Basic Stats

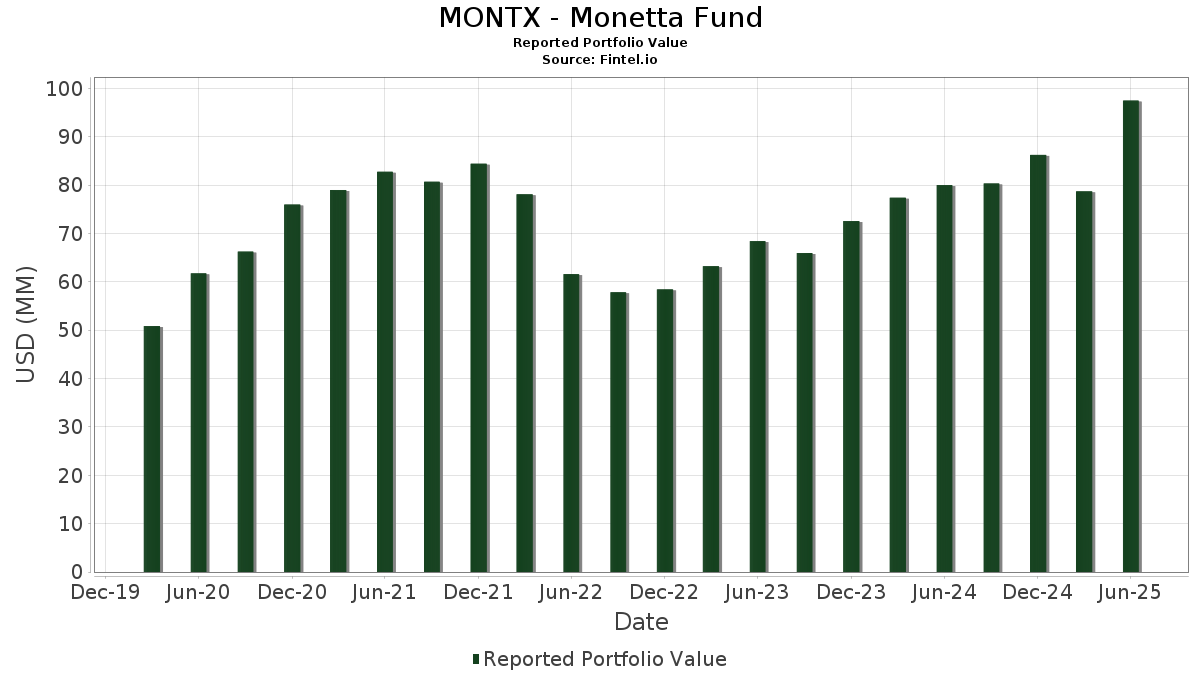

| Portfolio Value | $ 97,478,035 |

| Current Positions | 52 |

Latest Holdings, Performance, AUM (from 13F, 13D)

MONTX - Monetta Fund has disclosed 52 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 97,478,035 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MONTX - Monetta Fund’s top holdings are Amazon.com, Inc. (US:AMZN) , Palantir Technologies Inc. (US:PLTR) , NVIDIA Corporation (US:NVDA) , JPMorgan Chase & Co. (US:JPM) , and Alphabet Inc. (US:GOOG) . MONTX - Monetta Fund’s new positions include Interactive Brokers Group, Inc. (US:IBKR) , Royalty Pharma plc (US:RPRX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 2.53 | 2.5958 | 1.4315 | |

| 0.04 | 5.86 | 6.0189 | 1.4044 | |

| 0.02 | 1.11 | 1.1379 | 1.1379 | |

| 0.03 | 1.08 | 1.1099 | 1.1099 | |

| 0.00 | 0.91 | 0.9393 | 0.9393 | |

| 0.01 | 0.84 | 0.8660 | 0.8660 | |

| 0.01 | 1.53 | 1.5714 | 0.8604 | |

| 0.01 | 3.69 | 3.7894 | 0.8580 | |

| 0.04 | 5.53 | 5.6779 | 0.8547 | |

| 0.01 | 1.65 | 1.6982 | 0.6338 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.69 | 0.69 | 0.7087 | -3.0126 | |

| 0.02 | 4.08 | 4.1893 | -2.3660 | |

| 0.02 | 3.39 | 3.4761 | -1.1842 | |

| 0.00 | 0.00 | -0.8928 | ||

| 0.00 | 0.00 | -0.8683 | ||

| 0.00 | 0.84 | 0.8655 | -0.8071 | |

| 0.00 | 0.00 | -0.6789 | ||

| 0.01 | 1.21 | 1.2385 | -0.5876 | |

| 0.00 | 2.97 | 3.0494 | -0.5582 | |

| 0.03 | 6.91 | 7.0961 | -0.5243 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.03 | 0.00 | 6.91 | 15.30 | 7.0961 | -0.5243 | |||

| PLTR / Palantir Technologies Inc. | 0.04 | 0.00 | 5.86 | 61.50 | 6.0189 | 1.4044 | |||

| NVDA / NVIDIA Corporation | 0.04 | 0.00 | 5.53 | 45.77 | 5.6779 | 0.8547 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 4.35 | 18.18 | 4.4652 | -0.2133 | |||

| GOOG / Alphabet Inc. | 0.02 | -30.30 | 4.08 | -20.87 | 4.1893 | -2.3660 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 4.02 | 43.62 | 4.1251 | 0.5680 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 3.98 | 32.50 | 4.0860 | 0.2675 | |||

| META / Meta Platforms, Inc. | 0.01 | 25.00 | 3.69 | 60.09 | 3.7894 | 0.8580 | |||

| AAPL / Apple Inc. | 0.02 | 0.00 | 3.39 | -7.64 | 3.4761 | -1.1842 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 2.97 | 4.65 | 3.0494 | -0.5582 | |||

| HOOD / Robinhood Markets, Inc. | 0.03 | 22.73 | 2.53 | 176.28 | 2.5958 | 1.4315 | |||

| SPOT / Spotify Technology S.A. | 0.00 | 25.00 | 1.92 | 74.36 | 1.9698 | 0.5711 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.01 | 0.00 | 1.88 | 52.44 | 1.9292 | 0.3619 | |||

| DIS / The Walt Disney Company | 0.01 | 15.38 | 1.86 | 44.97 | 1.9100 | 0.2786 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 1.77 | 29.60 | 1.8168 | 0.0803 | |||

| AVGO / Broadcom Inc. | 0.01 | 20.00 | 1.65 | 97.49 | 1.6982 | 0.6338 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | 28.00 | 1.63 | 84.90 | 1.6735 | 0.5527 | |||

| TSLA / Tesla, Inc. | 0.01 | 25.00 | 1.59 | 53.28 | 1.6309 | 0.3128 | |||

| BA / The Boeing Company | 0.01 | 0.00 | 1.57 | 22.83 | 1.6136 | -0.0128 | |||

| ORCL / Oracle Corporation | 0.01 | 75.00 | 1.53 | 173.70 | 1.5714 | 0.8604 | |||

| WMT / Walmart Inc. | 0.01 | 0.00 | 1.47 | 11.40 | 1.5060 | -0.1684 | |||

| VST / Vistra Corp. | 0.01 | 0.00 | 1.36 | 64.96 | 1.3930 | 0.3478 | |||

| COIN / Coinbase Global, Inc. | 0.00 | -5.00 | 1.33 | 49.89 | 1.3676 | 0.2557 | |||

| ROKU / Roku, Inc. | 0.01 | 50.00 | 1.32 | 87.22 | 1.3537 | 0.4580 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 1.31 | 10.23 | 1.3494 | -0.1664 | |||

| VRSN / VeriSign, Inc. | 0.00 | 0.00 | 1.30 | 13.75 | 1.3344 | -0.1181 | |||

| CEG / Constellation Energy Corporation | 0.00 | 0.00 | 1.29 | 60.17 | 1.3257 | 0.3002 | |||

| GE / General Electric Company | 0.01 | 0.00 | 1.29 | 28.60 | 1.3215 | 0.0490 | |||

| WMB / The Williams Companies, Inc. | 0.02 | 0.00 | 1.26 | 5.10 | 1.2899 | -0.2298 | |||

| HWM / Howmet Aerospace Inc. | 0.01 | 0.00 | 1.21 | 43.42 | 1.2423 | 0.1701 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | -5.56 | 1.21 | -17.34 | 1.2385 | -0.5876 | |||

| UBER / Uber Technologies, Inc. | 0.01 | 0.00 | 1.17 | 28.13 | 1.1975 | 0.0395 | |||

| NOW / ServiceNow, Inc. | 0.00 | 22.22 | 1.13 | 57.82 | 1.1612 | 0.2501 | |||

| AIG / American International Group, Inc. | 0.01 | 0.00 | 1.11 | -1.59 | 1.1425 | -0.2946 | |||

| DASH / DoorDash, Inc. | 0.00 | 0.00 | 1.11 | 34.91 | 1.1390 | 0.0933 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.00 | 1.11 | -1.07 | 1.1384 | -0.2863 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.02 | 1.11 | 1.1379 | 1.1379 | |||||

| DLTR / Dollar Tree, Inc. | 0.01 | 0.00 | 1.09 | 32.00 | 1.1186 | 0.0687 | |||

| RPRX / Royalty Pharma plc | 0.03 | 1.08 | 1.1099 | 1.1099 | |||||

| SNOW / Snowflake Inc. | 0.00 | 0.00 | 1.01 | 53.12 | 1.0340 | 0.1977 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 0.00 | 0.99 | 1.33 | 1.0144 | -0.2245 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.97 | 12.51 | 0.9974 | -0.1011 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.02 | 47.83 | 0.95 | 32.50 | 0.9801 | 0.0789 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.00 | 0.93 | 28.63 | 0.9550 | 0.0351 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.92 | 9.75 | 0.9486 | -0.1220 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 0.91 | 0.9393 | 0.9393 | |||||

| V / Visa Inc. | 0.00 | -20.00 | 0.85 | -18.93 | 0.8750 | -0.4619 | |||

| EXPE / Expedia Group, Inc. | 0.01 | 0.84 | 0.8660 | 0.8660 | |||||

| MA / Mastercard Incorporated | 0.00 | -37.50 | 0.84 | -35.97 | 0.8655 | -0.8071 | |||

| BROS / Dutch Bros Inc. | 0.01 | 0.00 | 0.82 | 10.81 | 0.8424 | -0.0996 | |||

| ABNB / Airbnb, Inc. | 0.01 | 0.00 | 0.79 | 10.89 | 0.8153 | -0.0960 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.69 | -76.42 | 0.69 | -76.42 | 0.7087 | -3.0126 | |||

| DXCM / DexCom, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8683 | ||||

| IBIT / iShares Bitcoin Trust ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.8928 | ||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.6789 |