Basic Stats

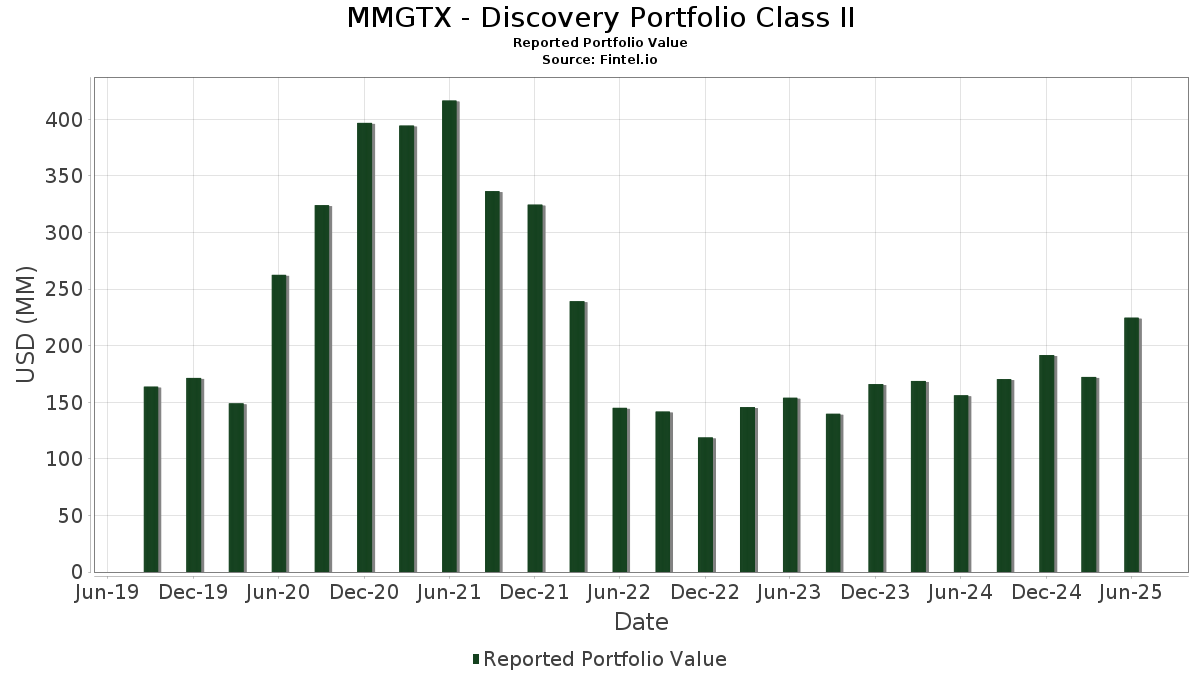

| Portfolio Value | $ 224,735,066 |

| Current Positions | 45 |

Latest Holdings, Performance, AUM (from 13F, 13D)

MMGTX - Discovery Portfolio Class II has disclosed 45 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 224,735,066 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MMGTX - Discovery Portfolio Class II’s top holdings are Cloudflare, Inc. (US:NET) , QXO, Inc. (US:QXO) , Affirm Holdings, Inc. (US:AFRM) , Strategy Inc (US:MSTR) , and Roblox Corporation (US:RBLX) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.26 | 11.37 | 5.0670 | 4.8090 | |

| 0.15 | 11.06 | 4.9297 | 3.9113 | |

| 0.15 | 29.13 | 12.9863 | 3.4330 | |

| 0.67 | 14.48 | 6.4560 | 2.3208 | |

| 0.11 | 8.13 | 3.6255 | 1.9736 | |

| 0.21 | 14.34 | 6.3931 | 1.5822 | |

| 0.04 | 2.98 | 1.3301 | 1.3301 | |

| 0.46 | 4.43 | 1.9767 | 1.0155 | |

| 0.13 | 13.24 | 5.9016 | 0.9307 | |

| 0.19 | 7.60 | 3.3894 | 0.5919 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 2.17 | 0.9656 | -2.6800 | |

| 1.53 | 8.00 | 3.5685 | -2.0976 | |

| 0.03 | 1.24 | 0.5547 | -1.7407 | |

| 1.27 | 2.92 | 1.3018 | -1.4498 | |

| 0.24 | 8.13 | 3.6234 | -1.0543 | |

| 0.01 | 1.13 | 0.5025 | -0.9798 | |

| 0.31 | 2.17 | 0.9670 | -0.4635 | |

| 0.26 | 2.94 | 1.3124 | -0.2688 | |

| 0.30 | 10.75 | 4.7923 | -0.2454 | |

| 0.08 | 5.44 | 2.4246 | -0.2047 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NET / Cloudflare, Inc. | 0.15 | 0.00 | 29.13 | 73.79 | 12.9863 | 3.4330 | |||

| QXO / QXO, Inc. | 0.67 | 25.46 | 14.48 | 99.60 | 6.4560 | 2.3208 | |||

| AFRM / Affirm Holdings, Inc. | 0.21 | 11.04 | 14.34 | 69.89 | 6.3931 | 1.5822 | |||

| MSTR / Strategy Inc | 0.03 | 0.00 | 13.93 | 40.22 | 6.2121 | 0.5488 | |||

| RBLX / Roblox Corporation | 0.13 | -15.90 | 13.24 | 51.78 | 5.9016 | 0.9307 | |||

| CNM / Core & Main, Inc. | 0.19 | -0.30 | 11.48 | 24.54 | 5.1191 | -0.1354 | |||

| DMYI.U / dMY Technology Group, Inc. III Units, each consisting of one share of Class A common stock and one-f | 0.26 | 1,189.73 | 11.37 | 2,414.60 | 5.0670 | 4.8090 | |||

| TTD / The Trade Desk, Inc. | 0.15 | 370.38 | 11.06 | 519.15 | 4.9297 | 3.9113 | |||

| RPRX / Royalty Pharma plc | 0.30 | 5.07 | 10.75 | 21.61 | 4.7923 | -0.2454 | |||

| SNOW / Snowflake Inc. | 0.04 | -13.89 | 8.20 | 31.83 | 3.6564 | 0.1107 | |||

| IL0011974909 / Oddity Tech Ltd | 0.11 | 60.83 | 8.13 | 180.61 | 3.6255 | 1.9736 | |||

| GLBE / Global-E Online Ltd. | 0.24 | 5.26 | 8.13 | -0.97 | 3.6234 | -1.0543 | |||

| AUR / Aurora Innovation, Inc. | 1.53 | 3.33 | 8.00 | -19.49 | 3.5685 | -2.0976 | |||

| CVNA / Carvana Co. | 0.02 | -23.36 | 7.97 | 23.50 | 3.5516 | -0.1244 | |||

| IOT / Samsara Inc. | 0.19 | 49.24 | 7.60 | 54.89 | 3.3894 | 0.5919 | |||

| FND / Floor & Decor Holdings, Inc. | 0.09 | 28.03 | 6.97 | 20.86 | 3.1053 | -0.1796 | |||

| IBIT / iShares Bitcoin Trust ETF | 0.11 | 0.00 | 6.43 | 30.75 | 2.8664 | 0.0641 | |||

| LB / LandBridge Company LLC | 0.08 | 25.49 | 5.44 | 17.88 | 2.4246 | -0.2047 | |||

| FNMA / Federal National Mortgage Association | 0.46 | 74.17 | 4.43 | 162.93 | 1.9767 | 1.0155 | |||

| DATABRICKS, INC. SERIES H PREFERRED SHARES / EP (000000000) | 0.04 | 2.98 | 1.3301 | 1.3301 | |||||

| ROIV / Roivant Sciences Ltd. | 0.26 | -5.00 | 2.94 | 6.09 | 1.3124 | -0.2688 | |||

| AGL / agilon health, inc. | 1.27 | 13.86 | 2.92 | -39.52 | 1.3018 | -1.4498 | |||

| HQY / HealthEquity, Inc. | 0.02 | 3.31 | 2.25 | 22.49 | 1.0028 | -0.0440 | |||

| PTON / Peloton Interactive, Inc. | 0.31 | -21.31 | 2.17 | -13.59 | 0.9670 | -0.4635 | |||

| CHWY / Chewy, Inc. | 0.05 | -74.17 | 2.17 | -66.15 | 0.9656 | -2.6800 | |||

| US61747C5250 / Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio | 1.79 | 299.95 | 1.79 | 300.45 | 0.7982 | 0.5431 | |||

| SYM / Symbotic Inc. | 0.04 | 0.00 | 1.60 | 92.31 | 0.7135 | 0.2390 | |||

| CELH / Celsius Holdings, Inc. | 0.03 | -76.28 | 1.24 | -69.11 | 0.5547 | -1.7407 | |||

| DXCM / DexCom, Inc. | 0.01 | -66.09 | 1.13 | -56.67 | 0.5025 | -0.9798 | |||

| DATABRICKS, INC. SERIES I PREFERRED SHARES / EP (000000000) | 0.01 | 0.79 | 0.3536 | 0.3536 | |||||

| TOST / Toast, Inc. | 0.01 | -1.92 | 0.56 | 30.86 | 0.2519 | 0.0060 | |||

| RIVN / Rivian Automotive, Inc. | 0.04 | 0.00 | 0.55 | 10.28 | 0.2441 | -0.0387 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.00 | 0.00 | 0.55 | 20.75 | 0.2441 | -0.0143 | |||

| ARGX / argenx SE - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.46 | -6.88 | 0.2052 | -0.0765 | |||

| CNHP33544 USD CALL/CNH PUT / DFE (000000000) | 0.10 | 0.0467 | 0.0467 | ||||||

| PROK / ProKidney Corp. | 0.13 | 0.00 | 0.08 | -32.43 | 0.0335 | -0.0298 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.05 | 0.0204 | 0.0204 | ||||||

| CNHP25303 USD CALL/CNH PUT / DFE (000000000) | 0.03 | 0.0147 | 0.0147 | ||||||

| CNHP03441 USD CALL/CNH PUT / DFE (000000000) | 0.01 | 0.0046 | 0.0046 | ||||||

| CNHP62664 USD CALL/CNH PUT / DFE (000000000) | 0.01 | 0.0045 | 0.0045 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0008 | 0.0008 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0001 | 0.0001 | ||||||

| CANTOR EQUITY PARTNERS INC / DE (000000000) | 0.20 | -0.17 | -0.0768 | -0.0768 | |||||

| SWAP STAND. CHARTER BANK BOCOC / STIV (000000000) | Short | -0.27 | -0.27 | -0.1204 | -0.1204 | ||||

| SWAP JP MORGAN BOC / STIV (000000000) | Short | -0.30 | -0.30 | -0.1337 | -0.1337 |