Basic Stats

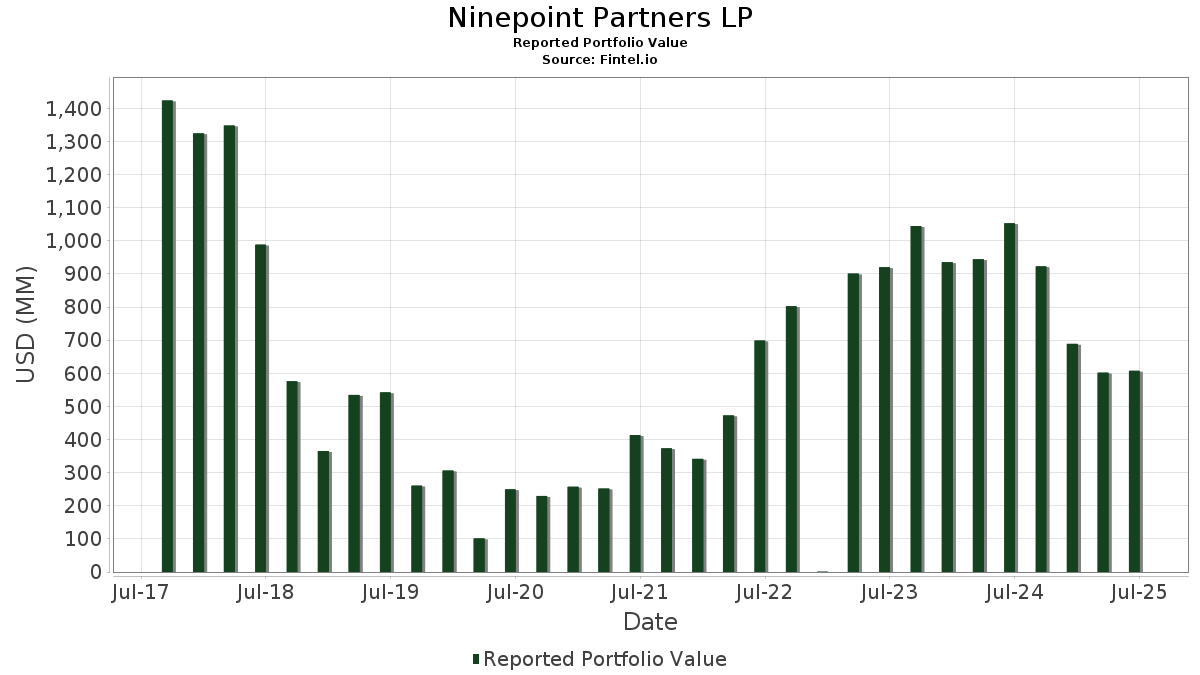

| Portfolio Value | $ 607,364,625 |

| Current Positions | 87 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Ninepoint Partners LP has disclosed 87 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 607,364,625 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Ninepoint Partners LP’s top holdings are Expand Energy Corporation (US:EXE) , EQT Corporation (US:EQT) , Range Resources Corporation (US:RRC) , Antero Resources Corporation (US:AR) , and iShares Trust - iShares S&P 100 ETF (US:OEF) . Ninepoint Partners LP’s new positions include Eaton Corporation plc (US:ETN) , SAP SE - Depositary Receipt (Common Stock) (US:SAP) , Dell Technologies Inc. (US:DELL) , Equinox Gold Corp. (US:EQX) , and Circle Internet Group, Inc. (US:CRCL) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.50 | 61.01 | 10.0442 | 10.0442 | |

| 0.60 | 52.95 | 8.7180 | 8.7180 | |

| 1.40 | 56.39 | 9.2847 | 5.9240 | |

| 1.60 | 93.31 | 15.3634 | 2.0429 | |

| 0.30 | 7.77 | 1.2798 | 1.2798 | |

| 0.06 | 37.69 | 6.2053 | 0.8593 | |

| 0.80 | 93.55 | 15.4029 | 0.6014 | |

| 0.33 | 8.76 | 1.4431 | 0.4209 | |

| 0.01 | 1.75 | 0.2886 | 0.2886 | |

| 0.05 | 3.71 | 0.6111 | 0.2690 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 2.84 | 0.4670 | -15.3528 | |

| 0.05 | 4.84 | 0.7973 | -1.2635 | |

| 0.00 | 0.00 | -1.0378 | ||

| 0.60 | 8.16 | 1.3435 | -0.9684 | |

| 0.15 | 4.25 | 0.7002 | -0.3047 | |

| 0.00 | 0.15 | 0.0248 | -0.1474 | |

| 0.35 | 4.77 | 0.7849 | -0.1359 | |

| 0.10 | 3.81 | 0.6278 | -0.1226 | |

| 0.05 | 3.23 | 0.5323 | -0.0666 | |

| 0.02 | 0.38 | 0.0626 | -0.0466 |

13F and Fund Filings

This form was filed on 2025-08-05 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| EXE / Expand Energy Corporation | 0.80 | 0.00 | 93.55 | 5.05 | 15.4029 | 0.6014 | |||

| EQT / EQT Corporation | 1.60 | 6.67 | 93.31 | 16.43 | 15.3634 | 2.0429 | |||

| RRC / Range Resources Corporation | 1.50 | 61.01 | 10.0442 | 10.0442 | |||||

| AR / Antero Resources Corporation | 1.40 | 180.00 | 56.39 | 178.89 | 9.2847 | 5.9240 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | Put | 0.60 | 52.95 | 8.7180 | 8.7180 | ||||

| SPY / SPDR S&P 500 ETF | Put | 0.06 | 6.09 | 37.69 | 17.17 | 6.2053 | 0.8593 | ||

| SPY / SPDR S&P 500 ETF | 0.05 | -4.92 | 32.25 | 5.02 | 5.3101 | 0.2059 | |||

| ALG / Alamo Group Inc. | 0.33 | 43.48 | 8.76 | 42.50 | 1.4431 | 0.4209 | |||

| KGCRF / Kinross Gold Corporation - Equity Right | 0.53 | 0.00 | 8.31 | 23.95 | 1.3686 | 0.2540 | |||

| CVE / Cenovus Energy Inc. | 0.60 | -40.00 | 8.16 | -41.34 | 1.3435 | -0.9684 | |||

| SOBO / South Bow Corporation | 0.30 | 7.77 | 1.2798 | 1.2798 | |||||

| AEM / Agnico Eagle Mines Limited | 0.06 | 0.00 | 7.57 | 9.71 | 1.2469 | 0.0995 | |||

| CHRD / Chord Energy Corporation | 0.05 | -54.55 | 4.84 | -60.95 | 0.7973 | -1.2635 | |||

| PR / Permian Resources Corporation | 0.35 | -12.50 | 4.77 | -13.95 | 0.7849 | -0.1359 | |||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.10 | -1.93 | 4.68 | 0.32 | 0.7712 | -0.0049 | |||

| NOG / Northern Oil and Gas, Inc. | 0.15 | -25.00 | 4.25 | -29.67 | 0.7002 | -0.3047 | |||

| CNL / Collective Mining Ltd. | 0.39 | -6.10 | 4.21 | 18.22 | 0.6935 | 0.1013 | |||

| VZLA / Vizsla Silver Corp. | 1.40 | 19.93 | 4.12 | 55.33 | 0.6786 | 0.2376 | |||

| MFC / Manulife Financial Corporation | 0.13 | 20.82 | 4.02 | 23.96 | 0.6619 | 0.1229 | |||

| VNOM / Viper Energy, Inc. | 0.10 | 0.00 | 3.81 | -15.55 | 0.6278 | -0.1226 | |||

| CCJ / Cameco Corporation | 0.05 | 0.00 | 3.71 | 80.32 | 0.6111 | 0.2690 | |||

| CM / Canadian Imperial Bank of Commerce | 0.05 | -2.70 | 3.46 | 22.43 | 0.5697 | 0.0999 | |||

| RY / Royal Bank of Canada | 0.03 | -0.28 | 3.43 | 16.40 | 0.5645 | 0.0748 | |||

| NVDA / NVIDIA Corporation | 0.02 | 23.91 | 3.33 | 80.61 | 0.5490 | 0.2422 | |||

| SLF / Sun Life Financial Inc. | 0.05 | -22.68 | 3.23 | -10.30 | 0.5323 | -0.0666 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.25 | 3.18 | 32.87 | 0.5238 | 0.1257 | |||

| TU / TELUS Corporation | 0.19 | -3.54 | 3.08 | 8.03 | 0.5074 | 0.0333 | |||

| IAG / IAMGOLD Corporation | 0.42 | 0.00 | 3.08 | 17.57 | 0.5069 | 0.0718 | |||

| SU / Suncor Energy Inc. | 0.08 | 5.61 | 3.03 | 2.16 | 0.4994 | 0.0058 | |||

| FTS / Fortis Inc. | 0.06 | -10.80 | 2.91 | -6.57 | 0.4796 | -0.0387 | |||

| CNQ / Canadian Natural Resources Limited | 0.09 | -97.08 | 2.84 | -97.02 | 0.4670 | -15.3528 | |||

| NXE / NexGen Energy Ltd. | 0.38 | 0.00 | 2.64 | 54.57 | 0.4342 | 0.1506 | |||

| FCX / Freeport-McMoRan Inc. | 0.06 | 9.09 | 2.60 | 24.93 | 0.4282 | 0.0822 | |||

| AMT / American Tower Corporation | 0.01 | 0.00 | 2.60 | 1.57 | 0.4273 | 0.0026 | |||

| WCN / Waste Connections, Inc. | 0.01 | 0.00 | 2.24 | -4.32 | 0.3680 | -0.0203 | |||

| WPM / Wheaton Precious Metals Corp. | 0.02 | 0.00 | 2.19 | 15.69 | 0.3606 | 0.0459 | |||

| TRP / TC Energy Corporation | 0.04 | 0.00 | 2.18 | 3.31 | 0.3594 | 0.0083 | |||

| COIN / Coinbase Global, Inc. | 0.01 | -16.28 | 2.16 | 70.37 | 0.3561 | 0.1451 | |||

| UNP / Union Pacific Corporation | 0.01 | 11.20 | 2.00 | 8.30 | 0.3289 | 0.0223 | |||

| SBAC / SBA Communications Corporation | 0.01 | 0.00 | 1.99 | 6.75 | 0.3282 | 0.0178 | |||

| TLN / Talen Energy Corporation | 0.01 | -11.09 | 1.93 | 29.47 | 0.3183 | 0.0701 | |||

| CEG / Constellation Energy Corporation | 0.01 | 1.75 | 0.2886 | 0.2886 | |||||

| AVGO / Broadcom Inc. | 0.01 | 12.03 | 1.67 | 84.50 | 0.2743 | 0.1242 | |||

| TRGP / Targa Resources Corp. | 0.01 | 14.60 | 1.53 | -0.45 | 0.2526 | -0.0036 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | -6.84 | 1.53 | -1.98 | 0.2522 | -0.0075 | |||

| CP / Canadian Pacific Kansas City Limited | 0.02 | 0.00 | 1.52 | 12.94 | 0.2501 | 0.0265 | |||

| DUK / Duke Energy Corporation | 0.01 | 4.30 | 1.48 | 0.88 | 0.2443 | -0.0001 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 8.21 | 1.48 | 2.77 | 0.2441 | 0.0043 | |||

| PPL / PPL Corporation | 0.04 | 13.09 | 1.46 | 6.10 | 0.2408 | 0.0118 | |||

| NI / NiSource Inc. | 0.04 | -7.29 | 1.45 | -6.74 | 0.2395 | -0.0197 | |||

| HOOD / Robinhood Markets, Inc. | 0.02 | 25.65 | 1.45 | 182.68 | 0.2394 | 0.1539 | |||

| CMS / CMS Energy Corporation | 0.02 | 6.73 | 1.44 | -1.58 | 0.2367 | -0.0060 | |||

| ERO / Ero Copper Corp. | 0.09 | 0.00 | 1.43 | 39.03 | 0.2358 | 0.0646 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.08 | 0.00 | 1.43 | -2.46 | 0.2353 | -0.0083 | |||

| EQIX / Equinix, Inc. | 0.00 | 3.49 | 1.42 | 1.00 | 0.2330 | 0.0000 | |||

| PAASF / Pan American Silver Corp. - Equity Right | 0.05 | 0.00 | 1.35 | 10.00 | 0.2228 | 0.0182 | |||

| AEE / Ameren Corporation | 0.01 | 0.00 | 1.34 | -4.35 | 0.2210 | -0.0122 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | -14.05 | 1.24 | -2.06 | 0.2038 | -0.0063 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 2.28 | 1.14 | 20.82 | 0.1884 | 0.0311 | |||

| ORCL / Oracle Corporation | 0.01 | 1.14 | 0.1869 | 0.1869 | |||||

| META / Meta Platforms, Inc. | 0.00 | 3.79 | 1.09 | 32.89 | 0.1797 | 0.0432 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 7.47 | 0.99 | 23.94 | 0.1637 | 0.0304 | |||

| GOOG / Alphabet Inc. | 0.01 | 10.20 | 0.99 | 25.06 | 0.1628 | 0.0315 | |||

| V / Visa Inc. | 0.00 | -6.69 | 0.99 | -5.47 | 0.1623 | -0.0110 | |||

| RBLX / Roblox Corporation | 0.01 | 0.00 | 0.98 | 80.55 | 0.1621 | 0.0714 | |||

| WMT / Walmart Inc. | 0.01 | 3.37 | 0.95 | 15.21 | 0.1560 | 0.0192 | |||

| COST / Costco Wholesale Corporation | 0.00 | 3.53 | 0.90 | 8.32 | 0.1480 | 0.0101 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | -4.82 | 0.85 | 23.30 | 0.1403 | 0.0254 | |||

| APH / Amphenol Corporation | 0.01 | 0.85 | 0.1402 | 0.1402 | |||||

| BSX / Boston Scientific Corporation | 0.01 | -7.13 | 0.81 | -1.11 | 0.1327 | -0.0028 | |||

| HUT / Hut 8 Corp. | 0.04 | 0.00 | 0.80 | 60.16 | 0.1311 | 0.0484 | |||

| MA / Mastercard Incorporated | 0.00 | 9.46 | 0.78 | 12.09 | 0.1284 | 0.0129 | |||

| UEC / Uranium Energy Corp. | 0.11 | 0.00 | 0.77 | 42.19 | 0.1261 | 0.0366 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.76 | 10.89 | 0.1259 | 0.0113 | |||

| GEV / GE Vernova Inc. | 0.00 | -38.16 | 0.76 | 7.30 | 0.1258 | 0.0073 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 40.84 | 0.76 | 94.85 | 0.1245 | 0.0599 | |||

| TJX / The TJX Companies, Inc. | 0.01 | -2.89 | 0.74 | -1.59 | 0.1224 | -0.0031 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.74 | 0.1224 | 0.1224 | |||||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | 0.73 | 0.1207 | 0.1207 | |||||

| DELL / Dell Technologies Inc. | 0.01 | 0.71 | 0.1166 | 0.1166 | |||||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.00 | 0.68 | -10.66 | 0.1119 | -0.0146 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.58 | 3.91 | 0.0962 | 0.0027 | |||

| DNN / Denison Mines Corp. | 0.23 | 0.00 | 0.43 | 40.00 | 0.0704 | 0.0196 | |||

| MAG / MAG Silver Corp. | 0.02 | -58.14 | 0.38 | -42.16 | 0.0626 | -0.0466 | |||

| EQX / Equinox Gold Corp. | 0.05 | 0.38 | 0.0620 | 0.0620 | |||||

| CRCL / Circle Internet Group, Inc. | 0.00 | 0.27 | 0.0448 | 0.0448 | |||||

| AAPL / Apple Inc. | 0.00 | -84.26 | 0.15 | -85.51 | 0.0248 | -0.1474 | |||

| C / Citigroup Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SO / The Southern Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BTE / Baytex Energy Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0378 | ||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NSC / Norfolk Southern Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABBV / AbbVie Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DVN / Devon Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GFR / Greenfire Resources Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HD / The Home Depot, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XYZ / Block, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CIVI / Civitas Resources, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HWM / Howmet Aerospace Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LLY / Eli Lilly and Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VRN / Veren Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |