Basic Stats

| Portfolio Value | $ 172,228,057 |

| Current Positions | 109 |

Latest Holdings, Performance, AUM (from 13F, 13D)

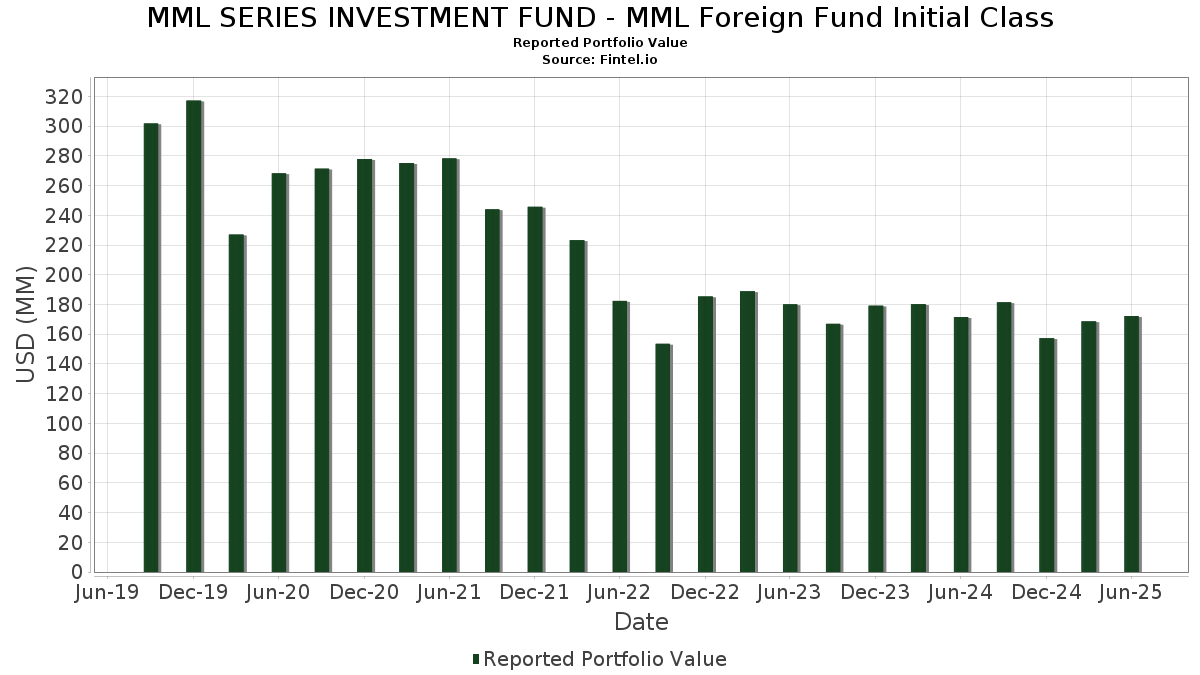

MML SERIES INVESTMENT FUND - MML Foreign Fund Initial Class has disclosed 109 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 172,228,057 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MML SERIES INVESTMENT FUND - MML Foreign Fund Initial Class’s top holdings are Sony Group Corporation (JP:6758) , Hitachi, Ltd. (DE:HIA1) , SAP SE (DE:SAP) , Société Générale Société anonyme (FR:GLE) , and Roche Holding AG (CH:ROG) . MML SERIES INVESTMENT FUND - MML Foreign Fund Initial Class’s new positions include Daikin Industries,Ltd. (JP:6367) , State Street Navigator Securities Lending Government Money Market Portfolio (US:US8575093013) , La Française des Jeux Société anonyme (FR:FDJ) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.61 | 0.3549 | 0.3549 | |

| 0.13 | 3.77 | 2.1806 | 0.3340 | |

| 0.11 | 1.23 | 0.7112 | 0.2844 | |

| 0.01 | 2.89 | 1.6695 | 0.2449 | |

| 0.08 | 2.82 | 1.6297 | 0.2440 | |

| 0.36 | 0.36 | 0.2060 | 0.2060 | |

| 0.00 | 2.80 | 1.6189 | 0.2011 | |

| 0.05 | 2.12 | 1.2242 | 0.1729 | |

| 0.04 | 1.10 | 0.6379 | 0.1705 | |

| 0.01 | 1.11 | 0.6441 | 0.1575 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.7311 | ||

| 0.00 | 0.00 | -0.6597 | ||

| 0.00 | 0.00 | -0.6597 | ||

| 0.03 | 1.93 | 1.1161 | -0.4708 | |

| 0.01 | 3.30 | 1.9075 | -0.4475 | |

| 0.02 | 1.22 | 0.7073 | -0.4014 | |

| 0.08 | 1.02 | 0.5900 | -0.3760 | |

| 0.08 | 2.87 | 1.6572 | -0.2831 | |

| 0.40 | 1.98 | 1.1415 | -0.2804 | |

| 0.02 | 1.75 | 1.0117 | -0.2771 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 6758 / Sony Group Corporation | 0.18 | -4.20 | 4.70 | -1.94 | 2.7124 | -0.2190 | |||

| HIA1 / Hitachi, Ltd. | 0.13 | 0.00 | 3.77 | 25.13 | 2.1806 | 0.3340 | |||

| SAP / SAP SE | 0.01 | -9.09 | 3.65 | 4.17 | 2.1088 | -0.0366 | |||

| GLE / Société Générale Société anonyme | 0.06 | -11.60 | 3.32 | 12.17 | 1.9166 | 0.1064 | |||

| ROG / Roche Holding AG | 0.01 | -13.68 | 3.30 | -14.17 | 1.9075 | -0.4475 | |||

| NESN / Nestlé S.A. | 0.03 | -4.49 | 3.17 | -6.19 | 1.8304 | -0.2373 | |||

| 8316 / Sumitomo Mitsui Financial Group, Inc. | 0.12 | -4.42 | 2.98 | -6.08 | 1.7235 | -0.2212 | |||

| HEI / Heidelberg Materials AG | 0.01 | -9.56 | 2.89 | 24.15 | 1.6695 | 0.2449 | |||

| LLOY / Lloyds Banking Group plc | 2.73 | -10.48 | 2.87 | 0.74 | 1.6607 | -0.0858 | |||

| S6M / Seven & i Holdings Co., Ltd. | 0.18 | -4.35 | 2.87 | 6.17 | 1.6604 | 0.0029 | |||

| SIE / Siemens Aktiengesellschaft | 0.01 | -3.45 | 2.87 | 7.93 | 1.6595 | 0.0303 | |||

| VIE / Veolia Environnement SA | 0.08 | -12.80 | 2.87 | -9.50 | 1.6572 | -0.2831 | |||

| ZOF / SBI Holdings, Inc. | 0.08 | -3.79 | 2.82 | 24.66 | 1.6297 | 0.2440 | |||

| DEVL / DBS Group Holdings Ltd | 0.08 | -4.21 | 2.81 | -1.30 | 1.6252 | -0.1198 | |||

| ASML / ASML Holding N.V. | 0.00 | 0.00 | 2.80 | 21.04 | 1.6189 | 0.2011 | |||

| 8591 / ORIX Corporation | 0.12 | 0.00 | 2.67 | 9.00 | 1.5397 | 0.0427 | |||

| 6702 / Fujitsu Limited | 0.11 | -24.17 | 2.66 | -7.32 | 1.5369 | -0.2204 | |||

| 1 / CK Hutchison Holdings Limited | 0.41 | -3.32 | 2.55 | 5.58 | 1.4757 | -0.0053 | |||

| AER / AerCap Holdings N.V. | 0.02 | -4.89 | 2.50 | 8.92 | 1.4465 | 0.0392 | |||

| D1NC / DNB Bank ASA | 0.09 | -4.35 | 2.43 | 0.62 | 1.4067 | -0.0746 | |||

| CAP / Capgemini SE | 0.01 | -4.35 | 2.26 | 9.50 | 1.3052 | 0.0420 | |||

| A5G / AIB Group plc | 0.27 | -11.36 | 2.22 | 12.32 | 1.2799 | 0.0727 | |||

| IFNNY / Infineon Technologies AG - Depositary Receipt (Common Stock) | 0.05 | -4.23 | 2.12 | 23.41 | 1.2242 | 0.1729 | |||

| AC / Accor SA | 0.04 | -4.26 | 2.12 | 9.68 | 1.2240 | 0.0419 | |||

| 1299 / AIA Group Limited | 0.23 | -4.32 | 2.11 | 13.85 | 1.2209 | 0.0844 | |||

| TYIDY / Toyota Industries Corporation - Depositary Receipt (Common Stock) | 0.02 | -28.79 | 2.06 | -6.02 | 1.1912 | -0.1515 | |||

| SHEL / Shell plc | 0.06 | -4.26 | 2.05 | -7.84 | 1.1823 | -0.1768 | |||

| KBC / KBC Group NV | 0.02 | -4.85 | 2.02 | 7.01 | 1.1647 | 0.0113 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.40 | -3.81 | 1.98 | -14.94 | 1.1415 | -0.2804 | |||

| FP / TotalEnergies SE | 0.03 | -4.22 | 1.96 | -8.86 | 1.1300 | -0.1836 | |||

| ABIT / Anheuser-Busch InBev SA/NV | 0.03 | -33.25 | 1.93 | -25.50 | 1.1161 | -0.4708 | |||

| PRX / Prosus N.V. | 0.03 | -4.26 | 1.89 | 14.92 | 1.0906 | 0.0853 | |||

| TSCO / Tesco PLC | 0.34 | -4.78 | 1.85 | 22.07 | 1.0709 | 0.1414 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.01 | -3.49 | 1.84 | -6.33 | 1.0609 | -0.1390 | |||

| LGI / Legal & General Group Plc | 0.52 | -4.64 | 1.83 | 5.65 | 1.0588 | -0.0030 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.04 | -19.04 | 1.79 | -9.36 | 1.0347 | -0.1750 | |||

| STO / Santos Limited | 0.35 | -3.79 | 1.78 | 15.86 | 1.0257 | 0.0874 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.01 | -4.46 | 1.76 | 13.08 | 1.0194 | 0.0640 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.08 | -4.29 | 1.76 | 7.31 | 1.0180 | 0.0125 | |||

| CFR / Compagnie Financière Richemont SA | 0.01 | -9.71 | 1.76 | -2.22 | 1.0161 | -0.0850 | |||

| GSK / GSK plc | 0.09 | -3.46 | 1.76 | -3.62 | 1.0154 | -0.1012 | |||

| RKT / Reckitt Benckiser Group plc | 0.03 | -4.44 | 1.76 | -3.78 | 1.0139 | -0.1030 | |||

| SEBA / Skandinaviska Enskilda Banken AB (publ) | 0.10 | -4.29 | 1.75 | 1.92 | 1.0120 | -0.0399 | |||

| SAN / Santander UK plc - Preferred Stock | 0.02 | -4.74 | 1.75 | -16.82 | 1.0117 | -0.2771 | |||

| ESWB / Essity AB (publ) | 0.06 | -4.12 | 1.74 | -6.60 | 1.0063 | -0.1351 | |||

| DPW / Deutsche Post AG | 0.04 | -4.10 | 1.73 | 3.85 | 0.9988 | -0.0203 | |||

| MRK / Marks Electrical Group PLC | 0.01 | 3.12 | 1.71 | -2.45 | 0.9875 | -0.0853 | |||

| ERF / Eurofins Scientific SE | 0.02 | -8.78 | 1.70 | 21.99 | 0.9839 | 0.1293 | |||

| DCC / DCC plc | 0.03 | -2.31 | 1.65 | -5.01 | 0.9525 | -0.1101 | |||

| DB1 / Deutsche Börse AG | 0.01 | -10.71 | 1.63 | -1.15 | 0.9425 | -0.0679 | |||

| MT / ArcelorMittal S.A. | 0.05 | -4.36 | 1.60 | 4.66 | 0.9221 | -0.0114 | |||

| ZAL / Zalando SE | 0.05 | -0.82 | 1.59 | -5.35 | 0.9206 | -0.1102 | |||

| ALV / Allianz SE | 0.00 | -11.36 | 1.58 | -5.78 | 0.9129 | -0.1141 | |||

| 4M4 / Macquarie Group Limited | 0.01 | -5.45 | 1.57 | 14.82 | 0.9046 | 0.0698 | |||

| NOVN / Novartis AG | 0.01 | -5.22 | 1.54 | 3.09 | 0.8876 | -0.0249 | |||

| LIN / Linde plc | 0.00 | -3.03 | 1.50 | -2.28 | 0.8674 | -0.0733 | |||

| FANUY / Fanuc Corporation - Depositary Receipt (Common Stock) | 0.05 | -3.32 | 1.43 | -3.65 | 0.8234 | -0.0821 | |||

| HEIO / Heineken Holding N.V. | 0.02 | -4.21 | 1.36 | -1.60 | 0.7842 | -0.0603 | |||

| AHT / Ashtead Group plc | 0.02 | -4.23 | 1.31 | 13.65 | 0.7555 | 0.0513 | |||

| IJCA / Inchcape plc | 0.13 | -4.26 | 1.30 | 10.00 | 0.7503 | 0.0274 | |||

| ARC / Aker BP ASA | 0.05 | -15.34 | 1.30 | -8.87 | 0.7483 | -0.1216 | |||

| GU81 / Aviva plc | 0.15 | -4.71 | 1.29 | 12.38 | 0.7450 | 0.0427 | |||

| KYR / Kyocera Corporation | 0.11 | -13.11 | 1.29 | -7.40 | 0.7449 | -0.1077 | |||

| TEN / Tenaris S.A. | 0.07 | 24.45 | 1.27 | 18.97 | 0.7359 | 0.0805 | |||

| BAER / Julius Bär Gruppe AG | 0.02 | -4.60 | 1.26 | -6.80 | 0.7282 | -0.0998 | |||

| Smurfit WestRock PLC / EC (IE00028FXN24) | 0.03 | -4.58 | 1.26 | -8.64 | 0.7279 | -0.1162 | |||

| OLY1 / Olympus Corporation | 0.11 | -4.16 | 1.26 | -13.44 | 0.7259 | -0.1626 | |||

| 6752 / Panasonic Holdings Corporation | 0.11 | 96.91 | 1.23 | 76.61 | 0.7112 | 0.2844 | |||

| UNA / Unilever PLC | 0.02 | -33.88 | 1.22 | -32.41 | 0.7073 | -0.4014 | |||

| GLEN / Glencore plc | 0.30 | -4.10 | 1.18 | 1.46 | 0.6834 | -0.0300 | |||

| SKHHY / Sonic Healthcare Limited - Depositary Receipt (Common Stock) | 0.07 | -4.23 | 1.16 | 4.70 | 0.6693 | -0.0081 | |||

| NEN / Renesas Electronics Corporation | 0.09 | -3.65 | 1.14 | -12.73 | 0.6576 | -0.1407 | |||

| 1CK / CK Asset Holdings Limited | 0.25 | -3.12 | 1.12 | 5.35 | 0.6490 | -0.0042 | |||

| HEN3 / Henkel AG & Co. KGaA - Preferred Stock | 0.01 | 42.00 | 1.11 | 40.30 | 0.6441 | 0.1575 | |||

| EDEN / Edenred SE | 0.04 | 52.14 | 1.10 | 44.69 | 0.6379 | 0.1705 | |||

| 7974 / Nintendo Co., Ltd. | 0.01 | -27.22 | 1.10 | 2.41 | 0.6372 | -0.0225 | |||

| RAK / Rakuten Group, Inc. | 0.20 | -4.43 | 1.10 | -8.08 | 0.6372 | -0.0974 | |||

| 7751 / Canon Inc. | 0.04 | -4.96 | 1.05 | -11.73 | 0.6091 | -0.1220 | |||

| CNI / Canadian National Railway Company | 0.01 | -4.72 | 1.05 | 2.04 | 0.6080 | -0.0235 | |||

| CNH / CNH Industrial N.V. | 0.08 | -38.68 | 1.02 | -35.26 | 0.5900 | -0.3760 | |||

| SW / Sodexo S.A. | 0.02 | -4.62 | 1.02 | -8.64 | 0.5866 | -0.0938 | |||

| AMUN / Amundi S.A. | 0.01 | -5.34 | 1.01 | -2.24 | 0.5807 | -0.0487 | |||

| RY4C / Ryanair Holdings plc | 0.03 | -3.94 | 0.96 | 35.39 | 0.5573 | 0.1210 | |||

| SN. / Smith & Nephew plc | 0.06 | -4.34 | 0.94 | 3.86 | 0.5447 | -0.0107 | |||

| BAS / Leverage Shares Plc - Corporate Bond/Note | 0.02 | -4.69 | 0.90 | -5.45 | 0.5215 | -0.0627 | |||

| CCDBF / CCL Industries Inc. | 0.02 | -4.97 | 0.89 | 13.49 | 0.5154 | 0.0340 | |||

| TEP / Teleperformance SE | 0.01 | 11.01 | 0.88 | 6.92 | 0.5091 | 0.0046 | |||

| PSO / Pearson plc - Depositary Receipt (Common Stock) | 0.06 | -4.34 | 0.84 | -10.89 | 0.4872 | -0.0922 | |||

| BDEV / Barratt Developments plc | 0.12 | -4.27 | 0.76 | 9.05 | 0.4386 | 0.0125 | |||

| BWJ / Boliden AB (publ) | 0.02 | -4.72 | 0.76 | -9.03 | 0.4373 | -0.0718 | |||

| IEA / Informa plc | 0.07 | -3.99 | 0.74 | 6.13 | 0.4302 | 0.0009 | |||

| PSN / Persimmon Plc | 0.04 | -4.50 | 0.72 | 10.14 | 0.4146 | 0.0160 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 10.71 | 0.65 | 11.34 | 0.3749 | 0.0185 | |||

| WC2 / Whitehaven Coal Limited | 0.17 | -4.13 | 0.62 | -0.32 | 0.3599 | -0.0226 | |||

| 6367 / Daikin Industries,Ltd. | 0.01 | 0.61 | 0.3549 | 0.3549 | |||||

| 6WS / Wise plc | 0.04 | 2.42 | 0.61 | 19.57 | 0.3498 | 0.0394 | |||

| EVD / CTS Eventim AG & Co. KGaA | 0.00 | 0.00 | 0.52 | 24.82 | 0.3022 | 0.0453 | |||

| KFI1 / Kingfisher plc | 0.13 | -6.67 | 0.51 | 13.39 | 0.2939 | 0.0190 | |||

| BNZL / Bunzl plc | 0.01 | -4.79 | 0.44 | -20.93 | 0.2558 | -0.0867 | |||

| RXL / Rexel S.A. | 0.01 | -5.59 | 0.42 | 8.33 | 0.2407 | 0.0055 | |||

| EXO / Exor N.V. | 0.00 | -6.82 | 0.41 | 3.25 | 0.2389 | -0.0062 | |||

| PHIA / Koninklijke Philips N.V. | 0.02 | -4.16 | 0.39 | -9.37 | 0.2236 | -0.0380 | |||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 0.36 | 0.36 | 0.2060 | 0.2060 | |||||

| PRY / Tion Renewables AG | 0.00 | 0.00 | 0.33 | 28.40 | 0.1911 | 0.0335 | |||

| SDF / K+S Aktiengesellschaft | 0.01 | -51.41 | 0.25 | -34.55 | 0.1461 | -0.0901 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.01 | -4.76 | 0.24 | -5.51 | 0.1388 | -0.0170 | |||

| ROCK B / Rockwool A/S | 0.00 | 0.18 | 0.1054 | 0.1054 | |||||

| BB2 / Burberry Group plc | 0.01 | -71.63 | 0.13 | -54.39 | 0.0752 | -0.0994 | |||

| FDJ / La Française des Jeux Société anonyme | 0.00 | 0.04 | 0.0249 | 0.0249 | |||||

| CAJ / Canon Inc. - ADR | 0.00 | -100.00 | 0.00 | -100.00 | -0.7311 | ||||

| NTOA / Nintendo Co., Ltd. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.6597 | ||||

| NTOA / Nintendo Co., Ltd. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.6597 | ||||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1559 |