Basic Stats

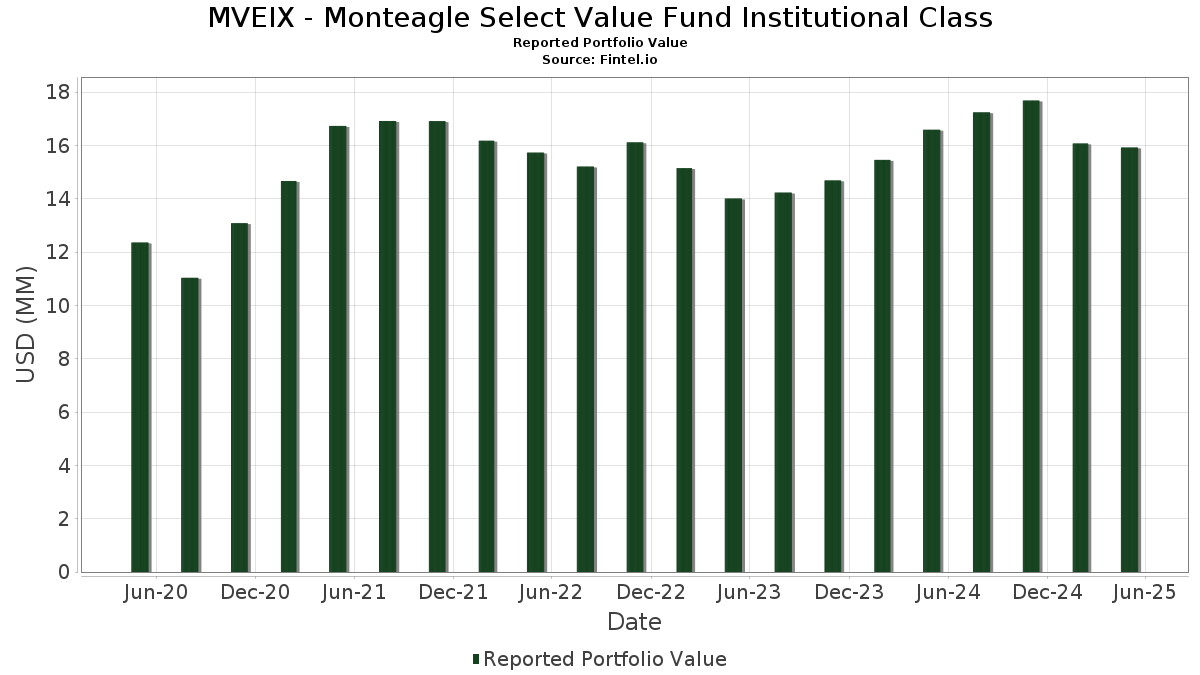

| Portfolio Value | $ 15,923,141 |

| Current Positions | 42 |

Latest Holdings, Performance, AUM (from 13F, 13D)

MVEIX - Monteagle Select Value Fund Institutional Class has disclosed 42 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 15,923,141 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MVEIX - Monteagle Select Value Fund Institutional Class’s top holdings are Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD (US:GOIXX) , DuPont de Nemours, Inc. (US:DD) , Caterpillar Inc. (US:CAT) , Delta Air Lines, Inc. (US:DAL) , and Nasdaq, Inc. (US:NDAQ) . MVEIX - Monteagle Select Value Fund Institutional Class’s new positions include Caterpillar Inc. (US:CAT) , Delta Air Lines, Inc. (US:DAL) , United Rentals, Inc. (US:URI) , Monolithic Power Systems, Inc. (US:MPWR) , and Lamb Weston Holdings, Inc. (US:LW) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.38 | 2.38 | 14.9700 | 3.7500 | |

| 0.00 | 0.49 | 3.0600 | 3.0600 | |

| 0.01 | 0.48 | 3.0400 | 3.0400 | |

| 0.00 | 0.46 | 2.8900 | 2.8900 | |

| 0.00 | 0.45 | 2.8300 | 2.8300 | |

| 0.01 | 0.44 | 2.7700 | 2.7700 | |

| 0.00 | 0.42 | 2.6300 | 2.6300 | |

| 0.01 | 0.39 | 2.4200 | 2.4200 | |

| 0.00 | 0.37 | 2.3400 | 2.3400 | |

| 0.04 | 0.37 | 2.3200 | 2.3200 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.28 | 1.7800 | -3.4300 | |

| 0.01 | 0.48 | 2.9900 | -2.2600 | |

| 0.00 | 0.05 | 0.3100 | -0.7600 | |

| 0.01 | 0.54 | 3.4000 | -0.7200 | |

| 0.00 | 0.24 | 1.4900 | -0.6200 | |

| 0.00 | 0.36 | 2.2600 | -0.4400 | |

| 0.00 | 0.37 | 2.3000 | -0.4000 | |

| 0.01 | 0.23 | 1.4500 | -0.3000 | |

| 0.01 | 0.30 | 1.9100 | -0.2500 | |

| 0.01 | 0.23 | 1.4600 | -0.1600 |

13F and Fund Filings

This form was filed on 2025-07-30 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOIXX / Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD | 2.38 | 32.13 | 2.38 | 32.15 | 14.9700 | 3.7500 | |||

| DD / DuPont de Nemours, Inc. | 0.01 | 0.00 | 0.54 | -18.28 | 3.4000 | -0.7200 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.49 | 3.0600 | 3.0600 | |||||

| DAL / Delta Air Lines, Inc. | 0.01 | 0.48 | 3.0400 | 3.0400 | |||||

| NDAQ / Nasdaq, Inc. | 0.01 | -44.12 | 0.48 | -43.60 | 2.9900 | -2.2600 | |||

| URI / United Rentals, Inc. | 0.00 | 0.46 | 2.8900 | 2.8900 | |||||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | 0.45 | 2.8300 | 2.8300 | |||||

| LDOS / Leidos Holdings, Inc. | 0.00 | 0.00 | 0.45 | 14.40 | 2.8000 | 0.3700 | |||

| LW / Lamb Weston Holdings, Inc. | 0.01 | 0.44 | 2.7700 | 2.7700 | |||||

| NEE / NextEra Energy, Inc. | 0.01 | 0.00 | 0.42 | 0.48 | 2.6600 | 0.0400 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.42 | 2.6300 | 2.6300 | |||||

| SJM / The J. M. Smucker Company | 0.00 | 0.00 | 0.40 | 1.77 | 2.5300 | 0.0700 | |||

| BWA / BorgWarner Inc. | 0.01 | 0.00 | 0.39 | 11.36 | 2.4600 | 0.2700 | |||

| CNC / Centene Corporation | 0.01 | 0.39 | 2.4200 | 2.4200 | |||||

| ES / Eversource Energy | 0.01 | 0.00 | 0.38 | 2.96 | 2.4000 | 0.0900 | |||

| LKQ / LKQ Corporation | 0.01 | 0.00 | 0.38 | -4.04 | 2.3900 | -0.0700 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 0.37 | 2.3400 | 2.3400 | |||||

| AES / The AES Corporation | 0.04 | 0.37 | 2.3200 | 2.3200 | |||||

| EPAM / EPAM Systems, Inc. | 0.00 | 0.00 | 0.37 | -15.47 | 2.3000 | -0.4000 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.37 | -1.62 | 2.2900 | -0.0200 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | 0.36 | 2.2600 | 2.2600 | |||||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.36 | -17.09 | 2.2600 | -0.4400 | |||

| ELV / Elevance Health, Inc. | 0.00 | 0.00 | 0.36 | -3.52 | 2.2400 | -0.0600 | |||

| MU / Micron Technology, Inc. | 0.00 | 0.00 | 0.32 | 0.94 | 2.0200 | 0.0400 | |||

| ADM / Archer-Daniels-Midland Company | 0.01 | 0.00 | 0.32 | 2.27 | 1.9900 | 0.0700 | |||

| DECK / Deckers Outdoor Corporation | 0.00 | 0.31 | 1.9200 | 1.9200 | |||||

| IPG / The Interpublic Group of Companies, Inc. | 0.01 | 0.00 | 0.30 | -12.68 | 1.9100 | -0.2500 | |||

| SWKS / Skyworks Solutions, Inc. | 0.00 | 0.00 | 0.30 | 3.50 | 1.8600 | 0.0800 | |||

| DHI / D.R. Horton, Inc. | 0.00 | -58.97 | 0.28 | -67.25 | 1.7800 | -3.4300 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | 0.27 | 1.7000 | 1.7000 | |||||

| ZBRA / Zebra Technologies Corporation | 0.00 | 0.26 | 1.6400 | 1.6400 | |||||

| TFX / Teleflex Incorporated | 0.00 | 0.00 | 0.25 | -8.21 | 1.5500 | -0.1200 | |||

| AKAM / Akamai Technologies, Inc. | 0.00 | 0.00 | 0.24 | -5.79 | 1.5300 | -0.0900 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 0.00 | 0.24 | -29.88 | 1.4900 | -0.6200 | |||

| ON / ON Semiconductor Corporation | 0.01 | 0.00 | 0.23 | -10.73 | 1.4600 | -0.1600 | |||

| APA / APA Corporation | 0.01 | 0.00 | 0.23 | -17.79 | 1.4500 | -0.3000 | |||

| BALL / Ball Corporation | 0.00 | 0.22 | 1.3800 | 1.3800 | |||||

| CCI / Crown Castle Inc. | 0.00 | 0.00 | 0.20 | 6.38 | 1.2600 | 0.0900 | |||

| HUM / Humana Inc. | 0.00 | 0.00 | 0.16 | -13.76 | 1.0200 | -0.1600 | |||

| BAX / Baxter International Inc. | 0.00 | 0.00 | 0.12 | -12.21 | 0.7300 | -0.0900 | |||

| USB / U.S. Bancorp | 0.00 | 0.00 | 0.11 | -6.61 | 0.7100 | -0.0500 | |||

| MKTX / MarketAxess Holdings Inc. | 0.00 | -61.67 | 0.05 | -71.01 | 0.3100 | -0.7600 |