Basic Stats

| Portfolio Value | $ 1,378,481,121 |

| Current Positions | 139 |

Latest Holdings, Performance, AUM (from 13F, 13D)

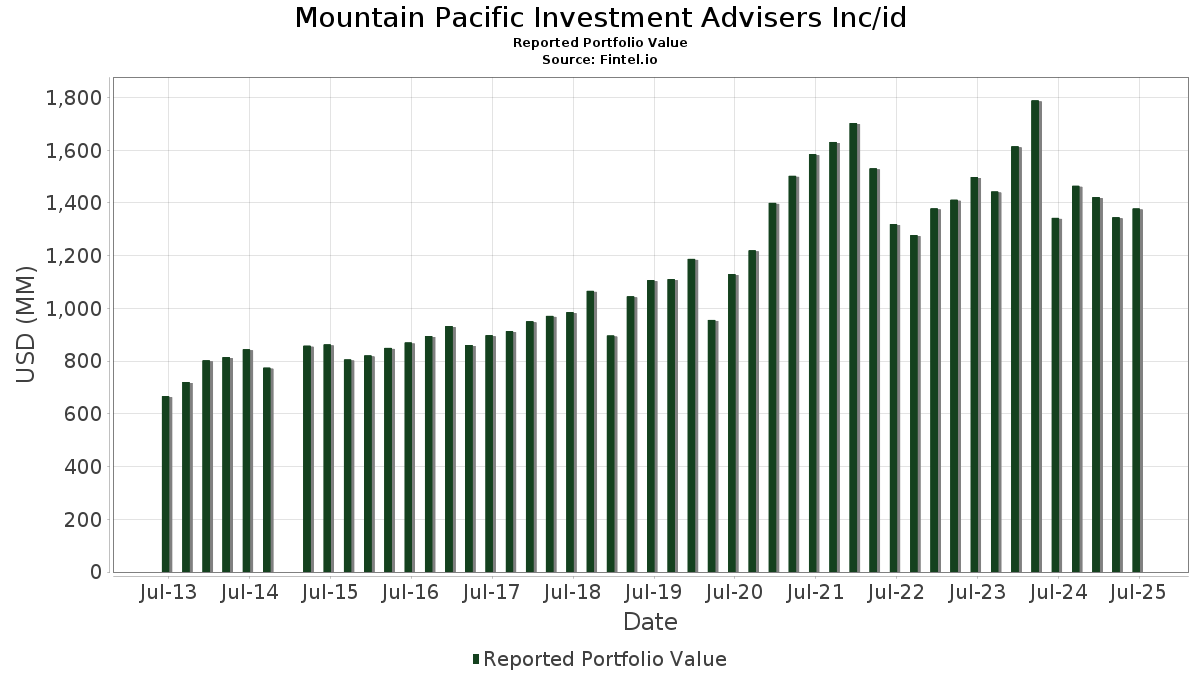

Mountain Pacific Investment Advisers Inc/id has disclosed 139 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,378,481,121 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Mountain Pacific Investment Advisers Inc/id’s top holdings are Amphenol Corporation (US:APH) , Fiserv, Inc. (US:FI) , AMETEK, Inc. (US:AME) , Arthur J. Gallagher & Co. (US:AJG) , and Vertiv Holdings Co (US:VRT) . Mountain Pacific Investment Advisers Inc/id’s new positions include Stride, Inc. (US:LRN) , Ralliant Corporation (US:RAL) , Glacier Bancorp, Inc. (US:GBCI) , GE Vernova Inc. (US:GEV) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.96 | 94.88 | 6.8832 | 1.6054 | |

| 0.40 | 51.07 | 3.7045 | 1.5313 | |

| 0.08 | 41.27 | 2.9936 | 1.1394 | |

| 0.23 | 14.53 | 1.0542 | 0.5310 | |

| 0.04 | 5.41 | 0.3924 | 0.3924 | |

| 0.09 | 34.50 | 2.5027 | 0.3568 | |

| 0.10 | 24.15 | 1.7519 | 0.3337 | |

| 0.03 | 10.76 | 0.7803 | 0.3266 | |

| 0.21 | 15.36 | 1.1144 | 0.3031 | |

| 0.07 | 3.46 | 0.2506 | 0.2506 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.43 | 73.35 | 5.3207 | -1.8617 | |

| 0.18 | 56.33 | 4.0867 | -0.5658 | |

| 0.21 | 11.14 | 0.8084 | -0.4931 | |

| 0.29 | 27.44 | 1.9906 | -0.4053 | |

| 0.04 | 16.29 | 1.1815 | -0.3694 | |

| 0.18 | 25.03 | 1.8154 | -0.2723 | |

| 0.09 | 48.88 | 3.5459 | -0.2693 | |

| 0.20 | 40.29 | 2.9226 | -0.2522 | |

| 0.01 | 1.99 | 0.1442 | -0.2456 | |

| 0.24 | 42.37 | 3.0739 | -0.1837 |

13F and Fund Filings

This form was filed on 2025-07-18 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| APH / Amphenol Corporation | 0.96 | -11.23 | 94.88 | 33.65 | 6.8832 | 1.6054 | |||

| FI / Fiserv, Inc. | 0.43 | -2.76 | 73.35 | -24.08 | 5.3207 | -1.8617 | |||

| AME / AMETEK, Inc. | 0.36 | -2.26 | 64.37 | 2.75 | 4.6696 | 0.0124 | |||

| AJG / Arthur J. Gallagher & Co. | 0.18 | -2.92 | 56.33 | -9.99 | 4.0867 | -0.5658 | |||

| VRT / Vertiv Holdings Co | 0.40 | -1.78 | 51.07 | 74.69 | 3.7045 | 1.5313 | |||

| VRSK / Verisk Analytics, Inc. | 0.16 | -2.02 | 49.51 | 2.55 | 3.5915 | 0.0025 | |||

| ROP / Roper Technologies, Inc. | 0.09 | -0.94 | 48.88 | -4.75 | 3.5459 | -0.2693 | |||

| ATR / AptarGroup, Inc. | 0.30 | -1.37 | 47.41 | 3.98 | 3.4389 | 0.0498 | |||

| IEX / IDEX Corporation | 0.24 | -0.33 | 42.37 | -3.30 | 3.0739 | -0.1837 | |||

| FIX / Comfort Systems USA, Inc. | 0.08 | -0.54 | 41.27 | 65.45 | 2.9936 | 1.1394 | |||

| DHR / Danaher Corporation | 0.20 | -2.10 | 40.29 | -5.66 | 2.9226 | -0.2522 | |||

| XYL / Xylem Inc. | 0.31 | -0.71 | 40.22 | 7.51 | 2.9177 | 0.1366 | |||

| GGG / Graco Inc. | 0.44 | -0.82 | 37.49 | 2.10 | 2.7194 | -0.0100 | |||

| RBC / RBC Bearings Incorporated | 0.09 | -0.06 | 34.50 | 19.51 | 2.5027 | 0.3568 | |||

| FAST / Fastenal Company | 0.77 | 96.93 | 32.17 | 6.65 | 2.3336 | 0.0914 | |||

| AIZ / Assurant, Inc. | 0.15 | 0.86 | 29.93 | -5.04 | 2.1713 | -0.1719 | |||

| DCI / Donaldson Company, Inc. | 0.43 | -5.32 | 29.63 | -2.09 | 2.1492 | -0.1002 | |||

| NDSN / Nordson Corporation | 0.14 | -0.75 | 29.31 | 5.47 | 2.1263 | 0.0604 | |||

| FIS / Fidelity National Information Services, Inc. | 0.35 | -2.31 | 28.47 | 6.49 | 2.0657 | 0.0779 | |||

| CHD / Church & Dwight Co., Inc. | 0.29 | -2.47 | 27.44 | -14.86 | 1.9906 | -0.4053 | |||

| RPM / RPM International Inc. | 0.24 | -0.43 | 26.27 | -5.46 | 1.9060 | -0.1599 | |||

| CSW / CSW Industrials, Inc. | 0.09 | 0.00 | 25.91 | -1.61 | 1.8797 | -0.0781 | |||

| LSTR / Landstar System, Inc. | 0.18 | -3.72 | 25.03 | -10.89 | 1.8154 | -0.2723 | |||

| CLH / Clean Harbors, Inc. | 0.11 | 0.03 | 24.74 | 17.32 | 1.7946 | 0.2270 | |||

| UFPT / UFP Technologies, Inc. | 0.10 | 4.58 | 24.15 | 26.59 | 1.7519 | 0.3337 | |||

| MSA / MSA Safety Incorporated | 0.14 | -0.56 | 23.01 | 13.57 | 1.6689 | 0.1629 | |||

| KAI / Kadant Inc. | 0.06 | -0.23 | 17.88 | -5.99 | 1.2972 | -0.1169 | |||

| FCN / FTI Consulting, Inc. | 0.11 | -0.15 | 17.16 | -1.72 | 1.2449 | -0.0532 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.04 | -4.19 | 16.29 | -21.93 | 1.1815 | -0.3694 | |||

| NVT / nVent Electric plc | 0.21 | 0.73 | 15.36 | 40.76 | 1.1144 | 0.3031 | |||

| PRGS / Progress Software Corporation | 0.23 | 66.61 | 14.53 | 106.49 | 1.0542 | 0.5310 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.06 | 0.70 | 14.21 | 3.88 | 1.0309 | 0.0139 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.17 | -1.57 | 13.70 | -1.04 | 0.9938 | -0.0354 | |||

| WINA / Winmark Corporation | 0.03 | 9.56 | 12.76 | 30.16 | 0.9258 | 0.1968 | |||

| FTV / Fortive Corporation | 0.21 | -10.64 | 11.14 | -36.35 | 0.8084 | -0.4931 | |||

| MUSA / Murphy USA Inc. | 0.03 | 103.53 | 10.76 | 76.24 | 0.7803 | 0.3266 | |||

| COST / Costco Wholesale Corporation | 0.01 | -0.10 | 9.97 | 4.57 | 0.7234 | 0.0144 | |||

| ECL / Ecolab Inc. | 0.03 | -5.85 | 9.11 | 0.07 | 0.6610 | -0.0159 | |||

| MMSI / Merit Medical Systems, Inc. | 0.09 | 34.10 | 8.78 | 18.59 | 0.6372 | 0.0866 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.10 | -5.06 | 7.56 | -4.38 | 0.5482 | -0.0394 | |||

| SPGI / S&P Global Inc. | 0.01 | -10.41 | 7.55 | -7.02 | 0.5475 | -0.0560 | |||

| CNMD / CONMED Corporation | 0.14 | 3.68 | 7.28 | -10.59 | 0.5282 | -0.0772 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -3.53 | 6.39 | 14.02 | 0.4639 | 0.0469 | |||

| MSFT / Microsoft Corporation | 0.01 | -0.30 | 6.12 | 32.12 | 0.4438 | 0.0995 | |||

| VLTO / Veralto Corporation | 0.06 | -3.01 | 5.59 | 0.47 | 0.4055 | -0.0081 | |||

| LRN / Stride, Inc. | 0.04 | 5.41 | 0.3924 | 0.3924 | |||||

| MOD / Modine Manufacturing Company | 0.05 | -0.03 | 5.26 | 28.30 | 0.3812 | 0.0767 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 0.54 | 4.04 | -8.86 | 0.2932 | -0.0365 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -3.36 | 3.99 | -2.47 | 0.2893 | -0.0146 | |||

| PNR / Pentair plc | 0.04 | -0.85 | 3.89 | 16.35 | 0.2824 | 0.0337 | |||

| AAPL / Apple Inc. | 0.02 | -18.84 | 3.77 | -25.04 | 0.2732 | -0.1003 | |||

| RAL / Ralliant Corporation | 0.07 | 3.46 | 0.2506 | 0.2506 | |||||

| ABT / Abbott Laboratories | 0.03 | -5.58 | 3.45 | -3.17 | 0.2505 | -0.0147 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.05 | -1.07 | 3.40 | -0.85 | 0.2468 | -0.0082 | |||

| WAT / Waters Corporation | 0.01 | -12.67 | 3.10 | -17.30 | 0.2251 | -0.0538 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.05 | 3.68 | 3.09 | 3.84 | 0.2239 | 0.0029 | |||

| ABBV / AbbVie Inc. | 0.02 | -6.86 | 3.03 | -17.50 | 0.2196 | -0.0531 | |||

| USB / U.S. Bancorp | 0.06 | -21.51 | 2.70 | -15.88 | 0.1960 | -0.0428 | |||

| VUSB / Vanguard Bond Index Funds - Vanguard Ultra-Short Bond ETF | 0.05 | -0.96 | 2.69 | -0.92 | 0.1953 | -0.0067 | |||

| JNJ / Johnson & Johnson | 0.02 | -2.56 | 2.48 | -10.23 | 0.1795 | -0.0255 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -2.45 | 2.36 | -2.76 | 0.1715 | -0.0092 | |||

| SNA / Snap-on Incorporated | 0.01 | 0.00 | 2.23 | -7.65 | 0.1620 | -0.0178 | |||

| PG / The Procter & Gamble Company | 0.01 | -5.28 | 2.18 | -11.46 | 0.1581 | -0.0249 | |||

| WMT / Walmart Inc. | 0.02 | 0.07 | 2.12 | 11.46 | 0.1539 | 0.0124 | |||

| GNRC / Generac Holdings Inc. | 0.01 | -1.12 | 2.08 | 11.82 | 0.1510 | 0.0126 | |||

| RRX / Regal Rexnord Corporation | 0.01 | -70.23 | 1.99 | -62.09 | 0.1442 | -0.2456 | |||

| CBSH / Commerce Bancshares, Inc. | 0.03 | -8.48 | 1.88 | -8.58 | 0.1361 | -0.0164 | |||

| AMGN / Amgen Inc. | 0.01 | -0.93 | 1.78 | -11.23 | 0.1291 | -0.0199 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.01 | -1.88 | 1.71 | 2.95 | 0.1240 | 0.0006 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.01 | -4.72 | 1.69 | 9.97 | 0.1224 | 0.0084 | |||

| MU / Micron Technology, Inc. | 0.01 | -17.08 | 1.56 | 17.62 | 0.1129 | 0.0145 | |||

| ZBRA / Zebra Technologies Corporation | 0.01 | -6.42 | 1.55 | 2.12 | 0.1121 | -0.0004 | |||

| VNT / Vontier Corporation | 0.04 | 3.30 | 1.49 | 16.07 | 0.1080 | 0.0126 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.46 | -8.71 | 0.1057 | -0.0130 | |||

| TFX / Teleflex Incorporated | 0.01 | -25.31 | 1.35 | -36.07 | 0.0983 | -0.0592 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 1.31 | 10.54 | 0.0951 | 0.0069 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 1.23 | 31.30 | 0.0889 | 0.0195 | |||

| RTX / RTX Corporation | 0.01 | -11.97 | 1.20 | -2.91 | 0.0870 | -0.0049 | |||

| ROST / Ross Stores, Inc. | 0.01 | 0.00 | 1.17 | -0.17 | 0.0851 | -0.0023 | |||

| WFC / Wells Fargo & Company | 0.01 | -18.69 | 1.15 | -9.25 | 0.0833 | -0.0108 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 1.08 | 18.51 | 0.0785 | 0.0106 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.01 | -13.12 | 1.06 | -12.21 | 0.0772 | -0.0130 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 1.05 | 0.00 | 0.0763 | -0.0019 | |||

| COF / Capital One Financial Corporation | 0.00 | 4.56 | 0.99 | 24.09 | 0.0718 | 0.0125 | |||

| V / Visa Inc. | 0.00 | -28.02 | 0.87 | -27.10 | 0.0629 | -0.0255 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.84 | 10.58 | 0.0607 | 0.0044 | |||

| CAT / Caterpillar Inc. | 0.00 | 2.38 | 0.84 | 20.49 | 0.0606 | 0.0091 | |||

| AWK / American Water Works Company, Inc. | 0.01 | -3.28 | 0.82 | -8.79 | 0.0595 | -0.0074 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -11.95 | 0.81 | -19.66 | 0.0584 | -0.0161 | |||

| FITB / Fifth Third Bancorp | 0.02 | 0.00 | 0.75 | 4.91 | 0.0543 | 0.0013 | |||

| MTB / M&T Bank Corporation | 0.00 | -33.21 | 0.73 | -27.54 | 0.0533 | -0.0221 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 0.00 | 0.73 | 26.33 | 0.0533 | 0.0100 | |||

| ACIW / ACI Worldwide, Inc. | 0.02 | 0.00 | 0.72 | -16.00 | 0.0522 | -0.0115 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.70 | -6.52 | 0.0510 | -0.0049 | |||

| SIGI / Selective Insurance Group, Inc. | 0.01 | -10.51 | 0.70 | -15.31 | 0.0506 | -0.0106 | |||

| PEP / PepsiCo, Inc. | 0.01 | -5.54 | 0.68 | -16.87 | 0.0490 | -0.0114 | |||

| LLY / Eli Lilly and Company | 0.00 | 137.75 | 0.66 | 124.23 | 0.0477 | 0.0259 | |||

| RY / Royal Bank of Canada | 0.00 | -16.60 | 0.62 | -2.65 | 0.0453 | -0.0024 | |||

| HON / Honeywell International Inc. | 0.00 | -1.90 | 0.60 | 7.73 | 0.0435 | 0.0022 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -8.44 | 0.59 | 1.21 | 0.0424 | -0.0005 | |||

| GBCI / Glacier Bancorp, Inc. | 0.01 | 0.56 | 0.0408 | 0.0408 | |||||

| KO / The Coca-Cola Company | 0.01 | 0.00 | 0.56 | -1.07 | 0.0404 | -0.0015 | |||

| CNI / Canadian National Railway Company | 0.01 | 0.00 | 0.55 | 6.85 | 0.0396 | 0.0016 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.54 | 43.43 | 0.0389 | 0.0111 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.01 | -21.43 | 0.53 | -26.40 | 0.0383 | -0.0150 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.01 | 0.00 | 0.53 | 9.56 | 0.0383 | 0.0024 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.52 | 18.55 | 0.0381 | 0.0052 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 0.52 | 22.48 | 0.0380 | 0.0062 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -23.49 | 0.52 | -42.51 | 0.0379 | -0.0296 | |||

| CARR / Carrier Global Corporation | 0.01 | 0.00 | 0.52 | 15.27 | 0.0379 | 0.0043 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | 0.00 | 0.52 | 6.12 | 0.0378 | 0.0013 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 0.00 | 0.51 | 6.04 | 0.0370 | 0.0012 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 2.75 | 0.50 | 3.95 | 0.0363 | 0.0005 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.00 | 0.49 | 46.11 | 0.0354 | 0.0105 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.48 | 17.65 | 0.0349 | 0.0045 | |||

| UNP / Union Pacific Corporation | 0.00 | -22.46 | 0.48 | -24.44 | 0.0346 | -0.0123 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.44 | 21.61 | 0.0319 | 0.0050 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.00 | 0.41 | -5.52 | 0.0298 | -0.0026 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -4.19 | 0.38 | 10.59 | 0.0273 | 0.0020 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.37 | 12.39 | 0.0270 | 0.0024 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.35 | 2.61 | 0.0257 | 0.0000 | |||

| GE / General Electric Company | 0.00 | 17.82 | 0.35 | 51.98 | 0.0251 | 0.0081 | |||

| GOOGL / Alphabet Inc. | 0.00 | -40.62 | 0.33 | -32.39 | 0.0243 | -0.0125 | |||

| HSIC / Henry Schein, Inc. | 0.00 | 0.00 | 0.33 | 6.49 | 0.0238 | 0.0009 | |||

| CVX / Chevron Corporation | 0.00 | -11.61 | 0.33 | -24.25 | 0.0238 | -0.0084 | |||

| RSG / Republic Services, Inc. | 0.00 | 0.00 | 0.32 | 1.89 | 0.0234 | -0.0001 | |||

| WRB / W. R. Berkley Corporation | 0.00 | 0.00 | 0.31 | 3.31 | 0.0227 | 0.0002 | |||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.29 | 6.55 | 0.0213 | 0.0008 | |||

| MIDD / The Middleby Corporation | 0.00 | -37.44 | 0.29 | -40.86 | 0.0209 | -0.0153 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.29 | -11.66 | 0.0209 | -0.0034 | |||

| PRU / Prudential Financial, Inc. | 0.00 | 17.86 | 0.28 | 13.20 | 0.0206 | 0.0020 | |||

| BAC / Bank of America Corporation | 0.01 | -40.03 | 0.28 | -32.02 | 0.0201 | -0.0102 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.26 | -14.71 | 0.0190 | -0.0038 | |||

| OTIS / Otis Worldwide Corporation | 0.00 | -8.74 | 0.24 | -12.27 | 0.0176 | -0.0030 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 0.00 | 0.23 | 5.43 | 0.0169 | 0.0004 | |||

| TFC / Truist Financial Corporation | 0.01 | 0.00 | 0.23 | 4.55 | 0.0167 | 0.0003 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.22 | 0.0160 | 0.0160 | |||||

| VZ / Verizon Communications Inc. | 0.01 | -6.85 | 0.22 | -11.02 | 0.0158 | -0.0024 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.20 | 0.0148 | 0.0148 | |||||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FNF / Fidelity National Financial, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CRL / Charles River Laboratories International, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CSX / CSX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ZD / Ziff Davis, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |