Basic Stats

| Portfolio Value | $ 45,602,000 |

| Current Positions | 22 |

Latest Holdings, Performance, AUM (from 13F, 13D)

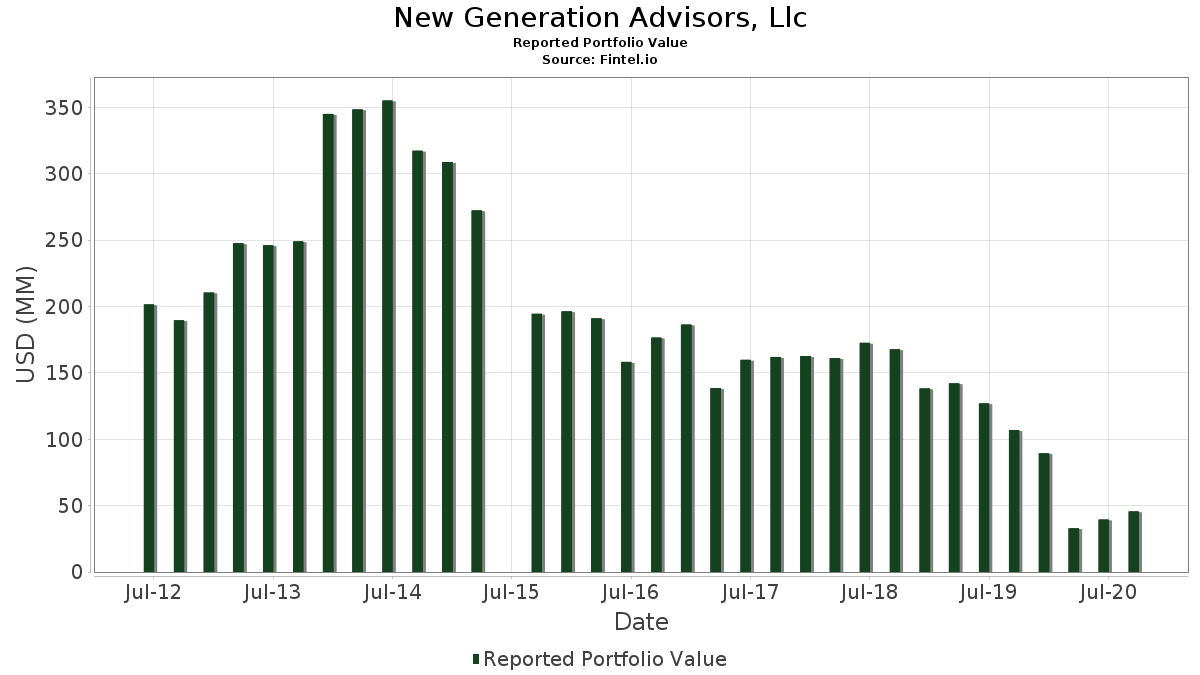

New Generation Advisors, Llc has disclosed 22 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 45,602,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). New Generation Advisors, Llc’s top holdings are Genworth Financial, Inc. (US:GNW) , Core Natural Resources, Inc. (US:CNR) , Civeo Corporation (US:CVEO) , Ambac Financial Group, Inc. (US:AMBC) , and Globalstar, Inc. (US:GSAT) . New Generation Advisors, Llc’s new positions include Select Interior Concepts Inc - Class A (US:SIC) , DLLTD 7 PERP REGS (JM:USG2761YAC78) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.97 | 2.64 | 5.7936 | 5.7936 | |

| 0.17 | 2.02 | 4.4406 | 4.4406 | |

| 0.27 | 1.86 | 4.0832 | 4.0832 | |

| 2.67 | 8.95 | 19.6176 | 3.9899 | |

| 0.61 | 4.83 | 10.6004 | 1.7619 | |

| 0.28 | 2.66 | 5.8375 | 1.2573 | |

| 4.56 | 3.08 | 6.7563 | 0.9425 | |

| 0.19 | 1.03 | 2.2653 | 0.3400 | |

| 0.11 | 2.31 | 5.0656 | 0.3157 | |

| 0.87 | 1.43 | 3.1314 | 0.3043 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.34 | 1.86 | 4.0832 | -5,165,290.4070 | |

| 0.08 | 2.20 | 4.8243 | -1.8888 | |

| 0.23 | 2.90 | 6.3506 | -1.8749 | |

| 9.13 | 2.80 | 6.1401 | -1.7206 | |

| 0.00 | 0.00 | -0.8233 | ||

| 0.37 | 0.32 | 0.6930 | -0.5255 | |

| 0.14 | 1.13 | 2.4802 | -0.4660 | |

| 0.12 | 1.20 | 2.6205 | -0.3079 | |

| 1.16 | 0.59 | 1.2982 | -0.2699 | |

| 0.00 | 0.00 | -0.2280 |

13F and Fund Filings

This form was filed on 2020-11-16 for the reporting period 2020-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GNW / Genworth Financial, Inc. | 2.67 | 0.00 | 8.95 | 45.02 | 19.6176 | 3.9899 | |||

| CNR / Core Natural Resources, Inc. | 0.61 | 5.21 | 4.83 | 38.55 | 10.6004 | 1.7619 | |||

| CVEO / Civeo Corporation | 4.56 | 22.58 | 3.08 | 34.25 | 6.7563 | 0.9425 | |||

| AMBC / Ambac Financial Group, Inc. | 0.23 | 0.00 | 2.90 | -10.81 | 6.3506 | -1.8749 | |||

| GSAT / Globalstar, Inc. | 9.13 | -3.93 | 2.80 | -9.76 | 6.1401 | -1.7206 | |||

| PCG / PG&E Corporation | 0.28 | 39.04 | 2.66 | 47.23 | 5.8375 | 1.2573 | |||

| NCMI / National CineMedia, Inc. | 0.97 | 0.00 | 2.64 | -8.61 | 5.7936 | 5.7936 | |||

| BXC / BlueLinx Holdings Inc. | 0.11 | -50.96 | 2.31 | 23.20 | 5.0656 | 0.3157 | |||

| EPR / EPR Properties | 0.08 | 0.00 | 2.20 | -16.98 | 4.8243 | -1.8888 | |||

| IMAX / IMAX Corporation | 0.17 | 0.00 | 2.02 | 6.69 | 4.4406 | 4.4406 | |||

| SIC / Select Interior Concepts Inc - Class A | 0.27 | 1.86 | 4.0832 | 4.0832 | |||||

| AMBCW / AMBAC Financial Group Inc. - Warrants (30/04/2023) | Call | 0.34 | 0.00 | 1.86 | -8.68 | 4.0832 | -5,165,290.4070 | ||

| SD / SandRidge Energy, Inc. | 0.87 | 0.00 | 1.43 | 27.96 | 3.1314 | 0.3043 | |||

| PVAC / Penn Virginia Corp. | 0.12 | 0.00 | 1.20 | 3.37 | 2.6205 | -0.3079 | |||

| IHRT / iHeartMedia, Inc. | 0.14 | 0.00 | 1.13 | -2.75 | 2.4802 | -0.4660 | |||

| BCEI / Bonanza Creek Energy Inc New | 0.06 | 0.00 | 1.04 | 26.96 | 2.2718 | 0.2047 | |||

| CMLS / Cumulus Media Inc. | 0.19 | 0.00 | 1.03 | 35.92 | 2.2653 | 0.3400 | |||

| TTI / TETRA Technologies, Inc. | 1.16 | 0.00 | 0.59 | -4.36 | 1.2982 | -0.2699 | |||

| SBOW / SilverBow Resources, Inc. | 0.15 | 0.00 | 0.58 | 22.43 | 1.2806 | 0.0723 | |||

| AMPY / Amplify Energy Corp. | 0.37 | -5.36 | 0.32 | -34.30 | 0.6930 | -0.5255 | |||

| USG2761YAC78 / DLLTD 7 PERP REGS | 1.02 | 0.13 | 0.2851 | 0.2851 | |||||

| VST / Vistra Corp. | Call | 0.07 | 0.00 | 0.04 | -5.13 | 0.0811 | 0.0811 | ||

| I / Intelsat SA | 0.00 | -100.00 | 0.00 | -100.00 | -0.8233 | ||||

| HALC / Halcon Resources Corporation NEW | 0.00 | -100.00 | 0.00 | -100.00 | -0.2280 |