 179.51 | 11.29 | 198.34 | 0.2372 | 0.0708 | |||

| ALLE / Allegion plc | 0.08 | -2.67 | 10.86 | 7.52 | 0.2282 | -0.2158 | |||

| BDX / Becton, Dickinson and Company | 0.06 | -7.89 | 10.52 | -30.73 | 0.2209 | -0.4463 | |||

| KVUE / Kenvue Inc. | 0.49 | -2.75 | 10.26 | -15.12 | 0.4188 | -0.1124 | |||

| ANSS / ANSYS, Inc. | 0.03 | 6.67 | 9.94 | 18.36 | 0.2087 | -0.1603 | |||

| GGAL N / Grupo Financiero Galicia S.A. - Depositary Receipt (Common Stock) | 0.19 | 9.72 | 0.3968 | 0.3968 | |||||

| EL / The Estée Lauder Companies Inc. | 0.12 | -10.20 | 9.47 | 9.93 | 0.1990 | -0.1798 | |||

| FUTU / Futu Holdings Limited - Depositary Receipt (Common Stock) | 0.07 | 8.59 | 0.3507 | 0.3507 | |||||

| MASI / Masimo Corporation | 0.04 | -2.27 | 7.16 | -1.32 | 0.1504 | -0.1685 | |||

| ILMN / Illumina, Inc. | 0.05 | -1.97 | 5.04 | 17.89 | 0.2058 | 0.0178 | |||

| STZ / Constellation Brands, Inc. | 0.03 | -2.32 | 4.58 | -13.42 | 0.0963 | -0.1363 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | -4.29 | 3.54 | 30.61 | 0.0743 | -0.0447 | |||

| PEP / PepsiCo, Inc. | 0.02 | -86.40 | 2.47 | -88.02 | 0.1007 | -0.8048 | |||

| HD / The Home Depot, Inc. | 0.00 | -5.62 | 1.05 | -5.60 | 0.0427 | -0.0060 | |||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 1.02 | -2.68 | 0.0415 | -0.0044 | |||

| RYAA.Y / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.86 | 36.12 | 0.0181 | -0.0097 | |||

| KSA / iShares Trust - iShares MSCI Saudi Arabia ETF | 0.01 | -49.48 | 0.38 | -52.99 | 0.0079 | -0.0273 | |||

| SQM / Sociedad Química y Minera de Chile S.A. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.22 | -11.16 | 0.0045 | -0.0061 | |||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| YMM / Full Truck Alliance Co. Ltd. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PBR / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |