Basic Stats

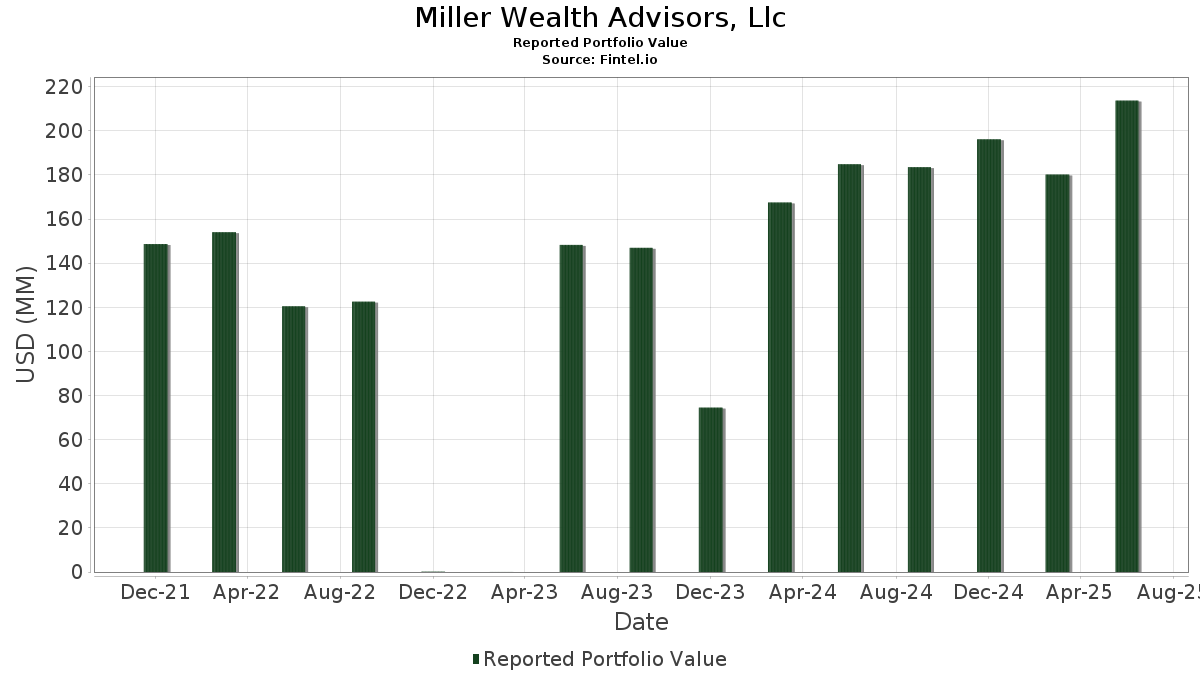

| Portfolio Value | $ 213,682,781 |

| Current Positions | 97 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Miller Wealth Advisors, Llc has disclosed 97 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 213,682,781 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Miller Wealth Advisors, Llc’s top holdings are Amazon.com, Inc. (US:AMZN) , Apple Inc. (US:AAPL) , Exxon Mobil Corporation (US:XOM) , Microsoft Corporation (US:MSFT) , and Alphabet Inc. (US:GOOG) . Miller Wealth Advisors, Llc’s new positions include Alphabet Inc. (US:GOOGL) , Rocket Companies, Inc. (US:RKT) , Chewy, Inc. (US:CHWY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 21.67 | 10.1434 | 10.1434 | |

| 0.05 | 23.59 | 11.0378 | 1.1638 | |

| 0.06 | 10.13 | 4.7405 | 1.0434 | |

| 0.05 | 6.78 | 3.1718 | 0.8319 | |

| 0.01 | 0.10 | 0.0456 | 0.0181 | |

| 0.00 | 0.23 | 0.1067 | 0.0090 | |

| 0.00 | 0.01 | 0.0066 | 0.0066 | |

| 0.00 | 0.04 | 0.0174 | 0.0030 | |

| 0.00 | 0.03 | 0.0130 | 0.0028 | |

| 0.00 | 0.00 | 0.0022 | 0.0022 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.29 | 31.38 | 14.6865 | -5.9145 | |

| 0.16 | 33.41 | 15.6364 | -4.7185 | |

| 0.26 | 56.22 | 26.3090 | -1.1822 | |

| 0.12 | 21.67 | 10.1434 | -0.6189 | |

| 0.01 | 3.42 | 1.6020 | -0.4699 | |

| 0.00 | 0.19 | 0.0869 | -0.0324 | |

| 0.00 | 0.23 | 0.1095 | -0.0294 | |

| 0.00 | 0.61 | 0.2834 | -0.0222 | |

| 0.00 | 0.13 | 0.0588 | -0.0204 | |

| 0.00 | 0.13 | 0.0588 | -0.0177 |

13F and Fund Filings

This form was filed on 2025-07-18 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.26 | -1.56 | 56.22 | 13.51 | 26.3090 | -1.1822 | |||

| AAPL / Apple Inc. | 0.16 | -1.36 | 33.41 | -8.89 | 15.6364 | -4.7185 | |||

| XOM / Exxon Mobil Corporation | 0.29 | -6.72 | 31.38 | -15.44 | 14.6865 | -5.9145 | |||

| MSFT / Microsoft Corporation | 0.05 | 0.06 | 23.59 | 32.58 | 11.0378 | 1.1638 | |||

| GOOG / Alphabet Inc. | 0.12 | -1.55 | 21.67 | 11.79 | 10.1434 | -0.6189 | |||

| GOOGL / Alphabet Inc. | 0.12 | 21.67 | 10.1434 | 10.1434 | |||||

| NVDA / NVIDIA Corporation | 0.06 | 4.32 | 10.13 | 52.09 | 4.7405 | 1.0434 | |||

| PLTR / Palantir Technologies Inc. | 0.05 | -0.46 | 6.78 | 60.78 | 3.1718 | 0.8319 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.54 | 3.42 | -8.28 | 1.6020 | -0.4699 | |||

| MBLY / Mobileye Global Inc. | 0.04 | -5.88 | 0.77 | 17.61 | 0.3598 | -0.0032 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.61 | 10.00 | 0.2834 | -0.0222 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.30 | 0.41 | 10.75 | 0.1931 | -0.0136 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.41 | 17.53 | 0.1918 | -0.0015 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.27 | 11.25 | 0.1252 | -0.0081 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.24 | 8.52 | 0.1133 | -0.0107 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.23 | -6.80 | 0.1095 | -0.0294 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 0.23 | 29.71 | 0.1067 | 0.0090 | |||

| CVX / Chevron Corporation | 0.00 | 0.93 | 0.19 | -13.55 | 0.0869 | -0.0324 | |||

| INTC / Intel Corporation | 0.01 | 0.00 | 0.14 | -1.43 | 0.0647 | -0.0131 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.00 | 0.32 | 0.13 | -8.76 | 0.0588 | -0.0177 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.13 | -11.97 | 0.0588 | -0.0204 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.12 | 18.10 | 0.0583 | -0.0002 | |||

| ACHR / Archer Aviation Inc. | 0.01 | 28.65 | 0.10 | 97.96 | 0.0456 | 0.0181 | |||

| APA / APA Corporation | 0.01 | 0.00 | 0.09 | -13.08 | 0.0436 | -0.0158 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.63 | 0.09 | 2.41 | 0.0399 | -0.0063 | |||

| PSX / Phillips 66 | 0.00 | 0.72 | 0.08 | -3.49 | 0.0392 | -0.0086 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.08 | -6.10 | 0.0365 | -0.0094 | |||

| NKE / NIKE, Inc. | 0.00 | 0.46 | 0.08 | 11.59 | 0.0364 | -0.0020 | |||

| TSLA / Tesla, Inc. | 0.00 | -36.72 | 0.07 | -21.98 | 0.0333 | -0.0176 | |||

| COP / ConocoPhillips | 0.00 | 0.92 | 0.05 | -14.04 | 0.0230 | -0.0086 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.04 | -12.00 | 0.0208 | -0.0071 | |||

| MMM / 3M Company | 0.00 | 0.00 | 0.04 | 2.56 | 0.0192 | -0.0028 | |||

| MS / Morgan Stanley | 0.00 | 0.00 | 0.04 | 21.21 | 0.0188 | 0.0003 | |||

| HWM / Howmet Aerospace Inc. | 0.00 | 0.00 | 0.04 | 48.00 | 0.0174 | 0.0030 | |||

| VZ / Verizon Communications Inc. | 0.00 | 0.00 | 0.03 | -2.94 | 0.0155 | -0.0038 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.00 | -11.39 | 0.03 | -13.89 | 0.0149 | -0.0051 | |||

| PFG / Principal Financial Group, Inc. | 0.00 | 0.00 | 0.03 | -6.06 | 0.0147 | -0.0038 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.03 | -3.23 | 0.0145 | -0.0027 | |||

| T / AT&T Inc. | 0.00 | 0.00 | 0.03 | 3.57 | 0.0138 | -0.0022 | |||

| NLR / VanEck ETF Trust - VanEck Uranium+Nuclear Energy ETF | 0.00 | 0.00 | 0.03 | 50.00 | 0.0130 | 0.0028 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.03 | 0.00 | 0.0129 | -0.0026 | |||

| CMCSA / Comcast Corporation | 0.00 | 0.00 | 0.03 | -3.57 | 0.0128 | -0.0029 | |||

| OXY / Occidental Petroleum Corporation | 0.00 | 0.00 | 0.03 | -16.67 | 0.0121 | -0.0048 | |||

| DG / Dollar General Corporation | 0.00 | 0.90 | 0.03 | 31.58 | 0.0120 | 0.0011 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.02 | 50.00 | 0.0113 | 0.0020 | |||

| SO / The Southern Company | 0.00 | 0.00 | 0.02 | 0.00 | 0.0107 | -0.0020 | |||

| ANET / Arista Networks Inc | 0.00 | 0.00 | 0.02 | 29.41 | 0.0105 | 0.0011 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.00 | 0.00 | 0.02 | 0.00 | 0.0098 | -0.0023 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.02 | 5.56 | 0.0091 | -0.0013 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | 1.72 | 0.02 | -9.52 | 0.0091 | -0.0029 | |||

| LB / LandBridge Company LLC | 0.00 | 3.77 | 0.02 | -5.26 | 0.0087 | -0.0019 | |||

| JEPQ / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Nasdaq Equity Premium Income ETF | 0.00 | 0.00 | 0.02 | 6.25 | 0.0082 | -0.0011 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.02 | -5.88 | 0.0078 | -0.0017 | |||

| D / Dominion Energy, Inc. | 0.00 | 0.00 | 0.02 | 0.00 | 0.0074 | -0.0013 | |||

| SLG / SL Green Realty Corp. | 0.00 | 0.00 | 0.02 | 7.14 | 0.0072 | -0.0008 | |||

| CINF / Cincinnati Financial Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0070 | -0.0012 | |||

| RKT / Rocket Companies, Inc. | 0.00 | 0.01 | 0.0066 | 0.0066 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.00 | 0.01 | 40.00 | 0.0066 | 0.0009 | |||

| OVV / Ovintiv Inc. | 0.00 | 0.00 | 0.01 | -14.29 | 0.0059 | -0.0020 | |||

| BMY / Bristol-Myers Squibb Company | 0.00 | 1.12 | 0.01 | -25.00 | 0.0058 | -0.0032 | |||

| BKR / Baker Hughes Company | 0.00 | 0.00 | 0.01 | -7.69 | 0.0057 | -0.0020 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.01 | -8.33 | 0.0055 | -0.0012 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.01 | -15.38 | 0.0053 | -0.0020 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0052 | -0.0010 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0047 | 0.0001 | |||

| AFG / American Financial Group, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0044 | -0.0010 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.00 | 0.01 | 28.57 | 0.0043 | -0.0001 | |||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0040 | -0.0007 | |||

| OKE / ONEOK, Inc. | 0.00 | 0.00 | 0.01 | -11.11 | 0.0038 | -0.0017 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.01 | -12.50 | 0.0037 | -0.0013 | |||

| VVV / Valvoline Inc. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0024 | -0.0002 | |||

| SOLV / Solventum Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0024 | -0.0005 | |||

| CHTH / CNL Healthcare Properties, Inc. | 0.00 | 0.00 | 0.0022 | 0.0022 | |||||

| CNX / CNX Resources Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0020 | -0.0002 | |||

| FIS / Fidelity National Information Services, Inc. | 0.00 | 0.00 | 0.00 | 33.33 | 0.0019 | -0.0002 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.00 | -25.00 | 0.0018 | -0.0005 | |||

| DJT / Trump Media & Technology Group Corp. | 0.00 | 0.00 | 0.00 | -25.00 | 0.0017 | -0.0005 | |||

| RC / Ready Capital Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0016 | -0.0006 | |||

| LUNR / Intuitive Machines, Inc. | 0.00 | 8.40 | 0.00 | 100.00 | 0.0014 | 0.0003 | |||

| IREN / IREN Limited | 0.00 | 0.00 | 0.00 | 100.00 | 0.0014 | 0.0007 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0013 | -0.0001 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.0013 | -0.0000 | |||

| NTR / Nutrien Ltd. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0012 | -0.0000 | |||

| ASH / Ashland Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0012 | -0.0005 | |||

| PFE / Pfizer Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0011 | -0.0003 | |||

| JOBY / Joby Aviation, Inc. | 0.00 | 0.00 | 0.00 | 100.00 | 0.0010 | 0.0003 | |||

| KVUE / Kenvue Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0010 | -0.0004 | |||

| SOFI / SoFi Technologies, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0009 | 0.0002 | |||

| MET / MetLife, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0008 | -0.0001 | |||

| KIM / Kimco Realty Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0006 | -0.0001 | |||

| SOUN / SoundHound AI, Inc. | 0.00 | 0.00 | 0.00 | 0.0005 | 0.0001 | ||||

| CRN / Coronado Global Resources Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.00 | -100.00 | 0.0004 | -0.0007 | |||

| CHWY / Chewy, Inc. | 0.00 | 0.00 | 0.0002 | 0.0002 | |||||

| OGN / Organon & Co. | 0.00 | 0.00 | 0.00 | 0.0002 | -0.0001 | ||||

| VTRS / Viatris Inc. | 0.00 | 0.00 | 0.00 | 0.0001 | -0.0000 | ||||

| ARKK / ARK ETF Trust - ARK Innovation ETF | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| HUN / Huntsman Corporation | 0.00 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| EGIL / EdgeTech International, Inc. | 0.00 | -25.00 | 0.00 | 0.0000 | 0.0000 | ||||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DVN / Devon Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ASTS / AST SpaceMobile, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RMTD / Remote Dynamics, Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| UNITED DEV FUNDING XXX / RES (910CVR018) | 0.00 | 0.00 | 0.0000 | ||||||

| SMCI / Super Micro Computer, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |