Basic Stats

| Insider Profile | Murphy Michael R |

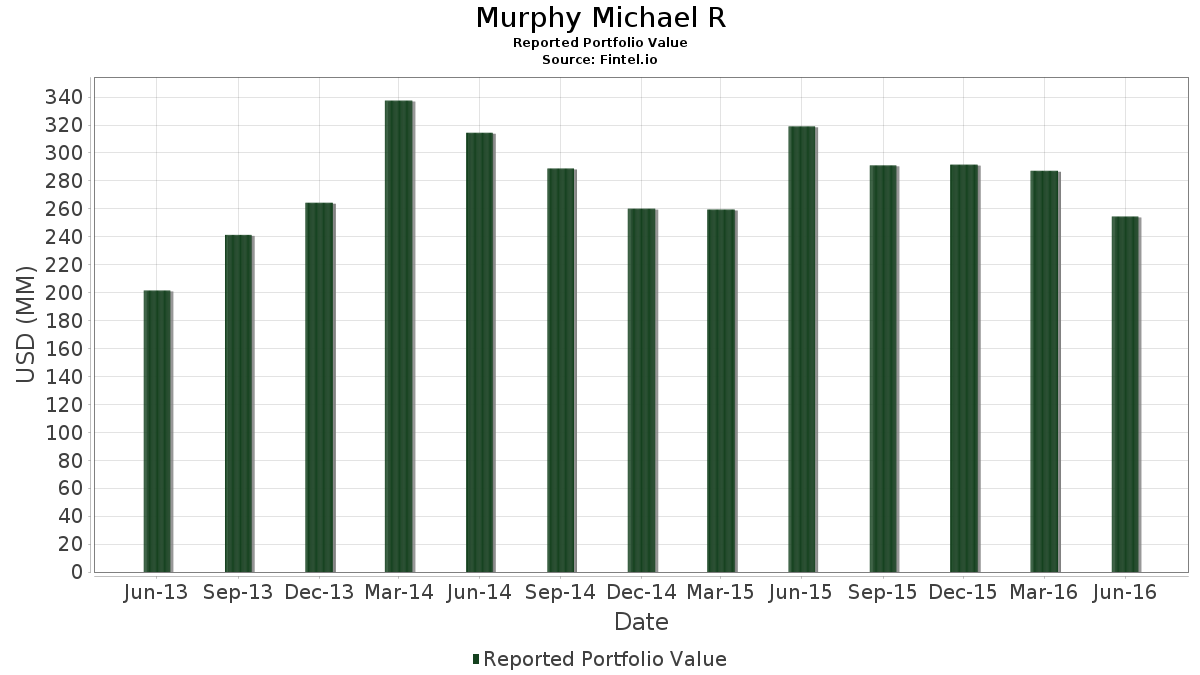

| Portfolio Value | $ 254,522,000 |

| Current Positions | 18 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Murphy Michael R has disclosed 18 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 254,522,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Murphy Michael R’s top holdings are TubeMogul, Inc. (US:TUBE) , Foundation Medicine, Inc. (US:FMI) , Aerohive Networks, Inc. (US:007786106) , Interactive Intelligence Group, Inc. (US:ININ) , and Agilysys, Inc. (US:AGYS) . Murphy Michael R’s new positions include IXYS Corp. (US:IXYS) , K2M Group Holdings, Inc. (US:KTWO) , LivePerson, Inc. (US:LPSN) , Imperva, Inc. (US:IMPV) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.97 | 12.43 | 4.8829 | 4.8373 | |

| 4.35 | 28.83 | 11.3255 | 4.5950 | |

| 2.58 | 19.88 | 7.8111 | 2.9549 | |

| 1.73 | 20.86 | 8.1961 | 2.6203 | |

| 0.51 | 5.19 | 2.0395 | 2.0395 | |

| 0.32 | 5.01 | 1.9680 | 1.9680 | |

| 1.84 | 12.86 | 5.0534 | 1.6979 | |

| 1.57 | 29.38 | 11.5448 | 1.6819 | |

| 2.48 | 29.49 | 11.5864 | 1.6793 | |

| 0.63 | 11.46 | 4.5037 | 1.4507 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -8.6828 | ||

| 0.00 | 0.00 | -3.6243 | ||

| 0.00 | 0.00 | -2.8751 | ||

| 0.00 | 0.00 | -2.6133 | ||

| 0.00 | 0.00 | -2.6081 | ||

| 0.00 | 0.00 | -2.3313 | ||

| 0.00 | 0.00 | -2.2130 | ||

| 0.23 | 1.81 | 0.7127 | -2.1993 | |

| 0.63 | 5.10 | 2.0041 | -1.7809 | |

| 1.28 | 3.62 | 1.4215 | -0.3306 |

13F and Fund Filings

This form was filed on 2016-08-12 for the reporting period 2016-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TUBE / TubeMogul, Inc. | 2.48 | 12.68 | 29.49 | 3.62 | 11.5864 | 1.6793 | |||

| FMI / Foundation Medicine, Inc. | 1.57 | 1.05 | 29.38 | 3.71 | 11.5448 | 1.6819 | |||

| 007786106 / Aerohive Networks, Inc. | 4.35 | 12.38 | 28.83 | 49.09 | 11.3255 | 4.5950 | |||

| ININ / Interactive Intelligence Group, Inc. | 0.67 | -10.50 | 27.41 | 0.73 | 10.7700 | 1.2963 | |||

| AGYS / Agilysys, Inc. | 2.26 | 0.00 | 23.70 | 2.54 | 9.3116 | 1.2659 | |||

| NTRA / Natera, Inc. | 1.73 | 2.77 | 20.86 | 30.24 | 8.1961 | 2.6203 | |||

| AMBR / Amber International Holding Limited - Depositary Receipt (Common Stock) | 2.58 | 0.00 | 19.88 | 42.52 | 7.8111 | 2.9549 | |||

| ONTO / Onto Innovation Inc. | 0.68 | -29.41 | 14.14 | -7.36 | 5.5563 | 0.2423 | |||

| US04351G1013 / Ascena Retail Group, Inc. | 1.84 | 111.14 | 12.86 | 33.44 | 5.0534 | 1.6979 | |||

| XTLY / Xactly Corp. | 0.97 | 4,959.30 | 12.43 | 9,387.02 | 4.8829 | 4.8373 | |||

| ENTL / Entellus Medical, Inc. | 0.63 | 30.14 | 11.46 | 30.71 | 4.5037 | 1.4507 | |||

| IXYS / IXYS Corp. | 0.51 | 5.19 | 2.0395 | 2.0395 | |||||

| CTRL / Control4 Corp | 0.63 | -54.24 | 5.10 | -53.09 | 2.0041 | -1.7809 | |||

| KTWO / K2M Group Holdings, Inc. | 0.32 | 5.01 | 1.9680 | 1.9680 | |||||

| EGAN / eGain Corporation | 1.28 | -9.50 | 3.62 | -28.11 | 1.4215 | -0.3306 | |||

| EXAR / Exar Corp. | 0.23 | -84.51 | 1.81 | -78.31 | 0.7127 | -2.1993 | |||

| LPSN / LivePerson, Inc. | 0.28 | 1.80 | 0.7092 | 0.7092 | |||||

| IMPV / Imperva, Inc. | 0.04 | 1.53 | 0.6031 | 0.6031 | |||||

| PMC / PIMCO Municipal Credit Income Fund | 0.00 | -100.00 | 0.00 | -100.00 | -0.0769 | ||||

| SUPN / Supernus Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.8751 | ||||

| SQI / SciQuest, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -8.6828 | ||||

| OPWR / Opower, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.2130 | ||||

| TTGT / TechTarget, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.6243 | ||||

| BV / BrightView Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.6133 | ||||

| INAP / Internap Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.3313 | ||||

| / Achaogen Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.3060 | ||||

| MKTO / Marketo, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.6081 |