Basic Stats

| Portfolio Value | $ 298,613 |

| Current Positions | 73 |

Latest Holdings, Performance, AUM (from 13F, 13D)

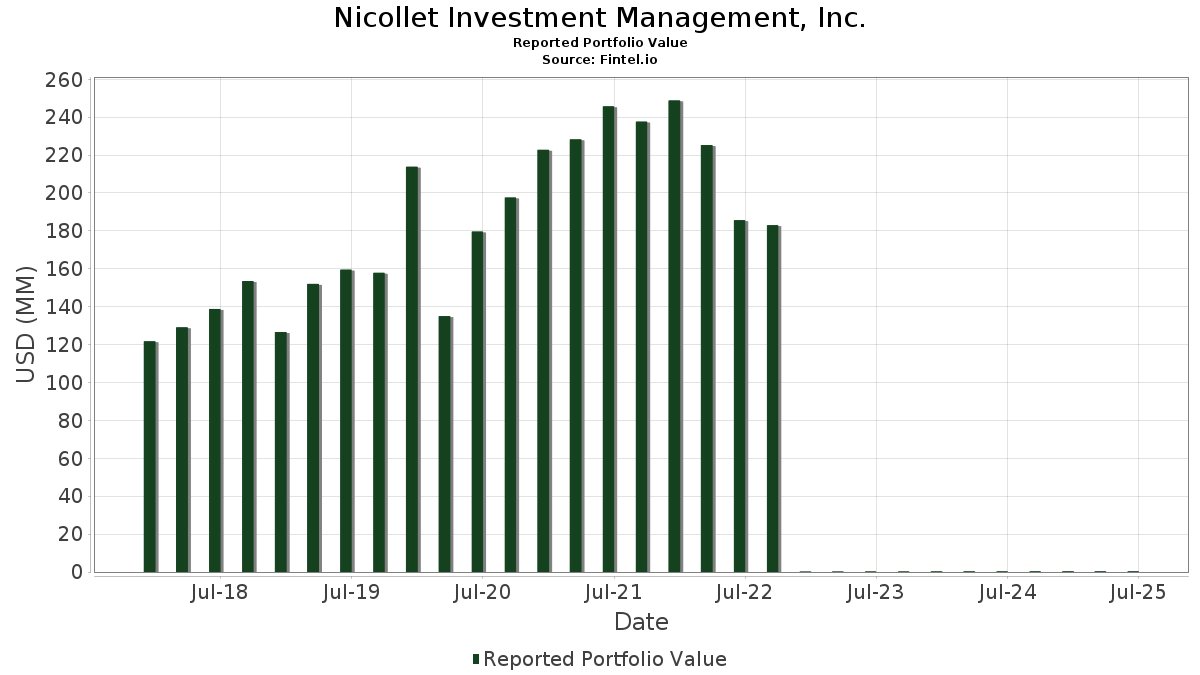

Nicollet Investment Management, Inc. has disclosed 73 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 298,613 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Nicollet Investment Management, Inc.’s top holdings are Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Meta Platforms, Inc. (US:META) , Apple Inc. (US:AAPL) , and Alphabet Inc. (US:GOOG) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 0.03 | 8.6071 | 1.4435 | |

| 0.08 | 0.01 | 4.1160 | 1.0797 | |

| 0.04 | 0.01 | 2.8837 | 0.8752 | |

| 0.02 | 0.02 | 5.8233 | 0.8639 | |

| 0.10 | 0.02 | 7.5583 | 0.2864 | |

| 0.07 | 0.01 | 2.1235 | 0.2827 | |

| 0.00 | 0.00 | 1.4554 | 0.2427 | |

| 0.05 | 0.01 | 3.1794 | 0.2317 | |

| 0.03 | 0.01 | 2.2909 | 0.2308 | |

| 0.01 | 0.00 | 0.1795 | 0.1795 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 0.02 | 5.4666 | -0.9845 | |

| 0.04 | 0.01 | 2.0230 | -0.8523 | |

| 0.01 | 0.00 | 0.8503 | -0.7181 | |

| 0.12 | 0.00 | 1.4082 | -0.5247 | |

| 0.04 | 0.01 | 4.2788 | -0.3421 | |

| 0.01 | 0.00 | 0.7876 | -0.2676 | |

| 0.02 | 0.00 | 1.5334 | -0.1812 | |

| 0.01 | 0.00 | 1.3422 | -0.1802 | |

| 0.02 | 0.00 | 0.9574 | -0.1716 | |

| 0.01 | 0.00 | 1.2936 | -0.1693 |

13F and Fund Filings

This form was filed on 2025-08-07 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.05 | -4.82 | 0.03 | 25.00 | 8.6071 | 1.4435 | |||

| AMZN / Amazon.com, Inc. | 0.10 | -5.38 | 0.02 | 10.00 | 7.5583 | 0.2864 | |||

| META / Meta Platforms, Inc. | 0.02 | -3.75 | 0.02 | 21.43 | 5.8233 | 0.8639 | |||

| AAPL / Apple Inc. | 0.08 | -3.71 | 0.02 | -11.11 | 5.4666 | -0.9845 | |||

| GOOG / Alphabet Inc. | 0.08 | -7.33 | 0.01 | 8.33 | 4.4951 | 0.0110 | |||

| V / Visa Inc. | 0.04 | -4.07 | 0.01 | -7.69 | 4.2788 | -0.3421 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.08 | -2.39 | 0.01 | 50.00 | 4.1160 | 1.0797 | |||

| 1GWW / W.W. Grainger, Inc. | 0.01 | -3.72 | 0.01 | 0.00 | 3.1944 | -0.1125 | |||

| GOOGL / Alphabet Inc. | 0.05 | -0.66 | 0.01 | 12.50 | 3.1794 | 0.2317 | |||

| ORCL / Oracle Corporation | 0.04 | -3.64 | 0.01 | 60.00 | 2.8837 | 0.8752 | |||

| SCHX / Schwab Strategic Trust - Schwab U.S. Large-Cap ETF | 0.31 | -0.83 | 0.01 | 16.67 | 2.5578 | 0.1121 | |||

| PANW / Palo Alto Networks, Inc. | 0.03 | -2.67 | 0.01 | 20.00 | 2.2909 | 0.2308 | |||

| RMD / ResMed Inc. | 0.03 | -5.13 | 0.01 | 0.00 | 2.2876 | 0.0917 | |||

| IWL / iShares Trust - iShares Russell Top 200 ETF | 0.04 | -3.76 | 0.01 | 0.00 | 2.2849 | 0.0486 | |||

| UBER / Uber Technologies, Inc. | 0.07 | -5.45 | 0.01 | 20.00 | 2.1235 | 0.2827 | |||

| MMM / 3M Company | 0.04 | -3.63 | 0.01 | 0.00 | 2.0488 | -0.1038 | |||

| FI / Fiserv, Inc. | 0.04 | -5.40 | 0.01 | -25.00 | 2.0230 | -0.8523 | |||

| ECL / Ecolab Inc. | 0.02 | -5.76 | 0.01 | 0.00 | 1.8673 | -0.0899 | |||

| EQIX / Equinix, Inc. | 0.01 | -1.34 | 0.01 | 0.00 | 1.8650 | -0.1688 | |||

| UNP / Union Pacific Corporation | 0.02 | -3.60 | 0.00 | 0.00 | 1.5334 | -0.1812 | |||

| KO / The Coca-Cola Company | 0.06 | -3.92 | 0.00 | 0.00 | 1.4993 | -0.1588 | |||

| NOW / ServiceNow, Inc. | 0.00 | -2.47 | 0.00 | 33.33 | 1.4554 | 0.2427 | |||

| SLB / Schlumberger Limited | 0.12 | -5.44 | 0.00 | -20.00 | 1.4082 | -0.5247 | |||

| CRM / Salesforce, Inc. | 0.02 | -4.84 | 0.00 | 0.00 | 1.4008 | -0.1194 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -5.64 | 0.00 | 0.00 | 1.3804 | -0.1342 | |||

| ACN / Accenture plc | 0.01 | -3.39 | 0.00 | 0.00 | 1.3422 | -0.1802 | |||

| CB / Chubb Limited | 0.01 | -3.27 | 0.00 | -25.00 | 1.2936 | -0.1693 | |||

| SCHM / Schwab Strategic Trust - Schwab U.S. Mid-Cap ETF | 0.12 | -0.80 | 0.00 | 0.00 | 1.1473 | 0.0134 | |||

| FAST / Fastenal Company | 0.08 | 89.18 | 0.00 | 0.00 | 1.1172 | -0.0273 | |||

| HD / The Home Depot, Inc. | 0.01 | -8.41 | 0.00 | 0.00 | 1.0167 | -0.1478 | |||

| EOG / EOG Resources, Inc. | 0.02 | -4.57 | 0.00 | -33.33 | 0.9574 | -0.1716 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.04 | -5.06 | 0.00 | 0.00 | 0.9209 | -0.1034 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -4.46 | 0.00 | -50.00 | 0.8503 | -0.7181 | |||

| SBUX / Starbucks Corporation | 0.03 | -5.58 | 0.00 | 0.00 | 0.8325 | -0.1584 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -3.85 | 0.00 | -33.33 | 0.7876 | -0.2676 | |||

| SYY / Sysco Corporation | 0.03 | -4.51 | 0.00 | 0.00 | 0.7384 | -0.0658 | |||

| PYPL / PayPal Holdings, Inc. | 0.03 | -3.76 | 0.00 | 100.00 | 0.7250 | 0.0304 | |||

| 1LHX / L3Harris Technologies, Inc. | 0.01 | -2.51 | 0.00 | 0.00 | 0.5974 | 0.0607 | |||

| UTHR / United Therapeutics Corporation | 0.01 | -3.00 | 0.00 | 0.00 | 0.5911 | -0.0951 | |||

| VMI / Valmont Industries, Inc. | 0.01 | -2.76 | 0.00 | 0.00 | 0.5850 | 0.0332 | |||

| AKAM / Akamai Technologies, Inc. | 0.02 | -2.79 | 0.00 | 0.00 | 0.5582 | -0.0502 | |||

| FIS / Fidelity National Information Services, Inc. | 0.02 | -2.67 | 0.00 | 0.00 | 0.5274 | 0.0058 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -4.38 | 0.00 | 0.00 | 0.5063 | 0.0708 | |||

| ALKS / Alkermes plc | 0.05 | -2.02 | 0.00 | 0.00 | 0.4427 | -0.1049 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | -2.64 | 0.00 | 0.00 | 0.4374 | -0.0590 | |||

| FFIV / F5, Inc. | 0.00 | -2.67 | 0.00 | 0.00 | 0.4340 | 0.0104 | |||

| GNRC / Generac Holdings Inc. | 0.01 | -4.33 | 0.00 | 0.00 | 0.3791 | 0.0111 | |||

| RDN / Radian Group Inc. | 0.03 | -1.23 | 0.00 | 0.00 | 0.3734 | 0.0092 | |||

| SCHA / Schwab Strategic Trust - Schwab U.S. Small-Cap ETF | 0.04 | -3.33 | 0.00 | 0.00 | 0.3640 | -0.0023 | |||

| SO / The Southern Company | 0.01 | 0.00 | 0.00 | 0.00 | 0.3523 | -0.0182 | |||

| CTRA / Coterra Energy Inc. | 0.04 | -2.61 | 0.00 | -100.00 | 0.3084 | -0.0698 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.00 | 0.3047 | 0.0155 | ||||

| SMG / The Scotts Miracle-Gro Company | 0.01 | -4.33 | 0.00 | 0.2857 | 0.0248 | ||||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.30 | 0.00 | 0.2793 | 0.0146 | ||||

| IONS / Ionis Pharmaceuticals, Inc. | 0.02 | -3.28 | 0.00 | 0.2746 | 0.0472 | ||||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.02 | -2.63 | 0.00 | 0.2739 | -0.0164 | ||||

| SPSC / SPS Commerce, Inc. | 0.01 | -3.38 | 0.00 | 0.2528 | -0.0150 | ||||

| CAVA / CAVA Group, Inc. | 0.01 | -4.45 | 0.00 | 0.2502 | -0.0317 | ||||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.00 | 0.2361 | 0.0027 | ||||

| SOLV / Solventum Corporation | 0.01 | -5.04 | 0.00 | 0.2264 | -0.0246 | ||||

| LULU / lululemon athletica inc. | 0.00 | -3.52 | 0.00 | 0.2177 | -0.0646 | ||||

| DINO / HF Sinclair Corporation | 0.01 | 0.00 | 0.1795 | 0.1795 | |||||

| SWKS / Skyworks Solutions, Inc. | 0.01 | -3.11 | 0.00 | 0.1788 | 0.0108 | ||||

| AVGO / Broadcom Inc. | 0.00 | -10.53 | 0.00 | 0.1765 | 0.0506 | ||||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.00 | 0.1684 | 0.0015 | ||||

| COST / Costco Wholesale Corporation | 0.00 | -6.68 | 0.00 | 0.1621 | -0.0119 | ||||

| XEL / Xcel Energy Inc. | 0.01 | -14.50 | 0.00 | 0.1614 | -0.0446 | ||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.00 | 0.1216 | -0.0183 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.00 | 0.1155 | 0.0034 | ||||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.0921 | 0.0921 | |||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.00 | 0.0897 | 0.0047 | ||||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | 0.00 | 0.0690 | 0.0690 | |||||

| LLY / Eli Lilly and Company | 0.00 | -65.45 | 0.00 | 0.0690 | -0.1528 |